Thanks to This Guide, You Can Form an LLC Company for Amazon in Usa at the Most Affordable Price

If you want to open a professional account to sell on Amazon USA through an Usan LLC company, you will first need to form an LLC company in Usa and obtain an EIN number for your company. All the details are in the rest of the article, and we have also added video content about company formment to this guide.

Read on to learn the details and form an llc in Usa at an affordable price.

Why is it necessary to form an llc in Usa for Amazon?

You can continue this business for a while by opening an individual account at the first stage, but when you reach a certain turnover, your personal account will not allow this business due to the US tax system.

When you reach a certain sales level, Amazon will warn you that you need to do this through an llc, and at that stage you will have to form an llc in Usa.

Amazon accounts maintained with the company will become more authoritarian in Amazon's eyes and you will prevent possible suspend problems.

Requirements to Open a Seller Account in Amazon Usa

Your requirements will be;

1- Forming an LLC in Usa for Amazon

, you can choose one of the 9 states where a company can be established for Amazon in the USA, including Wyoming

Below is the list of states in Usa where Amazon will form an llc with Northwest

- CA– California

- DE– Delaware

- FL– Florida

- ID – Idaho

- IL– Illinois

- MT– Montana

- NY– New York

- TX – Texas

- WY– Wyoming

these 9 states, including Wyoming, to establish a company , your agent will receive the Amazon verification cards delivered to your address free of charge, provided by Northwest Registered Agent, and deliver them to you digitally on the same day.

There are only 9 states where Northwest accepts these codes. You can ensure your business by forming an LLC with Northwest to receive address verification codes safely.

Among the 9 states, the state of Wyoming is among the states most preferred by foreigners in terms of taxation and low annual fees. We can say that it is a very low-cost state in terms of installation costs. You can also choose the state of Florida.

You can start an llc for Amazon business in any of the 9 states. The following items apply to the state of Wyoming, but company formation procedures are almost the same in the other 9 states.

Steps to Form an LLC in Wyoming

You can install in one of the 9 states mentioned above, but Wyoming is the state with the easiest procedures and easy access to requirements such as resale certificate.

There is no personal income tax in Wyoming and the annual fee is only $62.

You can form your company in Usa (Wyoming State) by following the steps in the video below.

It is possible to set up an llc in the State of Wyoming for $139 online by ordering through Northwest Agent (Passport not required)

Use Discounted Referral Link to start a company with Northwest for $139

We make your EIN application free of charge for the installations you make through this link, details are here.

Here is a detailed and simple step-by-step video of your company formment in Usa with Northwest.

In addition to the video, we can list the steps for forming an llc at an affordable price through Northwest agent as follows;

1- Determine the name of the LLC company to be established in Wyoming. Check Wyoming business name availability wyobiz.wyo.gov If you do not encounter any name as a result of the search, you can register a company with this name.

2- Establish your company online in the US state of Wyoming in 2 days by ordering from Northwest Registered Agent ( from this link

3- Get an EIN tax identification number free of charge for the LLC company established in Wyoming ( the Free EIN Application Campaign ). We will apply for your EIN number and your EIN document will arrive at your address as a free document within a few weeks.

4- As soon as you receive your EIN number, you can open a corporate bank account for your LLC company Mercurybank , Payoneer or Wise Corporate .

5-Now you can easily open your seller account on Amazon USA

How Does the Amazon Address Verification Process Work?

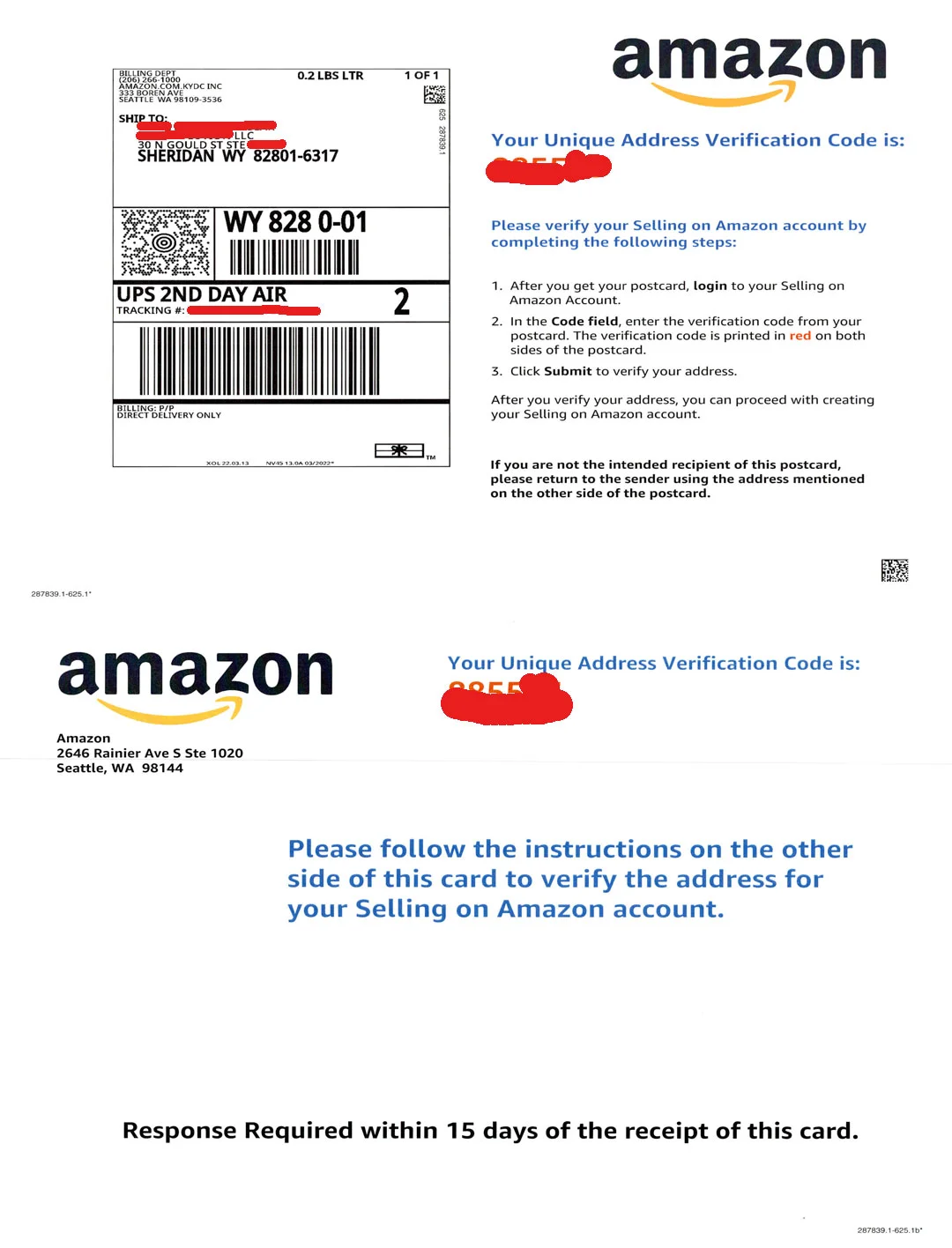

When you open an Amazon account by forming an LLC company in the USA, a verification card is mailed to your LLC address by Amazon to verify the LLC company address you formed in the USA.

When you enter the code on this card into the field on the verification page that appears during the Amazon account opening process, you can successfully pass the address verification stage.

The next process is the identity verification phase via video conferencing. Amazon will hold an online video conference with you to verify your identity. After your address is verified, the system asks you to choose a day and time for the video conference and thus, your appointment for the online conference is made. Video conferencing is now done by the Turkish team.

Within the specified time, you start a video conference with Amazon from a device with a camera, you are asked to show your documents such as your ID or passport to the camera, and after a few minutes of verification, your account will be opened.

Amazon Address Verification Code

The code reaches your address by express mail within 2.3 business days after the application is made.

A code like the one below will be sent to you by Amazon. (The visual in this example is the code sent by mail to a customer for the actual account opening. Customer information and the code are hidden because they are private information.)

Get a Resale Certificate for Amazon Suppliers

You can obtain this certificate from the state where your company was incorporated. It is generally preferred for Amazon to form an llc in the state of Wyoming. However, we have many followers who formed an llc in Florida and obtained this certificate easily.

You can obtain the resale certificate yourself from the state website. Once your company is formed and the EIN is obtained, there is no obstacle for you to register a resale certificate.

You can find a step-by-step video on how to obtain this certificate below. By following these steps, you can obtain a resale certificate for your company you formed in the state of Wyoming.

After going through these processes, you now have an Amazon USA seller account through your company in Usa.

NOTE: Amazon account opening processes are constantly updated, we have shared with you the most up-to-date account opening method. Older comments under the topic are for procedures implemented in the past. Very old comments may not be relevant to the current method.

242 Comments . New Comment

Hello, we have applied for Amazon USA with our company. We also completed the video conference call without any problems. However, it says that an account confirmation email will arrive within 48 or 72 business hours. It's been 3 business days. But we still haven't received any response or confirmation via e-mail. Does anyone have information on this subject? Where can we reach Amazon for support on the issue? Thank you in advance.

I formed an llc with Northwest in Wyoming and opened my Amazon Global Seller account after receiving my EIN number. In this process, the amazon address verification code arrived at my northwest wyoming address within 3 days and the address verification invoice etc. there is no need anymore. I just uploaded a bank statement in my name for individual address verification and my account was opened without any problems.

I would like to thank the startupsole team for their incredibly fast support during the company setup (including ein). I especially stayed in touch with Mr. Muhammet and he is really very knowledgeable.

I am writing this review to recommend it to everyone who wants to form an llc in Wyoming. I wish everyone success

Thank you for your comment, Ms. Defne :) We wish you success and good luck in your business.

You're welcome, Ms. Defne, we are trying to support all our followers as much as we can.

Hello Ms. Defne,

I uploaded the statement containing my business address of the Wyoming company we opened in Wise as a bank statement, but Amazon sent an email to update the statement. You have uploaded your account statement confirming your residence in Turkey, right?

Hello Ms. Fatma. I'm not an expert on this subject, but I researched and solved it. These registration screens can be updated frequently.

I remember that when I opened my account, I entered two addresses: residence and work address. It already sends the code to the work address (sometimes it does not send, according to what I heard from those around me), but to verify the residence address, send a bank account statement showing the residence address you entered, or if there is another option, send it.

If you have sent your Wise account statement, there may be a problem because there is a US company address there. If you have an account in your name from a Turkish bank, and there is, try sending a statement of that bank. If the address is the same as the format on that statement, your account will probably be approved.

You should not confuse your business address with your residence address, because Amazon is already aware of where you live, even if you have a company in the USA, and it just wants you to prove it.

I wish you success

Ms. Defne, thank you very much for your response. There is no address information on the account statement of my Enpara account. There is an address on the credit card statement, but it is too small and cannot be understood. I don't want to take the risk by sending him.

Which bank's statement did they accept when you uploaded it?

Thank you very much . I wish you success in your work.

You're welcome, Ms. Fatma. I sent a credit card statement, of course the address must be legible otherwise there may be a problem. I sent a card statement from Yapı Kredi bank. It would be beneficial if you send a legible statement from your own bank, they will verify the address from there.

I would like to update my individual Amazon USA account based on my individual residence address in Turkey to the LLc company address. When I change my business address on Amazon, will it ask me for a utilybill? For those who want it, can you please answer how you did it, thank you.

Hello. I get an error when I want to update Tax Information. When I write my name in the “Name (as shown on your income tax return)” section, it says https://ibb.co/YbWLP51 . When I write my company name, this time it says “I consent to sign my IRS Form W-9 electronically.” I also get the following error in https://ibb.co/x52dKqG . I wonder if I should write the company name in both, but the W-9 form directly asks for my name and surname, I may have a problem. Or do we fill out the form later rather than online? I wonder if we had a friend who experienced this and overcame it?

Hello

First of all, the W9 form does not ask for name and surname. It only asks for the name as "name". (Unless I'm looking in the wrong place)

The IRS issued an EIN number and sent you form CP575. Type the full name of the company in both fields you provided in the question. You will see the full name of the company on the top line in the address section of the CP575 form.

Also, select “Individual” and “Yes” respectively when filling out the information on this page.

Good luck.

Hello, I want to change the address of my LLC company. How can I?

Hello,

Which registered agent did you form the LLC company through?

Harvard Business Services

Can the agency make changes or do I have to make them personally?

Your current company won't make changes. The new company you move to makes the change, and you can also use the address of the new registered agent when making the change.

If you move your company to Northwest registered agent, you also get to use their own addresses for free.

We have an article about migration here: https://startupsole.com/registered-agent-degistirmek/

I want to get information about the address change job, but this article only contains agency change information. My address appears to be in Turkey, I want to move it to Usa. I am going to rent an address for this, but I did not see any details about address change or use as an office in the article you posted?

Once you know your agent, write a support email to Northwest. Let them know that you want to change the business address in state records to the agency address.

They also do this during the agency change phase. If you wish, you can learn the details about the subject from Northwest by sending an e-mail before ordering.

Thank you

Hello. Frankly, I am very confused about the address part. I will try to explain myself. I entered my address in Amazon TR, but I don't know if it was approved or not, I wonder where we check it (Everyone says address confirmation). I also created my Seller profile on Amazon Global.

1-When I came to Tax Information, I selected Business and Yes. I wrote the name of my LLC company in the Name section. Should I write the Türkiye address (because it says your own address) or the company address I got from Wyoming Mail Forwarding?

2-I enter my Wyoming address in Business address.

3- I enter my Wyoming address in the Official Registered Address.

4- I set Deposit and Charge method.

I think it's generally like this. If 2 and 3 are correct, just answering my questions in step 1 would be enough.

Also, since I have made a few sales, it would be beneficial for me to get my money inside first, in case of suspension, right?

Thank you in advance.

Hello. Is there anyone who can comment on the subject?

Hello

How many partners does the company you formed in Wyoming have? More than 1?

Hello. No it's just me 1

Hello

It is already mentioned in the Tax Information section, I think you missed it.

What is your tax classification? (What is your tax class?)

Below this, in the field that continues “Individual” includes… it says “sole proprietorship or LLC company owners with a single member choose Individual.” First, select Individual.

Then you ask: Are you an Usan citizen for tax purposes? He asks a question like: Say yes to this. I'm not going into details here now.

In step 3, enter the address of the company in Usa, enter the EIN in the last section and save the form.

That's all.

Thanks. I will write about the developments here again. Actually, I didn't miss it, but in some of the videos I watched, they were selecting Business, I thought it wouldn't be a problem, I can say that I got confused. Thank you. I will continue as you say.

After logging in this way, will Amazon provide utility bill verification etc.?

In Wyoming, you can form an llc in this way and verify with a postcard. Amazon does not require a utility bill anymore, they verify with this code sent to the address. So far, we have not seen any requests for a utility bill. Except for suspicious, deceptive information and incorrectly implemented transactions, there are not many problems.

Hello,

Thank you for the information you provided.

I set up my LLC for Amazon.com. When opening an account with Amazon, I will select united states for the company and enter my EIN number and northwestregistered agent address. So, what do you recommend I enter in the residential address section next? The address where I live in Turkey or the address of northwestregisteredagent?

Hello,

You are asked to enter the address of your country of residence. We kindly request you and wish you luck.

Thank you very much, so is there a problem if I use a Turkish credit card to charge the business account fee ($39.99) when opening an account with LLC and EIN at amazon.com?

You can use a credit card with your own address (card statement) and name.

Hello, I formed an LLC in Usa with my Turkish address. I registered my Payoneer account with the same address. However, when I entered USA in the jurisdiction section you specified when entering Amazon, it did not confirm my address. I couldn't go back and edit it, but when I reached out they said it couldn't be changed. Since all my documents are with my Turkish address, I cannot open them this way. How should I proceed?

Hello,

Why did you form an LLC in the United States at your Türkiye address?

This is not a sustainable system that we recommend.

First of all, you can start by getting an address with a private suite number and changing your main office and mailing address from state records.

Then you go to Amazon, because Türkiye is shown as the address of an llc formed in the USA. Under these circumstances, you will experience many problems in the future.

May 22, 2022

Good day, something is on my mind, we established the company in the USA, for example in Wyoming (Northwest for example), we used the Wyoming mail forward address, then we got our EIN number and opened our Mercury Bank account

. After that, when we opened our Amazon account (for the first time, there is no tr account), here Will there be a place where we need to specify the Turkish address (Business Address etc., that is, will verification be required with an invoice) or will the account be activated with the verification code sent directly to the mail forwarding?

Also, is the phone number we will receive from the USA required for opening an Amazon account? Since the company will be established in the USA (is there any harm in using our number in TR)

Hello,

You don't need to enter your address, Amazon doesn't ask for invoices anymore. Verifies addresses with verification code.

You can use your TR mobile phone number, but if you want a USA number, you can get one from Zadarma.

Hello,

Maybe I couldn't express myself fully due to lack of information. If we open an account by establishing a sole proprietorship through TR and then add the LLC and EIN number without changing the business address (Türkiye address). Can we write our Turkish address in the address section of the invoice to avoid any problems with the purchase invoice verification required for FBA? Should the limited company in Turkey or the LLC in the USA be included in the buyer section?

Thanks again for the useful information,

Ilker

Experienced friends on this subject will answer you, Mr. İlker.

Hello,

Thanks for the information you provided. I found a registered agent in Usa that provides mail forwarding services, but I could not fully understand the "suite number" part. Registered agent addresses are not enough to get the amazon verification card?

Thanks again,

Ilker

Generally, registered agent companies do not provide you with a special suite number and do not accept Amazon cards.

We recommend the method in this article:

https://startupsole.com/15a-wyoming-posta-yonloji-icin-adres-almak/

this company accepts amazon address verification cards.

First of all, provide your address, they will send you the suite number within 24 hours, and then you can form your company with Northwest.

Thanks a lot. As far as I understand, the key point here is to get a suite number, because Northwest Registered Agent also provides an e-mail forwarding service of 10 letters per year (they also said on the phone that they will accept Amazon activation card), but since they do not provide a suite number, you recommend this method, right? Does Amazon not send the activation card when it does not see the suit number or the Registered Agent address?

Thanks again,

Ilker

In fact, Northwest did not accept verification cards from Amazon in the past. It is interesting that they give you a guarantee of this, we can say that this is new information. They've probably made an update or the person you're talking to doesn't know the situation. We don't know who you talked to, but as a business partner, Northwest sent this to us in writing a few months ago, and the content of the e-mail they sent was as follows;

“Northwest mail forwarding service is free for up to 10 mails per year, but it covers legal correspondence and documents coming to the company. "Amazon verification or Google maps verification mails will not be accepted under any circumstances."

Since Northwest and other agencies do not accept this type of cards, the Wyomingmailforwarding system with suite number is used. Amazon does not check whether there is a suite number in the verification letters it sends, it just sends them. The important point here is that this mail is received by the service provider and delivered to you on time. Wyoming mail forwarding provides this service.

Thank you very much for your answers.

I will request written confirmation from Northwest and will keep you informed.

I wonder if the company you mentioned that provides mail forwarding for 15 dollars also does physical mail forwarding? So will they send me the Payoneer debit card in my name? I am asking so that I can enter the same address as the company for the Payoneer debit card (as far as I understand, it is recommended to enter the same address).

Thanks and good work,

Ilker

Yes, it does, but check the costs and confirm if you want. If possible, it would be safer to choose the shipping address of the card as the country you reside in.

Good luck

Hello,

Thanks for all your answers. There is only one question on my mind. After opening an LLC company in America, obtaining an EIN, and sending the products to FBA warehouses from Turkey, if Amazon asks for an invoice, my own name will be included in the invoice information of these products purchased from Turkey, not the LLC company name (many sellers and retailers in Turkey are an LLC in America). does not issue invoices for the company). I think this will cause problems if Amazon asks for an invoice. Do you have any suggestions on this matter?

Thanks again,

Ilker

It is difficult to understand how products can be exported abroad without an invoice.

Hello,

a utility bill is also requested on the Amazon seller site for company verification. If we open a company in Wyoming as an LLC in the USA, how can we meet this utility bill requirement? Do you have any suggestions for a solution to this issue?

Hello. In the comments, you suggested that in order to open an account with Amazon in Usa, we should form an llc in Turkey, open an Amazon TR account, change the address from which an invoice is received in Turkey to the company address, and then switch to an Amazon Usa account. I formed an LLC company in Usa and got an email forwarding address. Is the second option at the beginning of the article suitable for me? Can I proceed with an LLC company without forming an llc in Turkey? Can I make this option and open an account on Amazon without suspension? I added the text at the beginning of your article below. Thank you in advance for your help.

How Does the Address Verification Process Work?

If you choose the first option, that is, if you form a sole proprietorship in Turkey and open an Amazon Usa account, it will ask you to verify the TR address you provided during the account opening phase with documents such as an invoice or credit card statement.

If you choose the second option (opening an account by forming an LLC company directly in Usa), at this stage, the LLC company you formed in Usa will mail a verification card to your address to verify your address. When you enter the code on this card into the field on the verification page, you can successfully pass the address verification stage.

Hello,

A mail verification card is sent to your Wyoming address and your address is verified this way. Utility bills are not requested from accounts verified in this way.

Hello, I opened an Amazon account with an individual company in Turkey. I am thinking of opening an Usan company. Can I change the individual company in my existing account to the one in Usa?

Hello, yes, you can convert your individual account into an llc account. For this, you can form a Wyoming LLC. Once you receive your EIN number, you start the account conversion process.

During account conversion, you can complete the process safely by selecting your old address directly, without changing your currently verified address, entering the LLC company information and the company's EIN number. Usually, those who deal with Amazon convert individual accounts into company accounts with this method.

Hello again. I want to register my LLC company and EIN number with Amazon, but the questions include What is your tax classification? (Individual or Business) and Are you a US citizen, US permanent resident (green card holder) or other US resident alien? (Yes, No, I'm not sure if I'm a US resident alien) options appear. When I say no to this, it redirects me to my Türkiye address. Is there anyone who has gone through these stages?

Select Individual and Yes and continue.

This issue needs to be clarified. Mr. Admin, you do not interfere with this issue at all. It is very important that everyone is confused at this point.

When we say Yes, I think we are actually giving wrong information because we do not reside in the USA. Won't this cause a problem if it comes to light later? Actually, it would be appreciated if you could give a good explanation about this issue.

We do not comment on issues that we do not have clear information on and that we have not confirmed. We publish the comments of people who know, but

Hello.

When I answered these 2 questions on this and other platforms by selecting "Individual" and "Yes" respectively and continuing, there were people like you who insisted that it shouldn't be like this. Finally, I was saying that you can choose whatever you want. I am not in a situation where I want to convince anyone or try to make the other person understand something that would be wrong.

The issue is quite clear and obvious. Actually, “What is your tax classification?” “What is your tax classification?” he asks. Some people use this part as "What is the type of company?" he stated. What does this statement have to do with company type? Those who know a little English - we want to sell products on an English site - will benefit us, they will already understand. And under this line, Amazon also wrote what to choose.

” includes Sole Proprietors or Single-Member LLCs where the owner is an individual

Because there are two types of tax classifications on the part of the Usan tax office, the IRS. Individual and Business. The IRS has determined the tax class of sole proprietorships and "single member LLC companies" as "Individual". This is also stated on the IRS official website. Business is the taxation class of companies such as larger C and S Corp. It can be thought of as a joint stock company in Turkey.

Now let's come to the second question, why do we say "Yes"? First of all, what is the question?

Are you a US citizen, US permanent resident (green card holder) or other US resident alien?

It says, “Are you an American citizen? Do you have a permanent residence permit in the United States due to a green card or another reason?

I am not an Usan citizen, I do not live in Usa; I don't have a residence permit. Then naturally one thinks, "I should choose no."

Now I will go into the details of this at length, but again, Amazon is to the right of this line? He placed the icon and indicated who would choose "Yes" and who would choose "No" when they got there.

There is also a situation like this; When you select “No”, there is no field to enter the EIN number. We have to choose “Yes”. There is no other alternative.

Anyway, let's get back to Amazon's statement. Those other than Usan citizens and permanent residents also select "Yes" due to the following article. What was that substance?

Additionally, you will be considered a United States resident for tax purposes if you meet the Substantial Presence Test for the calendar year. More information about these distinctions is available on the US IRS Website.

It says here that if you have been in Usa for x days in a calendar year (details are available at the IRS), I will consider you, I underline, as an "Usan Citizen FOR TAXATION TERMS".

This option does not suit me either. In fact, I have never been to Usa and I will not go. So why do I choose "Yes" then? Why does the system force me to choose "Yes"?

The answer is simple: “Because you have an llc in Usa.”

We always think that only individuals should be citizens of a country. But when we look at it from a taxation perspective, things are different. There are details on the Usan Tax Office IRS website. You can go and look.

https://www.irs.gov/individuals/international-taxpayers/classification-of-taxpayers-for-us-tax-purposes

Here, Usan laws state that Usan citizens and foreigners are treated differently in terms of taxation and who, I am writing there again, will be considered Usan Citizens for taxation purposes.

Derki

A citizen or resident of the United States

A domestic partnership (a person who is a partner in an American company)

A domestic corporation (a company in America)

Any estate other than a foreign estate There are two more items.

In short, the IRS considers the LCC company, which has the only member in the United States, as an "Usan citizen" in terms of taxation. And carries out taxation accordingly.

Remember, if it were an LLC company with 2 or more members instead of one, that is, if we had a partner or partners, the situation would go to another dimension.

Individual is selected because on the IRS side, the taxation class of single-member LLC companies is Individual.

“Are you an Usan citizen?” "Yes" is selected because the IRS taxes companies in Usa the same way Usan citizens are taxed, although there are exceptions.

Thank you for the information, Mr. Şakir.

It was quite enlightening. With your permission, I would like to make a few additions.

So, if you insist on choosing No, we understand that you need to form a Corp company or MMLLC.

Then it is necessary to know that such companies have separate costs and maintenance procedures.

Why are single-member SMLLCs preferred?

It is easy to install, costs less, and taxation procedures are more reasonable. The IRS records single-member corporations as disregarded entities, so taxes go directly to the owner.

That's why ITIN is required to pay taxes.

Each owner of multi-member llcs has to make a declaration one by one, and making a corp declaration is a separate procedure.

These explanations should be taken into consideration and choices should be made in the same way when registering to such places, whether it is Amazon or a different platform.

Exactly what you said is very true. We prefer single-member LLC companies due to a number of advantages, as you mentioned. That's a good enough type of company to sell on Amazon.

It is unnecessary for C and S Corp companies to pay separate corporate taxes and for their partners to pay taxes individually, etc. I don't think it's a start-up type of company.

I believe that we have now been able to clarify this situation with your contributions.

S companies can already be formed only by US citizens or SSN holders with certain visas. A foreign corporation can be formed, but it is not necessary.

Single-member LLCs are sufficient for this and similar platforms,

with these types of LLCs, any business can be done after opening an account almost anywhere and submitting the correct documents and requirements.

Thanks to you it became clear 😀 thank you for your efforts, greetings

Thank you Mr. Şakir, the situation is now clear, of course, I had already solved the (Individual) issue, as you said, thanks to the explanatory line there, our English is not too bad. However, I have to admit that I did not read the details in the help button next to the 'Yes' and 'No' option. Looking at the explanations in the few lines below, I was in a natural dilemma because I am not one of them. Thank you for enlightening me. I'm glad I was here to warm up this issue a little more and cause you to cook it. I did 🙂 good luck.

Hello, I found the most satisfying information I have recently obtained on this page. First of all, I would like to thank you.

I have a question, if you have any information, I would be happy to answer it.

My friend has an llc with the "inc" type/extension, and I want to open an Amazon USA account through it. Could it have any advantages (other than formment costs) or disadvantages for me in the short term?

I have all the information and documents about the company. Do I need to submit anything personal about my "company owner friend" when opening an account?

Thanks for your comment.

You can open it, but you should not open it in your own name, you will have problems with authentication since the company owner is your friend.

Documents such as your friend's ID, a credit card in his name, and a bank account statement will be required. Amazon also sends a card for address verification. Will your address provider be able to receive this card?

Thank you very much for your answer, but I watched it in a video. I am not the owner of the company, but I think there is a section saying "I am authorized in the xxxx inc company I mentioned" in the membership section? Am I wrong? Or if he makes me a partner in the partnership section, will I still be able to open? The company has an existing address, but I am thinking of renewing it with the address I got from https://ipostal1.com/virtual-business-address-plans-pricing.php

Yes, you can add yourself to this company as a partner or manager. Talk to your friend's agent about this. However, in case of adding a partnership, you will become a partner in your friend's company, in which case you will also become a partner in the problems that may arise in the future, or vice versa. Instead of becoming a partner, you may consider forming a new LLC, which may be a better solution for you.

If you get the address you want from the address company you mentioned, how will you reconcile it with your company? It is not possible to comment much on this issue because this address will not appear in the company formation documents, it may cause problems in verification and similar situations, you may need to do a little more research.

I want to start fresh too, but I have some advantages, I have addresses in Istanbul and Delaware and I live in both countries. I am currently a law student in Delaware at “https://delawarelaw.widener.edu/”. But I don't have any sales experience. How can I benefit from this forum?

Hello, there is no clear information about sales and other details on our website, but we have Amazon account opening and store management + training and consultancy services in the link below. https://startupsole.com/amazon-hesap-acma-hizmeti/

If you want to take a look, fill out a form here https://startupsole.com/?fluent-form=48 and we will contact you and give you the details.

Have a nice day.

Hello,

I will open an Amazon account. There's something on my mind. Can I sell in the United Arab Emirates from Global Selling on Amazon account? Or do I need to establish a company in the United Arab Emirates and open a separate seller account for Amazon United Arab Emirates?

Hello,

you stated in your article that we should first open a company in Turkey for America Amazon, and you even added Mehmet Tek's video in February 2021, but Mehmet Tek states in his video in September 2021 that this system is not working at the moment and the company should be opened directly in America. . This news you published is a new, updated news dated January 7, 2022. I'm so confused. We founded our company in America with my partner a long time ago. We have our EIN number, we have our bank account (from Mercury). We are working with "Startpack.io" for the utility bill, although they have now changed their name to "Doola", but we cannot get an answer about the utility bill, even though it is included in our package. We have been waiting for months to open an Amazon account. We are stuck. Please can you help?

Thanks.

Hello,

I don't understand your problem very well. Is the problem related to startpack? Have you asked them?

You already have a company in America, so what's the problem? Why don't you use that method?

Hello, first of all, thank you for your extremely useful shares. As a first step, you mentioned opening an Amazon account in USA through an llc in TR and an Amazon TR account. I do not want to form an llc in TR at the first stage. Can I open an Amazon store in USA directly with USA LLC? Thank you for your interest.

Hello,

The recommended method is to first confirm the account via TR and then expand to the USA. However, there are also those who open an account directly with USA LLC and get the account approved without any problems. If you experience problems with address verification in the future, you may need to put additional effort into the verification process.

Amazon can apply very different policies on this issue, it is up to you to decide.

My question is as follows, let's say we have an llc (existent) in both Turkey and the USA. I will buy goods from suppliers in Turkey for my company in Turkey. In this case, my business address will be my company address in Turkey. Then my company in Turkey will invoice my company in the USA and I will send my products from Turkey to Amazon warehouses.

Now, when opening the first account on amazon.com.tr, I will write the address of my company in Turkey in both the business address and the registered address, confirm and register. Then I will open an account in Usa for global sales. The business address of my Usan account will remain the same, but I will enter the physical address of my company in the USA in the official registered address section and tax information section. Are these procedures correct?

Thank you very much for the relevant article. While I had a buyer account on amazon.ca, I opened a seller account with the same buyer account by receiving a confirmation mail from Amazon Canada with the necessary documents via Payoner, and I made sales through amazon.com with the online arbitrage system. Now I want to form an llc in Amazon Usa, I probably submitted the documents on amazon.com. I need to submit it to an llc. What is the path I should follow? Can you help me with this? Also, is it possible for me to handle the company's warehouse and virtual office phone from the same state?

Hello,

I think I read somewhere that according to the new update, Amazon requires Multi member LLC company instead of Single member LLC company in America when opening a seller account. Do you have any information on this subject?

Hello,

Multi member LLC is a type of company with more than one member with a partnership structure. We don't know where you heard this, but logically, in this case, every Amazon account holder should have established a joint company with someone.

This seemed like a very unnecessary action.

In summary, we have not heard of this before, such a condition cannot be imposed, but you can research it if you want.

hello;

We formed our company in Wyoming. We opened our shop on Amazon. However, now a sales certificate problem has arisen when purchasing goods from wholesalers. I received my sales certificate from Wyoming, but we also needed to obtain a sales certificate from the state where the intermediate warehouse is located. I've been searching for days for an intermediate warehouse in Wyoming, but I can't find it. How can I overcome this problem? If anyone has any ideas, I would be very happy if they could help.

Hello,

when we send products to Amazon America, we are making micro exports. Do we need to apply for importer of record (IOR)? After all, if we do micro exports, will we be seen as a Registered Foreign Importer?

Hello,

I have been selling on Amazon.com through my LLC company for a long time. Can I open a new seller account on Amazon TR and connect my seller account on Amazon Us? Thanks

You can connect; there will be no problem. You can sell on Amazon.com.tr with the Usan company.

However, according to my phone, bank and company information in my Amazon US account, I appear to be in Usa. So, in this case, will there be a problem since I will use my address information in TR as the registered address when opening an account at amazon.tr?

We have two separate companies run by the same person. We are considering opening separate Amazon accounts to sell on Amazon. In other words, we are considering opening Amazon Usa and Amazon Europe separately. If so, can we create an account on the same IP?

Your IP address changes every time you turn the modem off and on. Also, it is not clear whether there is such a restriction, but if you want to have peace of mind, do not worry about the IP address just in case, but instead install a different browser (such as Firefox or Opera) and open and manage accounts from separate browsers.

Hello,

after creating an account with our Turkish company on Amazon.com.tr and activating North America in the Global Sales section, we need to enter the information of our LLC company in the USA, right? In other words, when opening Global Sales through a single account, can we enter the information of our company in that country? Will it cause a problem if the company information in our Amazon Türkiye account is different from our US company information?

It does not cause any problems, just select the approved business address in TR in the address section when opening an account. If you enter a new address, it will ask you to verify it.

We have business addresses where our companies are registered in Usa and Europe. Can we enter those addresses and verify the address? The offices we rent already provide us with the Proof of Occupacy document, which serves as address proof for Amazon.

If the invoice requested from you in the future for address verification is a document that is accepted by the Amazon platform, you can of course arrange the address section according to the company location. Otherwise, it would be safer to choose your verified address in TR to avoid risk. Are the documents provided by the offices you rent accepted by Amazon? We recommend that you confirm this with your rental company.

Hello, will the business address we get from Northwest RA be valid for Amazon? Because there won't be a special suite number like a Wyoming registered agent. Also, does Google Maps address accept registration without a suite number? Thank you in advance for your answer.

Hello,

It may not be valid because they do not provide a unique address, they separate their public addresses by company. They may also not accept the verification code for Google business registration.

For these needs, you can get an address from the wyoming mail forwarding site and enter your private address when setting up with Northwest when your suite number arrives. They allow this.

I was in the same dilemma, thank you very much.

Hello Mr. Yiğit,

I also started these stages like you. I am establishing a company in both Türkiye and America. How did you open your Amazon America account? Did you log in via com.tr and open it through Global sales, or did you open a membership directly through Amazon.com? Also, is your number in Turkey sufficient? Or did you buy GSM from the USA? I would be very pleased if you answer.

Hello,

I have not opened an Amazon account, but now they apply directly through amazon.com with the company formed in the USA. A verification code is sent to your US address. I know that this is how account approval is obtained.

Can we change the name of the llc company we formed in KY?

Yes, there are agencies that do this. Incauthority does not have such a service online, but you can get service via https://startupsole.com/go/mycompanyworks/ In such a transaction, you may need to make changes on the IRS (EIN) side. Ask the agency about this.

Hello;

When opening an account on Amazon for our LLC company, I am hesitant whether it requires an invoice to verify our address or not. As far as I understand, they only send a verification code to the address. I would be happy if you give me information.

I couldn't verify my address from Turkey. My account has been suspended. I sell on amazon Turkey but amazon couldn't verify my US address 🙁

Those who open an account with a verification code are those who open an account with an LLC company via amazon.com. Please do not mix. Why couldn't you verify your Türkiye address? You must have made a mistake somewhere. In fact, you should not have entered an address into Amazon.com.tr that you cannot verify.

It was my first experience, we made many mistakes there. We fixed it but they don't respond anymore. What I was wondering about was opening an account with our LLC company in the USA. I got the answer, thank you very much. After I receive my EIN number and activate my bank account, we will apply to Amazon. Well, I have one more question for you. When opening an account with our LLC company, should we use our mobile phone number in Turkey or the GSM number we will get through Zadarma? They will already understand that we are in Türkiye from our IP address. That's why I'm hesitant about the need for a US GSM number. I would be very happy if you help.

Accounts are usually opened with phones with a US area code. I think sellers who open accounts use US phones to avoid risk, but if you are allowed to choose a TR area code in the account opening section, it seems that there will probably be no problem. They are already aware that you entered from TR, but it is still up to you, there is no clear information.

Thank you very much for the information you provided.

You're welcome, good luck

Hello Mr. Tolga,

I have started these stages like you. I am establishing a company in both Türkiye and America. How did you open your Amazon America account? Did you log in via com.tr and open it through Global sales, or did you open a membership directly through Amazon.com? Also, is your number in Turkey sufficient? Or did you buy GSM from the USA? I would be very pleased if you answer.

Hello Ms. Gamze;

I opened it directly from the USA. because I had been suspended from my Türkiye account before. Open an account with your LLC company directly from the USA. They open up the whole world. more advantageous.

I also use Turkish Amazon with my company in Türkiye.

Thank you for your answer, I have one more question. We have an LLC company, but our residence is in Turkey. Will Amazon cause any problems in this regard? I would be very happy if you respond.

Our residence is also in Turkey. Amazon is fine with this. It asks you for the address of where you live. You can easily give your address in Turkey. However, if you want to activate Amazon Europe through your LLC company, Amazon Europe requires an invoice to verify the address of where you live. so electricity, water etc. Write down your address written on your invoice. Then Amazon Europe asks you for that invoice.

By the way, since my Türkiye mobile phone was defined in my suspended account, I bought a GSM line through Zadarma. I also defined this number to my amazon account.

Mr. Tolga, thank you for your contributions.

Thank you very much, very useful information.

We are also establishing a company for Amazon in Germany. We can log in and activate this from our Amazon.com account, right? Will it be a problem if we enter company information in Germany?

I would like to thank you very much for your contributions to us.

Hello.

If we want to establish our company now, when do we need to file taxes? Should we file taxes until December 31 or one year after company establishment?

This situation varies depending on your turnover and the geography in which you sell. If you are actively selling and doing business through your company, inform your accountant of the situation.

It says that you must enter the address verification sent by Amazon within 13 days after it is delivered to you, otherwise it will be cancelled. Now my code coming from Shipito says that they do not scan such documents. They say let's send it to your address. But there are 10 days left, I choose dhl express. I don't know if it will arrive in Turkey in 10 days. I wonder if there is someone we can send from the warehouse in California to someone in the USA? Or is there an organization that can share a verification code with us?

I have a Wyomingmailforwarding address. If you send it quickly, maybe it will arrive. But there is a $10 payment because I don't have free postage left, you can pay it and use it. This is how I can help.

Write your e-mail address and we will contact you

Thanks for your support.

Thanks for the reply. If the code does not fit, we will have to do that when I want the second one.

Does the code sent for Amazon address verification have an expiration date? As you know, Shipito, which provides a free address, received the code in my name, but says it will only send by courier. I wanted it via DHL. But it will be difficult in a week. On Amazon it says it was delivered 3 days ago. Does the code have an expiration date? Is there anyone experiencing the same situation?

Have you looked at the Amazon documentation or is there a help link or explanation on the verification page?

Hello,

Yes, the code has an expiration date. For example, I applied on Sunday and I have to enter the code by October 19th. You can see the given time at the bottom when you log in to Amazon. Below video call duration.

Due to Covid-19, postcard delivery time may take longer than the estimated delivery date listed below.

It says under the video call button you mentioned, I made the video call and it will take 72 hours.

Additional information; I just received information from R.Agent, with whom I work. The mail came from Amazon and they scanned and uploaded it to the cloud. I entered the code and my address was confirmed.

On the document coming from Amazon: "Response Required within 15 days of the receipt of this card." The phrase is written.

Thanks for the information. We wish you good luck and good luck.

1. The interview takes place in English with a live Amazon employee, very politely.

2. I gave a Payoneer Bank account. I had printed it beforehand.

The third passport is examined in its entirety, front, back and every page.

4. It is said that a response will be given within 72 hours for the approval of your account.

5. He did not ask anything about the address. The confirmation code entry screen in the address is still fixed

Thank you very much for the information you provided, it was very useful. We wish you good luck and good profits.

Thank you. Hopefully the account will be approved, let's see.

Hello,

I just finished my meeting. First of all, they uploaded my passport again. They said the file I uploaded before was good, you can upload the same file (I scanned it at 800 dpi).

Afterwards, they asked me to take a picture of my "Bank Statement" and upload it. They examined it and said there was no problem.

Then they took the passport in my hand and asked me to show all its surfaces (inside & outside). They looked at a random page of it, then asked me to hold it close to the camera and show it, stretch it (reflections, etc.). Once this was completed, they also informed me that they would receive an e-mail regarding approval within 72 hours.

The meeting took place in English. The staff speaks in an understandable language and guides you on every issue.

In fact, I had uploaded the wrong document before and it took 5-10 minutes for me to upload the new one.

I was not asked anything about the address either. It was already approved before the meeting.

Congratulations. Thanks very much for the information.

Have you opened an account? The response is usually within 1 day.

Hello,

My account has been opened as of today. I made a few mistakes, so I went through a few ups and downs, let me elaborate a bit below;

First of all, I uploaded the document from Mercury for the Bank Statement, they told me there was no problem in the live call, but then I was informed via e-mail that there was a problem with the bank statement. It's probably my fault, they couldn't match Mercury with my TR credit card because I entered an Usan address in the billing address. Afterwards, I entered my home address in TR and uploaded the TURKISH statement of my bank in TR. In the address “:” “,” “.” Everything is there by the way. A day later, I received an email stating that my account was activated. I am writing these details because there were people on the internet who wrote that there were people who translated credit card statements into notarized English and that no punctuation marks should be used. As a result, my account could be activated without paying attention to such details.

Good luck to everyone.

Greetings, did you enter the EIN number of your company in the USA in the Tax section after opening the account? Or before opening an account? Since it is a frequently asked question, if you share what you have experienced, we can answer the questions.

By the way, thank you also for the detailed information.

Good luck with your account and good luck.

Hello,

It requests the EIN number at the first sign-up stage. He did not ask for it separately in the tax part.

By the way, my EIN number arrived in about two weeks, I think they have resolved the Covid density.

Thanks for the information. Yes, it is taking even longer now, Eins are exceeding about 3 weeks.

Hello:

When you opened a company in Amazon with your LLC company, did you use the credit card given by Turkish banks or the debit card given by Mercury Bank? I would be very happy if you could provide information and help.

Regards

Hello Startupsole,

Thanks to your information and guidance, I established my company in Kenducky state, USA, for Amazon and my own site http://www.sadik.store . I received my email number. I opened an account with Payoneer. Mercury is still awaiting approval. I wanted to open my Amazon USA store and I followed all the steps carefully. For verification, I received my passport and the statement of the account I defined from Payoneer, the one for Amazon, and submitted it to Amazon. Amazon sent a verification code to verify my address in the USA and requested a video call to confirm the documents I submitted. I made an appointment for October 12th. Now he wants me to show the documents I presented at the meeting on October 12th. Have you encountered such a situation before? If yes, what should I do? I would like to hear the opinions of friends who have gone through the same situation.

One of our followers opened the same type of account as you. The address verification envelope arrived and his address was verified. Saliya has been given an appointment, probably the same date as yours. If the results are completed before you, we will send the details here, but if you talk online before, sharing your experiences here will be a great contribution to everyone.

Conveniences.

Of course I will forward it. The address verification code, which will be interviewed on Tuesday at 20:00 Turkish time, says it is in transit process, will probably be delivered tomorrow.

We are eagerly waiting for all the details :) This verification method is probably a newer method, there is not much information about it. At what stage did you enter your EIN information? When opening an account? Or have you not encountered that stage yet because the account has not been opened yet? Thank you for the answers. We wish you good luck.

I'm in the final stages of opening an account. In the verification section, the company name and company setup code that have been requested from me so far. Email number has not been requested yet. I presented a USD bank account statement and passport from Payoneer. You will probably be asked for your eIN number after the account is confirmed.

You will probably be asked to enter the tax section after the account is opened. Thanks for the information, good luck.

I applied on October 5th, while the account is still being verified by Mercury. I did not enter a physical card from the options. Naturally, I only entered the company income. I couldn't get approval from here. They said, "We couldn't verify your address yesterday. The address you entered does not seem to be your home address. Please add your address, even if it is international." I wrote the address in Turkey and I'm waiting. To avoid the same situation, be sure to request a physical card. The purpose of giving is to see where we live.

Yes, there have been problems with this issue before. In the Mercurybank account opening article and comments, there are details about the need to write down your residence status, you probably missed it.

They will probably ask a few questions and activate your account. Don't worry, many Mercurybank accounts were opened this way and the cards were delivered to their home addresses.

Good day, during the video call, he asked for your passport and bank account document, which are the documents you submitted, and checked them. It asks for company information and asks for the name of the account owner. There is nothing else. It takes about 15 minutes.

Good day, thank you very much for the information. Your experiences are very important to us and our followers, so we would like to ask you a few questions;

1. Was this conversation with a live Amazon expert or a robot?

2. Is it necessary to have the printouts of the documents ready before the video conference?

3. Was your video call in English?

4. Is your account fully approved as a result of this conversation?

Thanks in advance for the replies.

The process went the same way for me. I have an interview on October 15th. Meanwhile, I'm waiting for the postcard. I activated my Mercury account by corresponding with him a few times.

I founded my company without any problems with Startpack, which I discovered thanks to Startsole. Including EIN & ITIN.

Good luck, we would like to hear about your experiences after opening your account. Good luck.

Hello,

I opened my account in Turkey 2-3 years ago and moved to another country. Later, I updated sections such as BA and ORA with my new address, but Amazon did not ask for verification again. Now I want to open an LLC in the USA, but I couldn't get myself out of the issues surrounding the utility bill. I'm not in the USA, so I don't understand the logic of pretending to be there and going through the trouble of finding a utility bill. Ugh. reg. We can provide the address part with a service from a company in the USA. The company is registered at this address. I don't understand why I have to change the BA address. When getting an EIN, when applying to the IRS, when working with an intermediate warehouse and issuing invoices? Where should I use the BA address so that they can tell me that you are a company in the USA but you have an address in another country. If anyone has information on this section and answers, I would be grateful.

Hello

First of all, what you mean by "opening in Turkey" means Amazon.com.tr or did you open an account on Amazon.com? I found it interesting that BA changed its address and did not ask for verification. If you have changed your bank account information to this new address, this may be why they did not request it.

Let's talk about your statement as to why I am not in the USA and I present myself as if I were there. This is a completely wrong approach. It is unthinkable. Then I can also tell you this, if you are not in the USA, why are you selling there? Anyway, let me explain it to you; Almost anyone in the world can form an llc in any country they want. There may be many exceptions; some countries may require proof of immovable property to form an llc, some countries may allow the formment of an llc after making a certain investment. One way or another, a person can form an llc in any country in the world. As a Turkish citizen and resident of Turkey, I can form an llc in the USA, Denmark, Azerbaijan or Kazakhstan. But I can live somewhere. I won't go into too much detail. Amazon's problem is this: you open an account and say you have an llc in the USA and this is its address? On Amazon it says prove it. How do I know that you have such an llc and that it was formed at this address? Maybe it's all bullshit. To make sure of this, a 3rd party wants to verify its address with a status. The best way to do this is to submit a bill such as an electricity or water bill at that address. Because the organizations that provide this service will not provide you with this service without verifying your address. Amazon currently verifies this address information primarily with a bank account statement and bank confirmation letter, rather than utility bills such as electricity and water bills. It also states in the help documents what should be included in these documents and how it should be done. You can look here as the only official source.

Amazon says you can write the address of one of the companies you have BA in different countries. So, you have opened an llc account on Amazon.com.tr and you can also open an account on Amazon.com with this Türkiye address. In other words, your company in Turkey actually becomes a sales company in the USA. International trade issue. But when you have an llc in the USA, you can write the address in the USA as ORA, but it can remain as BA Türkiye. No problem. You can also type a US address, but it will ask for verification. If this address is not verified. If the bank address in the Deposit Method matches this business address, there is no need to ask for verification.

Actually, this address issue was very difficult for me at first, but everything is clearly written in the help documentation.

I hope I could explain.

Hello,

In fact, I found the logical answer that I have been looking for for a long time among your articles. First of all, I would like to thank you for your explanatory notes, especially on the BA section and utility bill issues.

I expressed what I wanted to say in my article incompletely; What I mean by "opening in Turkey" is opening a pro account directly through amazon.com while residing in Turkey. About 3 years ago, there was no company obligation, com.tr did not exist at that time anyway. I moved to Germany and updated all my address information, but I forgot to mention it, I sent an e-mail beforehand and explained my situation. Charge method is still my card belonging to Garanti Bank in Turkey. The deposit is a Payoneer account as at the beginning. Yes, there was no confirmation request, but that doesn't mean it won't come. After a long time, I read about cases where these documents were requested on the seller forum.

I read your article again and frankly, I could not see any part where we differed except for one point. I also read the help documents you mentioned, but I did not see much of what was written there being implemented in practice. Since everyone was trying to find a utility bill and trying to show BA as the USA, I was inevitably hesitant. When opening an account via com.tr from Turkey, I did not take into account the obligation to form an llc, and now I can fully understand people's insistence on this issue.

Therefore, before the obligation to form an llc, someone who opened a pro account on amazon.com and verified his account before amazon.com.tr existed and while residing in Turkey, when he opens an LLC company in the USA, he should leave his BA address as it is, update the other fields with the address in the USA and continue on his way. Can we say we can? Because he has verified this address before and can provide utility bill again if desired.

I want to leave BA as my home address, open an llc in the USA, change the non-BA fields to the relevant USA address and continue on my way. BA is the house where I currently live and my address where I can provide a utility bill bank statement if requested.

My statement, "I am not in the USA and I present myself as if I were there", coincides with the statement that "I am not in the USA and I present myself as if I am there" while I was living in Germany, that is, as Amazon says, BA should be where you do your work from, so it does not comply with my logic to present myself as if I were in a place where I am not physically present. My company will be in the USA, but I am not in the USA, I am in a different country where address verification can be done. I don't live there and I don't have to live there to make sales. I made this statement with this thought in mind.

To summarize: If a person residing in Turkey is going to open an account at com.tr, he/she must have an llc in Turkey as a rule. After opening his account and passing the verification, he can open a US account from the global sales section. BA, ORA sections appear as Turkey (but I think this is not a preferred way since there is a problem in issuing invoices to Turkish addresses in the part of doing business with wholesalers in the USA). If the same person residing in Turkey wants to open an account directly through amazon.com, he must form an llc in the USA and be able to provide a utility bill for address confirmation. Other relevant fields and bank information must also match the company address. My comment about this second part is that the BA address is the USA, it does not make sense to me to record it as being there when it is not. Even the connection should be made via VPS so that there is no problem, because we showed ourselves in the USA. I tried to explain this above.

Finally, I would like to thank the page owners for providing us with this beautiful content and quality environment.

Hello

As someone who has previously opened an individual account on Amazon.com, I think that if you have formed an LLC company in the USA, it will be sufficient to update the address outside BA, that is, ORA, and the Tax Information section with the new address and company. BA Türkiye can stay.

For your other questions, a person residing in Turkey must have an llc to open an account on Amazon.com.tr. It is not possible to open an individual account on Amazon.com.tr without an llc. It is true that one can open a US account from global sales. However, when opening this Amazon.com account, BA and ORA Türkiye appear because the Amazon.com account was opened for the company in Turkey. As you said, there will be problems in doing business with US wholesalers and invoicing the company in Turkey. If you want to open an account directly on Amazon.com, there is no rule that you must have an llc in the USA. It can happen in any country in the world. Except for those on the US banned countries list. For example, Iran and Cuba. If he has an llc in the USA, he should be able to provide utility bills. Here, my last observation is that Amazon first verifies the company address with a bank statement or bank confirmation letter instead of the electricity, water, internet bill. If it detects that there are some inconsistencies in the account opened, then it asks for bills such as electricity, water and internet. It clearly states this in the help documentation.

It is normal if the BA address is USA. I don't have to be in the USA. Let me explain it to you simply this way.

I live in Turkey and my residence is Türkiye. Imagine that I am someone who does international import and export. I have a total of 4 companies registered in my name in Turkey, the USA, Kazakhstan and Jamaica.

Now I want to open an account directly from scratch at Amazon.com. Amazon asks me where your first company is. If I want, I can open an account on Amazon.com with one of my 4 companies. No problem. Let's say I am going to open an account for my company in Jamaica, but consider that I do not want to open an account for my company in the USA. My BA and ORA domains will appear as the official address of the company based in Jamaica. There is no problem with this. However, I am in Turkey, I opened an account on Amazon.com and the address is Jamaica. There is no problem.

The VPS issue is pure nonsense on Amazon's part. Showing ourselves in the US or anywhere else has no meaning or importance for Amazon.

Thank you too for your nice explanations and experiences.

May 22, 2022

Hello. I opened a company in the USA. I will be sending goods from Turkey to Amazon, based on ETBG, I intend to have them shipped to my own company and then to Amazon if necessary. Or directly to Amazon, but I don't know how the invoice will work. If I send it to my own company but the delivery address is Amazon, it will go from my company in Turkey to my company in the USA (technically Amazon). What is your advice about this process? I am also stuck on the invoice issue. I looked and did not see any comments on this issue. My question is, let's say I sent 100 products to the Amazon warehouse. 10 of these products will be released from Amazon as FBA. As you know, in FBA, it is difficult to keep track of who bought it, when, and how. At this point, I will invoice whom and what from my company in the USA. Will it be the person who took the sample or Amazon? Or will I be billed as a lump sum? Can you enlighten me at this point?

Thanks

Well, if I am going to continue with two companies and only use my company in America, will I only pay the setup fee since no transactions are made in the company in Turkey? Or is there a monthly financial advisor fee and if so, how much does it cost on average? Can you give an average price? If there are friends who do it, no commercial transactions will be made from the company in Turkey?

And can I register to Amazon with my company in Turkey without registering with the chamber of commerce?

16 August 2021

For example, you said something like this =

Hello

Business Address is the only address type that must be verified by Amazon with the utility bill. If there is an electricity, water or telephone bill in your name, you can enter an address anywhere in the world. If you write the address of the company you will form in the USA, you must provide an invoice for this address. This is unnecessary burden, waste of money and time. Additionally, even though you are going through verification, it is against Amazon's purpose for using this address. I currently have an llc in both Turkey and the USA, and I have been an active seller on Amazon for 1 year. My Business Address is my home address in Turkey. Because there is only an invoice record in my name at my home. If there is someone more experienced, I would like to know their information.

How do you have an llc in the USA but you can handle the utility bill with your house in Turkey? I need this.

He applied to Amazon.com.tr with the Turkish company, showed the address of the Turkish company and his home, and verified his account with an invoice recorded on him.

Afterwards, he opened an account with the LLC he formed in Amazon Usa for global sales. This has been written many times, it is already quite understandable.

He says that if you can verify the address of your Usa LLC company with an invoice, there is no need to form an llc in Türkiye. In order to verify your LLC address in Usa, you need to rent a physical office in Usa, buy a landline phone to this office and verify it with an invoice.

In addition, in order to open an Amazon.com.tr seller account, at least a sole proprietorship company must be formed in Turkey.

Please do not look for a more economical way to do this, because according to the information here, we do not have a more economical way of doing this.

I am thinking of forming an LLC in Usa, but there is a problem. Can I form an llc in Usa and provide utility bill in Turkey?

When I select Turkey as business location in the Amazon registration section, the following appears on the second page:

Trade Registry Number

Turkish Tax ID (10 digits)

Turkish Tax Office,

but my company is in America, I don't have these, how can I do it

? I cannot write my company's address, so where should I write the address of my company in America?

It shows them one by one on the page in this link, I looked here, can you take a look, I don't understand where and what I should write, where should I write my company in America?

link = https://blog.amzcozumleri.com/amazon-avrupada-magaza-acma

Someone asked a question like this before. Can I get a tax number from the US Tax Office by showing my company in Turkey? Your question is a bit similar to this. How can you provide proof of invoice from Turkey or another country for the company you formed in Usa? Does this make sense to you?

Why do you set up an llc in Usa and choose Türkiye as your business location? I don't understand. You do not have any relations with Türkiye. The company is in Usa, the address is in Usa. If you are going to choose Türkiye, then you must have an llc in Turkey.

I am rewriting this comment for those who will read it later. If you live in Turkey, you must have an llc in any country in the world on Amazon.com and write this company address in the business address. And you definitely need to provide proof of invoice for this address. The issue is actually clear and obvious.

As the next step, you can open an account in all countries where Amazon serves, and when opening an account, you will use the business address in the country where you first opened an account. Therefore, when you open an account in Turkey, your address is verified, and when you open an account in the USA, you will not be suspended.

My advice to those who want to do business on Amazon or other platforms is to do research on topics such as the company, accounting, import-export, customs procedures and taxes. These topics are topics that will be useful to us beyond opening an account on Amazon.

Hello Mr. Şakir, I saw in the comments I read that you have information about Amazon and the American company. I would be glad if you could help me.

First of all, I live in Germany and I want to sell on Amazon in America, but I also want to open my company in America, so do I need to rent a virtual address in America for my company because we need to enter our address information when opening a company account in Amazon. I will open the company in America based on an address in America or because I am located in Germany. Should I open it on the current address where my invoices are located? Because if Amazon asks me for a valid invoice and I rent a virtual address in America, I may not be able to provide this invoice to Amazon, but in some of the trainings I have received and in some places I have been, it is said that we must enter an American account in the company account address information on amazon.com. The financial advisor company told me that I needed to rent an address in America for the company. So in summary, in order to open a company account on amazon.com and sell, does my company's address in the USA have to be in the USA or can it be at my current address in Germany?

Thanks

And if I am going to form an llc in the USA, if a utility bill is required in the USA, will that utility bill be enough if I rent it for only 1 month or do I need to rent it forever, sample wire bill? And will amazon accept the phone bill?

The answers to this information are available in Amazon's help files. I recommend you to check out the help menu.

Amazon accepts most popular invoices. Electricity, water, natural gas, telephone and internet are the most known. If I remember correctly, the invoice must be an invoice issued within the last 6 months.

Hello, I want to ask something. You said =

Enter an address where you can provide invoices to the business address. I live in Turkey and I am thinking of establishing an LLC in America, so the business address is my home in Turkey. What is this and I came across something like this in the comments =

So basically I had 3 different places in seller central that showed an address:

1 – Business Address- this was my personal name and home address

2 – Official Registered Address- this was my personal name and home address

3 – Legal Entity- this was my business name and registered business address

During verification, amazon asked for a utility bill , I submitted a utility bill which matched 1 and 2 above. The bank statement I submitted also matched the same info on the utility bill and matched 1 and 2 above.

From what I understand, all documents should match 1 and 2. Number 3 is basically just for tax purposes. Not sure how accurate this is but I've read this in a couple places and after I got verified by providing documents that matched 1 and 2 that reasoning does make sense.

Hope this makes it clear

Let me know if you have any other questions

Thanks

I think you are contradicting what is said here. I need to write my home address, legal entity and company address in the Business Addresses and Official Registered Address address, or should I do as you say? Do I have to register with Amazon as an individual while doing these? Or do I have to register as an llc since I have formed an LLC company? Logically, do I have to register as an llc?

And if I do as you said, will there be problems in the future?

Hello

Actually, we are not contradicting each other, I also saw the comment you mentioned on the Amazon forum. When the addresses in BA and ORA are the same, you cannot know which address Amazon wants the invoice proof for, just like the person who wrote the review. He also stated this. Amazon only requires proof of invoice for BA. Legal Entity is the same as Tax Information. When you click on the Legal Entity menu, it takes you directly to the Tax Information page.