How do you prepare an invoice after products and service sales from your company in Usa? All aspects of the company in the United States to intervigate!

After setting up an llc in the United States, taking payment and opening the bank account process, the next business is to intervene as an e-commerce owner.

How Do I Invoice? Is There a Need for an Accountant?

We will offer you a few alternatives in this article about how to interrupt. If the accountant issue is initially, you can keep your own business by seeing your own business for your high cost future. After forming an llc in Usa and receiving EIN, the process does not work like in your country.

If you need to elaborate a little more;

Under normal circumstances, after forming an llc in Turkey and obtaining a tax certificate, the invoicing process is under the supervision of the tax office. It is necessary to get an invoice number and print a stub or become an e-invoice taxpayer in the new system. In addition, every company makes a 3-month provisional tax declaration. For these transactions, it is necessary to agree with a financial advisor or accountant.

There are no situations such as receiving an agreement and invoice coach with an accountant for pre-accounting transactions in the United States and having an e-invoice obligation. There is a declaration -based system in the USA and you can cut your own invoice by creating a template. Or online software that provides a complete invoice automation that holds pre -accounting is the best solution for this job.

When it comes to pre-accounting software, we recommend Freshboks, which is the most used solution.

Can I keep preliminary accounting records without using software?

Yes you can keep it. If you prepare the invoice in Excel, you can send a copy to your customer and keep a copy for yourself. If you are taxed as a real company (multi-member LLC or Corp) rather than an individual, the invoices or sales records (pre-accounting) you prepare while having the accountant fill out your tax declaration will make their job easier and reduce your accounting costs.

How to Prepare an Invoice?

Since Usa does not have an invoice system like our country, you can prepare this yourself in a few ways. Some of the options are:

- Word or Excel: If you want, you can prepare an invoice template with the office application and make invoices with your own template and keep the records yourself. This process may cause confusion over time, you need to file properly.

- FreshBooks : You can use an online invoicing system. The most professional example of this is FreshBooks. for FreshBooks here and get started. our detailed review of Freshbooks here . We recommend that you at least become a member and see their skills and what they can do. By purchasing the upper package, you can invoice unlimited customers and keep your own online accounting. This software is a complete accounting system. It has numerous capabilities such as invoicing the customer, automatic sending of invoices via e-mail, integration with all e-commerce applications such as Stripe, Shopify, Woocommerce, monthly, annual, daily sales reporting and templates.

For example, when a customer buys something from your Shopify store, it keeps his account, opens an accounting record, issues an automatic invoice and sends an e-mail. You do not have to store this information, all information is stored in the cloud.

If it's time to collect sales tax, it automatically calculates the tax rate by state, saving you from an incredible workload.

The application has a lot of capabilities, probably even if you hire a paid accountant, it may not be able to keep track as efficiently. I can say that it guides you at every stage and takes you to the next stage about what you need to do.

FreshBooks which we also use for our own companies , and even send payments such as digital products and services to the customer along with the invoice by connecting it with Stripe.

You can also integrate with banks. By integrating with Mercurybank, you can categorize your income and expenses and upload expense receipts, invoices and receipts to the system. Thus, it saves you and your advisor from a huge workload during the annual tax declaration processes.

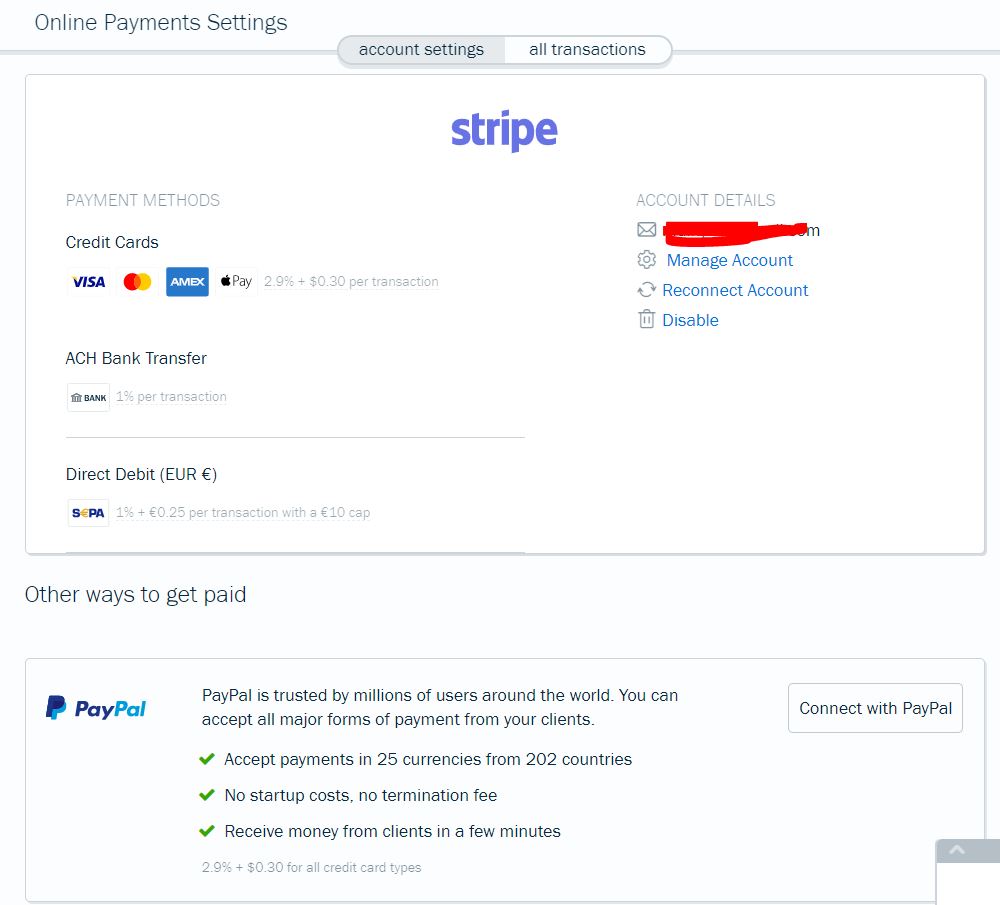

In the payment integration section, you can connect it to payment gateways, especially Stripe and PayPal, with a single click.

With Freshbooks, we have connected Stripe to one of our company accounts. When we sell digital services (marketing, advertising management, web design, license sales, special software, consultancy), we can prepare an invoice here and send it to our customers with a payment link embedded with the payment due date. It also has features such as payment reminders and sending e-mails to the customer before the due date.

The software has an incredible set of tools in its admin panel Once you become a member, you can use all the features.

Like your accountant:

Some of the most frequently asked questions on our blog were:

-What about accounting after forming an llc in Usa?

-Why don't we keep accounting?

-Are we going to keep it?

-What are the preliminary accountant prices?

Here is an application that works like an accountant in your company.

Automate all preliminary accounting. There is no need to collect invoices and receipts as in Turkey, and there is no need to send e-books etc. to the monthly tax office with a declaration for each transaction. Even though we talked about tax advantages, there are still people who are not comfortable about paying taxes and doing accounting. At this stage, you invite the accounting firm you have agreed with to freshbooks. Since most accountants already know this software, they can quickly handle the reporting and make your tax declaration for you thanks to this software.

So everything is automatic and based on solid foundations.

If you hire an accountant for taxes, all you have to do is give him/her authorization from freshbooks. It handles everything online and easily prepares your declaration. Every accounting firm or CPA in America knows about Freshbooks Become a member of Freshbooks, use at least the affordable package and understand the software, integrate Freshbooks into your online store and sit back, it's an automation that takes care of everything itself.

You can create an account from this link to become a member and see its advantages.

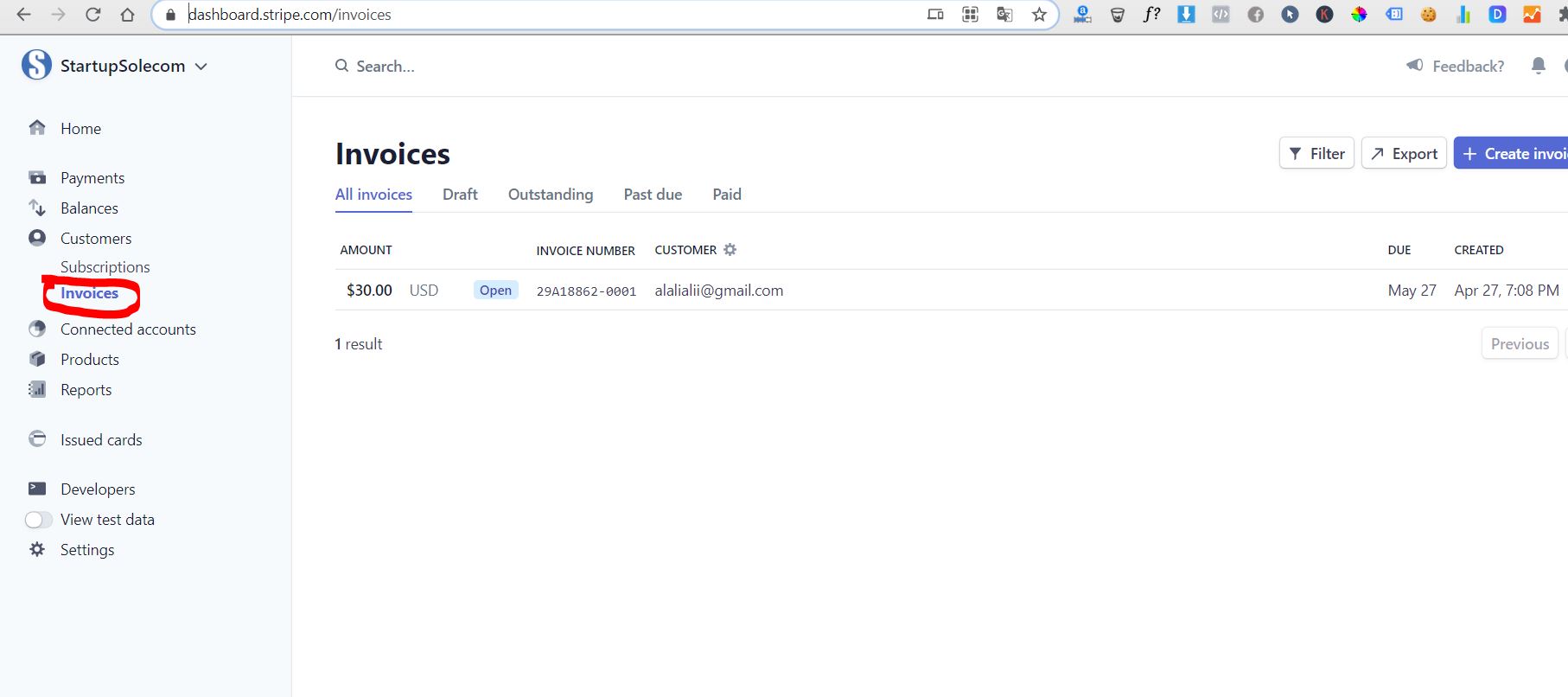

- Stripe: If you use Stripe to receive payments, the administration panel includes a mini accounting software and also a template tool with which you can prepare electronic invoices. To do this, you can log into your Stripe admin panel and open a customer client here https://dashboard.stripe.com/invoices

- Invoice template: Thanks to online tools that provide templates, you can download free invoice templates and choose one. There are many online tools on the internet for this job, for example, the most well-known one is invoice home . You can prepare your invoice by immediately downloading a template and adding your logo.

Issuing Invoices with Stripe (Preparing Invoices)

If you use Stripe, you may have discovered that it has a mini accounting tool. However, it is not as capable and functional as Freshbooks. If you don't know, log in to the Stripe panel and view the invoices section at www.dashboard.stripe.com/invoices.

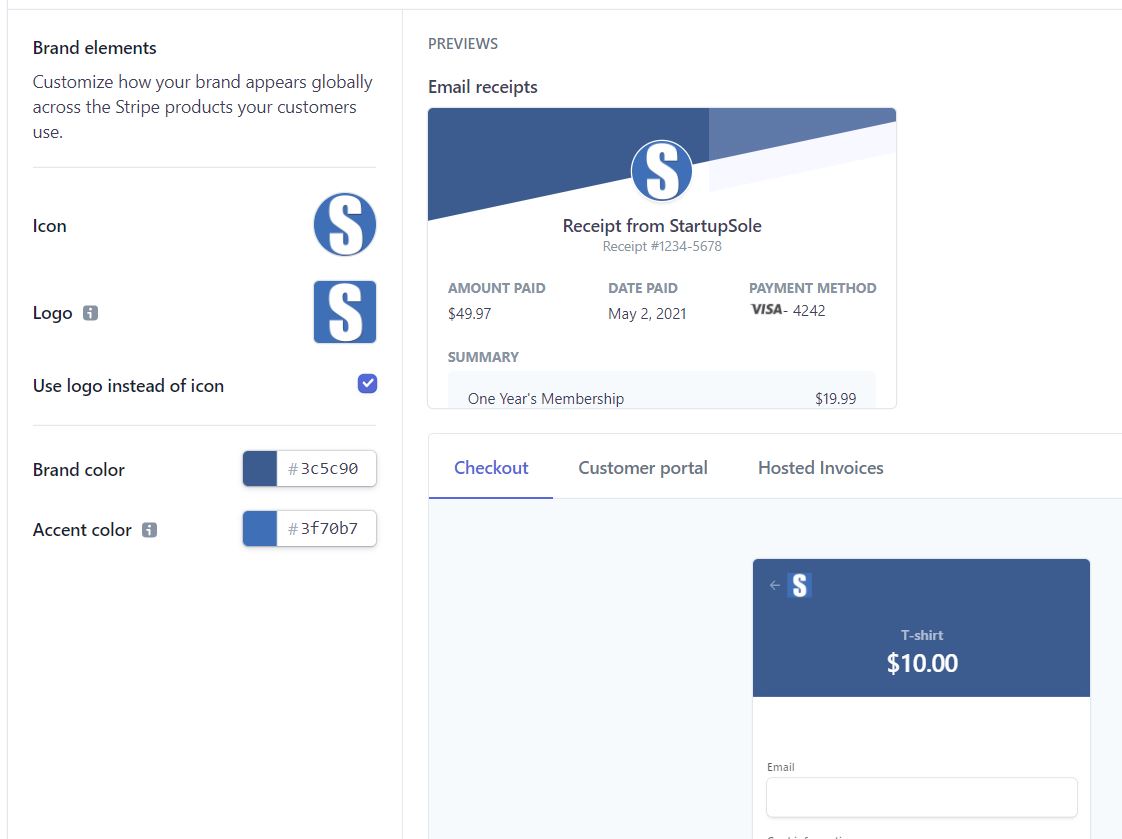

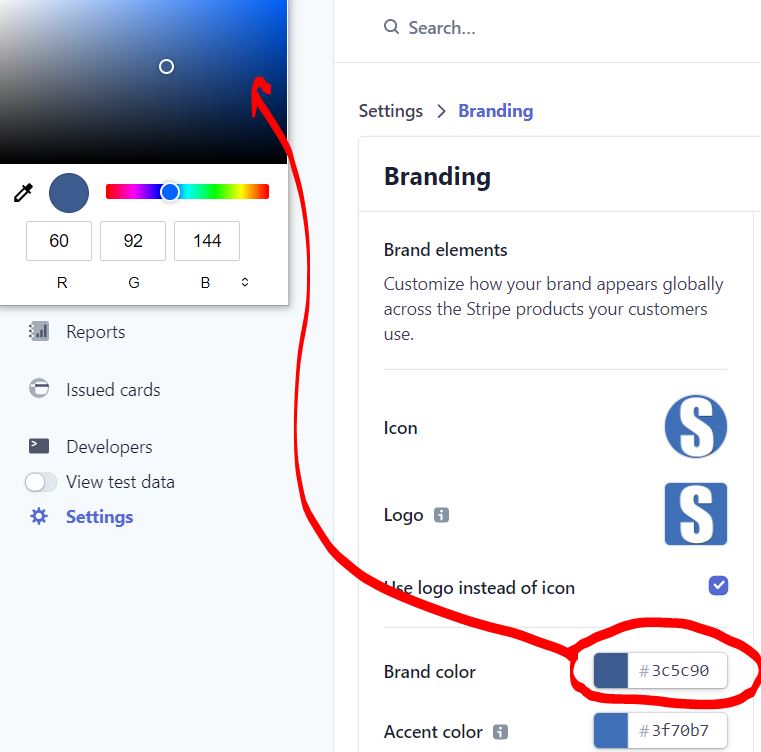

You can customize the invoice template before issuing an invoice. You can create a letterhead by uploading your own logo and applying your own corporate colors.

To do this, you can start by entering the branding

This customization is reflected in both your invoice template and the emails sent to customers upon successful payment.

Preparing Invoices

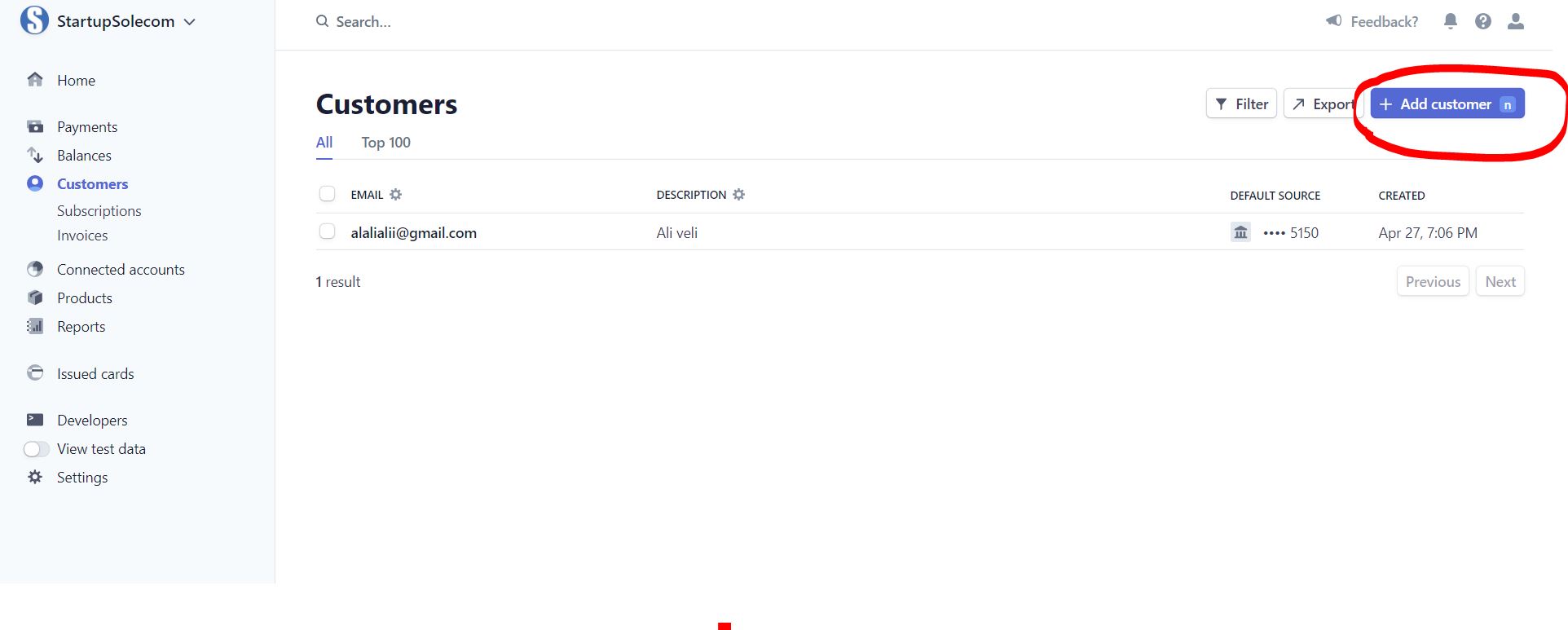

To create a manual invoice via Stripe, you first need to create a customer record. To do this, click customers from the left menu.

And click on the “Add customer” button in the upper right corner

Fill in your customer's current information and save it.

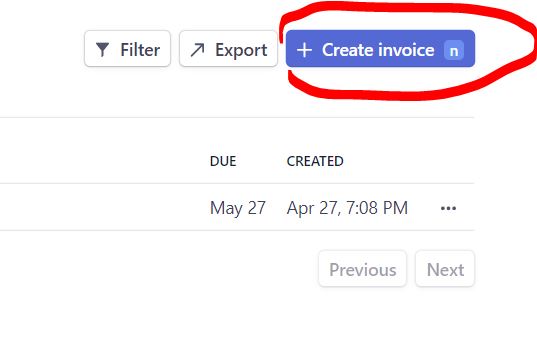

After creating a new customer record, click on the invoices link under customers.

Click the “create invoice” button in the upper right corner.

Click the “create invoice” button in the upper right corner.

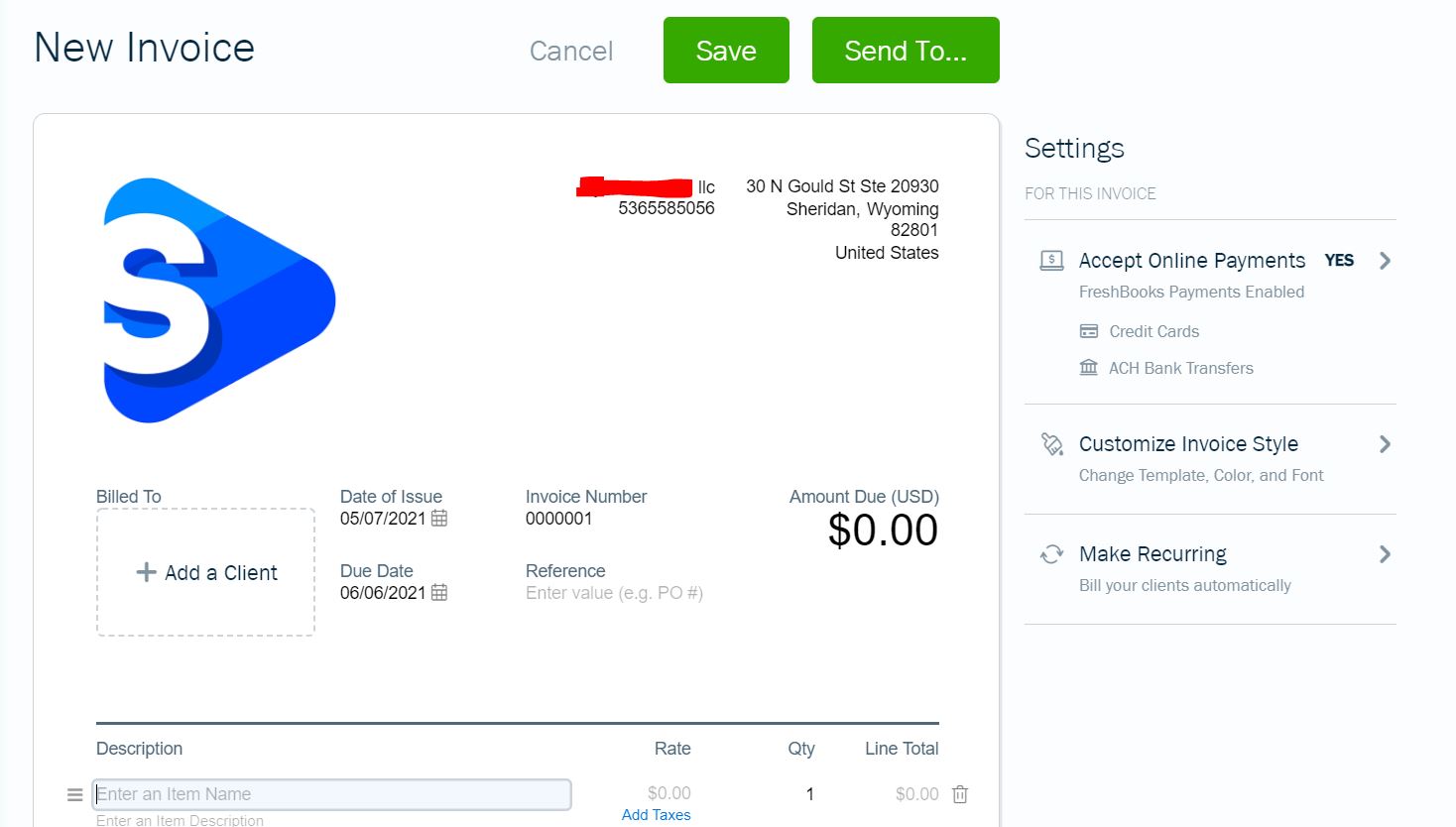

Find the customer you will invoice for, fill in the price and all required fields and save your invoice.

Find the customer you will invoice for, fill in the price and all required fields and save your invoice.

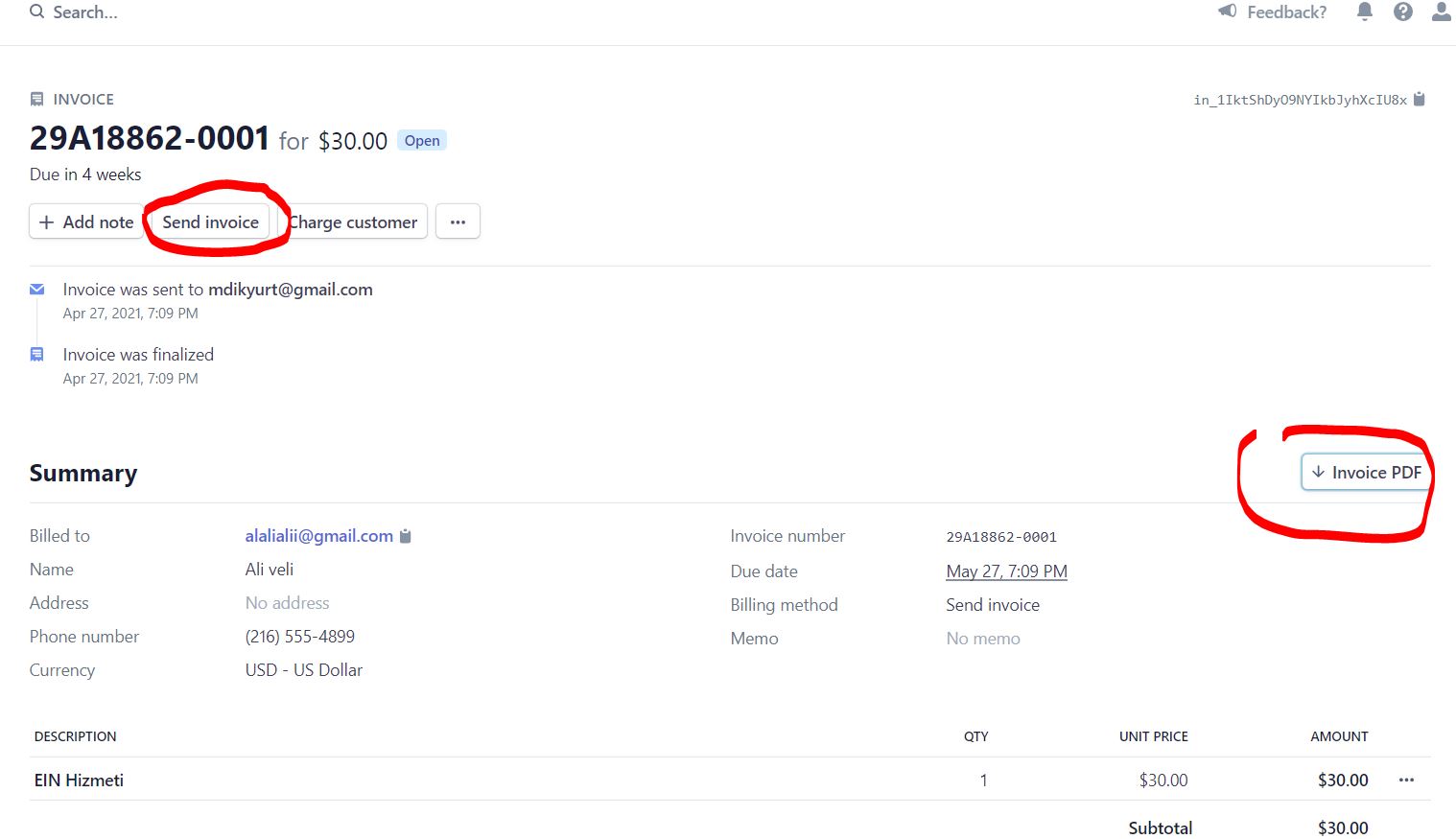

Then you can see the invoice you created in the incoices section. If you want, you can send it directly from here via e-mail, or download it as a PDF and print it.

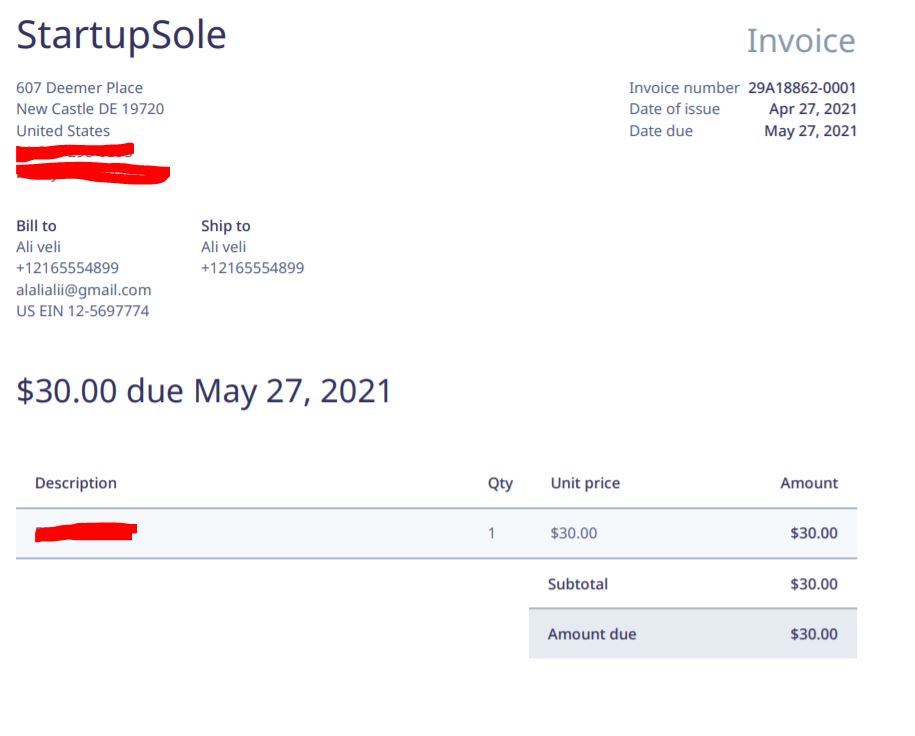

Sample Invoice:

Below is a screenshot of a stripe invoice I created for example purposes.

In this way, you can both create invoices and keep your accounting records amateurly.

However, this is not a full accounting system, it is just an invoicing system. Because you cannot process income and expenses, you cannot upload your expense receipts and invoices. You cannot get detailed reports. You can send invoices to your customer only to receive payment by credit card.

What Should Be on an Invoice? Should I Write an EIN?

In an invoice, information such as customer name, phone number, tax number (if any), address, name of your service, number, date, creation date, your address, phone number and company name must be precise. You can write your company's EIN number if you want, but you are not required by law to do so. Because sharing this number too much may create some security problems. You can share it with your customer if desired.

Conclusion

Creating an invoice for your company in Usa is different from the practice in Turkey. Everyone can issue their own invoices within the framework of some rules.

You can use online applications or templates for this. FreshBooks to keep records and calculate income and expenses gives you an advantage. When you agree with an accountant, it can reduce your accounting expenses because it reduces the accountant's workload.

31 Comments . New Comment

Hello, is it necessary for each invoice to have a purchase invoice like in Turkey? I can't find any information on this subject. Could you please shed some light on this?

It will be useful to you when you declare, it will be in your interest to buy it, you will have the chance to deduct it from taxes by proving your purchases with these invoices.

Hello, I have a Floridan llc, they have the same name title as my company in Turkey. Will there be a problem if we issue an export invoice to Florida from an llc in Turkey, with the majority of invoices among each other? I own 100% shares in both companies. In short, I sell goods from Turkey to my company in the USA.

Hello, it would be beneficial for you to consult the financial advisor you work with. They are certainly more knowledgeable about the subject than we are. Because this issue is special to you.

Mr. Nazmi

Can the place from which we purchase accounting services in the United States provide information on this matter? For example, when we receive an order, we issue an invoice directly to our company in Turkey, give it UPS, and then send it to the customer. We receive payment for the order via Shopify Payment in the USA. We do not invoice the customer. I think there is something missing here. Can you share with us what you know? Are we managing the wrong process?

Hello,

We have no knowledge about the subject, if you want, get professional support from a consultant so that you do not have problems in the future.

Hello,

I have an LLC company, but I have not started sales yet, I am waiting for some of my processes to be completed.

When I buy a product from my supplier, should I write my EIN number other than my company address when invoicing me?

thank you in advance

No, it is not necessary, the full name and address of the company will be sufficient. If you create an invoice when you make a sale, then add the company's EIN number to the document.

First of all, thank you very much for your quick response and information.

Hello, I have an LLC company. If I want to invoice an llc in Turkey, can I only invoice it in dollars or can I invoice it in TL? Do I need to add any tax items on it?

Hello,

Bill in dollars, but prepare the invoice in Turkish. You do not need to add taxes, just write the items and specify the total amount in USD. In this form, it is treated as an expense.

Hello, I am thinking of opening an llc in Usa. I am a software engineer and I work completely digitally. In terms of taxes, New Mexico appears to have 0 taxes. In which state would it be more advantageous for me to form an llc? Can I invoice the company in Turkey and will it be difficult for them to pay?

If you are not going to sell on marketplaces like Amazon and will only sell from your own website, we can recommend New Mexico.

Hello, I am thinking of opening an llc in Usa. I am a software engineer and I work completely digitally. Can I invoice the company in Türkiye and will it be difficult for them to pay?

Hello, you can cut it. If you pay with a card via Stripe, Stripe already gives you a payment receipt. You can also create your own letterhead and create an invoice. Payments must be made to your bank account in the USA and will be transferred internationally.

Hello. I understand that the LLC company registered with Amazon does not have to invoice the customer for FBA shipments, is this true?

True, but still keep a record of your transactions aside.

Hello, thank you for the information. There is a question that comes to my mind; if I am not mistaken, when we make sales to a customer in America with our company in America, we need to collect Sales Tax according to the state. So, what should we do about sales tax and VAT when invoicing a customer outside the USA?

So for example; In the state of Wyoming, when we make a $100 sale, the customer pays $104.

If we sell $100 to a customer in Turkey, how much will we invoice? Should we add VAT?

Thank you,

good work.

Hello,

It would be better to consult a financial advisor on this question. We do not want to mislead since we have no knowledge about the subject.

We thank you for your understanding and wish you luck.

Hello, first of all, thank you for your nice articles.

1- Can I issue the invoice in Turkish? Except for my company information, all other information will be in Turkish. I do business digitally and my customers are from Turkey, so I would like to speak Turkish if it is not a problem.

2-My company is in New Mexico. From what you shared and what I researched, annual reports etc. up to $100k. I don't have to give. As long as I don't exceed this amount, do I need to file a return or do anything annually?

3-Some Turkish customers receive money in person. Even though I usually pay it into my Wise TRY account, is there a problem if I still issue an invoice and get paid in cash when I need to buy it in person? Or should everything be electronic?

Thank you very much for your answers in advance. I ask the questions knowing that you are not an accountant or a lawyer, just share what you know. At least you know more than us. Regards 🙂

Hello, you're welcome.

Please send your questions to [email protected]

Thank you sir for your valuable information. Can we invoice a customer in Turkey through an llc we formed in the USA? Is this invoice accepted by the tax system? Is it subject to any extra processing during the import regime? Thanks.

Hello,

It's an accounting issue, but think about it this way: Have you never accepted an invoice from a foreign company?

Thank you sir for your nice writing. This came to my mind. How do we need to follow the invoice number? Ex. I will be making an invoice for the first time. Invoice No. 0000001 looked bad to me. Do I have a chance to change this? Also, do we increase the number by +1 for ongoing invoices?

Hello,

It's not a big deal, create a code you can understand for yourself and continue by increasing it by +1

. For example; You can continue like 002021-1, 002021-2, 002021-3.

I understand With your permission, I would like to ask one more question. Is it possible to issue invoices in currencies other than US dollars and receive payments to company accounts in other countries? Can I create a Transferwise business account and receive payments in euros from my customer in Germany to my Transferwise euro account?

You can also receive and send payments from other countries and other currencies to your Wise business account, you need to keep records of these transactions and forward them to your accountant because transactions in Wise business accounts are reported to the IRS, which may cause tax or financial aspects of the transactions. At the same time, I recommend that you consult a consultant regarding the billing and taxation aspects. Since we are not tax experts or licensed advisors, we are not authorized to give financial advice on public platforms. The information we provide here is misunderstood as tax advice and creates the perception that it can be valid for all commercial activities.

Please excuse me for this.

Hello, thank you for this beautiful site, well done.

For example, we established an LLC in Kentucky, we established a website for e-commerce and we will do dropshipping. Is it necessary to issue and send invoices to all customers by e-mail for the sales we make through our site? If necessary, how long should it be done?

Hello,

Invoice is easier for US companies than for TR companies. You can even have it sent automatically with Stripe. There is no specific time limit, but when you sell goods, sending an invoice gives the customer confidence.

We have an article about invoices and how to issue them, which will answer your other questions.

https://startupsole.com/amerikada-ki-sirketten-fatura-kesmek/

I would like to make a small addition, they can find invoice software on codecanyon.

Yes that's correct, thanks for adding it.