One Stop portal is a portal where business management can be done online for businesses formed in the state of Kentucky.

You can register your company on this portal free of charge. In this way, you can perform many transactions such as sales tax registration, reseller license, annual filing ($15 annual state tax payment) online through this portal.

the Kentucky One Stop Portal website from this link .

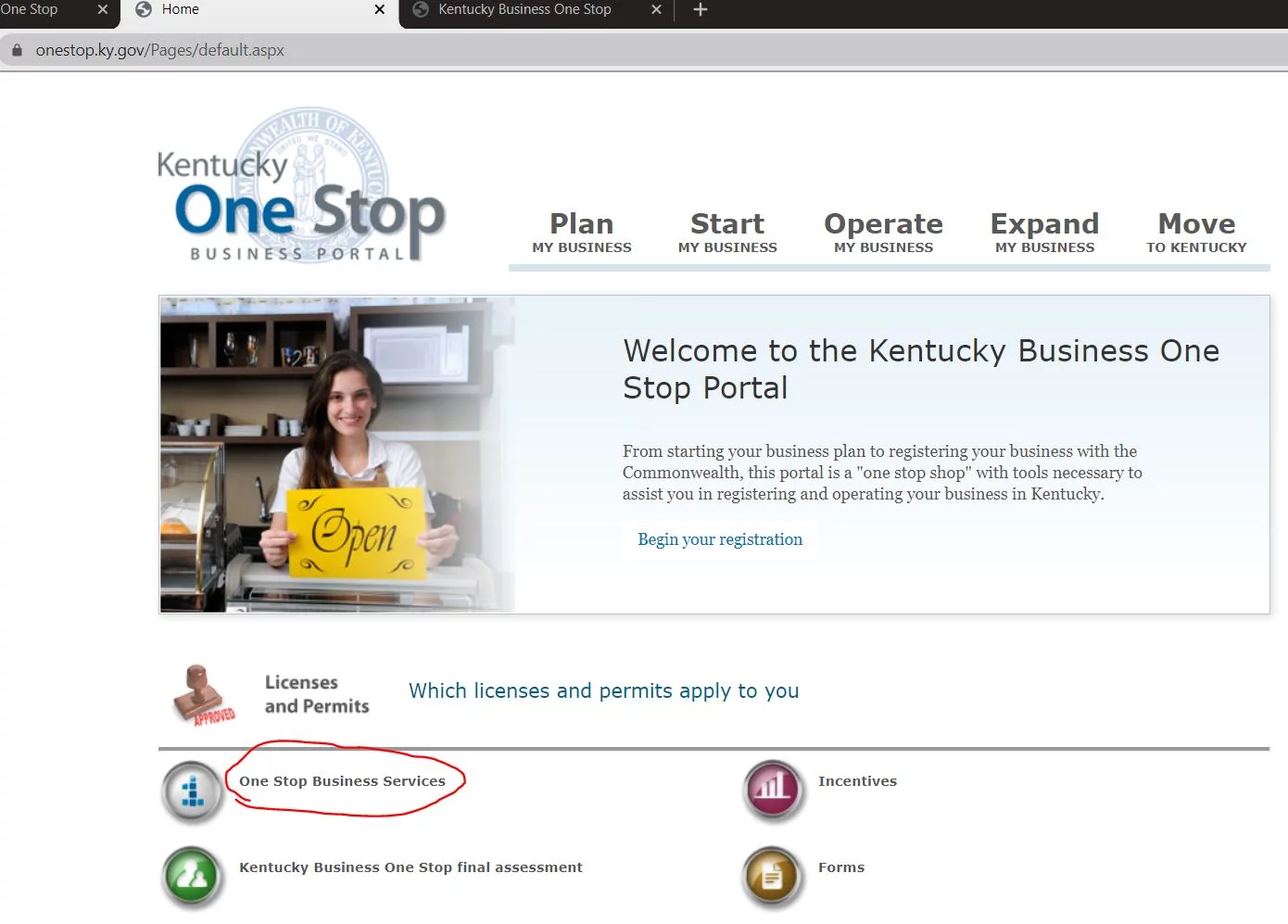

In order to register your company to the one stop portal, you must first create an Online Gateway Profile. To do this, you need to go to the profile creation page by clicking on the one stop online business services link.

If you have not been a member of the portal before, click on the create an account link.

For Kentucky Online Gateway membership, you will see a form like the one below. First you need to fill out this form and create an account.

Fill in fields such as your name and surname, your US postal address (company mailing address), the telephone number and e-mail you received from the USA, and your password.

A verification link will be sent to the email you entered in the form above.

Open your email and verify. You will receive an e-mail from this address.

Just click the link to activate the account.

Your account will be active after email verification. Click the Continue to sign in button.

Now that you have created your online gateway account, you can click on the field on the screen below and log in to the portal with the account information you created.

When you log in to the One Stop Portal, you will see a management panel like the one below. Since no company is connected to your panel yet, you need to complete this step first.

To connect your company to the One Stop Portal, click on the "Link My Business" link in the admin panel.

Before this linking, you need to find out your organization number. on the state website and copy the Organization Number somewhere. This number will be needed in the next stage.

In order to link your company to the portal, CBI and Security tokens are required. We don't have this information yet and you need to request it from the state. These numbers will be sent to you by e-mail. (They will arrive in approximately 2 weeks). When you receive the codes, you can come to this screen and connect your company.

First of all, to request CBI and Security token information by mail, click the link on the screen below and fill in the page you will see in the next step.

When you click on the link to request CBI and Security tokens, you need to make a short registration on this page. On this page, you must enter your name, surname, e-mail, company name, telephone and most importantly your company's organization number.

After entering the information, click the continue button. It is reported that CBI and S.Token information will be sent to you by mail within two weeks.

After entering the information, click the continue button. It is reported that CBI and S.Token information will be sent to you by mail within two weeks.

A letter will come from the state in about 2-3 weeks as follows;

A letter will come from the state in about 2-3 weeks as follows;

A document containing CBI number and Token numbers, we enter the numbers in the relevant field.

After receiving the mail, go to the mail link my business page again, look at the CBI Number, company full name and Security Token information in the document and enter it in the relevant fields and click continue.

If there is someone you want to manage your company, you can add a new manager here and send an invitation by e-mail. Since we will manage it ourselves, we click send invite on this screen where our automatic name appears.

If there is someone you want to manage your company, you can add a new manager here and send an invitation by e-mail. Since we will manage it ourselves, we click send invite on this screen where our automatic name appears.

When you reach step 3, the process is complete. You have now defined your company on the one stop portal. Proceed to mail by clicking the Go to Dashboard link.

When you reach step 3, the process is complete. You have now defined your company on the one stop portal. Proceed to mail by clicking the Go to Dashboard link.

Your company will now appear on the Dashboard. I completed the one stop registration for the new company I formed on April 19, 2021, thanks to the letter I received on May 13. While doing this process, I took practical screenshots and shared with you how it is done in real terms.

Your company will now appear on the Dashboard. I completed the one stop registration for the new company I formed on April 19, 2021, thanks to the letter I received on May 13. While doing this process, I took practical screenshots and shared with you how it is done in real terms.

There are many things you can do, you can read what they mean in your state's help articles. My advice to you is not to take action in sections that you do not know or have no idea about. This will be most useful in the future for transactions such as changing RA, changing address and annual reporting.

After this stage, you have now registered your Kentuck LLC company in the One Stop Portal. Afterwards, you will now have the management tools you may need for your company.

After this stage, you have now registered your Kentuck LLC company in the One Stop Portal. Afterwards, you will now have the management tools you may need for your company.

This service is free and once you sign up it is up to you whether you use it or not because there is no harm in signing up.

If CBI and Security Token do not arrive or if you have a different question, you can get information from the one stop support line at 502-564-5053

25 Comments . New Comment

have a nice day. I have 2 questions. Is it necessary to register for one stop Portal? I will do dropshipping. And would it pose any problem for me to use Northwest in the virtual address section? If it poses a problem, where would you recommend taking a virtual address?

Have a nice day.

There is no obligation to register with the One Stop Portal, physical businesses that do business in the US or state are registered, but there is no obligation to register for businesses like you. You have no mind to use Northwest in the virtual address section, strips and banks do not cause any problems with these addresses and do not take into account these addresses

I formed an LLC in Kentucky through Startupsole (March/2022), in the letter I received for the first time in April and then in September (in a harsher language, mentioning the penalty), it was written that I had to register the company to the One Stop Portal and register it via Link My Business, in the first one I wrote to the One Stop Portal. I signed up but I think I skipped the Link My Business part. Anyway, later, I activated the Link My Business section by answering 20 or maybe 30 different questions. Now, when I enter the One Stop Portal, in the taxing election section, Single Member Disregarded Entity-member is taxed as an Individual Sole Proprietorship; Under the tax accounts section, it says Sales and Use Tax (ACTIVE), Limited Liability Entity Tax (ACTIVE), Kentucky Nonresident Income Tax Withholding on Distributive Share Income Tax (ACTIVE) and in the document called Sales and Use Tax Account Number, Your filing frequency is: It says QUARTERLY. While making this tax registration, I marked the options that were most suitable for me. Sales are only on Amazon.com and there is no serious profit so far, I started being active in August, the number of transactions is 3 and gross earnings are around $100. I sent an e-mail to Kentucky, sales are only online on Amazon.com and I do not have an actual workplace in Kentukcy, there is no seller there from whom I buy from, that is, there is no such thing as economic nexus, I have not received a response yet. Is there anyone who has experienced similar things? Thanks.

Membership in the online portal and obtaining a TAX ID is required for local businesses located in the state of KY. If you do not have a physical location, physical office, shop, store, warehouse or payroll employee in KY, you do not need to become a member of the portal. You may receive a sign-up-by-mail notification from time to time as a document, but this is valid for businesses with physical presence within the state. Don't worry, there will be no problem.

Thank you Mr. Nazmi, do I need to send documents for this obligation in the document called sales and use tax, meaning "Your filing frequency is: QUARTERLY" every quarter? (Verb)

No, you do not need to send any documents. You're welcome and I wish you luck.

Hello. I founded my company in January this year. I received an e-mail to register to the One Stop portal. I did not register. Today, I received another notification to my address. It says that I need to register and even that I may be fined for missing the legal deadline. I have not been able to access the One Stop Portal website for 2 days. Is portal registration mandatory? If I do not register, will my company be closed because I did not submit a declaration? Also how can I solve this problem

One stop portal includes shops, stores, etc. with physical locations in Kentucky. Businesses do not disappear and do not have to register for local taxes. But you can register for free, the access problem is not related to you. Some government institutions in the USA may occasionally block entries from many countries due to global attacks. There seems to be a similar problem here too.

Install Opera Browser, activate the VPN feature and select the Usan location to access the portal or with a different VPN.

Hello teacher!

I might have made a mistake somewhere, it necessarily asks me for "Tax Type" and "Tax Account Number".

What path do you think I should follow?

If you send a screenshot, let's see, maybe you marked an area you shouldn't have selected.

Hello,

I opened our company in Kentucky 2 months ago and registered it on One Stop Portal. I need a Resale Certificate as I am currently actively purchasing goods from wholesalers. Do I have to Register for a Tax Account for this?

Hello,

Yes, you need to register for taxes with the state for this transaction. You can register for taxes through the state portal. There may be some points that seem complicated to you, if you are stuck, you can send an e-mail to the support address on the one stop portal or reach us by phone during working hours. The officers on duty provide one-on-one support in this regard, and some have received a Resale Certificate from the state of KY with this method.

The day my company was first formed, I received an e-mail from Kentucky, I created a password and username with the information I received, then today I received this e-mail, they sent me the token and CBI number, I did not want it, so I thought I would enter it to merge the portal, the company is already visible on my panel, it seems like they have made these steps a little easier. Or am I doing something wrong? Next to the company it says status: active, status: good

Sometimes they can send it more than once, no problem, you don't have to do anything right now.

This portal is useful for local businesses to register for taxes, and for foreigners only if the company is in the process of being closed.

Hello,

After forming the company in Kentucky, I received an e-mail containing the necessary information to register to the portal and I linked the company to the portal by entering the token information, but like Onur, the friend who just wrote here, I also received the FINAL REQUEST mail. Is there a different request? Do they specifically want us to do this tax registration part? What action should we take in such a situation? Or do we need to respond to the mail?

If you are going to engage in commercial activities through an llc you have opened within the state and collect sales tax and return it to the state revenue office, you need to register for local tax. Actually, making this registration will not cause any harm to you, you can register if you have time. Even if you do not register, you do not need to give any response. This letter will be sent to the address of each newly formed company after the portal is registered, for informational purposes.

Hello, I established a company in Kentucky in May 2021. You said that tax transactions would be done for us in April 2022, but I registered our company in the One Stop Portal (I also entered the CBI and token numbers), but yesterday the document was sent to me as follows : https://www.hizliresim.com/fy2wvjk , https://www.hizliresim. com/h256l2j I brought the procedures in the second document sent to the tax administration, but at this stage I was faced with a 20-step section. Is there an easy way to handle this part? Thank you in advance.

Hello, you are confusing. This document contains the necessary information to register to the portal. You can register the company to the portal for sales tax registration, company closure and different transactions. You will make an annual filing next year in 2022, it has nothing to do with this tax registration.

Next year, you can submit your annual report by paying $15 with your credit card from the annual report menu on the state portal. It's pretty simple, there are details on the blog anyway.

If you are not currently filing a sales tax refund with the state, there is no need for this 20-page record.

Thank you very much for your valuable comment, good work.

Hello, we used zadarma.com as our phone number, but unfortunately the phone number obtained from there does not offer SMS support. Is there a service that offers SMS support where I can get a different phone number?

It offers Hello SMS support. You have not turned on SMS support from the services in Zadarma. The article here explains how to do it

https://startupsole.com/abd-telefon-numarasi/#Sanal_Telefonlar_SMS_Alir_mi

Also, you do not have to follow the phone verification part.

Hello, yes, I saw it now, it requires identity verification, I sent it and I'm waiting for a response. Thanks for your answer.

You're welcome, I'm glad about that :)

I have a question, I founded my company on the address I received from Shipito, but when I entered the Shipito portal today, the address changed, what should I do? I sent a support e-mail, but I don't think it will work. The documents will be sent to the place registered at the old address and I will have to change my company's e-mail address. Do you know anything about this issue?

Yes, I sent an email to Shipito about this issue. The answer is that mails arriving at this address will be forwarded without any problems until the end of December 2021. As of 2022, this address will no longer be available. You will have already received many documents by that date. As of the new year, you can change your primary business address online for $10 on the Kentucy state website.