Every new company formed in Usa must obtain an EIN. Normally, to obtain an EIN, non-US citizens fill out an SS4 form, fax it to the IRS, and wait a few weeks for the results. But there is another way to get an EIN faster, which is to call the IRS. All the details, do's and don'ts about getting a fast EIN are available in this article.

If you plan to establish a company in America, you can do it yourself online. To do this, in this guide and start growing your new business by establishing your LLC company in the way hundreds of Turkish entrepreneurs have established.

If you do not want to wait a few weeks and your business is urgent, you can quickly get an EIN for your company from the IRS. Let's talk about what needs to be done about this.

First of all, you need to prepare the following requirements in advance. We recommend having all of these items ready and then calling the IRS.

Preparations before getting an express EIN

You should definitely make the following preparations before calling the IRS:

- An overseas phone or a US phone like Zadarma

- Each information in Form SS4

- Fax number with a US area code

- Call at a convenient time and place

Get a foreign phone or US virtual phone number

You will be making an international call and the telephone line provided by the IRS for foreigners is chargeable. This phone call may cost you a little bit, as waiting times can reach up to 1 hour due to rush hour. To make this a little more economical, you can get a virtual phone number with a US area code, such as Zadarma Activate your account through Zadarma, get a number and talk to America economically by loading credit. You can also continue to use this Zadarma number later for your LLC in the USA.

Be prepared for the questions you will be asked on the phone

When you call the IRS by phone, you will be kept on hold for a while because of the traffic jam. Do not give up at this stage and wait for an official to get on the phone. When a representative gets on the phone, indicate that you want an EIN for your newly created LLC. After this, the officer you encounter will ask you for some information.

To prepare for these questions, fill out an SS4 form before calling the IRS. Here is an article on how to fill out an SS4. This way, fill out your SS4 form as if you were to receive it via fax and take a printout.

They will ask you all the clauses of an SS4 form from start to finish and you will read them to them. After this process, they will give you an EIN number and the transaction will be completed. So you can get an EIN quickly.

Tell them you want to receive your EIN via fax.

One of the most important points is that you have documentation for an EIN. When EIN assignment is made over the phone, although you provide your US business address, sometimes they may not send your EIN approval document, sometimes called Cp 575, to your address. You will need this document in the future, for example, when opening a bank account, accounting transactions, or when Stripe asks you to or when you need to present your EIN proof document to another institution, you must have your EIN result document in hand.

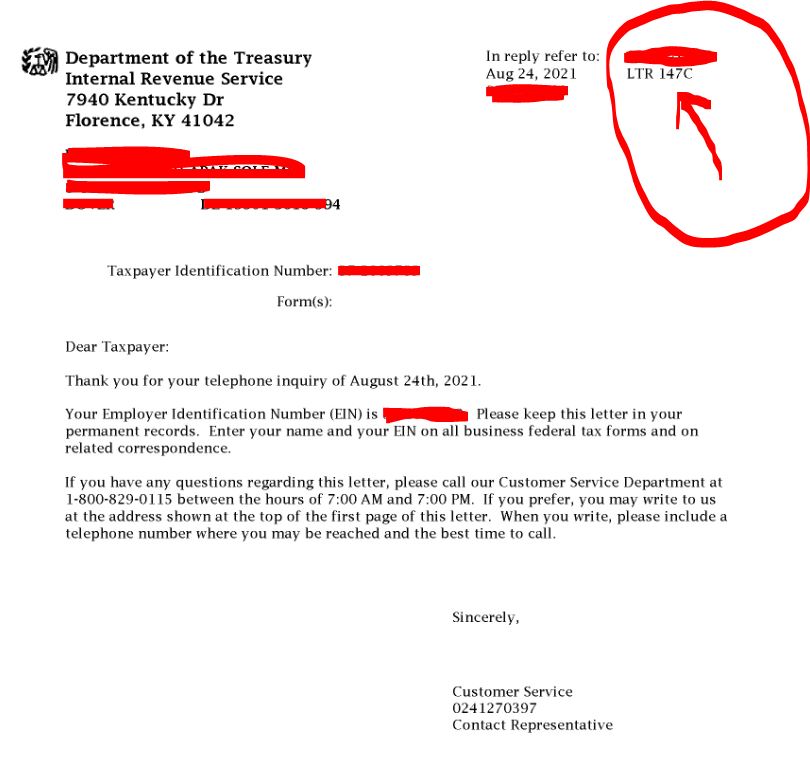

In order to avoid this problem and in order not to leave anything to chance as there may be a possibility that the Cp 575 document may not arrive in the future, ask the officer on the phone to send 147 C before ending the process. 145 C certificate is an EIN approval certificate that is valid just like CP 575.

Be sure to request this before ending the phone call.

You will need a fax number for this. Unfortunately, the IRS still uses fax instead of email. Fax, one of the world's oldest means of communication, is still popular in the United States. Anyway, since this document is very important, after you obtain the EIN number, fax the document without stopping the phone.

You will need a fax number for this. To be safe, avoid services that provide free temporary faxes. Instead, fax.plus for $5. You can activate it in 2 minutes and receive faxes via your browser. Details about fax plus subscription and account opening also available in this article .

You can get your 147 C ein documents online from the fax plus panel, without hanging up the phone.

147 C It is a document like this ;

;

Search in appropriate time period

You cannot call this line allocated to foreigners 24/7, which I will give you below. You must call between 7:00 am and 19:00 local time on weekdays. In short, it would be appropriate to call after 18:00 in the evening according to Türkiye time.

Which phone number should I call to get an EIN?

Number where you can get EIN quickly and on the same day over the phone +12679411099

As we mentioned at the beginning, this number is a number that people calling from outside the USA can call.

Research fast EIN getting agents thoroughly

Recently, we have witnessed many companies and individuals providing paid services under the name of same-day EIN and fast EIN. These people or companies can sometimes provide 9-digit fake EINs under the name EIN on the same day, XX-XXXXXXXX. Please be aware of these. EIN is a free service and the US Internal Revenue Service does not charge anyone for it. If your company is in your name, that is, you are the owner of the company and you can speak English, you can call the IRS and get an EIN on the same day as soon as your company is formed.

If you found this article useful, you can contribute to our blog by liking and sharing it.

Good luck.

43 Comments . New Comment

The company was formed on January 13th. I sent Fax for EIN the same day. When I didn't come, I sent Fax again on February 12th. I sent one to the number of 9471 and the other to the number of 6935. When can my EIN number come? BOI is approaching the last date.

BOI report was canceled no longer required a declaration. Eins are delayed, it is useful to wait for every number of faxes.

The person applying for an llc (relatives) is zero in English. I wonder if I can talk instead? I am age 16. Will any trouble occur?

No problem, talk as the owner of the company, just give the right information, they don't question identity.

Hello, I am here again yesterday, it was my 3rd week, we called again, after giving the necessary information, they asked for 2 minutes and gave me my e-mail number, then they sent the necessary documents by fax upon request, thank you.

Now it's time for ITIN :)

A few days ago, a week has passed since I applied for an EIN, and when it did not arrive, I had someone speak English online for a certain fee.

After a few calls, we connected to the official and said we wanted an EIN for the new company. They asked a few questions about the company and said that our EIN number had not been created yet and it was sent to the relevant unit via fax. He said that I couldn't get it done without reaching him, he suggested that I apply again by fax, he said that sometimes it could take up to 2 weeks, and if he didn't reach me again, he asked us to call. We are currently in the 2nd week and it still hasn't arrived.

Hello,

They now first take into consideration peer applications via fax. Just wait a few more weeks and your document will arrive. If you are in a hurry, they require 20 days from the fax date to call and receive it. It would be better if you call by taking this date into consideration.

I wonder what date they are finalizing right now?

Results in approximately 3.4 weeks

Hello,

I learned a lot from your website. Thank you.

I applied for the company through your link. After the establishment is completed, I am thinking of calling directly and requesting an EIN. Has anyone applied directly over the phone lately? Do they respond positively to getting an EIN over the phone? Or should I request the application via fax, wait a while, maybe 1-2 weeks, and then call you? What is your suggestion?

Love & Regards

Hello, glad we could help.

In fact, until the last 3 months ago, after faxing the SS4 form, it was possible to get the document via fax by calling within 6.7 days. However, 3 months ago, the IRS started to implement a new policy and 1 month after the application, they started giving information by phone.

There is no need for this lately, because the EIN document is received after 3 weeks.

Calling by phone will not be very effective, but you can try your luck again.

Hello,

has anyone tried to apply for an EIN by phone lately? I told them that I wanted to apply for an EIN, but after asking some information about the company, they said they would do the process over the phone, so I didn't understand the situation because it was an international line.

First of all, you need to prepare your SS4 form and fax it to IRS. If you do not receive your e-in number within a few weeks, you have the chance to call and continue your application over the phone to speed things up. Fax later. If you can get your spouse's ID number over the phone, under all circumstances ask them to fax your spouse's approval document because you will need this document in the future.

Hello, I have not received the e-mail for about 7-8 weeks. I want to call the IRS and get the e-in, but I do not know English and how can I communicate? What do you recommend? Thank you for your attention.

Hello,

Sometimes there may be confusion or delay in the IRS, although this is rare.

Talk to the Fiverr seller in the link below and they will get your EIN number from the IRS within a few days.

https://www.fiverr.com/tousifakrams

You can write via Google Translate, it may give a late response due to the time difference, but we can say that we received a lot of service and there were no problems.

Hello friends, I am writing to give information.

I called the IRS today at 16:25 TR time, and my phone was connected without waiting. I said that I applied via fax, it has been almost 4 weeks, I have not received a fax or an e-mail, and that I want to get a 147C. After asking questions about me and the company, I was told my EIN number over the phone. I said that I wanted to receive it via fax and wanted to give the startupsole fax number. The friend on the phone did not send the fax, saying that the fax should belong to you for security reasons. Because he said, I need to confirm whether you received the fax or not.

I opened a basic membership via Fax.plus and called again. It connected immediately this time too. This time, when I said I wanted to get a 147C, they asked for my EIN number and my and company information. When I told them that I wanted to receive it via fax, they sent it via fax. There was no wait for confirmation.

I made the call via skype.

If it is not necessary to open a bank account urgently, it will arrive by mail, perhaps after 1-2 weeks.

Hello, EIN applications made as of January 1 have started to arrive slowly. As we mentioned before, the process can take up to 5 weeks or even longer.

Your EIN approval document will probably arrive at your address in a short time (this week or the beginning of the next week). If you make a call and connect in one go, there is usually a waiting time of 45 minutes.

Still, thanks for the information.

Hello friends,

Today, our EIN CP575 approval letter arrived at our company address. It took more than 5 weeks to arrive. It is difficult to reach us by phone, so you need to be patient for the document to arrive during this period.

For your information.

Look out, this is good news.

Exactly, thank you very much.

Hello,

In your experience obtaining an EIN over the phone, what kind of questions are asked by the IRS representative for identity verification? I will make a call for my friend and get his information just in case. The approval document did not arrive, it has been more than 4 weeks. Maybe we can create it over the phone. Thanks in advance.

When you make a phone call, you must have the SS4 document sent with your application. Questions from the SS4 document are usually asked. 4 weeks is a little early, resulting in 5.6 weeks. Because it is tax season at the IRS, the deadlines can usually be quite long after the beginning of the year.

If you still want to call and check, we recommend that you have your SS4 form on hand. If an EIN number has been assigned, ask them to send you the EIN confirmation document by fax without hanging up the phone because you will need it. They are not very willing to do this, but if you insist, they can sometimes send it. You can give our fax number.

Enjoy your work.

Okay, thank you. We have a fax number because we send SS4. Let's see if we can at least call and try our luck.

Hello Mr. Yiğit, were you able to get the EIN number from the phone?

I've been waiting for 3 weeks, I'm wondering if I should call.

Thanks

Hello Mr. Muhammed,

I called 3 times last week and couldn't reach you. It's been 5 weeks and still no response by fax or mail. I'll try the other number tomorrow, starting with +1 800. Let's see.

I applied myself, it's been 5 weeks, I've researched from different sources, I can say that the situation is the same for everyone, so there is no mistake on our part. There is no response via fax anymore, but even if it is, a letter is still necessary. There are such congestions in the tax season and at the beginning of the new year, so you need to wait patiently. It is very difficult to call the IRS and get support and lower the number, their structure is very ridiculous and slow, it is difficult to understand. I hope it arrives in a few weeks.

Yes, unfortunately waiting is difficult. Of course, it also disrupts work. We made the application on January 3. As you said, the important thing is cp575 letter. If I reach you, I will inform you again over the phone. If not, we will wait anyway.

Hello

I applied via fax, the EIN arrived in 7-8 days, but there is no document sent to my address, it has been about 1 month, do you think I should wait?

After your EIN assignment, they will mail your EIN confirmation letter to your address within 2 to 3 weeks. It should arrive soon, it would be better to wait a little longer.

Faxed 08/02/2022 SS4 form IRS received EIN as of 08/03/2022. I received it in 28 days. Great people. I received quick answers to the questions I asked about the process within 10 days. Thank you very much.

Congratulations and we wish you success in your new job.

Hello,

thank you very much for the valuable information.

The thing I'm curious about: I have an old, expired passport, but I haven't renewed it. Can I open an account at Mercury Bank with this passport and LLC company information?

The account probably won't be approved because they will check that

Hello, first of all, thank you for the information. Today, after a long effort, I reached the IRS by phone. However, he told me that I had domestic status because my company was formed in Usa and that the line was only international applicant, and I could not get my e-in number over the phone.

Hello

If you have never applied, calling this line may not work. If you have never applied before, please apply by fax first. This line works to speed things up or solve problems when they arise. Previously, when you called this line, they would give information very easily, but now they largely reject it and direct you to apply by fax.

I had already applied by fax. I called to speed it up, but unfortunately it didn't work. How long does it take to respond to e-in applications via fax?

In fact, it is a matter of luck, while some civil servants act more moderately and take action, some cannot take action at all. It is necessary to wait at this stage.

It takes between 2 and 6 weeks. Since it is tax season in the USA, on average the income may arrive within this period, perhaps even earlier.

Hello,

can we get an EIN by calling the IRS without our ITIN number?

In your article here, you did not state that you must have an ITIN number, but in your article "Getting an EIN Number from America" you wrote, "You can get an EIN by filling out a form called SS4 and faxing it to the IRS, or by calling the IRS if you have an ITIN number." I wanted to ask to clarify.

Good luck

Hello,

You can get information over the phone without any registration. In order to get EIN online from the irs website, you need your itin number.

Could be a typo, thanks for waking up.

Thank you very much for your quick reply. Well, after setting up an llc without SSN or ITIN, can we call the IRS with the information in the SS4 Form and learn our EIN number on the same day?

If you send an application by fax and call a few days later, you will receive it the same day. Sometimes they may ask whether you have applied or not.

You are great! I am sure that you have undoubtedly benefited many people like me with the information you have provided and you continue to do so. My gratitude to the entire team who contributed to this blog, which still contributes to me! It is my go-to resource that I recommend to everyone around me who is interested in entrepreneurship and looking for resources in Turkish! 🙂 With love!

Thank you very much for your positive comment and motivating wishes. We are happy if we could benefit from it. With love and greetings, good luck.