Forming an LLC in USA

establishing a company in America did not mean much to most people a few years ago, Economic freedom, expanding an existing business, sailing to foreign markets or starting business for the first time are just a few of the reasons to establish a company in America.

If you are not a US citizen and want to form an llc in the USA for any reason, you are in the right place. In this guide, we will talk about opening an llc in Usa, company type, costs and many other topics.

Our new venture platform: Startuphub is on publication

Our Startupphub vehicle, which collects on a single platform, from business idea to company installation, state selection, brand creation, bank and strip pre -approval tools to advertising text production

Click here to discover the platform now !

Types of Companies in Usa

There are two types of companies you can start in Usa as a foreigner. The first and most popular of these is LLC, and the other is Corporation type companies. In the USA, an LLC is a single-member entity and is disregarded. LLCs' taxes pass to the owner of the company, but Corporations are different. For the income derived from an Usan corporation type, both the company and the owners of the company pay taxes.

Corporation type companies, which have double taxation, management difficulties and higher annual expenses than LLCs, are not preferred, especially by foreigners. In fact, it is not necessary because all commercial activities that can be carried out with an LLC or Corporation company can be carried out without any problems.

How to Determine Forming an LLC in Usa?

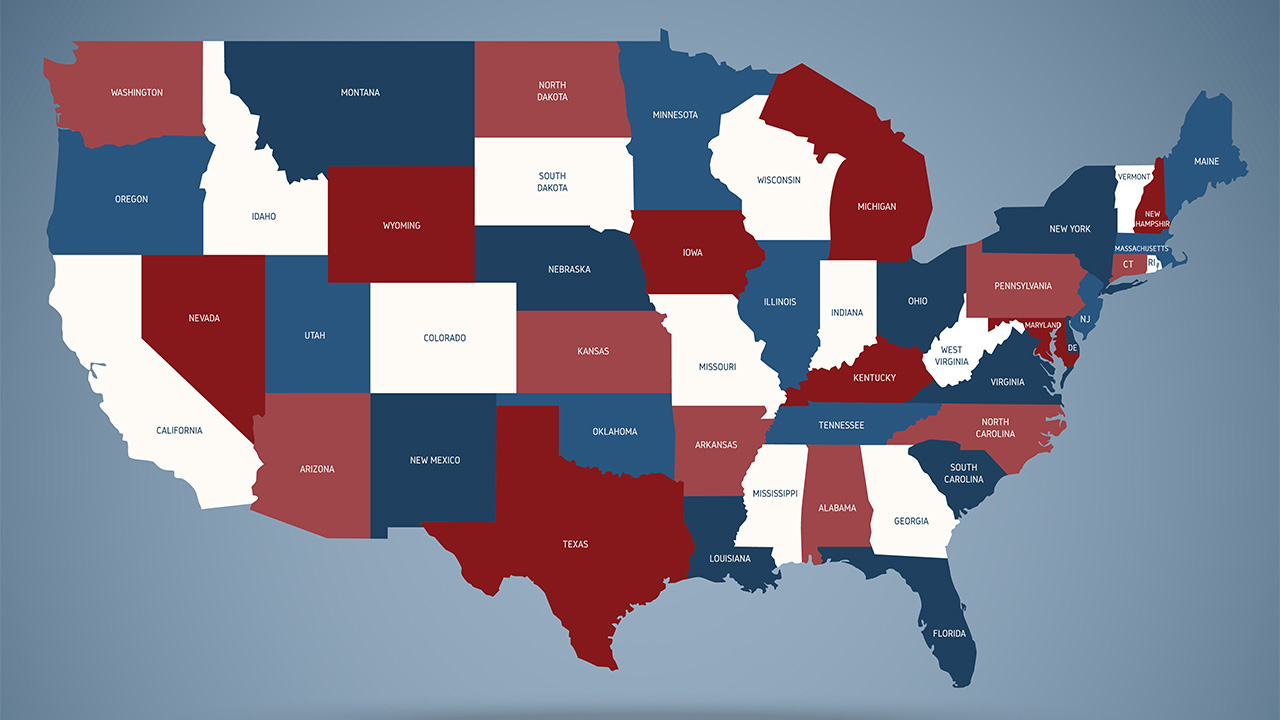

When you decide to form an LLC company in Usa, there are fees that vary depending on the state where the installation will be made and costs to be paid to Registered Agents. However, these costs are not at a daunting level, on the contrary, they are at reasonable levels. The most affordable and preferred states in Usa where an llc can be formed are Wyoming, New Mexico, Delaware and Kentucky. The fees charged by these states for initial installation are between $40 and $100.

There are 50 states in Usa and it is possible to form an llc remotely in these states. You can find a list of the installation fees of these states further down the page.

Forming an LLC in Usa, Costs and Things to Know

Forming an LLC in Usa, Costs and Things to Know

Regarding costs and expenses, you can find the price list categorized by state further down the page. With this UsaYou can also use the calculation tool below to calculate the exact cost of an LLC company to be formed in . You will also be able to get preliminary information about your general situation regarding taxation based on the answers you give here.

Tool to Learn Company Formment Cost and Tax Status

Filing Fees for Forming an LLC in the USA

When we look at filing fees, these costs are divided into two:

- One-time filing fee paid during installation

- Fees to be paid to the state in the next year following the installation and every year thereafter (also called Franchise Tax, Franchise taxes or annual report)

Things to know about filing costs;

- LLC filing fee one-time : This fee is paid to the state at the time of setup and you pay it one-time. Prices vary by state, the price list is available further in the article. The filing fee (state pilgrimage) payable at the time of installation is a fee paid to the state. When you choose a registered agent and place an order for installation, this fee is calculated from the beginning according to the state and included in other costs.

- Franchise Tax, Annual Report (Annual payment): Every year, states demand a fee from company owners called Franchise tax. When you establish the company, you do not pay this fee in the first year, you start paying it from the next year. These annual fees are different for each state. There is no annual fee in the state of New Mexico

Registered Agent Fees for Forming an LLC in Usa

Things to know about Registered Agent Costs;

- First of all, if you do not have any knowledge about Registered Agent before, what is Registered Agent . These registered agents, called Registered Agents in the USA, establish your company. These agencies must have a resident office in each state. Companies that meet these and certain conditions are authorized by the states for these works. You can find the pros and cons of many agencies on our Best Registered Agent

- While some of these Registered Agent companies do not charge an agency service fee for the first year, some collect this fee from the beginning. For example , Northwest, installation fee + first year agency fee is $39 including address. Northwest is a very large and well-established company with its own offices in almost every state in the USA.

Address Fees for Forming an LLC in Usa

Things to know about address fees

- When setting up an llc in Usa, you must provide an address where you can receive mail.

- If you set up your company with Northwest Registered Agent, the address is included in the package when setting up your LLC for $39. So, when you set up your LLC company with Northwest, you also have a business address where you can receive documents electronically.

- Another option is www.wyomingmailforwarding.com, where you can pay a reasonable one-time fee ($15) and make additional payments per incoming mail. To get an address through this company, Getting an Address for Wyoming Mail Forwarding for $15 . There are also mail forwarding companies that provide monthly services. You can find a complete list and prices of these companies in our article titled Getting an American Address from Companies That Provide Virtual Addresses in the USA

Forming an LLC in Usa: Formment and Annual Expenses by State

We have discussed average costs so far. Next, we will give you brief information about a few states (the states where the most companies are formed).

If you want to look at the installation and annual costs of all states, you can look at the table at the bottom of the page or use the calculation tool above.

New Mexico: Initial setup fee is $50. There is no annual filing fee, you do not have to pay any fees each year. ( New Mexico company formation guide )

Kentucky: Kentucky is the most affordable state with an initial filing fee of $40 for setup and a franchise tax fee of $15 for annual filing.

Delaware: Initial setup fee is $90. Annual state tax (franchise tax fee) of $300 must be paid by June 1 of each year or a penalty will be charged. For example: Assuming that you established your company in May 2022, you need to pay the annual franchise tax by June 1, 2023 at the latest. If payment is not made, a 200% increase + 1.5% monthly penalty interest will be charged. See: Establishing a Company in Delaware and Its Costs

Wyoming: Initial setup fee is $100. The annual reporting fee is $64. The annual report fee must be paid up to 10 days before the establishment date of the next year following the establishment date of the company. For example: Assuming that you established your company on June 1, 2022, you need to make payment on May 20, 2023 at the latest. See: Establishing a Company in Wyoming and Its Costs

Florida: Initial setup fee is $125. Annual state tax (franchise tax fee) of $138 must be filed and paid by May 1 of each year. Filing and payment after May 1 are considered late. In Florida, if your annual report is late, you must pay a $400 late fee, bringing your total to $539. If payment is not made, the Secretary of State will terminate your LLC after the 4th Friday in September.

In the table below, you can see the costs of the US states that are most preferred for company formation as of 2022.

Note: A general list of all states is right down the page.

| STATES | INSTALLATION FEE (ONE TIME) | FRANCHISE TAX (EVERY YEAR) |

| Delaware | 90$ | 300$ |

| Florida | 125$ | 139$ |

| New Jersey | 125$ | 75$ |

| New Mexico | 50$ | $0 (No Annual Fee) |

| wyoming | 100$ | 64$ |

| Kentucky | 40$ | 15$ |

Costs of forming an llc in Usa and annual expenses by state as of 2022

| STATE | COMPANY SETUP FEE (ONE-TIME PAYMENT) | FRANCHISE TAX, ANNUAL REPORT (PAYED EVERY YEAR) |

| Alabama LLC | $200 $ | Minimum $100 (each year) |

| Alaska LLC | 236 $ | $100 (every 2 years) |

| Arizona LLC | 85$ | $0 (no fees and no information reports) |

| Arkansas LLC | 45 $ | $150 (each year) |

| California LLC | 90 $ | $800 (every year) + $20 (every 2 years) |

| Colorado LLC | 50 $ | $10 (every year) |

| Connecticut LLC | 120 $ | $80 (each year) |

| Delaware LLC | 90 $ | $300 (each year) |

| Florida LLC | 125 $ | $138.75 (each year) |

| Georgia LLC | 100 $ | $50 (each year) |

| Hawaii LLC | 53 $ | $15 (every year) |

| Idaho LLC | 101 $ | $0 (Information report must be submitted annually) |

| Illinois LLC | 154 $ | $75 (each year) |

| Indiana LLC | 98 $ | $30 (every 2 years) |

| Iowa LLC | 50 $ | $45 (every 2 years) |

| Kansas LLC | 166 $ | $50 (each year) |

| Kentucky LLC | 40 $ | $15 (every year) |

| Louisiana LLC | 100 $ | $35 (each year) |

| Maine LLC | 175 $ | $85 (each year) |

| Maryland LLC | 155 $ | $300 (each year) |

| Massachusetts LLC | 520 $ | $500 (each year) |

| Michigan LLC | 50 $ | $25 (each year) |

| Minnesota LLC | 155 $ | $0 (however, an information report must be submitted annually) |

| Mississippi LLC | 54 $ | $0 (however, an information report must be submitted annually) |

| Missouri LLC | 52 $ | $0 (no fees and no information reports) |

| Montana LLC | 70 $ | $20 (every year) |

| Nebraska LLC | 104 $ | $10 (every 2 years) |

| Nevada LLC | 425 $ | $350 (each year) |

| New Hampshire LLC | 102 $ | $100 (each year) |

| New Jersey LLC | 130 $ | $75 (each year) |

| New Mexico LLC | 50 $ | $0 (no fees and no information reports) |

| New York LLC | 205 $ | $9 (every 2 years) |

| North Carolina LLC | 127 $ | $200 (each year) |

| North Dakota LLC | 135 $ | $50 (each year) |

| Ohio LLC | 99 $ | $0 (no fees and no information reports) |

| Oklahoma LLC | 105 $ | $25 (each year) |

| Oregon LLC | 100 $ | $100 (each year) |

| Pennsylvania LLC | 125 $ | $70 (every 10 years) |

| Rhode Island LLC | 156 $ | $50 (each year) |

| South Carolina LLC | 125 $ | $0 (no fees and no information reports) |

| South Dakota LLC | 150 $ | $50 (each year) |

| Tennessee LLC | 309 $ | $300 (each year) |

| Texas LLC | 310 $ | $0 for most LLCs (but Public Information Report must be filed annually) |

| Utah LLC | 75 $ | $20 (every year) |

| Vermont LLC | 125 $ | $35 (each year) |

| Virginia LLC | 103 $ | $50 (each year) |

| Washington LLC | $200 $ | $60 (each year) |

| Washington DC LLC | 99 $ | $300 (every 2 years) |

| West Virginia LLC | 100 $ | $25 (each year) |

| Wisconsin LLC | 130 $ | $25 (each year) |

| Wyoming LLC | 100 $ | $50 (each year) |

How to Form an LLC in Usa?

- First, determine the state where you will form your company (Wyoming, New Mexico or Delaware are among the most preferred states).

- Choose a name for your company. We also recommend you to take a look at our article Choosing a Name for an LLC Company in the USA

- Northwest Registered Agent 's LLC company setup page special discounted

- Complete your company setup order by following the steps in the video below

- Get an EIN number for your company. the Free EIN Application Campaign, we complete your EIN application free of charge in the LLC company setups you make with our biizm reference. For details and pre-application, you can visit our Free EIN Application Campaign

LLC Company Formment Video in Usa

In the video below, you can find the steps to forming an llc online in the state of Kentucky with Northwest Registered Agent. If you are going to install in a state other than Kentucky, you can continue with the ordering steps by selecting the state you want from the state selection section in the first stage.

The video has subtitles, please turn on the subtitle feature while watching.

Advantages of Forming an LLC in Usa

Establishing a company in America has many advantages for entrepreneurs. We frequently include these advantages on our blog, but to summarize, we can list them as follows;

- companies in America pay relatively lower taxes

- of establishing a company in America are quite affordable.

- companies in America can do business with these companies not only in America but also in Europe or other continents.

- The company's installation times are quite short, even in some states (Wyoming) it can be completed in as little as 2 business days.

- Brands can patent their names in the USA by spending low amounts

- It is easier for people who form an llc in Usa and keep this company profitable to settle in the USA by obtaining an E2 investor visa.

- Accounting and tax declaration procedures are submitted only once a year, not monthly. In this way, there are no recurring expenses such as monthly accounting expenses.

- Especially, LLC companies are very easy to manage. It does not require monthly maintenance. It has low expenses, such as the registered representative fee and the tuition fee paid online to the state each year.

What Should I Do After Forming an LLC in Usa?

a company in the USA and receiving the company's establishment documents, there are a few simple steps that need to be taken for the company to start its commercial activities;

EIN (Employer Tax Identification Number): After establishing a company in any state in America, the first thing to do is to obtain an EIN number for the company. Obtaining an EIN is required for the company in the USA to open a bank account or apply for a virtual POS to receive payments from the website.

To obtain an EIN, that is, a tax number, it is sufficient to fill out a simple form and send this form to the US Internal Revenue Service by fax. If you decide to form your company in the USA with Startupsole, we can obtain your EIN number for you.

Company Bank Account in America: If you need to open a bank account for your company in America, you must first obtain an EIN number for the company.

Once you receive the EIN, you can easily open your bank account remotely online. The most well-known examples of banks where you can open an account remotely are Mercurybank and Wise Business. These banks do not require an in-person visit.

Accounting and Tax Declaration: After establishing your company in the USA, it is recommended that you first use a cloud-based accounting program to keep the income and expense statement.

You can automatically keep the income and expense statement by integrating it into your e-commerce site with this type of software.

Accounting and tax processes in the US are done annually. You can easily make your tax declaration by authorizing your accountant through the preliminary accounting software mentioned above. It is possible to easily find a reliable Turkish accountant in America. You can benefit from our guide on this subject here .

Conclusion

To form an llc in the USA, you designate a Registered Agent and as long as your company remains active, your company must remain affiliated with an agency. Northwest Registered Agent is among the most preferred agencies due to reasons such as its price advantage, free agency for the first year (thanks to our agreement), free address service in every state and very fast support.

The agency you choose collects the installation fee to be paid to the state secretariat and the company installation fee from you at the very beginning of the ordering phase. The company setup service fee for Northwest is $39, thanks to the discount we offer. Afterwards, your company will be formed by the agency in a short time, in line with the information you provide in the application form, and your documents will be delivered to you digitally.

No documents such as passport or ID are required. You must only enter your residence address correctly because if your address cannot be verified by the agency, you may be asked for additional invoices or documents.

4 Comments . New Comment

Hello,

I read that he did not pay a franchise tax for the year when companies were founded in Delaware.

For example, the company, which was founded in 2024, should normally pay 2025, but isn't it exempt from this tax because it is the first year?

This is not a tax and no exemption is actually more accurate to use the term Annual Report instead of franchise tax, so the annual report is paid every year.

You can read this yourself from Delaware State Site yourself. Depending on the date of establishment, the final payment dates can change. : https://corp.delaware.gov/paytaxes/

Hello,

My company was opened at Delaware on 1/9/2024, but I did not make any sales and did not receive payments. I have 2 questions.

1- Should I pay a franchise tax?

2- Should I make any tax declarations?

Hello,

Delaware LLCs need to pay $ 300 franchise tax every year because this is the annual payment price in this state. Otherwise, your company will be terminated. You can also look at the details about the taxes you need to pay from this page: https://startupsole.com/yardim-cakelemeri/vergilem