We have prepared a comprehensive guide for those who are curious about forming an LLC company online in Usa and how to manage the LLC company remotely. Start your company in 2025!

What you will learn in this guide:

- What is LLC Company?

- In which state of Usa is it more advantageous to form an LLC company?

- Determining name and registered representative for LLC company

- Forming an LLC company in Usa step by step (You will be able to form it yourself)

- LLC Cost of Forming Company

- Obtaining an EIN Number and taxation procedures of the LLC company

and more.

If you are ready, let's get started.

My name: 1

What is an LLC Company? LLC Structure and States

What is LLC?

Limited Liability Company (LLC) is an Usan business structure that stands for limited liability company. There are 50 states in Usa and each state has its own labor laws.

Under the laws of the states, LLCs are not corporations. LLCs are the legal form of management of an llc. LLCs provide owners with limited liability in many jurisdictions.

An LLC is a hybrid legal entity with certain characteristics in the corporate structure created (a partnership or sole proprietorship). An LLC may consist of one or more members.

LLC owners are called members.

Under state law, there are no membership restrictions for LLCs.

An LLC can have a single member or multiple members. When LLCs are formed under standard procedures, they are not taxed like a corporation because the income of the LLCs passes through the company members.

For this reason, each member of the LLC (owner or partners) pays his own tax individually.

Double taxation is applied to a real company formed as a Corporation in Usa. Both the company pays taxes on the income generated and the company's shareholders are taxed individually.

Although LLCs are generally known to most people as a corporation, they are actually a business structure chosen to create a legal entity.

According to the IRS, a single-member LLC is a disregarded entity unless it elects to be taxed as a corporation.

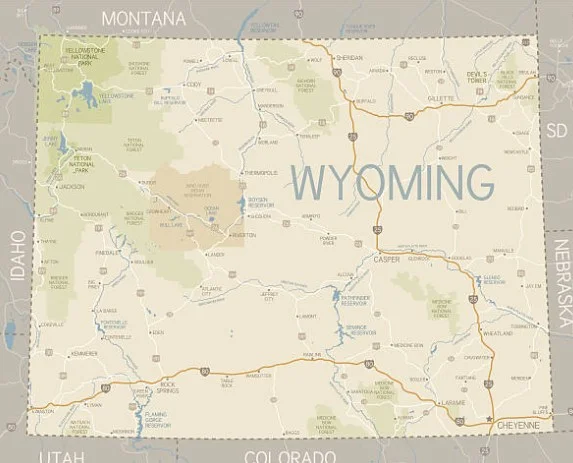

Wyoming State First to Introduce LLC Structure

The first state to enact legislation allowing the formment of an LLC structure was Wyoming.

Although the LLC law was first enacted in the state of Wyoming in 1977, the state began to gain popularity later.

According to statistics, while around 400 companies were formed per month in the state of Wyoming in the 2000s, this figure has increased to 3500 - 4000 per month in recent years.

![wyoming company formation statistics Forming an LLC Company in Usa in 7 Steps [2025 Detailed Guide]](https://startupsole.com/wp-content/uploads/2022/07/wyoming-sirket-kurulum-istatistikleri-1024x688.jpg.webp)

Especially since the state of Delaware advertises better in this area and allocates large budgets to promotions, it is both more popular and the number of company formments is quite higher compared to Wyoming.

Wyoming has surpassed Delaware's numbers in the last few years.

These statistics are provided for informational purposes only and not as a recommendation to form your LLC in the state of Wyoming.

LLC Rules and Management Form

LLCs are less regulated and require fewer procedures for management than traditional corporations.

For this reason, it can allow members to create a more flexible management structure than is possible.

As long as LLCs remain within the boundaries of state law, members decide how to manage their LLCs under the operating agreement.

What is Operating Agreement? Required for Single-member LLCs? You can have more detailed information about the operating agreement in our article.

If your LLC does not have an operating agreement, the default rules in your state statutes will apply.

Brief Information for US Citizens

The statement on the vaccine does not apply to non-citizens who reside outside the United States.

An individual residing in any state in the United States can also create an LLC outside the state in which he or she resides. If it does business through an LLC created outside its home state, this LLC becomes a foreign LLC.

A U.S. individual creating this type of structure must register as a foreigner in this new state in which he formes an LLC and does business.

You should have learned a lot of information about LLCs in this section.

The next step contains important information about the state election.

Step: 2

Best State to Start an LLC in Usa

In which state in Usa is it more advantageous to form an llc?

Actually, it would be more logical to ask this question this way.

In which state should a noncitizen who does not live in the USA form an llc?

The most advantageous state for a person residing in the USA to form an LLC company is the state in which he or she lives. Otherwise, the foreigner will be forming an LLC and must register in the foreign state. This situation may cause some tax problems.

If you do not live in the USA, you can form an LLC company in any state you want. Citizenship is not required for LLC company formation in any US state. (Also, almost all states do not require ID or passport)

As a foreigner, you can form an LLC company in any state you want, but some states have high installation and annual costs.

For this reason, it may be wiser to choose states with minimum installation and annual recurring costs.

Below, we have divided the states that can be chosen to establish a company in America low-cost and most preferred .

As a result of our research, we would like to point out that we could not find any sources regarding the reasons why entrepreneurs in our country prefer these states.

Lowest Cost States to Form an LLC

In the table below, you can find a list of the lowest cost states in Usa where you can choose to form an LLC.

| State | Initial Setup Cost | Annual Recurring Payments |

| New Mexico | 50$ | $0 (Free) |

| Kentucky | 40 | 15$ |

| Colorado | 50$ | 10$ |

| Hawaii | 53$ | 15$ |

| Iowa | 50$ | $45 (every 2 years) |

| Michigan | 50$ | 55$ |

| mississippi | 54$ | $0 (an information report must be submitted each year) |

| Missouri | 52$ | $0 (Free) |

| Montana | 70$ | 20$ |

| Utah | 75$ | 20$ |

Popular States Most Preferred to Form an LLC Company

Below are the most preferred and popular states that you can choose to form an llc in Usa.

| State | Initial Setup Cost | Annual Recurring Payments |

| wyoming | 103$ | 62$ |

| Delaware | 90 | 300$ |

| Florida | 125$ | 139$ |

| New Jersey | 130$ | 75$ |

| Nevada | 425$ | 300$ |

| california | 90$ | 800$ |

| New Mexico | 52$ | $ 0 (no mortar) |

The data in the tables above should have guided you in determining the most advantageous state in terms of cost.

If, after seeing these explanations and costs, you still cannot decide in which state to form your LLC company, we will tell you about a method that is not widely known.

Choosing a state according to the type of work to be done.

How to Determine the State Based on the Work You Will Do?

Assuming you are a non-US resident foreign entrepreneur, let's look at the situation from a different angle that may help you choose a state.

You should probably be setting up an LLC in Usa for one or more of the following business categories.

These;

- Selling on global marketplaces (Amazon, Etsy, Ebay, etc.)

- Shopify Dropshipping

- Selling products abroad from your own website

- digital marketing job

- Selling digital products or services

- software sales

- Online course sales

- online consulting

Almost all foreign entrepreneurs who do not live in the United States tend to form an LLC for the business types on this list.

We need to divide these business types into two: marketplaces and other.

Best State to Form an LLC for Marketplaces

If you are going to open an Amazon account to sell on a global marketplace platform such as Amazon, we recommend that you establish your company Wyoming .

Why Wyoming?

Address verification is very important in Amazon business.

Northwest that establish companies accept verification codes sent from Amazon to the company addresses they allocate for LLC companies established in the state of Wyoming.

We will discuss the subject of Registered Agent in detail in the next step.

- At least, you will not encounter any problems during the Amazon address verification phase, as they accept account verification cards sent by Amazon to the company addresses they provide to you in the state of Wyoming without any problems. Many registered agents require you to rent a virtual office for these types of address verification codes. But Northwest is OK with that.

- a Reseller License in the state of Wyoming .

- Some suppliers may request a Certificate of Good Standing for your LLC company. In Wyoming, you can download a certificate of good standing online for free. In other states, this document is subject to a fee.

These several reasons indicate that the most logical state to form an llc for marketplace platforms is Wyoming.

Otherwise, you may have to make more effort and spend extra money.

Best State to Incorporate for Other Business Types

It doesn't matter.

Because the common point of all other works is this;

Receiving payments from credit cards online and making online collections.

So you will need a Stripe account and a digital bank account. Choosing the most cost-effective state for this type of work would be a very logical decision.

The most cost-effective state with no annual payments and reporting requirements New Mexico .

If you plan to form an llc in the USA to do any business other than Amazon and marketplaces, choose the state of New Mexico.

LLC formation in this state is only $50. Additionally, you do not have to file a report every year and make annual payments to the state, as in the states of Wyoming and Delaware.

If you have decided on the most advantageous state to form an LLC company in Usa, you can complete this section and move on to the next step.

Step: 3

Designating a Registered Agent to Form an LLC Company

Registered Agent

A person who does not reside in the United States and does not have a physical address in the United States must designate a registered representative to form an LLC company.

These registered agents can form and organize your LLC in your state on your behalf.

At the same time, Registered Agent will also be useful to you in the processes after company formment.

Your Registered Agent will hand-deliver to you official, legal paperwork and important notices that may come to your LLC from the state or another agency.

In Usa, such legal notices are delivered by hand.

That's why you are not allowed to display a PO box when starting an llc. Instead of a po box, your company's address can be the physical address of your chosen registered agent in that state. All states in the US accept this.

However, options such as po box, Türkiye home address or country of residence address should not be preferred during the company formment phase.

If you do not have a person or address that can personally receive these notifications for you during business hours, you need to get service from a Registered Agent.

It is possible to set up a self-service company via the states' websites.

However, if you appoint yourself as a Registered Agent instead of receiving Registered Agent service, this situation will be detected in a short time and your company will be terminated and closed by the state.

Which Registered Agent Should I Prefer?

When you do a brief research on the internet, you will find hundreds of registered representatives providing LLC company formation services.

When choosing these representative agencies (Registered Agent);

Pay attention to the size of the agency you will receive service from, its continuity, its position in the sector, how long it has been in service, whether its annual costs are affordable and whether it has its own offices in the states.

It should also have technical support and services where you can get free help in case of some possible problems.

You must be able to show the address of your own offices as your company address.

They should scan the documents coming to your address and deliver them to you digitally, free of charge.

A registered agent like Northwest can provide you with all of these requirements. more detailed information about Northwest Northwest LLC Installation Service Review guide.

Within the framework of our partnership with Northwest, you can form an LLC in any state by paying $39 (+ state fee).

Step: 4

Choosing a Name to Form an LLC Company

In this section, we will talk about what you should pay attention to when determining a name (company name) for your LLC company.

Determining a Name for an LLC

Choosing a name for an LLC may have rules and restrictions in each state. The most important rule here is that your LLC name must be unique, meaning it can be distinguished from other LLCs.

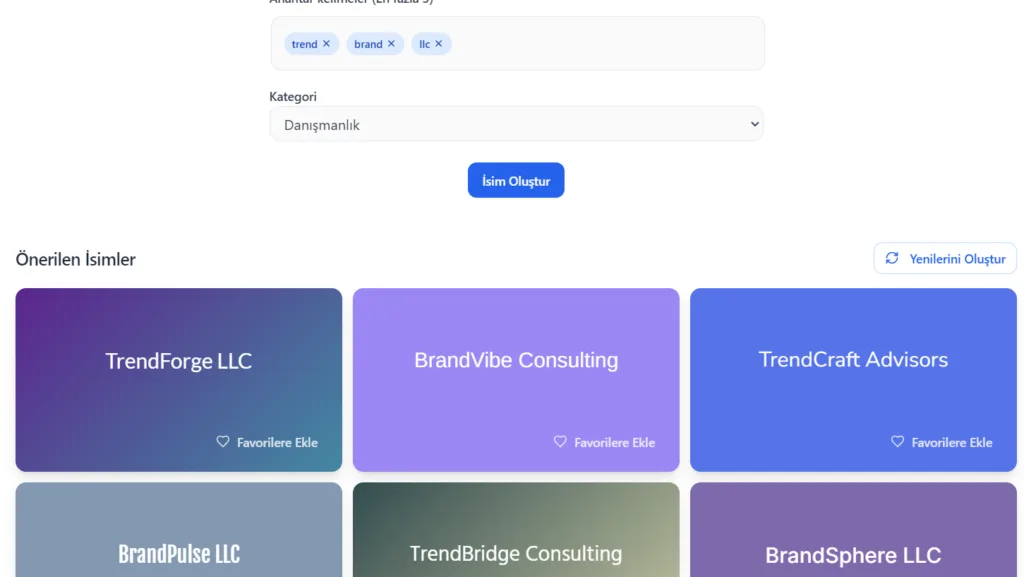

If you don't have a company name in mind yet, the brand name creating tool in Startuphub, and create unique company name suggestions for you.

General Name Rules for LLC Companies

One of the following extensions must be added to the end of the LLC company name.

- Limited Liability Company

- LLC

- LLC

Using the above is a must and requirement for an LLC

For example; STARTUPSOLE LLC or STARTUPSOLE LLC or STARTUPSOLE Limited Liability Company

LLC is not a Corporation company, therefore LLC cannot be suffixed with the abbreviations Corporation, Inc or Corp. For example, these cannot come;

- Corporation

- Incorporated

- Corp.

- Inch.

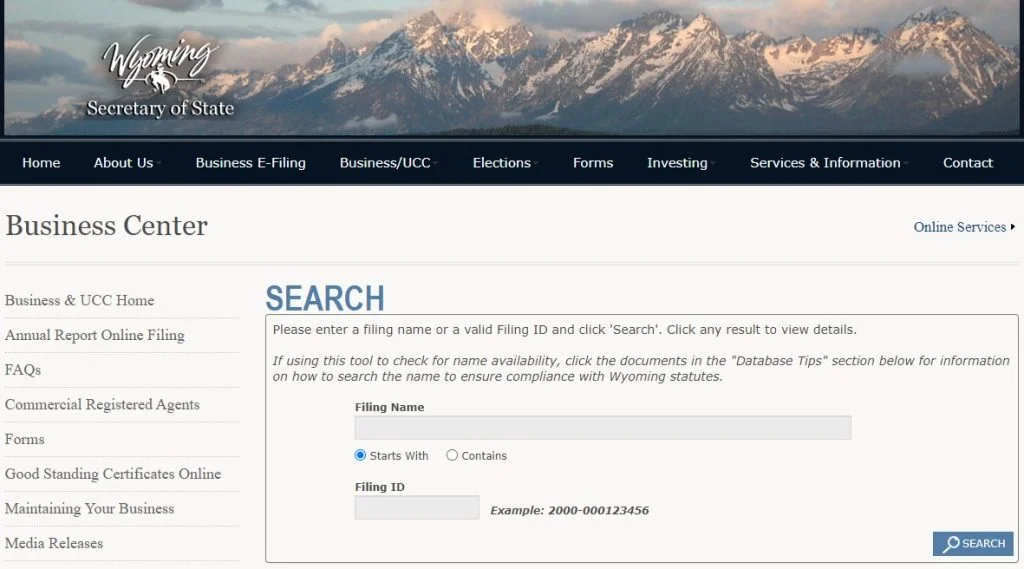

Do a Name Search in the State Where You Will Form an LLC

Each state has an online database for LLC name searches.

These databases are state websites.

You can search for the LLC name you have in mind on state websites. You can determine the LLC company name according to the rules we mentioned above.

How Do I Access LLC Name Search Sites by State?

from the list of LLC name search websites by state that we have prepared previously .

- Find your state from the list

- Check the suitability of the name you have in mind

- If the name you chose is empty,

So you've chosen the right name.

If you have determined the company name, you can now move on to the next section.

Step: 5

Forming an Online LLC Company Step by Step

Once you have determined your state and found a suitable name for your LLC, you can now form your LLC online.

You can get service for this job from Northwest Registered Agent, which we mentioned in step 3.

Forming an LLC Company in Usa

- Access the website northwestregisteredagent.com

- Select LLC as company type

- Choose the state where you will form an LLC company

- Enter the company name you previously determined into the relevant form

- Enter the name of the company member(s)

- Type an email and password to access the customer panel where you will manage your company

- Enter your address in your country of residence

- If you want additional services, select them and complete the payment with your credit card.

You can watch the video below to experience and implement the above steps in more detail.

(Video has subtitles)

Online Company Formment Video with Northwest in Usa

After you order, Northwest provides you with a customer panel. You can follow the company formment process online from your customer panel.

You can also manage your company and purchase additional services thanks to this customer panel.

Additionally, if your company receives any documents or mail in the future, you will be able to download them digitally from the Documents section.

Step: 6

Get a Tax Identification Number (EIN) for Your LLC

What is EIN? Employer Identification Number

Employer Identification Number ( EIN ) is also known as the Federal Tax Identification Number and is used to identify a business entity.

EIN is a 9-digit number that the IRS EIN is free of charge, and foreign company owners can apply to the IRS by fax or mail. Of these methods, fax is generally preferred.

Once you form your LLC, it is essential to obtain an EIN Number for your company. By the way, for those who don't know, the IRS is the US Internal Revenue Service. The IRS provides companies with these tax IDs, called EINs.

An LLC without an EIN cannot engage in business activities. Bank account, Stripe, virtual POS etc. cannot open accounts.

In short, after forming an llc in Usa, it is very important to obtain an EIN so that you can do business with your company.

How to Get an EIN?

To obtain an EIN, your company must first be set up. After receiving your company formation document (Articles Of Organization), you can apply for EIN by correctly filling out a form called SS4.

If you have an SSN or ITIN number, you can obtain an EIN for your company online from the IRS website instead of waiting for results by fax.

If you do not have an SSN or ITIN (SSN is issued to US citizens, residents, or Greencard holders), the only solution to obtain an EIN is to fax the SS4 form to the IRS.

After your company is established, you can easily prepare your SS4 form and apply for EIN via fax by following the steps in our guide titled Getting an EIN Number from America

EIN numbers are delivered by fax and mail to your US business address in approximately 2 to 5 weeks.

Step: 7

What to Do, Taxation and Making the Company Sustainable

First Things to Do After Forming an LLC Company

Once your EIN number is assigned, your company can now officially begin business operations.

There will be some useful accounts that you will need to open after installation in order to do E-commerce in global markets with your LLC company.

Let's list these with the links to the step-by-step guides we have previously created;

- Open a bank account: Opening a Bank Account in America

- Open a Stripe (Virtual Pos) account: Opening a Verified Stripe Account

- Open a corporate Paypal account for your company: Opening a Paypal Account

- Open a Wise Corporate account for cheap International money transfers: Opening a Wise Corporate Account

If you follow these 4 items, you can do almost any type of online business through your new LLC company.

Now that you have completed all the requirements and activated your company, let's talk about what you need to do in the next process.

Making the LLC Company Sustainable

There are a few routine actions you need to take each year to keep an LLC sustainable.

You must implement these procedures one year after forming the company and every year without interruption.

Registered Agent Annual Payments

You must make your registered agent payment on time every year. Registered representatives will send you a notification email when payment is due.

If your registered agent is Northwest, you can log in to your customer panel and pay the annual registered agent invoice they created for you with your credit card.

After making the payment, you do not need to take any further action.

You don't have to pay anything else for your registered agent until at least the next year

Annual reporting and annual payments to your state

If you have formed an LLC in a state where you are required to file an annual report, you must file an annual report and make your payment the year after you form your company (and every recurring year).

You can make this payment online with your credit card on the websites of all US states, including Wyoming and Delaware.

If you formed an LLC company in a state that does not require annual reporting and payment, you do not need to take any action.

For example, there are no requirements for an annual report or payment of a fee for the report for LLCs formed in New Mexico.

Taxation of LLC Companies

There are many articles on our blog about the taxation of LLC companies.

However, it is useful to briefly revisit the issue of taxation for LLCs.

How Is an LLC Taxed?

An LLC qualifies as a disregarded entity by the IRS unless it wishes to be taxed as a corporation.

In this case, the member or members of the LLC will have to pay the tax personally. LLC members pay federal taxes on the income they earn during the year. The LLC owner (member) does not pay state income tax if he does not have a physical location (shop, store, warehouse, physical office) within the state.

In short, we can say that LLCs are taxed this way.

However, as a result of certain criteria, you may not pay taxes as an individual and be exempt from taxes.

How?

This may vary depending on some variations.

If you have a single-member LLC (where you are the only owner and member), your company's source of income and the amount of income are important.

When trading through your LLC company, it is important from which geography your earnings are obtained. effective connected income ( ECI ) in the United States, you will not pay federal taxes.

For example, if you receive payments from your customers outside the USA via Stripe virtual POS through your LLC company, effective linked income ( ECI ) does not occur in the USA.

If your customers are US residents, this may generate ECI for you after a certain level of turnover. In this case, you must pay federal taxes by filing form 1040-NR.

I don't have any effective income from the USA, will I pay tax?

You don't pay, but you must file an activity report with the IRS each year. This report is an activity report known as form 5472. You only report your income and expenses. This is not a tax payment.

This topic is quite comprehensive, so we have a separate guide on the subject on our blog.

The LLC Tax Guide for Non-US Residents guide contains a lot of information that will clarify your situation.

Conclusion

You should now have very comprehensive information about LLCs.

It was a pretty long guide, but since this topic contains a lot of detail, we tried to divide it into sections.

If you follow the steps in this guide completely, you will have a very well-functioning LLC company.

Have you created your LLC company?

Or do you have plans to form a new LLC?

What did you encounter during installation?

You can ask all your questions in the comments section.

You can support us by sharing so that our guide can reach more audiences.

Hoping it is useful.

We wish you good luck.

17 Comments . New Comment

I want to form an llc in Usa. But I didn't know whether I should rent a physical address. If I'm going to rent, it requires an invoice to open a bank account, it requires bank documents, it will have to be my home address in Turkey. But the company is based on a physical address in the USA, so I'm very confused. I would be happy if you help.

Hello,

When you form an llc through Northwest, they provide you with an llc address free of charge, and you do not need to rent an extra address. Also, Mercurybank and wise Abd do not want you to rent a private address, there is no need for this. If you intend to open an account from a bank other than these, you will need a real address (in a real building with an invoice registered to you) and a personal visit to the bank in the USA. Due to these difficulties, digital banks such as Mercurybank and wise businesses are used. There is no need to rent a real house or office to open an account with these digital banks. You can use the company addresses assigned to you during the installation.

I tried 3 different credit cards, one was a virtual card. Even though I tried my credit card, which has a limit of 9k, it does not accept it. I cannot understand what the problem is and I could not find a solution anywhere. Thank you for your quick response.

Interestingly, if there is a problem with different cards, there may be another problem. If you want, try opening a clean page from a different browser or computer.

screenshot [email protected] (stating that you do not say different cards). Because there is no malfunction in its systems as far as we know.

Hello, I want to form an llc in the state of Wyoming through your current link. But I am getting an error saying your billing address is wrong. I watched the videos on YouTube, read your instructions, tried 3 different cards, no matter what I did, my payment was not accepted. I called the banks, they said there was no problem. Do you have an idea? I wonder if this is the subject?

Hello,

There were some people who encountered this type of errors. These are generally card-related problems, especially credit cards of some state banks and especially no debit cards are accepted.

Is your card a virtual card? Is it a debit card? Credit card?

We know there are problems with debit cards, but there is no problem with credit cards. Check if it is a card open abroad and if there is a limit problem.

As a last resort, you can try a different credit card or virtual card.

Hello,

it was great, frankly it was very useful, I wanted to congratulate you. I live in Menhattan, New York. I want to apply for an LLC. Who offers services to follow, including the IRS process?

Thanks.

We can get your ein number from irs. After installation, simply fill out the application form.

good luck

Hello, I want to form an LLC in Delaware and buy a boat. There was a good explanation for this. Is there anything other than this explanation? Is the EIN number required for boat registration? Does this platform help us with the EIN number? You said that a fax must be sent for the EIN number. Is there a fax left at this time?

Hello, EIN number is not required for boat registration. You can register the boat by getting support from an agency with only your company formment documents.

However, if you need a partner, of course, we take donations to companies formed through our reference link, free of charge.

Unfortunately, the Usan Revenue Administration only accepts mail and fax for tax applications.

It may seem strange that fax still exists at this time, but even in developed countries, it is still one of the most used communication tools for the transmission of official documents.

Hello,

I have a few questions for you. I have a marketplace idea and I'm at the stage of forming an llc. Currently, I plan to operate only in Turkey, and after a certain period of time, I plan to operate in one or more countries in Europe. After forming an llc in New Mexico, can I use a payment system in Turkey instead of Stripe? In this case, would I need to open an account in a US bank since there will be no money flowing to the US?

In such a case, do I need a liaison office in Turkey?

Thank you very much in advance for your information.

Hello,

You probably cannot use local payment gateways in Turkey with an llc you formed in New Mexico or another US state, they may not allow it. It would be more logical to form an llc in Turkey so that you can use these. If you wish, you can consult the virtual POS companies in Turkey.

By the way, you stated that your customers will be in Europe and the USA. At this stage, if you use local virtual POS, you will experience 90% payment problems at the checkout stage due to the 3D secure need of local POS. Because 3D secure usage is almost non-existent abroad. Because of such problems, foreign virtual POS companies such as Stripe are preferred.

In summary, the structure you are trying to form seems not healthy and sustainable.

Mr. Nazmi,

Thank you for your answer and interest.

Hello,

I will not engage in any commercial activity in the USA, my only goal is to buy a sailboat, unfortunately second-hand boats cannot be purchased in our country. That's why I want to buy an American flag boat. For this, it is necessary to open an LCC company.

In this case, what will be the opening costs of this company? In order to avoid paying annual taxes, would it be logical to open an LCC in another state other than Delaware and open a company in which state with the least taxes and expenses? How to do it at least cost?

Thank you very much for your answers.

You can register your boat most easily in the state of Delaware, so the most logical state for you would be Delaware. It will be both difficult and costly to register a boat in other states.

Hello,

As the company type;

I am thinking of establishing a company to sell through Amazon and to provide consultancy services to different companies (human resources, etc.). Would Wyoming be a suitable state for both types of companies?

I do not reside in the USA, I think of it as a global marketplace sales and service company that can invoice any country abroad.

Hello,

There are no restrictions, you can do the work you mentioned with your company you will form in the state of Wyoming.