Cloud-based software is used to calculate and report the income and expenses of companies formed in Usa and, most importantly, to keep accurate bookkeeping records.

On this page, we will talk about the most preferred cloud-based software that can automatically keep preliminary accounting records for small businesses formed in Usa.

Small business owners use accounting software to accurately track receivables, expenses and payments, clearly calculate profit margins and prepare for tax season.

Small businesses can easily use ready-to-use software that does not require many features and is not complex, right out of the box.

As a business grows, its accounting needs become more complex, and as growth increases, more specialized software may be involved. But up to a certain level, cloud-based software is more than sufficient for small businesses.

There are many different accounting software alternatives for small businesses with various capabilities and prices.

In general, factors such as industry type, integration, monthly transaction volume, number of employees play an active role in choosing the appropriate software.

In the list below, you can find the most preferred accounting software for small businesses.

List of Cloud Based Accounting Software

1- Suite Books

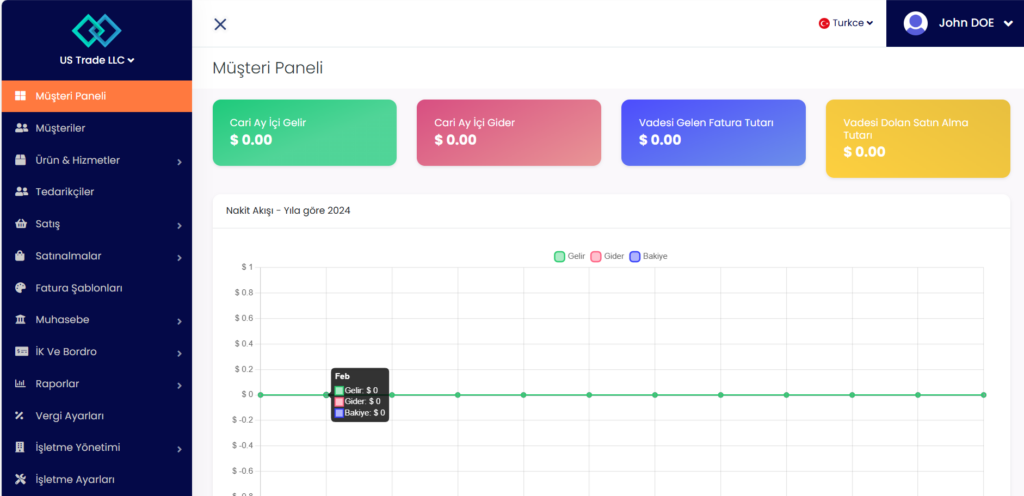

Suite Books is a cloud-based Turkish language supported accounting, bookkeeping and invoicing software. Suite Books is free with the free plan. For more features, you can check out the monthly plans.

Suite Books' capabilities are not limited to this; it also has the capabilities of HR and payroll management, income and expense processing, receiving payments from customers via credit cards, monthly collections with the subscription system, and product and service sales.

We recommend you to take a look at our Suite Books Pre-Accounting Software , where we explain the capabilities of Suite Books , the most preferred and most economical Turkish accounting and invoicing software for US-based businesses

2- Quickbooks

When it comes to bookkeeping of small businesses, the first and most preferred software that comes to mind is undoubtedly Quickbooks.

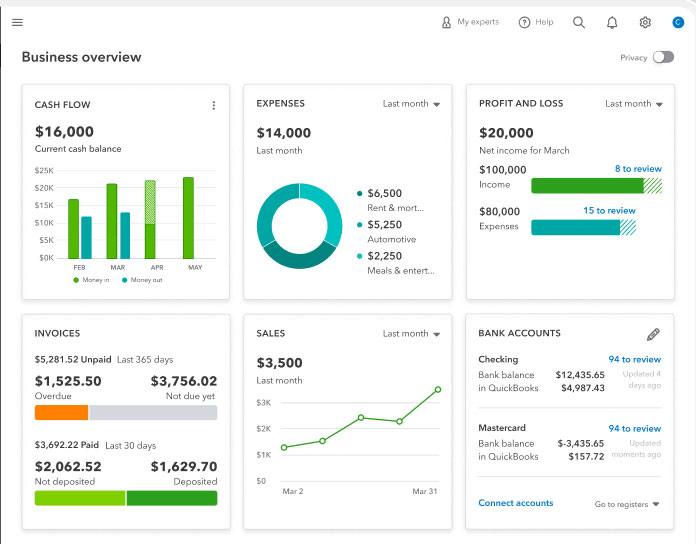

By purchasing a cloud-based plan from Quickbooks (requires monthly payment) you can quickly integrate your company, marketplace stores, payment gateway systems like Stripe, and bank accounts. Thus, you can automatically keep all your preliminary accounting records in this software, with almost no intervention required.

Additionally, almost all consultants (CPAs) who manage small business accounts use QuickBooks. Thus, when tax season comes, you can easily prepare tax returns by authorizing your consultant from the software.

With QuickBooks, you can easily access all accounting features, accounts, income and expense tables from a single panel. This makes bookkeeping more streamlined and efficient.

We can say that QuickBooks is the most used software, especially by internet entrepreneurs, as it can be easily integrated with platforms such as Amazon stores, Shopify e-commerce software, Stripe and Mercurybank.

QuickBooks is a cloud-based software that works with a monthly payment system. Frankly, the login plan will work for a single user. For prices and other details, you can check out https://quickbooks.intuit.com/pricing/

3- Xero

Xero is ideal accounting software for micro businesses looking for very simple accounting software. This software has a clean interface and can also fully integrate with a third-party payroll service. Businesses can collect payments from customers online as a result of Xero's integration with Stripe and GoCardless. Xero has the ability to integrate with almost all banks and applications, including Mercurybank.

Xero has plans starting from $7.5 per month with a 75% discount.

Pricing details: https://startupsole.com/go/xero/

4- Freshbooks Pre-Accounting Software

It is a preliminary accounting software generally aimed at service-based industries rather than product-based industries.

The most important accounting need of service-based businesses is to receive payments online and send invoices to customers. As a result of the online invoices sent, customers are charged one-time or monthly recurring payments.

Since payments are collected via Freshbooks by credit card

The worst part about Freshbooks is that it cannot integrate with Amazon stores. It requires third-party tools like Zapier for this. This increases costs. If you are looking for a bookkeeping software for your Amazon store, it would be more logical to consider the previous options.

As with other software, consultants and tax experts can be authorized through Freshbooks. It also has detailed income, expense and balance sheet reporting.

You can get Freshbooks software by paying an average of $7.8. You can check the website for Prices and Plans. freshbooks.com

What is the Use of Cloud Based Accounting Software?

Accounting software allows users to sync their business bank accounts, websites, marketplace platforms, and credit cards, saving time on data entry.

When synchronizing, many operations can be divided into various categories. While most accounting software is easy to use, mastery of general accounting principles is required to ensure financial reports are prepared accurately.

For this reason, many businesses employ consultants or accountants to maintain or review their records. Cloud-based online accounting software allows businesses to access their books simultaneously with the accountant. While the consultants carry out the technical report side of the work, the user can monitor the general status.

The most basic functions of accounting software for small businesses are:

- Billing

- Bank and credit card synchronization

- Integration into marketplaces or e-commerce software

- Payments

- Accounts receivable

- Online payment collections from customers

- Profit and loss statements

- Balance sheets and cash flow statements

- User access for accountants or tax professionals

If you own a small-scale business, you should use accounting software for both income and expense reporting and preliminary accounting purposes.

If you are starting a new job, you should create a proper infrastructure by recording all transactions from the very beginning. The best way to do this is to use a pre-accounting software.

8 Comments . New Comment

Hello, I will be filing my tax return this month. My only income throughout the year was the trial purchase I made on the website to see if it was working. That's about 50 cents or so. Apart from that, you have some expenses such as telephone expenses and website opening expenses. My question is, can I enter the declaration with everything as 0 without tampering with it? Or should I send an invoice or two just in case?

I don't want to pay someone else for the declaration again without making any profit, so I have to do it myself. Thank you very much for your help. This site is very important to me and has been very helpful. Thank you everyone in advance, good job

Hello,

If you have enough knowledge to make a declaration, you can.

In this case, should I enter with 0 dollars profit? This is my question actually

Since we are not consultants, we cannot comment on how such declaration forms are filled out. Just typing 0 should not be enough, because there are rows of data in those types of forms.

Hello. I generate two rental income each month on behalf of my LLC company. There is no other income. When I bought the house, I had to pay the property manager every month for renovations etc. I also made a couple of payments for home insurance etc. Will I need an accountant? Income started coming in September last year. The renovations started at the beginning of last year. Do you also offer accounting services?

Hello,

we offer our accounting and consultancy services through Full Accounting.

A tax declaration must be submitted at the end of this year for the real estate income you mentioned. For this, you can get consultancy service from a consultancy firm.

You can get a 100 USD discount by using the SOLE100 coupon code to get paid consultancy from the link below.

https://www.tammentor.com/courses/danismanlik?ref=90fc42

Do you think this would be an unnecessary cost at first?

In fact, we can say that it varies depending on the situation. If you are going to issue a small amount of 5-10 invoices annually and your expense items will be in these amounts, it may not be necessary. But if there will be high amounts of input and output, it becomes difficult to control. No accountant will prepare these records for you at the end of the year, and even if they do, they charge significant amounts of service/hourly work fees.

It's not necessary if you're doing a low volume job, but otherwise it's an absolute necessity.