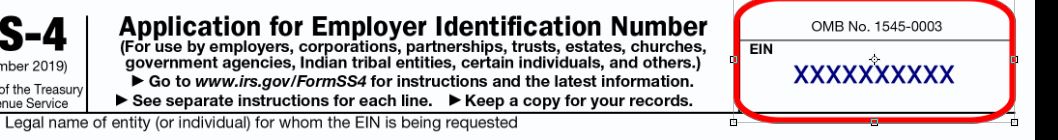

After forming your LLC company in Usa, you need to obtain an EIN Number for your company. An LLC company without an EIN number cannot engage in business activities. Yan cannot open accounts such as bank accounts, Stripe virtual POS, Paypal Business accounts for the newly formed company. In short, the first thing to do after forming an llc in Usa is to obtain an EIN number.

To obtain an EIN number, you must fill out the SS4 form and submit it via fax to the IRS. After your form is reviewed by the IRS, your EIN approval document arrives as an official document to the US mailing address you wrote on the form, and your address provider delivers this document to you digitally.

In this guide, you will learn how to fill out the SS4 form for your own LLC, send it to the IRS, and obtain an EIN this way.

Complete and sign the SS4 form correctly and fax it to the IRS along with your company formation document (Articles of Organization or Certificate Of Formation). Afterwards, you need to wait patiently until the EIN arrives. The time it takes to receive an EIN varies entirely depending on how busy the IRS is. Sometimes it takes 2.3 weeks, in some cases it can even exceed 6 weeks. You have no sanctions in shortening the time period, you just have to wait, but if you have waited for a very long time and you still have not received the EIN, Obtaining an EIN by Phone .

EIN numbers are assigned to companies by the US Internal Revenue Service (IRS) and are free. You are usually charged a fee of $50 to $200 for this service, but instead of paying this, you can rent a virtual fax number for a short time and apply yourself. You can find out where to get the fax number at the cheapest price and how to fill out this form, step by step.

To fill out the SS4 form and fax it yourself, without risking making mistakes during these transactions, you can order EIN Service for $39 from this link Or, if you establish your company with our reference, we can apply for your EIN free of charge. You can find the details on this page .

First of all, let's start by talking about the terms. After all, it is very important that you know what we do.

What is EIN?

EIN is the abbreviation of Employer Identification Number and can be translated into Turkish as "Federal Employer Identification Number" or "Federal Tax Identification Number". The EIN is issued by the IRS. IRS is the National Tax Office of the USA and is the authorized institution for all tax-related transactions.

We can define EIN as follows: It is a 9-digit number issued by the IRS to individuals or organizations doing business in the United States. Also known as Federal Employer Identification Number or Federal Tax Identification Number.

EIN is a number like this : xx-xxxxxxx

Why is EIN Required?

EIN is a tax identification number for your business (LLC). The IRS will use this nine-digit number to identify your business in tax purposes. EIN is also required when opening a bank account in the USA (including Mercurybank, Payoneer, Wise). A business that does not have this number cannot open a bank account. In addition, payment gateways such as Stripe also require this EIN from you during registration.

In short, after forming an LLC company in the USA, you cannot do anything without this number. Therefore, it is necessary to obtain this number, called EIN, by applying through the IRS.

Are Non-US Residents Required to Have an EIN?

Yes, it is necessary. No matter where you reside in or outside the USA, if you own an llc in the USA and have a commercial entity there, you must obtain an EIN.

Can I Get EIN Remotely Without Going to the USA?

Yes, you do not need to go to the USA to get an EIN. You can obtain an EIN by correctly filling out a form called SS4 and faxing it to the IRS. By the way, if you have an ITIN or SSN, you can get an EIN for your company in 10 minutes online from the IRS website

What is the Cost of Obtaining an EIN?

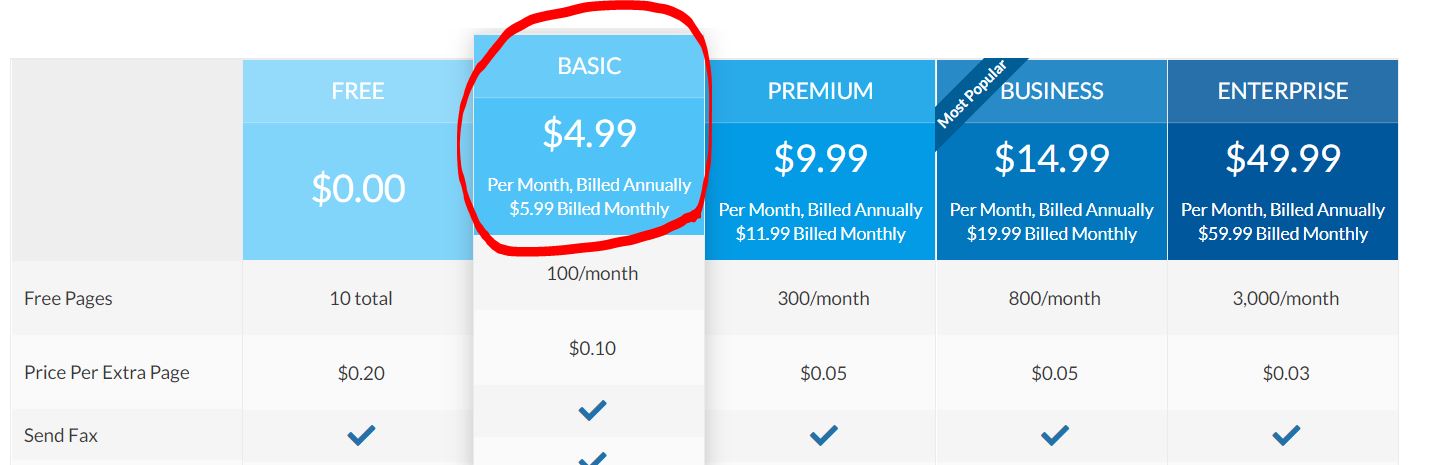

EIN is a number provided toll-free by the US Internal Revenue Service. You do not need to make any payment. You need a fax number to fax the EIN form to the IRS and receive it once the EIN is assigned. There are many sites where you can get fax service virtually, but the most cost-effective among them is Fax Plus .

Fax plus costs $5.99 per month. You can cancel your subscription after the EIN arrives. So, assuming that the EIN will arrive in two months at the latest, the EIN will cost you $12. If you choose an annual plan (you don't have to), it costs $4.99 per month. if you start a Fax plus membership from this link with our reference,

Once we know the details, we can now move on to the steps required to obtain the EIN.

You can start by obtaining a FAX number. This fax number is virtual and belongs to you as long as you pay the fee. Sometimes there may be an error in your SS4 form or it may not be legible to the other party. In such cases, the IRS may ask you to correct your error by sending a feedback to your same fax number. Therefore, the fax must be active until the EIN arrives.

Getting a Virtual Fax Number via Fax Plus

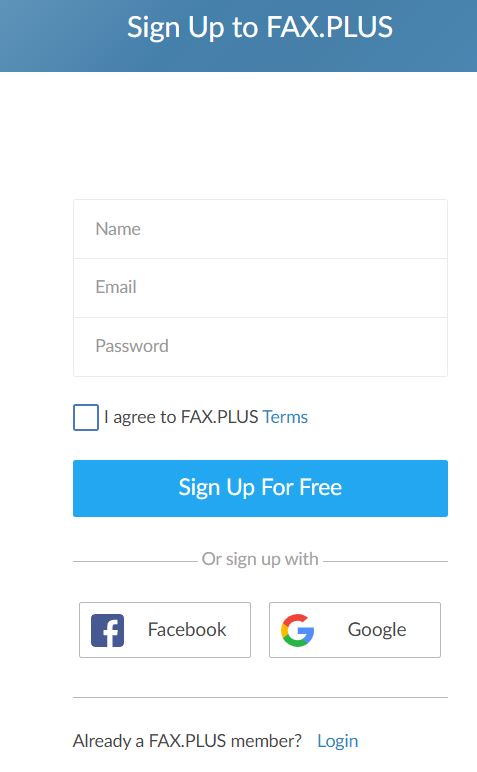

- First, visit the FaxPlus site here

- Choose Basic Plan

3. Choose the Basic plan, fill out the form and sign up.

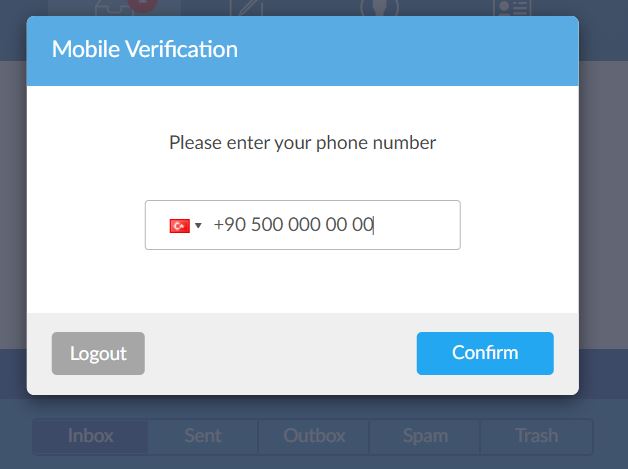

4. Enter your mobile number that you use in Turkey and activate the account by entering the SMS verification code sent to your phone.

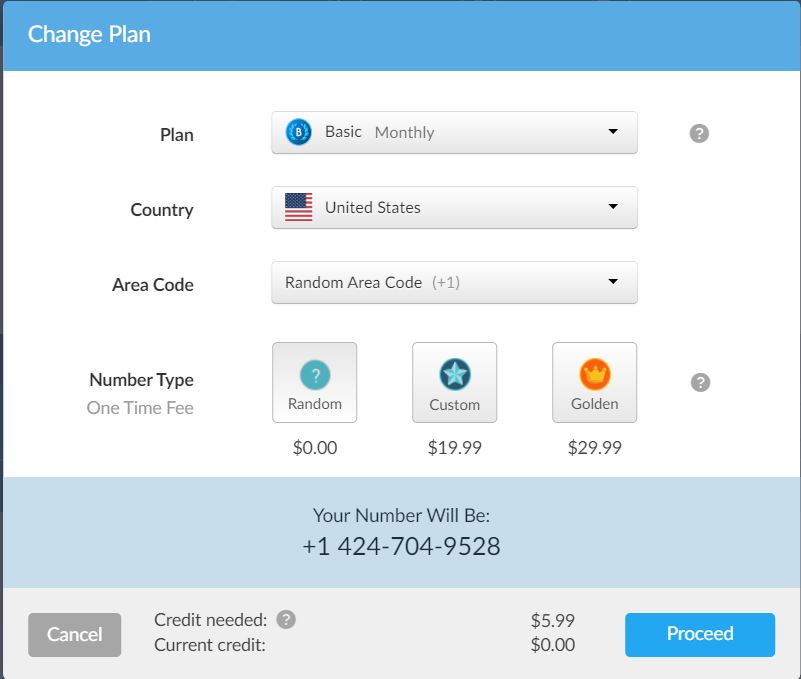

5. In this step, you need to determine your fax number and choose the plan. Select Basic, plan (monthly), select United States as Country, select Random as Number type. They will assign you a random fax number in the USA. It does not need to be in the state where the company is formed, a random number is sufficient. You can see the number assigned to you right below.

After this stage, you can make your payment by credit card and start your fax service. They now charge $5.99 every month until you cancel. However, you can use your card just in case. If there is no balance in it, they cannot withdraw money even if it is not cancelled.

Now that you have a fax number and an online panel to send the fax to, all that remains is to fill out the SS4 form and fax it to the IRS.

How to Fill Out SS4 Form to Obtain EIN?

Do not use Turkish characters when filling out the form, enter the parts to be written in capital letters. Pay attention to the date format, you should use month, day and year format instead of day, month and year.

- First, download the final version of this form from the IRS website. It has not been updated since 2019, but it makes sense to download it from the source just in case. the form from the IRS . Download and save the SS4 form somewhere on your computer. This link is the IRS's EIN page. If you want to review it, I leave it here for informational purposes.

2. At this stage, you can now start filling out the form. Fill out the form on the computer, then print it and sign it with a wet signature. Or you can digitally sign the bottom of your form with a free online application such as Sejda PDF Editor Place the signature in PNG format in the area related to Sejda, add the company establishment documents to the additional pages and save them again in PDF format. In this way, you can complete the work digitally without taking any printouts. If you have difficulty signing digitally, you should go to a quality blueprint office, print out the form you have filled out, then sign it and convert it back to digital environment (PDF format). (Tell Özalit company that this scan should be high DPI) Important: After filling out the form, whether you sign it digitally or print it, do not forget to add the company establishment document in the same PDF as the SS4 form.

2. At this stage, you can now start filling out the form. Fill out the form on the computer, then print it and sign it with a wet signature. Or you can digitally sign the bottom of your form with a free online application such as Sejda PDF Editor Place the signature in PNG format in the area related to Sejda, add the company establishment documents to the additional pages and save them again in PDF format. In this way, you can complete the work digitally without taking any printouts. If you have difficulty signing digitally, you should go to a quality blueprint office, print out the form you have filled out, then sign it and convert it back to digital environment (PDF format). (Tell Özalit company that this scan should be high DPI) Important: After filling out the form, whether you sign it digitally or print it, do not forget to add the company establishment document in the same PDF as the SS4 form.

3. Fill out the form as below.

Filling out Form SS4 for a Single Member LLC

The SS4 form is numbered line by line. You can fill out your form by entering the correct information in each line. This form is for single-member LLC. Do not fill out this form for multi-member LLC because the format is not the same

NOTE: If you fill out the form incorrectly or incompletely, you may receive a fax of incorrect documents from the IRS after a long waiting period. At this stage, you must correct the errors in the form and fax the SS4 form again to the specified address together with the cover letter sent to you. This may cause you to lose time, so be careful when filling out the form.

1- Write the full name of your LLC company in the USA in field 1.

2- Blank (Write the DBA name of your company, if any)

3- Blank

4a- Address of your LLC company in the USA (Street, Avenue, Apartment, Suite)

In field 4b-

Address continuation of your LLC company (City and Zip code) 5a- Blank

5b- Blank

6- City and State of the LLC address (Ex:Louisville, KENTUCY)

7a- Your name and surname are capital letters. Do not use Turkish characters.

7b- If there is an SSN or ITIN, if there is no “FOREIGN” 8a-

Check this box as “yes”. Because your company is LLC

8b- type “1”. Assuming that your company has a single member, the number of members is 1.

8c- Check the "YES" box.

9a- Check the Other box and type "FOREIGN-OWNED US DISREGARDED ENTITY".

9b- Empty

. 10- Check the "Started new business" box and type LLC as the specify type.

11- Write the establishment date of your company as month, day and year by looking at the documents.

12- "DECEMBER" can be written as the tax closing month.

13- Write "0" in all fields

14- Empty

15- Empty

16- Mark the business activity type. If you have no idea, you can mark other and write “GENERAL BUSINESS”

17- You can write the specific service and product type, it can be “GENERAL ACTIVITY”

18- Have you received an EIN for this business before? If you received it, mark YES and enter the EIN below. Otherwise, this box should be selected as “NO”

Leave the Third Party Designee box and the telephone and fax number fields opposite it blank as they are.

Enter your NAME SURNAME in the lower part (type or print clearly), and enter your TR area code and TR mobile number in the Applicant's telephone number (include area code) field directly opposite.

Type the fax number you received from Fax plus in the Applicant's fax number (include area code) field below the phone number.

Put your legible signature in the Signature section

In the Date field, write the date of the day you will fax the form as month, day and year.

Fax Form SS4

This is the last step. You can fax the documents you have filled out, checked, signed and returned to PDF format to the IRS.

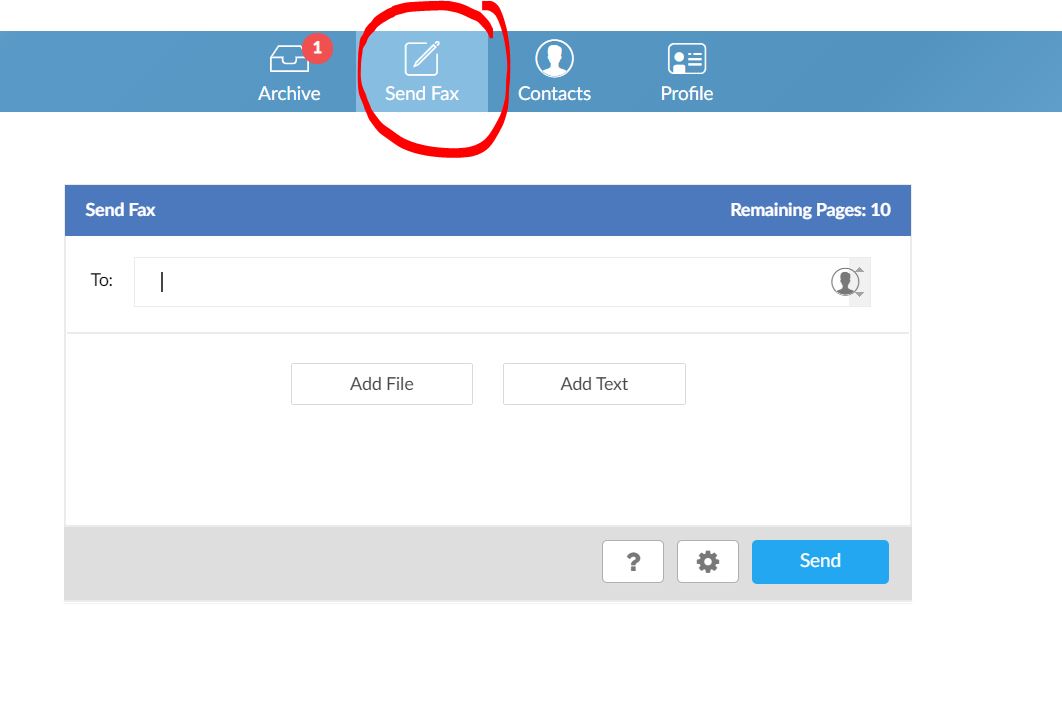

To fax, transfer your document as PDF to your computer and then log in to the Fax Plus

- Click the "Send Fax" button at the top of the Faxplus admin panel.

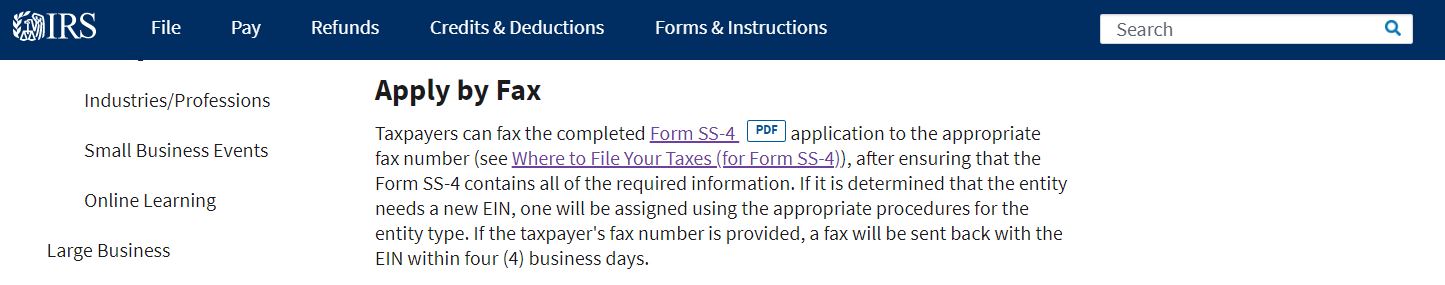

- In the “To” section, enter the fax numbers of the IRS: +1 855 641 6935 and +1 304 707 9471

- There are two numbers on the IRS website: inside and outside the USA. To be safe, faxing to both numbers will be guaranteed.

- , check this IRS page for current updates

- After typing the number, click the Add File button and select the digital version (pdf) of the completed SS4 form from your computer.

- Finally, you can send your fax by clicking the “SEND” button.

When will I receive my EIN?

IN numbers are assigned by the IRS and the process can take 4 to 6 weeks. Your official confirmation of your EIN Number (CP 575) is mailed free of charge by the IRS to your company mailing address in the USA (which you entered on the SS4 form).

Check your US business address panel from time to time. When the document reaches the address office, it is scanned and digitally uploaded to your panel on the same day.

Check your Faxplus panel and US business mailing address periodically. If your EIN number is sent by fax, it will be sent by handwriting it to the fax number you specified, at the top right of the same form.

Even if a handwritten EIN is received by fax, an official confirmation document will also be sent to your address by the IRS.

Second Request (You can apply for a second reminder)

, fax your SS4 form together with your company documents to the numbers given above by adding the text SECOND REQUEST at the top of the SS4 form

You can do it with a pdf editor, it should be like the example below

The EIN number (bibi in the example below) will be processed at the top right of the form you submit and will be sent to you via fax.

You can fill out the SS4 form for EIN and fax it. If you get stuck at any point, you can ask questions in the comments section. As mentioned above, fax your company formation document (also called formation certificate or Articles of Organization) together with the SS4 form.

254 comments . New Comment

Hello, good day. By sending the SS-4 form, I successfully got my Ein number. However, then I noticed that there were some errors in the SS-4 form. How can I correct these mistakes correctly? If I fax the SS-4 form to IRS again, will they make the necessary corrections unchanged?

Hello, you need to call IRS you cannot solve the mistakes via fax. Tell the problem by calling the phone at that stage at that stage, officials can solve your problem.

Thanks, as a single error, I wrote my home address instead of leaving the 5A and 5B sections empty in SS-4 form. Do you think this is a mistake or should it be corrected?

If you have come if you have come to consider those parts that do not constitute a problem.

Hello, I formed my company on February 29th and I already got my EIN code. But I have a question. While watching a video on YouTube, it was said that Northwest and SS-4 form should be sent to Northwest to get EIN number. I only sent the SS-4 form. Do you think this will create a problem? Does IRS give EIN number by evaluating the SS-4 form without looking at the company files?

In addition, I have written my Fax number and phone number in the SS-4 form to the “Designee” section instead of the “Applicant” section. So, I added this information to the wrong section. I learned that my EIN number came by entering Northwest's system. Do you think these mistakes will cause any problems in the future?

If you got the ein number, it's okay. It would be more accurate to ask the person who draws and publish this video here because we cannot interpret the content of others because it sounds out of every head. Thanks for your understanding

Hi, I applied for EIN on February 2, 26 days have passed, but still has not come, I check the fax+mail+northwest every day. I saw a new news ”The deadline for the BOI notification is March 21, 2025. Do you have any advice for this situation?

Ein applications come from behind, unfortunately there is intensity in the same situation in all accounts. Boi came into play again, but there is nothing to be done because Ein did not come.

Thank you for your interest. I will be following the developments on your page. Have a nice day

Hello, we applied through you for about four weeks. If the mail does not answer us, you wrote to send a second fax. Is there an example, how can we send what we write. My English is not enough to call.

Hello,

IRS is delaying the eın s these days there is a general delay, not a special situation for you. If you don't have a fax number, email [email protected] Company name, we will send the second fax for you with your name surname information. Since it is made from us, we must have your document update the same document and send it.

Hello,

apart from Ein, I think there is another document called 83 b election filling? Does it need to be filled by someone who lives in the USA?

This is not a topic we cover and you have commented it under the wrong topic. In fact, if you looked at the irs website, you would see that it is a form that is not really necessary. 83B is a form filled out by a US company owner when declaring stock income. If you are in the USA and will have stock income, let your advisor know at the end of the year and he will fill it in for you.

Greetings, I applied to Klarna with the EIN number I received from the IRS through Northwest. Klarna did not like the file I sent. They want me for a “full copy of the EIN letter issued by the IRS.” How can I achieve this? I sent an email to Northwest 4 days ago but did not receive a response. Can I claim it from the IRS myself or can you help?

Hello, they accept a confirmation letter called cp 575, which is not accepted with a written ein form on fax.

This confirmation letter is not among my northwestern documents. Are they sending it upon request from the IRS? How can I obtain this letter? Thanks.

This document comes from IRS under all circumstances, but it takes up to 3.4 weeks after the application. When was the application made?

Hello, my e-mail number was sent by e-mail, but it did not appear in the documents on the Northwest Registered Agent panel and it has been more than 3-4 months. Could this be because I wrote the address wrong?

Yes, if your address is wrong, your document will not come.

So, will there be a problem if I send it again, using the correct address, because it did not arrive on the panel, but an EIN number was sent via e-mail?

If you apply again with the new date, a second e-in number will be assigned and it will become a double e-in. The best thing is to call and get the 147c document by fax.

The e-in number does not come with the email, but shouldn't there be a mistake?

I'm sorry if I said it wrong, it came as a fax, it just didn't come to my panel, most likely it didn't come because I wrote the wrong address, will it cause any problems if it doesn't come to the panel?

In the future, you will be asked for your confirmation document and if you cannot provide it, you will have problems. Also, why did you give the wrong address to the IRS? Notifications etc. How will you receive important documents when they are sent? It would be better to call the IRS and resolve the issue; you cannot resolve it via fax.

As the address, I wrote the address at the end of page 1 in the company documents that came after the company was formed.

You stated in your previous messages that you wrote it wrong, and this issue took a lot of time. Write your address correctly and fax it to SS4 again. This comment cycle has become quite long so please let's end this thread.

Hello,

On the IRS website, it says that EIN applications made via fax will be processed within 4 business days. Is this something new? What is your experience? I asked because you always apply. What is the average result time? Does it take 4 days as they say?

I leave the relevant link below.

https://www.irs.gov/businesses/small-businesses-self-employed/how-to-apply-for-an-ein

We have been applying for EIN for years, unfortunately we have not yet seen a response within 4 days. In rare cases, they get back via fax within a week (very rarely) and send them by writing "ein" on the written SS4 form, but the official document still takes up to 3 weeks in any case due to mailing times.

Hello,

when I was creating the company's documents, I created them without a suite number.

Northwest for updates , but my document has still not been updated. I wrote the suite number on the application document, but it does not appear in the company documents. Will this issue pose a problem to me? Can I apply for an EIN number this way? Have you ever had such an experience?

Hello

No problem, you can apply in this way. No one will ask for a document for the address. It will not cause any problems since the suit address will be written on your e-mail document.

Hello, I formed an llc from Northwestagent, in Austin, Texas, and then I filled out the SS-4 form with the Faxplus application and sent a fax to the IRS on May 2, but there was no response from the fax, why do you think I should do from my address?

May 2, if I were in your place for a very long time, I would send a fax with a new date, and a few days later, I would call Irsi and ask for the document containing the eIN number via fax.

When I say send a fax again, should I send the SS-4 form again or should I send a fax stating that I want them to inform me about the situation that my EIN number has not been received?

Fax the form

I sent it via faxplus at 15.00 in Türkiye time and 08.00 in the morning in the USA. I think I sent it outside working hours. Does this cause a problem?

No problem, they accept shipping 24/7 as it is efax.

I sent a fax on July 9th, but there is still no response. Is this the normal process or should I send a reminder fax?

It takes 3.4 weeks, they won't get back to you, send a fax if you want.

I think they were waiting for me to write to you, my EIN number has now been uploaded, thank you, you are lucky to come 😀

Hello,

I applied for EIN on the 4th of this month, there is still no news, generally everyone I see says it takes 12-13 days. Do I need to contact the IRS? Thanks.

Hello, I received the EIN number via fax on April 28, but the documents have not yet arrived in my company panel. Even though it has been more than 2 months, is there any problem? Also, since I made the declaration on the website, the declaration warning on the panel is still there. I think there will be no problem, thank you.

2 months is a long time, it should have already arrived as an official document. It would be beneficial to call the IRS and obtain a 147 C certificate. In the future, there may be institutions that will ask for your EIN approval document, they may not accept the SS4 form sent by fax.

Hello,

Is it possible to make an online EIN application guide for SSN holders? Or if I apply for an llc through your link, can I get an online EIN with my SSN? I learned that you can get an online EIN in 10 minutes.

Hello,

Yes, if you install with our reference, we will help you with the installation. Install with our reference and send us an e-mail with your order number and we will start your process.

Hello, 1 week ago I faxed the SS4 form to the IRS for the EIN number.

If the EIN number is successfully obtained, will this number be sent to us by fax or is there a platform where we can check it online?

Hello,

it will reach your company address by mail within 3-4 weeks.

Hello, my company was formed through Northwest, my EIN number was received by fax, but my document still did not arrive on the panel. How should I follow the process for this?

Hello,

Sometimes the fax comes as a priority, it arrives as a document within a few weeks (sometimes earlier), you will have to wait a bit and your document will arrive.

Hello again, thank you for your response. I started the company in Wyoming for my Etsy shop. We appear to be at the exact same address as one of my competitors because we have formed it with the same registered agent. Last week, all my opponent's accounts were suspended. Of course, this situation scared me. I also wanted to work with a warehouse in New York for a while. In this case, do you think it makes sense to form a new company in New York? I read that companies formed in the states of Wyoming and Delaware are now viewed with prejudice in the USA.

People who say they are viewed with prejudice are generally intermediaries who set up companies, but some wholesalers rarely want to see serious buyers. This situation is partly related to relationships. Suspend status is completely related to Amazon policies, of course, the unique address can prevent some problems.

Hello, I printed out the form in black and white and had it scanned. Should it be colourful?

It does not have to be in color because the fax to be faxed is sent in black and white anyway.

Hello, should the date where I sign be the date I sign and send it?

Yes, it must be the date of the day of dispatch.

I faxed my SSN form and Certificate Of Organization documents to this number +13047079471 using the online fax service. How can I make sure my documents are delivered and everything is OK?

If you are not sure you did it right, you can confirm by calling the IRS. There is no other way to follow up.

Hello, I opened the company and made a declaration, but I have no knowledge of how and when the tax declaration should be made, and intermediary institutions require serious figures for the declarations. Do we have the chance to fill out these declarations ourselves? Also, do we have any other business other than tax declaration to make sales? Regarding the company, my company is an LLC with a single founder and in new mexico

Hello,

if you established your company in 2024, keep the income and expenses for this year in an Excel table and keep digital copies of your expense invoices. You need to declare this year's activities in April 2025, there is no need for anything this year, BOI is sufficient anyway, BOI is also a one-time application.

There is no annual maintenance, report or payment in New Mexico, you just have to pay the annual service fee of Northwest agent.

There is a Turkish consultancy company where you can get affordable service for annual tax declarations. Please note the information here for next year: https://www.tamaccounting.com/tr

Hello, I sent the SS4 form on February 29, due to the delay, I sent it again for the second time on March 21, and today my EIN number arrived via fax and another company's form and EIN number also came to me. I think there will be no problem.

Hello, no problem, keep your own document, destroy the other one, they may have probably confused the other company's fax number with yours, no problem.

Hello, I sent the SS-4 form via Fax on March 12, but I cannot use my Fax number anymore. My EIN number will be sent to the address given by the company I founded the company. How can I check when it arrives? Will the process be longer if I send a second reminder fax?

Looks like it won't arrive before April. If you formed the company from northwestregisteredagent.com, log in to the platform and check the Documents section. If your ein document arrives, they will upload it as a pdf to that section.

Hello, I sent the SS4 form this day last month and the EIN number has not arrived yet. Is this period normal?

Applications made until March 1 have started to be finalized. Applications made in February must be completed. Sometimes IRS can skip it, we have experienced this many times and unfortunately they do not give any information, so if the document has not yet arrived after 4 weeks, it may make sense to update the application date at the bottom of the SS4 form (write the day to be faxed) and fax it again. Then you will have to wait a few more weeks, this is the best solution.

I understand, thank you

Hello,

on 28.02.2024, I established my LLC company in New Mexico through Northwest, which was recommended on your site, and then I applied to benefit from your free EIN application campaign. All in all, the process was completed in three weeks and the EIN number was uploaded to my Northwest panel last night. Today, by taking advantage of the article on your website, I applied for BOI in about 15 minutes and received my Fincen ID number. Next is to open a bank account. Thank you very much for the useful information and effort on your site.

Hello, congratulations and wish you success in your work.

Hello, did you apply with a passport or ID when applying for BOI?

I applied with my ID, Melih Bey.

Okay, thank you, some people said passport is mandatory, so I asked.

Hello, it has nothing to do with the topic, but when filling out the BOI form via Northwest, there is a section called Issuing Jurisdiction. What exactly does it ask for here? Should I choose Turkey or Usa?

Hello, they say that a passport is mandatory when getting a BOI report, do you have any information? thanks

A passport would be better if possible, but if you are unable to obtain a passport within a 3-month period, you should at least report it with your ID rather than not doing it at all.

HELLO, WHEN FILLING IN THE SS4 FORUM (Date business started or acquired (month, day, year). See instructions.) DO I NEED TO WRITE THE DATE OF THE DAY I REGISTERED IN THIS DATE SECTION?

In this section, you need to write the formment date in the company formment document in Month / Day / Year format.

The northwest registered site wants me to fill out a forum called ONLINE FEDERAL BENEFICIAL OWNERSHIP INFORMATION REPORT FILING. Do you know if it is mandatory? Thank you.

Hello, you can send your Boi report by following the method in the article in the link below. If you send it yourself as a result of the same process, you do not need to pay attention to the warning on the Northwest panel.

https://startupsole.com/fincen-boi-beyani/

Hello, first of all, I would like to thank everyone who contributed to such a site. With your reference, I completed the company formment with Northwest in New Mexico. Yesterday, I applied to you to benefit from your free EIN campaign, but since I did not receive an e-mail or response from you after the application, I wanted to ask here. Is your free EIN campaign still ongoing?

Hello Mr. Murat,

We have seen your EIN application and completed its pre-approval, you must fill out the second form in the email we sent you in order to continue.

Thank you, Mr. Nazmi, for your quick response, help and excellent service.

You're welcome, good luck and success.

The form was updated in December 2023, is it possible to update the article?

There are no changes to update the article. We have already shared the form link from the IRS's current library, you can download it and look at it.

https://www.irs.gov/pub/irs-pdf/fss4.pdf

https://www.irs.gov/businesses/small-businesses-self-employed/how-to-apply-for-an-ein

Admin, something came to my mind: I am going to form an llc in the USA from Turkey, but it will have no employees. There is something called fein, don't we need it? Also, do I need SSN for tax forms?

You don't need a Fein, and you don't need an SSN anyway. Even though it is, it is not a number that can be obtained because it is only given to people who have citizenship and residence status in the USA. You don't need the things you mentioned.

We sent the required documents on June 11, 2023, we still haven't heard back, can you help us where should we apply?

Hello,

there was a disruption in the irs in June, try calling the irs if you want.

https://startupsole.com/ein-onay-mektubu-nasil-alinir/

Hello, it has been 6 weeks and I still haven't received my EIN number. What number can I reach you from?

Hello, e-in numbers are delayed these days. You can send a fax again as a second request and search according to the instructions in the link below.

https://startupsole.com/ein-onay-mektubu-nasil-alinir/

I completed my entire company formment phase by using your blogs. My EIN application had not arrived even though I made it 2 weeks ago, but after reading your article, I called and completed the process within 1 hour. I am leaving this comment as a thank you. You do a great job, you provide really useful and transparent information. Thank you and I hope you continue your work.

Hello,

Unfortunately, it can now take up to 4 weeks for invoice numbers to arrive, especially in Wyoming, as there is an incredible demand for the invoices. But we can say that Delaware is faster in this regard.

It is very pleasing that you completed the process by using our article. We thank you for your comment and wish you success in your new venture.

Sir, how can you write the fax number as +1 304-707-9471 with hyphens? I sent it without hyphens, will it be received or should I send it again with hyphens?

You should send it without hyphens, but send the fax again on weekdays around 17:00 Turkish time and send it 2 or 3 times in a row to be guaranteed.

I want to change my address, I haven't changed the company address yet, but will it be irregular if I send it with my new address?

If you have faxed the Ss4 form and it has been processed, your result document will be sent to the address you wrote on the form. It would not make sense to make changes after the hour.

Continue with your current address, then to change your address, you need to send a signed document to the IRS for the change.

HELLO

. Where can we obtain the documents with the e-mail number if we do not receive them via FAX OR POST AFTER THE APPLICATION?

Hello, sometimes there may be a delay on the IRS side or applications may be assigned, although very rarely we have experienced this.

If your application has not been finalized after up to 5 weeks (maybe in the 3rd week), you can easily request your e-approval document by fax by calling the irs.

The article below has a guide on how to do this and the phone number to call. You can call and get your EIN document quickly.

https://startupsole.com/hizli-ein-almak-telefonla-ein-no-alma/

thanks

I did it on January 23, still no results. I wonder if anyone has received an answer to the EIN applications made on this date.

Applications made at the beginning of January are still being finalized. If you want, you can call the irs and ask for a letter via fax. Some people received it this way early. But phone lines are very busy.

Hello,

Have you heard back from applications made in January? We sent a fax on January 23 and we are still waiting.

Enjoy your work.

Hello,

as of January 1, the EIN has not yet been received, it is known that it is busy, so we are waiting.

The IRS website states that non-US citizens can obtain EIN service by phone. I'm thinking of calling this number. Will sending a fax result in a situation where two different EINs are assigned for the LLC? So, after receiving an EIN over the phone, can another EIN be assigned and sent via fax/mail? I would be very happy if you could provide information. Thanks in advance.

No problem, you can call, but the lines are busy and you probably won't be able to reach them.

First of all, thank you very much for the information you provided. Finally, I want to ask one more thing. Does the IRS respond or take no action when a required field on the SS-4 form is faxed unfilled?

Hello,

No, it may not answer, the incorrect field will be recorded as specified. If there is a place or information that cannot be read, they will respond only to that by fax.

Hello,

I wonder what the latest situation is on the matter? Has anyone received an EIN number?

EIN applications made as of January 1 and later started to arrive as of this week. In other words, due to the busyness of the new year period (the IRS states this), it takes up to 6 weeks for new applications to be processed.

Additionally, IRs no longer respond by fax but forward all EIN numbers as notification to the company address. EIN assignment and delivery to addresses may vary depending on location. For example, mail reaches states such as Colorado and New Mexico earlier, while DE and WY arrive a few weeks later.

If you wait patiently, it will arrive somehow. However, for applications that exceed these deadlines, it may be useful to send the SS4 again with a second reminder fax.

You can also look at the comments on this subject. Someone called the IRS (luckily they reached them quickly) and received the assigned EIN letter, which was in the mailing phase, via fax: https://startupsole.com/hizli-ein-almak-telefonla-ein-no-alma/#comments

It arrived at our WY address on February 9th, in about 5 weeks. The fax arrived one day later, on February 10th. Unfortunately we have to wait a bit.

Hello,

Did you apply for an EIN in January? If so, how many days did it take to receive the fax or mail? We have been waiting for our new company since January 3. We have completed 3 weeks. It's never taken this long before.

Yes, we can say that the application was made in January, but it has not been finalized yet, because it is tax season in the IRS and the EIN results will take 4-6 weeks.

That's exactly what I predicted. Thanks for your return.

You're welcome Unfortunately, it requires some patience, Irs no longer responds via fax. For this reason, delivery of documents by mail also extends these periods.

It's good to know this. Because we are waiting for it to arrive via fax. Then we will just wait for the mail. As you said, delivery by mail also takes longer.

It rarely comes by fax, but the real document you need is CP 575, which comes by mail. In any case, you have to wait for the mail.

Hello;

My question is about fax. Do you think it makes sense to keep the number on fax.plus after getting your spouse's number? In the future, will this fax number be kept in the IRS's database for tax, court, etc. purposes and will I be contacted via this number regarding the LLC?

Note: I formed the company with nortwest through the link on startupsole and they do mail forwarding (can an alternative to fax be sent here?)

Hello, if you have not used this fax number anywhere else and it does not matter to you, you do not need to keep it only for IRS. After the IRS receives this fax, they will not reach you at any time and they will notify you in writing to the e-mail address you wrote to SS4.

They definitely send a document here, but sometimes they send the e-in number by fax beforehand. Try to keep the number until the e-mail arrives by mail or fax, just in case.

Hello, I shared it with you on this page on 11.04.2022.

My SS4 form arrived via e-mail-fax, but it has not yet arrived at my fixed address in New York. I need a document that must come as a letter for my work.

We have been waiting for about 3 months.

How can we reach IRS? phone-e-mail. We need to get our document urgently. What do you think we should do?

Hello, although rare, the problem you mentioned may occur. You can of course request your EIN approval document from the IRS. We have an article for this, you can apply one of the two methods in the article and request your EIN approval document 147C from the IRS. Cp575 will not be generated a second time by the IRS, but a 147C of the same value will be sent instead. You can access the guide here: https://startupsole.com/ein-onay-mektubu-nasil-alinir/

Thank you very much my friends for providing this information. I formed my New Mexico LLC company and applied for EIN. My EIN document (575cp) arrived at my Northwest address within 10 days. If I'm lucky, I'll open my Paypal and Stripe accounts. The LLC in the state of Mexico cost me around $95 all inclusive (fax for ein). You can trust the information on this site blindly. My best regards..

Congratulations, Mr. Kasim, it is pleasing that you completed the entire process without any problems. We thank you for your positive feedback and constructive comment.

Thank you very much, this site is my guide to setting up my company, thank you, I faxed my SS4 form ON APRIL 18, in 3 days on April 20 I got my EIN number hamdolah.

keep up the good work, thank you

Thank you for your comment, it's very nice that you succeeded

Hello . I also applied for EIN via fax and received a response. But the EIN number is not legible. What can I do about this? Because I don't want to have any problems applying for a bank account.

Thanks

The original CP575 EIN letter will probably be sent to your mailing address in the USA within a few weeks, and you will not have any problems since there is no handwriting there. Is the number you received via fax faded? Or is it not legible? If you want, send it to us and we will try to solve it. We are used to their handwriting now.

Hello, we received our e-in number for our LLC company by e-mail on 03.03.2022. but it has not yet arrived at our office by mail. How long does it take to obtain our EIN document via fax? We are having some trouble with the mail.

Hello,

Has EIN arrived? Or didn't he come? It is difficult to understand the exact result from what you said. You said it came as an e-mail, you said it did not come by mail. Isn't mail and mail the same thing?

By the way, sometimes the fax may not arrive at all. Your EIN letter by mail may take approximately 3 to 6 weeks after the application date. You can send a second reminder fax just in case.

"second application" in the title of the fax, you will emphasize that it is a second reminder application. There is nothing we or you can do during this period other than these, we need to wait patiently.

Hello,

a document was received by e-mail on 03.03.2022, but it did not arrive as an e-in letter.

Some companies we will do business with request the documents to be sent by post. this is our problem

When you say Mail, do you mean E-mail? Can you take a picture of the incoming document?

Yes, I received an e-mail with the SS4 form filled out and the EIN number written on it. Where can I send a photo of the document?

OK, now the situation is clear;

If what you receive is the EIN written on your SS4 form (which it looks like), you have been contacted by fax, and any return by fax is made by handwriting the EIN in the upper right corner of the SS4 form.

The EIN came to you via fax, and you thought it was sent to you via email because the documents you received were sent via email. In fact, the result that came via that fax.

As we mentioned above, there is still time for it to arrive by mail. In a few weeks, they will also send it to your US business address by mail.

Ok thank you, now it's clear.

So is the timing normal? This e-mail arrived on 03.03.2022. How long will it take for it to arrive at our business address?

It will arrive, don't worry, it will be mailed after a fax, it will arrive in a week or two. You have to be patient during this process. There has never been an EIN mail that hasn't arrived so far. They send it without any problems, as long as you write your address correctly on the SS4 form.

Hello,

They sent me my EIN number via fax, thank you very much, but when registering to my Amazon Account, I receive the warning 'The Name and Tax ID provided does not match the IRS records'. Has anyone encountered this problem before?

I request your support.

Hello,

This is a common problem. Since the ein assignment is new, the records may not be formed yet, wait a little longer and try again.

Good luck, good luck.

Perfect. The EIN number I applied for on March 26th arrived at 5 Nissan. I was waiting for nearly 2 months, but it arrived via Fax in 10 days. Thank you Startupsole.

Hello,

You are very lucky for the quick response, congratulations.

Hello. I have a few questions so we don't make any mistakes

. 1. When I download the SS4 form from the link you gave, it has 2 pages. The second page begins with the text “Do I Need an EIN”. Are we deleting this page?

2. I founded my company in Kentucky. I have Article of Organization, Operating Agreement, Release and Membership Listing Agreement files. Should we add these to the pdf file in SS4?

So, as I understand it, it should be 2 pages long. The first page is SS4 form and the second page is Article of Organization

. Am I understanding correctly? I would be happy if you could answer me.

Yes, delete the first information page and fill out only SS4. Add Articles of Organization to the second page of Ss4 and fax it to two pages in total.

Hello,

I have a virtual fax number in Turkey and I have been using it both domestically and abroad for years. Can I use this number? Does it have to be an American fax number?

Worst case scenario, when I successfully send the documents with the Turkish Fax number, I understand the IRS will send them to our address even if they cannot send them to the Turkish Fax number?

Do you think it will be a problem? Has it been tried?

It was never tried because since it was a number outside the country, no one took the risk in case it might not make a comeback. Yes, they also send the letter as a document, but if there is a correction or missing form, they return it via fax.

If you want, fax the form from your own number, but enter our company's fax number in the fax section.

If we receive a notification, we will contact you. If you can send an e-mail about this issue, we will support you.

Hello

My EIN number, starting with 61-XXX, arrived on January 25th. Before arriving, I faxed the same documents again because it was delayed. But today another EIN number arrived, starting with 35-XXX. Can the IRS define 2 EINs even by mistake? What should I do in this case, which EIN number should I use? What about the number I won't use? I applied for Amazon and banks using the first EIN number I received.

Use the first number that comes up. In case of repeating e-in numbers, the first number is valid.

Hello, good luck, all my documents are ready. The only thing that comes to my mind is that the company I founded is in Wyoming and my articles of organization document is 4 pages. Do I need to send those 4 pages as well? Do I only need to send the page with my company name and address under the title of articles of organization?

Just in case, we add 4 pages to the rest of the SS4 form and send it for a total of 5 pages.

Do the same, there is no need to risk it.

Hello

First of all, thank you for all this information. Thanks to you, I opened my company and received my EIN number.

I have a question I want to ask. In the article, you wrote that the IRS would write the EIN number on the form we sent and fax it to us, but I did not receive a document by fax, only an e-mail from the IRS stating that my EIN application was approved and the EIN number was sent to my company address.

Can I apply to businesses such as Stripe and Mercury with this document? Is it a valid document?

Thanks

Hello,

Good luck, sometimes a fax comes first, sometimes they send an EIN letter to the address.

The important thing is the letter you mentioned that came to your address. Keep your e-in document and do not lose it, and you do not have to wait for a fax anymore. With this document, you can legally open an account on all platforms such as mercurybank, stripe, wise business, relaybank.

Good luck.

Hello,

Is it necessary to write December in the 12th chapter? Is this standard for us? Or is it different for everyone?

It is best to write December

Hello,

I filled out the EIN form as described in your description and sent it. I received a fax on December 8th, the fax arrived today and I was able to get my e-in number. One number in the EIN number was not fully legible, so I called the IRS and after waiting on the phone for about an hour, the person on the phone repeated my EIN number to me after a few verification information. This is how he solved it. Thank you

Hello,

I established our company about 2 months ago and applied for EIN. At first, I received a warning about missing documents and completed the documents and sent them again. Even though it has been 45 days, they have not responded yet. I called but I still could not reach them. How should I proceed?

Thank you in advance

Hello,

It must be busy tax season, but EIN assignments take a long time to complete. If you sent the missing document (you need to send it to the fax number on that document), it should probably have been processed. But 45 days is quite long, I recommend you call the IRS and try to reach them. It is said that it is relatively less busy, especially around 02:00 at night according to TR time.

I founded my company by taking advantage of your cooperation with Northwest, thank you very much. I will apply for EIN, but in the last case, should I leave sections 5a and 5b blank or do I need to enter my TR address?

Congratulations, you can leave those sections blank, it doesn't matter if they are filled in, dozens of applications that were blank like this were successful.

My application has been completed, but it seems that the EIN information has not yet arrived in my Fax.plus account. A letter from the IRS saying "We have defined an EIN for you" was sent to Northwest Registered Agent's panel. My guess is that they received this document physically, they scanned it and uploaded it to the panel. Should I wait for a separate document to arrive in my Fax.plus account? Or can I close my account?

Congratulations, there is no need to wait for a fax, your EIN has been assigned and your document has arrived. We can turn off the fax.

Conveniences.

Hello,

I did not add a second page when faxing SS-4, such as a certificate of formation. I missed it in your article. It was not mentioned in other sources, I saw it for the first time from your comments.

It has been 14 days since my application. Do you think I should fax the form together with the certificate of formation again?

Thanks.

In these circumstances, if your EIN application is not approved, you will probably receive a notification fax within a few weeks for providing incomplete documents. Attach your company formation documents to the rest of the SS4 form (in multiple pages) and fax them again.

It's been exactly 2 months and it still hasn't arrived for me. I'm renewing my 3rd month fax number. I wish I had received service from you.

Hello,

If no application has been successful for more than 2 months, you may have made a mistake.

Have you checked your company address? Even if you do not receive a fax, the e-mail will somehow reach your company mailing address.

If the company has not received documents to your mailing address, there must be a problem. It would be beneficial to call the IRS immediately and get your EIN number online over the phone.

My address and fax number are correct. I e-signed via Adobe PDF, added the date on Seda Editor and sent it as a PDF. The quality was not bad. Should I handwrite my signature? I was doubtful about this and sent the same form several times. I plan to resend it with a completely new date.

The signature is not very important, as long as it doesn't look fake, it's okay. Have you also sent your company formation documents? Fax the form again with the current date. If there is no response, you may need to call IRs. Have any documents arrived at your address? Have you checked?

I added the Articles of organization page, and I sent 2 pages in total, including ein.

https://www.hizliresim.com/kyb6xrg

I received something like this in my mail

OK, there should be no problem with the application, the articles document is sufficient.

The document you added was registered to the portal from the state of Kentucky, your password did not come from the IRS.

That's what I guessed, I had to apply with the current date and wait 15-20 days, but now I can try my luck by phone. Thank you for your contribution.

If I were you, I wouldn't wait that long. You may have to wait a long time on the phone, but it is the definitive solution. Follow the instructions here, call and quickly get your EIN number. https://startupsole.com/hizli-ein-almak-telefonla-ein-no-alma/

My English is not very good, I have reservations, to be honest, I have never tried it because I would not understand it, but I think I will try it as a dare.

Don't worry, that number is the support line formed for foreigners, so you can speak in very basic English, don't be afraid, they just make you read the SS4 form letter by letter, that's all.

Hello. I have a question. My company was formed in Wyoming on October 31st and my eIN application form was sent to IRC by the company with which I opened the company. So I didn't send it by fax myself. We registered the address I gave at the company opening and the address I received via sasquatchmail. So I have a special suite number. The result of my application will be sent to this address and in such cases, the estimated time for the result of the application to arrive. Also, will resending the application form via the fax method you mentioned speed up my work? Thank you for your help.

Hello,

Sometimes it comes first by fax, sometimes it is mailed to the address. At this stage, it is best to wait and it will be sent to your address. If it reaches your agency via fax, they will send you the fax printout by e-mail. In all cases, after the fax, the IRS will send you a letter as well.

Applying again does not change anything. Your application has already been processed and your EIN Number will probably arrive soon.

I think it took longer for some of your friends, and it's been 50 days for me, and it still hasn't arrived. Do you think there might have been a mistake? The truth is surprising for some of my friends, who arrived in 10 days.

Thank you for the information you provided, it was a good guide.

Hello,

Mr. Necati, there were applications that took more than 6 weeks. Are you sure the fax was transmitted? Did you send the fax again at various times (e.g., a week or two after the first fax)? Do you check your address? Sometimes they send it directly to the address before notification via fax.

Send a few more faxes today, if there is no confusion they will arrive, but if they are to reach them they need to take the last date you sent as basis. If you wait a while longer and do not get a response, your last resort is to call the IRS and request an online EIN assignment over the phone.

Thank you for your return, yes sir, I have not received any fax or mail. I checked the EIN form and I wonder if there was a mistake in these parts. I opened my company in the state of Kentucky and my address is in Wyoming.

https://www.hizliresim.com/lefw6j8

Would you recommend me to resend the ein form today? I've never sent it before.

Thank you.

No, there is no mistake, your agency's address is in KY, so your company must be located in KY, there is no mistake in the form.

It will probably arrive soon, but you can still fax it a few times.

Thank you very much, my last question is, should I sign and send the form again, dated today? Or should I resend the same form?

Do not write a new date, fax the same form with the first application date. But do not resend, the quality may decrease, send the same form as a new message.

Hello, in the organizer section of the article of organization document, the address I received from wyomingmailforwarding is written. Will there be a problem when we write a TR residence address for partial 5a and 5b in the SS4 form? Since no residence address was required in the application, they reported it to the state in this way.

By the way, the company was listed in the state of Wyoming very quickly, within 1 business day. For the information of those who will install it. Thank you in advance for your support.

Hello,

The address you write in 4a and 4b is very important. Double check that your EIN document and future notifications from IRs will be sent to the address you wrote in that section.

Do not write your TR address in 5a and 5b, there is no advantage or disadvantage. We used to write it, but now we don't, the EIN comes without any problems even without writing it.

They do not want a residence permit, their mailing address there will not cause any significant problems.

We wish you good luck and good luck.

Just as you said, mailing addresses with suite numbers 4a and 4b are OK. Then we can leave 5a and 5b blank.

Thank you very much, good luck to you too.

Yes, leave it blank, no problem.

Hello,

at the stage of requesting EIN, we have already established an LLC and received our address. I don't quite understand why we chose outside US when sending a fax, because it says that those who do not have a "principle place of business" or "principal office" in any state should choose this option?

Thanks a lot.

If you choose the "I am in the USA" option, this time you need to enter the SSN that proves your USA citizenship. OK, your company is in the USA, but EIN is a process that also concerns the company owner.

It arrived on the 9th day, they sent it via fax and it was very fast. Thanks for your support. Thank you very much

Hello, good luck. Yes, these days the orders started to arrive quite quickly, there was a glitch for a while, but there is no problem now, as you stated.

My EIN result came. Thanks to all this information and sample documents, I received an EIN and applied for stripe. Greetings and thanks to the admins who created this platform. It is a guaranteed guide that you can trust until the end, friends.

Hello,

Congratulations, the waiting people are starting to arrive these days. We thank you for your positive comment and wish you good luck.

Hello friends; My EIN application, which I submitted on October 17, was just completed. They sent it to me by fax. The question I want to ask is; Will the cp575 form be mailed to my wyoming address? Can I apply to Amazon without this form?

The CP575 form will probably be mailed to your Wyoming address within 2 weeks, and they will forward it to you digitally. I know that CP575 is not required at the first stage of the Amazon application, and that EIN is entered in the tax ID section after the account is pre-approved.

Of course, it would be more productive if experienced friends share their experiences.

There are also a few comments under this topic.

https://startupsole.com/amazon-icin-amerikada-sirket-kurmak/

Yours arrived quickly, mine did not arrive after 40 days, so they do not send it according to the delivery order.

Mr. Mehmet, have a little patience. There will be no EIN unless it comes from the IRS. Don't worry, it will definitely come.

A lot of EINs were finalized this week, some of which took 45-50 days, and some of which were applied for within 2 weeks. Yours will arrive today or tomorrow.

Do you know a way we can follow the status of our ITIN application? Do you know that ITIN applications are said to be finalized within 15 days? I know that we can apply for EIN online after our ITIN number arrives. Can we access the status of our EIN application online? Sorry, I listed my questions one after the other :)

Unfortunately, there is no tracking mechanism for your dog, but if you do not receive any rejection documents within 4.5 weeks, you can think that there is no problem with the application, all that remains is to wait. It will be mailed to your address after approximately 8-10 weeks. We can say that it is a complete superstition that it will not be completed in 15 days.

There is no place where you can track your EIN application. If you do not receive a fax containing any rejection information or paperwork errors within a few weeks after the application, there is no problem. In these circumstances, there is no solution other than waiting. Of course, if you do not have a language problem, you can instantly obtain an application on the phone and receive the application document by fax.

If you have the job, you can get an e-ink instantly online and even download the ein approval document called cp575 as a pdf after registration from the same page.

Thank you for the information you provided.

Sir, I opened the company in Kentucky. Articles of Organization came on 1 page. My friends said it was 4 pages. Is there something missing? I will send it as 2 pages along with the ein form.

Kentucky is also a single page. In Wyoming, it comes to 4 pages, no problem. Use single page

I sent it, sir. I hope it's true. Do they get everything back via fax? And how long does it take for it to arrive?

Sometimes it comes to the address by fax, sometimes it can come to the address first, so it is variable. Just so you know, it's been more than 4 weeks these days.

It's been 4 weeks since yesterday, there is no one coming or going. The year is 2021, the USA is doing business via fax. Interesting.

There is a general slowness, unfortunately there has been a slowdown in the last 4 weeks. If your work is urgent, you can call and get it via phone, but you have to wait at least 1 hour.

Sir, will I have any problems with payment methods without an EIN number at the first stage? It will be 5 weeks on Monday and I'm still waiting for it to arrive, and I'm not at a level to talk on the phone.

Without EIN you cannot receive payments, you cannot trade. Be patient, it will come soon. Instead of constantly asking us when it will arrive, it would be more logical to wait, it will arrive within 4-6 weeks, this is the information we receive.

After all, you are waiting for official documents from a government institution and everyone is in the same situation. If your work is urgent, you can hire a translator and have him call the IRS. Unfortunately, asking us when the spouse will arrive does not speed up the transactions at the IRS.

Hello, my company with IncAuthority has been formed in the state of Wyoming as of today. They sent me the documents. I will get an EIN number. I read this article from beginning to end. I filled out the SS4 form as you show here. Is it enough to sign the signature part of the form with a digital signature from a pdf without the need for photoshop? Should I send the SS4 form as well as the Articles of Organization document in one piece, with the Articles of Organization being 5 pages and the SS4 form being 2 pages (I don't think the second page is for informational purposes, but I don't think it is necessary)? Should I send it as 7 pages? Also, there is a fax number in Turkey to which I can send faxes. Can I send the fax from this number and write the fax number below in the fax number section? I'm asking so I don't waste money on the fax number?

Signing digitally will be sufficient, the form must be legible.

Remove the 2nd Information page of the Ss4 form. Add Articles of organization as 4 pages to the SS4 continuation so that they are all combined into one file.

So, if you have spent so much effort, do not run away from $5. We don't know how the IRS officials will act, what if they don't send a fax with a TR area code?

The possibility of waiting for weeks and not getting results is like flipping a coin.

The choice is yours of course

Thanks very much for the answer. Again, you are very fast and respond to everyone without getting bored. I said it because I actually had such an opportunity, rather than to escape from $5. Since our company has fax, I try to use the opportunities I have. My purpose in asking was whether you have experienced it before, and as you commented, we cannot know the officers at the IRS, the most logical thing is to make sure.

You're welcome.

We have not experienced it, but it will most likely cause problems, so it is not worth the risk.

Conveniences.

Hello, thanks to you again, this time I have also received my EIN number. Thank you very much for everything. I made the application on October 22. As of now, my EIN application has been approved and I have received my EIN number.

Good luck and good luck!

Thank you for your hard work. May God bless you. Thanks to the instructions here, I formed my company in Wyoming. I just applied for an EIN with the IRS.

As if helping us with information wasn't enough, the faxplus program also gave us a $2 bonus for coming with your reference. I don't know how your rights will be paid.

I want to tell you that I am grateful. Please accept.

We thank you for your valuable comment. It's nice to see that things are going well.

We would be pleased if you leave your valuable comments on our google business page.

https://g.page/startupsole/review?np

Best regards

gladly :)

Thanks:)

When is the average response time for applications in this process? Do you have any information?

Thanks.

It varies between 2 and 4 weeks

Sir, it will be 3 weeks tomorrow, should I give up hope? 🙂

Hello,

We also have EIN applications for which we have been waiting for more than 2 weeks. In the last month, the deadlines have started to get longer again. Previously, there were applications that were completed in a week, but they will come, don't worry, there is just no rush.

If you have not received any notification of incorrect application through the IRS (they notify you when there is a problem via fax), then there is nothing to worry about.

Best regards.

Hello,

If we sign using the Sign feature on Adobe Acrobat, will it not be accepted?

It can be e-signed with Acrobat, but be careful, it can sometimes corrupt it. We generally use sejda.com editor, it is more practical and hassle-free.

I submitted my LLC company application today (Kentucky). Can I apply for EIN in order not to waste time waiting for the results?

Congratulations. You definitely have to wait. You need to enter the formment date of the company in a field in the Ein form. You also need to add the company's formation document to the second page of the eIN SS4 form.

Otherwise, you will not be able to get the money, do not rush, let your company be formed and your documents arrive, then apply accordingly.

Sir, first of all, we cannot thank you enough for sharing such valuable information with us in as much detail as possible. I searched and found 70+ links to learn detailed information about establishing a company, but your page provided me with all the information from A to Z, your rights will not be paid.

I had a question: As far as I know, and you also wrote, the EIN number is now arriving very quickly. If we want to get it a little faster, can we call directly and read the information on the SS4 form and get it immediately? Frankly, I'm not in a hurry, I just asked because I was curious.

Regards…

Hello,

Thank you for your positive thoughts, thank you very much.

They won't give you the approval by calling you on the phone and reading the SS4 form directly because they first ask you if you have a written application and when they look at the records and see if you have one, they tell you to make an application first.

In order to be accepted by phone, you must have previously made a written application and there may have been an error etc. during the application. If it has been done, you can speed it up by phone instead of queuing again. Otherwise it will be of no use.

If you also have an SSN, you can get quick information online or on the phone.

I understand, Sir, thank you very much.

Let me share my experience with obtaining an EIN. I founded the company on June 12 and immediately started a membership at fax.plus. On June 14, I faxed the S4 form and the 5 pages about the company that were sent to me (some of them may not need to be sent, I sent them just in case) for a total of 6 pages. On June 29, the IRS sent my EIN number by mail to the company address in the USA. The date of the document is June 24. After 10 days, Uani generated the EIN number and sent it by mail. The interesting thing is that I did not receive a fax either. I see the reason why it came to this situation so early. In the S4 form, I wrote the mobile number I rented in the USA in the mobile number section, and I also did not write anything on the 5a and 5b forms. Generally, our residence address in Turkey is written here. I think the IRS saw me in the US applicants class and processed it that way. In other words, he was not evaluated in a category that included perhaps thousands of people who applied from outside the United States. I don't know if I did a good thing or a bad thing, but I got my EIN number in 2 weeks.

Hello,

Congratulations. Fast arrival is not a matter of the address or phone number on the e-mail form; transactions have become faster and the intensity has decreased, so e-mails arrive within two or 3 weeks.

There is no special situation for you and there is no problem. They now send you e-mail directly, that is, CP575, instead of fax, which is a very important advantage.

Greetings and I wish you success.

Hello,

I just received a fax, they faxed my e-in number, finally, today is the 61st day, as a result, I paid 15 dollars for fax.plus membership and every day, I wonder if I did something wrong? Did I receive the fax etc. etc. So, instead of thinking about these things every day just to keep 10 dollars in my pocket, I would rather pay 10 dollars more and get an EIN number through the startupsole agency.

Thank you very much for the information you provided, I founded my company from scratch using only the information here and got my EIN number, thank you very much.

Note: 61 days ago startupsole agency did not have ein service.

Hello,

I waited 60 days, no fax or call, nothing happened. I got the EIN Number from the phone by calling +1 267 941 10 99. Let me explain here: You can call this number earlier than other contact numbers and reach the relevant people. The waiting time on the phone is generally said to be 15-30 minutes or 30-60 minutes. Additionally, this number has a “non resident” feature; since the person on the phone knows that you are not Usan, they speak to you with a more basic English accent. In short, if you have faxed your SS4 Form to the IRS, you can get your EIN number by taking the SS4 in your hand and reading your information letter by letter to the other party.

Hello, thank you for sharing your experiences.

When applications are rejected due to incomplete SS4 form or incorrect form submission, there is no choice but to contact them by phone.

It's good that you shared this trick you discovered. I'm glad you solved it, despite everything.

48 days after forming the company, the e-mail was finally received. My advice to new applicants is that if you don't make any mistakes in the form, it will arrive one way or another, just a little patience. By the way, thank you very much for the valuable information you provided.

You're welcome, good luck and good luck 😀

Thanks for the information Okan, this news came like a cure.

It's been a whole month today, no one has called or asked, we have empty hopes, we check the fax app every day, I will write again when I get an answer, for those wondering how long it will take to arrive, I check every 2 weeks and send the form again, just in case.

It's not empty hope. There are those who wait for two months, sending faxes all the time does not change anything, but recently it has decreased to around 40 days, it will take a few weeks.

Hopefully, we'll see, what I mean by false hope is checking the fax every day, 1 week after sending it, even though I know it won't arrive before 2 months.

Hello, do you think it makes sense to get EIN by phone? If our English is good, the process is quite long because it is done by e-mail and fax method. Have you had any experience?

Hello,

If you do not have an ITIN number, you cannot obtain an EIN over the phone. When you call the IRS and request an EIN for your LLC company, they will ask for your ITIN number. If you have an ITIN, you can try your luck, but if you do not have an ITIN, unfortunately there is no other way than filling out the SS4 form and faxing it.

Hello,

Do you have any information about how long it takes to get ein lately? I've been waiting for more than 20 days and I still haven't heard anything, I'm wondering if I should call.

thanks,

Hello, of course you can call, but we often hear that it will not arrive before 2 months because there is a serious rush and there are too many pending registrations.

It was really a very informative article, thank you and congratulations! I have a question? Do you think it would be beneficial for us to buy an llc even if we haven't opened one, or should we buy it immediately after we buy an llc?

You can get an individual EIN without opening an llc, but the form example here is for an LLC company, not an individual EIN. In other words, you cannot open an llc and use the method described here without knowing the address, phone number and company name. There is a different form for that, but what use it will be without an llc is a separate issue.

When you think about it, yes, what good is it without an llc! 🙂 Your content is really useful. Even though we tire you sometimes, thank you! 🙂

You are welcome to ask your questions at any time. I try to answer the questions in the comments on all the subjects I know. Hello.

Thank you very much, it was a very informative guide.

We are glad if it was useful for you.

Hello,

If we make a mistake on the form or something is missing, does the IRS reach us by fax? I don't think they will call the mobile number we wrote down. So we will wait for a few months, but actually we made a mistake and we are waiting in vain, but we don't know about it, I wanted to ask if it will happen :)

Unfortunately, if you make a mistake, the EIN number will not come even if you wait.

Hello, do I have to form an llc in the USA to get this number or is it enough to just fill out the form?

You can also get an individual EIN, but the form in this description was filled out for the purpose of obtaining the EIN for the company. You can also obtain an EIN as an individual, but you must fill out this form in a different way.

Hello, Isn't it necessary to send the passport by fax for identification information in order to get a tax number? Thanks

Hello,

No, passport or ID is not required, you just need to fill out the form as in the steps here and fax it.

Hello, aren't company formation documents also required? If the answer is yes, does the IRS check our company name on the state website? (Although I don't really care where he checks from:-)) In summary, is it enough to just send the first page of the SS4 form? Thanks.

Hello,

You need to attach the company formment document to SS4 and fax it as two pages. It is written in detail in the article. Otherwise, the application will not be accepted.

Hello. I missed the most important part, I was angry with myself for that. Well, the "Articles of Organization" I have is 4 pages in total. The last page contains “CERTIFICATE OF ORGANIZATION”. I will send 4 pages and the first page of the SS4 form as 5 pages, right? Would just sending the SS4 first page and CoO be enough? (I'll send it as 5 pages just to be on the safe side)

I wish you had read it carefully or asked before sending it. I think you should send it again with the missing documents immediately, before it's too late.

I think you formed the LLC in Delaware, if so, this document is called Certificate of Formation. Add the version, which is also downloadable from the state website, to SS4. If you are not sure, no matter how many pages it is, fax it again, adding first SS4 and others, but you have to add them somehow, otherwise you will receive a fax with a notification of missing documents after about 1 month, then the transaction will be suspended and you will have to receive the eIN via phone.

Hello Mr. Admin.

Thank you very much for your answers. You are very caring; I am grateful to you. I wanted to fax the documents without being sure. So I haven't sent a fax yet. I started the company in Wyoming. And I did all the documents as you said. There were 6 pages in total. I faxed them all.

Please, if you don't mind, could you send us the documents by e-mail? Let's check, it may not be necessary to send all 6 pages.