You can receive online payments from all over the world via credit cards on your website. You can easily do this by opening a Stripe account.

If you want to open a verified Stripe account, you are in the right place. What you will learn in this guide:

Our new venture platform: Startuphub is on publication

Our Startupphub vehicle, which collects on a single platform, from business idea to company installation, state selection, brand creation, bank and strip pre -approval tools to advertising text production

Click here to discover the platform now !

Stripe requirements

Opening an account with Stripe from Turkey

Does Stripe work in Turkey? Answers to questions like

Stripe commission rates

and more.

If you are ready, let's take a deep dive into the subject.

Brief Information: Stripe constantly updates the registration form and approval processes during membership. the latest details regarding account opening and approval processes in this guide . There are no changes in the requirements and other details, only minor changes in the account opening steps.

Why Do You Need to Open a Stripe Account?

It is not healthy to collect credit cards in different currencies globally with local virtual POS systems. In addition, the following situations are among the most common problems in local virtual POS systems:

- Many virtual POS systems that require security measures such as 3D secure cause customers who are not used to this to give up shopping.

- Unsuccessful orders during purchase due to limited card type support

- Unavailability of platforms such as Google Pay and Apple Pay

- High commissions or unsuccessful payment problems in collections with different currencies

- Software aspects such as integration and API are limited

- Lack of documentation and fast support problem

- Different problems experienced by many entrepreneurs who actively trade online.

As a result of its investments, Stripe has become a huge ecosystem that prevents the above problems.

Therefore, it is possible to say that it is the most preferred virtual POS system in the world.

Does Stripe Work in Turkey?

Stripe does not individually approve accounts opened in Turkey.

There are several account types on Stripe, individual and corporate.

It provides the opportunity to open individual accounts in the USA and some European countries, but Türkiye is not among these countries.

How to Open an Account with Stripe from Turkey?

Stripe does not accept individual accounts from Turkey.

This is correct information.

However, if this person resides in Turkey and owns an LLC company in Usa, the situation changes.

Stripe provides full support to Turkish Citizens who own LLC companies in opening an account.

Because there is a TR ID Number field in the section where the account owner's information is entered.

The presence of your TR ID number in the identity information section is sufficient proof that Stripe is working.

If Türkiye is not among the countries supported by Stripe, how does it accept the account opened?

Türkiye is not among the countries that Stripe supports for opening individual accounts. This is already known. At the same time, this is a subject that causes a lot of confusion.

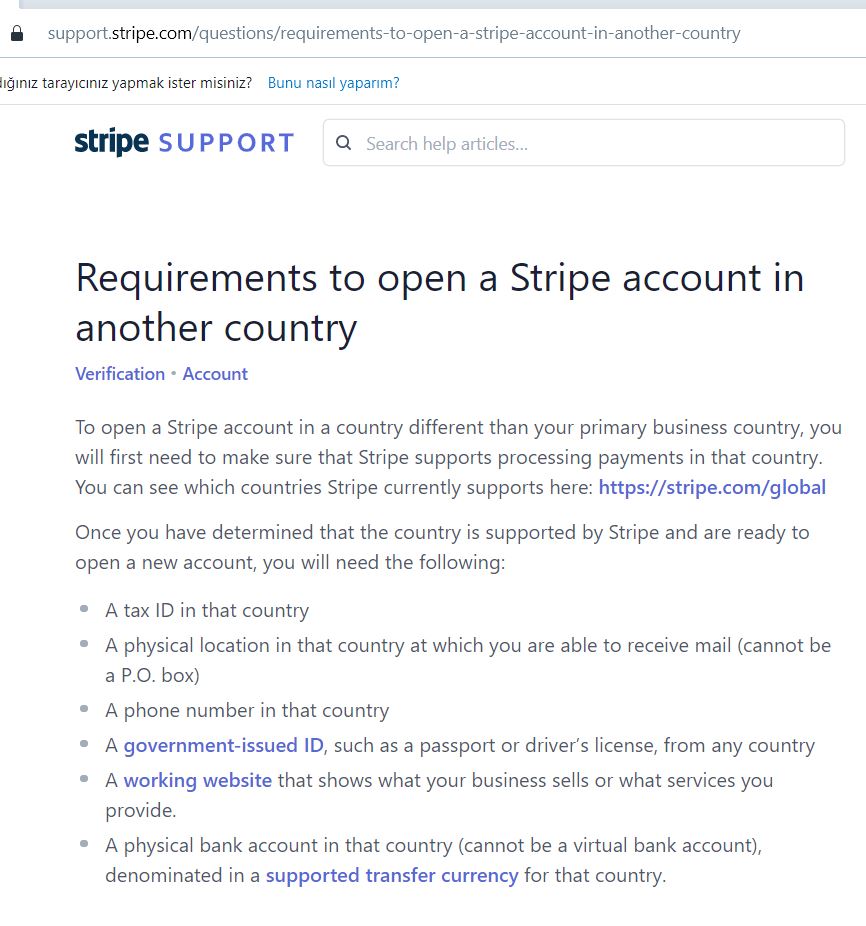

the Stripe FAQ without going into too much detail and creating confusion . They clearly state their requirements. Stripe says;

If you want to open a Stripe account in a country other than the one where you do business, first make sure that Stripe is supported in the country where you will open an account. It means that Turkish citizens who have an LLC company in the USA can open an account.

Once you've made sure Stripe is supported by opening an account in a country where you do business, it's time to look at other requirements.

Everything is clear above…

In order to open a Stripe account, the company must be supported in that country. Since the USA is among the supported countries, when you form an llc in the USA, there is no problem since your company is located in the USA.

In order to open a verified Stripe account, you need to establish an LLC company in America. Before trying to open your Stripe account, in this guide , set up your company and obtain your tax number (EIN).

The most reliable and guaranteed way to open a Stripe account is to form an LLC company in Usa and open a corporate account through Stripe.

After forming your company, you must meet the following requirements.

Requirements for Opening a Stripe Account from Another Country

- Company: A company registered in the account holder's name in the supported country (an LLC established in the USA is sufficient)

- Company Tax Number: EIN is the tax identification number of an LLC company. Received free of charge from the IRS once the company is formed

- A physical address where mail can be received: Underlined because it is not a virtual mailbox. It refers to the country where your company is located, not where you reside, so your US company mailing address is accepted.

- Phone number: You can obtain a virtual phone number with a US area code OneSimCard , Zadarma

- Government-issued ID, passport or driver's license: There is no need for a passport because a new type of government-issued ID will be sufficient.

- A working website: A proper website in English, which complies with Stripe's terms, is completed, has a contact, terms, conditions and about page, where legal work is done. A list of unacceptable types of jobs and websites is available here .

- A bank account that supports the currency used in the country where the company is established: to Opening a Bank Account in the USA . Mercury Bank or Payoneer Business are sufficient for this job because Stripe supports both platforms. Many of our followers have been receiving payments via Stripe for a long time without interruption, using these solutions.

Assuming that you already have an llc, we can say that there is nothing blocking you.

So, let's detail how you can complete this process step by step and open a verified Stripe account.

Does Stripe Require Address Verification?

Since your company is in the USA, there is no problem, no address verification is required. Because they do not need such a thing, what is important is the country where the company is located and the country of citizenship of the person who opens the account.

Stripe already knows that you do not live in the USA because it allows you to enter the address of your country as your residence address.

Address verification is not important for Stripe. The owner's identity is an llc, a bank account, and an llc's EIN number.

Now let's summarize all the requirements so far and see what is required;

- Since we will be opening an account in the USA, an LLC company formed in any state

- The company's formment certificate is already delivered to you after installation.

- An EIN (Federal tax identification number) after company formation

- A phone number in the USA

- A recommended website (or e-commerce) in English that works and complies with the conditions

- A physical bank account (Mercurybank or Payoneer Business)

Once you have these 6 items, you can open a verified and legal Stripe account and start receiving payments from your customers immediately.

Now let's detail how to implement these steps one by one.

1. Forming an LLC Company in the USA

There are many alternatives on this subject on our website.

However, to open your Stripe account at the most affordable price, you can establish the company in the state of New Mexico. Northwest , you can set up your LLC company in New Mexico for $89, including address.

2. Obtain an EIN (Federal Tax Identification Number) After the Company is Formed

After completing the company formation step, you need to obtain an EIN, or tax ID, for your company.

apply for a free EIN for you . However, for this, you need to establish your company through our reference link via Northwest Registered Agent, details are here .

3. A Phone Number in the USA

OneSimCard , Zadarma , Skype Business do this job. All you have to do is get a virtual phone number with a US area code and activate your number.

Is a Phone Number Required When Establishing an LLC Company? There are details in the guide on how to take it.

4. A Website That Works and Complies with the Conditions

We have provided preliminary information about this subject above.

Your website must be properly designed, products and services must be entered, and all necessary pages (about us, privacy, policies, terms, conditions, contact) must be prepared. Make sure that the native language of your website is English. It will be beneficial for you to open it in English first to avoid approval problems.

You must also have a job that complies with Stirep conditions. You can review the sectors that are not allowed here

5. Open a Bank Account in the USA

After your company is established, you can open a remote online account with MercuryBank open and use a Payoneer Business

Both banks with active USD accounts are accepted by Stripe.

After completing these 5 steps, all that remains is the easiest part: opening a Stripe account.

Without going into too much detail, let's cover the steps on how to open a Stripe account.

Opening a Stripe Account

Brief Information: Stripe constantly updates the registration form and approval processes during membership. There are no changes in the requirements and other details, only minor visual changes can be found in the account opening steps.

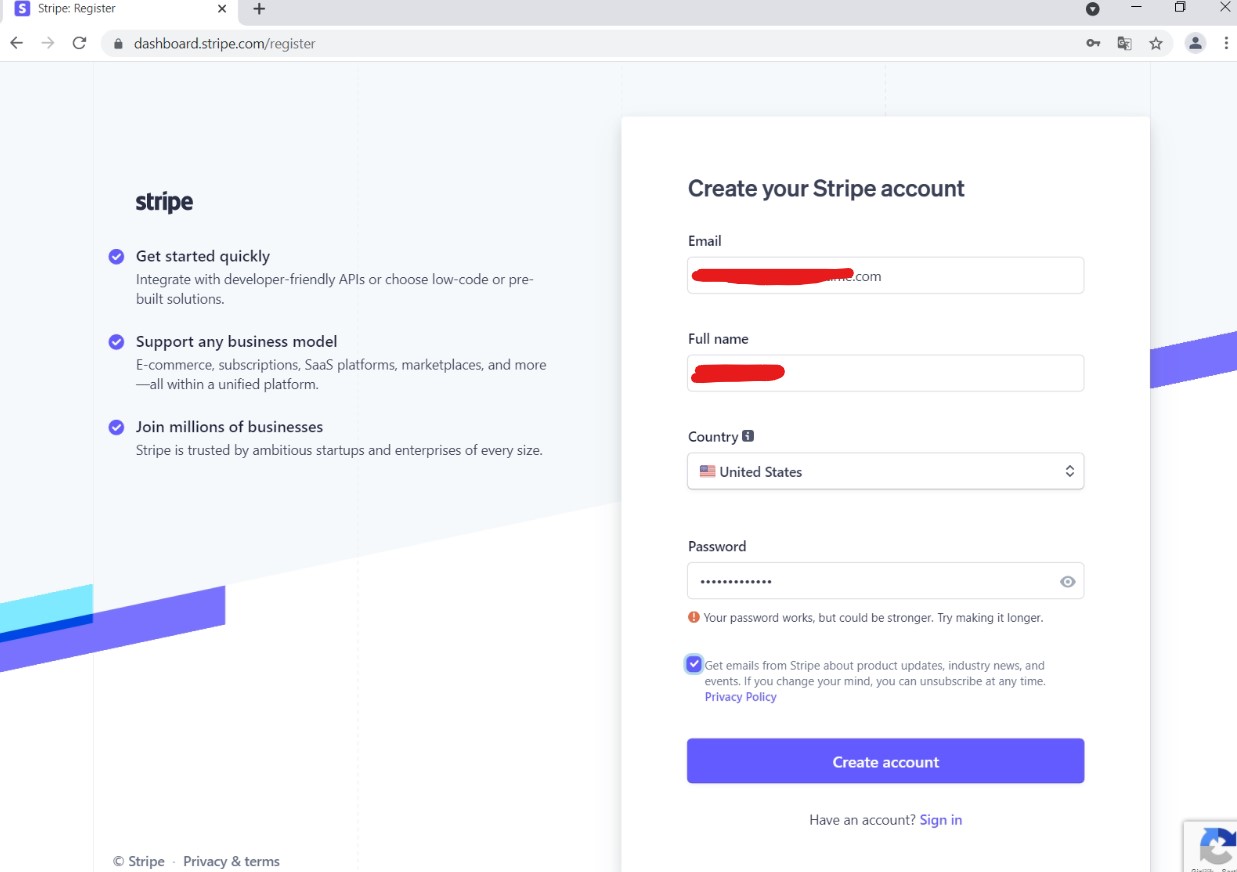

You can now create your Stripe account.

You do not need to connect from a foreign IP address such as VPN or VPS.

You can easily perform transactions from your own computer.

First, dashboard.stripe.com/register and fill out the form.

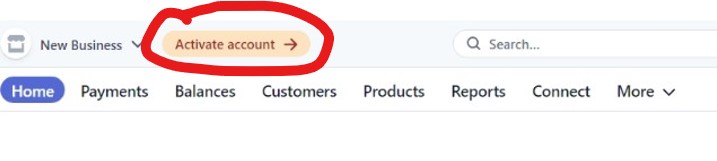

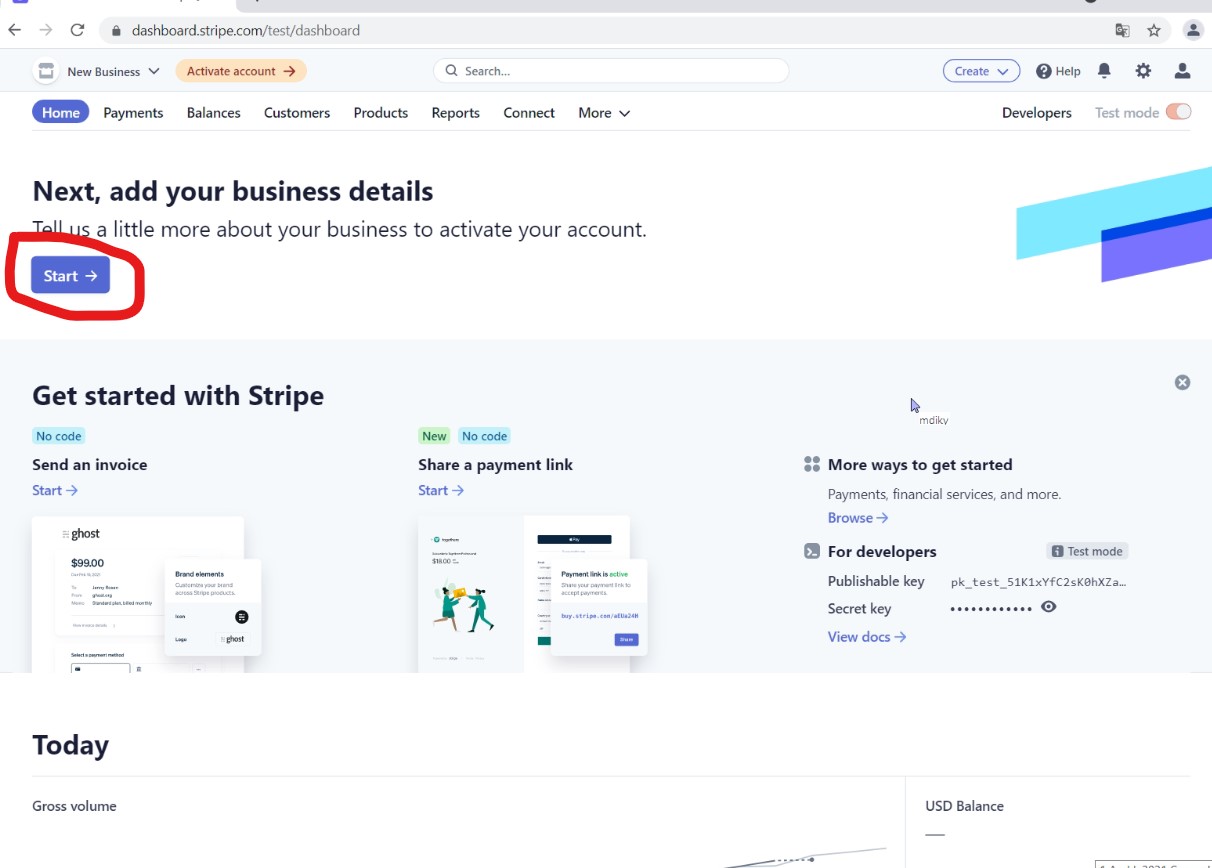

By clicking the “Start” button, you can proceed with the steps to activate your account.

First of all, you need to verify your e-mail by clicking on the verification link sent to your e-mail.

After verifying your email, click the “Activate account” link at the top of the Dashboard.

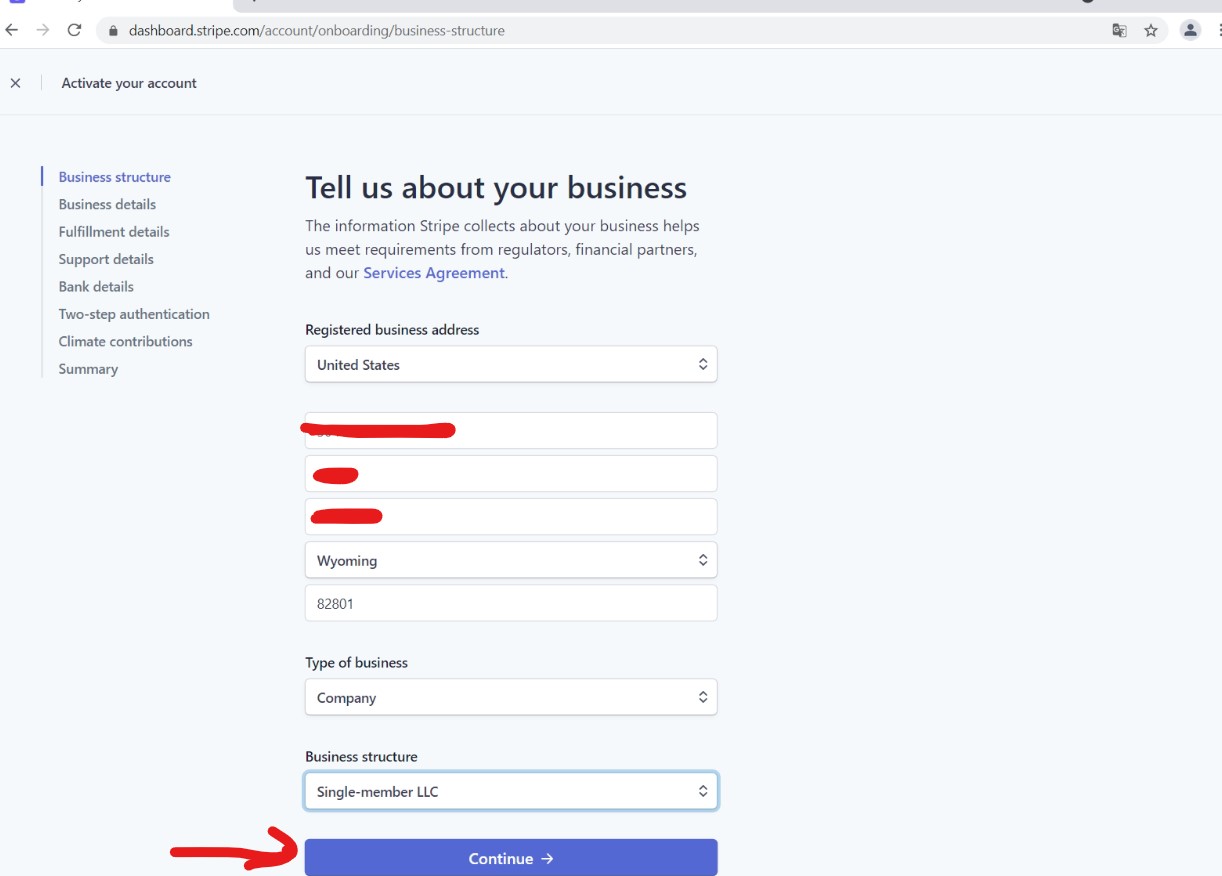

Registered Business Address should be United States, then enter your company's address.

Registered Business Address should be United States, then enter your company's address.

Continue by selecting Company in the Type of business section and Single-member LLC at the bottom.

In this step, you are asked to enter company details. Enter all information completely. Also, remember to enter your EIN number correctly.

In this step, you are asked to enter company details. Enter all information completely. Also, remember to enter your EIN number correctly.

Because Stipe does automatic verification from the IRS's database.

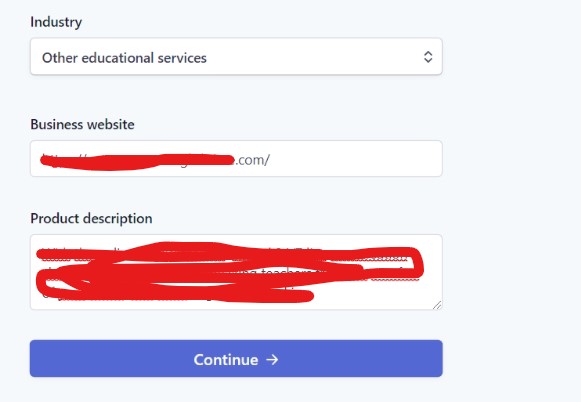

Choose your business category (e.g. education, e-commerce, toys, online course, etc.) and write your website address. Finally, enter a descriptive text in English about your work and products.

Choose your business category (e.g. education, e-commerce, toys, online course, etc.) and write your website address. Finally, enter a descriptive text in English about your work and products.

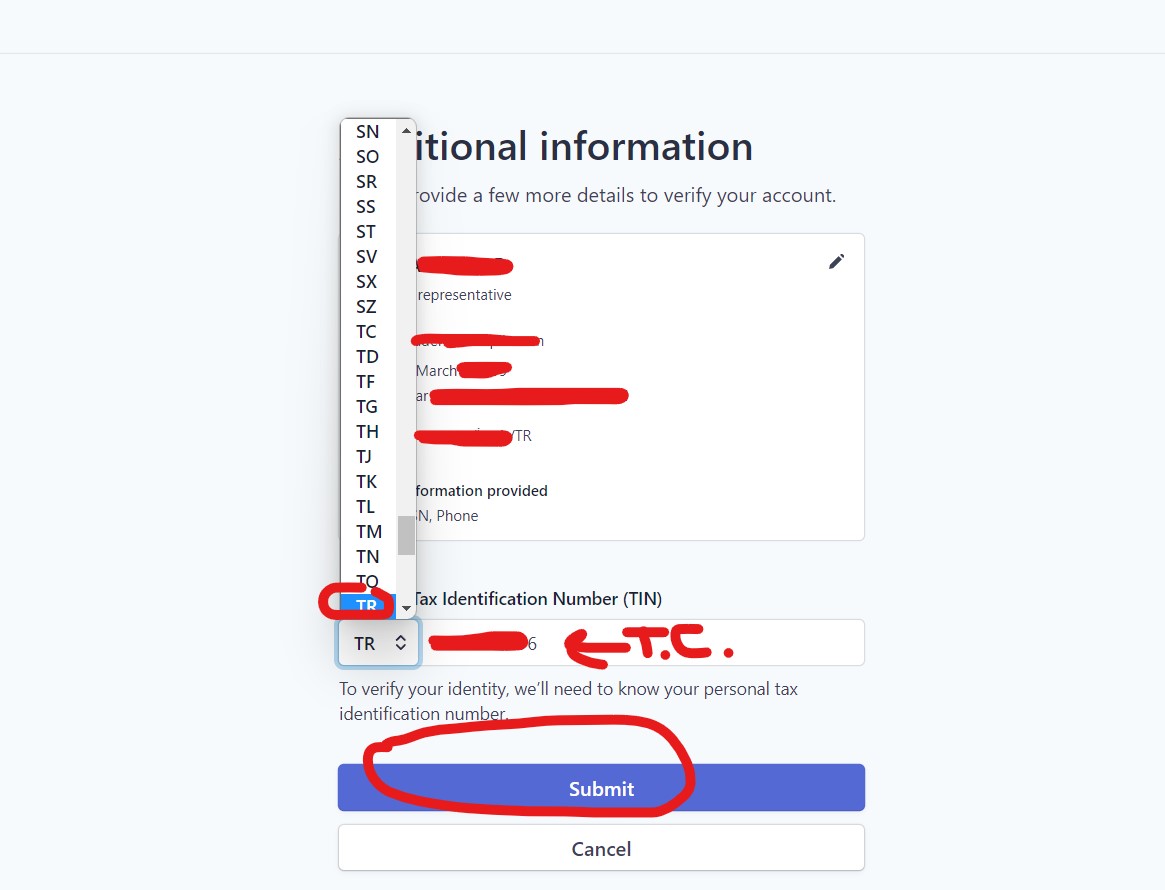

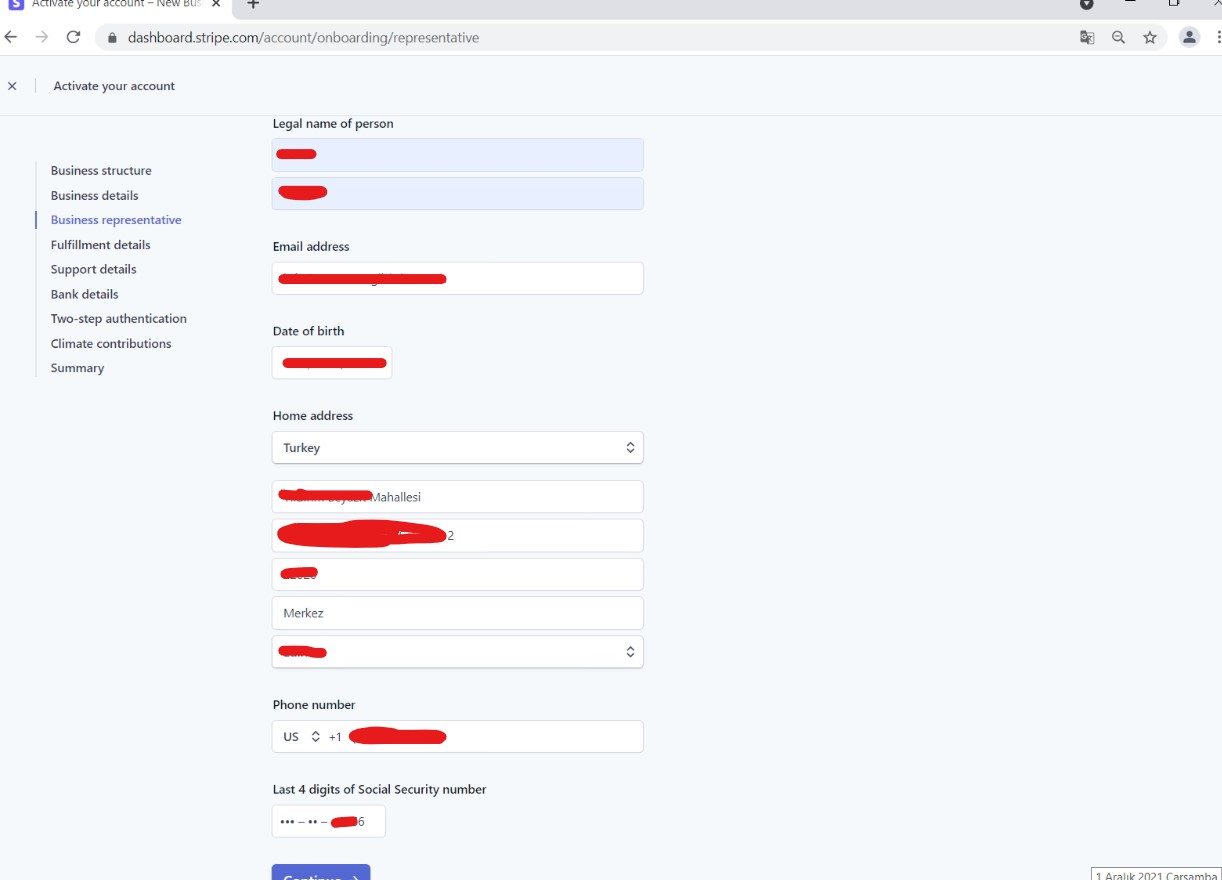

In this step, your personal information, that is, the company owner, is requested.

In this step, your personal information, that is, the company owner, is requested.

Enter your name, surname, email address, date of birth, your home address (they want to know where you live, not your US business address) and a personal phone number with a TR area code or a US area code.

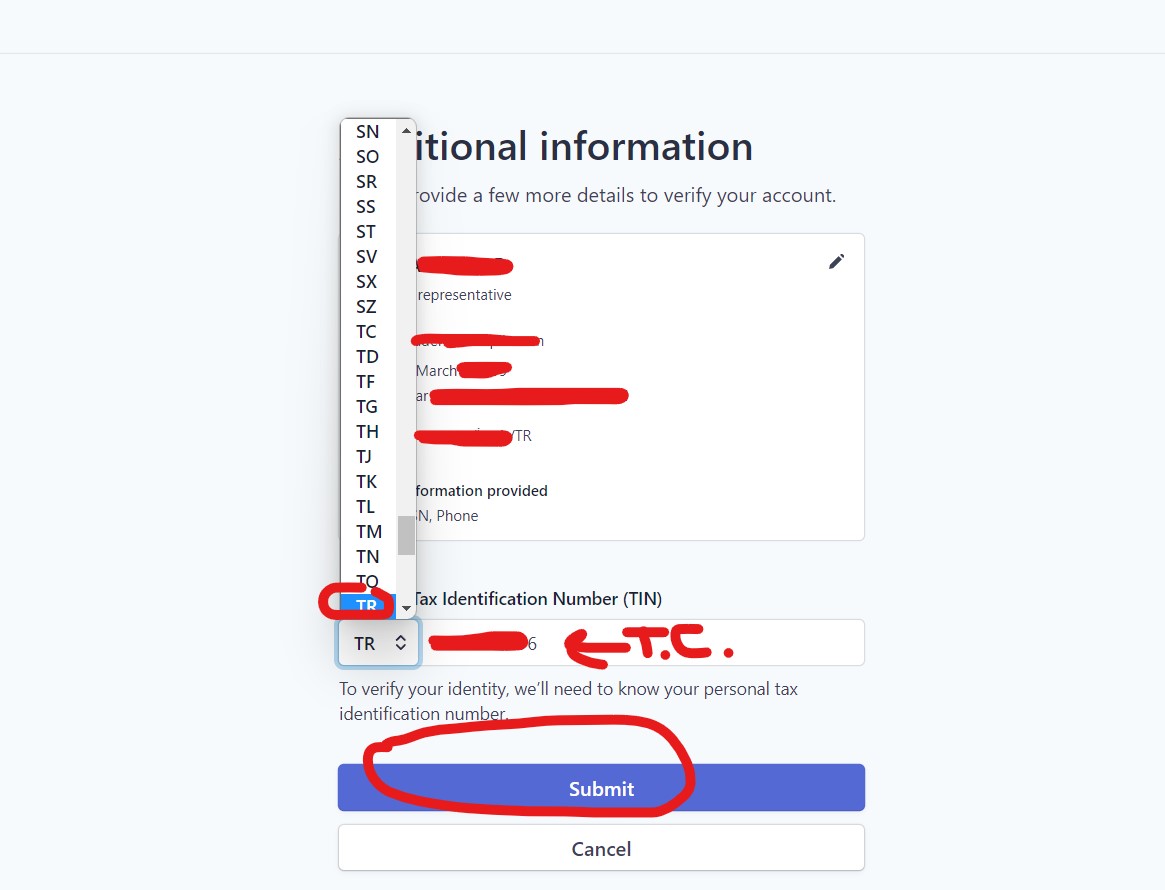

Note: This part is important because it can change constantly. Sometimes, there is a field where you can select the country and you reach the field where you can select TR and enter your TR ID number. Sometimes, the Upload an ID instead warning appears. Click on the link, select Türkiye as the country and enter your TR ID number.

If the TR selection field appears, enter your Turkish ID number. If not, click on the "Upload an ID instead" link and continue by typing your identity document after entering your TR ID number.

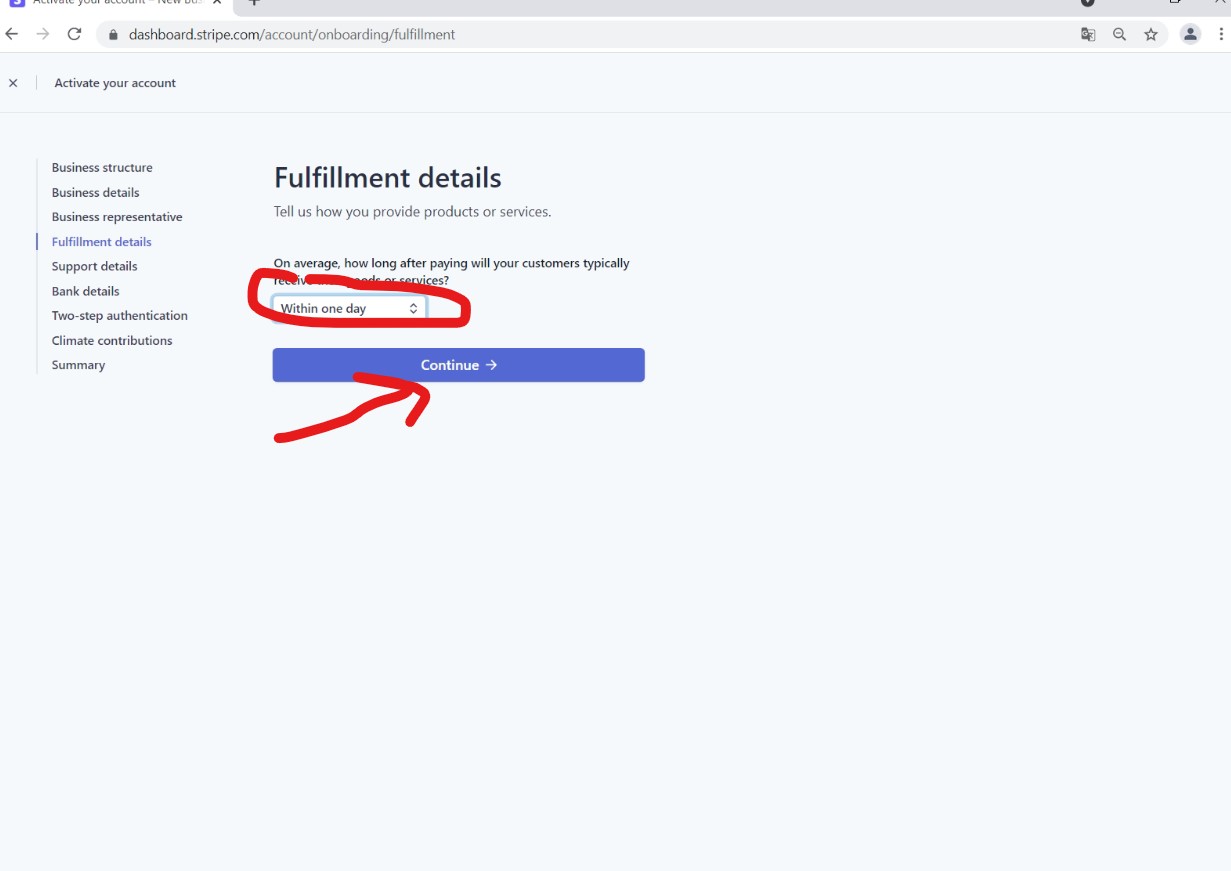

Select the Fulfillment section as one day and continue.

Select the Fulfillment section as one day and continue.

In the Support details section, write your company name, description, phone number with USA area code (phone number with USA area code is required for this section) and finally the mailing address of your company in the USA and continue.

In the Support details section, write your company name, description, phone number with USA area code (phone number with USA area code is required for this section) and finally the mailing address of your company in the USA and continue.

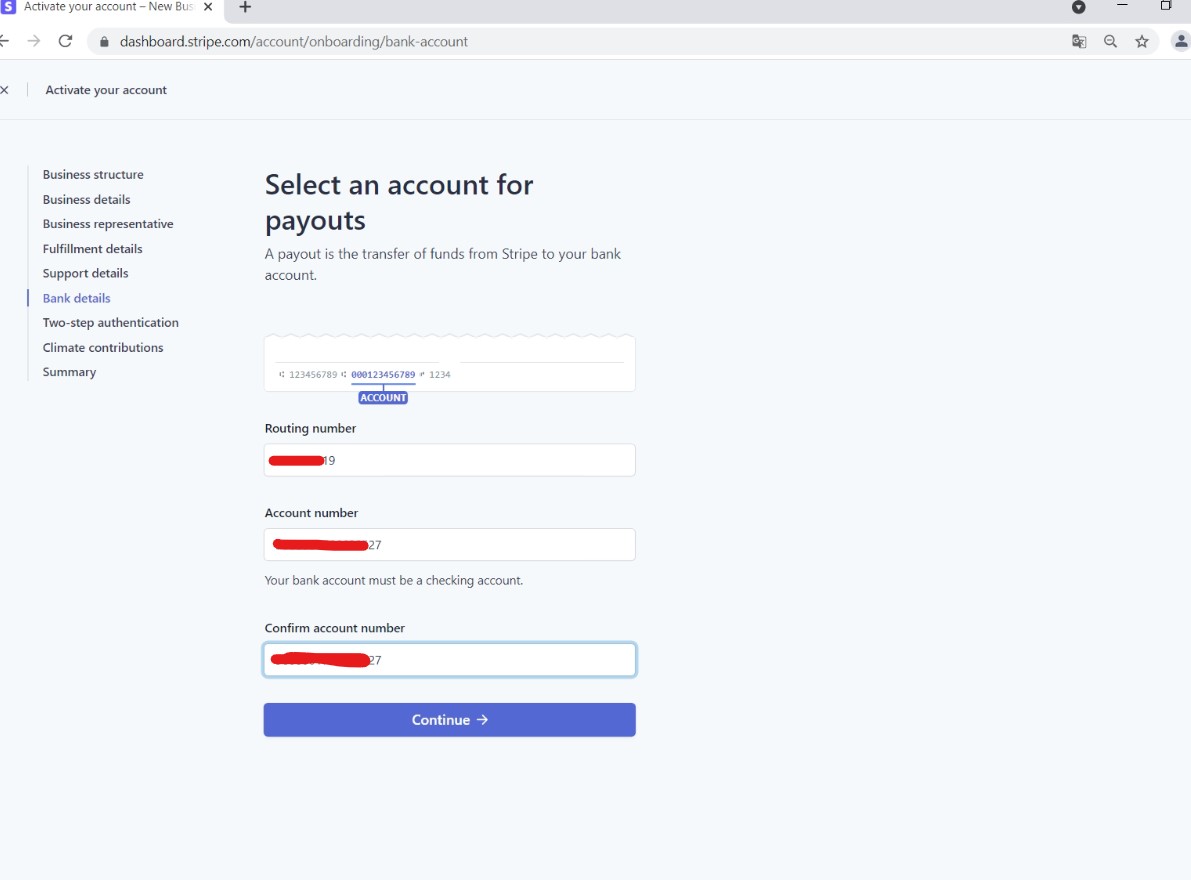

Enter your bank account information as shown below. Enter the account and routing information of any of your Mercurybank, or Payoneer corporate accounts and continue.

Enter your bank account information as shown below. Enter the account and routing information of any of your Mercurybank, or Payoneer corporate accounts and continue.

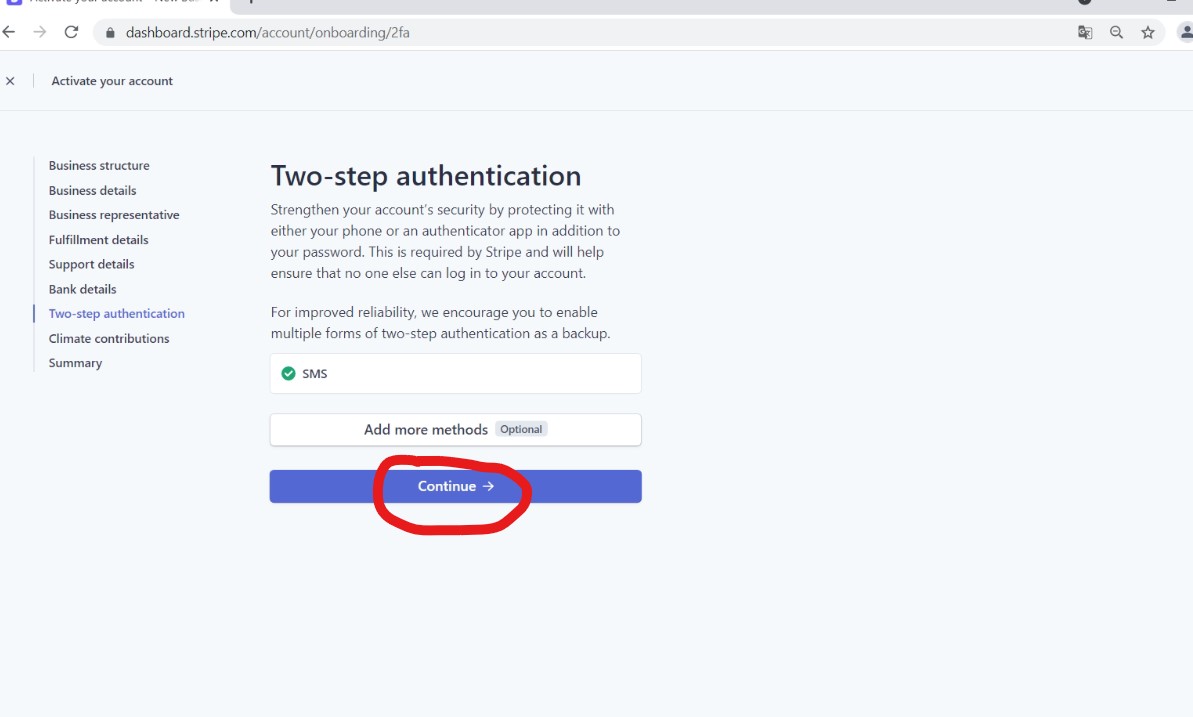

If you want to activate two-factor login, you can continue via SMS or the Google Authenticator application. Do not skip this step because you cannot end the process without doing this at the last stage.

If you want to activate two-factor login, you can continue via SMS or the Google Authenticator application. Do not skip this step because you cannot end the process without doing this at the last stage.

Follow one of the two methods and continue.

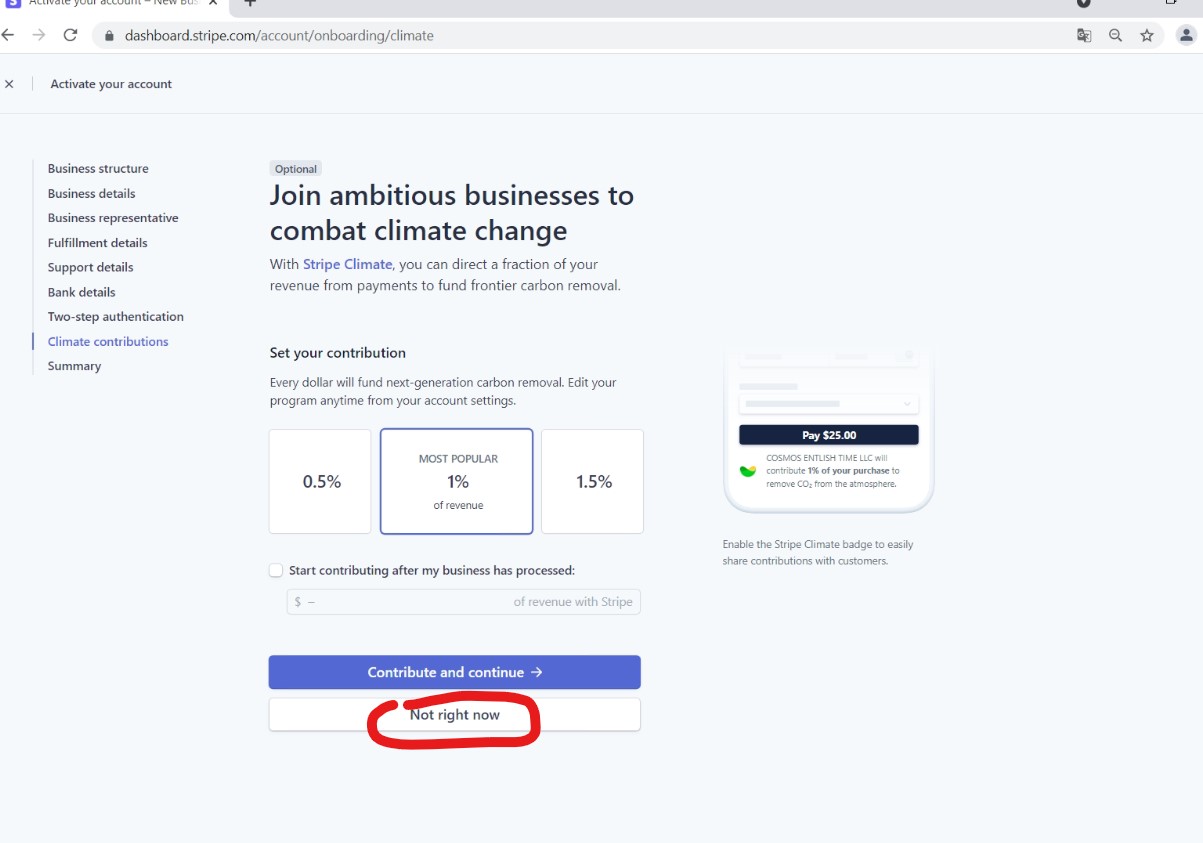

You can skip this option by selecting Not right now.

You can skip this option by selecting Not right now.

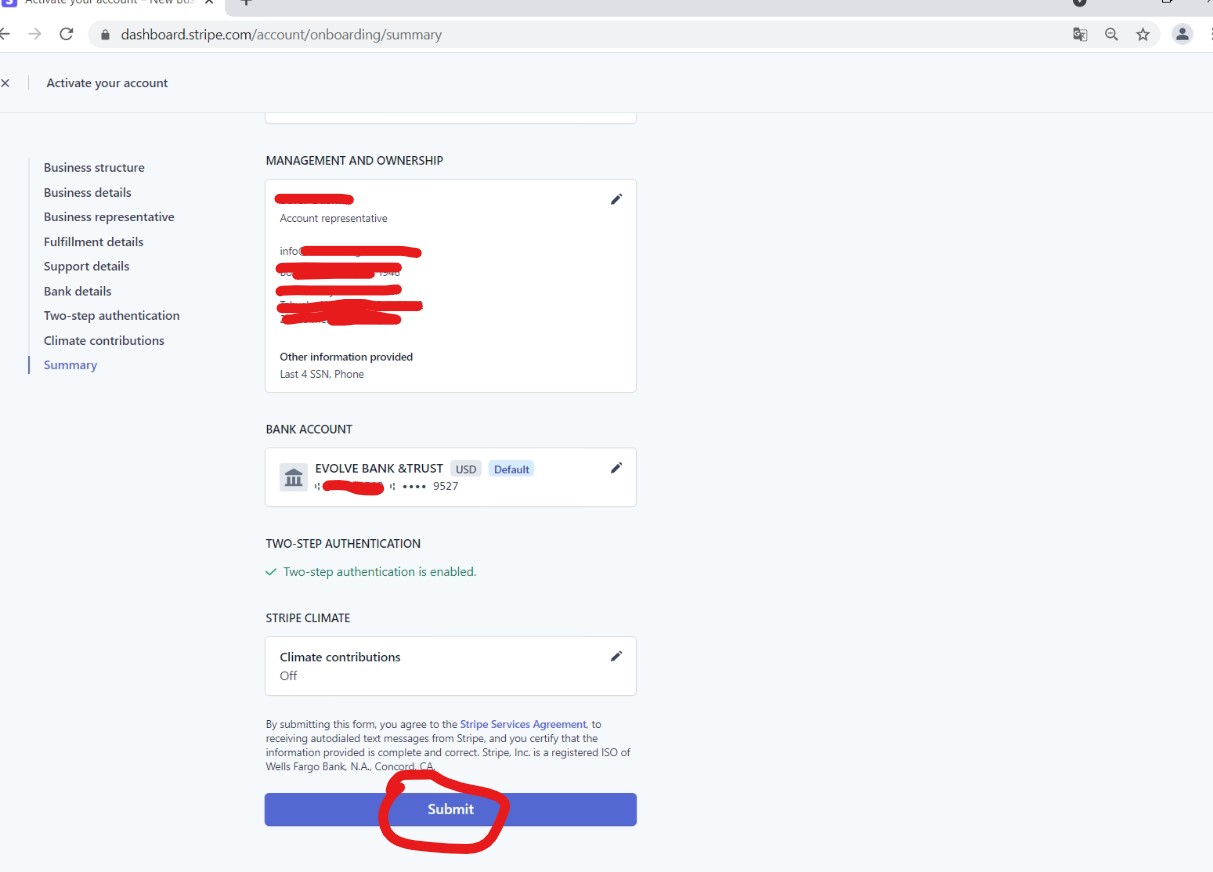

In the last step, you are asked to review the information you entered. Make final checks and correct any areas you need to edit and click the "submit" button to send the application.

In the last step, you are asked to review the information you entered. Make final checks and correct any areas you need to edit and click the "submit" button to send the application.

Approval Process

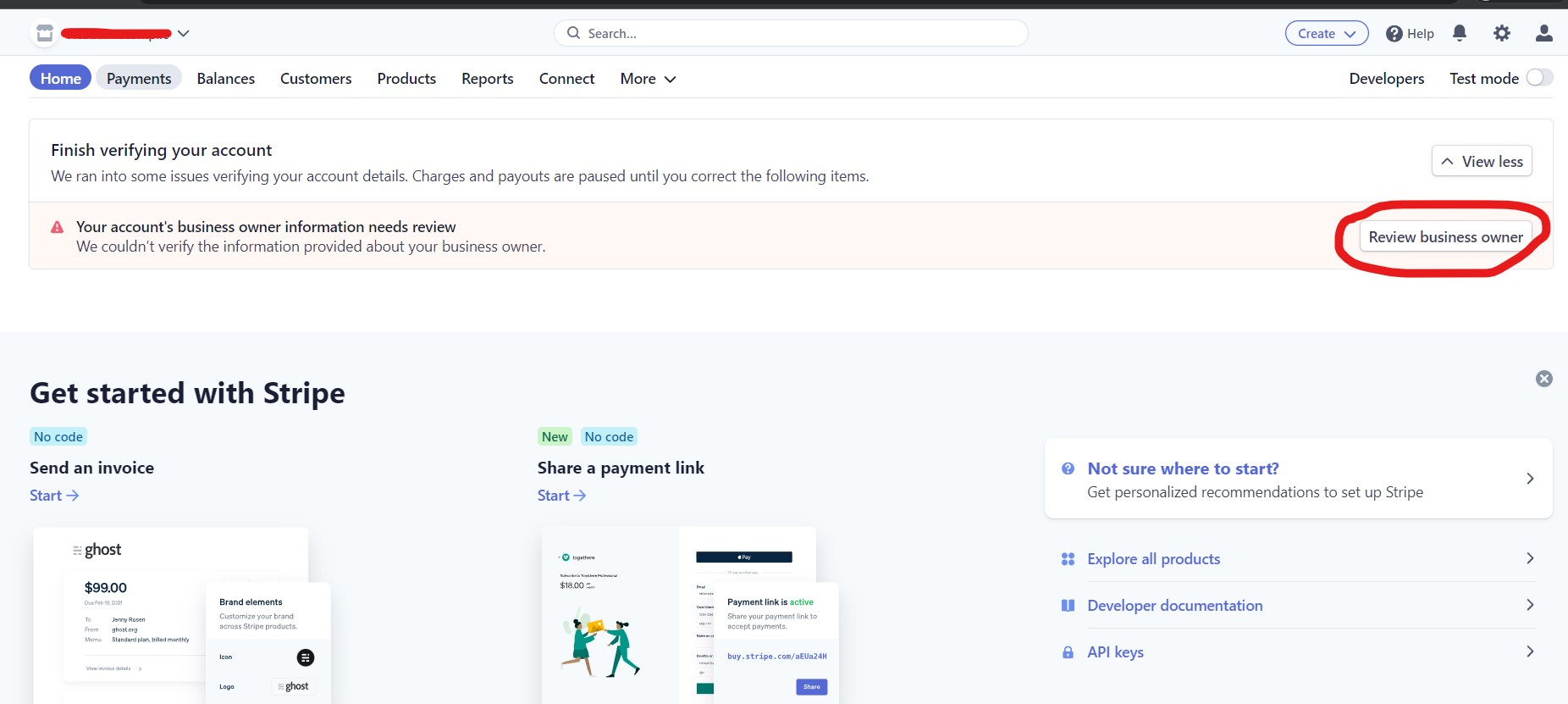

Log in to your Stripe panel again approximately 5 – 15 minutes after submitting the application.

At the top of the panel, you will see a warning that you need to confirm the account owner's credentials.

If you do not see this warning, wait a while and it will definitely appear.

Because you haven't uploaded your credentials yet, the account is not fully approved until you do so.

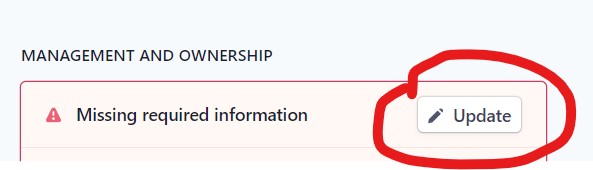

Click the “Review business owner” button to start the approval process.

We mentioned that sometimes there is no country selection when entering identity information.

If it does not appear at that stage, we stated that you should click on the ID upload link.

Now, if this field is active while verifying your TR ID number, select TR from the Country code section and enter your TR ID number in the relevant section.

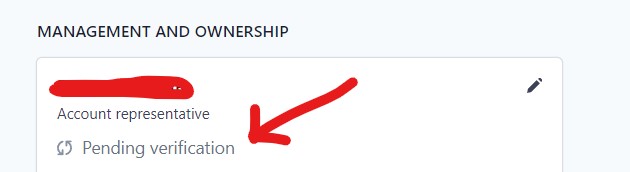

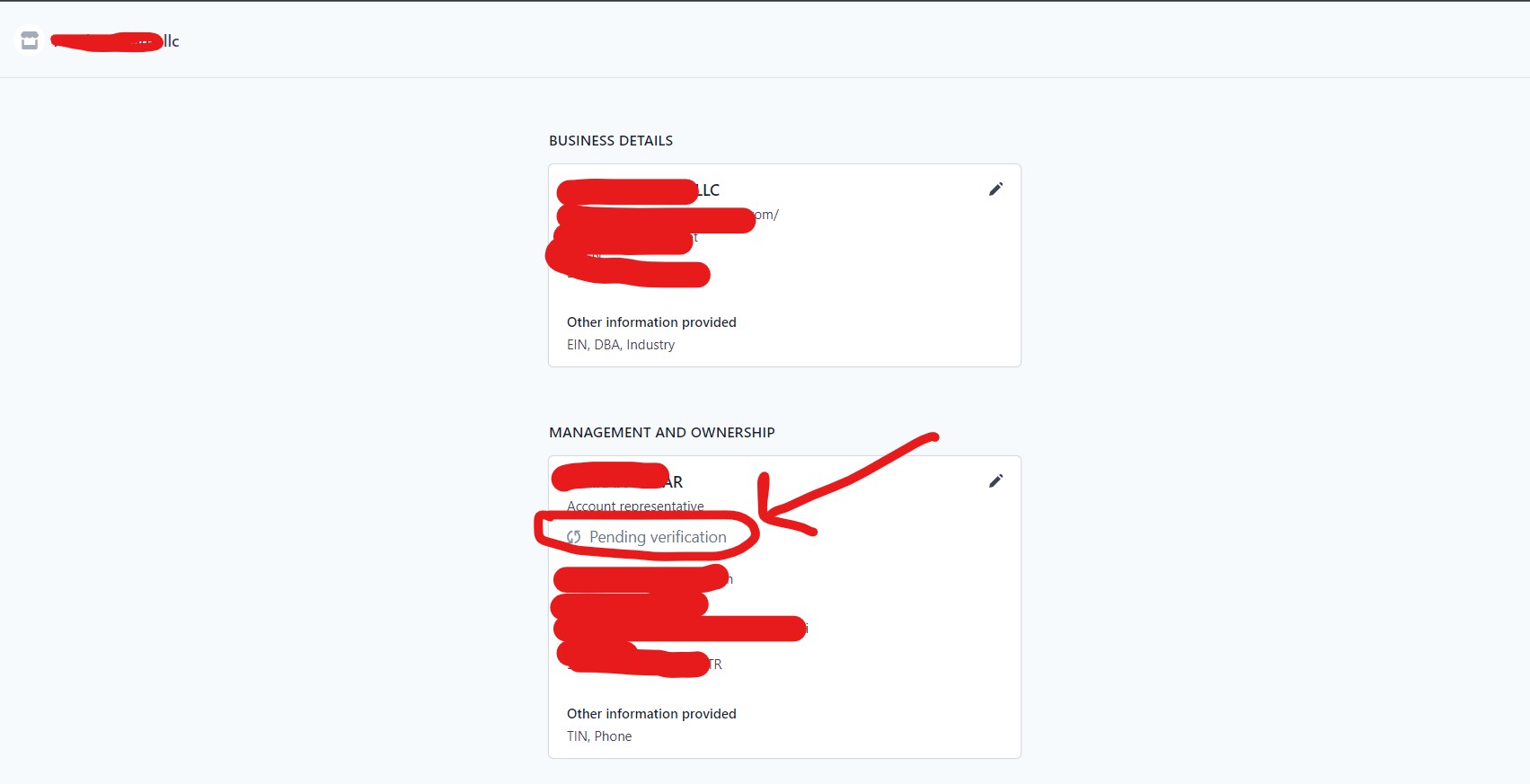

After entering your ID number, you will see that the ownership section is in pending verification status.

After entering your ID number, you will see that the ownership section is in pending verification status.

Click on the pencil mark on the side and follow the steps below.

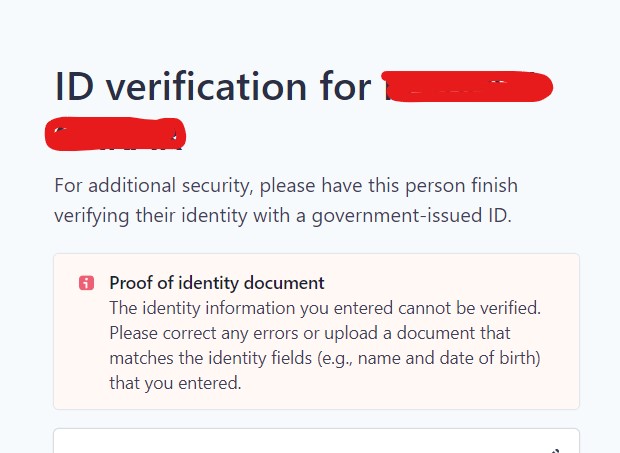

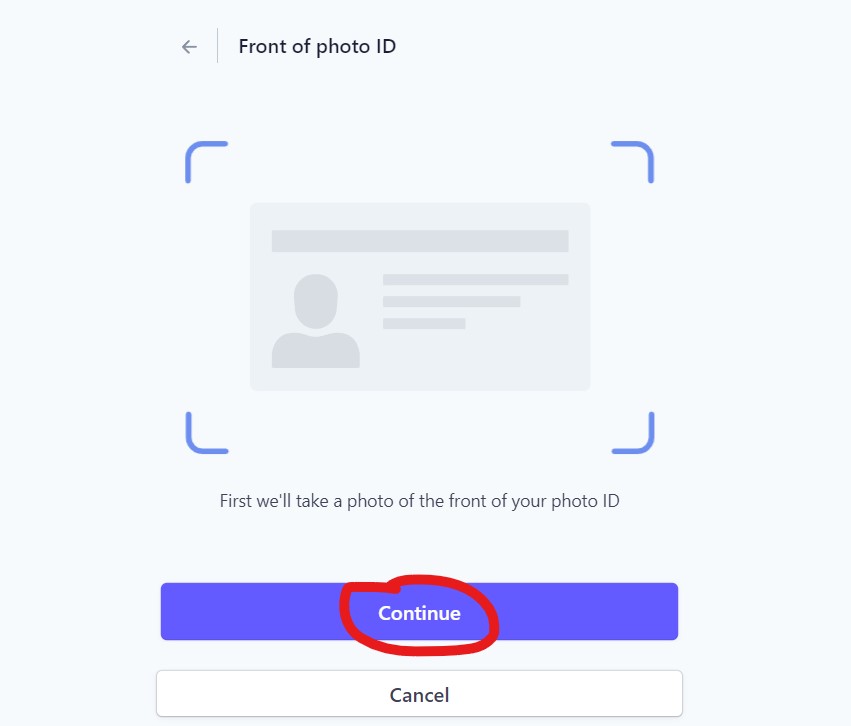

You should now come to the ID verification section.

You should now come to the ID verification section.

In this section, you will be asked to upload the front and back sides of your ID (or passport) separately to the system.

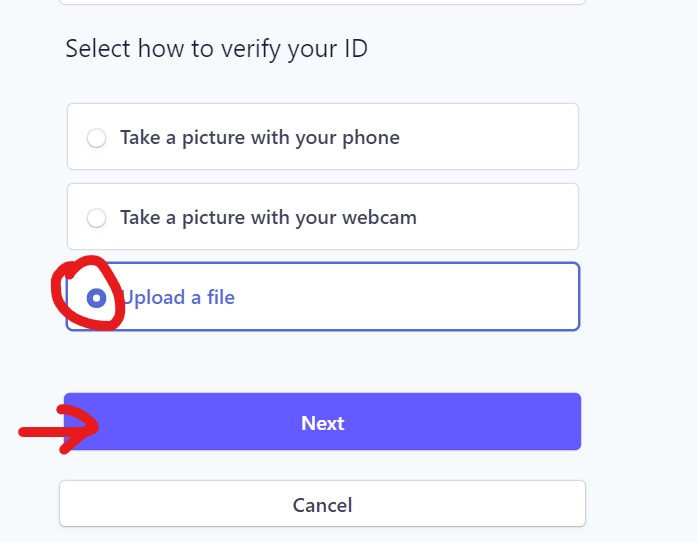

Check the Upload file option. If you want, you can also do this from your computer or phone camera.

Check the Upload file option. If you want, you can also do this from your computer or phone camera.

If you are going to use the upload method here, make sure that the ID photos are of good quality and legible.

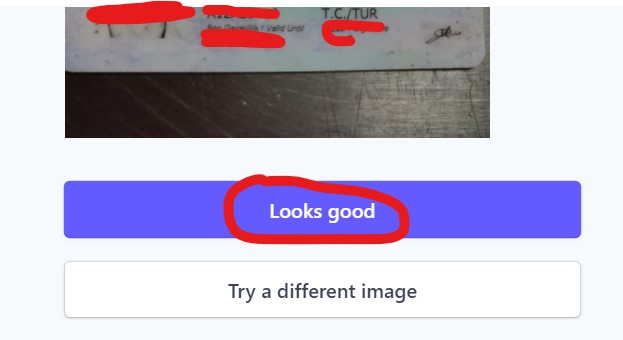

If the Looks good warning appears, it means that the photo will be accepted. Install the back side in the same way.

If the Looks good warning appears, it means that the photo will be accepted. Install the back side in the same way.

After the upload process is completed, it will enter the pending verification status.

At this stage, do nothing, wait for a while and update the page, then you will see that this warning has disappeared.

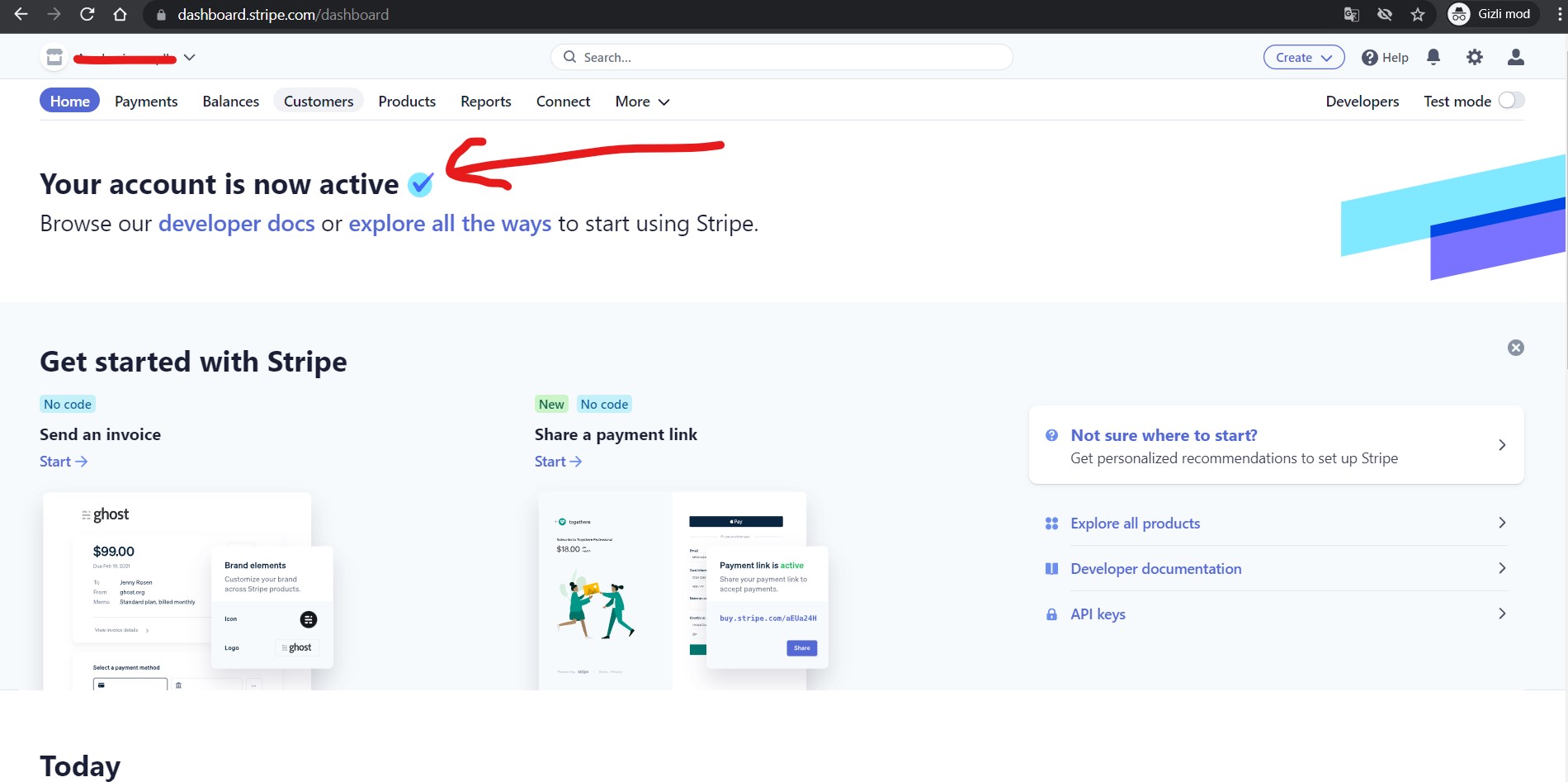

After the identity confirmation is completed, you will see that your account is fully approved on the stripe dashboard page.

After the identity confirmation is completed, you will see that your account is fully approved on the stripe dashboard page.

You will receive an e-mail within a few minutes stating that you can now receive payments.

This is how the Your account is now active message appears in the Dashboard.

After this stage, you can start receiving payments.

Checking Company and EIN Approval Status

Checking Company and EIN Approval Status

To check the approval status of your EIN number and company, go to https://dashboard.stripe.com/settings/taxation

On this page, you can see that your tax information (EIN) has been automatically verified by the IRS and the account has been verified.

When Does Stripe Make Payments to the Bank Account?

Once your account is fully approved, you can now start receiving payments from your customers. After receiving the first payment, the process of transferring your balance on Stripe to your bank starts automatically.

During this process, your bank account is actually verified by Stripe and this process will take approximately 5-7 days.

When your bank account is verified by Stripe, the money transfer to your bank account by Stripe is completed.

In the next process, the payments you collect from your customers with Stripe will be transferred to your bank account after 2 days with default settings.

Stripe Commission Rates

Stripe commission rates are very simple, as stated on their website.

Stripe charges a 2.9% commission fee for each successful order. It also charges a 30¢ (cent) fee per transaction in addition to a 2.9% commission.

Stripe does not charge you any other commission.

If you don't want to pay Stripe any commission up to $25,000 in turnover, check out this entrepreneur-friendly guide titled Get a $25,000 Transaction Discount from Stripe

If you can get approval from the AWS startup activate project, you can save up to $25,000 in Stripe commission rates.

You can also get $1,000 in AWS credits that you can use on your web projects.

You should definitely consider this.

Conclusion

When you complete these steps completely, you will have Stripe, the world's most used and safest payment solution.

The steps and process may seem long, but as of now, this is the most accurate, legal and reliable method of receiving payments with Stripe.

Don't waste your time and money with other alternative and illegal methods.

As a result, by allocating a starting budget of $89, you will have a solution where you can form your LLC company in Usa and start your new venture and online business safely.

We hope this has been a useful guide for you. You can ask anything you wonder about this subject in the comments section.

If you want to open a Stripe account in a country other than the one where you do business, first make sure that Stripe is supported in the country where you will open an account. It means that Turkish citizens who have an LLC company in the USA can open an account.

If you want to open a Stripe account in a country other than the one where you do business, first make sure that Stripe is supported in the country where you will open an account. It means that Turkish citizens who have an LLC company in the USA can open an account.

146 comments . New Comment

I have opened my Payooner business account, but I got everything confirmed, but when adding a bank account in the bank account confirmation section, I can only add a commercial account on behalf of my company, how can I overcome it, should I open a commercial account from a Turkish bank on my company in America.

Another question is that I will add when opening an account from strip, the website is a single -product site and Turkish does this create a problem for me, do I need to create my site again in English?

Thank you.

If you are going to send money to your personal account as a bank account, you need to add it to the buyer accounts. This information clearly writes in Payoneer documents. To pay, you need to add your own buyer account. Single product sites are not a problem by strip, but it is useful to have English or at least double -tongue

The main issue is not to have a business address in the United States, because the prices are usually monthly, the cost of the address is expensive from the cost of the company, but this is passed in the article. When the company opens, we don't automatically an address in the United States.

If you buy a special and unique address, you will be expensive. Already registered agent provides an free address service, you do not need to pay the extra address. If you want to observe again, even on almost every page, this address is mentioned

As far as I understand the probability that Strepe does not accept this registered agent address, we have to get an address service. I have read the article about the addresses, but others may not read, we have to know that we are obliged to form an llc that is expensive than forming an llc as expense, I have no accusation in this article.

Strip is not interested in these addresses, this happens only in the Amazon accounts. With these shared addresses, we have opened accounts to hundreds of companies for years and there are accounts that make trade in large amounts. What is your information and source that Stripe does not want shared addresses? Can you convey in which document of Stripe? Let's evaluate together.

I got the screenshot of my speech with strip chat, but I can't take pictures here. The answer is as follows. I especially asked because I saw this in the forums, and such an answer came. I don't know if there is an exception. Has an llc operating recently opened?

Stripe Requires a Valid Physical Address for Your Business and Does Not Accept Po Boxes Or Mail Forwarding Services As A Business Address. The Address Provided by a Registered AGESTER SERVICE NORTHWEST REGISTERED AGENT IS THYPICALY USED FOR Receiving Official Notices and Legal Documents, Not As Your Primary Business Address.

To us, you can show you can convict operations. This Could Be You Home Address If You Run Your Business From There. Strip may Ask For Documentation to Verify Address, Such As A Utility Bill or Lease Agreement.

Using your own Physical Address, Rather Than The Registeredered ADDRESS, is more likely to be accepted by strip and comply with the requirements for account

Every day accounts are opened and is processing, do not worry, there is no negative situation. Stripe atlas research strip in his own platform he also works in the same logic. Of course, if you have couscies, you can apply your alternative solution if you are not difficult to use. However, they do not problem with agent addresses because the address is not important for them identity is done and the real address is not in the United States that you are foreign to account that you are in the company.

I understood, I thought and decided to open the company. EIN number confused me, Northwest wants $ 200 on the site, how do you give free? Is it enough to go from the link of this site to make your reference? In the scenario where the EIN number is also free, is there any possibility that there will be another expense for this year after the first $ 140 cost?

I will use Strip to receive digital payment for my website, for subscription and in -app purchases.

Yes, as you mentioned, if you go from the reference link, we make an free application. This is related to our income generation, we use affiliate connection. Ein application process is exactly the same. This year you will not have an external additional expense. Enjoy your work

Hello, is a Turkish phone number sufficient to open a Stripe account? Or do I need to get an Usan phone number from Zadarma? Also, how much are the average fees, and do I need to renew my membership once it expires?

Hello, now TR mobile number is sufficient, there is no need for a USA number.

thanks. Should I select TR and enter my Turkish ID number in the SSN/ITIN entry field, or should I enter my Turkish tax number?

Simply select TR as the country and enter your TR ID number.

Hello, I have 6 questions:

1. How should we write the date of birth in Stripe? Is it like in TC or month first and then day?

2. Can the home address in Turkey be written on a single line? For example, is it okay if I write the entire address at the top instead of “Apartment Unit”?

3. Should the “Tax Calculation” feature added to Stripe be turned on?

4. In the Statement descriptor section, I wrote the full name of the company and LLC at the end, but what should I write in the Shortened descriptor section? For example, if my company name is “NAME SURNAME LLC”, should I just write “NAME” there?

5. Should the Show phone number on receipts and invoices option remain on or off? I don't want anyone to call me.

6. In the company address section, I opened the company in Northwest Wyoming. The legal address of the company is 30 N Gould St, Ste N, but you entered it differently. Is it okay if I enter it as 30 North Gould Street?

1. Select it from the form, it will give you the appropriate format, you have 12 months already.

2. Uste mah. Sk. alta building flat number

3. If you are going to collect sales tax, open it, otherwise close it and then open it

4. Write the company name as much as it fits, it appears on the stripe invoices

5. If you do not want it to remain closed,

6. Write it as it is in the company document, both are the same, it does not matter.

Thanks, I have one last question: I will be setting up Stripe for Shopify dropshipping. Should I write my brand name in Shopify or my company name in the Statement Descriptor section? Can this part be changed later?

You can write the brand name

I'm stuck in verifying my home address regarding Stripe. I've been using it for a year. I've just experienced such a problem. I also sent financial documents from Wise, whom I contacted via online chat. I also sent my e-government residence address. It doesn't work. Can you help me how to solve it?

So far, we have not heard that they require proof of home address. Frankly, you can prove your residence address with a bank statement or an invoice registered in your name. Could you have entered a fake address when registering? You had to enter your residence address

Hello.

Now I have SSN mrv. I got help from this address with my company's address. Therefore, would it be correct to enter my company address into my personal address? I will give my Turkish passport during passport loading. I'm so confused, honestly.

Hello, provide your place of residence to the residence address, company address to the company address, passport to the place where passport is requested. There is no need to risk giving false information, read and give what is asked.

Thank you for your comment. I used your reference link when opening an llc through Northwest, both to support you and to obtain an EIN with your support. But later, since I managed to get EIN online with SSN, I did not contact you to get EIN. I wonder if I use your reference link in accounts such as Mercury and Stripe, will it have a positive effect on opening an account?

It has no effect on Stripe and is approved very easily. However, when opening a Mercurybank account, go with our reference, the approval time is faster and priority compared to standard registrations. This is what the bank told us.

Hello teacher, I have a few questions on my mind. I would appreciate it if you could inform me.

– You said that the company's mailing address is accepted if it is the mailing address requested by Stripe. Is this the address given to us in the company setup?

– Regarding the bank account, I have an individual Payoneer account and also an individual Wise account. Is this possible? Or does it have to be a company account?

– When registering, should we register with a corporate e-mail belonging to the company website or can we use gmail?

Hello,

1. Yes, you can enter the address given to you when opening a Stripe account.

2. Individual accounts are possible, but if you want account health and ease of tax declaration in the future, it would be better to open a commercial account.

3. A corporate address is recommended, but if you do not have one, you can also sign up with gmail.

Sir, I think we need to enter a US phone number when opening the stripe. In the comments section of your opening article, I do not receive any SMS or anything like that. It is said that there is no need. Is it enough to give our own number or do we still have to add a US phone number?

You can enter your TR mobile number as your contact number, no problem because it is accepted.

Additionally, you are asked to enter a US number for support purposes, but a verification SMS is not required. If there is a virtual number with a +1 area code, you can enter it in the second part, otherwise you need to enter any number in that part because you cannot pass that part without entering the number.

Hello, I have had $1,600 on Stripe for about a year and I cannot get it back, because we do not comply with the security protocol, they say we will not work with you, I am verifying, but we cannot proceed, how can I solve this issue?

You need to find out what the problem is and fix it by chatting online with customer service. If it has been suspended due to policy violation, it can be very difficult to bring it back.

I am opening my Stripe account with my company in England, but only the residence address does not confirm the location. I would be very grateful if you could help me.

We do not have much information about UK companies. There is no such situation in US LLCs. You can get support through the agent you formed as an llc.

Hello, we have a site in Turkey, it is a high traffic affiliate site. We want to sell advertising spaces with credit cards, customers can be from TR or abroad. It is not an affiliate site against Stripe rules, but it is in Turkish. In this case, I wonder if Stripe will accept this, I would like to get information based on your previous experiences. Thanks

Hello,

Stripe accepts websites in any language if they comply with the policies, but to be sure, prepare a certain part of your website in English and submit your application in that way.

<a i=0>It is necessary to renew the annual registered agent service in Incauthority, this fee is a minimum of $179 per year.</a> <a i=1>A more affordable solution is available at Northwest for $125.</a> <a i=2>You can move to Northwestern if you want, there is a step by step guide here:</a> <a i=3>https://startupsole.com/registered-agent-degistirmek/</a>

Hello,

Have you opened a wise businesses account? You need to pay USD, it would be useful to open a ticket and ask.

If Wise does not open a USD account, you can open a Mercurybank account because Stripe asks for a USD bank account number for opening a US account.

Doesn't let you add other currencies

I deliberately wanted to write a long comment because I may have done more research than anyone else before getting into this business and forming an llc.

As soon as I formed an LLC company and received the ein, I opened my Mercurybank account and then completed the Stripe application. Stripe automatically verified my EIN number and did not ask for it even though I had my EIN confirmation document. I uploaded my ID by simply entering my TR ID number.

I can say that the Stripe account opening and verification process was completed in approximately 20 minutes. I had encountered many negative comments before, saying that Stripe does not open, does not give approval, etc. etc. but it doesn't matter. After reading all the documents on the Stripe website, I came to the conclusion that there would be no such thing as disapproval or rejection.

As long as you do not apply with an illegal site, your site is complete, apply with your LLC company, it does not require proof of address etc. complete lie. In the past, I connected via VPN and applied from the UK with a fake address using a UK SIM card, and even received a payment or two, but when they asked me for some documents, my whole deception was revealed :) and I really started researching how this could be done legally.

I can say that Startupsole has greatly expanded my horizons on this subject. I would like to thank them for their gold mine of articles and try to share and recommend them on every platform.

In summary, if you meet all the requirements (I implemented everything in this article), your account will be approved in an hour and you will start receiving payments. By the way, I also applied to Amazon AWS for Stripe's 25K USD commission free support. With the method in this blog, I hope my project will be approved soon and I will be able to use Stripe without commission for the first year.

Hello, do you think we should use VPN or not? I'm fully in the process of opening stripe.

No VPN required, you can connect normally

I currently have 1 LLC company, as well as corporate Wise and Stripe. When I open a new company with the same name, will there be any problems with wise or stripe? Because even in corporate offices, Wise requires personal approval, such as a passport or ID.

There is no problem with Stripe, but there is a problem with Wise because they may not open an account a second time since you have personally verified your identity. Alternatively, if you resolve the bank side with Mercurybank, you will not have any problems.

But Mercury only accepts customers if they are Usan, what is the alternative?

Apply through an English website, there will be no problem. They cannot track the payment because it will flow through the stripe. Unfortunately, there is no other easy alternative for Turkish citizens.

I made an application with Northwest on Monday, the installation was completed this evening, I set up the company for Amazon and now I will apply for an EIN. Forming an llc seemed very scary at first and I actually had my reservations, but I thought I had to start somewhere and I guess I figured it out. . I would like to thank the administrators of this platform for their support and creating a wealth of explanatory information for us.

Thank you very much for your positive comment. EIN numbers are arriving very quickly these days. If you apply immediately, your EIN number will arrive before the end of the month. Congratulations

Hello, I opened an LLC company from incauthority last year from Kentucky. I also opened Stripe and Wise business. My question is, if I don't renew this year, will anything happen to Wise or Stripe because the company is closed?

Of course it can continue, but it's a strange approach.

I received a renewal notice email from Inc Authority. When I click on the link in the email, this appears. If I choose one of them, will it be renewed?

https://i.snipboard.io/BroyAI.jpg

And if we don't renew, will Stripe know about it and ban us? Thanks.

It is necessary to renew the annual registered agent service in Incauthority, this fee is a minimum of $179 per year.

A more affordable solution is available at Northwest for $125.

You can move to Northwestern if you want, there is a step by step guide here: https://startupsole.com/registered-agent-degistirmek/

This will not affect the stripe and you will not be banned, but if you do not designate a Registered Agent, your company will be labeled as bad and then terminated by the state.

I provide services in the yacht rental sector, company setup and phone number, everything is ready. There is only one thing that bothers me right now. I take reservations through the site. When I look at Stripe, I think travel reservation sites seem to be in the risky group. In this case, what can I do to gain additional acceptance? Or if I apply directly, will it be accepted?

In fact, your business falls into the category of travel rental (Rent), which may not be a problem at first, but if a manual review is made or you are caught in a sector filter that is not really accepted, your account may be suspended. You won't know until you try this, if it is suspended, they may reactivate it if you send a support request and inform them that your customer portfolio is stable and there will be no chargebacks.

If they directly suspend your account and do not activate it, you may need to look for a payment gateway client that approves high-risk transactions as a plan B. Search "high risk payment gateway" on Google and see the alternatives that come up, try to get approval by sending an e-mail and explaining what you do.

I want to do Shopify dropshipping. Do you know if Stripe allows this?

Yes, Stripe allows this. The important point here is that your Shopify site complies with Stripe policies. It is possible to get stripe approval for all e-commerce sites that have full and completed content.

I'll ask again, just to be sure. I'm sorry, because I don't want to be rejected by Stripe or suspended after a month. I've been working on this for a long time, but I'm pretty tired now...

Until a few months ago, they had separated the objectionable business types by country, now they have gathered them all under one roof https://stripe.com/restricted-businesses There is also drop shipping among them, you are sure that they allow it, right? Have you had a shopify dropshippingcci customer using Stripe recently?

We have many followers who are engaged in dropshipping and use Stripe integrated with Shopify, and we even have Stripe accounts that are verified for dropshipping purposes by providing consultancy ourselves.

Stripe does not allow dropshipping for businesses in the Asia-Pacific or EMEA regions. Stripe accepts dropshipping for LLCs formed in the USA. By the way, there is not even an option regarding dropshipping when opening an account, it only allows the selection of sector and sub-sector. It would be in your best interest to not include any warning or content regarding dropshipping on your website.

The important point is that you do not have content on your website that does not comply with Stripe rules, copyrighted products, etc. not to keep it. If you pay attention to this, you can focus on your work without any problems.

Thank you very much. I will not make any mention of dropshipping on my website. So, what should I say if I receive a direct question from Stripe such as "Do you do dropshipping?" or "How do you source the products?" Should I be honest?

You're welcome

Frankly, I don't think you will be asked this type of question after Stripe is approved. Accounts are usually approved automatically on the same day. As long as there are not too many returns and your website is prepared within a framework that complies with policies, you will not undergo manual review.

However, if you receive such a question in the future (it is not a common situation), you can say that you buy products from the supplier and sell them to my customers. Keep your product purchase invoices, receipts or slips aside, just in case.

Hello. I am reviewing your blog and trying to become more familiar with the subject. The thing that comes to my mind is, isn't it one of the companies that provide Stripe payment services, like Payoneer or Wise? In other words, why should I open both Wise and Stripe when I open an LLC and can handle my transactions with Payonee or Wise (I wrote it that way because I thought I could handle it, there may be a situation I don't know about). To be honest, I couldn't understand exactly what stripe is for.

Hello,

Stripe is not a platform like Payoneer or Wise. Stripe is a virtual POS system, that is, a system where you can collect payments from your website by credit card. Wise or Payoneer are digital banks, they do not have the same function as Stripe.

With Stripe, you make a payment by credit card from your website, the money is transferred to Stripe and automatically transferred to your Wise or Payoneer account one business day later. So, the two are different from each other, but after all, you also need a digital bank account such as Wise, Mercurybank, Relay or Payoneer from which you can withdraw the money accumulated on Stripe.

I think it's been about a year since I opened it, and I received an email asking what should I do?

https://i.snipboard.io/zudLYc.jpg

Hello,

It is a general reminder e-mail for the tax season, which they automatically send to all LLCs they establish. All you have to do is fill out form 5472 -1120 between February and March and you can get service from https://oandgaccounting.com They send you your company documents and a simple table to fill out, they make the necessary declarations when you pay the service fee, so you can focus on your business with peace of mind.

Thanks for the answer. Since the customers are in Europe, there won't be much tax, right?

You will not pay taxes; if your income is not in the USA, no tax declaration is required. You only need to fill 5472

Thank you for the information, is it enough if I fill out 5472 and send it?

Do you know how and where to send it?

It is also said that it is necessary to add the 1120 form as a cover, these operations can be done by an expert professional.

However, the decision is yours, be aware that if it is done wrong, there will be problems.

Where you mentioned, the cheapest service is 500 USD, which is almost 7000 TL. Is there any other solution, or where can I get information about the documents I need to send?

Since the dollar exchange rate is high, it is normal for it to be 7000, but there are dozens of services out there, we do not know which section you are looking at, form filling fees may vary depending on the structure of the companies, so we recommend that you contact and get a quote for 5472. If you search our website about documents, you can find a lot of information.

By the way, we do not have any partnership or connection or income with this company. We only recommend it to those who want accountant advice. We recommended it because we work with the same company ourselves, you are not obliged to work with them. There are dozens of companies providing this service on the internet, you are free to search and get prices, as always. But you should know that it is not a job you can do on your own.

Hi,

I founded the company in Michigan. However, I did not write the company office address in the certificate of incorporation. Only the address of the registered agent INC AUTHORITY appears as the address. For the EIN document, I gave my address in TR. In this case, I think it is impossible to verify the address?

I created my website on Shopify. But I got rejected from Shopify Payment. The reason is that my main activity is not in the USA (or other applicable countries).

When there was no Shopify payment, I considered Stripe. I guess that won't happen either? Because I cannot verify the address. If I give the address of the registered agent, there may be a problem.

Do you have any advice on the subject?

If not, which other payment system would you recommend?

Thanks in advance for your answer.

Why did you use the Tr address in the EIN? Where did you reference this from? I wish you had done some research, anyway, now you can follow this path.

By the way, shopify payments is not used for non-US citizens anyway, shopify does not allow this, it asks for your SSN, and since you do not have this, do not try to use shopify payment.

To solve this, they open a stripe account. You can also open a stripe account (if you have an EIN) and receive payments by connecting to stripe via shopify. Stripe does not ask you for address verification or does not care which address is written on the EIN document or company document. If you have an EIN and your company is active, you can open a stripe account, integrate the payment system into your website and start collecting.

Note: When opening a Stripe account, you can write the registered agent address to the company address, it will not cause any problems. Type your real address in TR into the home address section and you will open your account without any problems. Of course, you must have a website that is supported by Stripe.

Actually, I opened the company with the information on your site. I gave my own address in case I received a document for EIN. (I read that somewhere too, but I don't remember).

There is no problem with SSN, it is available but it did not work in Shopify.

My hesitation and question is this:

Let's say that when we opened the account on Stripe, we made the first verification. I guess it asks for address verification after a few sales. If it requests address verification, will the Company accept the Registered Agent's address in the incorporation certificate? In case of failure to verify, does it suspend the account and the amount in the account?

Also, I guess the old ID is not valid for identity verification. Is there a problem if I use a passport?

Finally, do you know about alternatives to Stripe? Maybe the rules are not so strict, it's less risky?

I know you may not have the answers to these questions, but I wanted to ask in case you have experience on the subject.

Thanks again.

Once there are a few sales, it doesn't ask for verification, stripe doesn't want address verification anymore. Sometimes it asks for the spouse's certificate, although rarely, or the company establishment document but no other documents.

They already know where you reside.

Enter the registered agent address, it accepts.

The account will not be suspended as it will not require address verification.

You can use your passport if you have the passport's guarantee that negative ID will not be accepted.

Currently, there is no platform that gives approval as easily as Stripe, in fact, you can get approval more easily from virtual POS in Türkiye. Your website or products just need to comply with the conditions.

You own a company, why did you condition yourself to not get approval? Why should the account be suspended?

Stripe is a business, after all, it receives commission from you and this is how it survives. Your only obligation to them is to do business in a healthy, honest and appropriate manner.

If you have your account number, do not worry, it will be verified in a few hours.

I read in a few places that they suspended their accounts and their money remained blocked.

I may have been conditioned when Shopify Payment also returned negative.

Regarding requiring address verification, does it only apply to LLC companies or does it not require it in general anymore? It is said that after a certain turnover or money inflow and outflow, it is suspended and some verifications and documents (service invoice from the company address, etc.) are requested. How true is this? If you give me information, you will make me and many of my friends very happy :)

We have been using Stripe for 10 years and have never had any problems. No platform suspends an account without reason.

Conveniences.

Regarding requiring address verification, does it only apply to LLC companies or does it not require it in general anymore? It is said that after a certain turnover or money inflow and outflow, it is suspended and some verifications and documents (service invoice from the company address, etc.) are requested. How true is this? If you give me information, you will make me and many of my friends very happy :)

Stripe has not required address verification for LLC companies for a long time. The reason is that last year they started to verify citizens of many countries, including Türkiye, with their citizenship numbers.

When opening a Stripe account, the company owner now selects the country, enters the citizenship number of the country he is in, and uploads his ID card to the system and it is automatically approved.

We have customers who make very high turnover in the accounts we opened, and we have never experienced a situation such as suspension or address verification during this process.

If you are working with Stripe, there are two points to pay attention to. The first is customer satisfaction and the other is to apply with a business model that complies with Stripe policies. If your customers are satisfied with you and you do not receive excessive returns and complaints, your account will never be closed. Although it is not requested at the first stage, they may very rarely ask for your company documents or your spouse's approval letter. Other than that, they don't need address verification because they already know that the owner resides in another country. The fact that the company is formed in the USA, a website that complies with quality policies and an e-mail number for the company are sufficient for Stripe.

Brief Information: Stripe constantly updates the registration form and approval processes during membership. For this reason, you can find the most up-to-date details about account opening and approval processes in the article linked below.

https://startupsole.com/turkiyeden-stripe-hesabi-acmak/

Sir, on the Business Representative page, there is no option to select tr and write TC in the SSN section. Could there be an update?

Hello,

Yes, a change has been made. Write the last 4 digits of your TR ID number in that section. You will be asked to upload your ID and they will correct it manually at that stage. No problem, continue opening your account this way.

thanks a lot,

best regards

Good luck, good luck!

I don't understand why we enter the USA LLC address in the home address section, if we can open it from Turkey without any problems.

You do not enter, there is no such information transfer. Because there is no section called Home address.

When entering your personal information, you will now see the "home address" section and in this step, all you need to do is enter your USA LLC's mailing address.

You said that, that's why I said it. So, if I use it with my Usan fixed IP VPN, will I get stripe?

At the time the article was written, there was a home address section, but Türkiye as a country did not allow selection, so we wrote the LLC company address in that section. From time to time, Stripe may make changes to the forms during the registration process. I remember that the home address was not entered in the last updated registration process. We will check it again and update the article by taking the time.

By the way, if the home address section is added to the form again in the future and Türkiye appears among the options, you can select it and enter your TR address, there will be no harm in this.

If you have an LLC company, enter all the information correctly and you do not need to use VPN or VPS at all. Because they already know that you are connecting as an llc owner from Türkiye and they allow it. If you enter all the information correctly, you will not try to deceive the system because the registration process is not against the rules since it is on the company.

6 October 2021

Where and with which agency did you form your company? Why is your Türkiye address written in LLC Articles of Organization?

My company was founded in Wyoming state. I had it installed by an accountant I know a year ago. At that time they also added my Türkiye address. In the LLC Articles of Organization document, only my Turkish address is written in the "The organizer of the limited liability company is:" section, and in the remaining parts there is a physical US address in the main workplace and mailing address.

In other words, it was a very unnecessary installation. It is difficult to guess on what basis the Turkish address was entered. It is not known whether there will be problems in the future, after all, these documents may sometimes be requested for address verification. It is difficult to predict what will happen at that stage, if you continue to be in contact with the person you know, you can ask them to send an application form to the state for address change. Does Stripe support Payoneer platform? We don't know, if it's a corporate account, maybe it won't be a problem. While there is Wise, Payoneer is a bit unnecessary because transfer fees are incredibly expensive, cash withdrawals from ATMs are charged in dollars even for balance inquiries, and fees are inconsistent. However, it is your choice, if you wish, you can contact Stripe support and find out whether they support Payoneer accounts.

ITIN is not required for Stripe because it now allows TR citizens to enter their identity documents, so it is not difficult for them to guess that an account has been opened from TR, in short, there is no need to add it when the ITIN arrives. ITIN will be useful when opening Paypal. It will be useful to open Paypal by entering ITIN.

Hello, among the free website providers (Wix, Godaddy, WordPress, etc.), is there a service provider that you recommend or that you are satisfied with?

You can use Wix or WordPress which is free. Godaddy is very bad and not flexible at all. WordPress is the best among them

ok thank you very much

Hello, my EIN number arrived today. I followed all the steps one by one. Although everything is okay. It still doesn't ask me for verification such as enter your SSN or ITIN number. What should I do in this situation?

Enter your TR ID number, read the article carefully, and when you reach that stage, you can open an account by selecting TR as your country and entering your TR ID number. Accounts are now opened this way, in a differentiated manner specific to each country.

Thank you, I have one more question. Thanks to your guide, I formed an llc and received EIN service. My EIN has just arrived, but I was told that some documents will be sent to the mail address I rented (by incAuthority). Is 147C (confirmation of ein letter) included in these documents? Stripe asked me for this document for verification. If it is available, I guess I just have to wait for the document to arrive. Am I right? By the way, your guides are very useful, thank you again :)

Hello, this document is sent to you by the IRS and you will receive it approximately 2.3 weeks after the fax is received. Stripe sometimes asks for this document, so it is important and you need to wait for it to arrive.

We can also use wise when opening a Stripe account, right? Or do I need to open it with Mercury Bank first and then connect it to Wise?

You can use Wise. First, confirm your Wise or MErcury accounts, then you can select and enter one of them at the stage of opening a Stripe account. Stripe supports both Wise and Mercury bank accounts.

Hello admin,

I am in Stripe test mode, as you said, I waited for a while and they asked for ID confirmation, I uploaded my new type ID maybe 5 times, but I get an error like it cannot be read, in fact, everything is clearly visible in the picture, I remember that on the front of our IDs, the date of birth is the day, but it is in the USA. It came to be that there was a moon ahead?

I will try again after writing this comment, but is there anything different that can be done?

IMPORTANT: By the way, Zenbussines has removed the free reg agent for the first year, and they automatically deducted around 150 dollars from my card in the first year.

Stripe cannot read digitally uploaded IDs most of the time. Send a support request. They will approve your account manually on the same day. There is no problem.

We encountered a similar situation just two days ago. They approved the account manually immediately.

Zenbusiness removed the free registered agent service for the first year at the end of last month. We made this change in our articles, but you are right about this, they charge service fees for companies formed in the past.

Unfortunately, there is not much to do about this; companies can sometimes change their operational policies. Using a virtual card as a precaution always makes sense in such situations. If they didn't get paid, you could move to another agency (wyomingmailforwarding.com you can move for $50). If the fee is high next year, consider a different agency.

Hello,

as far as I understand from what I have read, we open the company in Kentucky and use our wyomingmailforwrd address.

Now, when I look at the comments and the examples above, something different occurs. In the examples, your kentucky address is present, but we established the company with a wyoming POSTAL address.

I applied for Mercury today and wrote my Wyoming POSTAL address in the address (as the company address).

I wonder if our company address

, "The street address of the company's initial registered office in Kentucky is"

?

Or

“The mailing address of the company's initial principal office is”

the address at the bottom of this article?

So which address should we use for bank and stripe wise applications?

By the way, thank you very much for the information you provided.

Hello,

Your company is formed in the state of Kentucky, but your office address is in Wyoming, so in this case, you will enter the mailing address you received from Wyoming wherever you register. Don't be confused because the situation in Usan companies is different from Turkish companies. When the company is in Kentucky, the mailing address (principal office address) may be in a different state, but the company remains a Kentucky company.

First of all, thank you very much for the information you provided. I connected my bank account at Mercury Bank to Stripe. I think Mercury cannot open accounts for currencies other than USD. When I sell in other currencies with Stripe, can I withdraw it from Stripe as USD? If I can withdraw it, how much is the commission for converting it to USD?

You're welcome. It's a good question. Let's try to answer it in detail.

Mercury trades with USD, they clearly state this on their website, please see. https://help.mercury.com/t/60h3d0p/other-currencies

If you want to work with another currency you can use Wise https://startupsole.com/go/transferwise/ or Veem.

Stripe can collect in 135 currencies and accumulates each currency in separate balances. They have such a procedure to avoid losses in currency translations. If you work with a provider like Wise, you can transfer the balances of different currencies you have accumulated through Stripe to separate currency accounts. This way, you won't lose anything from conversions. Detailed information about this is already stated in the stripe instructions, see. https://stripe.com/docs/currencies/conversions

After all, if you use Wise and assume that you receive money from Stripe to your Wise account in 10 different currencies, you can convert it to your local currency at the current exchange rate with Wise and transfer the money to your country. Translation and transfer fees are quite economical at wiseta. You can calculate by looking at the transfer and translation tools on their websites.

I hope it was useful for you.

Thank you very much, teacher. You explained it very nicely. I was going to ask one more question. I opened my Stripe account yesterday, I received a warning from Stripe asking me to upload a document that matches the date of birth information you provided during identity verification. I tried 2-3 times in a row from Stripe and finally it accepted. Does this cause a problem with authentication? And it did not ask me to upload documents for address verification. When will it ask for address verification? Do you think I should start using Stripe now?

Hello,

Stripe does the pre-verification with its automatic bot system, you first ask for your ID and you are approved.

It does the actual verification when you trade and start receiving payments and transferring the money to the bank. At that stage, they will ask for your EIN document or company formation document. Once you provide them, the account will be fully opened and you can use it unlimitedly. There is not much verification about the address anymore because they know that American companies were founded by foreigners.

There is no full approval without doing any trade and transferring money to your bank, all the way to stripe... Generally, they do not ask for confirmation regarding the address, they ask for the ein document about your company. Then they won't want anything else from you.

Thank you very much sir, the information you provided is really valuable. I'm reading everything you write.

Is there any problem if we write the address in Turkey in the home address field?

What should we write to avoid any problems? I use Wise.

No, the USA address is written on both parts. You just need to select Tr in the SSN section and enter your Turkish ID number.

Okay, they only accept customer support number US number;

https://i.snipboard.io/fhGDAE.jpg

Where do you recommend we get a US number?

Generally, Zadarma is preferred because it is easily verified, but Sonetel is a little more secure with address verification, identity, etc. They ask for address verification with an invoice. These are available at affordable prices. I can also recommend skype one step above.

Hello, I wanted to open an llc with you in Delaware, but this friend's experience worried me. If sending back a document costs 500 dollars, this is already a small profit in small businesses. Is there anything I missed? and something else. How do payments transferred from Mercury or Wise reach me at banks in Turkey?

Delaware is a state with a franchise tax of $300 per year. For this reason, it does not make sense to form an llc in Delaware unless absolutely necessary.

If you are going to do Amazon business, you can form it in Wyoming, or if you are going to sell products or services from your own website, you can form it in New Mexico, which has no annual expenses.

You can make transfers to your country on the same day via Wise or Mercurybank, there is no problem with the transfer.

If we add an American company, does the phone have to be from America?

Don't get me wrong, but believe me, getting phone number service from other countries is very risky, I blew up 2 accounts like this. I used another country's phone number service and 2 minutes later I received an e-mail saying that we cannot work with you, and this was the case both times.

It doesn't have to be Usan, it also supports +90, by the way, it might make sense to use 2-factor, it's safer than SMS.

Thank you, but can I use Stripe with a business account from Transferwise and an LLC company from the USA instead of Mercury?

We currently receive all our payments via Stripe + Wise. We have been using this combination for about 9 months. After a few transfers, Stripe starts processing payments the next day and passes to Wise 1 day later. If we make the transfer to our TR bank account via Wise in the morning (on weekdays), it will arrive at noon. We have been using this cycle for a long time.

Hello, Wise no longer provides dollar accounts. I also opened a Payoneer account. How do I connect it with Stripe? Thanks

Hello,

you can add your new account number to the bank information section in Stripe dashboard, it is quite simple :)

Friends, do not use Stripe, because Stripe is a big company that lives by setting a trap for small businesses. They perceive you as a risky customer at any moment of your business and keep your money indefinitely. You have no guarantee to avoid this situation. Even though everything I had was legal and in accordance with the rules, they literally robbed me of 23000 dollars. They said they will release it after 120 days. The 210 day period is still not there, they extend it every time. Since I have read such complaints a lot in trustpilot etc., when I opened the account and got it approved, I asked the customer representative, I said review my account, if everything is OK, I will start receiving payments, I had the account reviewed, everything has been completely verified, you need something else. He said no, I still have the screenshot of the conversation. There have been no chargebacks or suspicious situations in my sales, my customers have always given 5 stars on Google Review, my purchase and sales invoices are all in accordance with the money they have held for 210 days, no return or refund complaint has come to Stripe, most importantly, there are 100s of people in my situation, complaints in the USA. I did the situation, they removed the clause from the contract and put it in front of me. Stripe can keep the balance indefinitely if he wants, he can close the account whenever he wants, etc. I have given up hope of getting that money anymore.. I work with Authorize.net, my mind is at peace...

Get well soon, this has truly been a difficult situation for you. I wish you would have stopped the process when they blocked your money and switched to another payment infrastructure, so you wouldn't have accumulated so much.

Personally, we have been working with stripe.com through the USA company for years and payments are transferred to the account within a maximum of two business days. We have never experienced this type of problem.

Stripe is a very big company and Shopify made a huge investment in Stripe last week. I do not think it is this type of fraud, there is definitely a different situation, of course there should be an explanation for this, it is not normal for them to put you in this situation.

Also consider alternatives such as 2checkout, it is always beneficial to have a backup, because that's what we do.

Get well soon again.

Hello İlker, when you sign up for Stripe, everything happens automatically. The site you send, the documents, even the images of the directory are automatically approved. When the dispute rate exceeds 1 percent, Stripe bans you. Also, for example, selling likes on social media or YouTube hits, etc. is prohibited. You get banned because you get caught up in one of them. The same thing happened to me many times.

Dude, I live in England and my company is registered in England. I verified my identity with a British residence card. My company, formed in England, is still active and I have provided all the documents. The products I sell are physical products, clothing and accessories, and as I said, before using the account, I had the customer representative check it twice, he said it is a perfect account, no problems. There is not the slightest objection to my sales. However, it was closed after the 50th transaction. Is it because it is a high-risk sector? Actually, I solved the issue. Stripe is an llc that works entirely with bots and makes decisions. Bots regularly check your site. I was in a situation where it accidentally removed the flag. The incident ends unfortunately, it is very risky, doing business with Strip can happen at any time and you have no rights according to the user agreement, the money sent to Strip is not yours, my advice to you is that if you have a corporate structure, work with Adyen. It is difficult to open an account, but once you open it, you will be treated like a potential fraudster. There is an llc that does not see

Even though you never filed a dispute, you got banned, right?

Yes, if he said it's high risk, it's something related to the industry, sometimes things happen that, for example, if you are in the clothing industry, even selling a t-shirt with marijuana on it puts you in this risky section, there is probably something you overlooked.

There must have been a problem and there must be an explanation, otherwise such a situation is unacceptable out of the blue.

Why would something like this happen out of the blue? Is it that easy to collapse into money? Stripe is a very big company and I have been receiving regular payments for 5 months with Wise, no problems. We even formed our second LLC in WY for a new project and received Stripe approval. If you're in a high-risk industry, look for payment gateways that accept high-risk projects. There are POS systems that even accept betting sites. Stripe is good, no problem.

Hello sir, can we open a stripe account in England by opening an individual account without opening an llc? I opened paypal and I want to open stripe using the same addresses. Is it possible without opening an llc?

Hello,

If you live there, it is possible if you can prove your citizenship and residence as documents.

Otherwise, even if you open the account via VPN or illegally, they may approve it at first, but if they ask for verification after receiving a few payments (sometimes without receiving it), you will not be able to pass. For example, UK ID and UK address proof. We are already forming an llc to avoid such situations.

Sir, what do we call home address?

We leave the ssn blank?

The address of the company in Usa should be written in all address fields. When opening an account, you need to enter the address of the company since you will be opening an llc account, because these addresses are verified with the company formation certificate.

You can type "0000" in the SSN section and enter EIN in the company's tax number field.

With the new update, it is necessary to select TR instead of SSN and write Turkish ID non. When you upload your identity document, it is automatically verified. They already know that we are Turkish citizens and trying to receive payment through USA LLC. In other words, we are not trying to deceive, on the contrary, the calculations are cut more firmly.

So will we have an SSN number? Should we also get an SSN rather than an EIN number?

SSN is given to US citizens, otherwise you cannot get it even if you want.

No, you are wrong about this. Any foreigner can get it, you just need to have a work permit in the USA.

Yes, you are right, but if you look at it, SSN is not only limited to those with work permits, but also in many cases such as education, green card, temporary citizenship, visa classes, etc. Instead of writing all the terminology one by one, the term citizenship is used. A follower who already knows these terms will not ask this question under the strip. This is not our topic, this time it seems that you need to get a work permit to open Stripe, you need to write a lot of comments to get out of the situation...

It's a somewhat ambitious and broad interpretation that anyone can understand.

I meant everyone with a work permit. Yes, you are right, SSN is given according to many criteria, but when I first saw your comment, I perceived it as a situation specific to US citizens only, and it seems that way, so I thought I would write it down, so that others would also be aware of it, respect.

Hello, let's say we bought an individual LLC company and a Mercury account, what percentage of taxes do we pay?

Hello

I understand which tax you are talking about, no tax is paid to the bank. Did you mean money transfer commission?

Sorry, I'm new to this, I read everywhere that Stripe has very strict rules and that it keeps money after 1 percent chargeback and causes problems, so I examined other payment infrastructures and almost all of them want an American company. Then I looked at this page of yours, https://startupsole.com/inc-authority-ile-amerika-da-sirket-kurmak/ and I thought it made sense to establish a company in Kentucky. As for my question, let's say we established an individual LLC company and opened a bank account through Mercury, what will be the taxation procedure? I would appreciate it if you could inform me if there is a penalty if we do not tax the money received or how the process works.

It's okay, confusion is normal at the initial research stage. Actually, the answers to your questions are available in this article;

https://startupsole.com/amerikada-vegilatma/

To summarize, when you establish a single-member American LLC, you become a structure that is not taken into account by the IRS (Tax Office). If you do not have an office, affiliated representative or employee in the USA, you do not pay tax (when you exceed the limits, you only collect and declare sales tax, the limits are here: https://startupsole.com/yabancilar-icin-abd-eyaletlerini-gore-satis-vergileri/ ) but two In accordance with the national tax agreement between countries, you pay your income tax in the country you live in. This aspect is also quite interesting. As the amount of money you transfer to TR increases in the future, in order to avoid tax audit, you can go to the tax office of the district you are in in TR and pay my tax with my TR ID number. You can say you want to pay individually. What really matters here is your turnover expectation. If you are selling to the USA, the states have limits, if you exceed them, you will collect tax. If you do not have income within the USA, you do not need to collect sales tax.

IRS resources: https://www.irs.gov/businesses/small-businesses-self-employed/single-member-limited-liability-companies

List of companies specializing in e-commerce for consulting accounting firms: https://startupsole. com/amerika-muhasebe-firmalari/

Also, the tax form you must fill out every year as an LLC owner: https://startupsole.com/abd-vergişma-form-5472/

Thanks for the detailed answer. When you say "state limits if you are selling to the USA", did you mean that the users I receive money from are Usans? Another question, I looked at state limits and the limits on the number of transactions caught my attention. My product is a membership with digital currency and the product costs about 7 dollars per month. 200 transactions per year is quite low, so do you think it would be more appropriate for me to choose a state that does not have a transaction limit? Which place would you recommend with low opening costs, such as Kentucky?

Yes, the paying users are Usans. In monthly digital sales, every transaction is counted, that is, 12 transactions per year are counted for one person, so in your case, you have a quota of around 15 customers in a state with an annual transaction limit of 200. When you reach this limit, you will either not make any other sales to that state within that year, or you will choose states that do not have a transaction limit, or you will collect the sales tax from the customer (7 dollars x state rate) and declare it to the state (in the next tax period), and you can do this by agreeing with an accounting company. It is necessary because they have procedures.

By the way, these limits have nothing to do with the state where the company is located. The limits are general no matter where you form an llc.

Currently, the state with the cheapest opening cost is Kentucky. Wyoming or New Mexico are also states with very low annual and opening costs. It's up to you to choose Kentucky or a different state. If you choose Kentucky LCC, if you do not pay your annual 15 USD franchise tax, your company will be automatically suspended and stopped and you will not have to deal with closing it.

“By the way, these limits have nothing to do with the state where the company is located, the limits are general no matter where you form an llc.” Then, as far as I understand, these state limits are the limits of the places where the users who pay us are located, not the limits of the place where the company is formed. I understand now. I don't have any other questions now, thank you very much for your help, I will register through your reference links, I will open an llc and a bank account, I will write to you if I get stuck somewhere, thank you.

Yes, you understood correctly, sales tax is general, it has nothing to do with selling to the state where the company is located. I wish you success in your new job. If there is a problem, we will try to support you as much as we can. Best regards.

Thank you very much for providing us with this valuable information free of charge.

There are 2 problems. If it were all about opening an llc in Usa for 150 dollars, everything would be very easy and simple. First of all, when you open an llc in Usa, you will be subject to a lot of taxes. I would like to remind you why the biggest companies such as Google and Facebook foot the bill in another country. Secondly, Stripe does not require you to become an llc. You can open as an individual, but you will need to verify your address and ID in accepted countries. Let's say we gave 150 bucks and opened it as simple as you said, how will we prove our address and ID in Usa?

There are many topics and if you start from the end, it will be difficult to understand the situation.

Of course, there are taxation procedures for foreigners depending on the type of company you open and the partnership structure. By the way, if you reach a certain income level, you already have to pay taxes. I wish you could reach huge turnovers and pay your taxes.

1. Take a look here: https://startupsole.com/amerikada-vegişma/ and here: https://startupsole.com/amerika-disindaki-lccler-icin-form-5472-gercegi/

I also disagree with you on point 2 because Stripe does not allow you to open an individual account if you reside in a country that does not accept it. Yes, you can do this with a fake address or other methods, but your account will not be approved when address verification is requested. (Vpn, fake address, etc. These temporary solutions are nothing but a waste of time)

If you set up an official company and Stripe asks for address proof, it is enough to send your company's certificate of incorporation. Because the address is written on it, there is no such thing as not accepting the company establishment certificate. They already accept this, you can look at the Stripe FAQ, they say they accept this as proof of address, not me :)