In this guide, you will learn the step-by-step process of establishing a company in Wyoming by getting service through Northwest Registered Agent

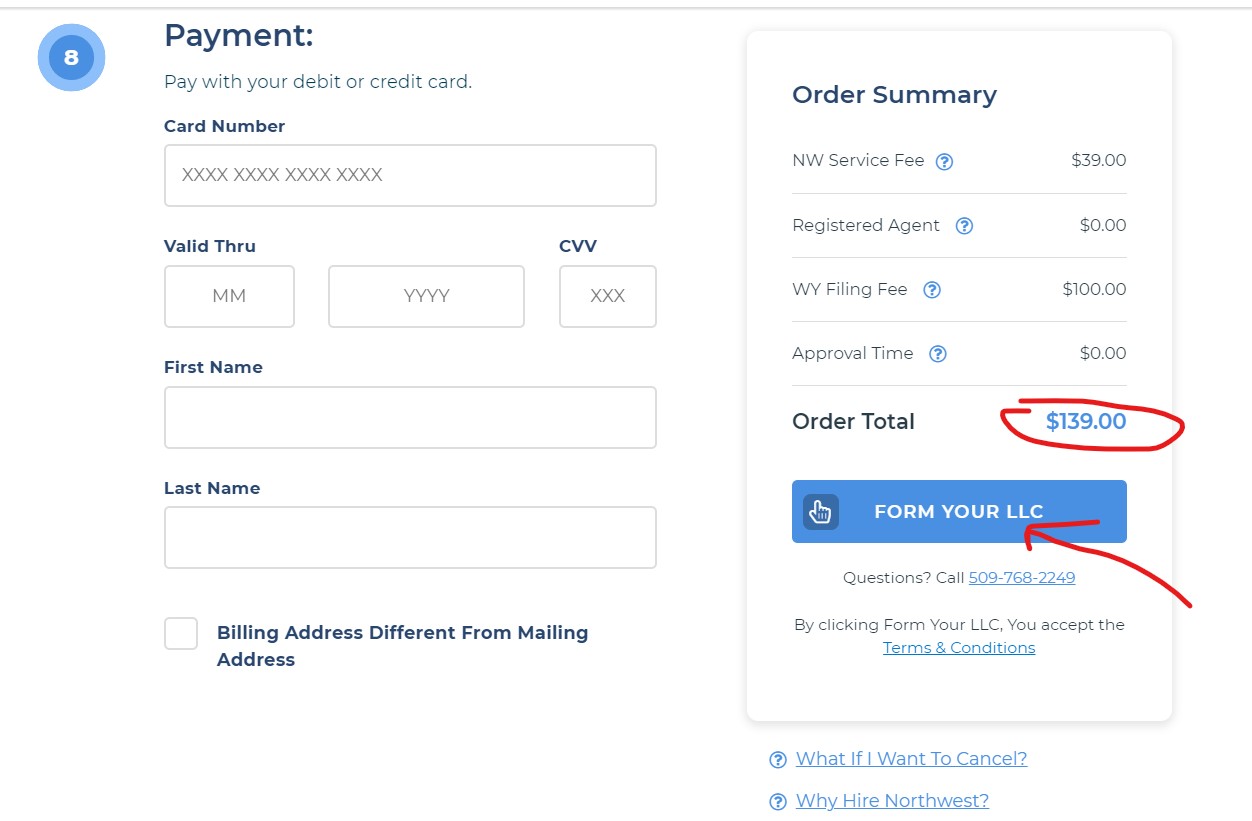

The total amount you will pay to start an llc in Wyoming is $139. US business address is included in the total cost. No passport or ID is required, and you do not need to visit the US in person.

Our new venture platform: Startuphub is on publication

Our Startupphub vehicle, which collects on a single platform, from business idea to company installation, state selection, brand creation, bank and strip pre -approval tools to advertising text production

Click here to discover the platform now !

Wyoming LLCs do not require annual maintenance and provide tax advantages. It allows you to open many accounts such as Amazon, Etsy, Stripe, Ebay, Shopify, Mercurybank and Paypal.

General Information About Registered Agents

In order to form a new LLC company in the United States as a foreigner, you must have a registered representative agent with an office located in the state where the company will be formed.

These registered representatives are called Registered Agents.

Registered Agent can file your LLC formation application in the state where you will form the company, and your company must have a registered agent for your company to remain active after your LLC company is formed.

If you are not a US resident and your LLC does not have a registered representative in the US, your company will become inactive and will be dissolved.

For these reasons, you must always have a registered agent in the state where your company is registered, both during the LLC company formment and after the formment.

There are many companies that act as registered representative agencies. You can find detailed reviews of the most popular registered representative agencies in the United States on our blog .

After giving a general reminder about registered representative agencies, let's talk about Northwest Registered Agent, an llc where you can get service to form a new LLC in the USA.

About Northwest Registered Agent

Northwest Registered Agent is an llc that has been forming an LLC since 1998 and operates in the Registered Agent industry.

With Northwest, you can form an LLC company in all states of the USA. Additionally, because Northwest has offices located in every state (their addresses do not change easily), they allow their customers to use their addresses as their business mailing addresses.

They even scan all incoming documents free of charge and deliver them digitally on the same day.

Compared to other registered agents, Northwest is a registered agent that stands out for its top-notch service and support, providing a free business address, free first-year registered agent service (exclusive offer from us), and free operating agreement.

We signed an exclusive agreement with Northwest and became Northwest's business partner, thus receiving free registered representation for the first year and a new discount of $39 setup fee on LLC formations with Northwest.

With our reference, you can now set up an LLC with Northwest by paying $39 (including address) + state fee. If you receive standard service through Northwest (without our reference), you will not be able to benefit from the free registered representative and affordable installation discount for the first year .

Note: When you establish an LLC company with Northwest with our dealership reference, we apply for your EIN free of charge during our campaign. this page for conditions and details .

also take a look at the review article we prepared for Northwest Registered Agent here .

What Does Northwest LLC Formation Service Include?

When you start working with Northwest and receive service from them, you will receive the following free of charge, in addition to unlimited phone and e-mail support.

- Business address you can use for your company

- Free registered representation for the first year

- A carefully written 6-page Operating Agreement that you can use for your company.

- An LLC membership certificate for your company

- Free LLC Business Bank Account Resolution document (A document required to go to the USA in person and open a bank account in the future)

- Advanced customer panel where you can manage your company

- Quick support

Northwest provides all these features free of charge to all its customers.

Northwest is one of the agencies with the highest service quality among registered agents located in the USA. For this reason, you can blindly trust Northwest in LLC formation processes.

After providing detailed information about Northwest, let's examine step by step how to own an LLC company by getting service through this agency.

Forming an LLC in Usa with Northwest

You can form a new LLC company in Usa with Northwest by following the steps below.

Important Note: Installation steps may change frequently, so there may be minor differences in the steps in our article. However, there is not much difference in general operation. Continue following by reading the installation steps yourself. If you get stuck at any point during the installation, on our WhatsApp line and get support.

The example setup in this guide will cover creating an LLC in the state of Wyoming, but if you want to form an LLC in a different state, you can follow the same steps. You are free to choose a different state instead of Wyoming in the state selection section because Northwest is an agency with address offices in every state.

Online Company Formation Video in Wyoming with Northwest

After providing all the details about Northwest, we can now move on to the LLC setup step.

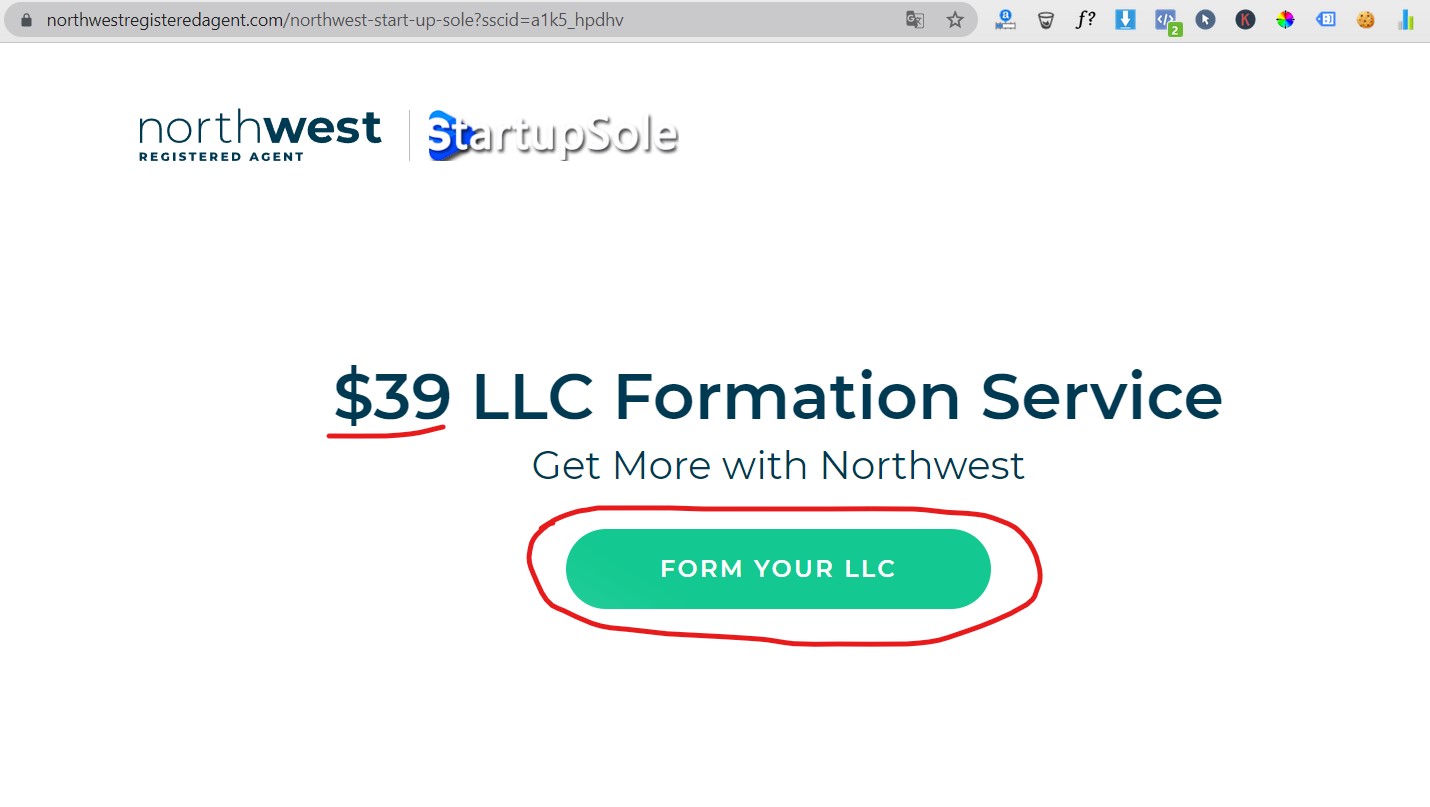

First, log in from this link click the FORM YOUR LLC

NOTE: When you access the Northwest website linked link,

(Video has subtitles)

In addition to the video content, you can also perform the same steps for installation by using the step-by-step guide. Read on for this.

After accessing the Northwest landing page with the Statupsole logo from our linked link, the FORM YOUR LLC button and take the next step.

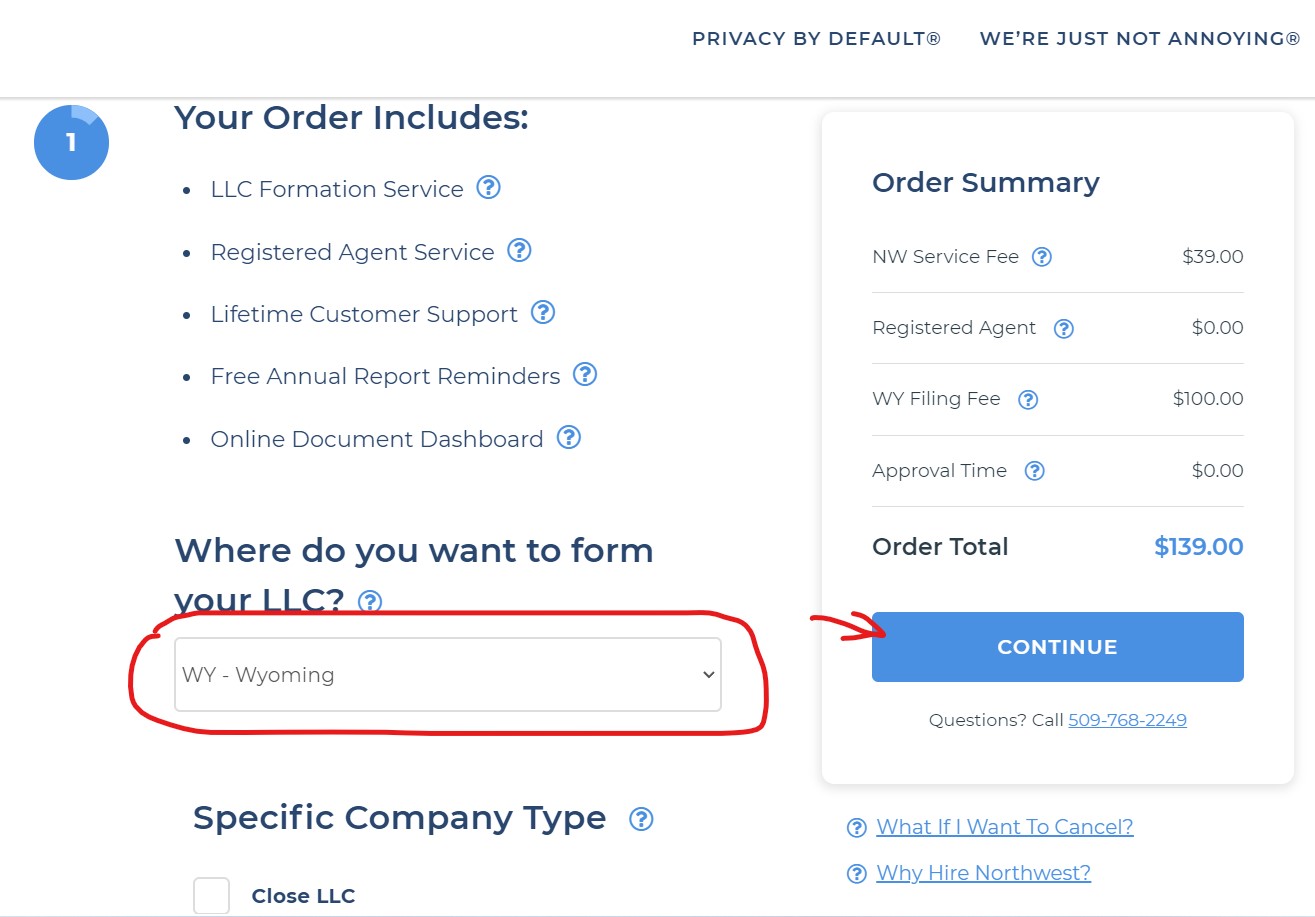

- Where do you want to form your LLC? You can select the state where your company will be formed from the section. In this sample guide, since we are installing in the state of Wyoming, we select Wyoming from the state section.

- As seen in the screenshot below, the price is calculated as a free registered agent + business address for the first year, with only $39 + State filing fee after the state election.

- If you do not want to get extra services, you can have a Wyoming LLC for only $139 including business address.

- Continue to move on to the next step. In this step, you will determine the company name.

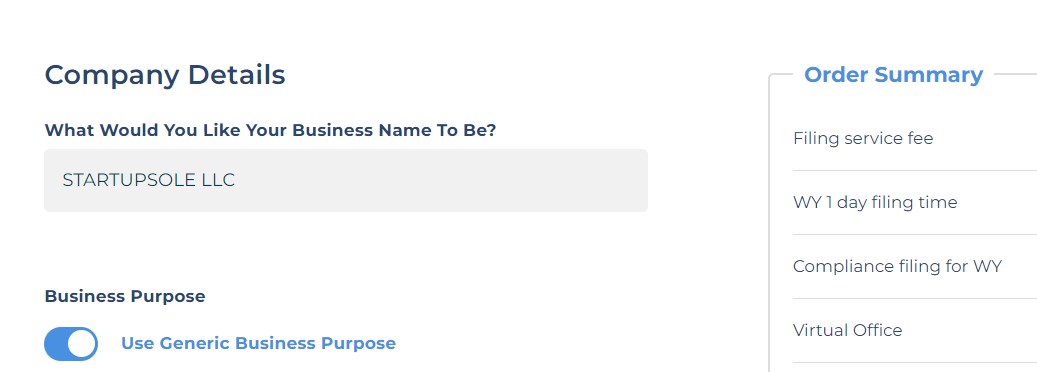

- At this stage, we determine the company name and company address. You can enter a few words of description text about your company in the Business Purpose section. When determining your company name, open the Wyoming state portal here and check if the company name you have chosen has been used before. also Company Name Selection guide in Wyoming LLC Formation .

- If your company is for general use, you can select Use Generic Business Purpose. This is not important because it is not a part of the state records, it is only for keeping information about your company's field of activity in the agency database.

- After determining the company name, you can scroll down the page and move on to the address section.

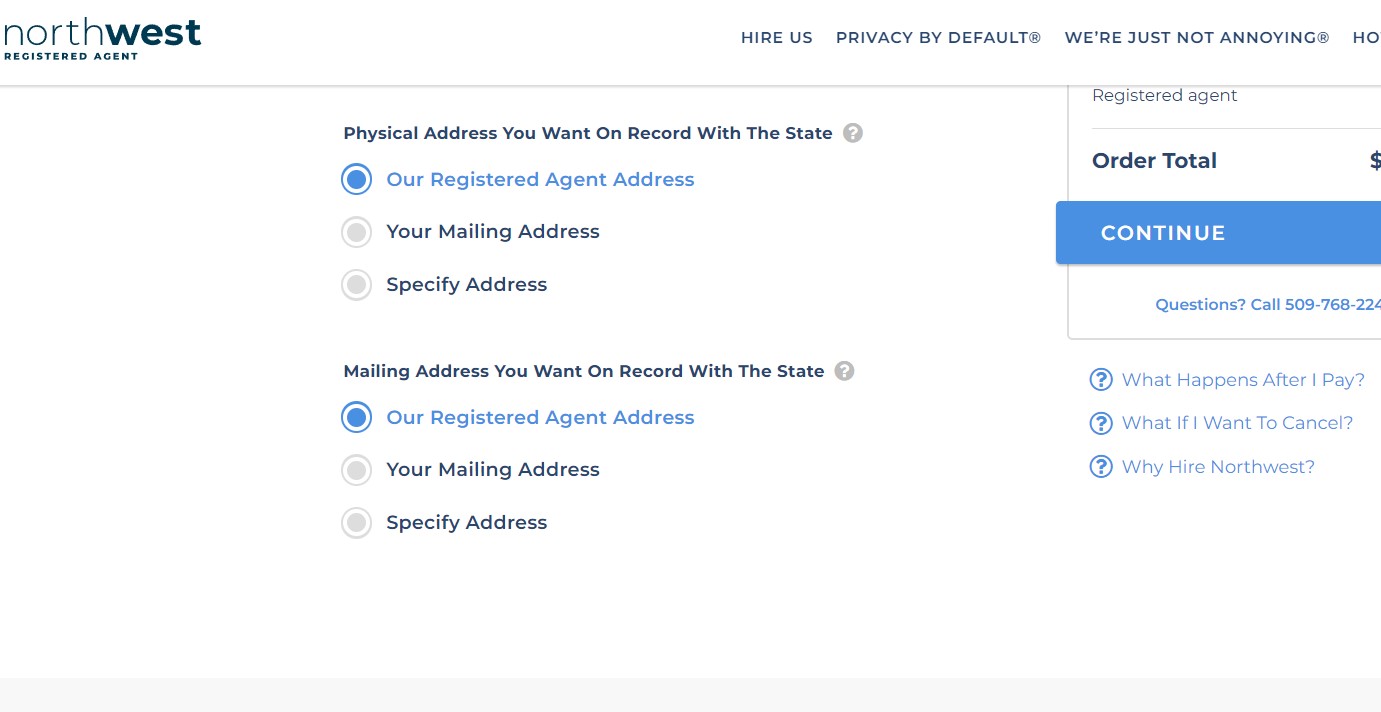

At this stage, we determine the company mailing address. If you don't have a specific company address, let's leave the Physical Address and Mailing Address options as they are because Northwest is an agency that allows us to use their own addresses.

At this stage, we determine the company mailing address. If you don't have a specific company address, let's leave the Physical Address and Mailing Address options as they are because Northwest is an agency that allows us to use their own addresses.- If you want to establish your company on a different mailing address, you can mark the options as Specify Address and enter a specific address. For example, you can get a unique address with private suites in Wyoming. You can get a here for $15 with wyomingmailforwarding, select the Specify Address options and enter your private address.

- If you do not want a private address, you can leave the options as below and move on to the next step with Continue.

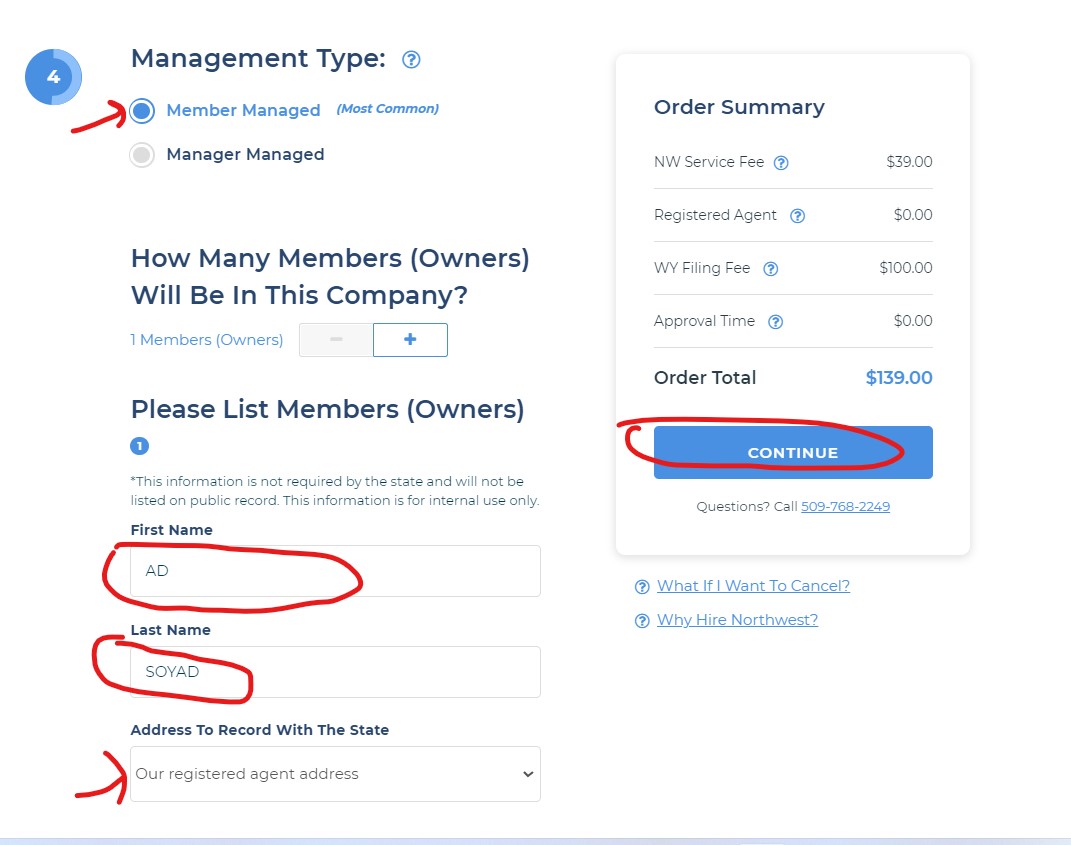

- At this stage, we choose "Member Managed" as the Management Type because you will manage the company. If a manager will manage the company, then you will need to select the Manager Managed option and provide the information of the manager you will appoint.

- Number of members: Select the number as 1 because we are forming a single-owner LLC, then enter your name and surname without using Turkish characters. (Ex: OMER instead of ÖMER, ALI instead of ALI, etc.)

- We can leave the address as Our Registered Address and click “CONTINUE” and move on to the next stage.

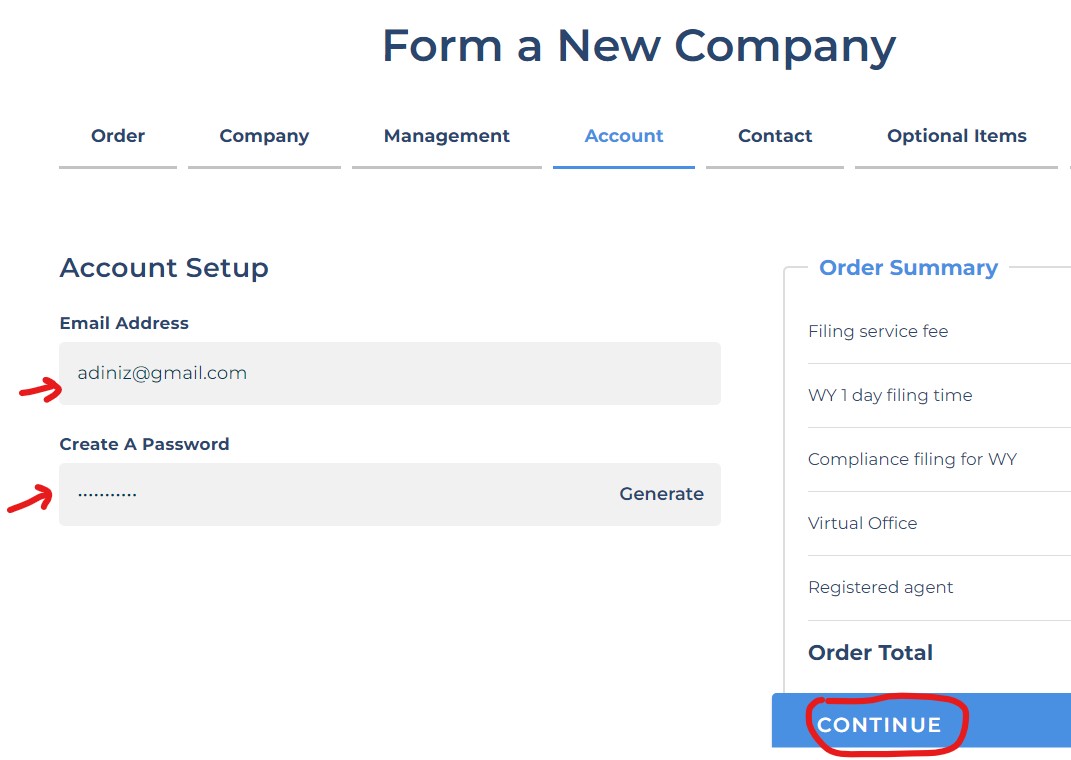

- In the Account tab, specify an email address and a password to access the Northwest panel, then proceed to the next step.

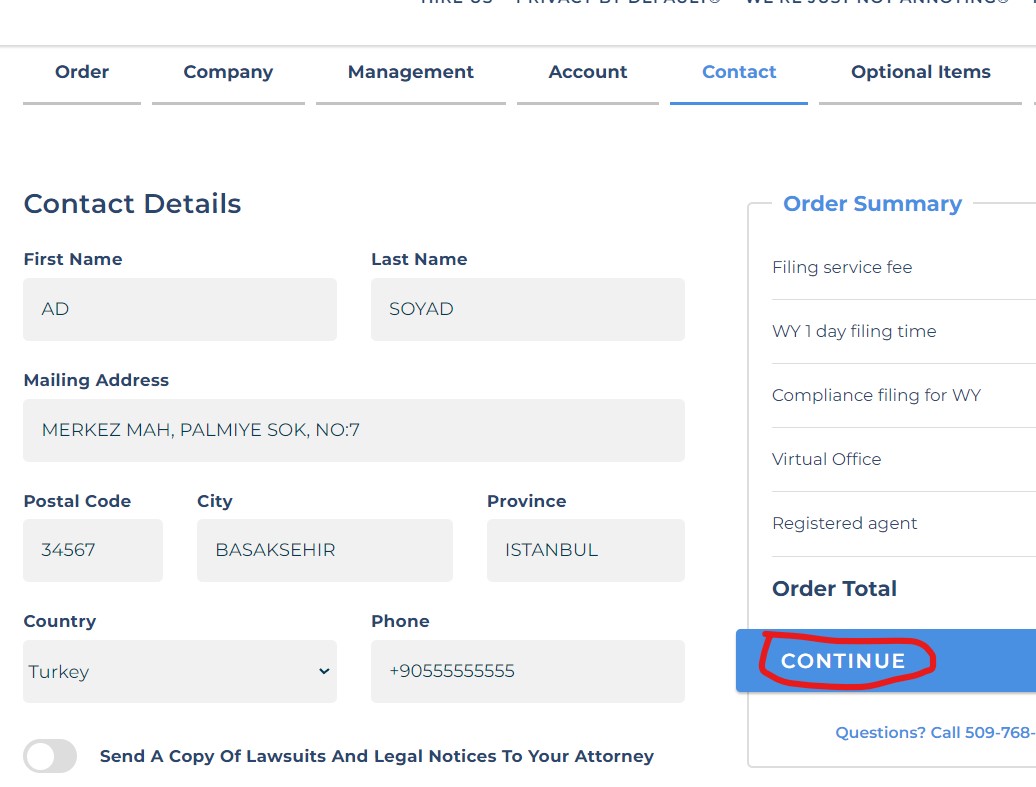

- In the Contact tab, enter your full address in the country you are in (Türkiye) in the correct format. Before entering your address, type your address into Google Maps and confirm that it appears on the maps. The address should appear with a picture when entered into Google Maps. Otherwise, Northwest may send you an e-mail and ask for your residence document.

- Enter your mobile phone

- Send a copy of your lawyers and/or legal notices to your attorney? Tick No.

- Go to the next stage by clicking “CONTINUE”

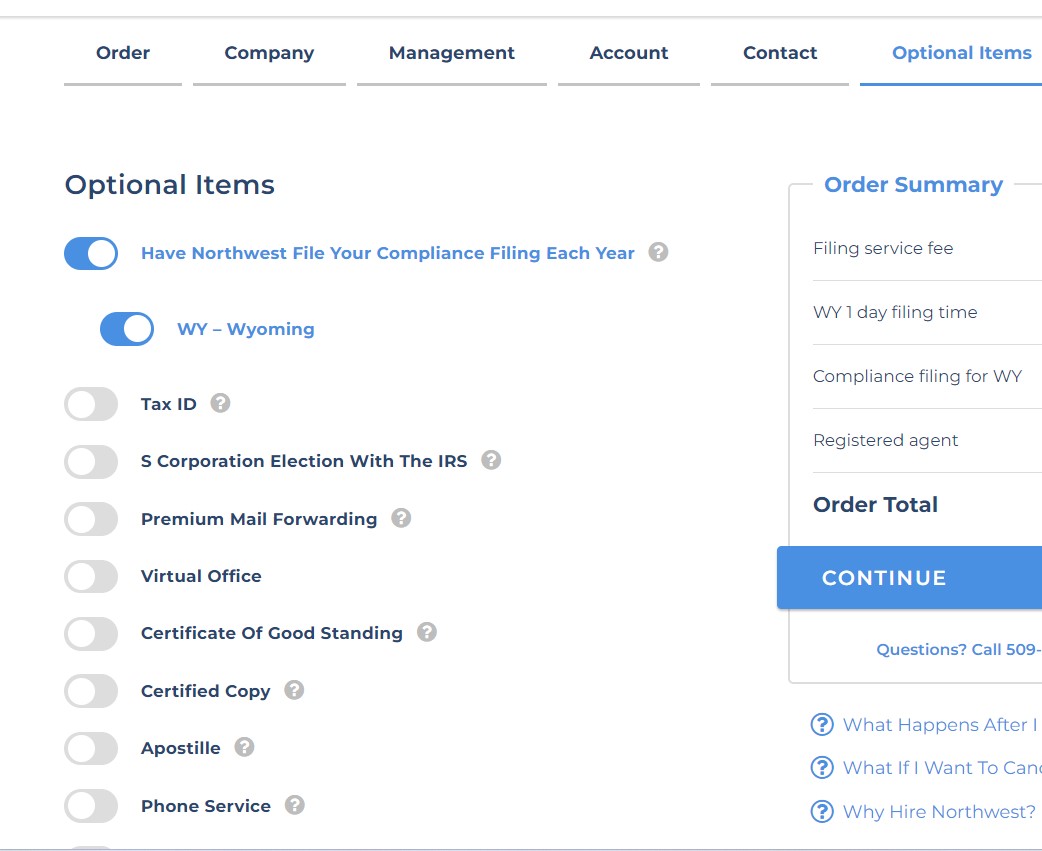

In the next step, go to the “Optional Items” tab. Just tick the field below. Extra services are charged extra. For example, virtual office or Apostille service. These additional services are optional, you can choose according to your budget, but even if you do not want extra services, your company will be formed correctly. You can click the Continue button and proceed to the payment step.

We have come to the last step, Payment. In this step, you can see the total amount you need to pay on the right. Let's look at this;

- Filing service, $39

- Wyoming filing fee payable to the state 100$

- Annual Registered Agent fee (including Address) 0$ Total 139$

You can enter your billing address by selecting the “Credit Card Address Different From Mailing Address” option. If the card belongs to someone else, you can write your own name and surname. You can place your LLC formation order by paying the total price with your credit card.

You will only pay a registered agent fee of $125 for the next year following company formment, so these setup fees are one-time. In summary, the amount to be paid next year, including address, is $125.

Company formation takes approximately 3 to 5 business days (sometimes less) for this state. Afterwards, you can download your company formation documents from your panel and save them electronically.

Note: When you establish an LLC company with Northwest with our dealership reference, we apply for your EIN free of charge during our campaign. To benefit from the free EIN service, visit our Free EIN Application Campaign

Everything appears clearly and clearly on your panel. Northwest has a pretty easy panel. You can find some information about the customer panel in the article Advantages of Establishing a Company with Northwest Registered Agent In this way, you will have an idea about what kind of customer panel you will have after your company is established.

If you see a warning like "You have Services Requiring Attention" at the top when you reach the customer panel after the order, follow the short steps in the guide below.

If you see a warning like "You have Services Requiring Attention" at the top when you reach the customer panel after the order, follow the short steps in the guide below.

Thanks to this guide, we explained the process of setting up a Wyoming company, including address and operating agreement, for a price of only $139.

If you want to form an llc in other states (New Mexico, Florida, New Jersey, Delaware, Kentucky, etc.), all the steps are the same.

When you receive LLC service through Northwest, you will have very friendly customer support. They quickly answer any questions you may have via email or phone, and you don't have to pay extra for it.

We hope this article was useful for you, if you have any questions, you can ask in the comments section. All comments are responded to as quickly as possible.

Good Luck!

30 Comments . New Comment

Hello

, we will establish a company in Wyoming

.

The possible taxation process for your situation is as in this guide: https://startupsole.com/abd-vergi/

I rented a virtual office in wyoming to make sales in amazon, amazon from me utility bill or business licensse asked for it because I could not provide my account.

Thanks

Utility Bill is requested when you try to change the address of an active account. If you don't have any rental house or physical office in the USA, you can't easily find a service bill. For Business License, contact agent you have set up, maybe they will help.

Hello, when calculating the company's income and expenses, do I need to include Northwest's annual fee and monthly payments for applications on Shopify? What other expenses should I include?

It would also be useful to calculate Northwest agent annual renewal, Wyoming state fees and other expenses. Such as Shopify store subscription, advertising and marketing expenses, additional software and tools

Hello teacher. I had 2 questions:

1) After establishing a company in Wyoming, can the company be required to have a physical presence or a local representative in Wyoming? I didn't come across anything like that in your articles, but I was doing a Q&A with ChatGPT and he wrote something like that, so I wanted to ask.

2) Considering that we will be selling products to Usa in the coming years, is Wyoming or New Mexico more advantageous? (From what I understand, Wyoming is better, but I wanted to ask you too. Of course, your answer will not constitute advice in any way, I have already made my decision, but I would like to hear your opinion)

Hello,

1. If you do not have a physical office, shop, warehouse, etc. in Wyoming (rental or your own), you will not have a physical connection.

2. Wyoming would make more sense. If you are going to sell on marketplaces (Amazon, Etsy, etc.), it will be easier and more economical to obtain a private suite business address in Wyoming.

Sir, during the company setup with Northwest, there is an additional service called Permium mail service.

1) If we choose it, is it considered that we have any physical ties with the state?

2) Is such a service necessary? If it is necessary, why, that is, what might it be necessary for?

No, it doesn't count, it's just a necessary add-on to get special suites and more documents.

It also provides a special suite number required for businesses with a lot of document traffic, so that each company has an independent address.

Hello, after forming the company in Wyoming, is it possible to forward all incoming e-mails to my own address? Does Northwest do this job?

Hello,

Northwest is not a logistics company, they only open and scan the documents related to the company that come to your address and deliver them to you as a pdf. If you wish, you can have the original copies of the documents sent to your address for a fee, which is also an option. They do not receive your incoming parcels, packages and other cargo, they just receive your documents and send them to you digitally first.

Hello,

1. Northwest After the company is opened, letters, mail etc. I understand that they are doing the job and is there a limit if there are too many amazon etc. If mail comes from somewhere.

2. What is the difference between making a Suite and a Northwest company address? Don't they both provide address and postal services?

Thanks in advance

Hello

, 1. They open and scan up to 5 mails a year, they just do not take documents, parcels etc.

2. The suite is useful to prevent address suspension from Amazon in the future. If possible, it would be beneficial to buy a special unique suite.

Hello, I am trying to form an llc by following the steps above. However, it does not accept card information in the payment section, saying the address is different. I tried with different cards, both credit card and debit card. I have made payments abroad before. Their permission is clear. I couldn't solve the problem. Have you ever encountered a situation like this before? How can I solve it?

Hello,

You can try to order again by opening a new browser window (may also be a secret tab). If the same error appears after you try it again, please send an [email protected] . Let's take a look at the situation. The address is not a mistake we've ever faced before. It could be a systematic error.

Hello, I have a few questions. I founded an online education company. I founded an llc in Turkey and the world (I especially want to sell in the east and middle east) and I closed it a month later because there are many procedures regarding training. That's why I decided to form an llc in Wyoming.

My fears right now are taxes, and when I was a student, I spent 3 months in Wyoming in 2012.

1. Will federal/state tax be charged and how much?

2. Is the tax collected based on any sales amount or does the tax start being collected when a certain sales turnover is reached?

3. After the installation, how many working days will the active carpet arrive and can it be connected to wise or mercury in order to use stripe payment.

4. The company is in the USA but operates (students) not in the USA but rather in the middle/far east countries. Will the federal tax still be charged?

5.Since the company is in the USA, how do you deal with lawyers and accounting?

Hello,

1. You pay federal taxes. LLC corporations pay state taxes. It is calculated at the end of the year, we cannot give the exact figure, if there is a tax form sent through consultant accounts or stripe, you give it to the consultant, they will calculate the accounts and declare them in an appropriate class.

2. It depends on the geography you sell in, that is, your source of income. You can look at taxation on our website.

3. As soon as your e-in number arrives, you open your bank account and get started. Expect about 4 weeks. Supports both wise and Mercurybank stripe.

4. It is federal, and since it is not connected to Stripe and is not within the USA, you will have an advantage. Stripe already knows the customer geography, makes the necessary calculations and sends you a tax form if necessary. If it is not sent, there is no tax, you just fill out the annual form 5472.

5. There is no need for a lawyer, it is easy to find a Turkish accountant for year-end tax declaration, write to us when you need it and we will refer you to an accountant. You don't need a monthly accountant anyway, you'll need it once a year.

Hello,

What are the advantages and disadvantages of forming a company in several states?

For example, we established a company and opened bank accounts in New Mexico. But as it is known, New Mexico address is not available for Amazon. Can we open a branch of this company in Wyoming and use this address for Amazon? So the company will be the same company but with two different addresses. Or since it is an LLC, can't an address be found in another state for the same company? Do they have to be separate companies?

Companies are separate and independent from each other in each state, there is no such thing as a branch. It makes more sense to form it directly in Wyoming. Why are you forming two separate companies?

After all, every new company means extra expense.

We already have an llc in New Mexico that we do business through our own website. But we cannot use it for Amazon. In this regard, should I move my company or open a new company? What do you recommend?

Rent a virtual office in the state of Wyoming or buy a Wyoming suite from Wyomingmailforwarding.com Give this address to Amazon. If Amazon does not mind having an address outside the state where the company is formed, you can do it this way.

Hello, thank you very much for your contributions. I am planning to form an llc through Northwest in the near future. Do you know about Wyoming sales tax? I will sell software to many states in Usa. Are only products I sell within Wyoming subject to 4% sales tax? How is this tracked? I will receive payment via stripe. Also, if there are different sales taxes in different states, do I need to report separately for each place I sell? In short, I sell a software service that reaches 150 people monthly across Usa with a monthly turnover of 5 thousand dollars. But I fear taxation complications. Do you have any information about this? Thanks :)

Hello,

You must collect sales tax not only on sales you make within Wyoming, but also on sales to all US states when you exceed the limits.

By the way, the number and turnover of the software, which is sold to "150 people monthly throughout Usa with a turnover of 5 thousand dollars" in each state at the end of the year, is important. Each state has a certain number of transactions and turnover limits. If you do not exceed these limits, there is no need to collect sales tax and remit it back to that state; if you do, you collect it and repay it at the rates provided to each state.

See the example below:

For example, as of April 2023, you are selling software to customers in Connecticut. It doesn't matter in which state the company is formed. Once you exceed 200 transactions and $100,000 in sales to the state of Connecticut, you must register to collect sales tax. If there are no other nexus triggers in Connecticut, there is no need to register up to these limits.

For sales tax https://stripe.com/tax . It calculates all sales taxes automatically and you share the reports with your year-end accountant, who will make the necessary calculations and serve you with refunds.

See also here: https://stripe.com/docs/tax/registering

You can't do this on your own anyway, trying to do and learn will probably take all your energy and time. Start your business by forming your company and activating your stripe account. You start working with a consultant as soon as sales start, otherwise, instead of focusing on your business, you will spend hours trying to understand the tax system in the USA and you will probably not be able to fully understand it.

There are Turkish consultants who provide very good services in the USA. After you get your affairs in order, look at this list https://startupsole.com/amerika-muhasebe-firmalari/ and focus on your business by getting service from an expert.

Thank you very much, you are right. The limits are already quite high in the states. Even if I start right away, I won't have any problems with this for at least the next year. I have 2 more little questions.

1)Do I need to file a federal income tax return in April when I establish it now? When do I have to do it? You said in your campaign that if you do it now, there will be no need until April 2024. Can I learn this?

2)Different states impose limits on collecting a sales tax on sales. However, when I establish a company in Wyoming, do I need to apply for a license, open an account, etc. to collect sales tax in the state on the day I establish the company? There is no limit of 200 thousand in my own state, I guess I am directly considered nexus. Thank you very much. Good luck.

Hello,

1. If you install it now, you do not need to file any declaration this year. You need to submit your first declaration by April 2024, so you will not have any expenses or tax declaration problems for approximately 1 year.

2. There is no such thing as your own state, you are not considered Nexus in your own state. Revenues within the USA are taken into consideration, it is not important where the company is located. You need to collect sales tax in states where the limit is exceeded.

As for where the revenue comes from, Stripe receives and records it from customers' credit card locations. At the end of the year, if there is an excess, it reports it to IRs with 1099K and also sends this 1099K to you for informational purposes. When you receive this document, you give it to your accountant and they prepare a statement accordingly.

Hello Startulsole, I have three questions for you.

1- Is the free EIN application campaign continuing? If it continues, when will it end?

2- When an llc is formed with Northwest, is it appropriate for Amazon to use the address provided by Northwest within the scope of the campaign? Does it lead to a situation where the association is embellished?

3- Which state would you recommend for the company I plan to form just to use Amazon? (I read the information on your site about the state election, but unfortunately something is still unclear in my mind.)

Hello,

1- Actually, we were thinking of finishing EIN due to the intensity, but for some reasons we will continue for a while, we can say that we are continuing for now, the duration is not clear.

2- The shared address offered by Northwest in Wyoming is still used for Amazon and they still receive amazon address verification mails in Wy. There is only one post office in Wyoming that offers address service, and they are all in the same building on the same street. No matter where you form an llc, you will always encounter the same address. Hundreds of thousands of companies are formed in Wyoming, and everyone cannot be provided with a separate street and building. Additionally, there is no online notarization when purchasing a private suite address in Wy, and therefore it is very simple to obtain an address or private suite. The same situation applies in other states, companies are registered to the same addresses, and Amazon knows this and now verifies the address by postcard. We have never received a situation such as association, but if the issue confuses you very much, buy a special suite from Wyomingmailforwarding.com for 15 USD and register the company in this suite.

3- If it is only for Amazon, choose Wyoming because the address issue is easy in Wy, as we mentioned above. If you want a private suite from Northwest, you will need to purchase premium mail forwarding with an extra monthly payment or rent an external address. Generally, Wyoming is chosen because of the address issue, and you can form it in this state. Do not worry too much about the state, taxes are already paid federally, taxes are not paid to the state, we can say that no matter which state you form an LLC in, if you do not have a physical store there, they are all the same.

Hello, when forming an llc in Wyoming, is it necessary to get the company address from this state? For example, is it possible to form the company in Wyoming and show the company address as California? Does this have a positive or negative side?

Hello,

Yes, it is possible and there is no harm in it, but this may cause some confusion in the future.

The company is formed in Wyoming, but when the office address appears to be California, it can be difficult to explain this to someone and can cause some problems when opening marketplace accounts such as Amazon.

Apart from these, there is no problem. If these situations will not affect you, you can do this. There are no such restrictions in the states anyway.