We've been getting a lot of questions about Form 5472 lately. Previously , Form 5472 Truth for Non-American LCCs , we talked about how important this is for a foreign and single-member LLC.

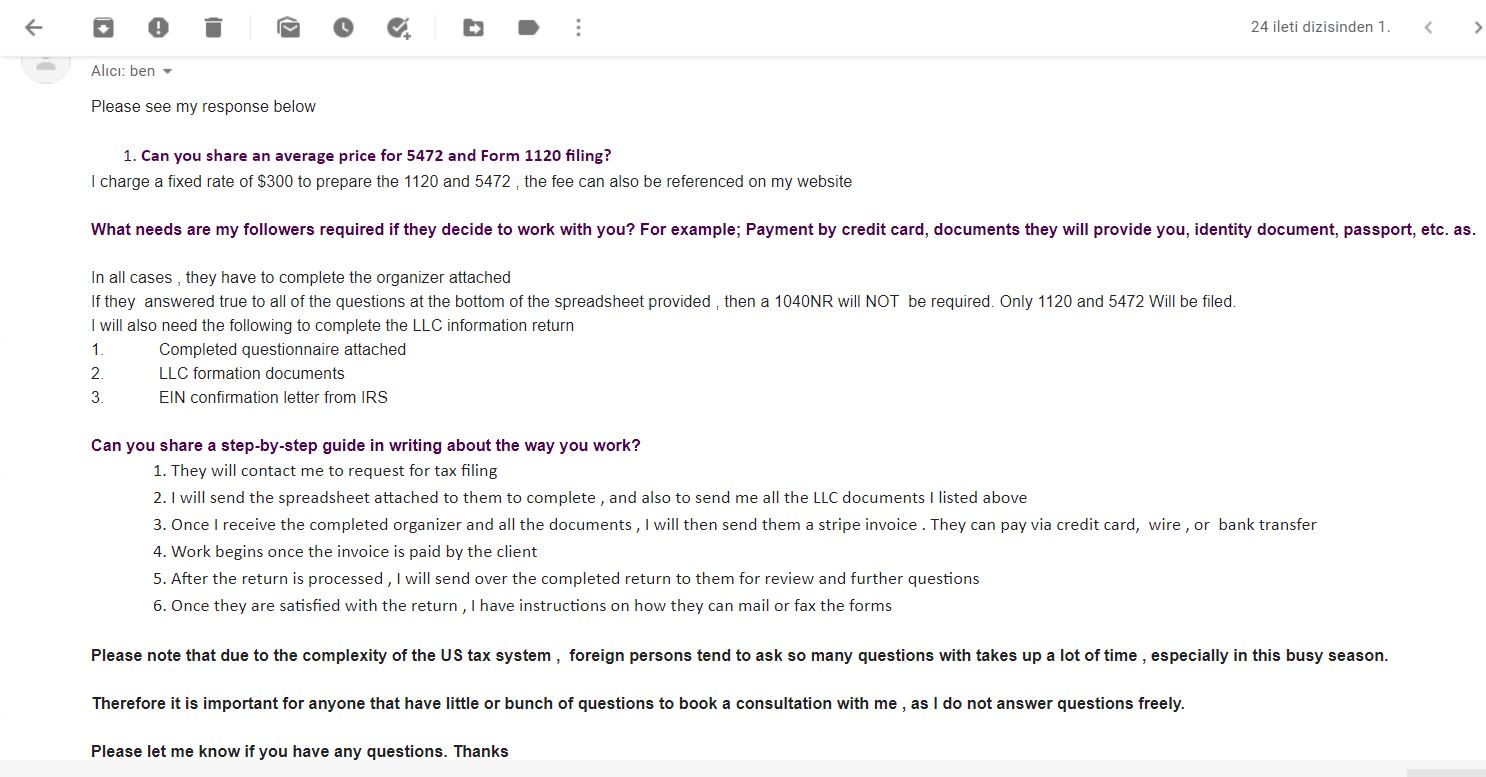

In this article, I will share the answers to some questions about Form 5472 that I asked via e-mail to Alex Oware, a CPA (Accounting and Taxation Expert) in the USA.

Alex Oware is a tax professional and member of the Massachusetts Society of CPAs, USA. The website is oandgaccounting.com. I found Alex Oware as a result of my research. He and his team carry out tax and accounting transactions, especially for foreign companies (Amazon traders, e-commerce, company owners in the dropshipping sector). He has very enlightening articles for foreigners on his blog page.

While I was in touch with such an expert, I wrote him an e-mail and asked him some questions about Form 5472 and Form 1120, which must be filed annually for foreign, single-owner LLCs. He kindly answered my questions in a very short time.

You can find all the details about these forms, which must be filled out every year, in the form of questions and answers below.

Question 1: What are Form 5472 and Form 1120? Is it important for a foreign company?

Answer: These forms are a report document submitted to the state about the amount of income generated by single-owner LLCs established in any of the US states and where this income goes. The government does not charge any fees etc. just to find out where foreigners' income within the country goes and its amount. It requires reporting every year without requesting it. It is a very important notification for the good standing of the company and must be filled out and sent to the state every year, otherwise there will be penalties.

Question 2: If you or another CPA fills out this document on our behalf, what kind of documents will you request from us?

Answer: Before making this filing, the organizer table that I have attached must be filled in under all circumstances. You can download the table from the link.

After completing this table, if the answer to all questions at the bottom is “Yes”, Form 1040NR is not required. Only filing 5472 and 1120 is sufficient.

Question 3: What are the questions in this table? What does it mean?

Answer: The questions are as follows. If all the answers to these questions are positive for that person, that is, yes, a different 1040NR is not required.

Translations of the questions are as follows:

1. I own a single member LLC

2. I do not have any physical presence in the US

3. I do not have any employees or sales representatives in the US

4. I do not have warehouses or offices in the US

5. 1099 from payment processor or e-commerce marketplace -Didn't receive K or any tax forms?

What is being asked here in article 5 is this. Payment gateways like stripe will send you form 1099-K when US State Limits for Foreigners In other words, a situation has arisen that requires you to collect sales tax and this form has been forwarded to you. If you have not exceeded the state limits and you have not received this 1099-K, the answer to this question is positive. In this case, the only form you need to send to the IRS is 5472, you do not need to submit an extra form 1040NR.

Question 4: If you or another CPA fills out Form 5472 on our behalf, what other documents will you request from us other than this table?

Answer: In order to create LLC information return, i.e. Forms 5472 and 1120 (if all the questions in the previous table are answered positively), I need the following.

- LLC formment documents (Articles of organization, Operating Agreement and etc.)

- EIN approval document from the IRS

Question 5: Could you give detailed information about your way of working? What steps will you take when filling out these forms?

Reply :

- First of all, you need to contact me to request this. You can reach me by e-mail or via the appointment calendar at https://oandgaccounting.com/appointment-booking-form/.

- Afterwards, I will send the attached organizer table, it needs to be filled out.

- If there is no problem, I send the customer a Stripe payment link and they need to pay the service fee required to fill out this form by credit card.

- Once payment is made we start the process.

- After filling out the forms and preparing the documents that need to be sent to the entire state, I send them back to the customer for final approval. If there is no addition or problem, I send it to the state.

- After the process is completed, I ask how I can send the original forms to them. I give instructions on this matter and send the original documents to my customers if they wish.

Question 6: Can you share an average price for Form 5472 and 1120 dual filing? How much is this service, all inclusive?

Answer: We have a price list on our website to prepare the 1120 and 5472 duo. I charge a fixed fee for this process. You can see the fee plans on this page . I apply the same price policy to everyone. I don't want hidden contracts and extra fees for this.

Last words:

Alex Oware;

-I can understand that there are a lot of questions, especially from non-US LLC owners, during this busy period because the US tax system can seem quite complicated. It is important to contact us so that I can answer the questions clearly, because each company's work and situation may be different, which requires different procedures. If you have any questions feel free to contact me

Alex Oware finally stated these and our messaging ended. The impression I got from him was very positive and he answered the questions sincerely. By the way, it is a plus for us that he and his team specialize in foreign small businesses and e-commerce initiatives. Because the tax system in the USA is already complex and in this case, it is a waste of time to explain your work to someone from start to finish.

By the way, I would like to state that I have no financial or moral connection with Alex Oware. My goal was only to find answers to these questions from the first expert in response to the messages and comments. You do not have to work with him and this article does not mean that I am referring him, just that he is a licensed CPA and his kind answers seemed sincere. That's why I wanted to share this, hoping it will be useful to everyone.

By the way, I would like to state that I have no financial or moral connection with Alex Oware. My goal was only to find answers to these questions from the first expert in response to the messages and comments. You do not have to work with him and this article does not mean that I am referring him, just that he is a licensed CPA and his kind answers seemed sincere. That's why I wanted to share this, hoping it will be useful to everyone.

12 Comments . New Comment

Hello,

assuming we have an ŞLC company established in Florida, do we need to pay income tax separately to those states after exceeding the sales limit in some States by selling via e-commerce?

Thank you

Hello,

No, you do not have to pay income tax in every state; you must pay sales tax in the state you cross the border into.

Thank you.

Well, if our presence is not a physical office, sales tax is not paid in the state where the company is registered.

You do not need to collect sales tax in any state (including the state where the company is formed) where you do not exceed the limit. Whether there is a physical location or not, there will be no need.

Hello,

My Delaware LLC company is established at a physical address. In the questions above: Will we choose NO physical presence and NO office? I don't live there, I reside in Turkey.

Thanks.

If you say no, it means a physical location belonging to your company or you. For example, an office, warehouse, branch etc.

Hello,

I founded the company in 2021 and since there were minor movements, I hired a CPA and had them fill out these forms. They asked me to print out the forms, sign them and send them to them. They never said that you could apply by fax, so I sent the documents to them.

I have a problem, I have a tax amount to pay and they want me to pay this amount only by check and they want an extra commission of 100 dollars to do this.

Is it possible to pay the tax amount issued in this form by a method other than cheque?

Hello,

Normally, applications are made via fax, although sending by mail is also an option.

We cannot predict the commission fee and payment type to be paid. It would be more logical for you to ask them about this issue rather than us.

Hello,

we need to file a tax declaration with the IRS this month for our LLC partnership company, which my partner and I established on 20.04.2021, but the company has not operated yet.

1- Should we prepare it ourselves or an accountant?

2- If we can prepare it ourselves, which form(s) do we need to fill out?

thanks,

Hello,

You cannot do it yourself, so it is useful to work with an accountant. If it is wrong, you will have problems.

Hello,

I have heard that

there is no need to fill out these forms in single-member LLC companies if there are no sales or no entry or exit from the bank account Do you have any information about this? Thanks.

Hello, yes you need to send a form stating that you have not shown any activity.

A few of our followers hired an expert from Fiverr and completed this job at a very affordable price. It is useful to research and get support from a professional instead of receiving a penalty letter. For companies that are not active, this service is provided at a more affordable price.