Güncelleme!

Amazon Amerika hesabını artık Amazon Türkiye’den açıp sonra Amerika hesabını açabiliyorsunuz. Adres doğrulamasını Türkiye hesabınızdan tamamlayıp, Amazon Amerika hesabına geçiş yapabilirsiniz. Amerika Amazon hesabınızı 55$’ a kuracağınız bir Amerikan şirketi üzerinden açabilirsiniz. Bunun için detaylı rehbere ulaşmak için tıklayın.

Adrese fatura kanıtı ile ABD’de bir telefon numarası nasıl alınır?

Son zamanlarda Amazon FBA ve Amazon E-ticaret ile ilgilenen bir çok kişiden Amazon’un doğrulama adımlarında utility bill yani hesap açarken gösterilen adrese bir fatura kanıtı istemesi yönünde mesajlar geliyor.

Aslında bir Amazon uzmanı değilim fakat konuyu biraz araştırdıktan sonra aslında bazı yanlış uygulamalar sonucunda hesapların kapandığını veya daha açılış sırasındaki doğrulama adımının geçilemediğini gördüm. Aslında konu başlığı utility bill (adrese kayıtlı fatura) fakat sorun daha en baştan kayıt esnasında başlıyor.

Önce Şartları Yerine Getirin

Genellikle en çok yapılan hata istenen şartları bilmeden ve sağlamadan hemen hesap açmaya başlamak. Yani işe tersten başlandığında olası tersliklerde bazı şeyler geriye dönülüp düzeltilemiyor. Bu yüzden öncelikle Amazon Celler central hesabı açarken Amazon’un istediği şartlar neler? Bunları öğrenip yerine getirmeniz sonra hesap açmanız gerekiyor.

Amazon Celler Central Güncellemeleri

Daha önceleri Amazon Celler central üzerinde Amazon.com için yani global pazarda bir satıcı hesabı açılırken artık ülke olarak Türkiye seçilemiyor. Bunun sebebi tam olarak bilinmemekle birlikte büyük ihtimalle sürecin Amazon.com.tr’ ye aktarılması olabilir. Her neyse, artık Amazon.com’a satıcı hesabı açmak için öncelikle Amazon.com.tr ‘ye hesap açmalısınız.

Amazon Türkiye’ye hesap açarken vergi numaranızı vergi dairesinden öğrenerek girin, Mersis şart değil ve tüm bilgileri eksiksiz doldurmaya dikkat edin. Her ihtimale karşı Türkçe karakter kullanmadan adres ve diğer bilgileri doldurun. Zaten bir kaç küçük adımda hesabınızı kolayca açabilirsiniz. Doğrulama için sizden kimlik bilgilerinizi yüklemeniz istenebilir bazen istenmiyor şahsen ben, Amazon.com.tr den bir deneme amaçlı hesap açarken istenmedi taaki Global hesap açana kadar. Hesabı globale bağlarken kimlik bilgilerinizi istiyor, bu aşamada kimliğinizin yüksek çözünürlüklü dijital halini panele yüklüyorsunuz okadar.

Amazon.com.tr Üzerinden Global Hesap Açmak

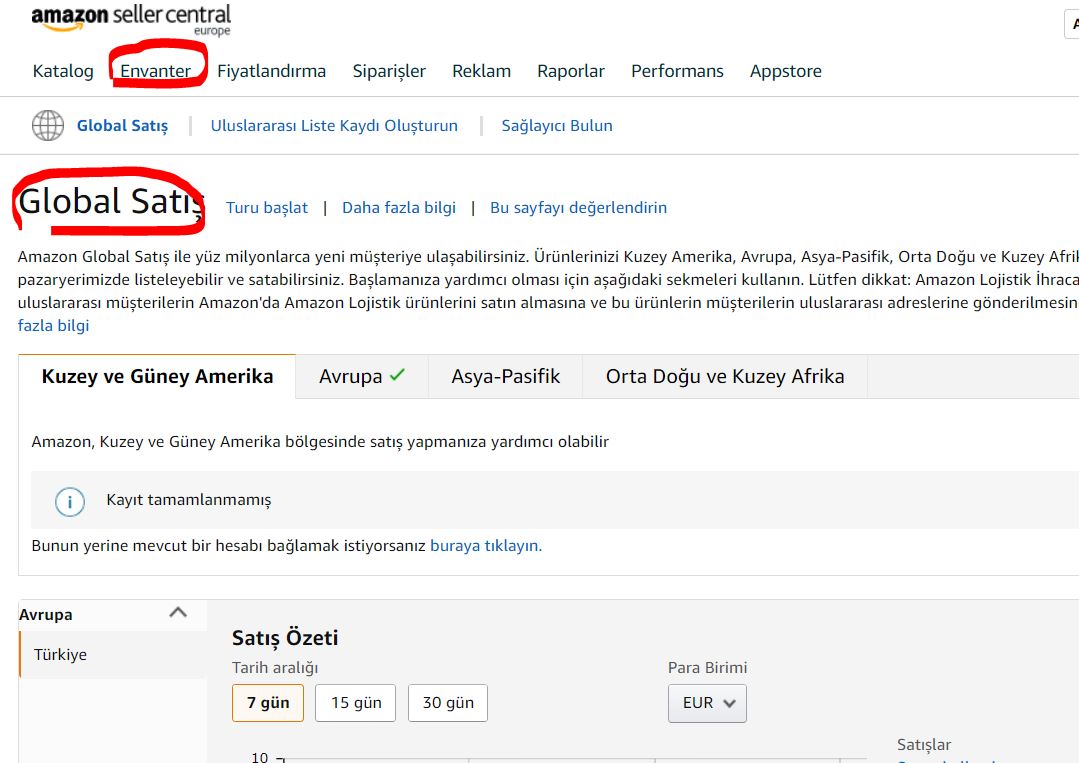

Amazon.com.tr üzerinden bir satıcı hesabı açtıktan sonra artık bu hesap üzerinden global hesap açabiliyorsunuz.

Bunun için üst menüden envanter kısmından global seçeneğini seçerek farklı coğrafyalara hesap açılışı yapılabiliyor. Türkiye’ de açtığınız satıcı hesabı üzerinden Amerika, Asya ve Orta doğu üzerinde farklı hesaplar açılabiliyor.

Kısacası, Amerika da bir hesap açmak istiyorsanız ve ürünlerinizi Amazon.com’ da satmak istiyorsanız hesabınızı buradan açmanız gerekecek.

Bu durumda öncelikle, gelecekte sizi hangi adımların beklediğini bilmeniz gerekiyor eğer bilmiyorsanız araştırıp ilk olarak gereksinimleri sağlamalısınız.

Amazon Amerika Satıcı Hesabı Açmak İçin Gereksinimler

Bu hesabı profesyonel hesap olarak açmak mantıklı. Profesyonel bir Amazon hesabı açmak için öncelikle Amerika’da bir şirketinizin olması gerekiyor. Bu arada standart bir LLC şirket kurmanız lazım fakat adres doğrulaması kısmında takılmamanız için aşağıdaki listeyi takip edin ve devamındaki yazılanları dikkatlice okuyun. Çünkü bir registered agent üzerine şirket kurduğunuzda size bir kira kontratı veya bir adres doğrulama belgesi standart paketlerde sunulmuyor. Bunun için çözüm sunan şirketler var şimdi size bundan bahsedeceğim.

Amazon Amerika satıcı hesabı açarken kayıt adımlarında karşınıza çıkacak gereksinimler şunlar olacak.

Burada detaylı bilgi verilmiş : https://sellercentral.amazon.com/gp/help/help.html?itemID=GQRP483PDN88Q3M9 ben bunları madde madde özetleyeme çalışacağım fakat siz bu verdiğim linki yine de dikkatlice inceleyin çünkü doğrulama sürecinde bunlar isteniyor.

Sistemi kandırmakla bir yere varamazsınız sizden istenen ne ise onu sağlamanız gerekiyor aksi taktirde doğrulama adımını geçmek mümkün değil. Bir şekilde geçseniz dahi (sahte belge vs.) güvenli bir iş kuramazsınız.

İstenenler şunlar:

- ABD’de bir LLC şirket

- Şirket kuruluş belgesindeki adres, kayıt esnasındaki adres ile eşleşmeli

- Şirket kuruluş belgesindeki isim (şirket sahibi ismi) sizinki ile eşleşmeli

- Aynı adrese kayıtlı bir telekominikasyon, elektrik, su, doğalgaz faturası. (Utility bill)Adınız bu faturada geçmeli

- EIN Numarası

- Telefon Numarası (Yukarıda açıkladığımız fatura için zaten bir numaranız olacak)

- Banka hesabınızdaki isim şirket belgenizdeki isim ile eşleşmeli (adınız da eşleşmeli)

Belgeleri yükledikten sonra 3 iş günü içinde hesabınız açılır.

Adres Kanıtı Utility Bill İçin Ne Yapmak Gerek?

Bunun için çok çeşitli seçenekler var ilk akla gelen şirketinizi kurmadan önce Amerika’da size fatura kanıtı sağlayacak bir hizmet bulmak. Fakat bu yol biraz dolambaçlı ve size çok fazla maliyeti olabilir çünkü en mantıklısı bir ofis kiralamak.

Daha ekonomik bir çözüm olan ikinci seçenek ise, Amerika’da şirketinizi kurarken size bir telefon faturası sağlayabilen ve ayrıca kendi adreslerini size kullandırabilen bir şirketten hizmet almak.

Bu şirket startpack web sitesi : www.startpack.io

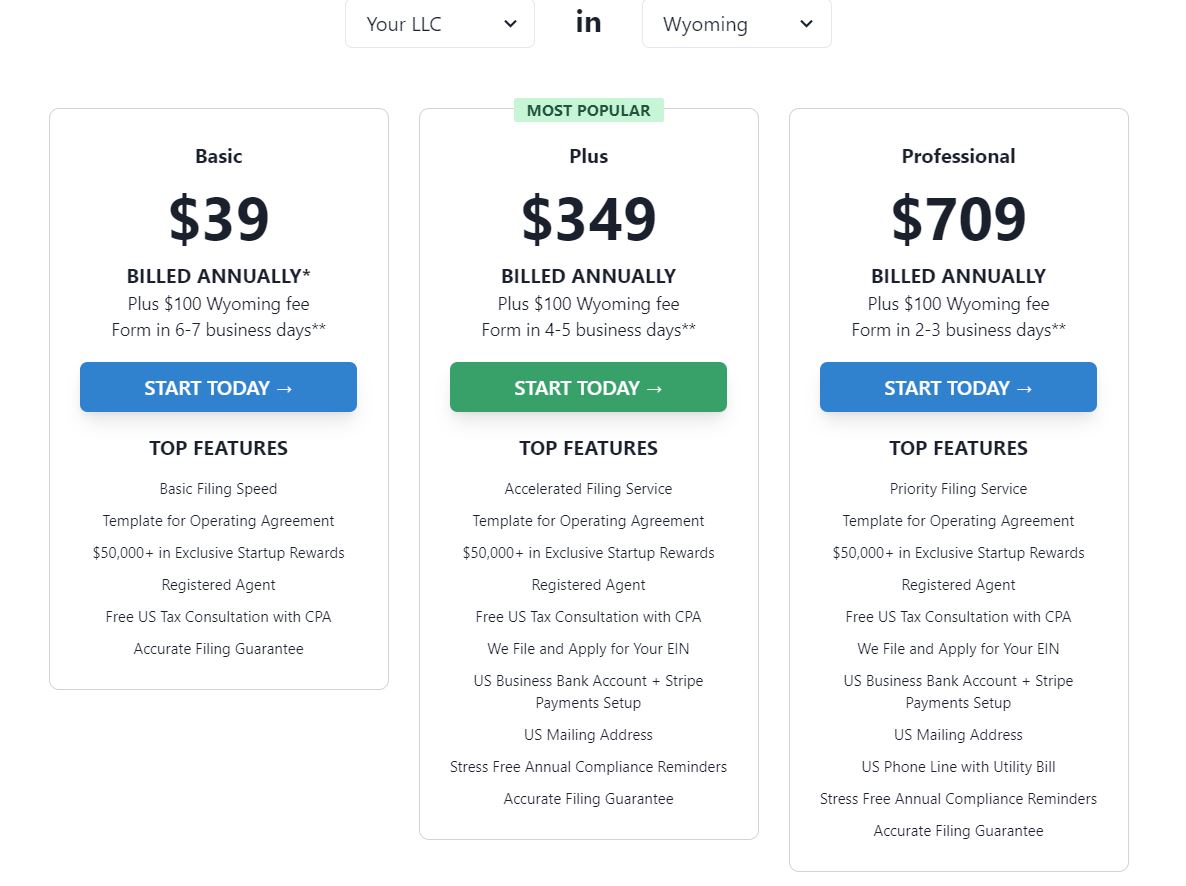

Startpack.io, Amerika’da ikamet etmeyen yabancılar için farklı çözümler oluşturan bir şirket. Şirketin web sitesinde birkaç plan var. Amazon için bir doğrulanmış hesap için her şeyi karışıyorlar. Bu planların farklı fiyatları var. Amazon söz konusu olduğunda gereksinimler için Professional pakette her şey bulunuyor.

Neler Sunuyorlar?

- Wyomin Eyaletinde isminize bir LLC şirket kurulumu

- 1 Yıllık Registered Agent hizmeti

- ABD vergi danışmanıyla ücretsiz danışmanlık konuşması

- ABD’de bir banka hesabı

- ABD’de bir adres

- ABD’de bir Telefon Numarası (Adres doğrulaması için fatura kanıtı yani utility bill)

- Şirket evraklarının kopyalarının hazırlanması

- EIN (Employer Identification Number)

- ITIN ( İsteğe bağlı ek ücret karşılığı bu sayede paypal sorununu da çözebiliyorsunuz)

Tüm bu hizmetleri 709$ ‘ a sunuyorlar. Ayrıca +100 dolar da eyalete şirket kurulumu sırasında dosyala ücreti ile beraber 809$^ye mal oluyor.

Şirketin web sitesini incelerseniz özellikle ABD dışındaki girişimcilere yönelik (E-ticaret, Amazon FBA ve Dropshipping) hizmetler ve paketlerle dolu. Trustpilot gibi inceleme sitelerine baktığımda yorumlar epey olumlu. Bir destek talebi açıp destek hızlarını ölçtüm mesai saatleri içerisinde hemen geri dönüş yapıyorlar. Ayrıca online chat ile (mesai saatlerinde) yaptığınız işi, ülkenizi belirtip çok doyurucu bilgiler alabilirsiniz. Kısacası işleri ile ilgili hiç bir bilgiyi saklamıyorlar ve müşterilerini aydınlatıyorlar.

Karar vermeden önce sizde bir destek talebi gönderip sormak istediğiniz her şeyi sorabilirsiniz.

Amazon hesap açma veya doğrulama ile ilgili tüm gereksinimleri baştan sapladığınızda çok sağlam temeller üstüne kurulmuş bir hesabınız olur ve gelecekte suspend sorunu yaşamazsınız.

Umarmı faydalı bir yazı olmuştur şimdiden bol şanslar dilerim!

51 Yorum. Yeni Yorum

Merhaba

Utilitt bill konusu hala güncel mi ? Adrese gelen kod yeterli oluyor mu ? 2024

evet yeterli oluyor

Merhaba hocam bu araları suspend olayı çok arttı çoğunda utility bill alakalı. Önlem almak için soruyorum ne gibi yol izlememiz lazım ? ABD Telefon faturası vardı önceden şimdi nasıl olacak, nerden ne gibi fatura bulabiliriz.

Suspend sebebi genellikle adres değişikliği yüzünden oluyor ilk acilislarla dogrulama mektubundaki lod girilirse suspend olmuyor. Fatura bulmak cok zor ve mailiyetli bir is

Selam,

Okuduğum kaynaklarda karşılaşmadığım bir adres doğrulama adımı olarak Amazon “Recipient Name in English” (açıklaması şu “The person who will receive the postcard containing the verification code sent to your address.”) başlığı altında bir isim istiyor benden. Kendi adımı yazasım geliyor; Northwest ise “belirli bir isim yok, çok gerekliyse Northwest Registered Agent, Inc yazın” diyor. Ancak sorun Ad, Soyad kutularının ikisini birden doldurmadan “Doğrula” butonunun aktif olmaması.

Ne yapmalıyım sizce?

Merhaba, amazon satıcı hesabını şirket olarak açarken bank statement ve certificate of incorporation dışında başka belge isteniyor mu? utility bill ile ilgili çok yazışılmış ancak tarihler eski belki bir değişiklik vardır diye tekrar sormak istedim. Herhangi bir fatura da isteniyor mu hala?

Merhaba,

Artik utility bill istenmiyor, özel suit numarası içeren bir Abd posta adresiniz varsa ki olmali (wyomingmailforwarding . com dan alınabilir) adresinize Amazon dan gelen doğrulama kartindaki kodu girerek hesabi açabilirsiniz.

Acentenizin paylasimli (suit no suz) adresini girmeyin çünkü Registered Agent adresleri paylaşımlı olduğu icin bu tip doğrulama kartlarını kabul etmezler.

HOCAM MERHABA. SITENIZDE COK FAYDALI BILGILER MEVCUT. BASKA BIR KANAL BULAMADIGIM ICIN BURADAN YAZIYORUM YAYINLAMAYABILIRSINIZ. TURKIYE UZERINDEN AMERIKA HESABI ARTIK ACILMIYOR BILGILERINIZE.

Bilgilendirme icin teşekkürler

merhaba.

Tek bir kişinin üç farklı ülkede şirketi varsa hepsi için ayrı ayrı satıcı hesabı açabilir mi? Yoksa amazon bu kişiye sen tek bir kişisin tüm şirketlerini tek bir hesap üzerinden açılmalı buradan global satış yapmalısın mı der? (her ülke için ürünler oranın FBA deposuna gönderilecektir.)

cevaplarınız için şimdiden teşekkür ederim

Merhaba, mantik olarak global satış kısmından tek hesapla ayri işletmeler eklenebilir fakat bu konuda daha deneyimli olan Amazoncular daha net yanit verirler size.

Merhaba

Açabilirsiniz; sıkıntı olmaz. 3 şirket 3 farklı tüzel kişilik demektir. Ayrıca zaten 3 farklı ülkede satış yapacaksınız. Velev ki aynı ülkenin pazaryerinde bile satsanız Amazon buna da karışmaz. Ama rakip satıcılar bu konudan çok muzdarip olacaklardır. 🙂

Amazon aynı kişinin aynı pazaryerinde ikinci bir hesap açmasına belirli istisnalar (farklı kategorlerde ürün satışı) dışında izin vermez. Açabilseniz bile hesabınız bir kaç gün içinde bloklanır.

teşekkür ederim Şakir bey 🙂 Farklı ülkeler ama ürünler aynı olacak sıkıntı olmuyor anladığım kadarıyla

merhaba,

amazon türkiye hesabını türk şirketi bilgilerimiz ve ikametgahımızla açıp daha sonra global satıştan amerikayı açmak istersek amerikadaki LLC şirket bilgilerimizi girebiliyor muyuz? Amazon iki hesapta da aynı şirket bilgilerini ister mi?

Ayrıca Amerika’da LLC şirketimiz var ama ikametgahımız istanbul da bir sıkıntı olur mu

teşekkürler

Evet Abd LLC şirket bilgileri ile hesabınızı globale genisletebilirsiniz. Bu aşamada Abd sirket bilgilerinizi girin fakat iş adres kismindan TR deki doğrulanmış şirket adresini seçin. Yeni adres ekleyip Abd LLC adresinizi girmeyin yoksa doğrulama istenebilir.

Eger iş adresinizi TR şirket adresi olarak seçerseniz böylece hesabınız açıldığında sizden adres dogrulamasi istenmez.

Merhabalar. Yazılarınız için sizlere teşekkür ederim. Benim hali hazırda türkiyeden açtığım ve sonrasında açılış suspendi atlattığım amazon hesabım var. Ve satış da yapıyorum. Şirket açmak istedim USA da. Yönergelerinizle Kentucky eyaletinde de açtım. Şimdi EIN numaramı bekliyorum. Sorum şu. Business adresini değiştirmem gerekecek sanırım ? . O zaman benden Utilty bill ister mi o adrese ? bir bilginiz var mı ? teşekkür ederim

Adres değişikliği olacağı için bir doğrulama süreci olabilir fakat adres kodu mu gonderirler yoksa faturami isterler net bir şey söylemek zor

Hocam madem öyleydi keşke kuruluş aşamasında ki yönergelerde bunu belirtseydiniz. Şimdi EIN bekleyeceğiz. Ondan sonra adres değişikliği için bir kez daha bekleyeceğiz. Yani şunu kuruluş yaparken orda belirtseniz. Çok makbul olurdu. Wyoming den aldık adresi. KEşke belirtseniz Burdan alırsınız adres ama değişmek gerek vs. Biz de zannediyoruz sadece EIN a kaldı iş. Faturayı adrese alacağız E peki sonra ? Yine de teşekkürler…

Özür dileriz gerçekten kusura bakmayin. Yeryüzündeki tüm varyasyonlari hesaplayip ona göre oluşabilecek herseyi yazmamiz gerekiyordu buraya. Haklısınız:) sizin durumunuzu adres değiştireceğinizi, Amazonun yonergelerinin değişeceğini bilmemiz gerekiyordu. Bilemedik.

Merhaba

Benim sorunum utility bill ile ilgili ;

şuan hali hazırda kuzey amerika da satışlarım devam ediyor, türkiyede şirket kuruldu ve amazon bu hesap üzerine açıldı şirket sahibi babam şimdi amerika da firma ismi aynı ama kurucu ismi bu sefer benim adıma ve amerikada şirketimi kurdum EIN i aldım ve sanal ofis adresim var. Utility bill için nasıl bir yol izlemeliyim?

Yorumları okuyunuz lütfen aynı soru daha önce de soruldu ve yanitlandi. Abd şirketi kendi adinjza olmali, utulity bill tr de ki şirket dogrulanirda istenmez.

Selamlar, bu konuda bir çok soru soruldu ve yanıtlandı fakat artık startpack ile devam etmenize gerek yok. Amazon Amerika hesabı için bir şirket kurmanız gerekiyorsa bu makaleye göz atabilirsiniz:

https://startupsole.com/amazon-icin-amerikada-sirket-kurmak/

tamam teşekkürler. peki size geri dönüş oluyor mu bu konuyla ya da startpack.io ile ilgili. kendilerine güvenebiliriz anladığım kadarıyla. Merak ettiğim daha sonra irtibat kuramama ya da sahiplenmeme gibi sorunlar yaşandı mı?

Bu firma ile ortaklığımız veya bağlantımız bulunmuyor. Henüz şahsen kendilerinden bir hizmet almadık ama referanslarına bakılırsa epey zamandır faal ve ulaşılabilirler. Web sitemiz üzerinden bir kaç kişi kendilerinden hizmet alacaktı ama alıp almadıklarını bilmiyorum. Siz kendileri ile konuşup detaylı bilgi aldınız mı?

merhaba. startpack firması şirket adresi için kendi adreslerini kullandırıyor. bu durumda birden fazla şirket aynı adresi kullanıyor. bu sorun olmaz mı?

Suit numarası sağlıyorlar ve tümü bunu yapıyor her şirket icin ayrı bir adres tahsisi yapamazlar isterseniz kendilerine danışın mail yolu ile.

Merhabalar,

Web sitenizdeki bilgilere binaen Kentucky eyaletinde çok hızlı bir şekilde geçici bir adres ile yeni bir şirket kurduk. Bu amazon gerçeğine ( Utility Bill ) binaen ideal adres hizmeti veren firmadan hizmet almamız gerekecek. Henüz EIN numarası gelmedi. Bu durumda adres değişikliğini nerelere bildirmemiz gerekiyor ve de nasıl yaparız. Bu bekleme sürecini daha da mı uzatır. Bilgi verebilir misiniz.

Teşekkürler,

Şirketi Kentucky eyaletinde kurduysanız bu linkten http://web.sos.ky.gov/ftsearch/ şirketinizi aratıp üstte “File Statement of Change of Principal Office” linkine tıklayarak 10$ karşılığı online olarak şirketinizin posta adresini değiştirebiliyorsunuz.

EIN tarafında ise eğer henüz numaranız gelmediyse beklemek gerekir EIN geldikten sonra IRS ye adres değişikliğini 8822-b formunu doldurarak bildiriyorsunuz https://www.irs.gov/forms-pubs/about-form-8822-b

Bu formu doldurup (şirket adı, EIN no, eski adres, yeni adres şeklinde) eski adresinizin bulunduğu eyalet hangisi ise oraya postalamanız gerekiyor.(PDF in ikinci sayfasında nereye postalamanız gerektiği yazıyor eyaletlere göre iki ayrı posta merkezi var sizin eski adres neredeyse oraya postalayın) Fax olmuyor bunu posta yoluyla ıslak imzalı olarak göndermelisiniz.

Merhabalar,

Sadece IRS için mi beklemek gerekiyor, yoksa eyalet içinde gerekiyor mu? Tüm bu süreçleri IRS için telefondan çözebilir miyiz. Yine de evrak işlerini tamamlamamız mı gerekecektir?

Kentucky Eyaletinden adres değişikliğini yaptıktan sonra yeni bir SS4 formu ile EIN numarası almayı deneyebilir miyiz. Bilgi verebilir misiniz.

Teşekkürler,

Irs ye ne zaman başvurdunuz bilmiyorum ama IRs için ancak ein geldikten sonra adres değiştirebilirsiniz. Fakat eyalet için beklemeye gerek yok her koşulda değişikliği yapmaniz gerekecek zaten.

Irs yi telefonla çözemezsiniz sizden her koşulda adres değişim formunu postalamanizi isterler.

Merhabalar,

IRS’ye 8 Nisan da SS4 formunu faks çektim.

Daha yeni, her neyse cok onemli değil irs deki adres ilk aşamada sizi bağlamaz once şirket adresinizi degistitin sonra irsyi cozersiniz ein geldikten donra. Ein ye engel değil bu durum.

merhaba. murat bey utility bill için ideal bir firma bulabildiniz mi? Paylaşır mısınız?

Henüz istediğim gibi bir firma bulamadım.

Merhaba.

Utillity bill için dünyanın herhangi bir yerinde üzerinize kayıtlı bir fatura olan adresi Amazon’a bildirebilirsiniz. Bu Amerika Amazon’da satış yapıyorsunuz diye Amerika’da olması gereken bir adres değildir. Amazon’daki “Business Address” yani “İş Adresi” ifadesi biz Türklerin ev adresi ve iş adresi gibi algıladığı bir durum değildir. Amazon’da “business address” olarak ifade edilen adres sizin Amazon işini nerede yaptığınızı öğrenmek istediği adrestir. Bundan dolayı bu adresi gelişi güzel istediğiniz bir ülkede ki adres yazmayın diye Amazon adres doğrulaması için sizden bir fatura ister.

Amerika’da bir adres kiralamak o adrese bir internet hizmeti almak ve bir fatura elde etmek hem gereksiz hem de yersizdir. Eğer Türkiye’de üzerinize kayıtlı fatura olan bir adres varsa o adresi iş adresi olarak kullanın. Amazon’un istediği budur. Ama Türkiye’de yok ise Türkiye’den bir üzerine bir fatura sağlamakla mı daha kolay yoksa dünyanın herhangi bir ülkesinden mi? Hangisi sizin için az maliyetli ve kolay ise onu yapabilirsiniz. Böyle olunca aslında Amazon tam olarak istediği bilgiye erişemiyor ama zaten onlarda %100 olarak fatura kanıtından o satıcının faturadaki ülkede satış yaptığından emin olamıyorlar. Ama yine de bunun için arka planda bazı doğrulama işlemlerine sahipler. IP adresi gibi.

Özetle dünyanın hangi ülkesinde adınıza fatura sağlamak az maliyetli ve zahmetsizse o ülkede fatura sağlayın.

Kolay gelsin.

Merhaba. Turkiye’de yerleşik bir sanal ofis kullanıcısı ve şahıs şirketi olarak, sanal ofis adresini ispat eden bir utility bill sağlamak mumkun değil ne yazık ki. O ofis adına düzenlenen tüm faturalar sanal ofisin kendisi için düzenleniyor, biz sözleşmecileri için değil. Bu durumda da amazon kabul etmiyor. Bununla ilgili bilinen bir çözüm yolu var mı acaba? Teşekkürler.

Sizin de belirttiğiniz gibi sanal ofisler gerek Türkiye’de gerekse ABD içinde olsun geneli aynı mantıkta çalışıyor. Size sadece bir kira sözleşmesi tarzında bir evrak verirler bu evrak Amazon’un istediği türden bir elektrik, gaz, telefon faturası olmadığı için kabul görmüyor. Genelde Amazon.com.tr den adres doğrulatanlar sanal ofis yerine şirketlerini, fatura sağlayabildikleri ev adreslerine ya da gerçek bir fiziksel ofise kuruyor. Bunun dışında bilinen bir çözüm yok. Süreç ve gereksinimler aşağıdaki gibi olmalı;

1. Amazon.com.tr ye hesap açan isme ait bir şahıs veya LTD şirket. (Türkiye’de)

2. Bu Türk LTD veya şahıs şirketi sahibinin üzerine gösterebileceği iş adresinin doğrulanabileceği fatura (Elektrik, telefon,doğalgaz)

3. Amazon.com.tr den iş adresi doğrulandıktan sonra Amazon globale geçişte bir Amerikan LLC şirket (Yine aynı isim üzerine açılmalı)

4. Türkiye’de fatura ile doğrulanan hesap Amazon globale geçildiğinde doğrulama istememesi

Özetle Amazon diyor ki, Türkiye’de ki işinizi fiziksel bir konumda fatura ile doğrulayın yeriniz be ikamet ettiğiniz iş adresiniz belli olsun. Sonrasında doğrulanan aynı iş adresi ile Globalde (Amerika için)kendi adına kayıtlı bir LLC şirketle hesap açabilirsiniz. Bu sayede Amerika’daki LLC adresiniz zaten posta adresi olduğu için ve orada fiziksel bir bağınız olmadığı için ana iş merkeziniz Türkiye olarak hesabınız doğrulanmış olsun. Bunu sağladığınız zaman ortada herhangi bir problem kalmıyor aslında.

3. maddede bahsettiğiniz bir zorunluluk mu? Dünya’nın bir noktasında ispatlı bir adresle ticaret yapan birisi neden bir de Amerika’da şirket kurmak zorunda olsun? Ya da LLC şirket dediğiniz bir kayıttan mı ibaret sadece, illa bir aracı mı gerekiyor bunun için, iyi düzey İngilizceyle insanların kendi halledebildikleri birşey midir? Teşekkürler.

Aslında bir zorunluluk değil bireysel olarak ta hesap açabilirsiniz fakat Amazon’da belirli bir ciro üzerinde işlem yapıldıktan sonra size şirketleşmeniz konusunda bildirim gönderecekler. Bireysel olarak ABD içine yaptığınız satışlarda işlem ve ciro limitleri var bunları aştığınızda artık profesyonel olarak şirketleşmeniz istenir. Önce bireysel devam edip ikinci aşamada LLC şirket üzerine geçiş te yapabilirsiniz fakat çoğu kişi bu aşamada suspend riskini göze almak yerine en baştan şirket kurup bu şekilde hesaplarını açıyorlar.

LLC şirket ABD hükumetinin yetkilendirdiği acentelerin sizin adınıza seçtiğiniz bir eyalete şirket kurmak için başvuru dosyalama işlemlerini yürütmesidir. Şirket kurulumu sonrasında EIN denilen vergi numarası da almanız gerekiyor aksi taktirde bu şirket üzerine banka hesabı, Amazon hesabı veya sanal pos (stripe) gibi hesapları açamazsınız. Aslında çok ileri seviyede ingilizce bilgisine ihtiyaç yok fakat konuya yabancıysanız şirket kurma ve vergi (EIN no) alma ile ilgili detayları öğrenip uygulamak istemiyorsanız sizin yerinize bu işlemleri bizler de yürütüyoruz. Aşağıdaki linkten detaylı bilgi alabilirsiniz;

https://startupsole.com/amerikada-sirket-kurma-danismanlik-hizmeti/

telefon aboneliği amazon utility bill icin yeterli oluyor mu? yani fiziki bir adres yok sanırım. sadece telefon aboneliği ile halloluyor. bu amazon için yeterli mi ?

Tam olarak değil, Amazon icin kullandığınız adres ile telefon numarasi fatura adresi ortusmeli. Yani sadece telefon numarası almaniz yeterli değil adres ve şirket oluşumu içeren bir paket almaniz gerekiyor.

Merhabalar, startpack.io hakkında bir soru sormak istiyorum. Bu şirket ile anlaşmayı düşünüyoruz fakat bizim için açacakları banka hesabına erişme gibi durumlar söz konusu mu? Çok hakim olmadığım için bu konulara endişelendim biraz.

Ulaşamazlar onlar sadece aracılık ediyorlar zaten açacakları banka hesabı Mercury bank. Bu banka oldukça girişimci dostu bir bankadır o kadar basit bir işlemle sizin hesabınıza el koyup erişeceklerini sanmam. Zaten internet bankacılığı sistemi ile çalıştıkları için hesap sizin adınıza açılacak. Onlar satış ortaklığı yapıyorlar merak edilecek bir durum olacağını sanmam.

verdiğiniz yanıt için çok teşekkür ederim. mesajınızdaki linke ve sayfanızda okumadğım kalan yazılarınızı okuyacacağım.

ellerinize, kaleminize sağlık.

Rica ederim selamlar.

iyi günler, haftalardır süre gelen araştırmalarım sonucunda şu günlerde şirketi kurmak üzere iken sizin sayfanıza denk geldim; iyi ki de denk geldim.

“Inc Authority ile Amerika’ da Şirket Kurmak” yazınıdaki linkle bu sayfanıza geldim.

öncelikle teşekkürlerimi sunuyorum. aklımda iki ufak şey kaldı. belki diğer yazınızın altına yazmam daha mantılıdır ama mahsuru yoksa buraya yazıyorum:

1-www.startpack.io’nun utility bill için bana vereceği telefon numarasını amazon.com üyeliği esnasında kullanmak zorunda mıyım? çünkü ben zadarma’dan aldığım telefon numarasını girmek istiyorum. ama bu sefer de verification işlemleri için arayacak veya sms gönderecek olursa zadarma numaram bir işe yaramaz? zadarma numarasını girebilir miyim kayıt esnasında?

2-wyoming sales tax’i %4. bu %4 vergi konusu toplaması ve uğraşması ile sağda solda gördüğümüz okuduğumuz kadar korkutucu değildir diye düşünüyorum. eğer zor derseniz delaware’de kuracağım şirketi.

son olarak, ismim gizli kalsın istediğim için birkaç eyaletle sınırlı tutuyorum kendimi.

sayfanız gün geçtikçe değerlenir…

saygılarıma.

çok teşekkürler.

Selamlar Çağlar bey,

1. Amazon ile ilgili çok fazla bilgim olmadığını rahatlıkla söyleyebilirim fakat mantık olarak Amazon hesabı açarken bir telefon numarası kullanıyorsanız ve bunu utility bill için de kullanacaksanız bunların örtüşmesi oldukça önemli olacaktır. Dolayısı ile zadarma numarası muhtemelen bu aşamada işe yaramaz zaten sanal bir hat bildiğiniz gibi. Startpack tarafında işleyiş biraz farklı. Çünkü birden çok paketleri var ve bunları ayrı ayrı da sağlıyorlar (söylediklerine göre) ama sitelerinde ayrı ayrı satın alabilecek bir alt yapı henüz yokmuş. Bu sebeple gönderdikleri mail, Amazon için hesap açacak kişilerin kendileri ile direk temasa geçmesi yönündeydi. Eğer şirketinizi Amazon için kuracaksanız öncelikle bu firma ile mail veya telefon yoluyla iletişime geçip detaylı bilgi alın. Böylelikle olası bir hatayı bertaraf etmiş olursunuz.

2. İsim gizliği için bir kaç eyalet var seçebileceğiniz bu konuda size katılıyorum. Eğer Amazon’da iş yapacaksanız vergilendirme konusunu iyice araştırın bu blogda epey kaynak var hatta https://startupsole.com/amerika-muhasebe-firmalari/ bu yazıda sırf amazon ve drop. üzerine uzmanlaşmış firmalarda var. Wyoming %4 sales tax fakat satışlarınız Wyoming ‘de olursa. Diğer eyaletlere de satış yaptığınızda eyalet limitlerini geçtiğinizde oralardan da vergi toplayıp devlete teslim etmeniz gerek. Dropshipping de böyle yapıyorum ama dediğim gibi Amazonda işleyiş farklı olabilir.

Neticede eğer satış yapıyorsanız ve para kazanıyorsanız bu işi uzman ellere bırakıp siz işinize odaklanın vergi toplamak gerekiyorsa toplanır ve ödenir önemli olan para kazanmak.

merhaba,

startpack bu 709$ yıllık fatura diye yazmış. bu ücreti her yıl mı ödüyoruz? anlamadım.

Evet yıllık ücret 709 usd. Bunun 480 USD si zaten Telefon faturası hizmeti için alınıyor. Geriye kalan 229 USd ise pro pakette Registered agent hizmeti +adreslerini kullanma +vergi danışmanlığı + banka hesabı açılışı ve hesabı sağlıklı tutma + sürekli telefon ve eposta desteği + hızlı işlemler gibi özellikleri var.

bu paket utility bill desteği sunuyor anladığım kadarıyla öyle değil mi?

Professional paket seçilip yeni bir şirket kurularak adres ve telefon numarasını tek yerden gösterdiğinizde doğrulama geçilebilir. Fakat bu pro paket yıllık olarak size yansıtılıyor bilginiz olsun. http://www.startpack.io ‘dan Arjun ile iletişime geçip bu konu hakkında daha detaylı bilgi alabilirsiniz böylece aklınızdaki sorulara daha net cevap bulabilirsiniz.