The name of the company owner may not be included in the founding documents of companies formed in the USA.

How to prove company ownership in this case?

If you want to find out, keep reading.

Anonymity exists in states such as Wyoming, Delaware, New Mexico and Nevada. In other words, after your company is formed, your name, address and personal information will not be included in the company formment documents.

If you do not want anonymity during the setup phase, you can choose this in some states, but generally in some states the name of the company shareholder is hidden by default during the setup phase.

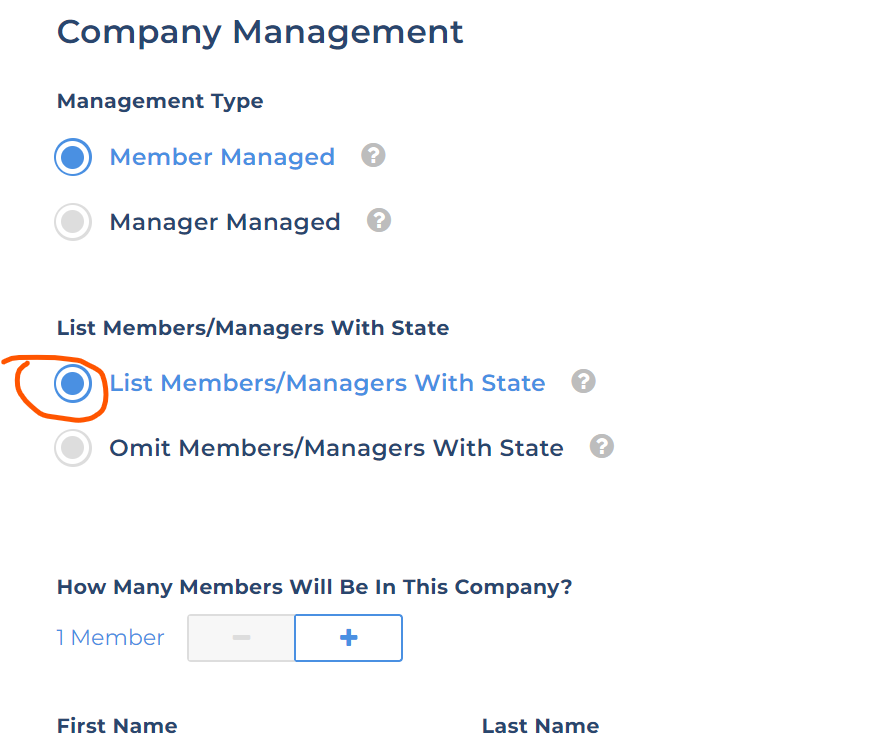

For example, if you form an LLC company with Northwest in the state of New Mexico, you can turn off the privacy option during the ordering phase.

If you check the “List Members/Managers With State” option…

Under these conditions, your name will appear in the company formation documents. Otherwise it is hidden.

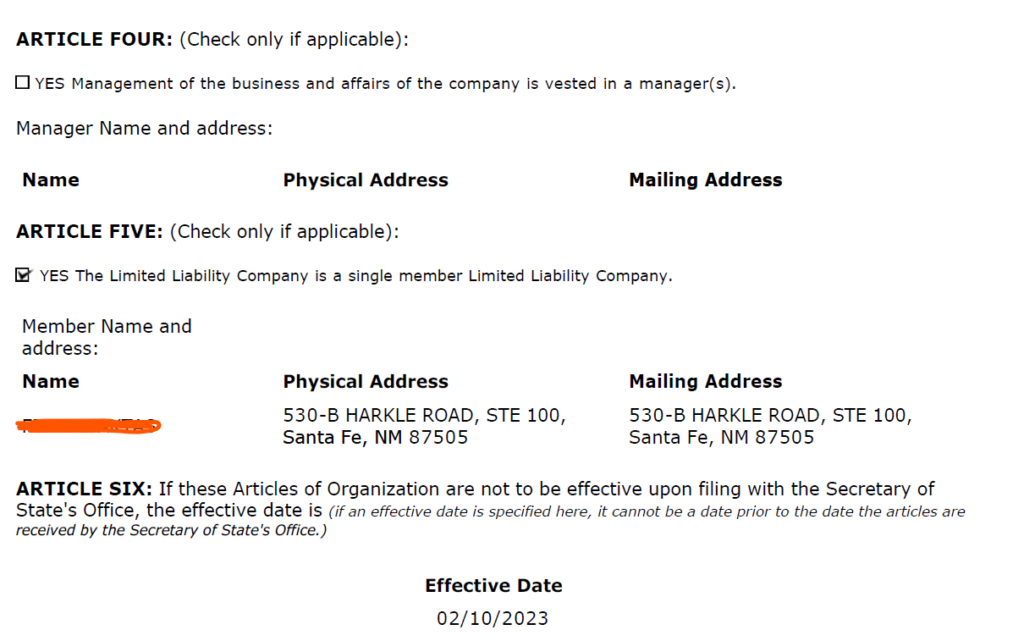

In the screenshot below, this feature is turned on and since the LLC has been formed, the name of the company owner is visible in the records and documents.

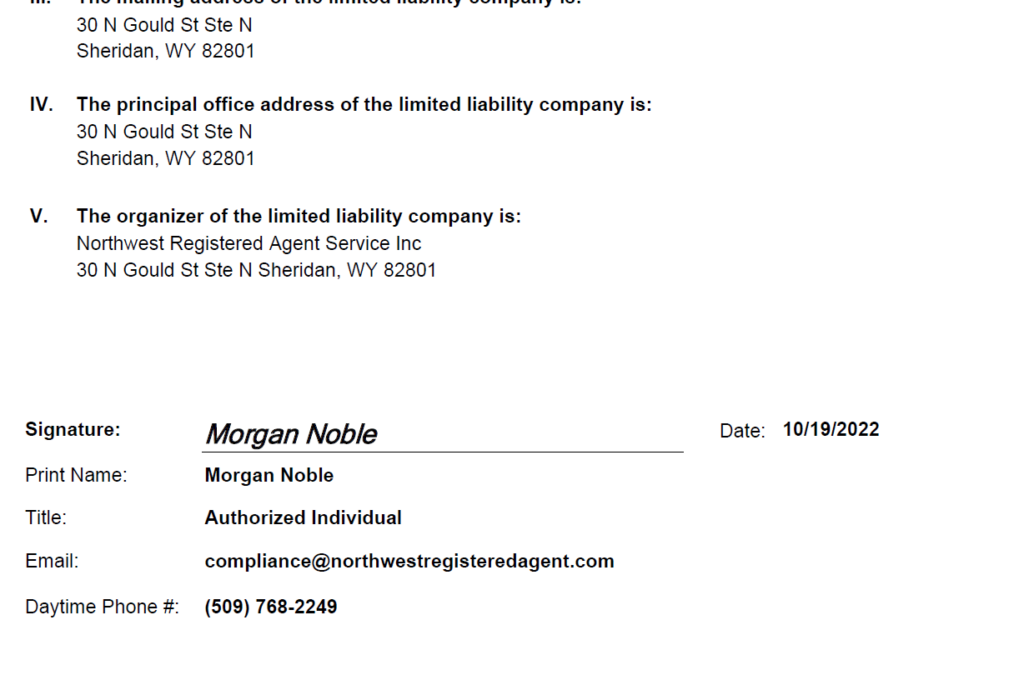

This option is not available in Wyoming and Delaware because the privacy option cannot be canceled in these states. In this case, you will see the name of the person called the organizer in the company formation documents.

Organizer is the name of the person who registers your company with the secretary of state. So this person just means the organizer who created the company registration.

When registering a new company with the state, the Organizer records the name and information of the company shareholder.

The fact that the name of the organizer who files the company formation in a state is written on the company formation documents does not mean that the company belongs to him. Because he is just the organizer.

Sometimes;

“All companies in the USA are virtual!”

“All in someone else's name!”

“No one is the real owner of your company”

You can read nonsense articles such as and watch unconscious videos.

Please do not believe them because they are really just content created without knowledge.

An organizer can form and organize hundreds of companies in a day. If every company the organizer founded belonged to him, then he would have tens of thousands of companies and he would have assumed ownership of every company.

Who takes such responsibility?

Especially in the USA, can the organizer of a Registered Agent who is licensed to do this job take such responsibility?

This situation is definitely not possible. No institution or individual can assume such a great responsibility.

You will see below that the organizer who founded the company provides a document stating that you will manage the company and declares that he is not responsible for this.

For these reasons, do not believe unconscious information coming from unreliable sources. You are not asked for identification, but the company is registered in your name.

What to do with an llc?

Of course, trade!

What does it take to trade?

A bank account.

Are the owner's identity and the company's EIN stated when opening a bank account in the company's name?

Yes.

In this case, since the trading point is your bank where an account is opened with your ID, company documents and company's EIN number, the company and the bank account belong to you.

Now that we have clarified the issue, let's take a look at how we can prove the ownership of an LLC formed in a state where confidentiality is essential.

There are many ways to do this.

Ways to Prove LLC Ownership

The items mentioned below can be used to prove company ownership.

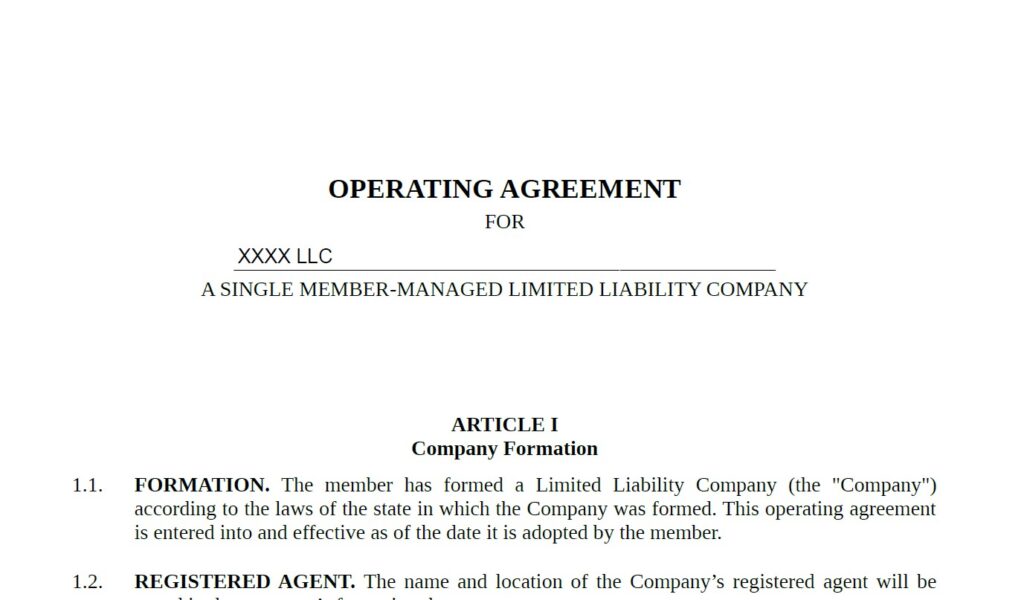

1-LLC Operating Agreement

The LLC operating agreement serves as a contract between the members of the LLC that documents the company's internal policies, management structure, and members' interests. Even if you form a single-member LLC, Northwest provides you with an operating agreement.

Each LLC member's name and ownership percentage are included in the operating agreement. The document must be signed by all members. Because an operating agreement is legally binding, it can also be used to prove ownership of your LLC.

The operating agreement is an internal document, so you don't need to send it to a government agency. Just keep it in a file with other documents.

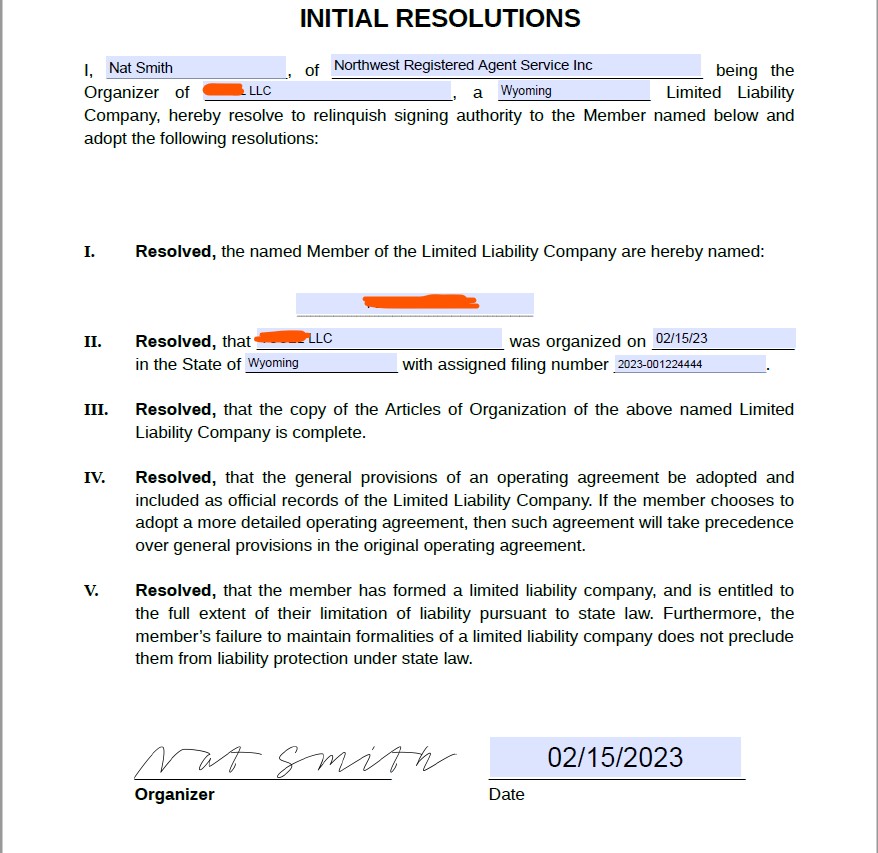

2-Initial Resolutions Report

It is one of the most important documents proving LLC ownership. The Organizer who files your company declares by signing that you will manage this document.

If you install with Northwest, it provides Initial Resolutions on the first page of the Operating Agreement document it provides you free of charge. In this way, you can prove with this document that you are in control of the company.

Initial Resolutions are a legal document that can be used to prove LLC ownership and specify who has control over your LLC.

This document must be signed by the organizer of the LLC (the person who signed the Articles of Organization). Like your operating agreement, the Initial Resolutions document is an internal document that should be retained.

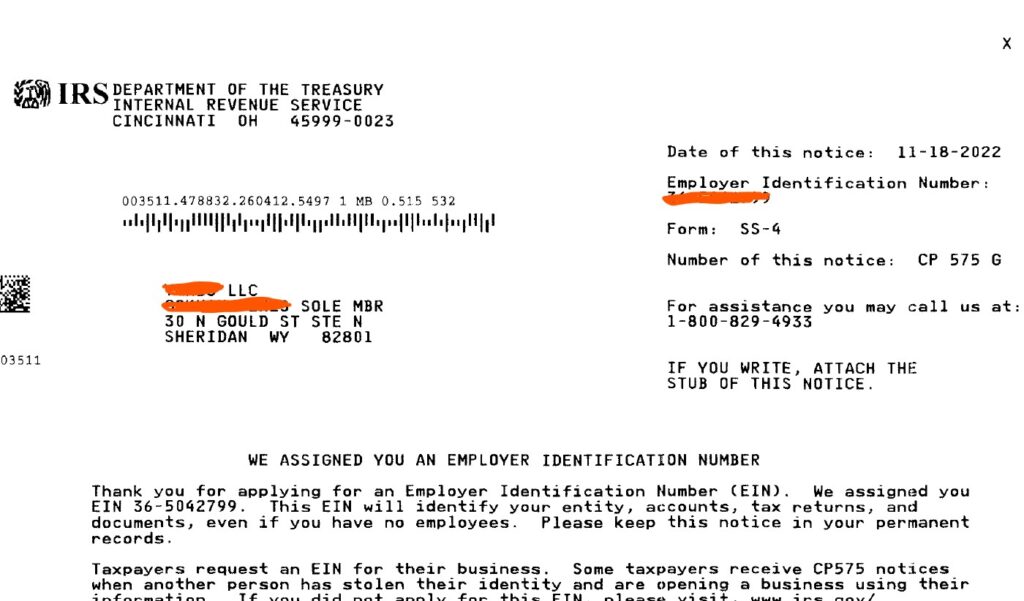

3-EIN Approval Letter. (EIN Letter)

Your EIN approval letter also proves ownership of your LLC. This document is the official document you receive from the IRS after applying for an EIN.

Your EIN (Federal Employer Identification Number) is a tax identification number assigned to your business by the IRS. Your EIN approval letter includes your LLC's EIN, business name, and the responsible party's first and last name.

Below you can see an example of an actual EIN approval letter.

The company name and the name of the company owner are written in the hidden fields on the left.

Expensive same-day delivery EIN services offered by third parties under the name Express EIN do not include your own name.

You'll probably see someone else's name instead of your own in this section. Therefore, it is useful to pay attention to this type of EIN acceleration applications.

Otherwise, you may encounter many problems when opening a bank account or different accounts. Also, this is actually a crime because they get multiple EINs for the same person.

The best way to get an EIN is to naturally apply to the IRS with form SS4 and wait for the EIN deadline.

4-LLC Articles of Organization (In Some States)

As we mentioned in the first part, some states require members to list their names and addresses on company formation documents such as Articles of Organization and Certificate of Formation. In some states, this is not mandatory and there is a privacy option.

States such as Wyoming, Delaware, Nevada, and New Mexico do not list owners' information in any public records. This shows that those states care about privacy.

If you incorporate in a state other than privacy-protected states, you usually have the option of making membership information public.

You can officially prove your LLC ownership thanks to the four different methods we mentioned above.

6 Comments . New Comment

3 partnerships can be installed. Multic partnerships should have information about LLC, do you have information on the blog on the subject?

Of course, the LLC does not have a common limit. You can add as many common (Member) as you want during the installation.

Good day, if we open the company ourselves, what do you recommend we do for the initial resolutions part?

If you install yourself with Northwest, they will already deliver this document to you with your signature. A document signed by the authorized organizer in that state is delivered to you within the installation package.

Hello,

Google requires a signature authorization document. I sent most of the above documents to show that I was a sole membership, but it was not accepted. Is there such a document and how can it be obtained?

Thank you for the information on the site.

Hello,

If you have installed with Northwest agent, if the initial resolutions document provides a document showing that all signing authority has been transferred to you by the agent, send that document.

Example:

https://startupsole.com/llc-sahiplik-kanitlama/#2-Ilk_Kararlar_Tutanagi_Initial_Resolutions

They generally deliver to everyone under a single or operating agreement.

No other document is available in llcs