Update: There are payment problems with Turkey-based credit cards when receiving service through IncAuthority. For this reason, you can make your installations in the State of New Mexico through Northwest company for $ 89. the article we prepared for this here : startupsole.com/northwest-ile-amerika-da-sirket-kurmak Thank you for your interest in this article.

Due to IncAuthority not accepting Turkish credit cards when ordering, this article is no longer up to date and to this page .

In fact, the steps and method of forming an LLC company are the same, but we recommend that you form an LLC with Northwest instead of IncAuthority.

You can set up your New Mexico LLC company through Northwest for around 89 USD, including the address. In addition, we make EIN applications free of charge for the companies you will form within our business partnership with our reference.

For the current article and Northwest installation steps, please view this article

Our outdated article is below. You can still read it, but we kindly ask you to ignore it.

Establishing a Company in America with Inc Authority, we explained how to set up a company in the state of Kentucky by purchasing an Operating Agreement and a phone with an American area code for a price of approximately $129. With the method in this guide, dozens of people established their companies in America, obtained an EIN (federal tax number), opened bank accounts and received stripe approvals. here , you can also look.

In this article, I will talk about the processes of a Kentucky company that I founded by spending $55 (for the purpose of receiving stripe payment) for a project. The company was formed in 6 days after applying, even though there was a weekend in between. I shared with you how this happens, with evidence and screenshots, in this article.

I will be able to receive payments by opening a bank account (or Wise, I haven't decided yet) on this company I formed for Stripe, but do not misunderstand that it was formed for Stripe, this is a real Usan Kentucky company.

Now let's look at how this process works, step by step.

Can You Form an LLC for $55?

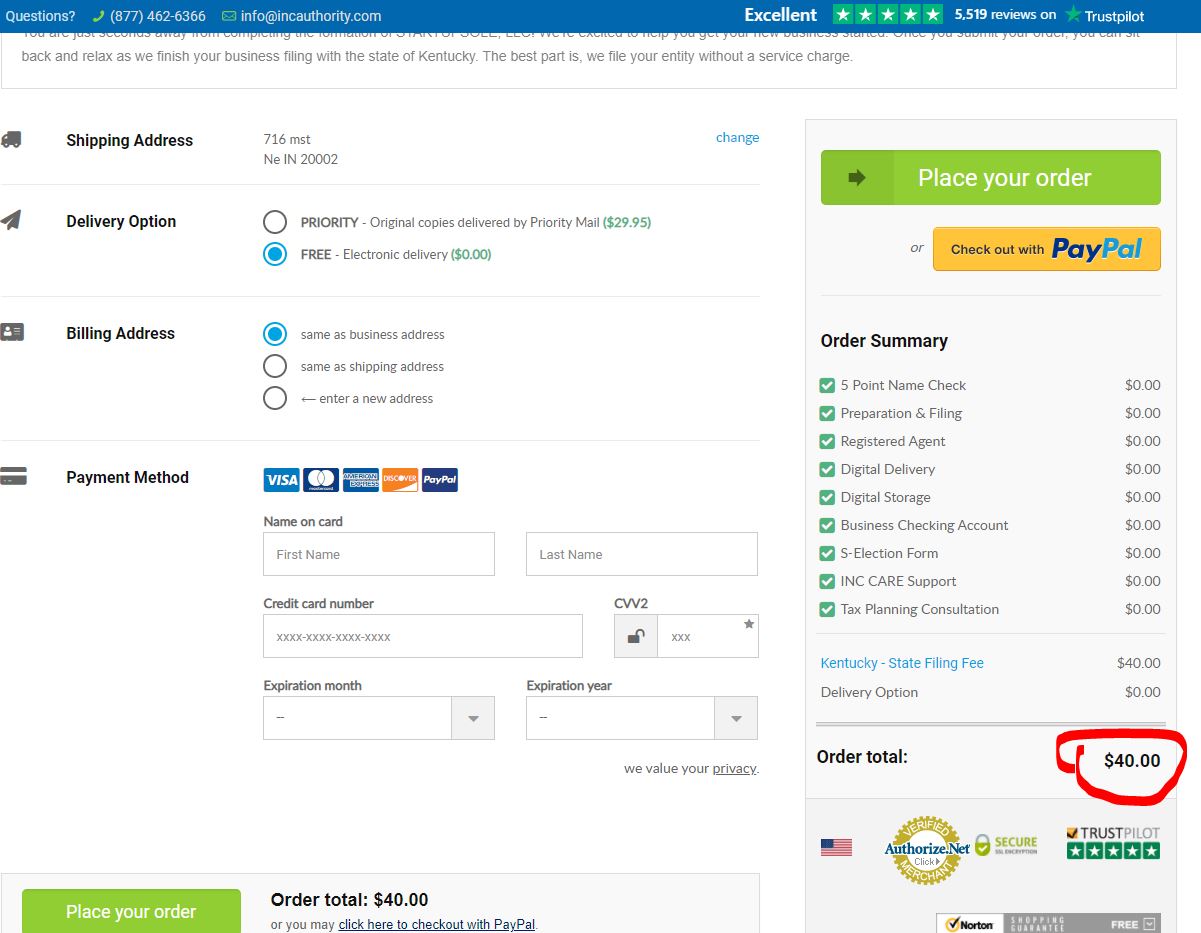

Yes, it is established because IncAuthority does not charge the registration agent fee for the first year and does not charge extra for the installation, so they file it with the state for us. In this way, a company can be established for a total of $55 with $40 state fee + $15 address.

So how does this happen?

Establishing a Company in America with Inc Authority, the operating agreement document cost 89 dollars, and IncAuthority prepared this document for 89 dollars and sent it to us for signing. This $89 document is not a requirement for single-member LLCs, but it is an important document to protect the company owner.

Here details about the Operating Agreement, how to fill it out, and a template for a Kentucky LLC you can fill out . After establishing the company, I filled it out, signed it and sent it to Incauthority, you can do the same.

We can also prepare this operating agreement document ourselves. This document is not required for company owners in the state of Kentucky according to the laws of the Ministry of Foreign Affairs, so you do not need to send it to the state. It's a contract that you can prepare, sign, and keep aside.

Since a company can be established without documents, IncAuthority .

Starting an LLC in Kentucky for $55

We recently established a new LLC company in the state of Kentucky for a new project. We did not include the operating agreement in the installation and chose to create it ourselves. Our company was established in a few days with IncAuthority by paying only the state fee

Can I Choose Another State?

Yes, you can, you do not have to establish your company in Kentucky. When you follow the steps to establish a company with Inc Authority or another agency, you can choose another state in the state selection section. It is generally preferred for Amazon to establish a company in the state of Wyoming. Wyoming has many advantages in terms of tax, but another advantage is that Amazon suppliers, in particular, apply fewer procedures to companies established in this state and value the resale certificate they receive more. Many e-commerce entrepreneurs dealing with Amazon say this based on their past experiences. also view detailed information about this resale certificate and how to obtain it in this article . After establishing the company and obtaining an EIN, the first thing Amazon employees usually do is to obtain this certificate, so I wanted to give brief information here.

Get a Mailing Address for an LLC for $15

You can show your address during company establishment, notary approval, USPS Form 1583, etc. is a company that offers a mail forwarding service that you can use for a lifetime with a one-time payment ($15) .

The mailing address does not have to be in the state where the company will be incorporated, there is no such requirement, so when forming an llc in Kentucky, your mailing address can be in Wyoming, or vice versa. In summary, you should not try to look for an address in the state where you will open an llc.

If you, like me, have chosen Wyoming mail forwarding in this setup, you must first start by purchasing a mailing address from this reliable company for $15.

You obtain a mailing address for your company by following the steps in the article Getting an Address for Mail Forwarding for $15 I first started by opening an account with this company.

Once you get your mailing address from Wyoming mail forwarding and receive your suite number via e-mail, you can start the installation. (This is an important step, usually the e-mail arrives in the evening after 1 day, due to the time difference. After receiving the e-mail and obtaining the suite number, I recommend that you proceed with the company setup steps, please do not rush and wait for your address to be completed.)

Do I Need an Usan Phone?

Actually it is necessary, but not when forming an llc. After setting up the company, a USA phone is required when opening a Stripe or bank account, but it is not at the installation stage. Since there is no +90 option on the IncAuthority registration screen, the only option is a USA phone.

At this stage, I typed in your TR mobile number and the area code appears as +1, but since this information is not recorded in state records, you do not necessarily need to get a phone call. At least I didn't buy it and entered my own phone. If you want to have a USA phone number, Zadarma and OpenPhone and get one. Zadarma , and OpenPhone provide a USA number with monthly payment plans.

Start Setup with IncAuthority

Once you have provided a mailing address (optionally phone number), you can begin the registration steps for installation.

NOTE: Due to its financial policies, IncAuthority rejects the transaction with an error on MASTERCARD-enabled credit cards from non-US countries. You must use VISA enabled cards. If you do not have a VISA card, you can purchase an ininial prepaid card and make transactions with this card. You can create a virtual card instantly by downloading the ininial card mobile application.

- First, log in to Inc Authority.com website from this link

your company with Inc Authority by clicking this link , you can earn an extra 20% discount coupon during the installation phase. (If you enter the discount coupon from the computer, it will not come out from the phone. If it is not displayed on the computer either, refresh the page and from this link and start the installation steps again.) The coupon gives you a discount on additional services.

On the next page, you can select the business type and state in which you want to form the LLC.

- We select LLC as the Business type and Kentucky as the State, then we continue by pressing the Save and continue button.

- In this step, we need to enter information about the business owner. For a single-owner (single-member) LLC, we enter the name, surname, e-mail and phone number and accept the contract below and move on to the next step. (Phone is unimportant, I mentioned above)

- In this step, we are asked to enter the details of the LLC company. write a name for your company (it would be good if you look at the name selection procedures in this article) and enter a short English description about your business.

- Also, search the Kentucky state website ( at this link ) for the name you are considering for your company, you can use it if it has not been used before. If you are going to establish an LLC company in Wyoming, you can check whether the company name has been used before by searching for the name on the state website at this link

- After determining the name, we can proceed to the next step by typing E-commerce or Digital Services in the description section, checking the following boxes (Will your business accept credit card payments? It asks you whether you will accept credit card payments) and checking the online box.

- from the $15 Wyoming Mail Forwarding Address into the screen in the step below. Check the same address box as the Shipping address

- Then, check the "I want to receive messages on my phone" section below or not, it doesn't matter, go to the next step.

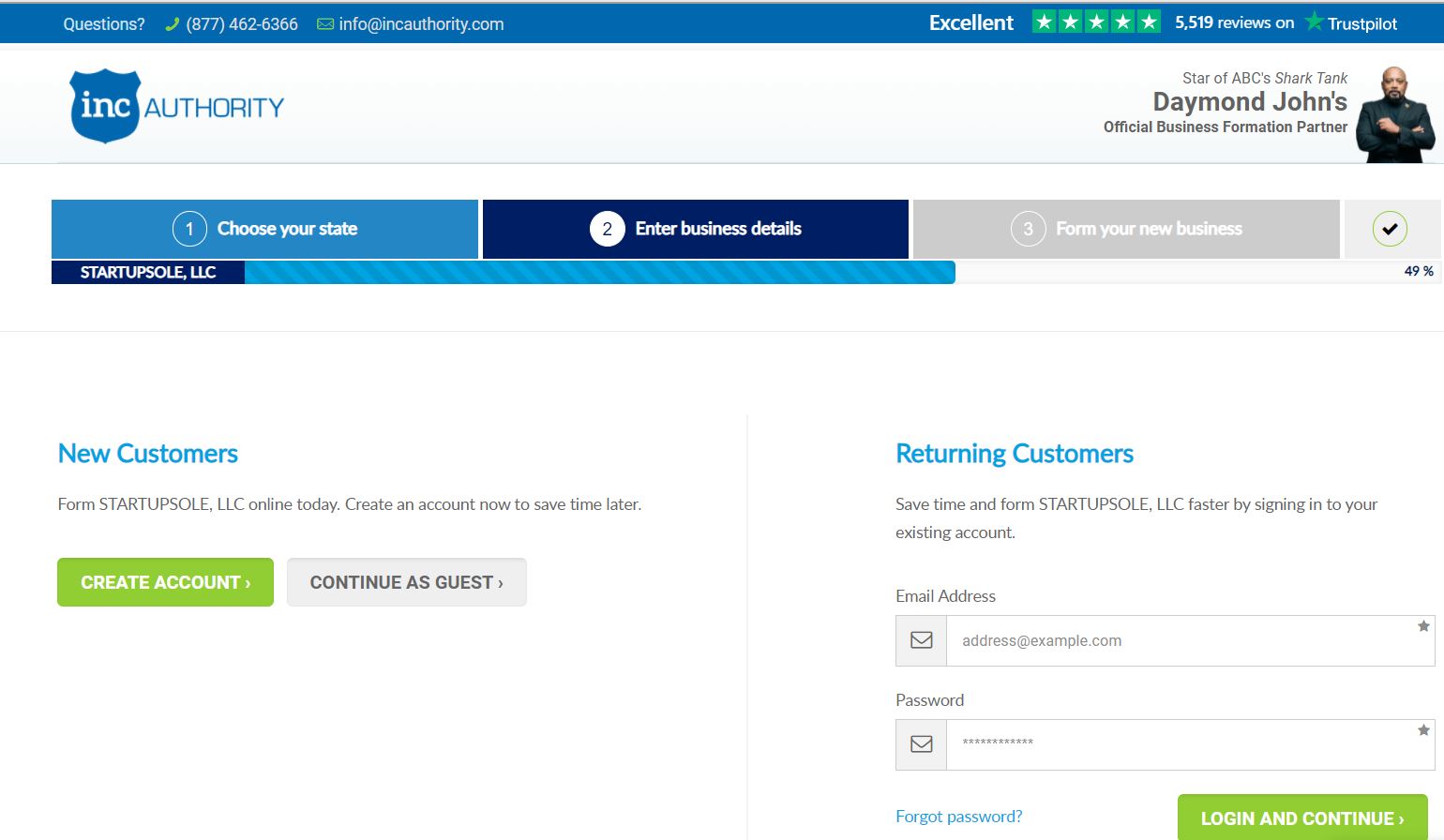

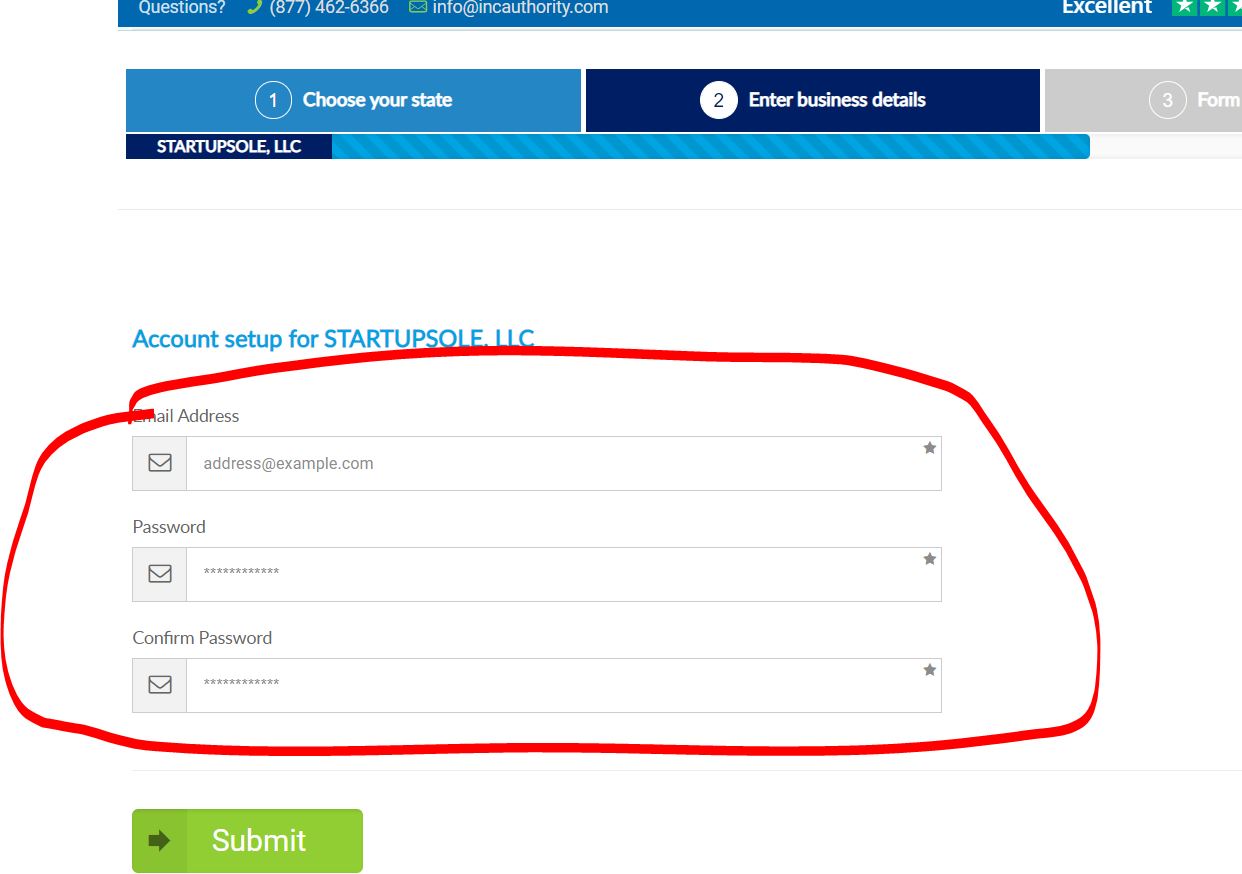

- In this step, you are asked to create a new account because you do not have an incauthority account. This is only required for registration in the incauthority panel.

- Click “Create Account”

- Set a password by entering your email

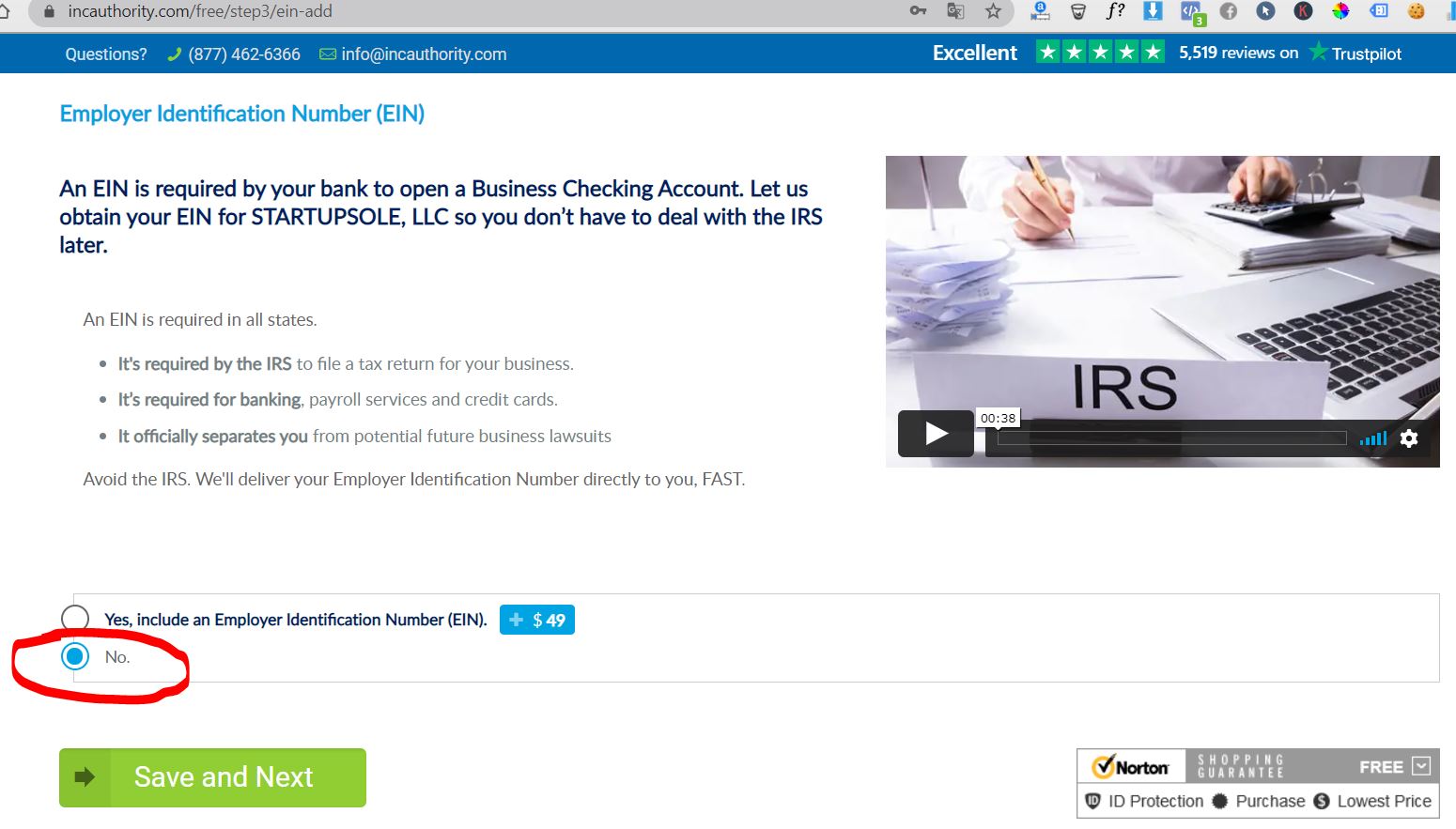

- the EIN number Inc Authority for $49. I did not want to pay $49 because I would fill it out myself. EIN (Federal taxpayer identification number) is a toll-free number. to Obtaining an EIN Number from America, you can fill out the form and apply yourself. However, if you do not want to deal with these and pay fax fees every month, EIN Service for a fee from this link . Or you can get a free EIN from the IRS on the same day by phone, we explained the details here.

- We select No and move on to the next step.

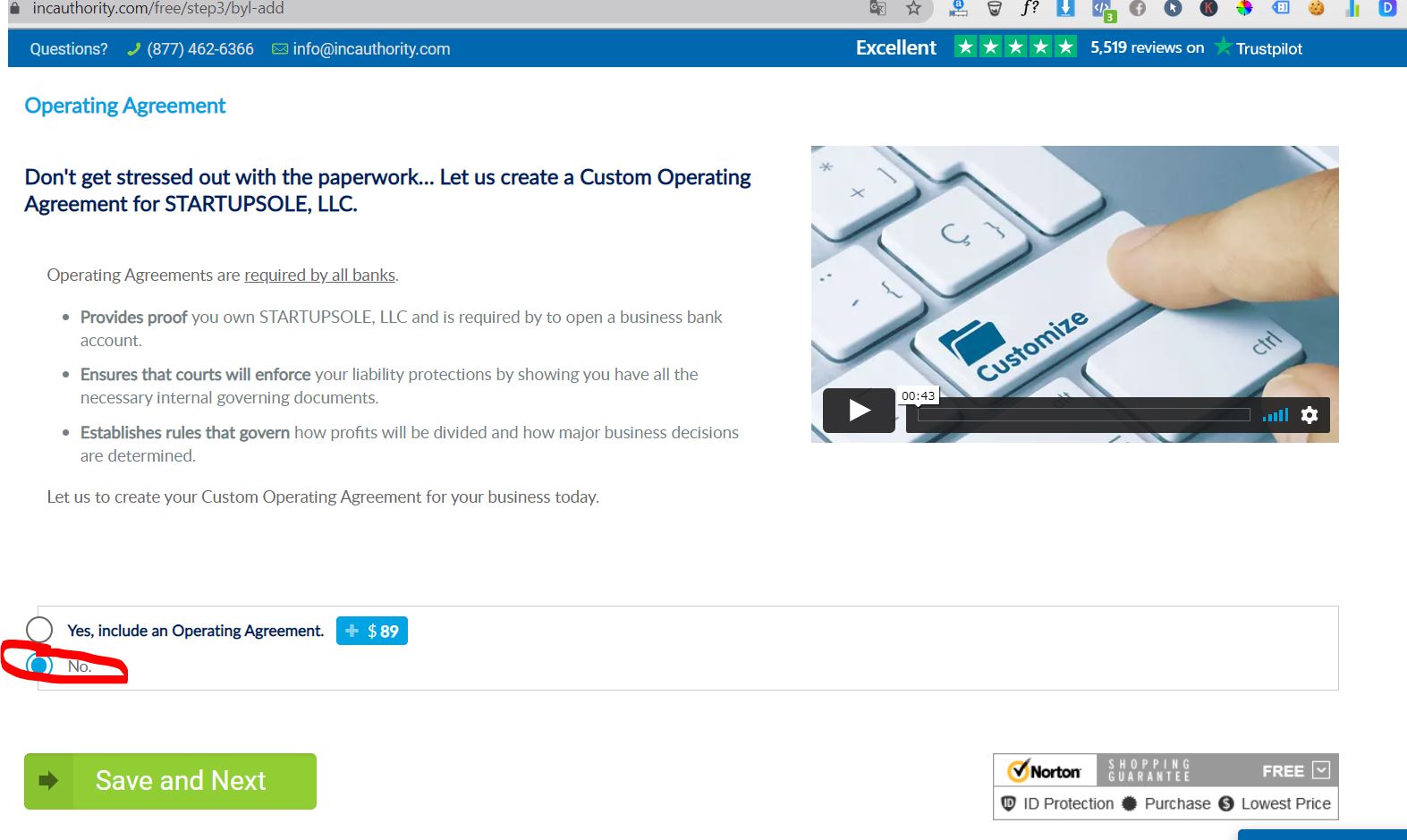

- I choose No because I created the Operating Agreement myself, but you can pay $89 if you want. What is Operating Agreement? Required for Single-member LLCs? There is a template in the article, you can create it yourself.

- It asks if you would like an llc stamp and a few additional document options. You can buy it by paying $99. I proceeded by selecting "No" without selecting it.

- You may want to speed up company formation by paying extra. I preferred to wait and selected "No" and continued.

- Com domain name for your business. I select “No” and move on.

- If you want extra fast support and access to a document repository where you can have special access, you can pay monthly. When you pay extra, the support department works faster and they take special care of you. If you do not want it, you can mark “No” and continue.

- The option below is offered for the purpose of opening a bank account, but this bank only serves those living in the USA. Let's select No and continue.

- If you do not choose any additional services in total, you can start the process by paying $40 for the state of Kentucky. If you choose to form an LLC in the state of Wyoming, the fee to be paid to the state is approximately $110. Because IncAuthority files company formation applications for free, it only charges you the state filing fee.

NOTE: Due to its financial policies, IncAuthority rejects the transaction with an error on MASTERCARD-enabled credit cards from non-US countries. You must use VISA enabled cards. If you do not have a VISA card, you can purchase an ininial prepaid card and make transactions with this card. You can create a virtual card instantly by downloading the ininial card mobile application.

- After making the payment, you will see this screen stating that your order has been received.

After you make the payment, a customer panel will be created for you, where you can follow the entire process and download a few documents you need to sign. The same information is also transferred to you via e-mail.

The Company Has Been Formed, Now What's Next?

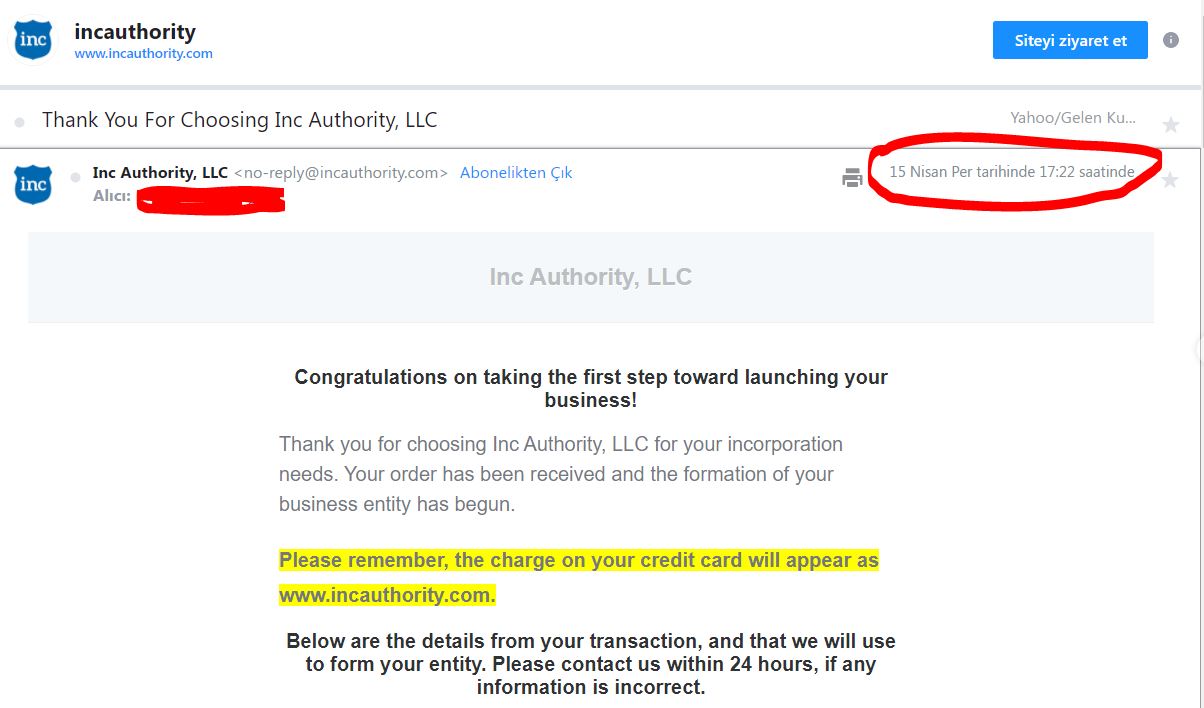

After you make the payment, you will receive an order e-mail. You have 24 hours to make any changes, otherwise the state application to form your company will be completed with the information you provide.

The order email was as follows;

-I started the installation on Thursday evening, April 15th

Exactly 6 days after placing the order (there were 2 weekend breaks, so 4 days), the company formment e-mail arrived.

They will send you a two-page package, one page called RELEASE and the other page called MEMBERSHIP LISTING STATEMENT, where you will write and sign the name, surname and address of the company member. Send them back to the specified e-mail address by digitally signing them with sejda.com pdf editor (you add a picture of your signature in png format).

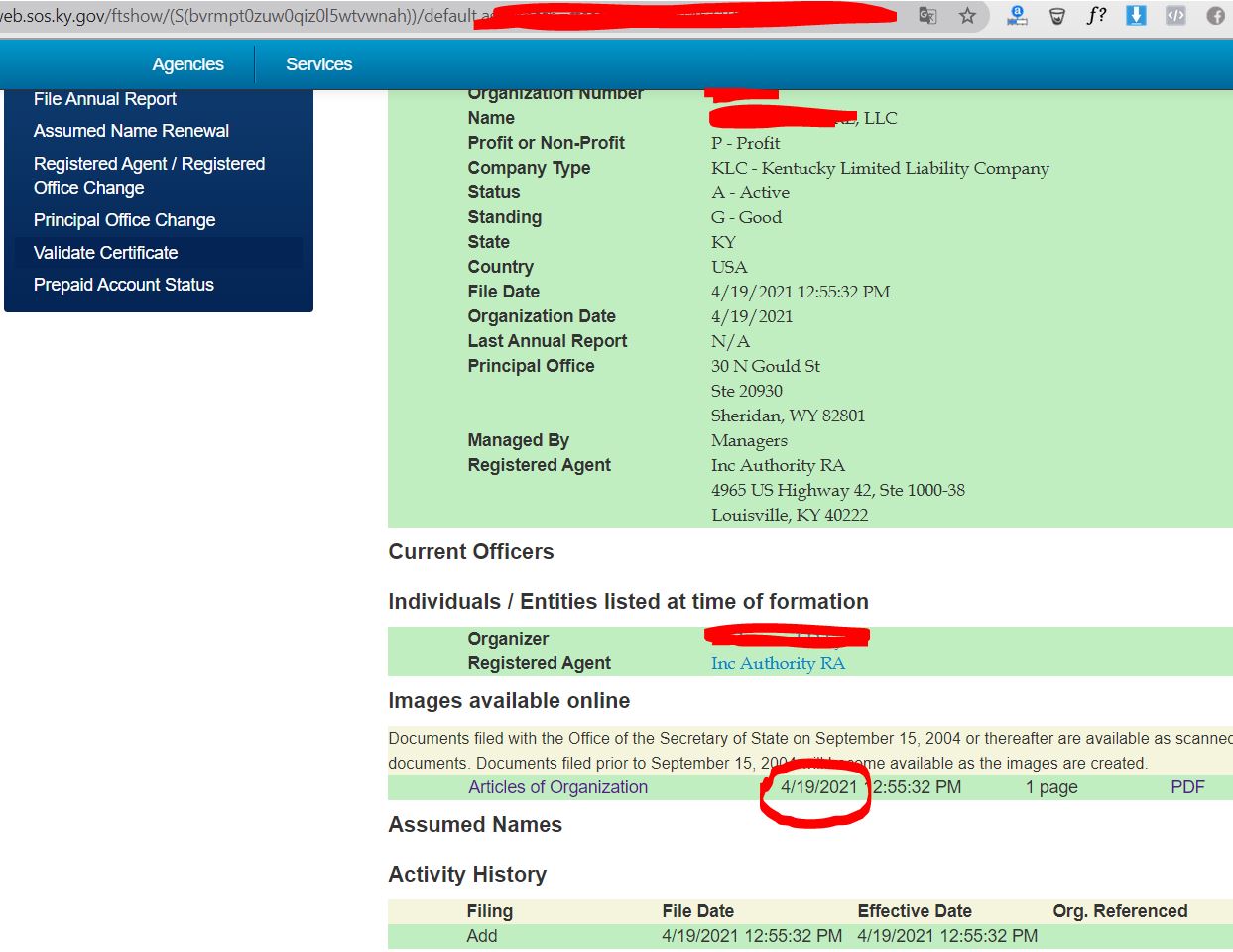

Then I went to the state website and searched for my company name. Actually, they founded the company on April 19 :)

Conclusion:

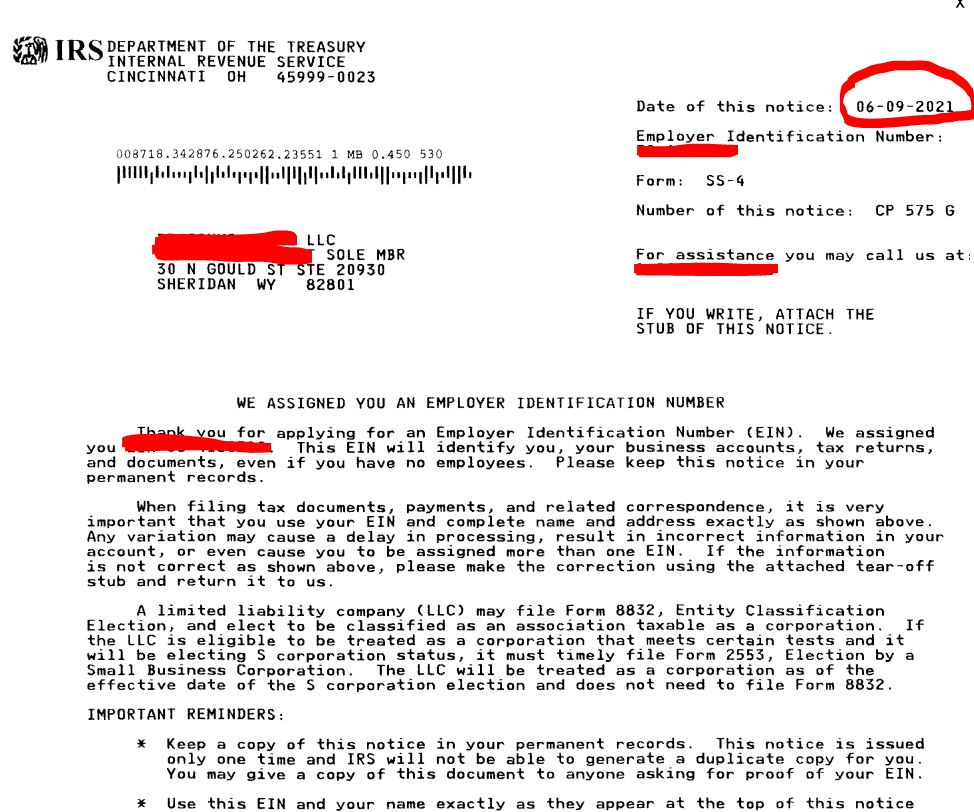

Company setup was completed in 4 days. Afterwards, I immediately filled out the SS4 form for the EIN, downloaded the incorporation document from the state website, and faxed it to the IRS in two pages, along with the completed SS4 form.

Let's see how long it takes for the EIN I faxed on April 21 to arrive. As soon as it arrives, I will share it under this article.

Update: The EIN arrived in the form of a letter from the IRS on June 6th. After the application, the EIN was first sent via fax, this time the fax came later. They sent the EIN letter to the mail address first. An EIN letter named CP575 like the one below came from the IRS.

Update: These days, the fax comes first, the EIN letter comes later, and then the mail. It may change from time to time, but if you apply correctly, the EIN will somehow reach you, don't worry and wait.

In fact, when the EIN arrives, I will create a bank account and Stripe account for this company. You can follow the details under this article.

In fact, when the EIN arrives, I will create a bank account and Stripe account for this company. You can follow the details under this article.

Note: You can get a free EIN from the IRS on the same day by phone, we explained the details here.

Update: Mercurybank account and Stipe account were opened for this company on June 10 and were successfully approved

If you want, you can use this method to form a Kentucky company (Address included) for $55, or you can use the same method to form an llc in Wyoming or Delaware or any other state you want. All you have to do is choose the state you want in the state selection section, all other steps are the same.

I wish good luck to those who will form an llc.

134 Comments . New Comment

You mentioned getting a mailing address for 15 dollars in Wyoming. Didn't Northwest already provide a mailing address?

They do, but they provide a shared mailing address. If you want a private suite number, it is more expensive with monthly payment at Northwest. If you want a private suite in Wyoming and want to provide it more cost-effectively without having to pay monthly, you can use this service.

Well, sir, Kentucky makes sense as an initial installation cost, but with income tax,

isn't it expensive compared to other states?

Federal taxes are not determined by state rates. Federal taxes are reported to the US Internal Revenue Service, not to the states.

Where did you get this information? If you want, consult the place where you got the information or look at the irs documents.

Dude, isn't income tax etc. higher in Kentucky? Aren't we losing more money when we look at the results?

If foreign-owned LLCs do not have a physical location in the state (shop, office, warehouse, store) and are an online business, there is no corporate income tax or state tax in any state. Only annual federal income tax returns are filed, which are categorized based on your situation and source of income.

I was going to get consultancy, they gave a price of 600$ for llc company formation and ein. I found this site at the last minute, researched and read your comments, everyone is satisfied, the information was given very generously. I also ordered from my company Inc. Thank God, we completed the installation without any problems and at an affordable price.

It was more convenient for me to do the transactions myself because it is safer this way.

I would like to thank each and every one of you who created the site and wish you continued success.

Thank you very much for your comment. We wish you success in your new job.

Thanks to you, I founded my company at an affordable price with INCauthority. I did not receive an operating agreement, I created and signed one myself. Thank God, my EIN number, which will open a Stripe account, arrived at my mail address in 7 days. I wonder if they require an operating agreement when opening a Stripe account?

Thanks so much for the information.

Good luck, yes ein numbers are coming very fast now.

Stripe will not ask you for an operating agreement or any other document. Enter your e-mail number and open your account. The system will verify your EIN number and company online through the IRS system in 10 minutes. You can then upload your ID and have the account fully verified.

Hello sir, thanks to you, I opened my company in Kentucky

https://resimyukle.io/r/KqcHMqxxPm

I received a document like this in my mail, do you have any information?

Thanks

Hello,

It's like a document like an annual report reminder, the contents of which need to be read.

Hello. First of all, thank you for this excellent article. There's one thing I don't understand. I founded my company with Inc Autirty in Kentucky. We received 2 pdf documents. Article of Organization and 2 pages of RELEASE and MEMBERSHIP LISTING STATEMENT. There is no space below to sign the Article of Organization of these documents.

It is in the RELEASE and MEMBERSHIP LISTING STATEMENT document. But enter your Name, Surname and Physical address as written above. We only have a mailing address from Wyoming. Should we write this instead of physical address?

And in the Article of Organization document it says 3 different addresses. When opening stripe and paypal accounts in the future, should we write the address taken from Wyoming instead of address?

I would be happy if you answer my questions. Thanks in Advance

Articles of organization Your company formment document is not signed, it is the certificate issued by the state anyway.

In the Release section, write your residence address in TR, sign it and send it back to incauthority.

Stripe vs. You will give your Wyoming address, the other addresses are the agency's address. By the way, Stripe does not require address verification, now EIN is sufficient.

Congratulations.

Understood. Thank you. Only I saw that when opening a PayPal account, the address you gave in the address section cannot be the MAIL address. It was a little confusing for him.

I think you are talking about Po box. This wyoming address is not a pobox, this is a physical address, do not worry.

Thanks for the Quick Reply.

I read your current article and tried to form an llc with Incfile, but now I saw that you also have an article like this.

https://startupsole.com/incfilei-neden-onermizi/

Frankly, I'm confused. Which one is correct? Should I proceed?

Also, I'm having trouble paying with Incfile. Even though I had visa, it wasn't accepted. I applied for an ininal card and I'm waiting for it. Nope, I'll leave it at that, if it's as bad as it says in that article?

Hello,

You must have confused Incfile with Incauthority. The article you mentioned is about incfile, you are on the incauthority page. They have similar names, but they are different companies.

Hello,

I founded my company in December and did not make any profit, but I think I need to take action by the end of March.

Do you have an article explaining this stage?

incauthority.com I founded it from here, from the state of Kentucky

Hello,

Yes, you need to fill out form 5472. We do not have an article about it. This is more of an accounting-related process.

However, you can look at the comments on the topic in the link below. A few people were planning to get together, buy a tutorial on the subject, and fill it out themselves.

https://startupsole.com/amerika-disindaki-lccler-icin-form-5472-gercegi/

Hello, I want to open an llc, but I have some questions, I have gathered them all together;

Can I move the company I opened to another state?

What is Federal Income Tax? Do we have the right to avoid percentage and taxes?

What is Sales Tax? Do we have the right to avoid percentage and taxes?

What is Income Tax? Do we have the right to avoid percentage and taxes?

What are the special taxes levied by the states?

How can I track taxes?

What are the tax payment limits?

What is the installation and total annual cost?

Is closing an llc easy? Is there any risk or distress?

Do you have a legal address, cheapest service suggestion? Or does it make sense to do it with registration agents?

Will Türkiye tax the money I earn in Usa again? Or can I spend the money directly with a US debit card or credit card without taking it to Turkey?

Will Türkiye perceive me as tax evader?

How do you open an account and receive money?

How to open a credit card and spend?

Hello, these questions have been answered many times before and the answers to each of your questions are available in the articles. Let's answer them anyway;

1. It is movable, but it is a more costly process than establishing a new company.

2. Definition: https://www.investopedia.com/terms/f/federal_income_tax.asp – Tax bracket and tax payment status are determined according to the geography in which you sell, there are many variations here. Unfortunately, it is not a tax calculation platform. You can ask a tax lawyer about your way of doing business and create your road map.

3. The answer is here: https://startupsole.com/abd-eyaletlere-gore-satis-vergileri/

4. It is the same as the federal income tax, that is, the same answer as the 2nd question.

5. States charge an annual report fee every year, each state's is different. . You can access the details by searching for the state you are interested in on our website. For example; Wyoming is $60 annually, Delaware is $300, Kentucky is $15.

6. The accountant tracks and declares the tax.

7. The accountant calculates and pays it according to your situation. You can get support from the accountant

. 8. Costs vary by state. If you install with a Northwest agency, we have a special discount. You can install by paying $ 39 + state fee. You can calculate the costs by state from this link: https://startupsole.com/amerikada-sirket-kurma-maliyeti/

9. Closing procedures and prices vary by state. For example, in Kentucky you can close it from the online portal for $40.

10. Address registration agency (Northwest) is a very reliable and trouble-free solution. If you want a special suite, you can get it without notary approval through Wyoming mail forwarding.

11. If you regularly transfer money from the USA to Turkey, your bank may or may not automatically report you to the tax office. Therefore, it may be necessary to pay tax depending on the amount and money transfer transaction. By the way, if you report the money coming from abroad to your bank for 2 years (still continuing), the state does not tax the foreign currency entering the country within the scope of asset peace. You can benefit from this advantage like everyone else.

12. Answered in the previous question

13. You can open an account with digital banks such as Wise or Mercurybank. You can transfer your money to your country from the account you opened.

14. You can't get a credit card. No US bank will give you a credit card unless you live there, even if you own a company. However, if you open a Mercurybank account, they send you a debit (ATM) card. You can either shop online or withdraw cash from ATMs by loading the money in your account onto your debit card.

You can also start a test using this tool to find out your status regarding taxation: https://startupsole.com/amerikada-sirket-vergiloji/

Hello,

I have a question. According to your guidance, we established a company in Kentucky and received our EIN number through you. Now we are constantly receiving e-mails about how we will do the taxation transactions, the deadline is around March 15, etc. Could you please give me information about paying taxes?

Hello,

Since the tax season is in mid-March, you will receive general information e-mails from many platforms. These information e-mails are sent to all of us. As a single-member LLC owner, all you need to do is file a general information return called Form 5472 each year. If you have not reached an agreement with any accountant, you can get price information about this service by looking at the topic on this link and contacting the accounting expert we recommend.

https://startupsole.com/abd-vergişma-form-5472/

The purpose of this declaration is only to report the income and expenses you receive from your company to the IRS. You only pay the service fee, you probably will not have to pay extra taxes.

Hello, I am writing for February 20th. Currently on incauthority.com it says something like LLC is free. It says you only pay government fees. Is this true?

Hello,

Yes it is true and still valid. Forming an llc with Incauthority is free of charge. In line with the information you enter in the form on their website during the application phase, they only collect the state fee from you and file your LLC.

As soon as the new year entered, I started the company formment process. Thanks to you, we are learning a lot. Thank you for your efforts and support.

Are there any monthly expenses in Usan companies? I recently asked about the UK company, you said no, does the same apply to Usa? How much money comes out of our pocket monthly? Does it have monthly expenses like TR companies? Or do we pay tax on annual profits?

You won't have any monthly accountant or other expenses, but you may have to pay federal taxes depending on your situation. Where you sell, your turnover and different indicators determine whether you will pay tax or not.

You can take the test that determines your situation from the link below, so you can learn in which situations you will or will not pay tax.

https://startupsole.com/amerikada-sirket-vergişma/

First of all, I would like to thank you very much for sharing this wonderful knowledge and experience. May God turn what you hold into gold and bring success to your business.

I also want to start selling with shopify. I need a stripe account as payment infrastructure. I've been researching this for a while. In order to open a Stripe account, many places recommend setting up a company in England. Do you think it makes more sense to establish a company in England or the USA? Which one do you think would be the better decision in terms of the speed of activation of the Stripe account, in terms of taxes and in the long term? I would be happy if you answer with the reason.

Thank you very much for your positive comment and wishes.

There were many people who wrote to many stripe sites opened through secretaries formed in England that their Paypal accounts were closed in the long term and that the verification process could not be completed, and for this reason they asked us for help.

That's why UK is not a region we recommend or know much about.

Moreover, if the issue will have a tax aspect in the long run, it has become easier to explain your troubles to accountants and the Turkish revenue administration. After a long time, at least they started to solve the US tax system. Trying to explain the UK system is unthinkable.

At least these reasons make the USA more logical in this period, of course, this is our opinion and the opinion of the entrepreneurs who have experience.

It doesn't make much difference in terms of speed, both are a few weeks, because the company formed in the UK also has a watt registration (like EIN). An LLC without a watt registration cannot carry out any commercial activities.

Still, it's your decision.

I set up an LLC for my online education company and applied for EIN. A few e-mail questions I sent to the startupsole team during this installation process were answered in a very short time. We received free support and consultancy :) Thank you for answering the questions without getting tired. I wish you continued success.

You're welcome, we're glad we could help.

Thanks to you, I formed my company on my own, received my EIN number, and as of today, our Stripe account has been verified. We started receiving payments for our training company.

Thank you for the accurate information and guidance you provided, thank you for your efforts.

We wish you good luck and good luck.

Hello sir. Now we will do dropshipping on Amazon. Do I need an ITIN? Can't we do this with just EIN? What's the difference? What are the differences when we pay taxes? (Note: on your page it was not written that ITIN is required, I just wanted to confirm because I heard it somewhere)

You do not need to check when opening an account. Since you will be paying the taxes of your LLC individually in the future (when you need to pay taxes), your accountant may ask for a check during the tax payment. However, this is not necessary at first. It is useful to apply for a license after a while after making the company active.

Sir, will there be a problem if we fill out these documents without a digital signature? Is it necessary to have a digital signature? I don't have a digital signature? Also, they sent me not just 2 pages but 23 pages. Is this normal?

Then sign it wet, scan it from the scanner and convert it to pdf. It also happens this way.

By the way, I'm curious about what the 23-page document was sent to you. Please e-mail us the document you received and let's take a look.

Shouldn't the date format in the manager section of the membership be entered as day month year instead of month day year because 10 is like the 15th day of 2021, for example. Can we also meet for ein? I am sending the documents now

Hello,

Their date format is month day year. Ex: 10/15/2021 you can write and send in this format.

We will prepare your SS4 form and send it to you for you to sign within the same day we receive your application. Thank you for your order, good luck.

Do I need to send the Operating Agreement together with the RELEASE and MEMBERSHIP LISTING STATEMENT documents or before these?

You can send them all together, no problem.

I registered with Shipito, they gave me the address, will this be enough, can I use it?

Hello,

Shipito is no longer a method we recommend because when the documents arrive, the shipping fees are high and the processes have become very complicated. In the future your EIN letter etc. You will have to make a lot of effort to get a future. Instead, rent an address from Wyomingmailforwarding.com for $15. They will identify your Suite number the next day. Using this will be healthier and painless in the long run.

I started to form an llc, but there was one element that caught my attention. There is a ' sign at the end of the company name. But it doesn't appear that way in the installation with DelawareInc.

Hello,

Incauthority adds commas to the ends of all llc names. This doesn't cause any problems; all states allow commas. As a result of the transaction procedures of the agencies, Incauthority provides its services in this way. Delawareinc vs. We cannot comment because we do not know the working principles.

Hello, the company setup email has arrived. I couldn't understand how to fill in the relevant blanks in the forms I received.

https://prnt.sc/1ty6wdf

Will we write the TR address in the address section on the 2nd page?

I would be very happy if you could help.

Thank you very much in advance.

Hello,

Write your name and surname on the Release document on the first page, your name and surname in the manager section right below, and the date in the form of month, day and year in the date section and sign your name digitally under it.

On the membership listing document on the 2nd page, write your name, surname, TR address, postal code and country in the member name section. Put a digital signature under your name. Write the date at the bottom as month, day and year.

After signing the documents, send them by e-mail to the specified e-mail address and that's it. You do not need to take any further action.

We wish you good luck.

Hello,

I did not receive an e-mail stating that the company was formed, but when I check it, it shows Articles of Organization as 9/23/2021. Can I apply for an EIN number?

Thanks..

The mail may arrive late, if it is displayed in the state, the formation is completed, good luck. You can apply for EIN, do not forget to add articles of organization to the SS4 form.

Hello,

I applied with incauthory.com, but they called me last night and sent me an e-mail saying that they could not reach me and that there were situations that we needed to review together. Is this the standard operation or is there something I'm doing wrong? How can I solve the problem?

Hello,

If there was something wrong, they would tell you about the mistake you made and they will probably give you information about getting additional service. Do nothing and follow the customer panel, they will complete the installation in a few days.

Congratulations, you have created a wonderful resource for your ambitions.

By following all the steps written here, I formed my llc company, received ein and activated my stripe account.

Since I started a subscription-based business, I had a website and it was not difficult to integrate it into Stripe. Thanks to you, we started receiving payments correctly and legally, everything is fine :)

I wanted to comment to thank the team that created these guides. I wish you continued success.

Thank you for your valuable comment, it is really pleasing that you resolved it without any problems. Success and convenience in your new business life.

Hello,

I found your page while trying to verify my stipe account in order to receive payment on ClickFunnels. What is the difference between establishing a company in USD with this guide and establishing it with your packages?

Will IncAuthority remind us of the things we need to do regarding tax declaration when we install it ourselves with this guide?

I will also do coaching and e-courses targeting England and Europe. Does it matter in which state of the USD I form it? Does it matter if it's Kentucky or another state?

Hello,

We manage the entire process in installation packages and get your company ready for business, you do nothing. You can do it yourself, the process is actually similar. We only manage the address and installation process from the same place with the registered agencies we have agreements with.

We or any other agency (including Inc. Authority) do not carry out tax-related transactions. Tax is a separate category and you need to work with a competent company that is specialized in that field.

There is already an agency fee and state fee for next year, which you can pay online. You can carry out accounting transactions by working with an expert after the company is established and acquired.

The state is not very important, but Wyoming has become more preferred recently compared to other states. Certificate etc. required for Amazon and similar marketplaces. The state provides documents such as these more easily and free of charge, so it is easier to manage.

However, the choice is yours of course.

Thanks to the guides, I formed an llc in the state of Nevada, thank you very much. I discovered something. A few days after I faxed the SS4 for EIN, I called the IRS and got the EIN on the phone, and I didn't have to wait for 2 weeks. I even asked them to fax my wife's letter and they sent it directly. If you do not have a language problem, there is no need to wait for your e-in, they also give it over the phone. By the way, I don't know if it can be received without faxing beforehand. It may be necessary to make a written application under all circumstances. I wanted to share my experiences, good luck to everyone.

We welcome you and wish you success. We thank you for sharing your experiences.

Have you had any problems sending money from your bank in the USA to Turkey, etc.?

Greetings startupsole team and dear followers. I founded my Wyoming llc company with Incauthority for 115 dollars. On the 12th day, I was able to open my Stripe + Wise accounts and start trading. During this process, I sent e-mails for support and they responded quickly to all my e-mails. Endless thanks to the team for their support.

Thank you for your valuable comment, we wish you success in your business. We try to respond to support emails very quickly.

Healthy days.

Sir, is the thing called business bank account something like Payooner because I saw it somewhere, if not, I am not sure if it is an Usan phone number, of course, and if we are going to form an LLC, is an Usan phone number required to sell on Amazon?

The bank account is where you collect the money you earn there. You can think of Payoneer as an intermediary for money transfer, not a full bank. Payoneer is not preferred much anymore, Wise.com or Mercury bank are used more instead. These platforms give you an Usan-based account number, so you can transfer the money you collect on platforms such as Amazon or Stripe to your country. For Wise and Mercurybank, a phone with an Usan area code is not required because they accept TR area code, and a phone is not required when forming an llc. It is only required when opening an account for a virtual POS system such as Stripe, since it is opened from the USA. If your target is only Amazon, there is no need for a phone right now.

Is Business Banking Account necessary for the company and what does it do? I am thinking of opening Payoneer, will it not be enough for my company?

And let's say we started e-commerce abroad, should I make the payments through Payooner, Business Banking Account or my own debit card? Also, I don't have a credit card, so there won't be any problem, right?

A bank account for your business is of course necessary if you will receive payments from abroad. Shouldn't you be getting paid instead of paying? What will you pay for? For dropshipping and if you are going to buy goods, a credit card is required. Find out if the transaction you are talking about is possible with Payoneer, because most platforms do not support that type of prepaid cards.

Hello teacher.

First of all, I am grateful to you for creating a magnificent site like this and providing us with valuable information that we cannot buy even with money in most places, free of charge and in incredible detail. I have read almost all your articles and 17 questions stuck in my mind. I know it is a lot, I would be grateful if you could take a look at it and answer it briefly when you have time. (If the answer to any of my questions is in your articles, then it does not matter whether you answer my question or leave a link to the article).

NOTE: I will sell products to other countries and then to America by Dropshipping on Amazon.

1) I don't know exactly how to fill out the Operating Agreement for other states. Can you provide a link with an example of this? Where can I find it?

Answer: https://www.northwestregisteredagent.com/legal-forms/llc/operating-agreement. Templates that you can use in every state are free of charge.

2) Do we have to fill out Form5472 and Form1120 every year without exception, even if we do not exceed the income or sales tax limit, starting from the year we established the company? Or must those limits be exceeded to submit the forms?

Answer: You are required to fill out this form as an LLC company owner, whether you exceed the limit or do not trade at all.

3) Is it enough to hire a tax expert like Alex Oware once to fill out these forms until April 15 of each year after the year we founded our company? (So it will cost around $300 at the end of each year). So, we don't have to be in touch throughout the year, right?

Answer: It is enough to work with a consultant every year during the tax period, he will guide you. Unless you have a very large trade volume, you do not need to work with a consultant constantly. You can only work with a consultant when you fill out the 5472 form.

4) What information does the expert need to fill out these forms? In other words, how many sales did we make each year, where did we sell them, how much turnover did we achieve? If he needs this information, do I just send him the Amazon data or do I have to keep a record somewhere?

It would be better if you keep all the information, because when you fill out that form, they ask for the total of your annual income and expenses. Even if not individually, accountants report the income and expenses in total to the IRS with that form. In this way, what you bought, what you sold, and what you earned will be a good report for you.

5) I am thinking of establishing the company in Wyoming. So, the only tax I will pay will be federal income tax (Since I sell on Amazon, Amazon will collect and pay the sales tax itself anyway). Well, this is it. What is the limit we must exceed to pay federal taxes?

Answer: Taxes vary depending on the geography you sell in. The best answer to this question is your accountant, you sit down and present the reports at the end of the year. Good accounting will save you from a serious tax burden on Amazon.

6) All Register Agents provide a customer panel in the standard package, right?

Answer: IncAuthority sometimes gives panels and sometimes closes them. It has become a bit inconsistent lately, but all other agencies provide panels.

7) If we are going to fax the Artificial of Organization document together with the SS4 form, should we turn these two documents into a single PDF or send them separately?

Answer: A single PCF is faxed as multiple pages, with the first page being SS4 and the other pages being formation documents.

8) Is there any useful website/software you recommend other than what is written on the site? (For accounting or other work)

Answer: Stay tuned, we share new methods as we find them.

9) If we sell on Amazon to other countries rather than America, will we pay income tax?

Answer: We have no information, you can talk to your accountant about this.

10) Can you recommend an affordable tax expert (or one you use) to fill out and declare the annual forms? Or should we read the article in which you provide information about accounting firms and choose it ourselves?

Answer: Since giving accountants and accounting advice involves serious legal obligations, it would be more appropriate to make such choices yourself.

11) A website is important to open a Mercury bank account. That's why I want to set up a website. Where can I find out how to set it up? Is there a resource you can recommend?

Answer: You can set up a simple site with WordPress. When opening an account, it is important that the site is in English and has full content.

12) ITIN is definitely required for Paypal, right?

Answer: If you connect with a foreign VPS and enter “1234” or “0000” in the last 4 digits of the itin field, that part is passed, but there is no definitive information whether identity verification will be required afterwards, but this way, an account can be opened and bank payment approval is passed.

13) Other states like Kentucky also have a place like OneStop Portal to register our own company, right?

Answer: There are similar portals in all states, but they have different features.

14) In one of your previous articles, you said, "If I establish a company, Delaware and Wyoming will be my last option." Could you please explain the reason for this in detail? Out of all the states, which one would you choose and for what reason?

Answer: I would choose the state according to the work done, if you are interested in Amazon, Wyoming makes more sense, but if you only need a stripe account to make payments, Kentucky or New Mexico make sense.

15) Which Register Agent would you personally recommend us to work with?

Answer: I recommend incfile. Incauthority has recently changed its policy and support and response times have become very long. I will continue with Incfile for the first year and move to a cheaper Registered Agent in the following years. It is possible to find many affordable Registered Agents on Google.

16) In the Wyomind Discount Agent review, you wrote "No Franchise tax" in the advantages section. Is this Franchise tax what you call Franchise tax? If so, that's $50. Did I mess it up?

Answer: The annual filing fee is $50. It is available in Wyoming, the franchise tax part may be spelled incorrectly, we will check it again and correct it.

17) You wrote in the review that IncAuthority's registration agent fee is $99. But when I talked to them about the fees, they said it was $149, which confused me. Did I misunderstand something or has the price changed?

Answer: It's still $99, but they always charge extra when you contact them. It would make sense to use such agencies only for company establishment and move to a different agency next year. The most stable agency at the moment is incfile.com, with the first year free.

Hello, thank you for your comment. I answered all your questions under your comment.

I can't thank you enough, teacher. May God bless you. No one could help you this easily. You are the king :)

You're welcome, what does that mean, greetings.

Hello,

“Your business must register with the Department of Revenue for a corporation income and/or limited liability entity tax account” from Commonwealth of Kentucky department of revenue. Has anyone received a state notice with its content?

I tried to register as described. But I couldn't proceed because it required an SSN for the relevant person. I would be happy if anyone has experienced a similar situation and shared information.

ps. Also included in the article:

Failure to respond to this request within 10 days will result in administratively issued tax

account number(s). Estimated tax assessments may be made pursuant to KRS 131.180( 4 ). An additional penalty for no less than $50.00 may be assessed per KRS 131.180(6) for failure to obtain all required account numbers, permits, and licenses. To avoid these assessments and penalties, complete the online registration using the Kentucky Business One Stop portal. Instruction for using the Kentucky Business One Stop portal are included in this mailing.

Hello.

There is an article on this site about how to register the company you established in Kentucky to the OneStop Portal. If you haven't seen it, search for it, read everything written carefully and follow the instructions exactly. But I don't know if you have already seen the article and acted accordingly and it still asks for an SSN.

We have completed the process regarding this issue that I asked about. I would like to share our experience.

We called the contact number in the incoming letter and explained the situation. *We have been informed that we can proceed without getting stuck in the SSN stage by filling out the 10A100 form. We filled out this form carefully. We called again and got information about the points we were stuck on. They are very helpful. When we completed the form, we sent it by e-mail.

The next day, we received an e-mail from the revenue department stating that a member of staff's SSN information was missing and that we could call them for this information. We called this person and told him that we were Non-US Non-Resident and that we could not provide an SSN. He said that this information was sufficient and that he would complete the transactions. The next day, we received an e-mail stating that the process was completed.

*https://revenue.ky.gov/Forms/10A100.pdf

Thanks for sharing.

Thanks to you, I formed my company in Wyoming with Incfile. They filed it within 4 days in total and processed it very quickly. Incfile customer panel is very good guys, they have thought of everything for company management, you can manage taxes, domain, website, everything from the panel. I can recommend it to my friends who want to set it up, they can trust it blindly.

I would like to thank Startupsole for providing us with such convenience.

Congratulations to your company, yes Incfile is a very customer friendly and reliable agency and its processes are very fast. When you add an extra acceleration package, they form an llc on the same day. Even if you don't buy it, they take action quickly anyway.

Do we have the chance to form the company first and then apply for e2 (to get the company in order) or should we do it on the same dates? Thank you.

Hello

We do not know much about visa systems, but logically, you must first have a presence (company) in the USA and the application must be made by showing this presence. Otherwise, if you apply on the same date, you will be applying for an asset that does not exist yet.

Hello,

I cannot make the payment. I enter my credit card information (I tried both virtual and normal ones.) But the result is the same. The strange thing is that the credit profit remains in the authorization for the payment.

The transaction was rejected due to AVS mismatch. The address provided does not match the cardholder's billing address.

That's why it gives an error. Has anyone experienced this?

Hello,

This happened to one of our followers before, but his card could not be withdrawn even though it was open abroad.

Card address mismatch (AVS) returns with the address mismatch problem in some payment gateways, especially for foreign buyers.

The transaction in the provision will be deleted anyway, it will probably disappear after 24 hours, there is no problem there.

If you do not have another card, do not force it from Inc Authority, instead install it https://startupsole.com/go/incfile/ This agency is exactly the same in terms of price and service.

Good evening.

Thank you very much thank you

I also established my Wyoming company with the incauthority agency. I had a lot of questions in my mind and was undecided, but the Startupsole team supported me more than necessary via e-mail during this process, thank you.

I thank them and wish them success :)

You're welcome, Ms. Esin, we try to help everyone who needs support whenever we have time. It's nice to find it useful. Congratulations to your company, good luck and good luck.

They say you cannot work for the company we formed in the USA. Is this also valid in the scenario where we stay in Turkey?

What exactly do you mean when you say you can't work? Do you mean working as a registered worker/personnel in the company?

I saw something like you can't work without a visa. In most places, they said you just set up an llc and hire employees and it works, but I don't know if it is valid while living in Turkey or the USA.

If you open an llc in the USA while living in Turkey, that company will not offer you a Visa opportunity to live in the USA. The issue of recruitment is as follows: It does not matter whether you live in TR or the USA, you can recruit and employ one or more insured employees in your company, but the employees must have a social security number (social security number is provided to those with a green card, temporary work visa or a US citizen). . You cannot hire a citizen of another country as an employee in an LLC in the USA if they do not have a social security number in the USA.

What I want to tell you is whether working for the company I founded in the USA from Turkey creates a problem or not. Thank you for your interest and speed.

It won't cause any problems, have a nice day, I wish you luck.

Hello, I want to set up an llc for Shopify store using the same way. Can I open a business account on PayPal with the company I will form and the virtual phone number I have received?

Hello,

there are many shopify dropshipping entrepreneurs who established a company using this method and started receiving payments by credit card. However, the situation is different for PayPal because when you open a business account, they ask for your itin number and you are also asked to confirm the address of your company in the USA with a document.

If you can verify your address with an invoice (this is not possible with the system) and get your itin number, you can open paypal.

Wyoming today with Inc Authority

. When do the documents arrive on average? I wonder how many days it will take? Can I get eIN service from you after the installation?

Good luck, they complete the installation in 4 or 5 days and send the documents by e-mail as soon as the process is completed, so the process will be completed before the end of the week at most.

You can apply for Ein as soon as your company is listed on the state site. To do this, you just need to fill out the eIN form and we will do the rest.

Hello,

I will buy and sell products from wholesalers through Amazon. Therefore, I will need a Resale Certificate. I also need to work with an intermediate warehouse. I was thinking of establishing a company in the state of Wyoming, but if there was no difference, I thought why not establish it in Kentucky.

Do you think there is a difference between Kentucky and Wyoming that would affect me? Which one do you think I should choose?

Hello,

In Wyoming, a resale certificate can be easily obtained from the state website. It is also accepted in Kentucky, but the process is a little more complicated.

You can see a video about obtaining a resale certificate step by step in a comment under this topic.

https://startupsole.com/reseller-license-resale-certificate-seller-permit-nedir/#comment-903

In general, Amazonians prefer Wyoming, and wholesalers are said to be more accustomed to working with Wyoming companies. However, the choice is up to you.

Thank you for the response. Well, let's say my company is in Wyoming but my intermediate warehouse is in another state. Will I get this certificate from the state where the company was formed or from the state where the intermediate warehouse is located?

I thank you.

The document is obtained from the state where the company was established, but you cannot obtain it from another state since the company has no ties with it.

Hello, I sell via dropshipping on Amazon Canada and I have exceeded the $30 thousand limit.

Do I need to establish a company in the USA or Canada for my Amazon Canada account?

Will the company I establish with Incauthory or Incfile be valid on Amazon.ca?

Thanks in advance for your answer.

Hello,

Need to open a new account? Will you continue with your old account?

Thank you for your answer, let me summarize the situation as follows:

We have a 3-month sales account on Amazon Canada, based on our current company in TR. Yesterday I received an e-mail from Amazon, in a nutshell it says, “You must understand and comply with Canadian federal and provincial sales tax obligations for your sales on Amazon.ca.”

According to my research on the internet, there is a rumor that a company should be established in the USA after a sale of 30 thousand dollars is made, but there is no clear information. Our sales figure is close to 30 thousand dollars.

In other words, we are researching opening a company abroad to pay the taxes on our current account. Many people direct us to open a company in America, but the place where we sell is Canada and the place where we buy the product is America.

In this case, should we open a company and where should we open it :)

Thank you again for your interest and work.

Since you are selling to Canada, it is difficult to say anything clear about this. Your situation is a little different. Generally, those who sell to Usa form an llc in Usa and pay their taxes to Usa. You convey this situation to a financial advisor and they will give you the most accurate information. Now, if we tell you to form a US company, that part is easy, but you should consult an expert about the tax-related processes so that you do not endanger your business by making transactions again in the future.

Thank you…

Hello teacher!

I do the same job and I applied for a company in America 4 days ago, but my situation is not like yours, so I will leave a link here in terms of earnings 'instagram account':

https://instagram.com/muhammetcihangiraydin?utm_medium=copy_link

Search for muhammet cihangir aydın on Instagram. There is a telegram link at the top of the page that appears, there are 1000s of droppers there, I hope someone can help!

On this occasion, I will ask for your prayer! 🙂 🙂 May God grant you fruitful earnings!

Thanks for the support.

We would like to thank you admin, for providing us with such valuable information and allowing us to benefit from it!! May God bless you!

Frankly, there is no other source in Turkey that explains and details how to set up a company so easily and even guides you!

I sincerely thank you for your services, I'm glad to have you!

I hope all entrepreneurs benefit from this page!

“I have now applied to receive my EIN service application from the startupsole team. I am looking forward to the results. I will share the details on the startupsole ein page!”

Hello, thank you very much for your comment and thoughts. A detailed email about your EIN application has been sent to you. Success and good luck!

Sir, I have 2 questions. The 1st question is how will we pay the annual fee of 99 dollars that we have to pay since Incauthority does not give us a panel? The 2nd question is when and where should we pay the state fee? I would appreciate it if you could give me information about these. Also, I completed the installation today as you said, thank you.

Congratulations on your new business and good luck!

1. Yes, there is no panel in the free package. When it's time to pay, they send you a reminder email. If you want, you can move it to a different agency next year. The decision is yours, but if you have not used a virtual card (I always recommend a virtual card), they can automatically collect $99 when the payment day comes.

2. If you started your company in Kentucky, this is very simple. You can make your annual payment online through the state portal with your credit card. It is generally done online this way in most states. You can make this annual report by June 30 of the next year or you can pay it even earlier, the important thing is that it is next year. There is a step by step guide on this topic here: https://startupsole.com/llc-icin-yillik-raporlama-annual-report/

I wish you good luck again.

Thank you again sir, I received the ssn from incauthority during the installation, do you have any information about the time it takes?

You're welcome The company will be formed by the end of this week, they will inform you via e-mail. The ein you call ssn will arrive in around 45 days.

Hello,

I would be glad if you could answer my questions.

– A different address appears in the The street address of the company section in the Articles of Organization document. Does this have anything to do with Inc Authority? The correct contact address I received appears in the mailing address of the company section.

– Should we write the TR address or the virtual address in the address section of the Membership Listing Statement?

Hello, the answers are below;

1. The address in the Company section is the address of the registered agent, that is, the incauthority's office in that state. They must have an address in that state and the address of registered agents must be written in that section, so this is normal, so there is no problem.

2. You can write your US address on the Membership Listing document. Sign the relevant areas and send them digitally, keep the originals in a file.

Thank you.

So I founded my company, and when the coupon came out, I ordered a seal and a certificate. It worked out. For your information, the coupon provides discounts on additional services.

I applied to install it today, thank you for your help, YOU ARE GREAT!!!

You're welcome, I wish you good luck :)

Thank you sir, thanks to you, I completed the wyoming address + kentucky llc installation for 55 dollars. The documents arrived today, I signed and sent them from incauthority, I did not receive any additional service or agreement. Now the only thing left to do is to get the certificate. I can recommend it to those who want to install it because they installed it in 5 days and I had no problems.

I hope you enjoy your new venture and good luck!

Hello, what are the latest situations? Can you still recommend it?

Hello, there is no problem with the installation, the system always works the same, do not worry.

Hello, were you able to get the email number or push it?

Ein applications are made after the company is formed, the eins of the applicants have started to arrive. You can read our article for itin. Itin is not necessary for stripe, it is enough.

Thank you sir, you explained it very well. But there are 3 questions that come to my mind.

1- Currently it is May 4th, but taxes are paid on June 1st. When should I apply for the company? Is around June 4th appropriate?

2- Let's say we formed the company and completed all our transactions. After starting its operations, are there any fees (annual or monthly) other than the state tax, registration agent fee, telephone fee, etc. that you mentioned in your articles? For example, accountant fee, withholding tax as in Turkey, corporate tax, withholding tax. Can you tell me exactly what kind of expenses are incurred, including taxes?

3- Let's also say that there are problems with the company, who will we deal with? Is just the registration agency enough? Isn't there something like an accountant like in Turkey who guides us and informs us that now it's time to do this and that?

You're welcome

All your questions have been asked before and answered. Moreover, the answers to all of them are actually available in the taxation category in the form of long articles with their sources. But I'm writing again, you can read it.

1. Even if you set it up now, you won't be paid franchise tax this year, you'll pay $15 next year, so it makes sense to set it up now.

2. There is no obligation to have an accountant. They do not have a system like ours in the USA. Even the fatutanuzi are written by hand and you save them somewhere. Not every invoice is processed monthly to the tax office. In addition, you fill out a form called 5472 every year, and at that stage you need an accountant.

3. There is no problem in the company, that is, it is not something that can break down like a car :) The people authorized to run the company there are the registration agencies and the government is the one dealing with them. However, a lawsuit filed against the company etc. If so, then they will step in and ask if you will hire a lawyer. When there is a subpoena or legal correspondence, they take the documents and provide you with information. That's why they are paid a fee every year.

Thanks to your valuable information, I formed my company. Thank you very much. When will I hear back from incauthority?

I wish your company good luck and success. Your company will probably be formed during the week and they will send the documents before the end of the week. They generally install in 3 or 4 days and turn around in varying times depending on the additional services you receive (varies depending on document preparation times).

Hello sir, thank you for your valuable articles.

I will start a dropshipping business. Will this company be suitable for dropshipping and e-commerce?

Hello,

Of course, it is suitable for e-commerce or dropshipping. You can easily and legally receive payments via Stripe with this company. You are forming a normal LLC company, there is no problem after all.

Can I get a utility bill from Zadarma or Sanotel?

No, unfortunately telecommunication companies that provide this type of SIP service do not provide utility bill proof.

Thanks for your effort, this method will work for me. I had a digital product project in my plan, I was going to get service in return for commission by using an intermediary for Stripe, but this method is more convenient than that. I look forward to your posts, good luck.

Thank you, this method is perfect for you. You can quickly set up, submit your EIN application and stay tuned for different content.