Single-member LLCs, or LLCs with only one owner, are one of the most popular types of businesses. Many entrepreneurs choose LLC formation to take their new project to the next level. Operating a single-member LLC is a less complex structure than a multi-member LLC and requires much less paperwork than a C-Corp or multi-member.

In this article, we will explain in detail what an LLC Operating Agreement is, how it works, how to create one, and its importance to your business.

What is Operating Agreement?

For LLCs, the Operating Agreement is a legal document that outlines the ownership and member duties of your Limited Liability Company. This agreement sets boundaries, allowing you to define financial and operating relationships between business owners (“members”) and members and managers.

Not all LLCs have an Operating Agreement except in some states, but having one is highly recommended.

There are two basic documents required for the formation of an LLC;

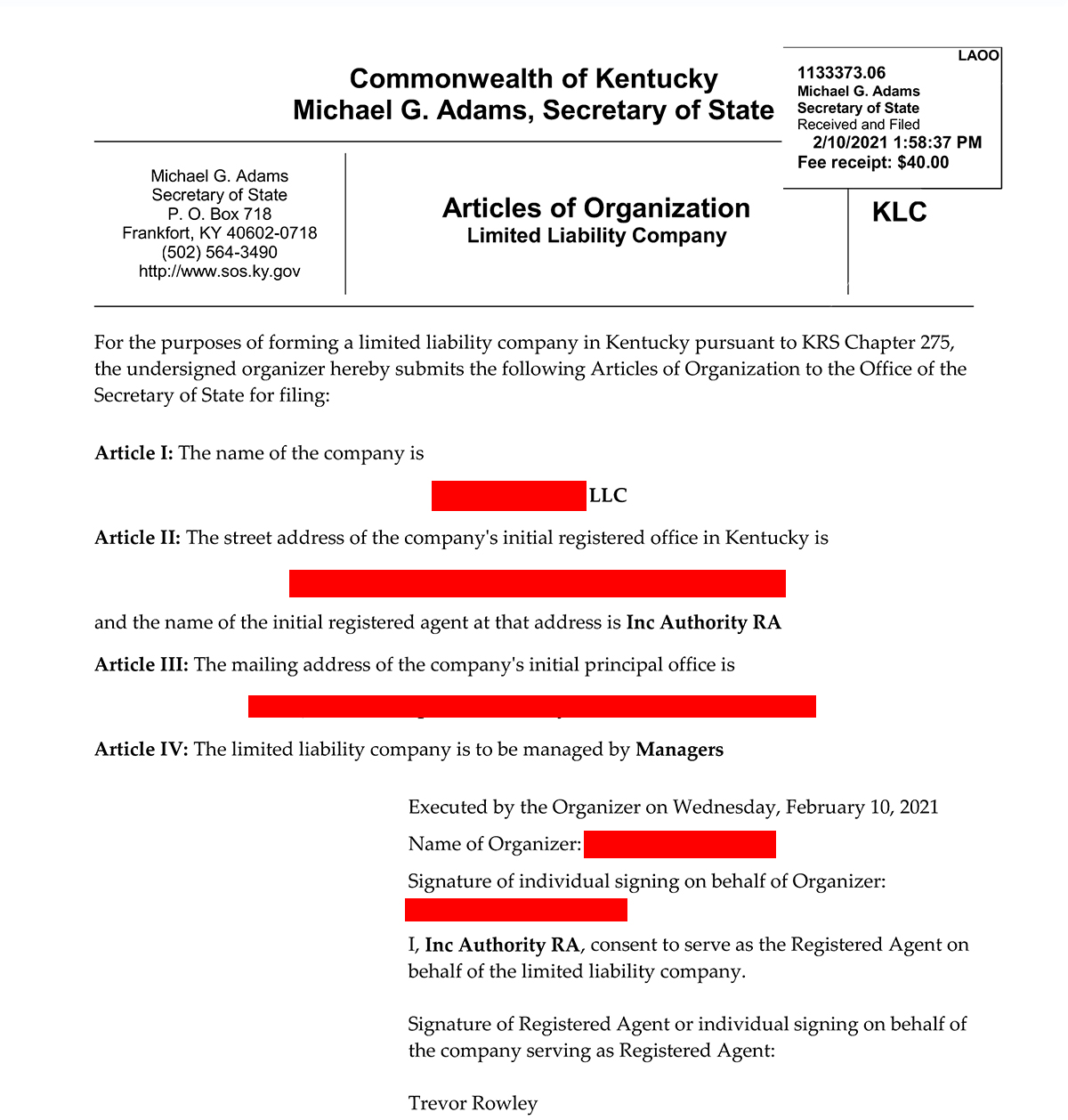

The first is the Articles of Organization, which must be filed with the state where your business is formed for your business to be legal.

This document includes the company name, founder name, purpose of the company, registered agent information and planned management structure. The details of Articles of Organization documents vary from state to state, but in general they specify exactly what your company is, how it will be managed, and who will run it.

This document includes the company name, founder name, purpose of the company, registered agent information and planned management structure. The details of Articles of Organization documents vary from state to state, but in general they specify exactly what your company is, how it will be managed, and who will run it.

The second document is your Operating Agreement.

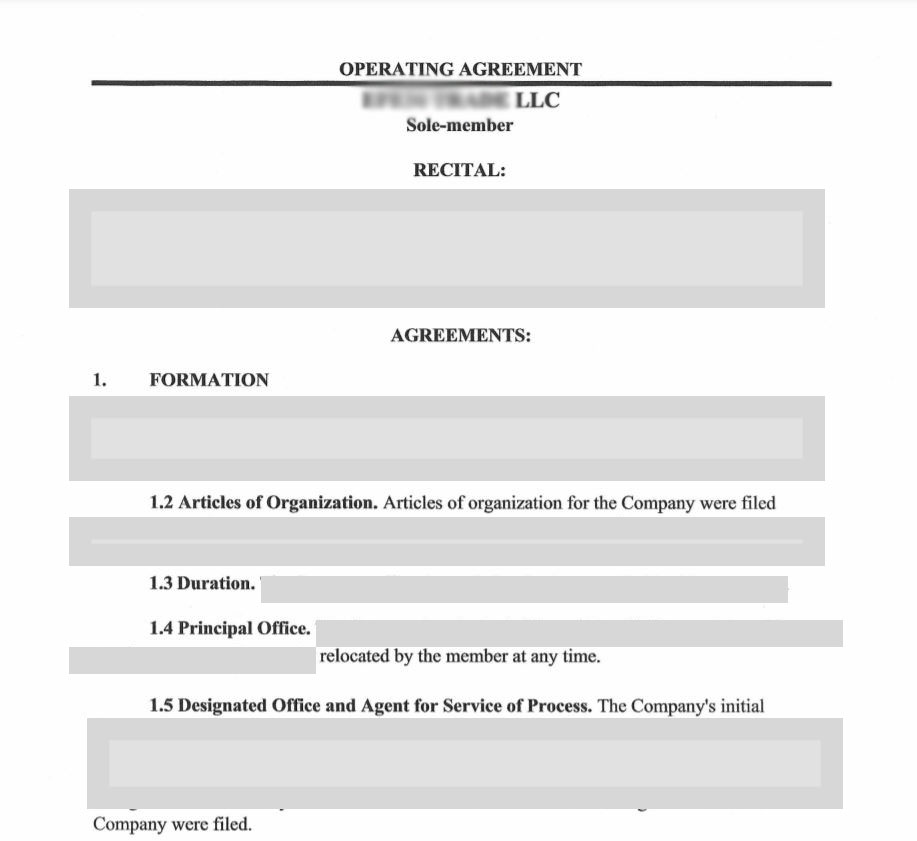

Operating Agreement Template

You can download the blank template suitable for your company structure from the links below.

Download to your computer for single-member LLCs ( Kentucky LLCs)

Download for single-member LLCs (General States)

Download for multi-member LLCs

Download for manager-managed LLCs

Preparing Operating Agreement

If you have created your LLC in the state of Kentucky, download the pdf file I shared above to your computer (or download the Kentucky LLC Operating Agreement )

Tailor the PDF to your own company

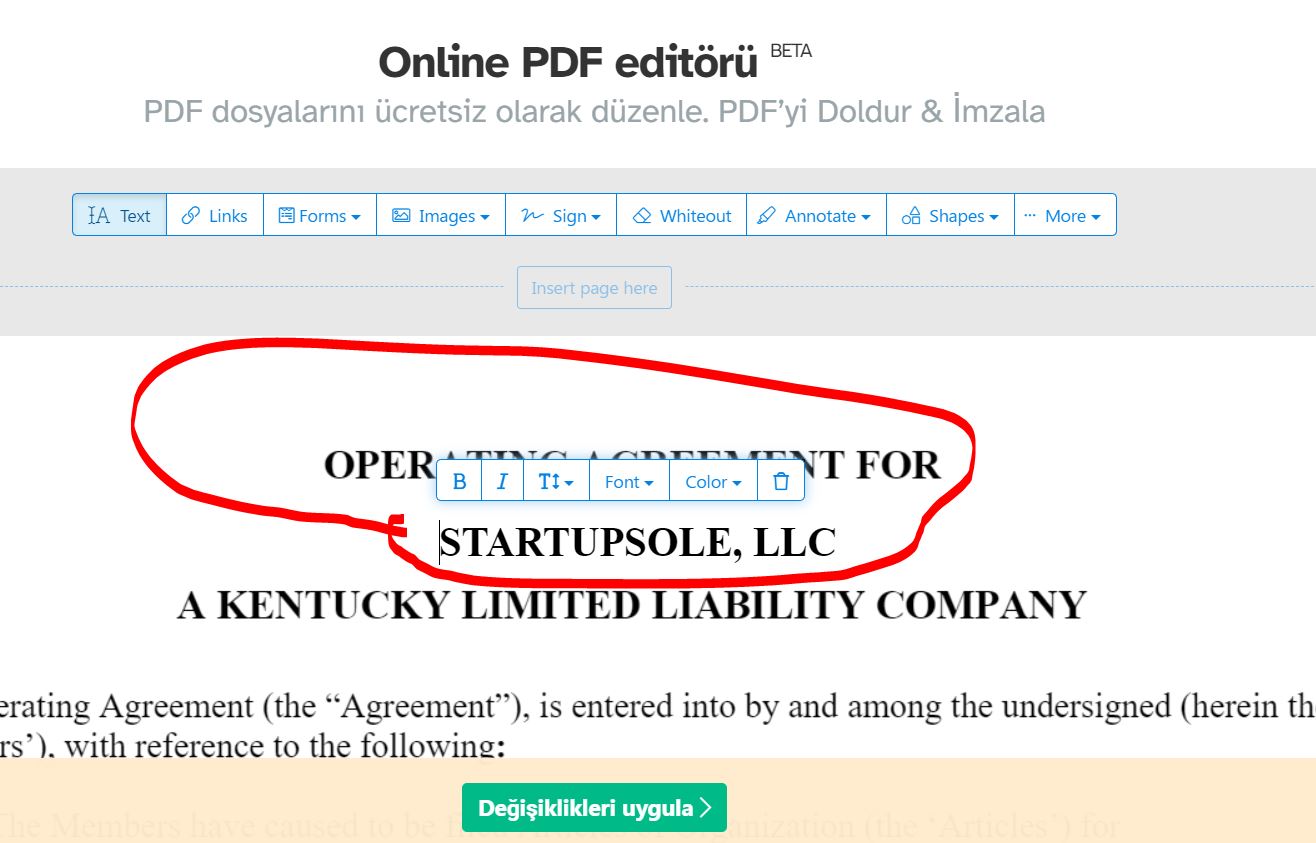

sejda pdf editor for this . Open the link sejda.com/tr/pdf-editor and upload the operating agreement template you downloaded to sejda.

After uploading the template to Sejda, an editing editor will open as shown below.

You can now edit the contract according to your own company. The parts you need to change are already stated as “COMPANY NAME, LLC”. Therefore, the required fields consist of the first few pages and the sections at the bottom of the last page.

Fill in your own information by clicking on the part you want to change.

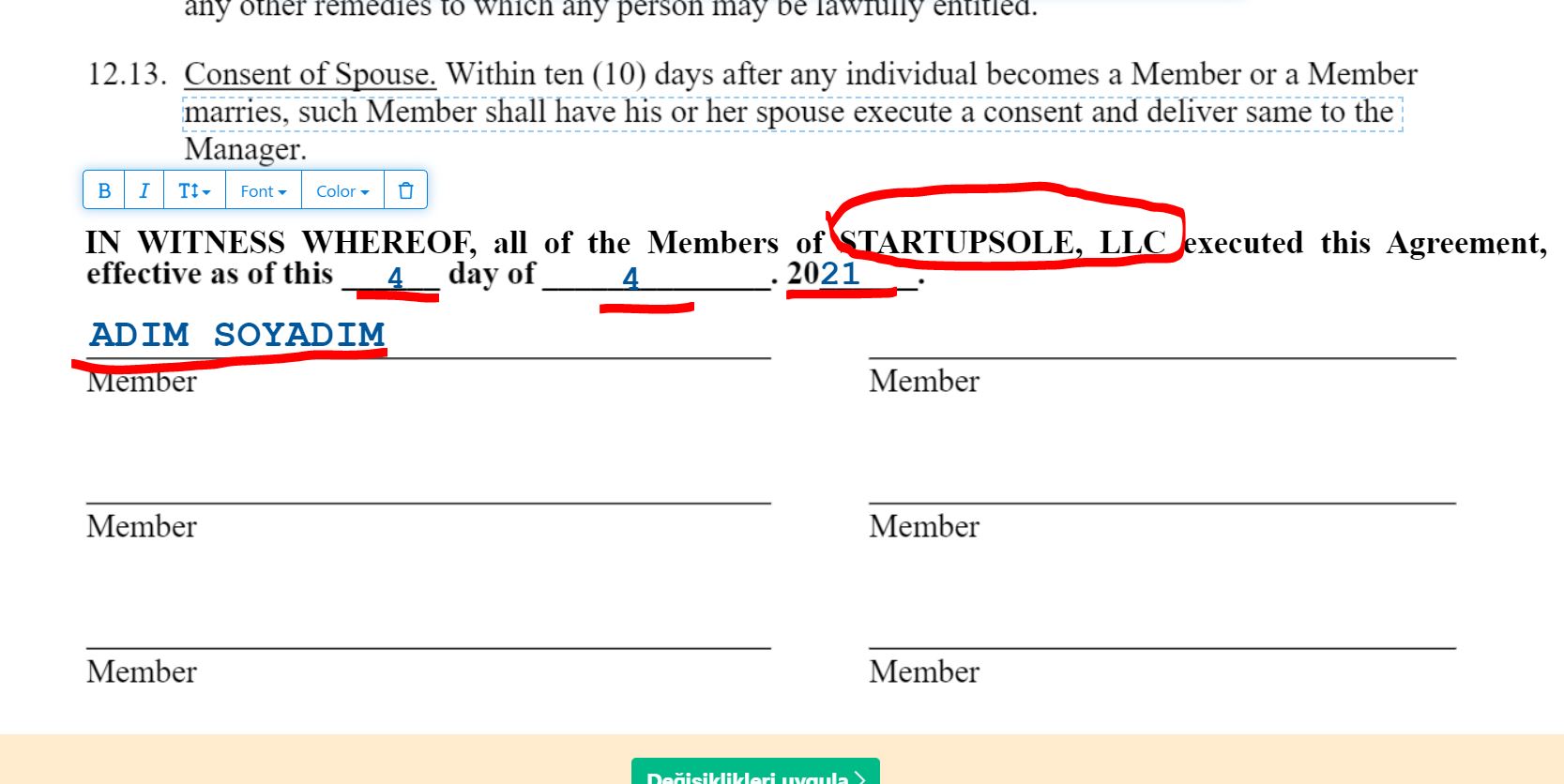

However, take a look at all the pages to make sure that no other areas have been changed. When you get to the bottom, sign this via sejda if you want. If you want, you can print it out and sign it wet, but in this option, you will need to transfer the signed version again in digital form. If you don't have a scanner or an editor, you can convert it to high quality PDF.

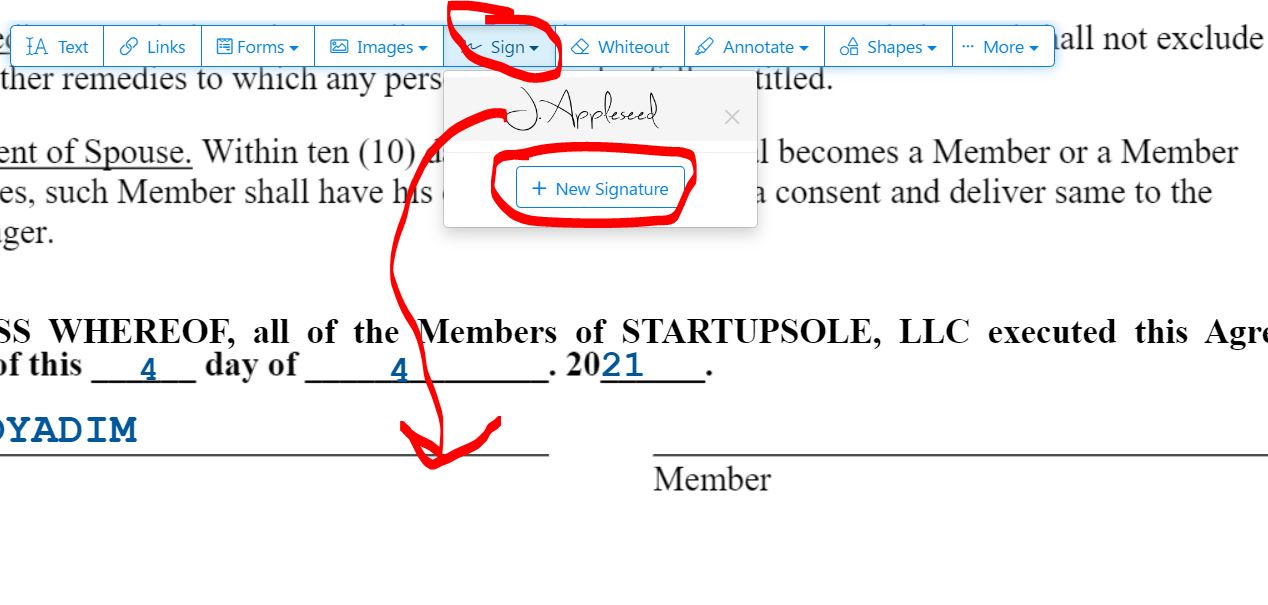

I will use digital signature in this example. Click on the sign button at the top and add it in png format with new signature (you can take a picture of your signature in Photoshop without a background and clear its background).

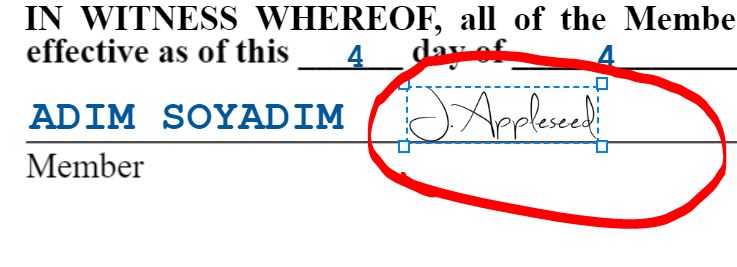

And drag it to the area where you will sign. If you want it to be in blue, you can initial the bottom of each page.

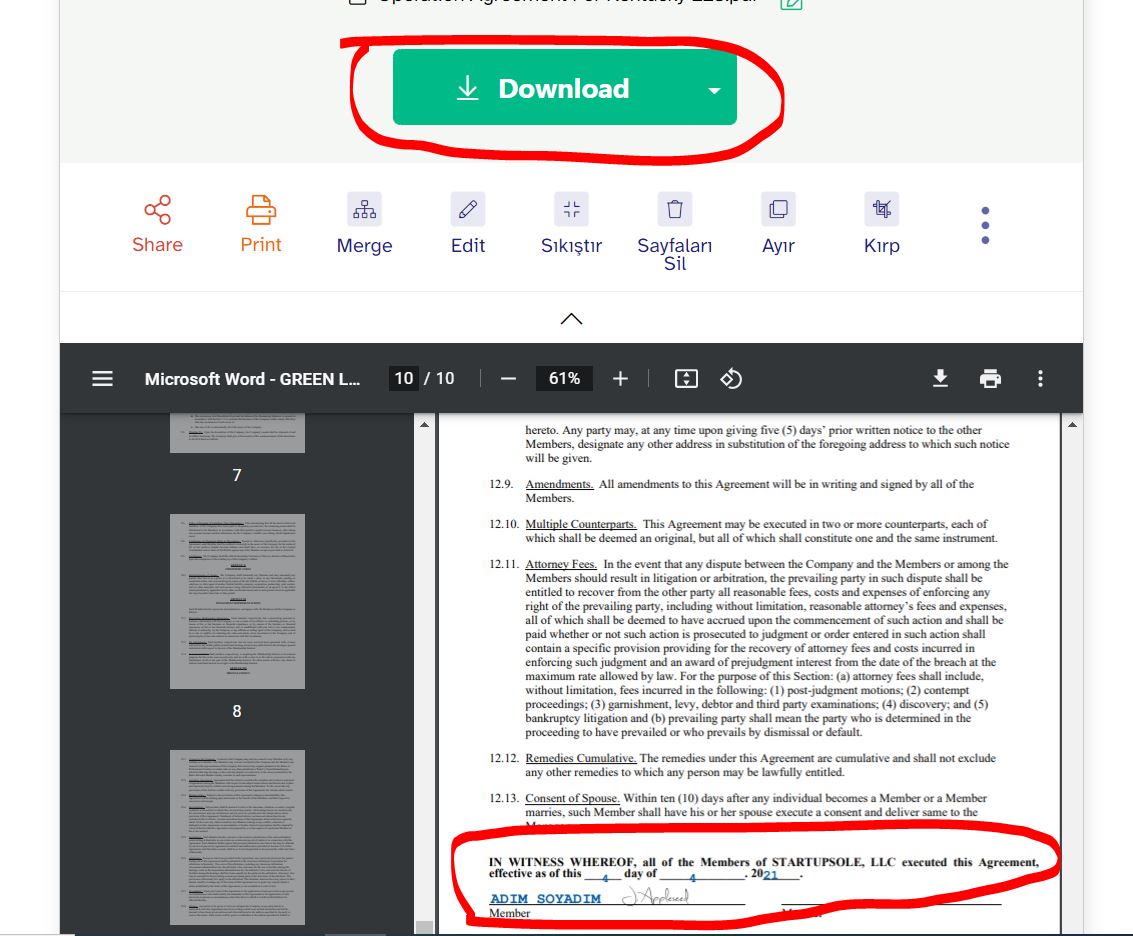

The next step (if you digitally signed) is to save and download the file

Save the document as PDF and your document is ready. Keep this document and you can send it to them via e-mail along with the other documents from IncAuthority (release document). I sent it to them via e-mail with the release in the last company I formed, but I did not receive any information saying that it is invalid because you did not receive it from us. But don't forget to keep a copy.

Thus, you have created your own operating agreement file. You could also buy it from a registered agent, but you can also create it yourself. Because the state of Kentucky does not require this for you when forming an llc, and you do not have to send it to them.

This document is important to prevent possible problems in the future and to draw boundaries.

Why is an Operating Agreement Required?

An Operating Agreement is a contract similar to a partnership agreement between members of an LLC. It shows the structure of the organization. It formes the duties, rights, and responsibilities of members in the operations and finances of the LLC. Most importantly, it covers what happens when a member wants to leave the business and how and when a member can transfer or sell their LLC interests.

Now, as a single-member LLC owner, the question that comes to your mind is, “why would I need an Operating Agreement for myself?” or why do I need to sign an agreement on my own? you can say. In fact, the biggest and most important reason for this protect .

If you are starting a business, all legal documents must be complete. In some states where you will form an LLC, an Operating Agreement is an absolute requirement, but in states that do not require it, this document is also important for you.

An Operating Agreement is required for these 6 states: California, Delaware, Maine, Missouri, Nebraska and New York.

If the State Doesn't Require an Operating Agreement, Why Is This Necessary?

We will detail this in a few items below, but it is important to emphasize that this document is necessary for your business, regardless of whether it is a legal requirement or not.

Who owns this LLC? You need an Operating Agreement to answer your question. Let's give an example:

Let's say you have an llc called ORNEKISLETMEM, LLC, and a few years later you put this company up for sale. Let's say a customer is interested in your company and decides to buy it. To prove that this company really belongs to you, you can directly show your signed Operating Agreement document.

The Articles of Organization document filed when forming your company in the state may not fully prove that you own the company in some states. Registered Agent information is included in this document, but this may not mean that you fully own that company. The Operating Agreement fully proves this. Let's continue talking about other reasons;

Operating Agreement Requirements

1. It Assures and Protects You:

An Operating Agreement creates a shield between your personal assets and your business assets. We can say that this article is the most important reason why a single-member LLC needs an Operating Agreement.

Let's take a look at what this protection means.

LLCs protect your personal assets, such as your home and bank accounts, against people who sue your business (company) for any reason. If you do not keep your business and personal assets separate, you will be at risk of a possible lawsuit. In this case, since your business does not have the status of a real business, there is a high possibility that it may cause you legal harm.

The Operating Agreement is an important document that shows that your business operates as a legal company. Without an Operating Agreement, your state may not recognize you as an LLC in case of problems. This means that anyone can sue you in situations that arise regarding your business. If you do not have any shield to protect your personal assets, the outcome of the court decision may endanger your personal assets.

2.Banks and Investors May Request:

Banks or investors may want to see the Operating Agreement as proof that you own the LLC. In some cases, the Articles of Organization given to you by the State at the time of incorporation may not alone prove that you are the owner of the LLC. Therefore, it is a good option to have the Operating Agreement ready.

3. State Laws Come Into Action:

If you do not have an Operating Agreement, your business may be subject to state default laws. Many states have default laws regarding how an LLC should operate. If you do not describe how your LLC operates in an Operating Agreement, you may be forced to comply with the laws of your state.

Who Should Sign the Operating Agreement?

Each member of the LLC and the manager or managers (if any) must sign the Operating Agreement. The Operating Agreement specifies who owns the LLC and the percentage each party (member) owns.

Should the Operating Agreement be Notarized?

There is no clear rule regarding the notarization of the Operating Agreement. Even if it is not notarized, this document is considered legal between the parties. However, some businesses may require notarization, although it is not required, to conduct business more formally.

As a result, the Operating Agreement is an important document. When forming an LLC company with IncAuthority, a standard Operating Agreement will be created for you and its price will be added to the order as $ 89 as of March 2021.

40 Comments . New Comment

Mr. Nazmi, I am at the IncAuthority deadline, but I will pay the $102 WY state filing fee. I'm trying to pay with a visa virtual card. I refresh the page and the same page appears unpaid again. I tried with payoneer and the same thing happened. I made Google Chrome browser Usa from the top and the same thing happened again. I'm stuck at the last stage of how to make the payment.

Sometimes these types of payment problems occur. We asked Inc Authority for the reason, but they did not give a very explanatory answer.

If you have the opportunity, continue the installation via Northwest, because Inc Authority's annual renewals are quite high and Deatek systems are not very good anymore. You can install it for 139 USD with Northwest, they also provide the operating agreement for free.

However, the decision is yours of course.

Hello, I benefited greatly from your information. I hope your business and health are always good. Today I launched the Company with IncAuthority. I don't want to pay $89 for the Operating Agreement. After I download and fill out the document as you showed, will I keep it for myself? If I don't need to send it somewhere, can't they make a fake Operating Agreement and have rights in our name? So, won't we submit this document to the Usan government or any institution?

Hello,

Operating agreement is a document that the company owner must fill out and keep locally. No need to send it in-state or anywhere. Fill out the template, print it out, sign it and keep it among your documents. Taking on partners in the future or possible lawsuits etc. It's a document that may be useful in some situations, other than that you won't need it.

Enjoy your work

FIRST CONTRIBUTIONS. Members will primarily contribute capital to the Company,

as described in Exhibit 1 attached to this agreement. The agreed total value of such property and

cash __________. There is an item left blank: What does this mean? what to do

Hello,

you are talking about the Operating Agreement. You can write a specific capital in this field, it must be in dollars. You do not need to show any cash in the bank, you only indicate the capital you have put into the company as a shareholder. To summarize, it will be enough to write some amount in that empty space.

Thank you very much for your quick return. Should I specify Turkey as the address?

Yes, it would be better to write your residence address.

You are truly wonderful. Everything is explained here, point by point. There is no need to search tons of how-tos on Google. Thank you

Thank you for your comment, we are glad if you benefited from it.

HELLO, I WILL SET UP AN LLC IN WYOMING TO SELL ON AMAZON. DO I NEED TO FILL IN AN Operating Agreement THERE? OR DOES IT MAKE A DIFFERENCE IF I SET UP THE COMPANY IN Kentucky?

Hello,

If you are going to do a business related to Amazon, Wyoming would be more advantageous. Those who deal with Amazon generally prefer Wyoming.

By the way, the Operating Agreement has nothing to do with Amazon. Although it is not necessary for every LLC company to prepare an Operating Agreement, it is recommended.

If you form an llc with Northwest, they prepare a free Operating Agreement for you and upload it to your panel. If you form an LLC company with IncAuthority, we will prepare a free Operating Agreement for you. If you form the company with IncAuthority, send us an e-mail and we will prepare it for free and send it to you, or you can download one of the templates in this article, fill it out yourself and keep it. You don't need to send this document anywhere, you just need to keep it.

You are truly wonderful, you respond to everyone's comments and provide information that is available elsewhere for money, may God bless you.

Thank you, we try to respond as quickly as possible. We wish you good luck.

Hello,

I was asked for an "Operating Agreement" to authenticate in my Amazon UK account.

Things to be included in the document:

– A copy of the Company's Operating Agreement. This document must include the total number of company shares, the shareholding percentage of all business owners, the share transfer procedure, and the dates and signatures of all shareholders. You can create an Operating Agreement online.

They say send an Operating Agreement containing this information. What should I add to this Operating Agreement you have prepared and how can I add it? My company is located in the state of Kentucky.

Thanks for the help.

Hello, actually there is a template link in this topic, I'm adding it anyway.

https://startupsole.com/wp-content/uploads/2021/05/Operation-Agreement-For-Kentucky-LLC.pdf

You can fill out the document yourself and send it.

I had never had anything to do with these issues before, but I came across you yesterday while researching. That's why I unfortunately have to keep asking questions. My phone number is ok, I applied for the address today. Tomorrow I will most likely apply to my company through Inc Authority.

My question is, I can fill out and send it myself as you mentioned here by selecting the Operating Agreement option no in the application steps, right?

I will not risk it for EIN and request your support. The Operating Agreement just stuck in my mind.

Also, in the Inc Authority payment step, all my cards are mastercard. I opened an ininal account today and created a virtual card. Will Visa cause this problem? Thank you in advance for your answers :)

Hello, you can ask, no problem, we will try to answer.

You can prepare the operating agreement yourself, sign it and keep it aside, it is available as a template on our website, you can use it.

Unfortunately, Mastercard does not accept incauthority, and pre-paid cards do not support this type of systems, because they rightly feel confident that the agency fee will be collected in the coming years.

You will need to obtain a screw card somehow, or ask a relative to create a virtual card. In the next process, you will issue one and pay the annual agency fee with your new visa card from your customer panel.

If you cannot find visa at all, write to us on our contact page and we will try to support you.

Unfortunately, I'm having trouble finding it. It has arrived at my address now. Can you help me with the card, if possible?

We will try to help, send us an e-mail from the contact page and we will elaborate.

I fixed it, thank you. I created an ininal virtual card, they accepted it and I made the payment.

Ok then good luck

Hello,

How similar is the Operating Agreement content of the example in the article (for Kentucky LLCs) to that obtained through any registered agent (e.g. IncAuthority)? What are the drawbacks of using this sample operating agreement?

Thank you.

Hello,

the Operating Agreement created for Kentucky has exactly the same features as IncAuthority's. There is no harm in using it, on the contrary, it contains many specially written articles to protect the company owner from possible problems in the future. You can download and read the draft. In addition, some lawyers can customize a more comprehensive version of this for you for a fee, of course, you have to pay an extra fee for this, in fact, even this will be enough.

Thank you very much for the answer.

Speaking of which, do you have any recommendations for lawyers in Usa in terms of possible legal needs?

Normally, there is no need for a lawyer unless there is a special situation, but if needed, you can hire a lawyer for every sector from the platform in the link below.

https://www.avalara.com

Hello sir, after sending this operating agreement document, it is true that it should appear on the state website under natural conditions. When I search for a few companies, I see their operating agreement documents on the Kentucky state website. Do you have any information? Do you have any information? I see their operating agreement documents on the state website for 55 dollars.

Hello,

the contract you created is invisible on the state website because it is not sent and is not stipulated. Can you give a link to which company as an example?

The ones you see may be multi-member LLC companies; they draw administrative boundaries between the partners with an operating agreement, which is very important for them.

The state does not require single-member LLCs, so this agreement is not filed. Naturally, it does not appear on the state website.

They are probably partnerships and formed businesses. They may have filed it directly with the state while forming their company without intermediaries.

I didn't scan it in color, is there any problem?

No problem, they accept it.

Should we add our own address or the company address in the address section?

You will add your company address and sign.

Is the name and surname signed at the bottom of the Articles of Organization?

As soon as the Article of organization is signed, it is your company establishment document and you will keep it. You will sign the other two documents, Release and Membership Listing, and send them back. If you are going to prepare an operating agreement, you can use the draft on this subject. It is not necessary to send the operating agreement, but you can send it along with the others if you wish. All submissions will be digital, sign, scan and forward, keep the originals in a file.

There is a click button to see sample documents on this subject, there are examples there.

https://startupsole.com/inc-authority-ile-amerika-da-sirket-kurmak/

Will the regestered agent send the Release, Membership Listing documents to us, or will we find them somewhere, sign them and send them? In the meantime, I founded the company. “Thanks to you, you are a great team. God bless you, by the way!” 😉 " I'm going to apply for the ein. Is there anything I should know from your page?

Hello, Thank you for your positive comment. Congratulations on your new venture, good luck and success.

Release and Membership Listing documents are not available anywhere. The registered agent will send them to you, and you will sign them digitally and send them back.

When applying for EIN, you only need to fill out the form completely and accurately, nothing else is required. We handle the rest.

My company was formed, they sent me the Articles of Organization document, I just need to sign it and send it to them, right? Is there anything else?

They must have sent two documents called Release and Membership Listing, fill them out and send them back. All you have to do is prepare an operating agreement, sign it and send it all together to the specified e-mail address. Congratulations

Hello,

it was a useful article, first of all, thank you. Is it necessary to take any action after filling out and signing the operation agreement document ourselves? So do we need to send it to the state or registry agent company?

Hello,

If you want to keep it on hand, you can send a copy of it to the agency along with other documents after the company is formed.