Wave Apps has now become paid and has disabled the free version.

Alternatively, you can check out Suitebooks, the most preferred cloud-based accounting and invoicing software with Turkish language support. Suitebooks is a capable and economical solution to meet your basic needs.

Click for more details and pricing about Suite Books Pre-Accounting Software, which offers a free plan.

Wave Apps

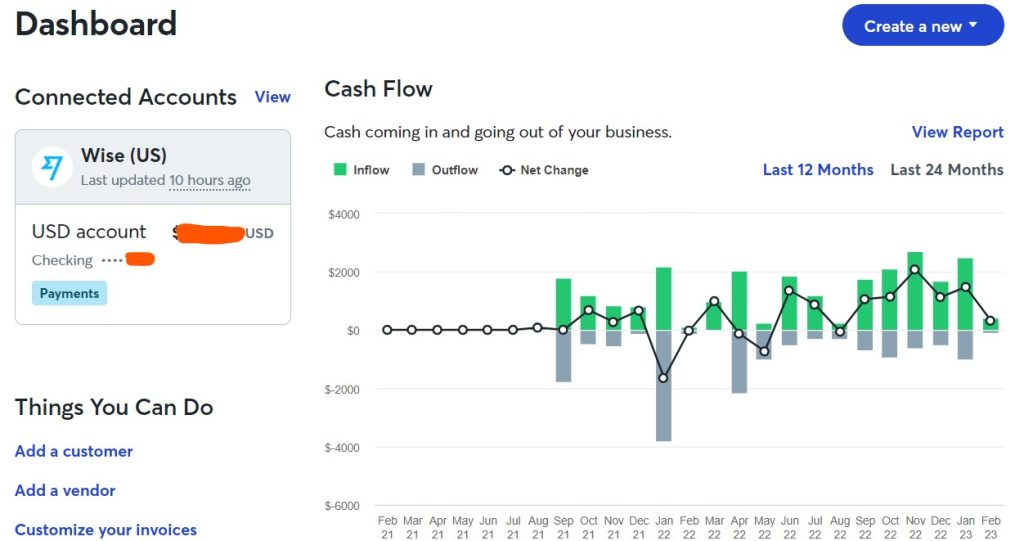

If you own an LLC company in the United States and continue your business, you can use cloud-based software to calculate income and expenses, report them, and most importantly, make profit and loss calculations easily by keeping accurate transaction records.

Cloud-based accounting software not only keeps income and expenses, but also makes it easier for your advisor to prepare tax returns at the end of the year. Additionally, since all activities are recorded on the Wave platform, it saves you extra time and money during the year-end tax declaration process.

There are many cloud-based software that automatically keeps these types of accounting records. Most of these are paid, but there are alternatives that are at least free and provide you with many advantages. Wave, where you can keep preliminary accounting for free, is the best alternative.

In this guide, you can find a lot of information about Wave. If you have never done accounting before, Wave may make you love this job.

What is Wave?

Wave Accounting is an llc that offers financial services software for microbusinesses, entrepreneurs, freelancers, and other service-based businesses with fewer than 10 employees. This financial management platform offers a user-friendly and functional interface, especially for those with no prior accounting experience.

Thanks to internal integrations, it allows you to manage the entries and exits of your bank accounts from a single place. You can also send offers to your customers, maintain a customer database, and upload expense receipts.

Is Wawe Free?

Wave accounting software and simple CRM system are 100% free. There is no trial, subscription or hidden fees. Wave's optional paid features include add-ons such as online payment processing, payroll software, and access to personalized bookkeeping services. If you're interested in using payroll software, you can start a free 30-day trial when you sign up for Wave, but you'll likely never use this feature.

Features

- Unlimited income and expense tracking

- Customizable sales taxes

- Unlimited bank connections (Mercurybank and Wise support)

- Exportable, basic accounting reports and financial statements.

- Reporting

NOTE: Wave alone cannot connect to Amazon stores and payment processors like Stripe. If you want to connect to your platforms, Zapier .

For fully automatic integration, you can also check out the links below.

Amazon > Wave Integration with Zapier

Stripe > Wave Integration with Zapier

How to Become a Member of Wave?

Wave is free and you can open an account with your company information based in the USA.

But there is a small detail during the account opening phase.

Wave checks your IP address. If you are trying to register with an IP address outside the USA, you cannot register. As a solution, you can complete your membership if you access the registration page from a US-based IP address with a VPN.

If you do not have a VPN, the free VPN (incognito tab) on the Opera browser can also work for you.

To open a free account on the Wave platform, you can start by browsing the registration page

Once you sign up, you do not need to connect with VPN again. As soon as you become a member, you can log in directly without using a VPN and use the software for free.

First Things to Do

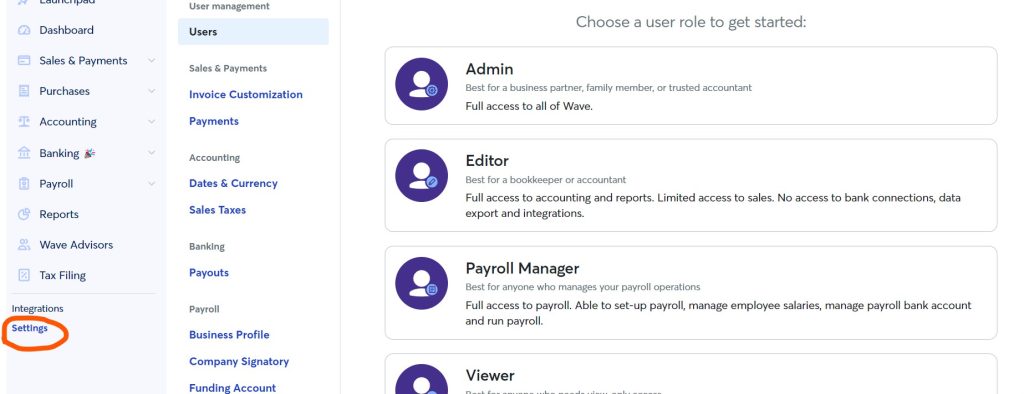

After completing your Wave membership, the first thing you need to do is create your business profile and enter your company information.

You can do this from the settings menu.

Fill in all the fields here and save.

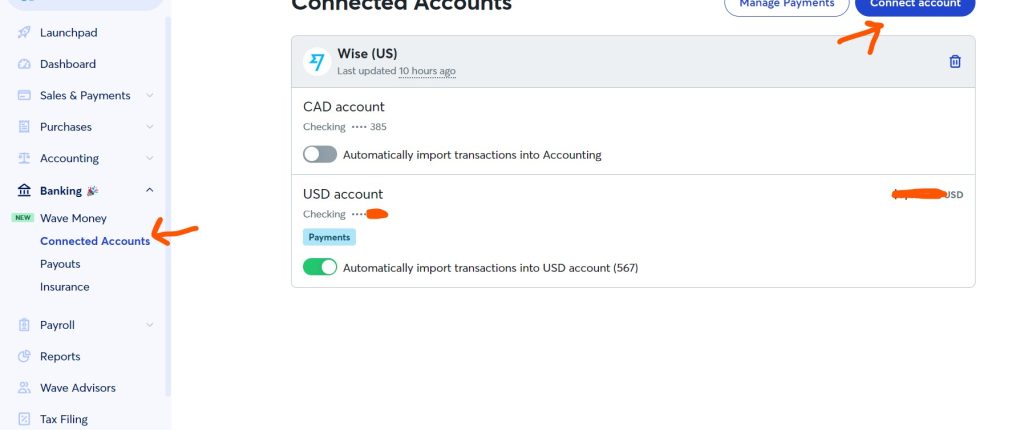

Connect your bank account

After filling out your profile, you can now link your bank account. This is the most important part because since the source of money is the bank, the whole process is based on the movements in the bank accounts.

You can integrate Wise, Mercurybank or a different bank into Wave. Provide the necessary integration by entering your bank information in the connect section.

Here, if you wish, you can process past transactions by integrating them into the system. If you do not want to use this feature, only your account movements after the integration will be reflected in your panel.

You can connect unlimited bank accounts through Wave.

How Do I Use It?

Wave has an interface in English, but if you have language problems, just click on the Chrome translate icon.

Above, we mentioned the important actions you can take regarding Wave. It will be enough to do these in the first stage. Next, it is necessary to spend some time inside to learn all the capabilities of the software. As you use it, you will experience that it does not have a very difficult interface.

Although it is free, the features available are sufficient. We can say that it has sufficient features for your preliminary accounting and year-end consultant to make tax declarations.

By the way, Wave also has the ability to give reporting authority to consultants for year-end tax preparation.

Highlights:

- After completing your membership, fill out your company profile correctly.

- Complete the synchronization by connecting your bank account (more than one bank, if applicable) and matching past records if desired.

- Integrate your Amazon store or Stripe account using Zapier if you need

- When you make your expenses from your bank, upload the invoices, receipts and receipts from the place you receive service as documents to the (negative) balance expenses. This way, your accountant can prepare your tax return in a few hours, asking you fewer (or no) questions in the future.

- Categorize your expenses. For example: supplier payments, advertising expenses, personal payments, domain expenses, server expenses, equipment or fixture expenses, etc. It is useful to categorize each expense.

If you haven't done preliminary accounting before, it's not too late for anything.

While you have not even completed the first quarter of the new year, you can focus on your business with peace of mind during the possible tax declaration processes at the end of the year by processing your income and expenses since the beginning of the year.

14 Comments . New Comment

Does Zapier charge us for Stripe Wave Integration with Zapier or are its basic features sufficient?

You probably need to switch to a paid plan, you can check the waveapps documentation

Mr. Nazmi

, when should we start using these applications? Can we not use accounting applications until we exceed the tax threshold?

It would be better to keep it tight and use it from the very beginning.

Hello, Bank integration costs money. Do you think Wave still has a meaning? Is there any other alternative to this?

Hello,

it is at least a useful application for keeping records, even if manually. Of course, different alternatives can be researched.

I researched many of them, all of them are automatically deducted for paid Stripe payments, I started to create Stripe manually for transactions such as transfer to bank account.

You now need to add the pro version for integrations :)

Now I pay my first expenses. Is it okay if I connect a bank account in Turkey to send it?

You cannot connect Turkish bank accounts. In order to enter expenses in this way, you must manually enter expenses and upload the receipt.

Sir, when we add our bank account to this Wave application and integrate it with Shopify, does it automatically fill in forms such as form 5472, 1040, 1040NR?

No platform makes data declarations automatically. Tax declarations can be made by licensed consultants in the USA. When you reach that stage, you can get service from our business partner if needed, details are on this page: https://startupsole.com/amerikada-sirket-vergi-beyani/

Wave Apps application is an application where you can only keep income and expenses, it does not have the ability to declare taxes.

Sir, what I mean is that I will make the tax declaration myself. Can this application fill out the tax forms?

We have already written a detailed answer on this topic. This application is a preliminary accounting software, it cannot make a tax declaration, no accounting program can make a tax declaration, you can hire an expert from Fiverr for the declaration or you need to get support from a consultant.