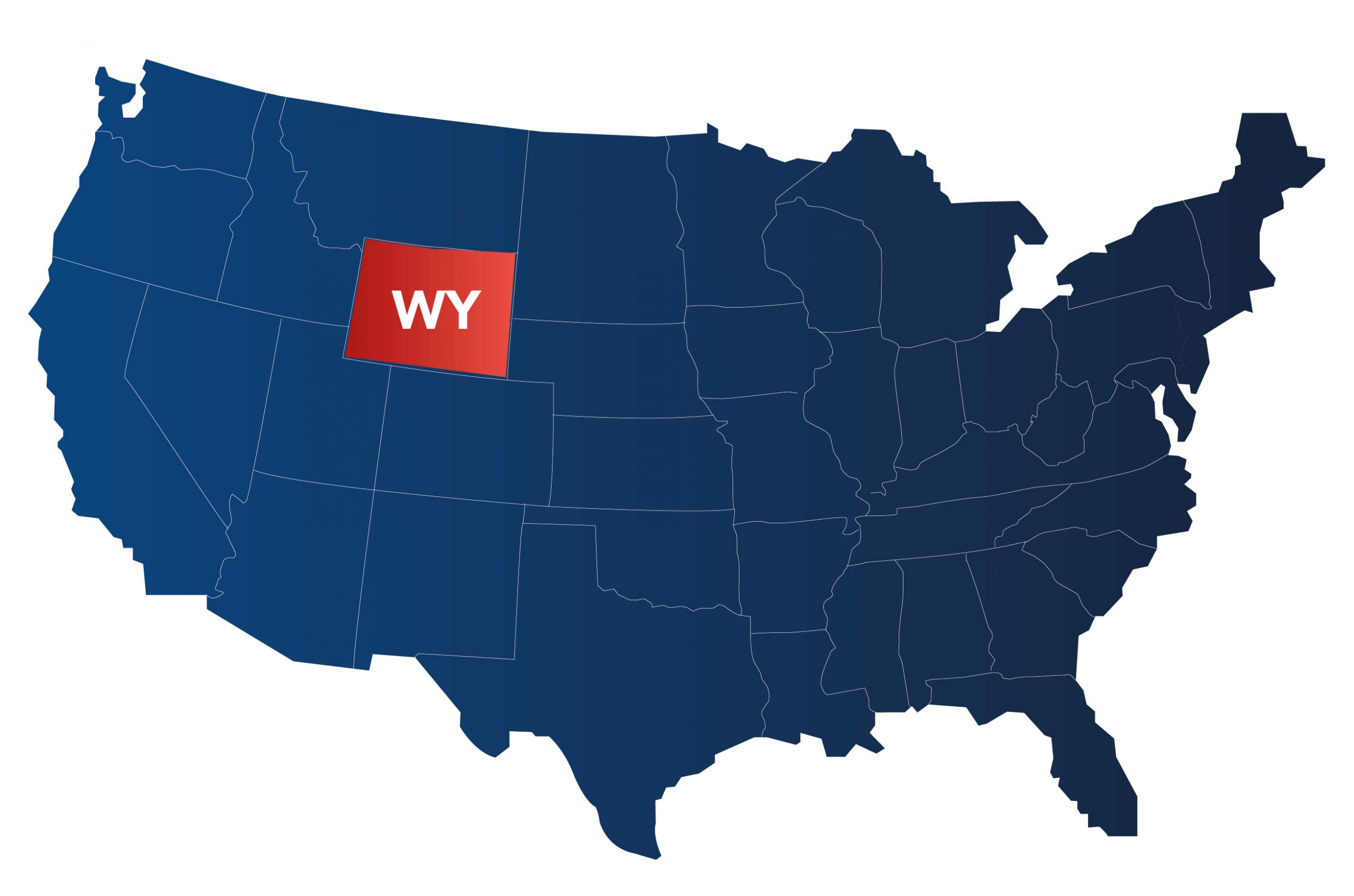

Is Wyoming Really Advantageous for Starting an LLC?

Wyoming is one of the most advantageous states to form an llc! Here we have collected everything you need to know about the state of Wyoming, which has become very popular lately, especially for foreigners. Read this content now and start learning more about Wyoming companies.

It has been observed that foreigners forming companies in Usa have preferred the state of Wyoming in recent years. Accordingly;

It has been observed that foreigners forming companies in Usa have preferred the state of Wyoming in recent years. Accordingly;

- From 2015-2017, the number of LLCs formed in Wyoming increased by 76%, from 20,971 to 36,967.

- This number increased significantly between 2018-2019

- In 2020, many businesses closed due to the pandemic and online commerce took off, resulting in a 26% annual growth rate in new LLC applications.

Wyoming is one of the most preferred states when it comes to LLC company formation. Lower wages and ease of doing business distinguish this state from others. Below, we have listed some of the advantages of Wyoming LLCs, here are these advantages and their details.

Why Should You Form an LLC in Wyoming?

When it comes to asset protection and LLC statutes, Wyoming comes out ahead of other states. Low initial and annual costs, installation in one working day, confidentiality and many other advantages are very attractive to entrepreneurs. Below you can find detailed information about the many other advantages of forming a Wyoming LLC.

1.Privacy

In Wyoming, personal information (name, phone number, email) of LLC members or owners may be kept confidential upon request. Wyoming is a state that values privacy and has no requirement to be listed in public records. Whether you run your business from home or in your office, Wyoming is a state that guarantees anonymity.

In case of possible legal situations in the future, your business information will not be disclosed. This service also serves as a protection for company owners. Therefore, you can avoid subpoenas, harassment and spam.

If you want to establish a fully incorporated LLC in Wyoming (the name of the company owner is not public), you can register your LLC by receiving service from Northwest Registered Agent Northwest LLC sets up your company anonymously by default. Your personal information is not included in the public state portal and company formation documents.

If you form your LLC with IncAuthority, they will not form your company anonymously and your name and information will appear in state records. If you do not want to form an anonymous LLC with Northwest and want your name to be included in the records, you can report this by sending a support request after the installation order.

2.There is No Income Tax in Wyoming

Wyoming does not collect any state or business taxes from its LLCs. This is also very beneficial for Wyoming residents as they will not have to pay double taxes.

That's why Wyoming, one of the states with a zero income tax, appeals to many LLC owners. There is also no corporate tax, franchise tax or stock tax. Apart from this, personal income tax is not applied in Wyoming. However, multi-partner LLCs are taxed as businesses. The best option to avoid Wyoming taxes is to form a sole proprietorship LLC.

In Wyoming, taxes on multi-partner LLCs are passed through to their owners, and the taxes are reflected on their income tax returns. Note that combined state and federal income taxes are approximately 45-54% in this state. In summary, the tax burden of multi-member LLCs falls entirely on the members. However, since Wyoming does not impose a state tax, a double tax return is not required.

3.Wyoming LLCs' Information Is Not Shared and Remains Private

As we mentioned earlier, when you form an incorporated LLC with Northwest, the LLC owners' information is not made public. Your information will not appear anywhere (including the state portal and formation documents). It also ensures the prevention of state, state and federal red flagging. This is because the state does not have an information sharing agreement with the IRS.

4. Citizenship is not required

Anyone over the age of 18 can form an LLC in the state of Wyoming. In addition, you do not need to reside in Wyoming or the USA for this, in short, there is no citizenship requirement. No matter where you live in the world, you can form an LLC company in the state of Wyoming. Additionally, even if you are not a U.S. citizen, Wyoming LLCs provide you with a layer of asset protection so your personal assets are kept separate from your company assets.

5.Legal Protection

Since personal records of Wyoming LLCs are not publicly available, LLC members are not subject to lawsuits in any way. In this way, you will be relieved of personal responsibilities while running the business. The lawsuits only target your LLC company. According to the law, LLC owners are not exposed to lawsuits.

However, if fraud or illegal transactions are involved, Wyoming courts may request information about LLC members from the registered agent or state registries.

6.No Capital Required

You can form an LLC in the state of Wyoming and trade remotely, without having to keep any capital or cash in a bank account. As of today, with zero capital, you can form a Wyoming LLC in 2 business days by paying a $139 filing fee.

7.Less Formality and Bureaucracy

Some states may require meeting minutes even for LLC companies, but this is not the case in Wyoming. During the LLC formment process, information such as identity, passport, residence is not required, and there are no requirements such as monthly reports or accounting.

8.Free Services Available

In many states, there is a fee to obtain a certificate of good standing, but in the state of Wyoming, this document can be downloaded free of charge from the state website.

There is also an annual report reminder and notification system. You can sign up for the state's mailing list by going to the state website, finding your company in the search section, and saving your e-mail. Thus, you will be reminded of notifications and reminders in advance via e-mail.

The resale certificate required for sellers who do business in marketplaces such as Amazon to give to their wholesalers can be obtained free of charge after registering on the portal.

9.Other Advantages

Wyoming does not require directors or members to be listed in a public database. A third-party registered agent can file the necessary filings on behalf of the LLC. Initial installation and maintenance are economical. The initial filing fee is approximately $100.

Wyoming does not require any corporate income tax or limited liability company franchise tax. Assuming you have less than $250,000.00 in assets in Wyoming, you pay a $50 annual fee to file a report and do not have to pay anything else to the state.

Other than that, you need to have a registered agent, which costs about $125 per year.

To summarize;

- Unique lawsuit protection and entrepreneur-friendly laws

- Privacy Policy

- No franchise tax

- No personal income tax

- No corporate taxes

- Provides free services

- There is no citizenship requirement

- Less red tape and bureaucracy

- asset protection

- zero capital

If you would like to take advantage of these benefits, you can form a Wyoming LLC with Northwest in approximately two business days. If you want to establish a Wyoming LLC for only $139 including address, you can start your process immediately by using our special discounted order page at this link