Update: There are payment problems with Turkey-based credit cards when receiving service through IncAuthority. For this reason, you can make your installations in the State of New Mexico through Northwest company for $ 89. the article we prepared for this here : startupsole.com/northwest-ile-amerika-da-sirket-kurmak Thank you for your interest in this article.

Due to IncAuthority not accepting Turkish credit cards when ordering, this article is no longer up to date and to this page .

In fact, the steps and method of forming an LLC company are the same, but we recommend that you form an LLC with Northwest instead of IncAuthority.

Our new venture platform: Startuphub is on publication

Our Startupphub vehicle, which collects on a single platform, from business idea to company installation, state selection, brand creation, bank and strip pre -approval tools to advertising text production

Click here to discover the platform now !

You can set up your New Mexico LLC company through Northwest for around 89 USD, including the address. In addition, we make EIN applications free of charge for the companies you will form within our business partnership with our reference.

For the current article and Northwest installation steps, please view this article

Our outdated article is below. You can still read it, but we kindly ask you to ignore it.

We will share with you step by step how to form an llc in Usa, down to the smallest detail.

Don't have any doubts about its affordable price. The process consists of a registration agent applying to the state on your behalf and completing the process in a few days.

Additionally, if you read real user comments on this topic, you will see that dozens of people have established their companies in a healthy way with this method. also read the comments of those who founded real companies in the user comments section

We are aware that many entrepreneurs in Turkey experience the same problems we have experienced in the past when it comes to receiving payments by credit card. That's why we wanted to share our useful experiences with you in this blog with all our sincerity.

If you want to form an LLC in Usa at an affordable price, with low annual maintenance costs and minimum cost, and run your online business, you can follow this guide step by step.

If you are ready, let's get started.

To form an LLC company in Usa, you need to work with a Registered Agent. We repeat this many times because there may be people who are unfamiliar with the subject.

Registered Agents are organizations authorized by the state that help us form our company remotely and from which we need further service.

We have introduced many registered agents in this blog, you can find many articles on this subject here we will set up the company by getting service from Inc Authority (you can click here to review)

The reason why I chose IncAuthority was because its price is very affordable, it does not charge registered agent fees for the first year, it does not charge extra fees for company setup, and the company is reliable.

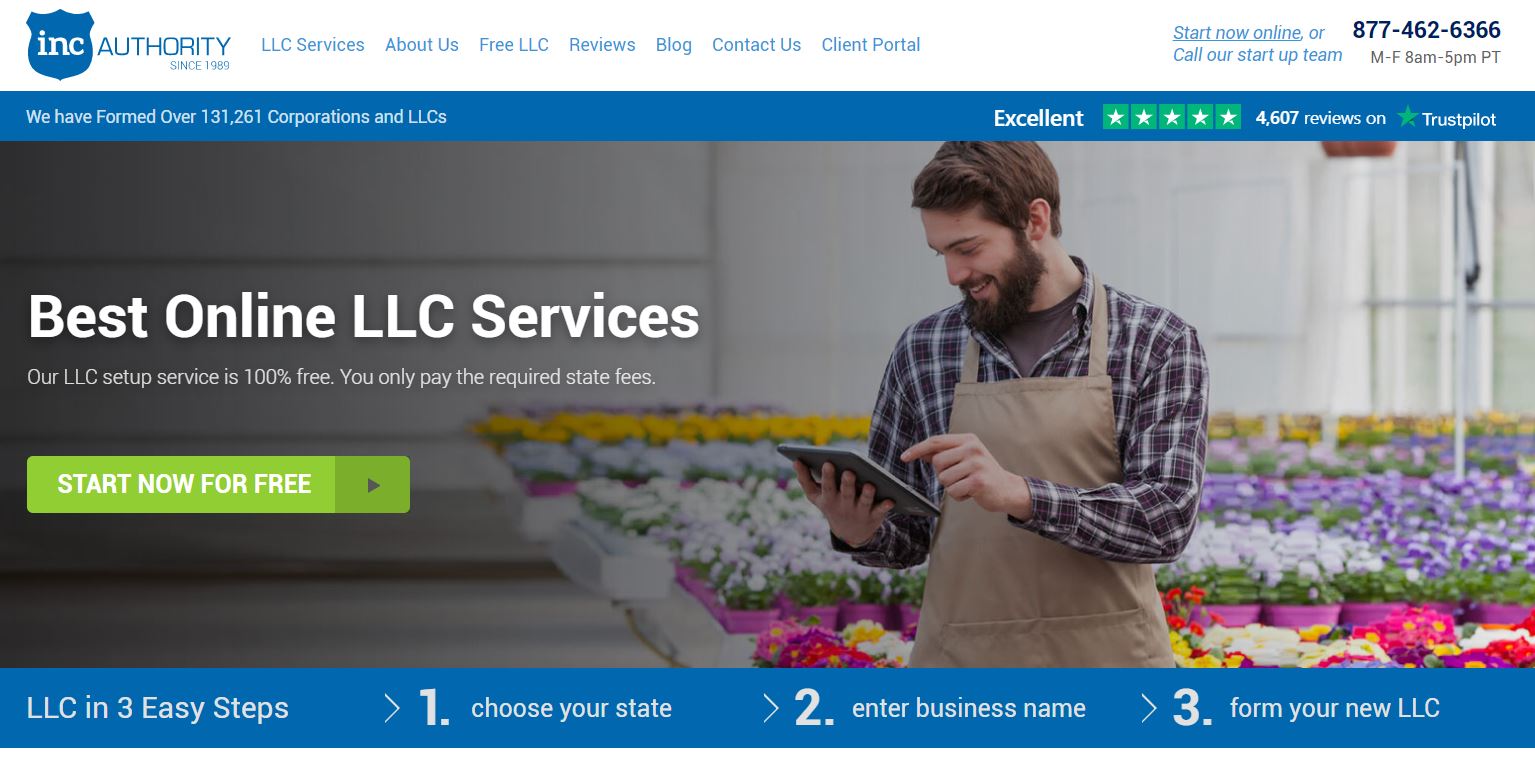

About IncAuthority.com

NOTE: Due to its financial policies, IncAuthority rejects the transaction with an error on MASTERCARD-enabled credit cards from non-US countries. You must use VISA enabled cards. If you do not have a VISA card, you can purchase an ininial prepaid card and make transactions with this card. You can create a virtual card instantly by downloading the ininial card mobile application.

Inc Authority has been providing Registered Agent service to entrepreneurs in different parts of the world to form their companies for nearly 30 years. Their aim is to provide affordable and quality service to entrepreneurs as they start their business life.

Inc Authority provides services to entrepreneurs residing in the USA or outside the USA to establish companies in different states of the USA. Their portfolio includes almost all states of the USA. Their prices are also very affordable compared to other Registered Agents. They do not charge a Registered Agent fee for the first year, company setup is free and a 20% discount coupon may appear during setup. (If you enter the discount coupon from the computer, it will appear and not from the phone, so log in to the site again from this link

Inc Authority provides services to entrepreneurs residing in the USA or outside the USA to establish companies in different states of the USA. Their portfolio includes almost all states of the USA. Their prices are also very affordable compared to other Registered Agents. They do not charge a Registered Agent fee for the first year, company setup is free and a 20% discount coupon may appear during setup. (If you enter the discount coupon from the computer, it will appear and not from the phone, so log in to the site again from this link

If you ask where their income comes from, they sometimes offer extra services and retain their customers who should continue with a registered agent in the coming years. In the coming years, they will offer you registered agent service for only $99, we can say that their prices are very affordable.

If you want to form an LLC in Usa at an affordable price and receive credit card payments from your online store with Stripe, Inc Authority is the most affordable solution to start with.

Inc Authority provides a very good reference in terms of customer satisfaction. Real customer reviews on Trustpilot prove this.

your company with Inc Authority by clicking this link , you can earn an extra 20% discount coupon during the installation phase. (If you enter the discount coupon from the computer, it will appear and not from the phone. Therefore, log in to the site again from this link The coupon may appear during the installation and registration.

Requirements and Things to Know

- No ID or passport required.

- Their costs are lower than other Registered Agent companies. They do not charge a Registered Agent fee for the first year; it will be charged as $99 in subsequent years. It is the cheapest and most reliable solution for starting out.

- You only pay the required documents and state fee for installation, you do not pay any extra fee for installation.

Cost of Forming an LLC in Usa with Inc Authority

Depending on which state you will form the company in, there are one-time state filing fees that must be paid at the beginning of the formment, which vary on a state-by-state basis. These vary by state and we will include this fee during the installation phase.

In this guide, we will follow the steps of forming an llc in the state of Kentucky, so I tried to calculate the costs based on this state. First of all, it is useful to talk about the state of Kentucky.

The state of Kentucky is an entrepreneur-friendly state that welcomes new entrepreneurs from all over the world. Many dropshipping entrepreneurs and digital product-service sellers choose the state of Kentucky to establish their company. The annual filing fee is incredibly cheap ($15) and they have policies that do not overwhelm foreign entrepreneurs. Therefore, we can say that it is a preferable state for new startups. Additionally, if you do not pay the annual state fee, your company will automatically close without charge in 60 days. Kentucky company closure details are here: Company Closing in America (Kentucky)

One-Time Costs for Installation

- For the state of Kentucky, the installation fee is $40

- You can use Wyomingmailforwarding.com for the address. This company allows you to have a unique suite number and address to establish your company for only $15. It scans incoming mail and prices you per email send. If you are going to use wyoming mail forwarding, which is a paid solution, first obtain your address from here, the step-by-step guide is here because the definition of your suite number is completed after 1 day.

- Virtual phone number in the USA: 2$ from this link , do not wait for activation, you do not need a phone immediately, just get the number because it is needed during registration.

- Optional fee is 49$ for EIN service the form for free and apply yourself). Or if you do not want to deal with these and pay fax fees every month, EIN Service for 29$ .

- Company Agreement 89$

Monthly – Annual Costs After Installation

- $15 franchise tax (annual report) to the state each year This amount is really quite affordable as an annual expense. You can also pay this fee online annually with your credit card on the state website. It is not paid in the first year, it is paid in the following year following installation.

- Virtual phone number: 2$ /month (You can get it from Zadarma here ) Or you are free to use a different virtual phone service. (Ex: You can choose companies such as Talku, Skype, Sonetel 2$ per month according to your budget)

- Registered Agent annual service fee is $99 / Year. This service is free for the first year, but you have to pay this fee starting from the next year.

- These are the periodic expenses after the company is formed.

Steps to Establish an LLC Company in America with Inc Authority

After reading the explanations above and taking into account the annual and monthly expenses, you can follow the steps below to form an LLC company in Usa with Inc Authority.

1-Having an address for your business in Usa

As I mentioned above, a Wyoming Mail Forwarding Address for $15, $15 will be added to the initial costs, but you will benefit in the long run. To get service from this company, pay $15 and register to the panel, and they will send your suite number to your e-mail the next day. As soon as your address is defined, you can start setting up your company.

2-Start Company Setup

Since we will form the company with an incauthority registered agent, the next process now consists of applying to the agency online.

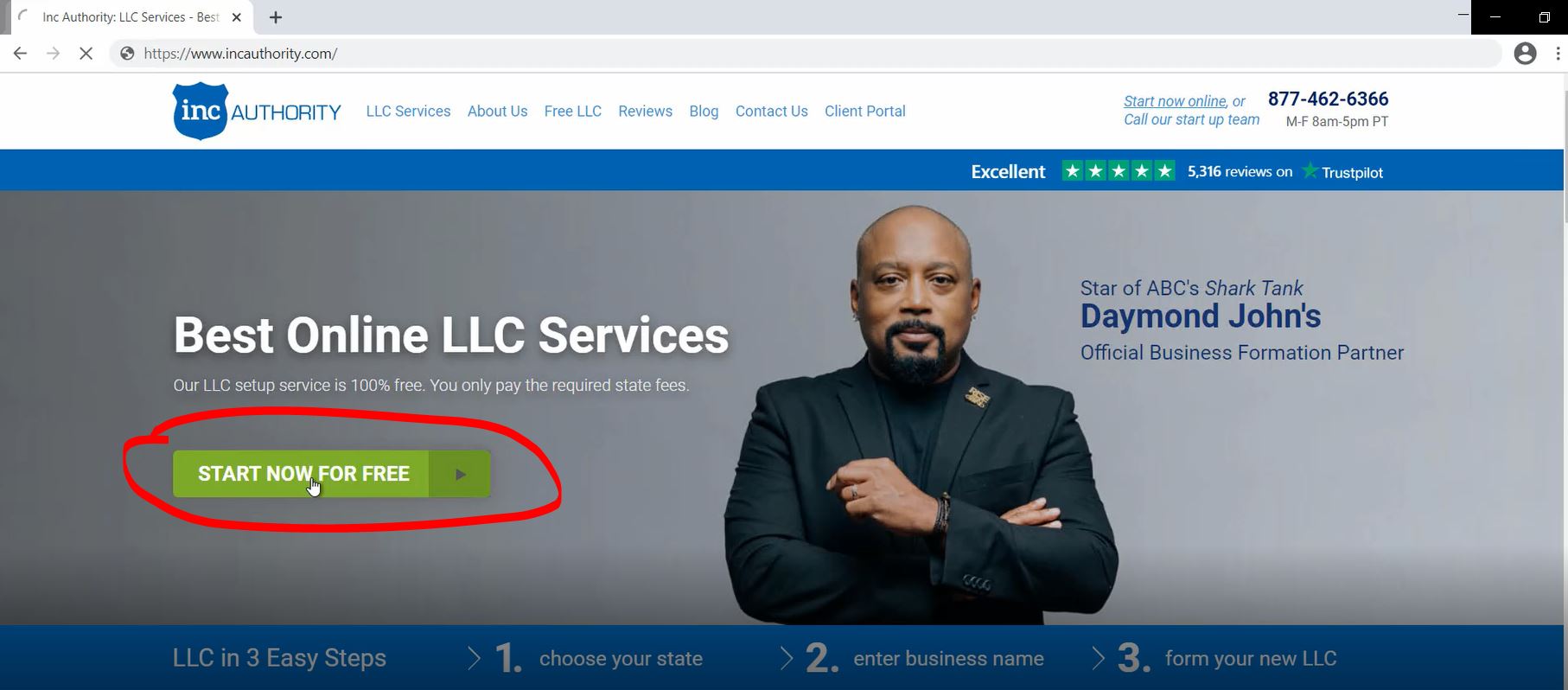

- First, log in to Inc Authority.com website from this link

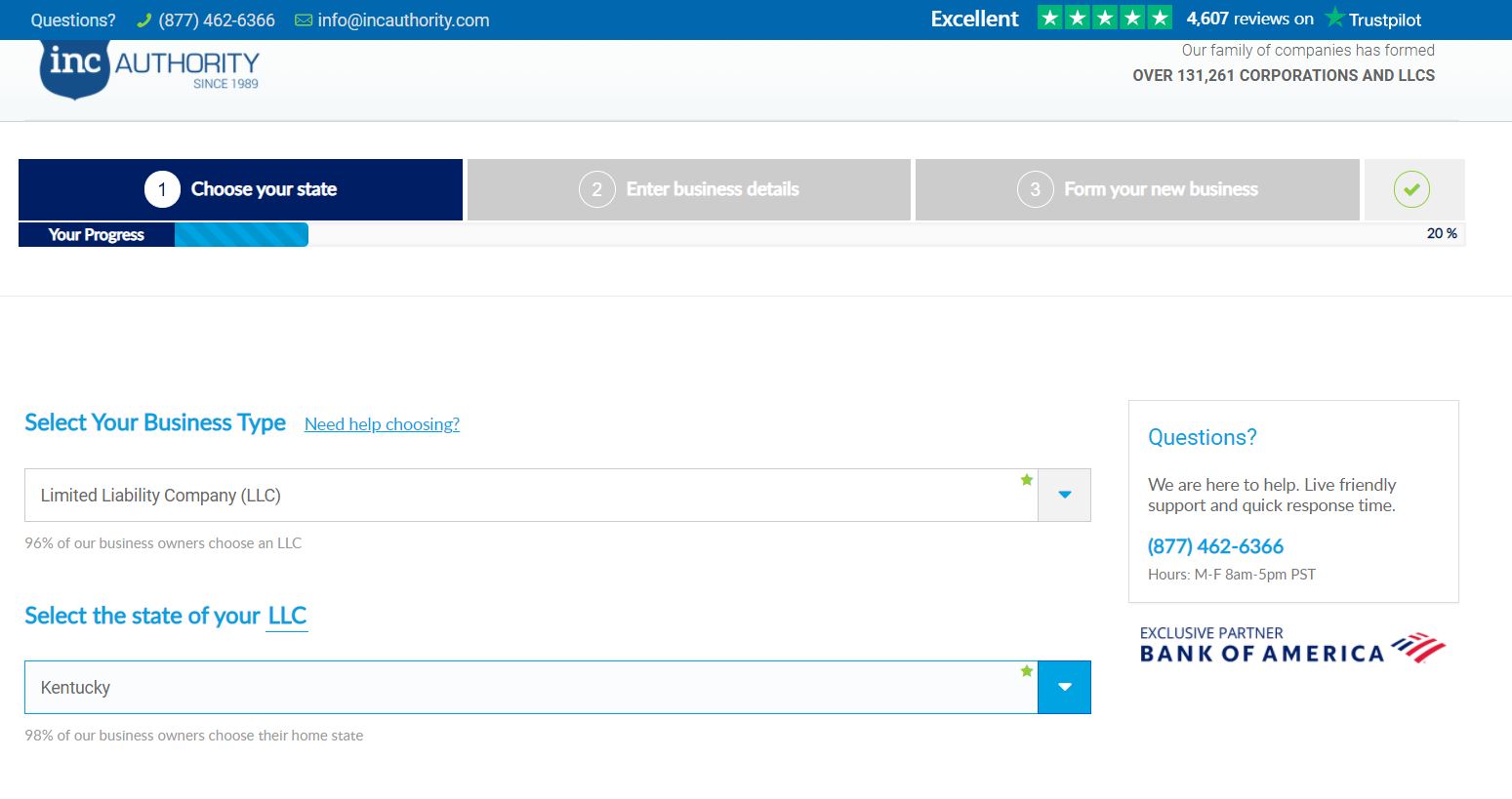

On the next page, you can select the business type and state in which you want to form the LLC.

- We select LLC as the Business type and Kentucky as the State, then we continue by pressing the Save and continue button.

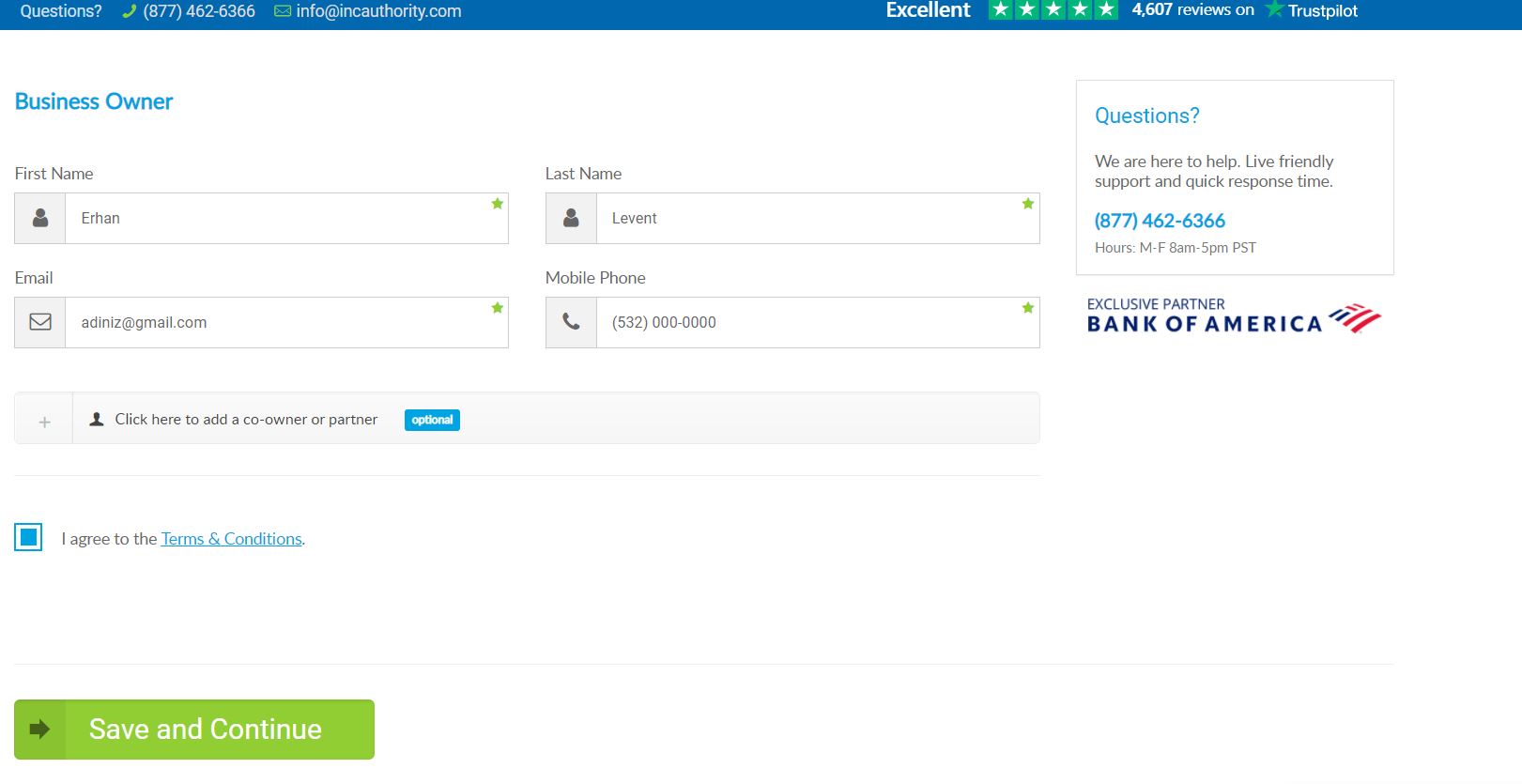

- In this step, we need to enter information about the business owner. name, surname, e-mail and Zadarma or TR phone number as 5xx xxx xxxx without the country code and accepting the contract below.

Note: If you have received a phone number without any damage, do not wait for the activation. You do not need a phone immediately. Enter the number assigned to you during the installation. It is only needed during registration. Afterwards, your number will be activated after authentication. It is not very important anyway. Is a Phone Number Required when Establishing an LLC Company? In my article, I explained why a phone was needed. Enter the information correctly in the fields below.

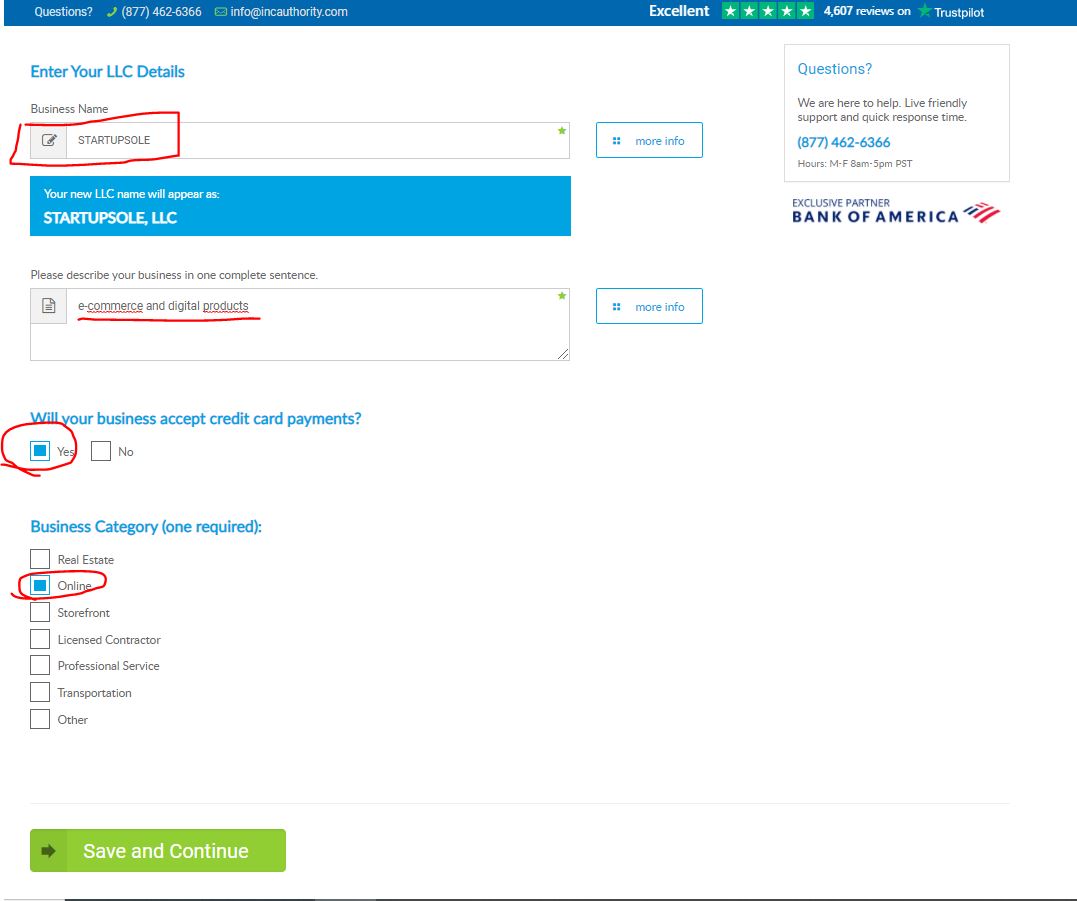

- In the following step, we are asked to enter the details of the LLC company. Before writing down a name for your company, check on the state website ( at this link ) to see if the company name you have in mind has been used before. If the name has not been used before, you can use this name.

- After entering the company name, you can enter a short English description about your business in the field below. We can go to the next step by typing E-commerce or Digital Services and checking the boxes below (Will your business accept credit card payments? That is, it asks whether you will accept credit card payments) and checking the online box.

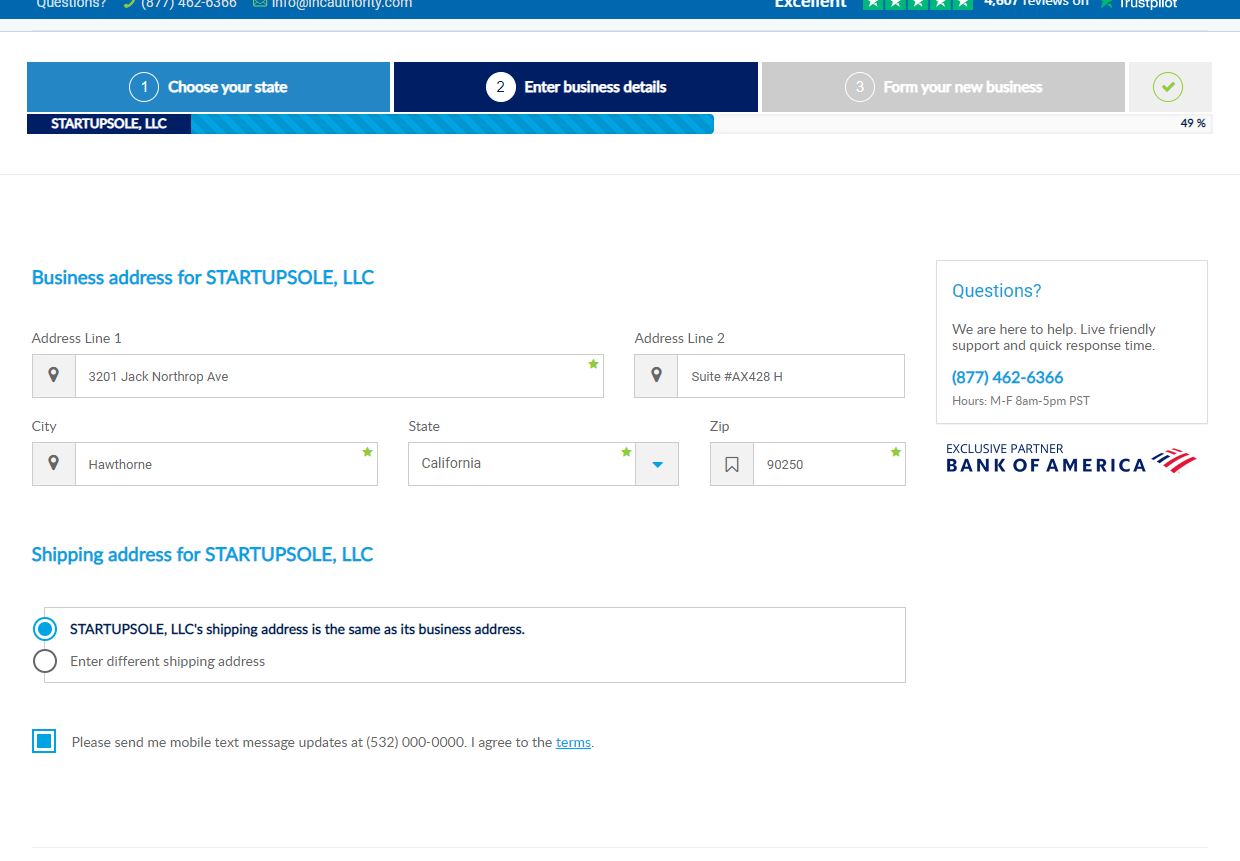

- Now for $15 you can enter the address information you received from the Wyoming Mail Forwarding Address into the screen in the step below. You can check the same address box as the shipping address, tick the "I want to receive the following messages on my phone" section and proceed to the next step.

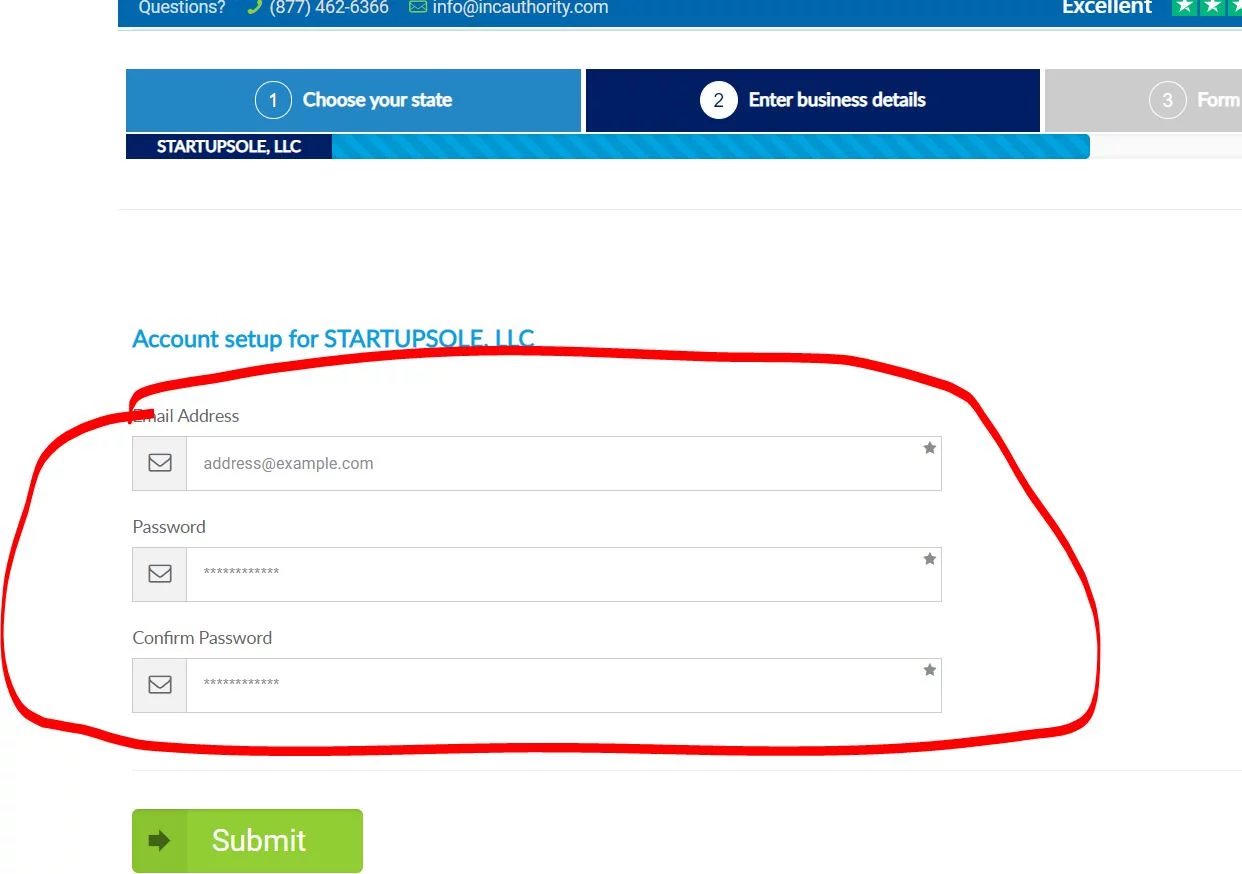

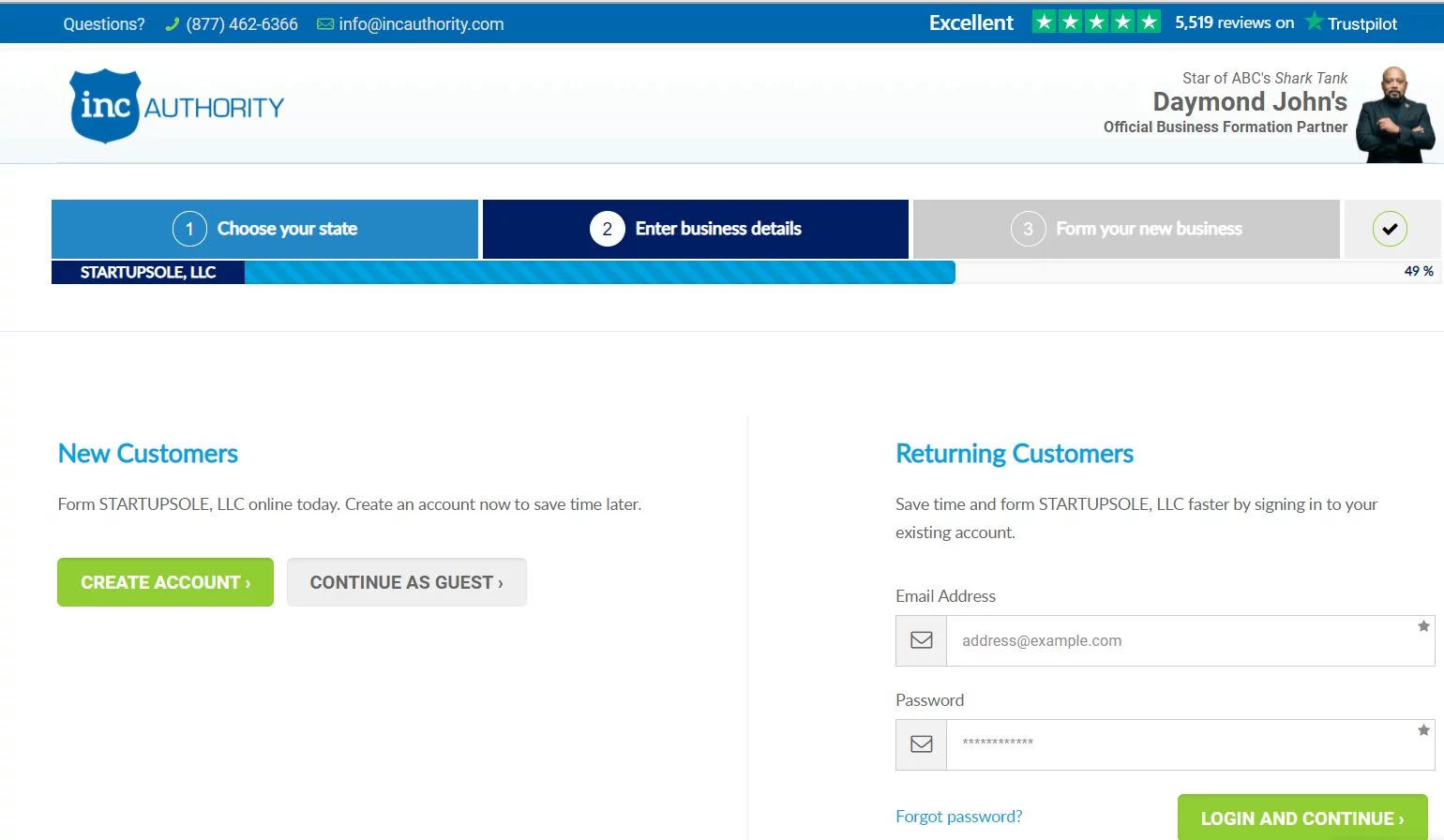

- In this step, you are asked to create a new account because you do not have an Inc Authority account. This is for inc authority customer registration only.

- Click “Create Account”

- Set a password by entering your email

- In this step, it asks you whether you want to receive EIN service. You can ask them to get the EIN number for you by getting a service from Inc Authority for $49. EIN (Federal Tax Identification Number) is a number issued free of charge by the government. to Obtaining an EIN Number from America, you can fill out the form and apply yourself. However, if you do not want to deal with these and pay fax fees every month, you can get this service from us for $29 from this link .

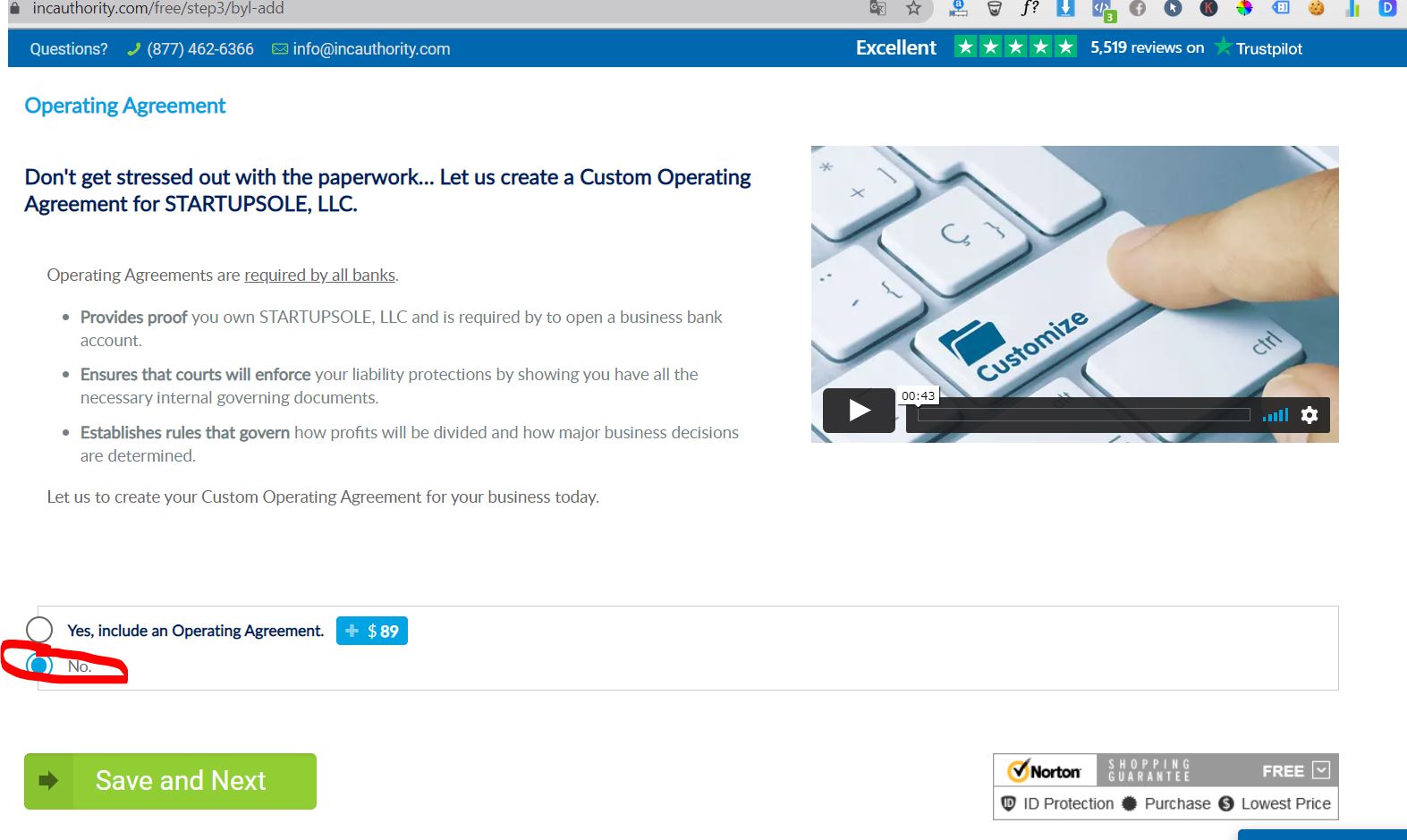

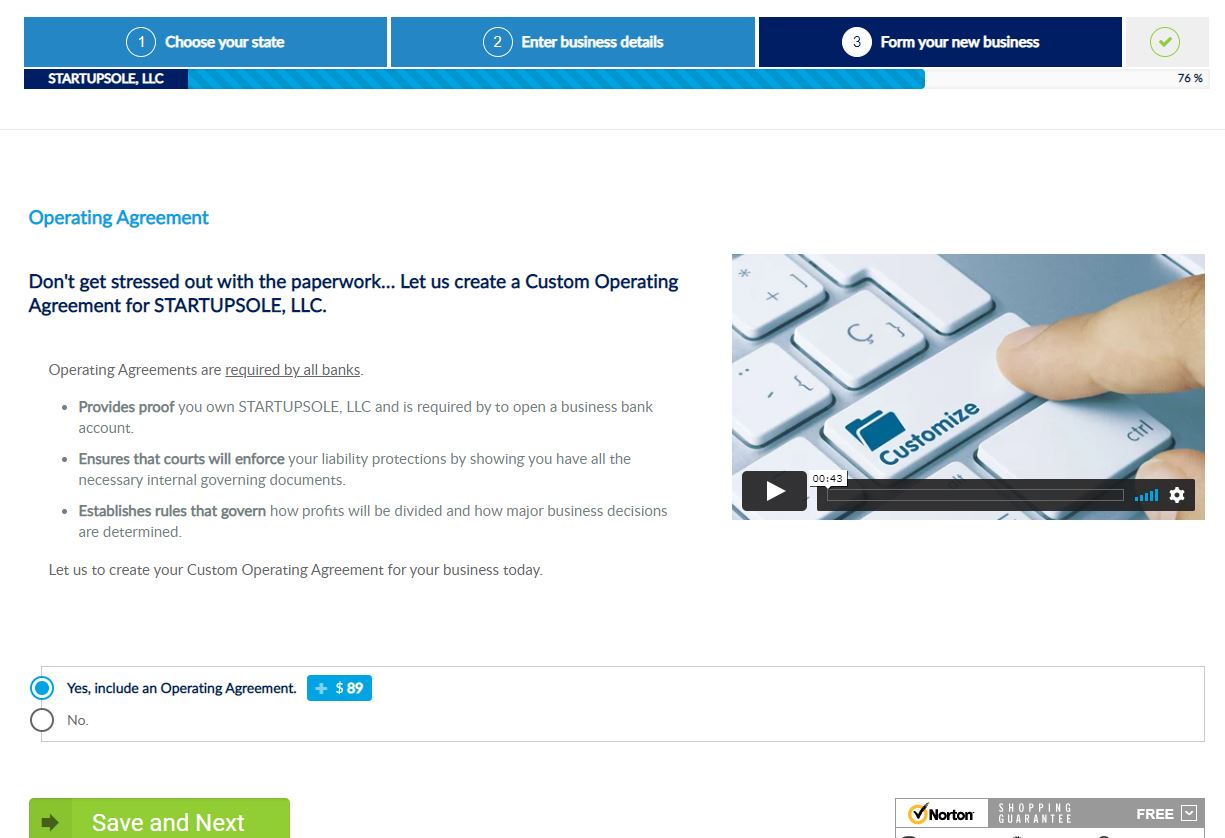

- If you want, choose YES, if not, choose No and move on to the next step. I choose NO and continue.

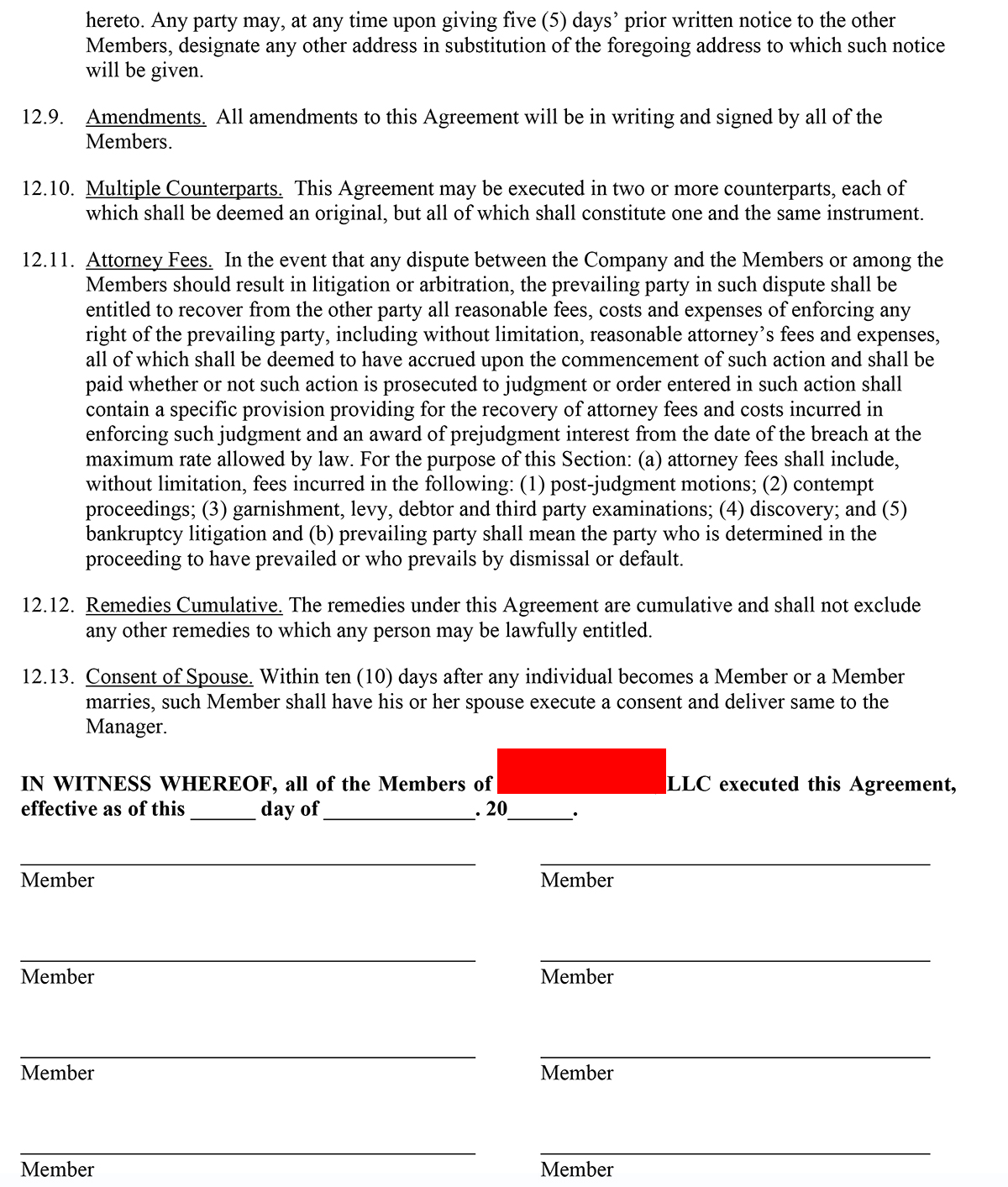

- In this step, it asks whether to include the Operating Agreement option. You can also create the Operating Agreement yourself, but if you wish, you can request it to be added by paying $89. What is Operating Agreement? Required for Single-member LLCs? There is information about what it is in the article and a free template that you can create yourself. At this stage, I add it by selecting yes.

- It asks if you would like an llc stamp and a few additional document options. You can buy it by paying $99. I proceeded by selecting "No" without selecting it.

- You may want to speed up company formation by paying extra. I preferred to wait and selected "No" and continued. They dry in 4-6 days anyway.

- Com domain name for your business. I select “No” and move forward.

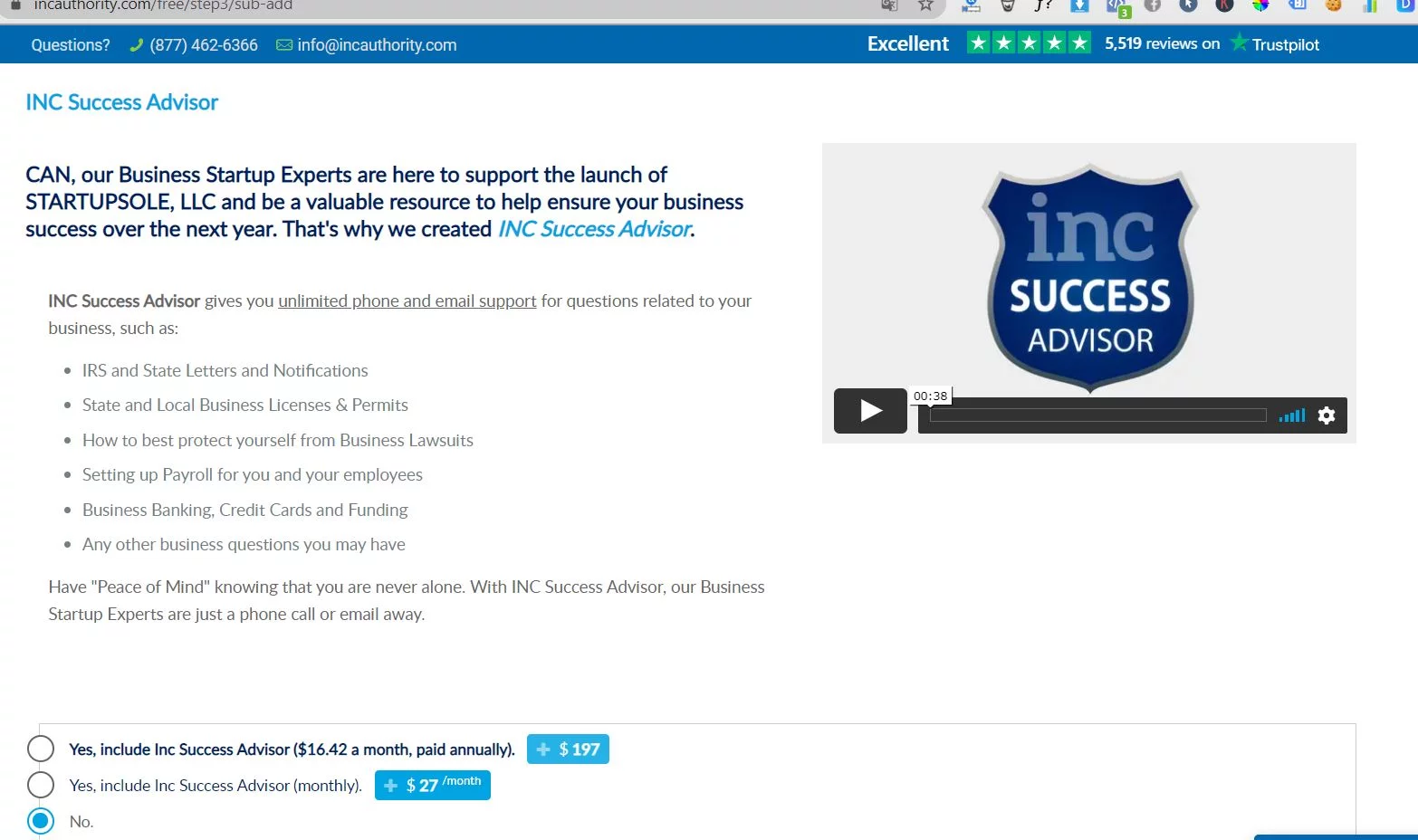

- If you want extra fast support and access to a document repository where you can have special access, you can pay monthly. When you pay extra, the support department works faster and they take special care of you. If you don't want it, you can mark "No" and continue. I continued like this.

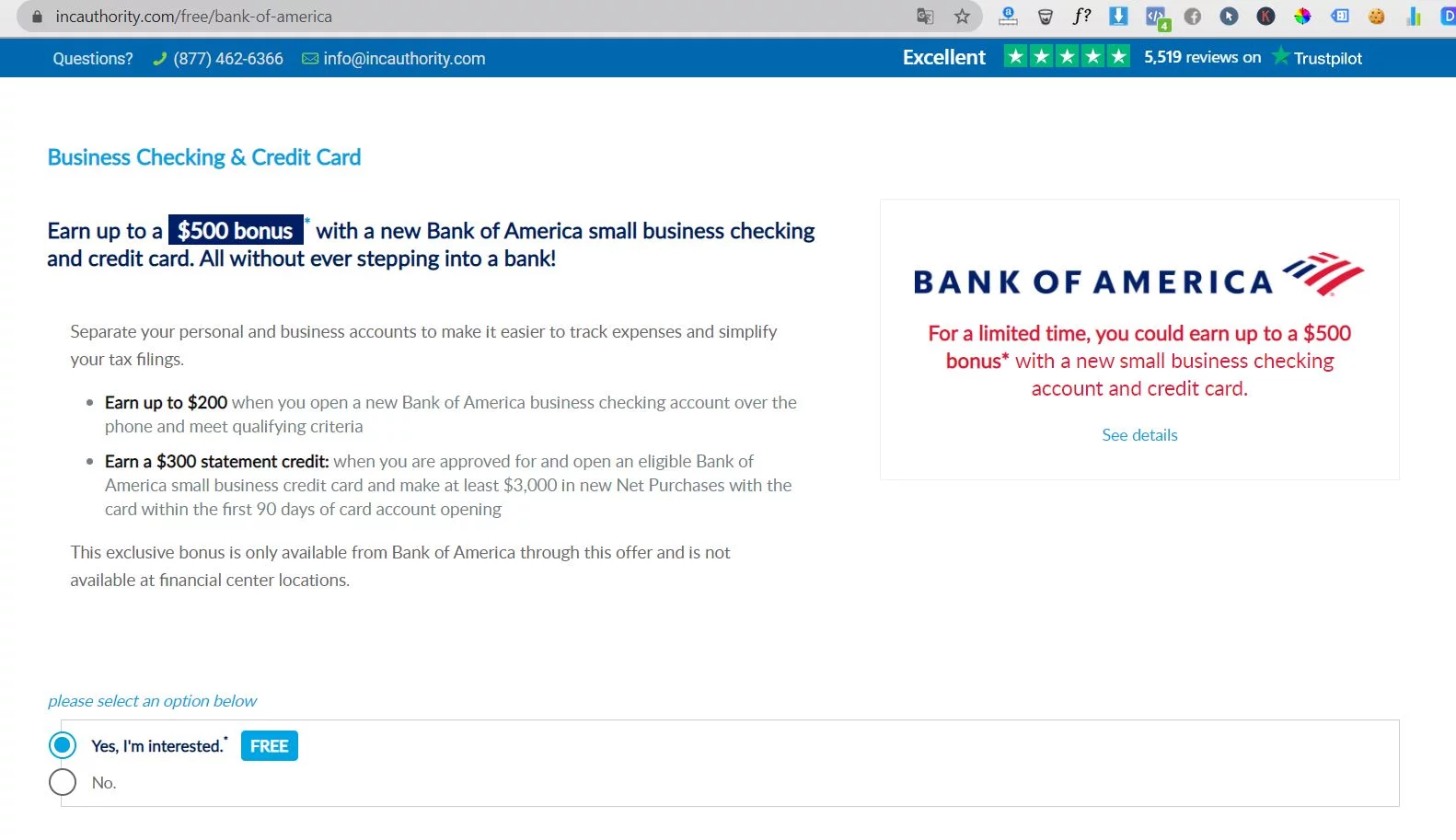

- The company offers you the option of opening a special American bank account for your LLC. Since I haven't tried it before, I don't know how healthy it will be. Instead, I prefer free digital banks such as Mercury bank or Wise I mark this option as NO and continue.

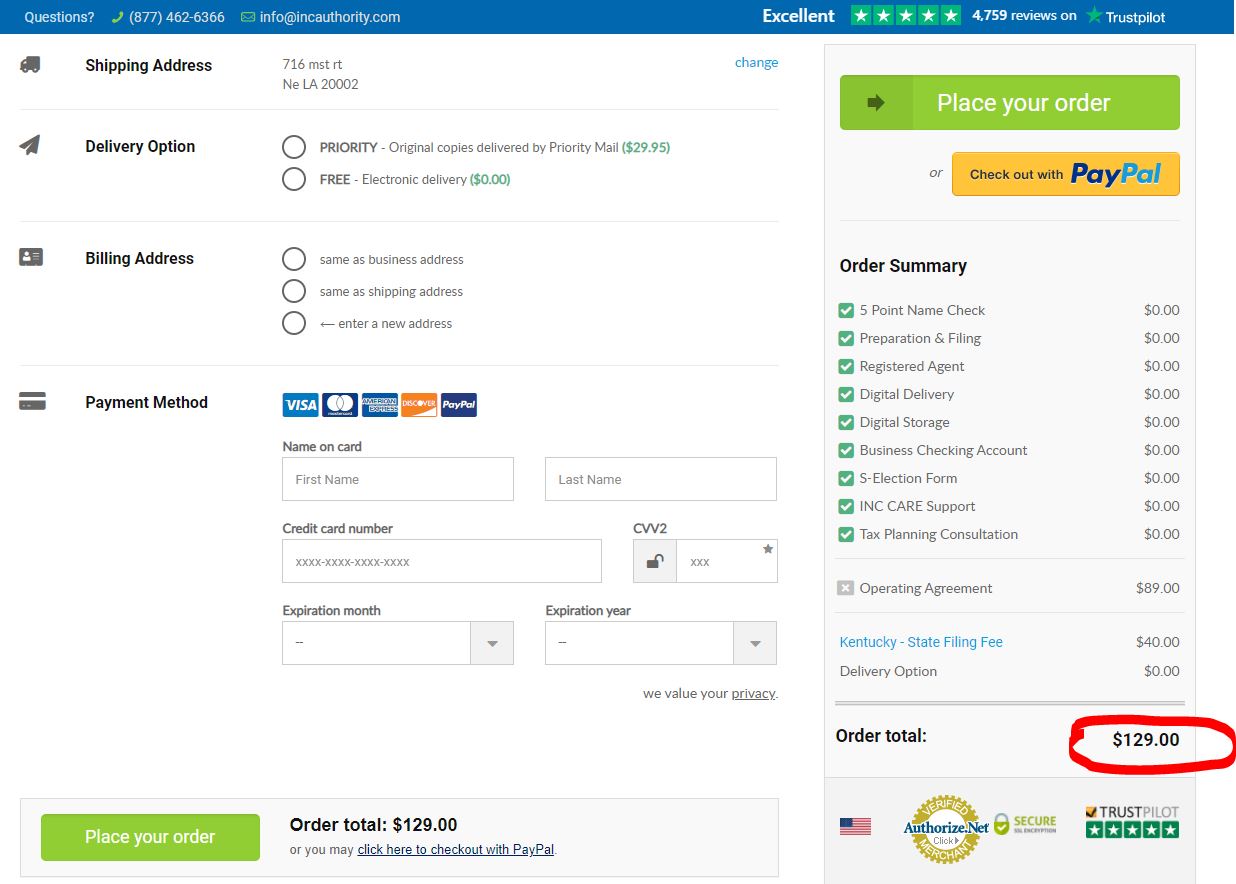

- That's it for the registration process, now you need to pay. The calculated costs should be as follows;

- EIN/Tax ID – $49 (Optional and if you choose)

- Operating Agreement – $89 (Optional and if you choose)

- State of Kentucky Filing fee – $40

Tick free $0 in the Delivery option section. You can choose the billing address section as your company's address or you can also enter your address in Turkey. It does not appear in company documents.

Total Price to be Paid Without EIN option: $129

NOTE: Due to its financial policies, IncAuthority rejects the transaction with an error on MASTERCARD-enabled credit cards from non-US countries. You must use VISA enabled cards. If you do not have a VISA card, you can purchase an ininial prepaid card and make transactions with this card. You can create a virtual card instantly by downloading the ininial card mobile application.

When you see a 20% coupon while applying these steps, do not miss it because a 20% discount will be applied to all additional services you receive, except for the state filing fee.

(If you enter the discount coupon from the computer, it appears, but it does not appear from the phone. If it does not appear, log in to the site again from this link

After following all the steps and making the payment, they start setting up the company.

“I recommend that you always use a virtual card on the internet and remove the limit you have defined at the end of the day.”

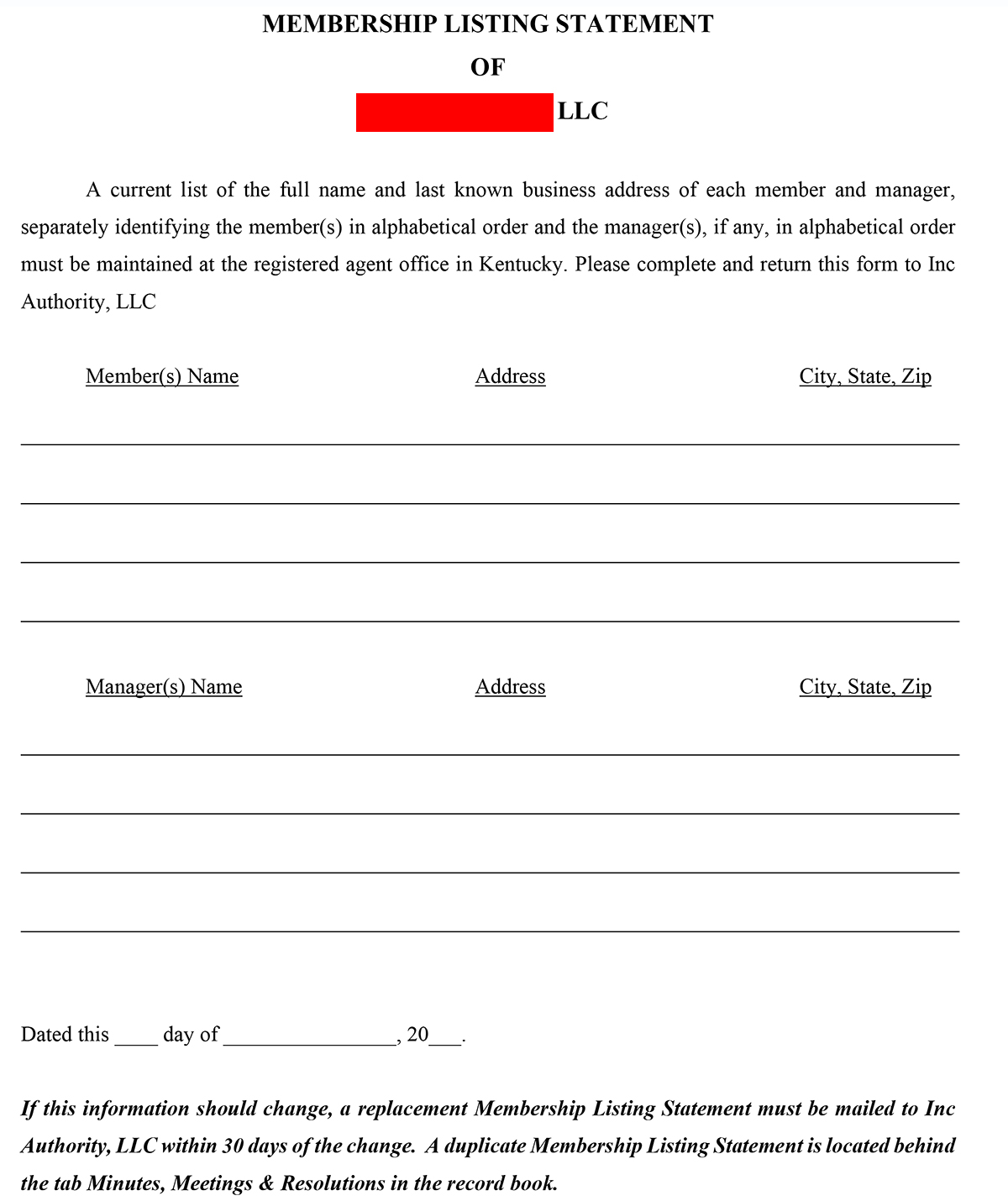

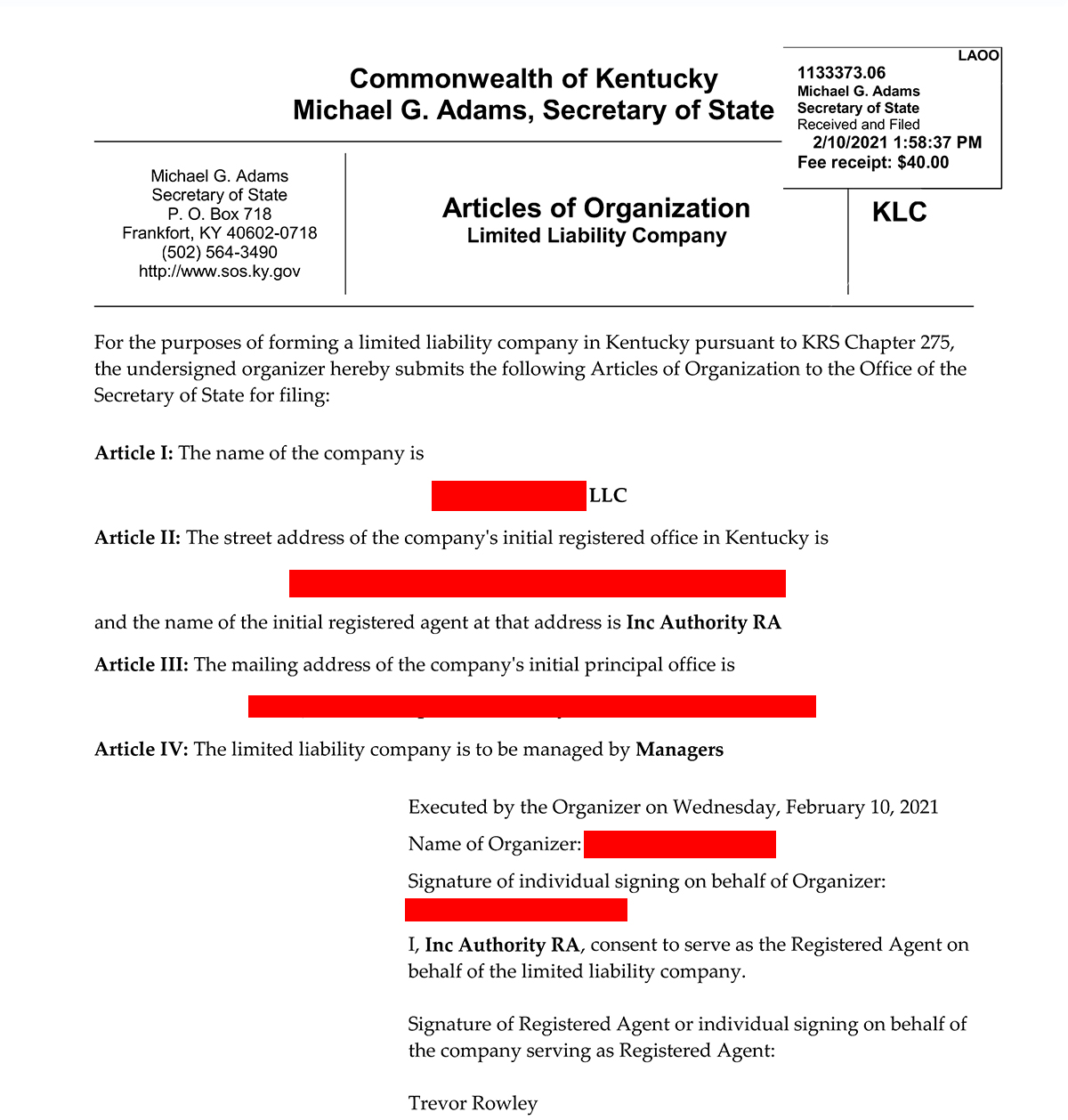

Company formment will take approximately 5.6 business days for this state, sometimes they can form it earlier. Afterwards, you will receive your company formation document by e-mail within a few days and some documents will be sent to you for you to sign. Sign them and keep a copy, then send it back to them with all the instructions in the email.

You can click on the button below to see examples of the documents you need to sign.

See Your Incorporated Company on the State Website

, you can see whether your company has been established by typing your full company name on the Kentucky state website ( here Before you receive an email from them, your company will already be listed on the state website. As follows;

That's it, your company has been formed.

If you would like to obtain a "Good Reputation Certificate / Existence Authorization Certificate" signed by the Minister of Foreign Affairs for your company, you can obtain it separately, although it is not required. how I got this for my own company here .

Once you receive your EIN number, you will now be able to open your bank account. to Opening a Bank Account in America . Or you can use Transferwise instead of opening a bank account because it is 100% legally supported by Stripe. Here 's a step-by-step guide on opening a Transferwise account and connecting it to Stripe.

Then, Open a Verified Stripe Account, you will take the last step of setting up your online business and solve the problem of receiving payment by credit card.

You should expect an EIN for a Stripe account. Please be informed that without EIN your account will not be verified. If you have any questions or are wondering about something, you can contact me by filling out the contact form

Good luck!

231 Comments . New Comment

On average, how many documents are physically sent per year for an llc? I would like to know if it would make sense to get a free mail forwarding address. Because there is a $10 scanning fee per post.

Maybe 1 or 2 pieces will not come.

Hello, thank you for the useful information. I would create the company. It doesn't accept my visa card either. What should I do and after forming an llc, I need to receive payment by credit card. What path should I follow?

Hello, you can use Northwest Registered Agent instead of incauthority. Incauthority will not accept customers from Turkey for a while.

Form your company with Northwest, we will apply for your EIN number free of charge, our campaign continues.

Sir, I formed an LLC in Kentucky in October last year, thanks to you, I am now receiving the Inc Authority Renewal Notice email. Does it have to be renewed?

Hello,

Yes, registered agent service is free for the first year of installation, but it must be renewed every year thereafter. Otherwise, the company will be terminated after a certain period of time.

Incauthority has increased its renewal fees. Alternatively, you can move your company to Northwest, a more cost-effective registered agent. According to Incauthority, it is quite economical.

This guide https://startupsole.com/registered-agent-degistirmek/ has details on how to easily change the registered agent company. You can move your company to Northwest in a few days for a price of 125 USD / year. You will also benefit from Northwest's shared Kentucky address system for free.

Hello, when forming an llc, does the credit card used for payment have to have the same name as the person who founded the company? Or can payment be made with a credit card of any name? (For the company formment phase with Inc Authority)

Thanks.

Hello, there is no such rule in incauthority. Northwest is paying attention to this issue. If you install with Northwest, you must write your own name in the name and surname section, even if the card belongs to someone else. Otherwise, you will receive an email requesting the cardholder's identity and confirmation.

By the way, for your information, Incauthority has been experiencing some card problems while receiving payments for a few weeks.

If you have the opportunity, we recommend that you allocate an additional budget of 39 USD and install with Northwest. Your renewal fee next year will be more cost-effective in Northwest.

I was very hesitant between Northwest and Incauthority, but I chose Inc as Incauthority seemed more reasonable as the initial starting cost. They sent me a few e-mails and asked if I wanted to receive additional services, but I did not respond to this either, as I do not respond much to promotional e-mails. Contrary to what is said, inc is an llc that does its job on time, I think I liked the customer panel, after all, they give free agency for the first year, they did the installation completely and it worked for me.

In total, my LLC company was formed in 3 days. I also sent my EIN application. I will open a stripe as soon as it arrives. My friend also formed it in this state. The stripe account has been working for about 1 year. There was no problem. I came with his reference and we completed the process safely. I can find all the information I'm looking for here, thank you for your efforts.

We wish you good luck and good luck. Incauthority is still a well-functioning agency, they do their job quickly and on time, they can make promotions, but we can say that it is the most trouble-free registered agent in the market who formes an LLC free of charge. They received a large investment 5 months ago and a few more well-known people in the industry became partners in the company. Then they developed the system further and formed a problem-free infrastructure. We are glad that you are satisfied.

Stripe accounts work smoothly because Stripe wants;

1- LLC company in the USA

2- EIN

3- A proper and compliant website

4- Bank account with a USD account such as Wise

If you provide these, you will use the Stripe platform for life without any problems.

Hello ;

I am trying to use a company with Inc authority and I do all the transactions. But when I come to the payment part, I cannot make the payment. My card is a Visa card, but it also says "'ALERT: This transaction has been declined by your credit card. Please contact us at 877-462-6366 so that we can assist you with your order.”' error. I can't get through the process, I would appreciate it if you could help me.

Hello,

Have you tried a different credit card? By the way, we have seen that ATM-style prepaid cards or cards of banks such as Ziraat and Foundation are rejected many times. Try using a different card, but if you don't have such an option, you can also choose to make transactions through Northwest.

Hello, were you able to solve the problem? I have the same problem, I tried with several cards but I couldn't solve it.

State banks or some mastercards definitely do not work. Alternatively, you can ask someone you know who has cards in banks such as YKB and QNB to create a virtual card. Or, set up with Northwest because they do not have card problems and your payments next year will be at more reasonable levels. Incauthority increased the price for renewals next year. At Northwest, there is a $39 + state fee for the first year and a $125 fixed price guarantee for the next year.

Hello,

Today, when I was paying with my Visa card on Inc Authority, I got the message 'This transaction has been declined by your credit card.' Please contact us at 877-462-6366 so that we can assist you with your order.' I encountered such an error. Does anyone know the problem and the reason?

Thanks

Hello, there is no problem with Visa card. This error is not similar to the problem or error experienced with Mastercard. It looks like your bank rejected this payment. You probably used an ATM (Debit) card or there is a problem with your card. In addition, credit cards of public banks may not allow shopping abroad. It may be useful to try another credit card

Hello;

Can a second company be formed in a different state with our current EIN number?

Unfortunately, EIN is required separately for each company.

Hello, we followed everything as in your guide and reached the end, but at the end we receive a warning saying "the addresses provided does not match billing address of cardholder". We cannot open the company and the amount on the card appears to be blocked. Is there any solution or why does this problem occur? Thanks

Hello,

The virtual POS system used by Incauthority has a security procedure applied to cards with the Mastercard logo. Selection of country as billing address on the Incauthority order page is allowed only USA. Therefore, your address in the mastercard database does not match and therefore payment cannot be received. The payment will be held in authorization for approximately 5 business days and then returned to your card, because the balance is never transferred to the Incauthority account, it just remains in authorization as a standard procedure.

We have placed warning texts in many places in the articles on this subject that cards with the Visa logo should be used, but you may have missed it.

You can place your order and set up your LLC with a card with the Visa logo (virtual cards are also accepted). The balance on the other card will be restored to the card within a maximum of 5 business days.

I founded the company with Incauthority and got the address from wyomingmailforwarding.vom. The EIN arrived at my Wyoming address in 17 days, they scanned it and sent it to me. Can I open a stripe account now? Is there anything else I need to do?

By the way, thank you very much for the valuable information you provided. success in your business life

We wish you good luck with your new job. Yes, you can now open your Stripe and Wise account, as a result, you can now start commercial activities with your company that has been assigned to EIN.

I want to motivate undecided friends and write about my experiences for reference purposes.

On June 17, I bought an address via wyomingmailforward for $15. The address became active the next day, June 20. On the same day, we applied for the establishment of a Kentucky LLC with Incauthority.

On the 4th business day, the company was established and the documents arrived. Immediately afterwards, I applied for EIN and as of yesterday, my EIN letter arrived at my address in Wyoming.

I established a company for approximately 55 dollars including the address, 5$ fax subscription (I canceled it when I received it) and completed my transactions for 60 dollars. I opened my Stripe account today and they confirmed it directly after uploading my ID. I am now in a position to start receiving payments. I hope my experiences are useful.

I would like to thank the site admins for the informative resource.

We wish you good luck with your new company and good luck.

I have a question. After opening an llc in the USA, can we invoice and receive payment in any country we want? For example, 70-80% of my customers are in Turkey and the rest are in countries such as England, Germany and Russia. Will this cause a problem?

Hello, you can receive it, there is no restriction on this, in fact, you will have a more advantageous position in terms of taxes since your income is not from the USA.

Thanks to you, we formed the company and it was listed in the state registry in 5 days in total.

Thanks to Admins for this valuable information.

Sir, in the incoming documents,

Membership Listing Statement

Document, my company is single-member llc.

Member side

I bought EIn service from them but they want my SSN number

Hello,

“We know how important it is that you have an Employer Identification Number/Tax ID for your business. That's why we're working diligently to process your SS-4 application. However, the SS-4 application you sent us is missing information.

Please reply to this email with the following information:

– Missing Social Security Number

”

Do you have any information about this, sir? What kind of answer would you suggest I write?

Tell them that you are not a US citizen and they will write foreign on the EIN form. They may have thought you were a US citizen. If you write a description like this, there will be no problem. They will send you the SS4 form for signature. You will see that it says foreign there.

Thank you very much sir

You're welcome

Exactly 32 days after forming the company and applying, the receipt arrived. I received the service from the StartupSole team, thank God, there was no problem, I would like to thank you here.

I had the idea of forming an llc in Usa for a long time, but I always postponed it with different excuses and due to lack of comprehensive information. However, the night I came across startupsole, I instantly completed all the operations. Thank you, they helped me many times day and night via WhatsApp on all my issues. We are currently waiting for you. I can say this with all sincerity. You can get sincere support from the StartupSole team on any issue you have in mind. I'm glad to have you

We thank you for your sincere comment. We tried to support as much as we could. We are glad if it was useful. Greetings and respect.

I had Delaware in mind, but considering the comments and costs, I applied in Kentucky.

Thank you for your valuable information and effort.

You're welcome, good luck with your new business. Good luck.

“You can present your company formation certificate to Stripe, they accept it.”

Which do you mean when you say company establishment certificate? Is it accepted if we screen our company page on the Kentucky website? Thanks.

Articles of Organization document, which you can also download from the Kentucky state website. This document is available for download as a PDF in the "Images available online" section of the state website. You can download it from there and send it if desired. The same document is given to you by the registered agent after installation.

Hello, I am forming an llc in Kentucky, so I received a Wyoming mail forwarding address this morning. But I still haven't received the suite number identification e-mail. How long should I wait?

Hello,

Due to the time difference, you usually receive an e-mail in the evening. If the time difference saves the applications made during the day, they are finalized and the suite is defined on the same day.

It arrived 4 weeks after the company opened. I opened my stripe account today and it was verified. I connected transferwise as my bank. I already had an active Shopify store, I connected it to Stripe, tested it and I can receive payments.

Friends, don't be robbed by looking elsewhere. I was going to set up with US Formation, but at the last minute, I went ahead and applied with Incauthority, no problem. So, everything is working. I would like to thank the site admins for their articles.

Congratulations, I'm glad everything went well 😀 good luck.

Hello

, I also applied for a company in Kentucky. I applied on Tuesday, they haven't sent the documents yet, but I looked on the state website and it looks like the company was established today. I can download the company formation document from the state. The documents may come from the register agent today or tomorrow, but my question to you is, should I not wait until the documents arrive and apply for EIN? After all, I can download the certificate of incorporation, should I apply?

Thank you for the unique information you provide.

Hello Mr. Mehmet, first of all, I wish you good luck.

If you see that the LLC has been formed when you inquire on the state portal and you can download your Article of organization document, you can apply for EIN without wasting time. The documents you will receive to sign do not contain documents that will prevent you from applying for EIN because they have formed your company.

I think you should quickly fill out the SS4 form and fax it to the IRS along with your incorporation certificate.

Friends, you can trust Startsol. The news arrived 48 days after I founded my company. I work on Amazon, I applied for a Mercury bank account, there is no negative situation, thanks to the admins.

. Congratulations on your new venture

The LLC was formed in 4 days, the documents arrived, I will buy it from you, I did not want to make a mistake and wait again, so we can contribute. Best regards for your hard work.

Thank you for your comment, I wish your company good luck and good luck :)

I would like to thank the admins of this site. Approximately 45 days ago, I formed my company and applied for EIN. Thank God, EIN arrived :) We completed the installation safely.

In fact, there was no problem during this process. There is nothing we can do about it except the time period. I used Mercury to open my bank account. As soon as it arrived, I applied two days ago, sent my passport, my identity was verified, and they opened my account as of today. I also applied for an ATM card and it looks like it will arrive from Mercury within 2 weeks. My advice to you is that if you do not have a passport, you can also open a Wise account. As a commercial account, you can enter the EIN you received for Wise Da LLC and open an account. I opened an account for both Mercury and Wise and they approved it. I will open and confirm my stripe and 2checkout accounts, now that's all that's left.

I wanted to write a comment here both to share my experiences and to thank you. I wish everyone a good work.

Good luck to your company and your business, good luck in advance. When opening a bank account, if your website is functional and complete, there will be no problem, and you must do business in accordance with their policies, otherwise they may not approve some sites. Alternative Wise might be a good idea. By the way, another alternative is https://relayfi.com/, . It is not known by many people, but Relayfi is known as an extension of a large bank, you can use it with peace of mind.

Hello, while following the stages of forming an llc, after approving and passing the operating aggregation stage, the new page asks if you would like to get the Legal Documents Package with Ownership Certificates, and Seal option. Do I need to purchase the fee of 99 dollars?

This option is not necessary for forming an llc and keeping it active, but if your budget allows it, you can of course add it, so the choice is up to you, it is not mandatory.

Thank you for your answer, I have another question, it is not related to the company part, but if you have an opinion, I would like to get information. Will there be a problem if I do dropshipping via Amazon USA from my shopify store that I opened for the company I formed in the USA? Thank you again

After all, you have a legal company with a tax number, there is nothing stopping you from carrying out all your commercial activities through this company. Since we do not have much detailed information about Amazon, we cannot go into too much detail, and we do not want to share anything here that we have not experienced. Instead of misleading people, it seems more logical not to mislead them at all.

As far as I know, Amazon has options to open an account from TR or the USA. If you open an account directly from the USA, as far as I know, you will be asked for verification for residence. I know that if you open an account through TR and verify the account, then add your US LLC as a new marketplace, the verification process becomes more painless.

These parts are not about your company, they are about Amazon procedures. If you can overcome these verification processes, you can use Amazon for your new LLC.

My ein also arrived, it was opened to stripe from my US company, thank you. I was going to ask something. I use iyzico. It has a link payment system for e-commerce transactions within Türkiye. I think there was such a feature in Stripe, but I couldn't use it fully because of checkout. Do you have an article on this subject? I couldn't find it on the site. Or could it be? :) It would be greatly appreciated. Thank you again.

Congratulations and good luck.

I think you say Stripe checkout, you set a price yourself and create a product, it sends a payment link via e-mail through the panel.

https://stripe.com/payments/checkout

There are actually details here. It's not on the site right now, but maybe if we find time we can prepare an article about it.

Hello

I also established a company on March 13 and commented here

https://startupsole.com/inc-authority-ile-amerika-da-sirket-kurmak/#comment-254

Two weeks ago, my e-mail arrived, I opened stripe, it matched and now stripe verification is completed. They also approved my Mercury bank account this week so everything is ok. I wanted to comment again to say that you can trust it. I would also like to thank the site admins for sharing these unique experiences.

It is good news that the EIN has arrived and the accounts have been approved, congratulations;) I wish you good luck.

The EIN arrived on the 44th day :) I waited a few days for it to be recorded, I opened Stripe and uploaded the company documents today and verified them. Thank God. I have completed the Shopify – Stripe connection and completed the tests, and I will start receiving payments.

This process cost me $145 in total, including the fax (I canceled the fax when Ein arrived, I also canceled the phone because I don't have work yet), I can say that everything is fine.

When I first found this site, I had a lot of questions in my mind as to whether it would work or not. They quoted me a price of $750 for setting up an llc, I refused, I took a dare and as I said, I completed the job with the methods on this site for $145. I cannot thank you enough for the information and support you provide. I wanted to comment as soon as the process was completed so that people could benefit from it. Good luck.

Congratulations on your company, Mr. Adem, the second EIN news came today :) We are happy too... I hope your business goes well and I wish you good luck. In the meantime, telephone and fax may no longer be needed. If you wish, you can cancel or do not make a payment and it will be closed automatically. Thank you for your comment. Greetings.

First of all, hello. I wanted to step into the world of e-commerce to earn some income during this pandemic period and I came across your website. If I couldn't find all this information here, I would have lost a lot of time and money. Thanks to you, I formed my company in Kentucky through INC and they sent me my EIN number after 40-50 days. They said it took so long as a result of the pandemic. After receiving it, I applied to Mercury Bank with my passport and ID card, and they approved it without any difficulty. They told me that they would send my bank card to TR, which I wrote as my mailing address. Frankly, Shipito's process was a bit long. As the last step, I came to the payment method, I will inform you after I finish it. I can say that I was able to find answers to most of my questions thanks to your website. Thank you.

It's great to hear such good news and comments. Good luck to your company and your bank account. Now all that's left is to withdraw your earnings from Turkish ATMs. I hope you earn a lot and your business goes well. Good luck.

Hello, are there monthly accounting fees? How can we handle the accounting work?

There is no need for a monthly accountant in the initial stage. You collect or do not collect the sales tax according to your turnover and sales volume, you are exempt from tax until it exceeds the limits. [email protected] you expect from your in -US sales, I can transfer detailed information. Or in this article, you have the answer to your question, I suggest you read it if you have time. https://startupsole.com/amerikada-and

I started the company setup in line with the information you provided. I prepared the Operating Agreement with a template. It cost $40 in total. I will get the service from you, at least we can contribute to such valuable information. Thank you, I wish you continued success.

Thanks for your comment and support. Let's wish you good luck with your new job 😀

Hello, I am starting a dropshipping business, I received advertising and shopify training, I chose my products, the supplier is ready, I am setting up my website right now, and thanks to you, I founded my company for 120 dollars. Now I am waiting for you, I hope it comes quickly.

I knew that forming an llc was a very costly thing, but actually it wasn't, and I even thought of getting the brokerage firm to start Stripe in return for a commission, but when I saw your site, I gave up. I wanted to have my own payment infrastructure and I'm glad I did so. I wanted to thank you again, you answered all the e-mails I sent and supported me. I couldn't have succeeded without you, respect and love.

Thank you for your comment. Congratulations to your company. I hope you will be successful in your new job.

Hello, I am an Usan citizen, I want to form a software company and hire software developers from Turkey to work in Usa. Can I invite with an H1 visa? Is it valid for a new company? Thank you very much in advance for the information.

Hello,

As far as I know, there are 185 different visa types in Usa. H visas are called temporary work permit visas. You can form a technology company and obtain an H1b visa, but you need to first check whether the staff you will employ are qualified to meet the conditions of this visa type. There are some criteria such as the conditions of the state in which you will do business, general conditions and the competence of that person. If you are serious about this issue, I recommend you get advice from a professional agency. This way, you can foresee possible problems that may arise in the future.

Thank you very much for your answer, is there an agency you can recommend?

You're welcome, we don't want to mislead you since it's not an area we're very interested in.

There is no company that I have direct experience with, but after a short research, I am leaving a link to a company that is satisfactory in terms of content. https://www.vizemerkezi.com/ I recommend you contact them and get support. By the way, if there is an authorized agency in the state you are in the USA that deals with these matters, I think it would be better to talk to an agency from there, since the invitation will come from that side.

Okay, thank you very much for the information again.

Hello, thank you for your efforts, I opened my LLC company at a cheap price, I am grateful to you.

You're welcome, good luck.

Hello, I first saw this website thanks to a post in a Facebook group. The articles attracted my attention and I was already in the process of setting up an llc for my dropshipping business. I formed the company with the methods on this site. Thank God, it arrived after 40 days and we opened an account as Stripe Verify. Since I do not have a passport, instead of applying to Mercury Bank, I opened a Transferwise commercial account, connected it to Stripe, there is no problem now, I have received the test payments and the system is working smoothly.

I don't care about taxes etc. anyway, if I win, I will somehow hire an accountant and pay my taxes. The important thing is that with this company, I have the convenience of doing dropshipping today and doing another online business tomorrow. I am writing this comment to thank the team that wrote these articles for their valuable sharing. Thank you for your efforts and wish you all the best.

Hello,

Congratulations to your company, it is really motivating to see such positive results. It is very gratifying that you followed the entire process well and correctly from the beginning and reached a happy ending. As you mentioned, the EIN has arrived, the company has been formed and the stripe has been approved, now you can do many internet projects by keeping this company active (paying $15 annual tax and declaring form 5472). I hope you will be successful, congratulations and I wish you good luck.

Dear admin,

let's say we have an EIN number, do we need to get an ITIN node?

Hello,

It is not necessary at the first stage, but if you need to declare taxes in the future when you exceed the limits, your accountant will ask for an ITIN. Because single-member LLC companies are taxed like individual sole proprietorships and this is declared with ITIN. Although it is not needed immediately after forming the company, ITIN may be required if you need to pay taxes the next year.

Hello, first of all, thank you for your article, it was very useful. I completed the process of forming an LLC, made the payment, and the transactions started. It has been 3 business days today. However, I cannot access the member panel to follow the developments. It gives an error when you enter the my account section from the services section at the bottom of the site and when you click on the client portal tab. I log in as a member, enter my information and only then; The requested resource could not be found but may be available again in the future. gives this warning. As a follow-up, IncAuthority.com apologizes for any inconvenience, please click here to return to your previous page or click here to visit our home page. He offers two options. My question is, is this a temporary problem caused by the site, and if I still do not have the chance to access my documents to sign after 7 business days while this problem continues, will they send them from my e-mail account due to this panel tab problem or do I need to contact me for this?

Hello,

There is a temporary problem in the portal, yes it is not something specific to you, you should be getting an error like the following;

“The requested resource could not be found but may be available again in the future.”

On Friday, I started a company setup for a new project, I get the same error, I sent a notification to support, you can send it too. I did not receive any documents via e-mail, but when I made an inquiry on the state website at

http://web.sos.ky.gov/ftsearch/ They will send you a registered agent contract, you will sign it. In fact, if your company has been established, the paperwork can be done later and they will definitely reach you. You can at least make an inquiry from your state and see if the company has been established. In the end, there is no problem and the postal issue is solved somehow.

Hello, thank you for your answer. After you replied, I searched on the state website, my company was formed, but my surname was entered incorrectly, so I did not apply for EIN and waited. Then, the documents to sign and the Articles of Organization were sent to my e-mail address. My last name is wrong there too. First, I reported this in response to the e-mail that sent the documents. I wrote that my surname was Akpınar, not Akinar, and that it was written incorrectly in the contract, and that I would sign and submit the other documents correctly, but that I wanted this error to be corrected as Akpinar, and that it was also incorrect on the state website. When I did not receive any response, I sent the same e-mails to Inc authority's account starting with info@, help@ etc. and to the account of Trevor Rowley, who edited the file, for 4 days and no one answered. Finally help@incauthority. com over and over again, "Thank you for notifying us of this and sending us an e-mail, we will definitely fix this." The answer came. However, even after 3 business days, there is no change. What should I do now while filling out the SS-4 form? I have not been able to apply for EIN for 7 days and I am waiting for this error to be corrected. If I write correctly in the Name and Surname section of the form, my surname does not match the surname on the state website. Is there any problem or will it be considered valid as my surname on the official ID? Or even if there is no problem, since I will send the SS-4 form by fax along with the Articles of Organization, it still does not match the contract I sent in the attachment. I would be very grateful if you could guide me on what should I do. I did research and tried to contact all addresses, but there was no solution. Is there a way to do this? Will my surname be corrected? Or if I'm waiting because it's taking a long time, will it be accepted if I apply for EIN? Finally, I will edit my surname in the contract myself :) If you have knowledge and experience, I am waiting for your help. Thank you very much in advance.

Actually, you have experienced a great misfortune, it is not a situation I have encountered before, probably the wrong entry was entered during the application, either you or they made a mistake. After all, an error has occurred, of course, it would be more logical to fix it first. Have you tried contacting them by phone? They respond faster on the phone, and they usually respond to emails the next day. They may have even processed it because state records also need to be edited and this may not be immediate. I think it would be in your best interest to contact us after 20:00 in the evening and try your luck a little more due to the time difference.

If they do not change it, there may be problems like this: You will have problems verifying your identity information and passport when opening a bank account or registering somewhere else. Because the name and identity in the company document will not match. Of course, this applies to EIN. When you receive an EIN letter, the name on it will not match yours. This does not prevent you from getting an EIN, but as I said, you are likely to have problems when your ID / passport is requested for verification somewhere in the future.

Try to reach us by phone, it makes more sense, but if you fill out and send the contact form from this link https://www.incauthority.com/contact-us, you will receive a faster response.

I hope this problem is resolved quickly, good luck.

I formed an llc in Usa, my LLC formation documents arrived, I formed my company thanks to the information you provided, thank you very much, I am waiting now, I have a question. I have a lot of knowledge in an art-related field. I will shoot online course videos and sell courses by taking payment by credit card. I looked at Teachable, but there are monthly fees. Can you recommend an affordable or free course platform? What kind of site infrastructure should I use? I want to finish the infrastructure work at least until the site arrives. Thank you again.

Hello, you can publish your online courses on a WordPress-based platform and receive payments with Stripe. For this purpose, I can recommend the most widely used WordPress plugin, learndash. https://www.learnndash.com/ Thanks to this plugin, you can add many features to your site such as member levels, different course packages, different video platform support, monthly subscription. I hope you find success in your new job. You're welcome and I wish you good work.

With the method I learned from this website, I set up an LLC company in Kentucky and applied for EIN about 2.5 months ago. The EIN finally arrived yesterday via fax, now I am no longer having to f5 on faxplus every day :) For your information, it has been 2 months, you should wait patiently.

After receiving the EIN, I opened my stripe account as of today and finally entered the EIN into the relevant field and my account was verified. In fact, I had a lot of doubts at the beginning, wondering whether it would be possible or not, then I started this business thinking that I had nothing to lose, and I am very pleased with the results.

I would like to thank everyone who prepared this site and wrote these articles, it is a working system and I can recommend it to everyone with peace of mind. Best regards and good luck to everyone

We thank you for your comment and wish you good luck. I'm glad you came, you can now receive payments securely with your stripe account.

Hello, I applied for EIN on February 11, after completing the company setup. I received a fax about Missing Information on March 30, and I completed the required information and faxed it back, but I did not receive a response even after 2.5 months. When I called today to get information, I was told that I had to re-apply. Have you encountered anything like this?

Hello,

you must have made a mistake in the Ss4 form. What exactly was written in Missing info? Usually, when there is an error, they explain the deficiencies at the bottom of the form and ask you to correct the deficiencies and apply again. I hope you double checked when faxing again because wait times are known to be quite long. I sent a notification via e-mail to Mr. Oğuz, who made the comment. I think if he sees it, he will share his experiences.

In the Missing Information section, phone, fax and available hours were asked, I answered and forwarded them.

That information is not important, phone etc. There should be a few more lines of explanation text just below the written part. The cause of the error or the deficiencies that need to be corrected are stated there.

I am forwarding the incoming fax directly as an attachment.

https://i.hizliresimdddddddddd.com/ddd3dddddNy.png

Mr. Mehmet,

The bottom part is not completely visible in the screenshot (I changed the link so that your personal information is not visible) but as far as I can see, there is a problem in the 7th line of the SS4 form. In that line, you should have written 7a: NAME SURNAME and 7b: FOREIGN. You probably missed it. Errors are written under the part that starts with please note.

Additionally, attach your company establishment document to the rest of the SS4 form and fax it again as a single page, because this document may also be requested for second applications. You can apply again by looking at the sample form https://startupsole.com/amerika-dan-ein-numarasi-almak/ Re-send your form to both the fax number at the top left of the missing form and the IRS general fax number you first faxed. (Do not forget to attach the document provided during company setup)

I completed it and faxed it, I will post it under this topic for informational purposes in the meantime.

I hope it will be concluded quickly, we are waiting for the developments.

Hello, after sending the fax that day, as a result of my conversations with the IRS, they asked me to call if it did not arrive within 2 weeks. When I called today, they assigned me my EIN number over the phone.

Congratulations, I'm very happy about this, otherwise

you would have to wait for a long time again, good thing you called. Giving it over the phone is not something they do very often, but they probably did it so that you wouldn't have to wait any longer because your transaction was interrupted due to missing documents. Actually you are lucky.

Wait a few more days to open Stripe, it may take time for the systems to sync.

Good luck again.

No, I did not encounter it, you probably filled out the form incorrectly, so you received a notification that it was incorrect and you will need to re-send the form.

I didn't choose that 89 dollar service when I signed up, because a friend here said you can download it, fill it out and do it too. Now I received this e-mail:

My boss wanted me to reach out as a favor to you. We still have not completed the last step in your business formation, which is solidifying your legal documents. Remember from our last conversation, these are the documents that will give you that legal separation between you and your business. Your business WILL be viewed as a Sole Prop rather than a single member LLC in the eyes of the United Stated Judicial Courts. You will be held personally liable until these are put into place.

Give me a quick call so that we can fix this

_———————————————

I said, "Why do we have to talk on the phone? My English is not very good. Could you write me via e-mail?" and they sent me this e-mail.

https://i.snipboard.io/dlqup2.jpg

What should I do?

You said in your previous comment that your company was formed and listed on the state website. You don't have to consider every email and accept every offer. After all, they want to sell additional services from time to time, it is up to you whether you accept it or not, but there is no necessity right now because your LLC has already been formed, you may not respond.

It was set up and listed on the state site, but for some reason I still haven't received my EIN number. Yes, you are right, but when the e-mail comes from the men and they say that you have to complete your documents incompletely, otherwise some blah blah things will happen, people become suspicious.

Don't worry, it's okay. Anyway, site seal etc. As far as I can see, they want to sell things like this... There may be people who need these. Some people may ask for documents such as stamp, membership certificate, apostille, it is a matter of preference, they also offer them, but their offer style is a bit strange, I agree with you on this issue, but do not worry, there will be no problems. Ein does not come immediately, some come after 50 days, some take 55 days. Unfortunately, it is not something under my or your control.

You can look here: https://startupsole.com/ein-ne-zaman-gelir/

Hello… First of all, thank you for your article. It helped a lot. I have an llc in Turkey and I am forming an llc that sells via e-commerce abroad, just like you, and sends products directly from Turkey to the customer's address via Fedex. Can I consult you on invoicing and operation issues (such as Usan invoice forum stub filling service, etc.) between the company I formed in Usa and the company I formed myself? Does IOnc provide me with accounting services for 1 year free of charge?

You're welcome, I hope you will be successful in your new job.

The business you are talking about is actually different from the business model we do, your business is actually a matter on which an export and foreign trade expert can be consulted. We are not accountants or consultants, we are trying to share our experiences and research on this blog, so unfortunately we do not have the authority and skills to give you consultancy.

We would still like to assist you in your work to the best of our knowledge, but instead of occupying the comments on this topic, if you give us a few details about the work you do on our contact page, we will support you to the best of our knowledge. Please send us the answers to the following questions by e-mail;

Are the products sent wholesale or individually to the USA?

What is your sales volume? Your monthly turnover etc.

Which states will you sell to? One state or every state?

Enjoy your work.

They sent me an SMS to my Usan number, asking them to choose a schedule call date from this link and meet. Is this call very important or are they just trying to sell additional services? Also, when I set up an llc, won't they give me an llc file with a certified signature? The document they give is a document with very normal writings. Will this be our company document?

They have formed your company and the transactions are completed. Sometimes they call and offer additional services, no problem, you can refuse. Your document is a digital article of organization document, that is, the Ministry of Foreign Affairs issues a document in this way, it is not a special process for you. Generally, the process is the same in all states. Since the same is also available on the state portal, it can be verified from there.

If this document does not satisfy you and you would like to obtain a company authorization certificate approved by the Minister of Foreign Affairs for your company, follow this link. We have prepared a step-by-step guide for our own company: https://startupsole.com/kentucky-llc-iyi-itibar-sertifikasi/

Friends, the admin explained it in detail, so I formed an LLC in Kentuck and my company formment certificate was on the panel on Friday evening. It has already been explained in great detail, but I would like to share my experiences.

First, I bought a phone number (six from sonetel for $1.99/month).

Then, I bought an address from wyomingmailforwarding for $15. They said the first delivery was free. The other digital delivery was $10

. Then, I completed my application step by step with incotoriti. I bought the operation agreement from them. During the installation phase, a coupon appeared and it cost 103 dollars. I set up the company for 120 dollars, including everything, address etc.

Then I received documents from Incautorie for me to sign, release, operation agreement and registered agent agreement. You sign them, scan them and send them back digitally. After the process was completed, I applied for EIN via fax today, now we are waiting for the EIN to arrive.

Lastly, you can query your company name on the Kentucky state website and see whether it has been formed or not. They even have a portal called Onestop, I registered there and in the future, you can do all processes online, such as reseller permit and good standing certificate, state tax registration.

In short, I cannot thank the founders of this site enough because my own research was not enough for the installation and all the question marks became clear in my mind. Don't be robbed by giving 1000 or 2000 dollars to others. Most entrepreneurs from 3rd world countries form their companies themselves using this method. You can also see it in Facebook groups. Incautority The only situation was this: They wanted to sell me additional services, I did not accept, they did not insist. They already do the installation for free, and the first year of registered agent service is free as well. Let's make it easy for everyone.

Hello. Let's say we founded an llc. How will we pay taxes on our income? Is it paid annually? How do we issue invoices etc. I do shopify dropshipping. Do we have to pay taxes in Turkey and Usa?

Greetings Mr. Ibrahim. Similar issues have been asked and answered many times, please excuse me in the comments. Still, I leave you a few links, if you read them at your leisure, you can get answers to all your questions:

https://startupsole.com/amerikada-vegiloji/

https://startupsole.com/abd-eyaletlere-gore-satis-vergileri/

All articles about taxation: https://startupsole.com/amerikada-sirket/vergiloji/

I established an LLC in Kentucky for 49 dollars, I did not pay 89 dollars for the operation agreement, create one from this link and sign it, that's what I did

https://eforms.com/operating-agreements/

The application is complete, the LLC was established in 3 days, they gave the document, they tried to sell the operation agreement, so I wrote it myself, I said no problem. It didn't come out now, we'll just wait. Those who have question marks in their minds, don't worry too much, it's not a camel, it didn't work, I will close it down, I already founded the company for 50 dollars.

Hello!

Dude, I have a question?

You say you installed it for $49, what about the wire for the installation? How did you handle the number, fax or address information? Bi

It should probably be excluding address and phone number. You can get a one-time fee of 15 USD for the address, Wyomingmailforwarding.com, phone, 2 USD per month, Sonetel or Zadarma. It cost $65 in total, but he prepared the operation agreement himself, thus saving $89.

Oh my God admin!

Do you think that this friend, an American, founded this company, or as you say, the address and phone number are from America. I don't think it's possible without buying it. What do you think? By the way, as you said, is it possible to establish an LLC with $49 + $15 + $2?

Yes, it is possible in America under these conditions and at this price. He already stated that he built it in Kentuck. Phone and address are absolutely required. You must prepare and maintain the operating agreement yourself. Kentuck does not require this contract, it is recommended to create one to avoid problems in the future. By the way, we have shared detailed information about what this operation agreement is: https://startupsole.com/operation-egreement-nedir/ .

Sir, I have a question. Will they ask us to send any passports or IDs etc. for company opening with this method, especially when the IRS witnessed such an incident in a video? I would be happy if you help!

Hello,

A passport is required when opening a bank account, but it is not required when setting up an llc or getting an EIN from the IRS. I mean, I don't know where you saw it, but I've never heard of it before. You mail the original passport to the IRS when getting an ITIN number, not when getting an EIN number.

Hello teacher! I watched the company opening video on Incfile.com. I saw it there today. For Amazon.com company setup!!! I wonder if it differs from company to company?

I mean, it's very interesting, maybe it's a special situation for US citizens, I've never encountered such a situation before.

Sir, I formed an LLC, I applied for an EIN, what do you think if I open it to stripe, I am using shopify drop, thank you, I got the company job done cheaply, thanks to you.

I wish your company good luck and good luck. At this stage, wait for the EIN because you will need to enter the EIN when opening the stripe. As for the EIN, you can open a verified stripe account by following the steps in the article here. https://startupsole.com/stripe-hesap-acma/

Hello, they sent me an e-mail and asked me to fill out this document. They ask for my SSN number, what should I write? https://i.snipboard.io/rjGFik.jpg

Hello,

Did you only receive EIN service? I don't know if you started an llc, but tell them you don't have an SSN and you're not a US citizen. SSN is a number unique to US citizens only, you cannot have it. If you formed an llc, did you choose your country of residence as the USA during registration? Maybe that's why they're asking for an SSN, let them know you're not a citizen, this form is not for you.

I formed an llc and received EIN service. Which country should we write in this field? I sent an e-mail saying I am a Turk and I am waiting for a reply. When I registered, I think I wrote USA when asked for business location, because after all, the company would be located there. Did I make a mistake?

Congratulations to your company. No problem, since you say you are Turkish, you do not have an SSN, you will receive an answer depending on your situation. Based on the information you entered in this form, they will fill out an SS4 form for you and send it to the IRS to obtain an EIN. Do not worry, it will be resolved somehow. They will send you the form digitally for signature before sending it to the IRS. This is just a preliminary information form.

Yes, they said that "foreign citizen" was not written in the section where SSN number is written. So, what should we write in these sections?

https://i.snipboard.io/7mdyfs.jpg

Will we write America/Kentucky at number 6 or our shipito address?, What will we write at number 7a? Shouldn't we write 1 in 8b because the company consists only of us?

Hello, you can fill out the form here,

https://startupsole.com/amerika-dan-ein-numarasi-almak/

Hello, my goal is to form an llc that provides online payment services (like Stripe). Will Mercury Bank provide this service to us after forming the company? (a kind of virtual pos)

What you're talking about is something else, it's not that simple, unfortunately, I suggest you don't think in vain.

Admin, your articles are very informative. I also formed an llc in Kentucky with INC.authority. Address from mailbox and phone from Zadarma. I got the line. I am currently waiting for an EIN. However, in order to open an llc account on Amazon or Ebay, do I need a utility bill to my USA address? Where can I find enlightening information on this subject?

Hello,

Don't be confused about address verification, this article will enlighten you: https://startupsole.com/amazon-icin-amerikada-sirket-kurmak/

Hello Mr. Gökhan. Have you been able to solve this problem? It's something I'm curious about as well.

I'm still waiting for EIN. We paid millions of dollars to form an llc, and I think Amazon will certainly accept the address. Jokes aside, I will send the Articles of Organization document for address verification. I read on the forums that they accept it.

Greetings Mr. Gökhan, I hope the EIN of the million-dollar company will arrive soon :)

You can share the developments here. There are a lot of comments and questions about this subject, there may be many people who want to benefit from your experiences. I hope Articles of Organization will be accepted. I wish you luck.

By the way, if you established the LLC in Kentucky, get a good standing certificate and attach it to the document you send, I hope it will be useful, the details are here. https://startupsole.com/kentucky-llc-iyi-itibar-sertifikasi/

Well, let's see, we formed the company and thanks to you, we got it done at an affordable price, thank you very much. I got the address from woyomingmail forward, I asked if the first mail delivery was free, they said it was free and sent me an e-mail. If an important document arrives, I will have it mailed at least physically, the others are digital, now let's see. At least a free mailbox for life

Congratulations on your company, Mr. Nihat. Yes, shipito is free, but in the long run, Wyomingmailforwarding.com may be more affordable. They also stated that since they have their own buildings and have been registered agents at the same address for years, they do not have to change their address, so at least we can say that it is a reliable company. Yes, they confirm this as the first mail is free, so let's say good luck again.

Can we use this system for Paypal?

Unfortunately, for PayPal address verification, an invoice or credit card statement or company establishment certificate is not sufficient for PayPal.

This method works for Paypal, but the annual cost is a bit high.

https://startupsole.com/paypal-hesabi-acmak/

If we want to open an E-bay company account, the data we have will not be enough... So how will we overcome this problem on E-bay? Paypal will be removed towards the end of the year, should we wait for that or is there another solution? For example, if we organize a utility bill or not... Crazy questions in my mind...

My phone number and address are ready. If I'm lucky, I will start my company, thanks to you, but the dollar exchange rate is high, frankly, I expect it to drop a little :)

Yes, unfortunately, the exchange rate is quite high these days, I hope it will drop soon.

The information you provide on this subject is truly a unique treasure. Thanks a lot. I can say that this is the best source for my research on this subject. I would also like to thank you for your close attention.

Thank you for your valuable thoughts. We are trying to help as much as we can. I wish you luck.

Hello,

thank you for the useful information you provided. You explained it in detail, almost practically. I sell through Amazon and Ebay. Companies in America ask for a "resale certificate" from your company. Normally, the company comes with opening documents, but it is not obvious. Sometimes you may need to fill out and collect the form in person, or it may incur an extra fee. When we establish a company with inc-authority, let's say in Kentucky, does this document come with us?

Thanks for your comment.

Normally, that certificate does not come free of charge in any LLC formation, unless you specify it.

It doesn't come with incauthority installation either, but do they contact Incauthority and provide this document before installation? I recommend you to get information about the details and price. They will probably give the best guidance.

Additionally, there are guides regarding this type of documents on the Kentucky State website, and they even put the resale certificate form on the page. Do a little research, maybe you can get it yourself. The link is here: https://revenue.ky.gov/Business/Sales-Use-Tax/Pages/default.aspx

Actually, I'm wondering about something else; accounting fees and turkish accountants! Actually, I came across an article of yours on this subject, it was informative, thank you for your efforts, but my main concern is whether Turkish accountants can do our job there. Also, what are the average monthly wages of an accountant?

Hello,

In fact, the important point here is the accountant's mastery of the subject rather than whether he is Turkish or Usan. He really needs to know the legislation there well. Now, when you go to a consultant who keeps the books of Turkish companies, hours pass until you explain your problem. Also Amazon, Dropshipping, foreign LLC, sales tax etc. Once you get involved, the situation becomes even more complicated. Of course, if you find a Turkish accountant who knows e-commerce legislation within the USA and even e-commerce for foreign companies, he will serve you better. There are many factors regarding prices, for example, business model, whether sales tax limits are exceeded, your monthly and annual turnover, company partnership structure, whether you have a subsidiary representative office in the USA, Amazon, Shopify, selling your own services, etc. Prices change according to this information. If you fill in the items I have listed and communicate before getting a quote from them, you will get a faster and more efficient price.

Thank you very much for all your prompt answers.

You're welcome, I hope it was useful to you.

There is an SMM company called Manaycpa in the USA. Do a search on the internet. They offer 15-minute WhatsApp call appointments. They answer all kinds of questions we have in a very descriptive way, by thinking like a Turk and speaking Turkish :)

The information you provided is very valuable, I wanted to thank you. I don't know if you will publish my comment, but since I am a researcher, I prepared the $89 Operation Agreement document myself. Since it is a single-member LLC, there is no obligation to have a notary or another partner sign the copies. That's why I found a template myself and filled it out according to my company, thus saving me $89 :) Of course, English knowledge and a little research on these jobs are required, otherwise it is not very difficult.

In short, I founded the company with $40 Incauthority in total :):)

https://hizliresim.com/AlLaIO

I wanted to write a comment in case it might be useful to someone, thank you again.

Congratulations to you, of course we try to publish every comment, no problem. In fact, there is no need to pay money for the Operation Agreement, there is no need to send this document to the state or somewhere, even if it is notarized… Just having it on hand is enough. In fact, we thought a lot about writing down this method and preparing a guide at first, but it did not seem ethical to do something wrong and direct people, so we left it fallow. Now it's actually good for you to implement this yourself. You have probably paved the way for many entrepreneurs who will form an llc for $40.50 using the same method.

In fact, this situation is written in many places on the internet, so let's say you need to do some research. It is even available as a blank template on the blog pages of many registered agent companies. Find a general contract there, download it, fill it out according to your company and keep it. The important thing is to form the company and get money, the contract and others are only optional.

You are right, there is no information that cannot be obtained after researching. Good luck to your company.

Now let's say we formed this company in Kentucky and our business did not go well and we wanted to close it down. How does the process work? Will we have problems in the future?

Now in Kentucky you must pay a $15 franchise tax the next year after you form the company. If you do not pay this tax, your company will be suspended and closed by the state after 60 days. However, if you want to close it before, this is also possible with a form. Details are in the article here: https://startupsole.com/amerikada-sirket-kapatmak/

It was a very informative article, thank you for your hands and pen. 😊I have a question. First of all, I am dealing with Amazon dropshipping, how can I handle accounting in this process? Or how can I identify which accountant is reliable? I would be very happy if you inform me!

Hello, thank you for your comment. Although we do not have any partnerships, I can recommend a licensed CPA who specializes in foreign Amazon and Dropshipping companies. There is also contact information in the link below. You can plan a calendar and get free consultancy over the phone. (At least that's what he said when we e-mailed him)

https://startupsole.com/abd-vergişma-form-5472/

I wish I could recommend an expert from Turkey, but no matter which one we try to get support from, unfortunately they get us into even more of a dead end. That's why an Usan CPA specialized in foreign E-commerce taxation makes more sense. I hope it will be useful.

Thank you, I have started the installation in Kentucky as of now, I have solved it thanks to the information you provided. Thank you very much.

Thank you, congratulations to your company. I wish you success

Thanks to you, I started my company for dropshipping for $110, thank you very much. I wanted to ask a question, can I use Trnasferwise bank account instead of mercury bank for Stripe? Does stripe allow this? I would be very pleased if you answer

Congratulations to your company. Of course, you do not have to use Mercury bank, you can use transferwise. Stripe allows transferwise, and there is an information text on their website stating that it is allowed: This article contains detailed information on how to use it; https://startupsole.com/stripe-para-cekme/

I wish you luck.

I read a lot of articles about company formation. It was a very useful and informative article, with links that are clearly understandable and support every action to be taken. Thank you very much. You excite entrepreneurs on this subject, and as far as I read in the comments, many people have formed their companies without any problems, are in the process of forming them, or intend to form them like me. May God bless you. Greetings from Eskişehir.