Once you form an LLC in the state of Wyoming, you must make a payment by filing an annual report with the secretary of state each year following formation. The annual report ensures your Wyoming LLC remains compliant and active.

How Much Does Wyoming LLC Filing Fee?

The annual Wyoming LLC filing fee is approximately $50 - $60.

Will I pay more?

The amount you will probably pay will not be more than this, because your assets (real estate, real estate, vehicle, etc.) within the state are less than $ 250,000, the annual report you will have to pay will not exceed the $ 50-60 range. As a foreigner, you pay this much for an LLC you form in Wyoming because you don't have physical assets there.

Are Different Names Used for Annual Report?

Since it is written as Annual Report in English, it is translated into Turkish as Annual Report. In addition, the terms annual filing or License Tax are also used instead of annual report.

How to File a Wyoming LLC Annual Report? How to Pay?

There are two types of filing options, the first is online and the other is by mail. Our suggestion to you is to file and pay this report online from where you live. Because after you file online, it is instantly recorded and you do not need to do anything extra.

When Should I File an Annual Report?

If you own a Wyoming LLC, you must pay your annual report every year, as the name suggests. You do not need to pay any annual report in the year you form your LLC. You must make the payment before the first day of the LLC formation month of the following year.

For example, if you formed your Wyoming LLC on September 15, 2021, you must complete your annual report by September 1, 2022.

Can I make an early payment?

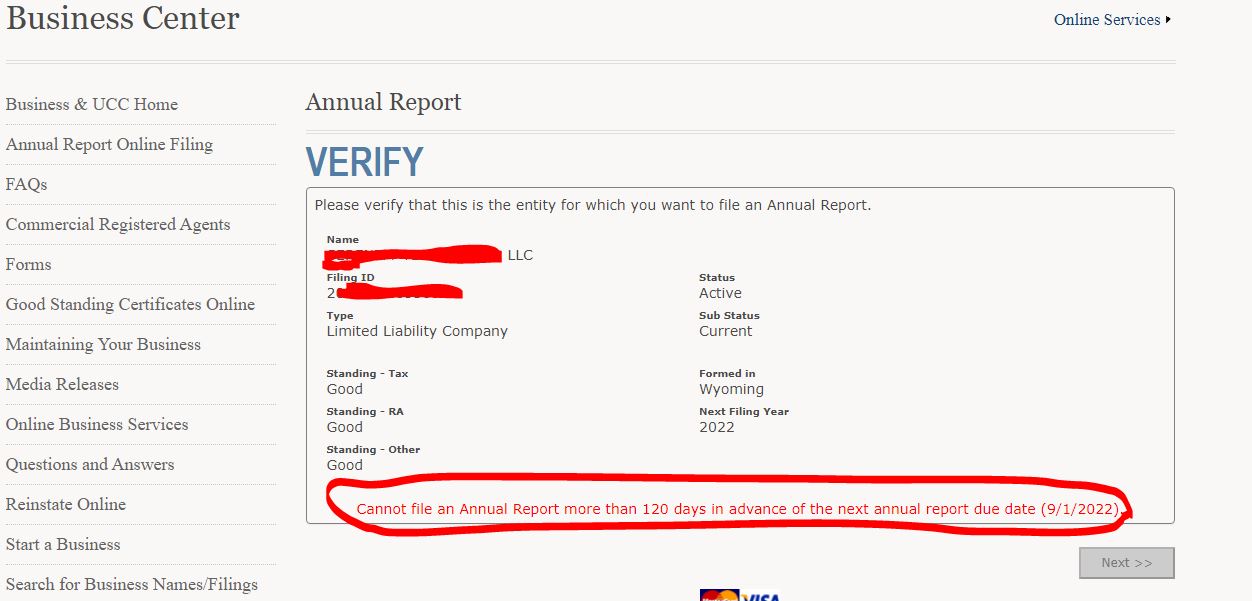

In fact, when you search the Wyoming state portal with your company filing number, the system will show you the earliest time you can file. You can make transactions up to 120 days before the first registration date, the system may not allow you to file annually earlier. Just in case, get information about the filing date by searching https://wyobiz.wyo.gov/Business/AnnualReport.aspx

Is There a System That Reminds Annual Filing via Email?

Yes there is!

In the state of Wyoming, most transactions are free, including the annual filing reminder. If you set up a Wyoming LLC with IncAuthority, Incauthority records your email address in state records during setup. If you would like to receive an annual report reminder via this email linked to your company name, simply following the simple step below will be enough to receive notification.

Go to this address and see instructions

https://sos.wyo.gov/Business/E-MailAddressInfo.aspx

It is already explained in detail in the instruction, but to summarize;

Send an empty e-mail from the e-mail account entered in the company installation to [email protected] In this way, you will subscribe to the reminder list. The system will automatically send you a reminder 60 days before the annual filing time.

What Happens If I Don't Make the Annual Report?

Certain penalties may apply and your company may be terminated by the state secretary if you exceed the payment deadline by 60 days. (So your company is closed)

How is Annual Reporting Paid for a Wyoming LLC?

First of all, when you start these transactions, the system defines a 30-minute session period for you. If you cannot complete the process within this period, the session will be closed and you will have to start from the beginning again.

You can pay this online with your credit card. First, find out your company's file number, this is called Filing ID, it is a number in the format 2020-000XXXXXX

You can see this number on your company formation document or https://wyobiz.wyo.gov/Business/FilingSearch.aspx .

After learning the number (filling ID), https://wyobiz.wyo.gov/Business/AnnualReport.aspx and type your company filling ID in the search line.

When you enter your file number, you will see the company name at the bottom. If it is too early to file, you will receive a notification like the one below. In these circumstances, you do not need to file yet because there is still time for this work.

If it is time to pay the annual report, you will not receive a notification as above and you can continue the transaction by pressing the next button.

1-Mailing Address

The postal address is the address to which notifications and documents from the state will be delivered. The first step is the mailing address section. If you need to change the mailing address of your LLC, you can enter your new address in this field. In this way, if there is a change in your company's mailing address, you can update it at the annual report stage. If you do not need to make any changes, you can proceed to the next step by clicking the Next button.

2-Principal Address

This address is the main office address of your LLC. It does not have to be located in the state of Wyoming. Although your LLC is registered in Wyoming, both your mailing address and office address may be in another US state. If you want to make a change in this information, you can enter your current office address.

By the way, you can also change your e-mail address in this section. If you want to use a different e-mail address to receive notifications, you can update this section and even enter more than one e-mail address (by adding a semicolon between them).

If no changes are needed, you can continue with Next.

3. Filing Fees

Your LLC does not own any assets or real property, etc., in the state of Wyoming. Otherwise, you do not need to update this field. Leave all fields as “0” and continue by clicking the Next button.

4-Confirmation

If there are no errors and you are sure that all the information you entered is correct, you can now confirm the transaction. If you think you have made a mistake in any area, you can go back and make the necessary changes with the back (previous) button. Click the Continue button to select the option to file online.

5-Signature

After choosing to pay the annual report online, you now digitally sign the platform by checking the box to accept the terms and entering your name and email in the relevant field. Click the Next button to continue and move on to the next step, payment.

6 - Payment

The total amount you need to pay will appear on this page. After clicking start the payment process, you will be directed to the payment page, at this stage you can make the necessary payment with your credit card.

Conclusion

After you make the payment, the transaction will go to the approval stage and since it is online, the transaction will be approved in a short time. From now on, your annual report will appear in records on the state portal. Search and find your company on the portal. When you click on the History tab at the bottom, you can see the annual report document in pdf format.

By following this process step by step, you can submit the annual report of your Wyoming LLC and complete it on your own, without any support from anyone. If you have any questions, write them in the comments section and we will try to answer them.

15 Comments . New Comment

Hello;

I established a company in Wyoming in June 2024. It is now tax declaration period. I have not had any active transactions so far. Do I have to file a tax declaration? If this is a mandatory situation, how should I proceed?

Hello, if you have not earned any income, you may need to fill out form 5472 and declare zero income. If you don't, there may be some fines if there is an audit in the future, or luckily there may be no problem. We can say that this is your initiative.

If you want to make a declaration, you can get service through Full Accounting, details are on our page: https://startupsole.com/amerikada-sirket-vergi-beyani/

Good day, my brother and I have an llc we formed in Wyoming. My brother is currently the sole owner of this company and I want to be one of the owners of this company. 50 percent ownership of assets, 50 percent of which will be mine. Is it possible for us to change this llc company in such a way and if we can make this change, what will be the taxes we have to pay once a year and the fees for this transaction? Have a nice day.

Hello,

You can first sign this with an operating agreement as two partners. Afterwards, you will need to apply for a new email address to the IRS and get a new email account as a partnership.

After completing these procedures, you can declare your taxes 50% as two partners, but your annual tax declaration service fee will increase by X2.

Thank you, can we do the signing process as two partners and applying for a new EIN from the IRS through Startup Sole and how much will the estimated fee be? Also, do you have any information about how much we have to pay, excluding our earnings, when this declaration fee doubles? I'm sorry I'm making this article so long, but let me ask you this: While our company is a single LLC company, will it be a problem if we now have 2 partners?

We do not provide this type of services. For partnership companies, the accounting fee should be around 1100 USD. If the prices do not change in the new period, the average price is at these levels.

However, these transactions (transition to the partnership structure) will take a long time, especially the change on the IRS side, probably months. If this partnership structure is very important to you, you can terminate the old company and form a new partnered company. This will be faster and the EIN number will be applied as a partnered system. Of course, if you have no activity in the old company. Otherwise, continuing as a single partner seems like a better choice.

Hi, I set up my company with Northwest in Wyoming, got an EIN number and started selling via dropshipping via Shopify. As far as I understand, there is no income tax in the state of Wyoming, but there is a sale tax. I guess I don't have to pay any tax when I sell the products I buy from China to people outside the country and state, but if I buy an order from this state, do I need to pay a tax? How should I report this and where should I pay? Thanks a lot

We have an article related to the question you are asking, read it carefully and you will find answers to all your questions. Be careful while reading; whether the company is located in Wyoming or another state is a different matter, and sales tax is a different matter. There are limits in every state. If the sales made to the states exceed a certain limit, you must refund the sales tax to the state in which you exceeded the limit. If you stay within the limits, you don't need to file any sales tax returns, just file your standard tax return at the end of the year.

I found it and read it, thank you. Do I need to declare taxes at the end of the year even if I have not made any sales through the company?

If you enter your EIN number somewhere (bank, stripe, amazon, etc. platforms) and a record is opened, these records are automatically sent to the IRS. For this reason, IRS knows that companies are actively trading through the EIN number. In cases where such transactions are made, form 5472 must be filled out and declared as zero income, even if there is no sale.

I understand, but by the end of the year, do we mean the last day of the current year (December 31) or the 1st year after the formment of our company?

For example, if the company was formed in 2023, activities in 2023 must be declared by the beginning of April 2024. You can think of it as the same cycle every year.

Thank you very much, don't miss it.

Greetings,

Does this process differ from state to state or is it basically the same logic? Thanks to you, I established SMLLC in Kentucky and now I am trying to learn tax affairs. Two questions stuck in my mind;

Is there a source where I can find out how the annual report is paid for Kentucky?

I have not made any sales yet or earned any income through the SMLLC I established. Is there anything I need to declare to the state? I would be glad if you help.

Hello,

The annual report for Kentucky is made on the state website, it is a very simple process and payment is made by card.

There are details here: https://startupsole.com/llc-icin-yillik-raporlama-annual-report/

Even if you do not engage in any commercial activity, you are required to fill out form 5472 by April next year. Here are the details and information about who you will receive service from: https://startupsole.com/amerika-disindaki-lccler-icin-form-5472-gercegi/

Good luck.