In this guide, we will detail how to form an LLC company step by step with Northwest Registered Agent in the Usan state of New Mexico.

With the steps in this guide, you can form your company not only in New Mexico but also in different states because the installation steps and processes are exactly the same.

Our new venture platform: Startuphub is on publication

Our Startupphub vehicle, which collects on a single platform, from business idea to company installation, state selection, brand creation, bank and strip pre -approval tools to advertising text production

Click here to discover the platform now !

There is no annual report, no annual fee, and no state income tax in the state of New Mexico. Generally, it is a very advantageous state for shopify, e-commerce, software and consultancy type businesses.

If you plan to establish a company to do e-commerce on Amazon (or if you are going to run other types of business at the same time), Wyoming would be more advantageous instead of New Mexico. If you are going to establish a company related to Amazon business, you can find the reasons and details Wyoming LLC Establishment guide.

It is essential to receive service from a Registered Agent in the USA during and after the company formment phase. Authorized representatives can carry out the company formation process remotely for people who do not reside in the USA.

In this guide, we will try to explain step by step how to establish an LLC company through Northwest Registered Agent First, let's talk a little about Northwest.

We signed a special agreement with Northwest and became Northwest's Premium business partner. Hereby, we received free registered representation for the first year and a new discount of $39 setup fee for LLC setups with Northwest. With our reference, you can now set up an LLC with Northwest by paying $39 (including address) + state fee.

Northwest is a very large Registered Agent employing over 300 employees. Northwest is an llc known especially for its legendary customer support and service. Trustpilot and Google reviews confirm this because there is almost no one complaining about this company.

Features such as high-level service, support, no hidden fees, free operating agreement, company membership certificate, fast company setup, and advanced customer panel distinguish it from its competitors. This does not show that other companies are bad, but their interest, support and business follow-up are truly tremendous.

Once you form an llc with Northwest and continue to work with them in the years to come, you will realize the difference in their services.

Requirements and Things to Know

- Northwest, the address is free in the installation package. In other words, you can set up your LLC at their address using their own address, thus eliminating the US business address problem for life.

- Passport etc. from you. They don't want it, they don't have any extra requirements.

- Compared to other Registered Agent companies, their support services and customer panels are tremendous. You can manage your company completely from the panel.

Cost of Forming an LLC in Usa with Northwest

Depending on which state you will form the company in, there are one-time state filing fees that must be paid at the beginning of the formment, which vary from state to state. These vary by state. Additionally, some states require you to pay franchise tax in subsequent years, while some states do not.

One-Time Costs for Installation

- Filing fee payable to the state:50$

- EIN Number: Free (If you install through Northwest with our reference, we get your EIN number free of charge, details are here )

- Northwest Registered Agent service and company setup fee: 39$

Post-Installation Costs

- Registered Agent annual service fee is 125$ / Year (The first year is free)

- Annual State Tax (Franchise tax): $0 No annual state tax in New Mexico

LLC Company Formment Steps in Usa with Northwest

You can follow the steps below to form an LLC company in the state of New Mexico.

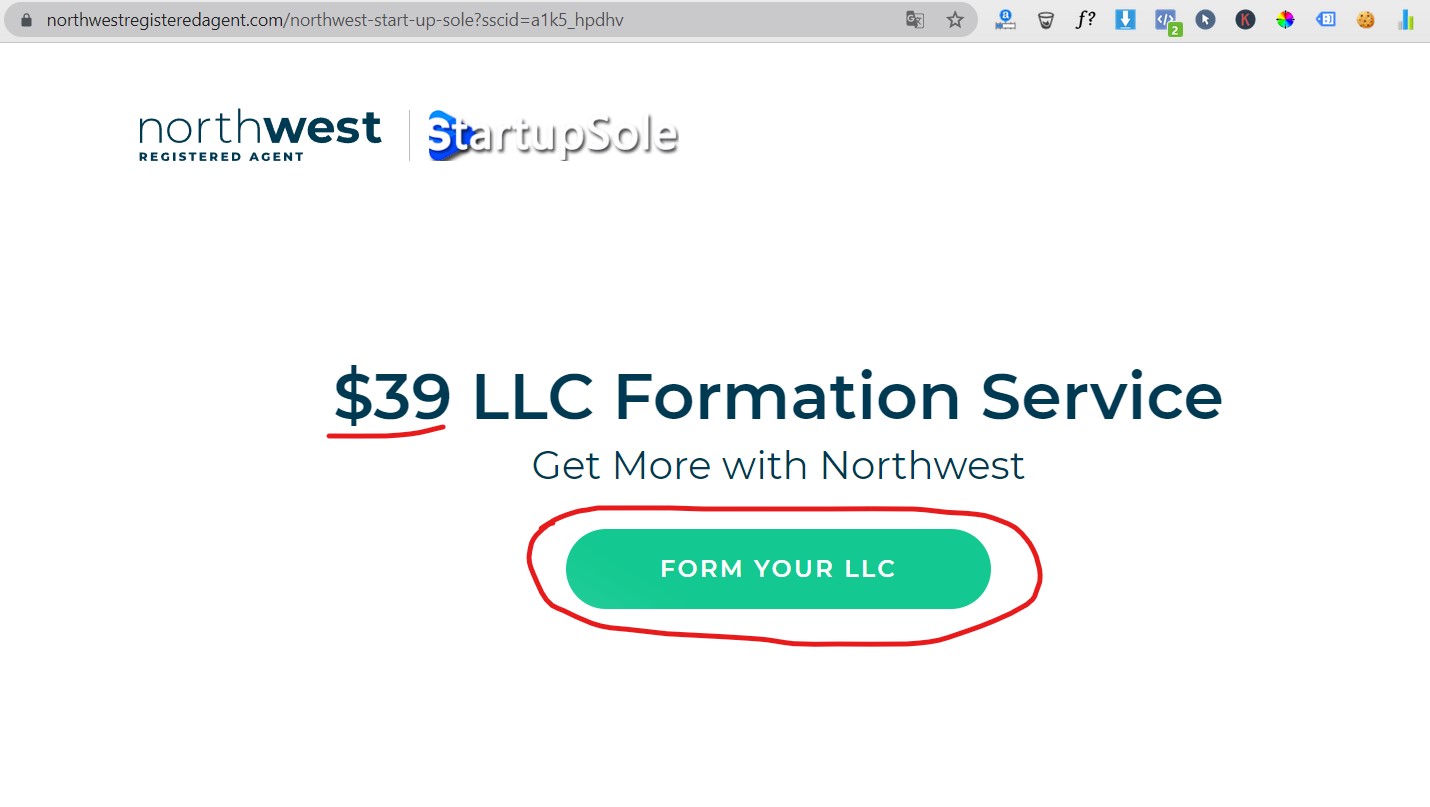

- First, log in from this link click the FORM YOUR LLC

NOTE: When you access the Northwest website linked link, We also get your EIN number free of charge. To apply for EIN, simply fill out the form

After accessing the Northwest landing page with the Statupsole logo from our linked link, the FORM YOUR LLC button and take the next step.

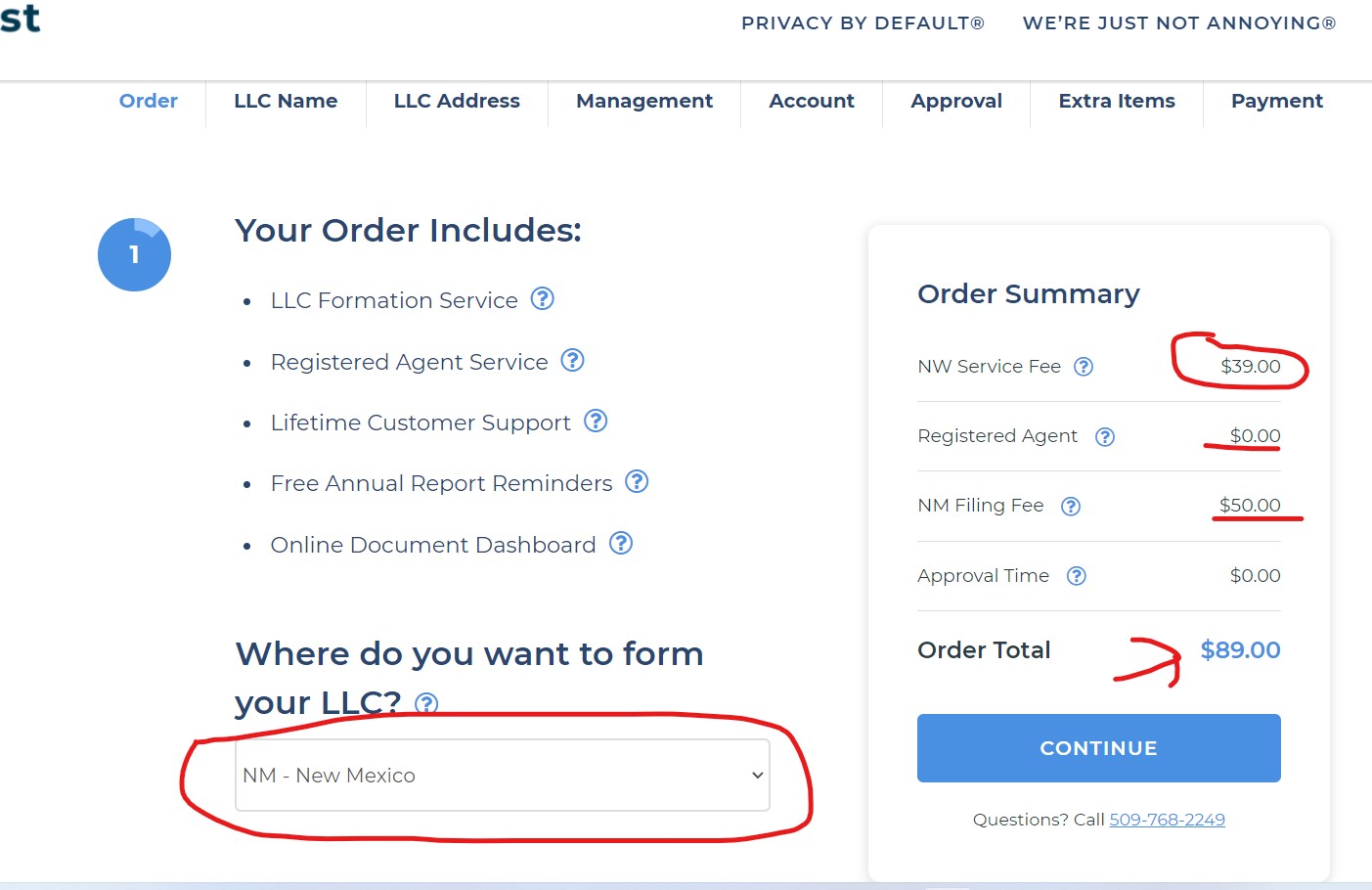

- Next, select New Mexico as your state

- $89 as a free registered agent + business address for the first year, with only $39 + State filing fee .

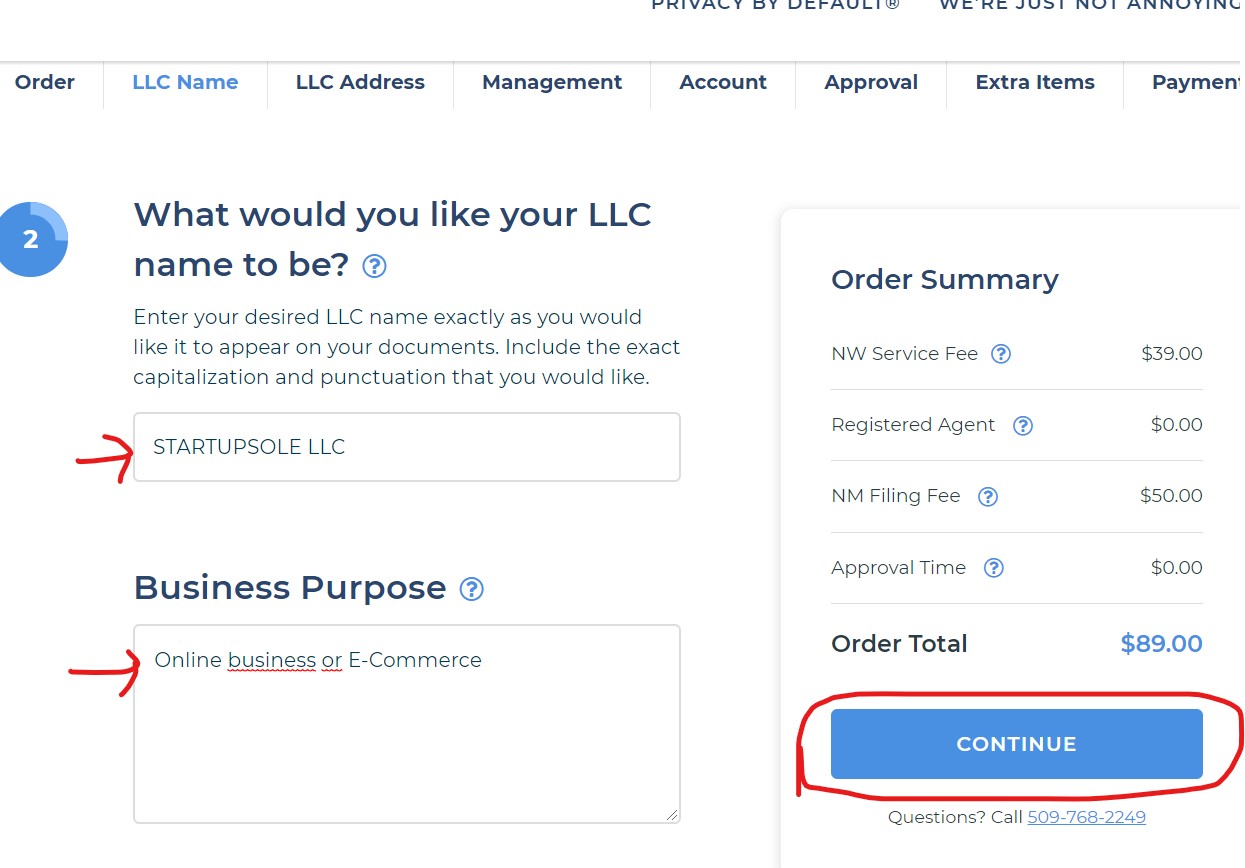

- Continue to move on to the next step. In this step, you will determine the company name.

- We determine the company name and enter a few words of description about our company in the Business Purpose section. After entering the company name of your choice in the required field, Continue button and move on to the next step.

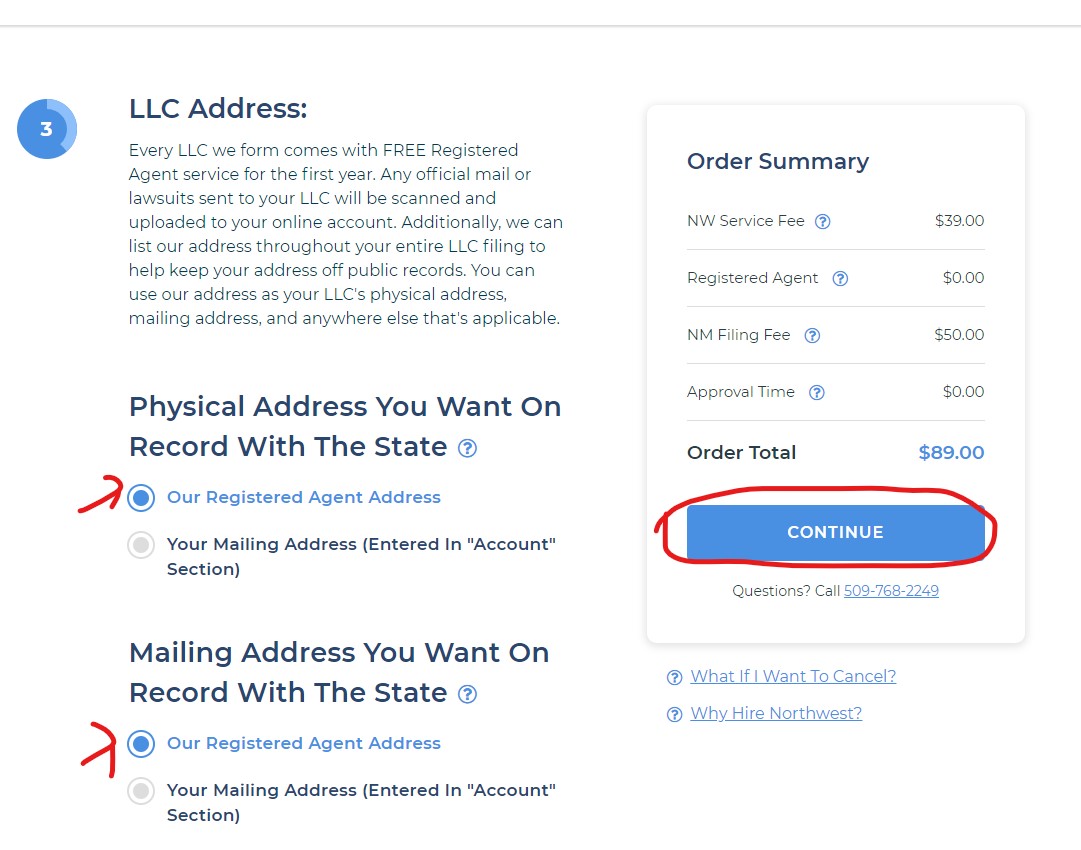

Leave the address options at the bottom as they are, because Northwest is an agency that allows us to use its own addresses. Therefore, there is no need to use different address options, they already provide them for free.

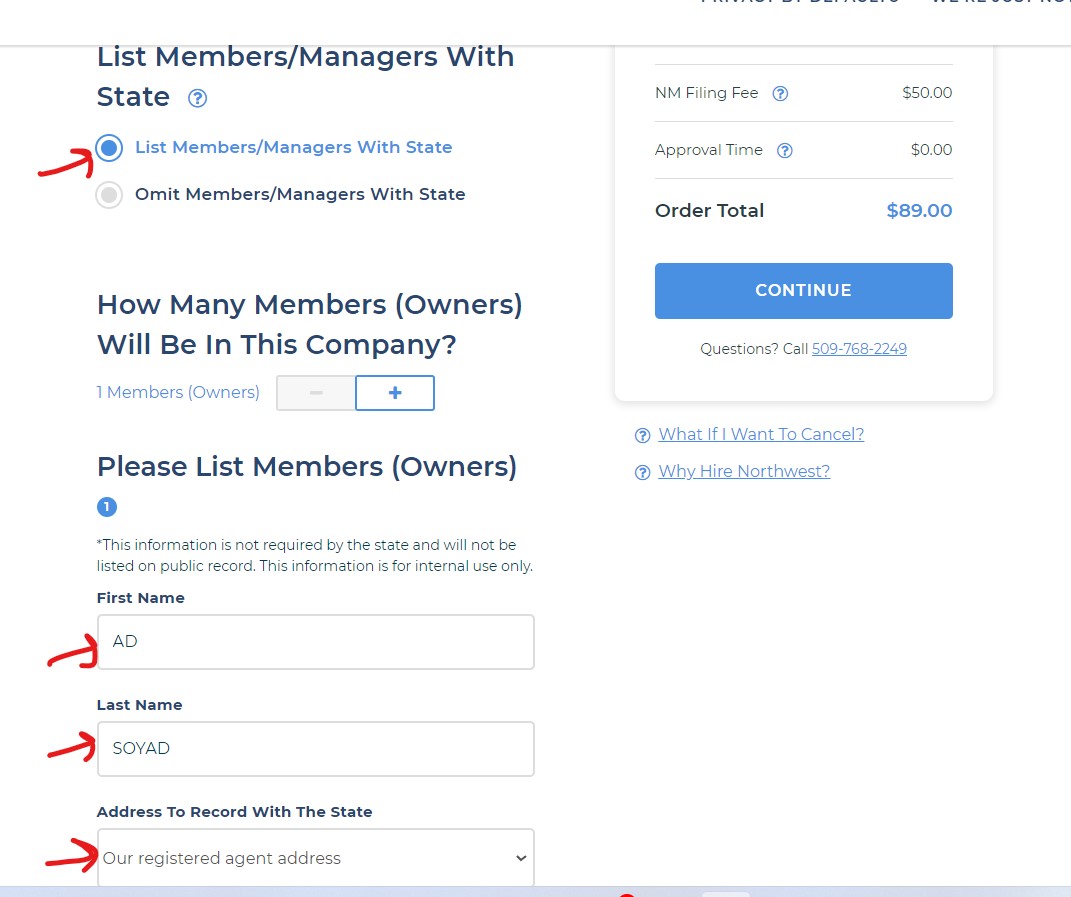

- Management Type: At this stage, we choose "Member Managed" as the Management Type because you will manage the company. If a manager will manage the company, then you will need to select the Manager Managed option and provide the information of the manager you will appoint.

- Number of members: Select the number as 1 because we are forming a single-owner LLC, then enter your name and surname without using Turkish characters. (Ex: OMER instead of ÖMER, ALI instead of ALI, etc.)

- We can leave the address as Our Registered Address and click “CONTINUE” and move on to the next stage.

- In this step, set an email address and a password to access the Northwest panel.

- In the contact information section, enter your full address in your country (Türkiye).

- Enter your mobile phone

- Send a copy of your lawyers and/or legal notices to your attorney? Tick No.

- Go to the next stage by clicking “CONTINUE”

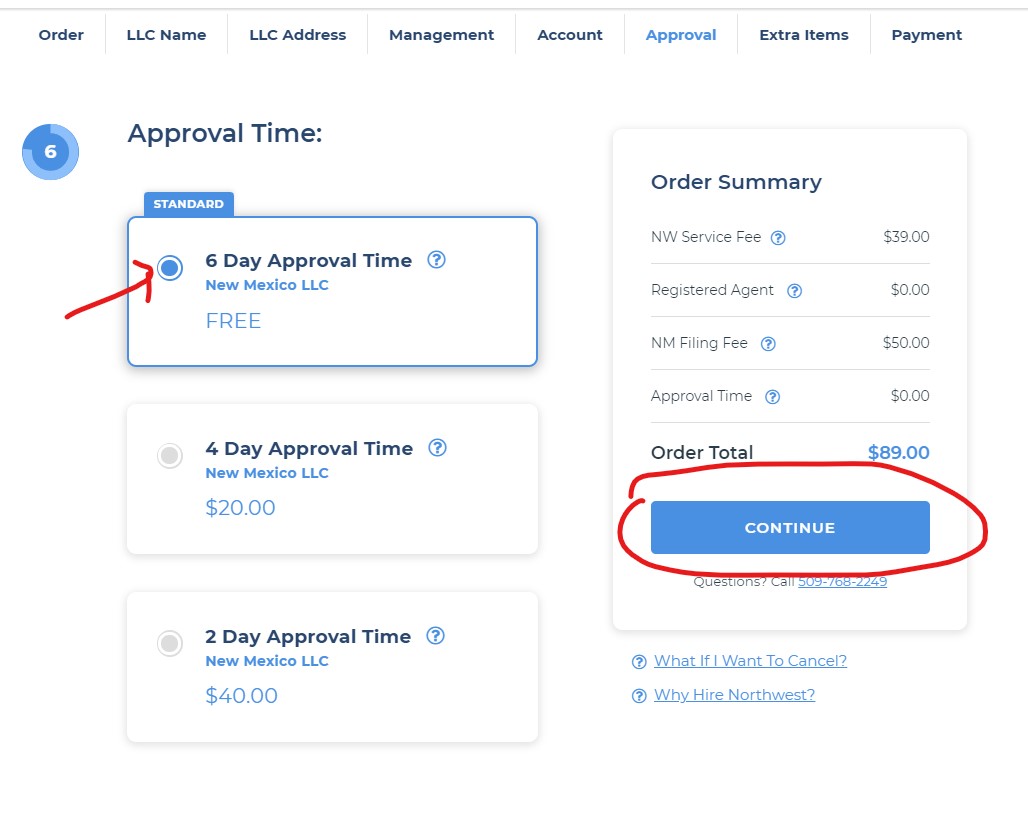

Select the Approval Time section as Free, the approximate installation time is 6 days. If you want to speed up, you can pay extra, but there is no need for this because your company will be formed in 4 business days. Select the Free option and click the Continue button

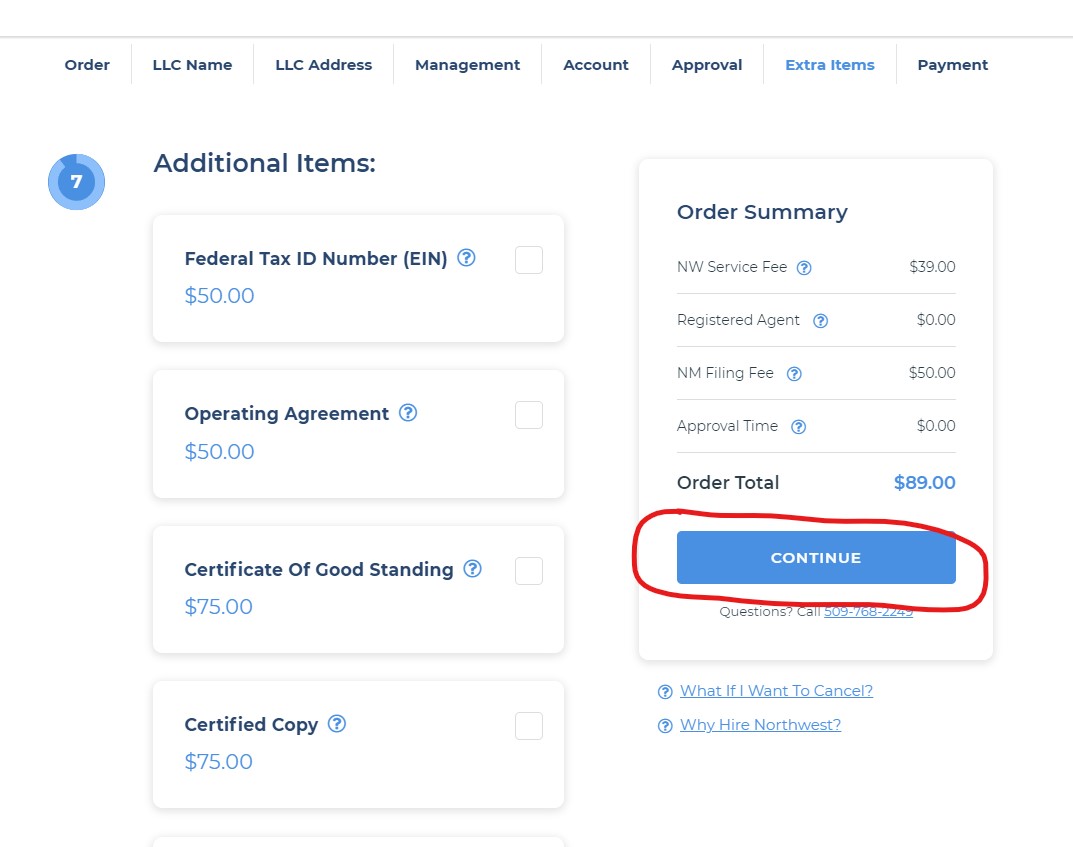

In this section, additional options are presented to you. If you prefer one of these additional services, you can choose and pay extra. If you do not want additional service, proceed to the next step by clicking Continue.

Last step. In this step, you can see the total amount you need to pay on the right. Let's look at this;

Last step. In this step, you can see the total amount you need to pay on the right. Let's look at this;- Filing service: $39

- New mexico standard filing: $50

- Annual Registered Agent fee (including Address) 0$ Total 89$

You will only pay $125 registered agent fee (including company address) for the next year, so these setup fees are one-time and the amount to be paid next year, including address, is $125.

You will only pay $125 registered agent fee (including company address) for the next year, so these setup fees are one-time and the amount to be paid next year, including address, is $125.

On average, agencies' annual registered representative service fees are between $100 and $200. Therefore, we can say that Northwest, including the address, is a very economical solution.

Company formation takes approximately 3 or 4 business days for this state. Afterwards, you can download your company formation documents from your panel and save them electronically.

Everything appears clearly and clearly on your panel. Northwest has a pretty easy panel. You can find some information about the customer panel in the article Advantages of Establishing a Company with Northwest Registered Agent In this way, you will have an idea about what kind of customer panel you will have after your company is established.

Thanks to this guide, we explained the process of setting up a New Mexico company, including address and operating agreement, for a price of only $89.

Thanks to this guide, we explained the process of setting up a New Mexico company, including address and operating agreement, for a price of only $89.

If you want to form an llc in other states (Wyoming, Delaware, Florida, Kentucky, etc.), all the steps are the same.

When you receive LLC service through Northwest, you will have very friendly customer support. They quickly answer any questions you may have via email or phone, and you don't have to pay extra for it.

If you are stuck on any point, do not hesitate to comment. All comments are responded to as quickly as possible.

Good Luck!

179 comments . New Comment

Hello, I'm having a problem with Northwest. When we were going to make a tax statement last year, they changed their free address when we set up the company. After long correspondence, the Northwest official said that we could use the new address, then we showed my new address with my accountant in the declaration and we proceeded in that way. In the declaration approval form from IRS, that address is now registered. But the problem starts here, when I enter my Northwest customer panel, I see two addresses, one of them is the old Company and Mailing Address in the Formment Universe, and the other is the new address that you can use the registered agent service address. We did not have a problem last year.

This year we will make a tax declaration and ITIN application at the same time. Full Accounting Naturally, the company wants me to enter the company's address and at the same time asks for an address where ITIN's letter will be physically delivered. I got stuck in my mind and I contacted Northwest to clarify the address before the statement. Then they say that I should not be able to use their address for the declaration of IRS or to come to the letter of ITIN, instead of renting a paid address. However, the situation of our EIN letter came to their first address, even EIN, you made my application. I couldn't get out of it, we solved it in a way last year, but I am looking for a reasonable solution because it would force me to buy an extra payment for this year. Is there a way you can recommend? Sorry it has been long. I would be glad if you answer, thanks.

If your new address is defined, you can use your new address in all the next process. Probably they may not understand the issue as long as you continue to receive the Registered Agent service from them, you can use the updated new address both in the application of ITIN, both in general and in the tax declaration. Forcing them to get a new address may probably be due to disagreement. Have you paid your Northwest Registered Agent? Does your service continue? Answer If yes, you can use the current address

Thank you for your quick answer, Mr. Nazmi, yes I made my payment, the service continues. In fact, I explained everything very clearly to them if they misunderstood or if they did not understand, I will not be able to comment, I will say such things. Already the same address in the tax declaration last year because I do not have a lot of problems legal as a legal end. But my only concern and my fear is not to reach the hands of the letter or not to be delivered to me, I hope I do not experience a setback, thank you again.

The new address is already active, if you make your payment on time, you will not have problems with the documents that install the incoming documents on your panel. Now you just need to use this new address.

Hello today, I made an llc application in the morning, but I got a payment error. My card is not a normal debit card prepaid. What should I do?

Did you talk to the bank? In general, such problems may be due to the lack of compliance of the address entered with the address in the card center. Try a different card or talk to your bank may be useful, especially in an overseas card expenditures.

I just talked to the bank, the amount appears to be as 0 I asked him to be at the address, but he said not that thing and he said call the place you want to buy.

If you want to do it, maybe a update may be a update, sometimes they can be a software update because they are out of working hours.

TR clock with a new hidden scanner on a new hidden scanner and pity the order page again and try to create an order. If there is a problem again, send the screen image to create support request to solve.

Have a nice day

Greetings again, thanks to your information, I applied for the company, I will write you for EIN for the documents. In the video of a person who knew like you, I saw that some operations should be done after the application of Northwest's own panel. I was checking from there, you also visually mentioned on this page, but I want to confirm it because it was not written as text.

We need to select List Member, one of the 'List Member and Omit Member' options during the application phase, right? I did so because I saw it in the visual.

It also seems as follows in the panel:

Would You Like Members Managers on the State Record

Yes

Would you like to list Members Managers on the State Record. In this way, your name is displayed in state records and company documents. If you choose an Omit Member, your name will be invisible privacy, ie anonymity in company documents and state records. They usually want it to be listed, but you can choose OMit Member if you want privacy.

Greetings, this way, so I want to open a company with this campaign in New Mexico. And I will get support from you for EIN. But I have a few questions that I think of. For a long time, I have researched and examined every topic from every site and video. Let me briefly pass:

We can use the address of the 1st company, but will there be a problem with other operations as there will be no unique suite number? (I don't open Amazon, but it may be in the future, I will do youtube adsense and global media works + bank transactions)

2. When I establish my company in this way, does this agent provide all the necessary documents such as the company installation certificate? Or will I have to do other operations. Nobody says where to be obtained by very important documents.

3. I will enter my address here because I am in Turkey right now, but when I change in the future (city or country) I think I will have to report it somewhere, but is IRS and Agente?

4. With the Wyoming site you recommend with Suit number, if I get an address, the installation of the company is a different state (New Mexico)?

5. When you searched this site on Google, I saw serious bad comments, do you think reliable?

6. How can I do invoice cutting with my company?

Sorry for asking a lot of questions, I want to open it right away, I wanted to clarify all issues. thanks.

Hello,

1- The bank does not have an address problem in strip opening, but the Amazon side needs a unique address. If you want both NM and special unique addresses, you need to get premium mail forwarding service during the order, then you pay 19 USD every month (for life).

2- They give you a panel, and after the installation, you do not need to obtain an extra document. Only send us a form for eın application and make your application. As a result of the EIN, the same panel is loaded as PDF.

3- IRS is not given a residence address to the US company address is given only agnet A residence address is given, which is also replaced from the panels easily.

4- Normally there is no problem, but if you open the Amazon ETSY account in the future, it will be a problem, other plalarforms will not be a problem. The company can be in different states in different states. The Amazon side is changing this situation.

5- There is no other address provider in Wyoming. The supports are very slow, but we have been using it for 7 - 8 years, even once we have not needed support, they upload to the system that comes once a year. Each business has bad comments, expectation is important, but as you use it at a more affordable price, there is no system. If you have a budget, you can use virtual office or monthly premium plans

6- Our blog has the subject of the research as a bill from the US company.

In fact, there are answers to all the questions you ask as an article, but we still answered your questions.

Thank you very much for your answers. I actually read almost all your blog. I may have forgotten when I read a lot of information.

I think I can open the company like this for now and change the company's address in the future (in the same state). I do not pay a monthly fee in vain, I get an address when I want to open the amazon. I guess that's the way, right?

And I guess this address is not a problem with Shopify.

Please, yes, you do not even need to change from the state you will take the extra address in the future and give it the address to the amazona. Only after the Amazon account is delivered at the opening of the account, the process is complete after taking it and entering the Amazon. They do not question whether your address is written in documents or whether it is in the state records because there is anonymity in NM and WY states.

Greetings, you shared a website link to check the company name in your Wyoming article, how can I find this control address for New Mexico?

Hello,

New Mexico State Portal is limited to access to some country IP addresses. For this reason, if you do not reach, we recommend you to access it with a VPN.

Name Search Link: https://enterprise.sos.nm.gov/search

Hello, I have established a northweste company, I have to pay a payment, what is the payment of the Representative Service registered in Wyoming ve

and what exactly do you help me?

The registered representative of your company in the USA is authorized to receive notifications and documents. We recommend your payment every year, or you can look at your company does not stay harmonious and healthy: https://startupsole.com/registerered-egent-Nedir/

Hello, I am trying to make $ 125 annual payment with my enpara card. I get the error when I set up my first company, I did it from the same bank.

Hello,

There is usually a problem with prepaid cards recently. We recommend using another credit card if any

Hello Northwest, we formed our company and I got a mail I have to pay $ 163, I need to pay for the annual report under the name of the annual tax declaration is something different?

This annual report is paid to the state every year. Normally 63 dollars, but Northwest adds 100 USD service fee for you. If you take it yourself, you will only pay the mortar. There is an article about how to do it here; https://startupsole.com/wyoming-llc-icin-yillik-rapor-nasil-

If you do it yourself, do not take into account the invoice or do not want to deal.

I got a similar message from Northwest. My company is at New Mexico. How can I do this myself? Do you have a article to help Nazmi Bey?

Yours must be different. There is no annual report in New Mexico. The invoice that comes to you is for the annual registered representative renewal. Because the first year is free representative service company is renewed close to the anniversary of the formment, so you should have received an invoice. All -in -one service fee invoice for address service and registered representative fee. This is the invoice that you should pay for your company to remain healthy.

Greetings Nazmi sir,

It has been a year since I opened an LLC in New Mexico. I have registered and used many services, especially Wise, without any problems. Last time I was using the Facebook&Instagram shopping feature, it asked me to verify my LLC. It asks me for ITIN number. I tried giving my EIN number but it was not accepted. We formed an LLC and obtained an EIN number, but we do not automatically receive an ITIN, right? Do we need to buy it separately?

Yes, it will not come automatically, an extra application must be made.

Hello.

Now I got this mail from Shopify:

The Taxpayer identification Number (TIN) on your shopify payments Account, which is requirered to prepare your annual 1099-k form, Doesn't Match IS Records.

Does this 1099-K form come with ITIN?

You haven't been asked for 1099-K form. The number of pushing you entered was not correct. It writes this way in the English message you sent

Hello,

I have established my company, but do you have an annual tax declaration service? If so, what should I do? Do you also have a BOI report service?

Hello, we do not provide declaration services, but there is a Turkish consultancy firm in the USA that we recommend and have a business partnership with. You do not need to make a BOI report because it has been stopped by a court decision, but if you want to get tax service, you can look at this page and get the appropriate service.

https://startupsole.com/amerikada-sirket-vergi-beyani/

Thank you very much for your quick response. When I enter my company's website, there is a notification that I need to fill out an empty report. Is there any harm in deleting it? Because I did research in several places, I was told that there was a penalty.

You can delete BOI, it is not mandatory at the moment, it is optional, there is no penalty, details are here: https://startupsole.com/fincen-boi-raporlamasi-iptal-edildi/

Hello, should I use accounting software even if I make sales to places outside Usa? Will I submit a declaration of these sales at the end of the year?

Keeping preliminary accounting records regularly gives you an advantage; you can review what happened financially (both for you) during retrospective checks. If there is no record, bigger problems may occur. It is better to do so since it is kept free of charge.

My company was formed in New Mexico, but my address says STE N in the suite number section. Shouldn't I have a special suite number assigned to me? Like STE 1234.

If you have not selected the premium mail forwarding or virtual office options on the form page during the order, a special suite will not be assigned to you free of charge. If you need a suite address, you need to purchase it as an extra service from the panel.

Thanks for your quick response. Can I get the private suite address now? Can I open a stripe and walmart seller account without a special suite address?

Of course, you can order it from your Northwest panel. You can definitely open your Stripe and bank accounts with these stock addresses and you will not have any problems. But Amazon doesn't like shared addresses very much, believe me, we don't know the Walmart side at all.

I've been reading and researching for days. I thought I would set up the company, your link is from the incognito tab, step by step. After setting it up, I realized that I forgot to write LLC in the company name. I wish they had put this pick on the form like all other agents. There is no change option on the panel. A stick stings the eye that is careful. Now I'm waiting for support to get back to me. Do we write to you for the EIN campaign after the company setup is completed?

Hello, do not panic, they will add the LLC extension automatically during the installation. Since you have selected the LLC type, they have to add it themselves. There have been additions before, but don't worry, the agent already added it during the installation.

You can fill out the preliminary application form for EIN.

Hello;

I have a few questions.

1- I think there were some changes during Northwest registration. NM-2 Days Processing fee is 52 dollars, I think there is a 2 dollar increase. There is also an option at the bottom of the same page: "We'll File Your Beneficial Ownership Information For You". When you select this option, an additional 25 dollars is added. Should this option be checked or can we just leave it off?

2-I read that foreign-owned LLCs do not pay taxes up to a certain limit. I wonder what this limit is, how much profit is exempt from tax until?

4-Once we complete the registration process, do we make any payments to Northwest for future years?

3-Do we declare foreign earnings in Turkey? Is there any tax deducted from us at the end of the declaration?

Thank you in advance.

Hello,

1. Yes, it is 52 dollars.

2. Boi is no longer required. You may not receive that service

. 3. You will pay taxes on US-sourced income. It does not matter whether there is a limit or not

. 4. It is billed as 125 USD annually.

5. If there is regular income, you can follow up. It would be beneficial to consult a consultant in Turkey for this advice. there is

Hello,

I founded my company in New Mexico in February 2024 (with Northwest). I got the USA phone number required for the transactions from Zadarma. My Stripe and Wise accounts are active, I opened them and it works. Do I still need to keep this number? Will a USA phone number be required from now on? I don't want to pay money every month if it's not necessary. Can I not upload money?

If you are using this number for verification when opening an account, do not cancel it. If you have not used it anywhere, you can cancel it.

Yes, I received it for verification when opening an account. Then I will continue the subscription. It may be necessary. Thanks.

Hello, I need help with something again. I hope I'm asking my question in the right topic. As a Single member LLC owner who does not live in the USA, what procedure should I follow if I want to work with an assistant to work together within the company? What are the specific steps to be taken to prove that he/she will work/work in the company legally? Or is it possible to present this person as an llc partner rather than an employee? Maybe we can do something like this, but it is very important that the process is completely within the framework of the law. I did some research, but I thought the process was very complicated.

It seems like a strange question, but since I always work alone, I didn't know exactly what kind of process I would face until now, so I wanted to ask you. I would be very pleased if you answer. Thanks.

Hello,

If you do not have US citizenship as the company owner, you cannot recruit or register employees on payroll to your llc company. Showing up as a company partner is also an option, but it is a bit complicated.

The best thing is that you can include your employee or business partner (for whatever reason you are making the agreement) in the company with a contract between you. Sort of like a contracted employee, partner or employee...

If you want to be even more professional, you can have a lawyer write a contract with your conditions and sign it for a certain period of time or indefinitely. If you want, you can also have it notarized. The easiest way might be this way

Mr. Nazmi, thank you for your quick response. Yes, in this case, the easiest way seems to be to make a contract, but I think that if we wanted to write the contract ourselves and have it notarized, the notaries in Turkey would not handle this matter. I don't know, am I wrong? As you say, I think you need to find a lawyer in Usa and get it written. This should be the most professional solution.

Another thing that comes to my mind is the issue of assigning a bank account. As far as I know, we can define additional accounts in Mercury for the people we will work with. Since we are not US citizens, will this also pose a problem in the future?

You can ask a lawyer about this issue. They also know the Notary part better.

You have account authorization at Mercurybank, you can open additional accounts, open additional Virtual cards and set limits.

Hello, I had a few questions, I would be very happy if you could answer them. It's time for the annual renewal of the LLC I formed in New Mexico, I will make my first renewal soon. I have a $125 payment to be made through Northwest. Is there anything else I need to do after paying this?

Another question I have is, do we have to make this payment on the same day? Could we encounter any problems if the payment is made after the due date? Since I don't know exactly how the procedure works, I felt the need to ask. Thank you, have a nice day, good work.

Hello,

you do not have to pay anything other than the registered agent fee of 125 USD. There is no annual state report or fee to be paid in the state of New Mexico.

You can pay Northwest's 125 USD registered agent fee in advance, on time, or it is recommended that you pay it within a few weeks from the invoice date. Otherwise, they will cancel the registered agent service. It would be better to stick to the payment due date and you don't have to make any extra payments other than that.

Thank you for your answer. I wish you a happy weekend.

Hello,

I am working as a digital marketing agency and Shopify E-commerce. Can I do these 2 jobs under a single LLC? Or do I need to open a separate LLC?

In this case, should I leave the "Business Purpose" field on the Northwest side as Using generic business purpose? Thanks.

Hello,

you can do more than one job type, there is no limitation. Mark it as Generic businesses purpose.

After the company is formed, it will be useful to use separate stripe accounts for each stripe business. You can open multiple accounts. You can connect different websites to the same company with more than one stripe account. Keep income and expenses separately, it will make sense to make accounting calculations at the end of the year.

Thank you. You are really helpful and this platform is the most informative place on these issues.

Hello teacher, first of all, good luck. I want to form an llc in Florida, USA based on Dropshopping. But I need to form a partnership company. Could you please explain to me how this process will proceed? Will the EIN number be obtained for two people or one person? And what will taxation be like in this process? I wonder if this situation would be healthy for me? Thank you in advance, sir.

Hello,

the establishment of partnership companies is the same as single-member companies. The company has two members, and Northwest also provides you with an operating agreement free of charge. This agreement contains the information of the partners, and you print it out and sign your partnership among yourself. The installation is briefly like this.

The EIN number is assigned to the company, not the individual. Therefore, the EIN number assigned to your company is applied as a partnership. The EIN application requires only the signature and name of one of the partners. When the result comes, the name of the applicant is mentioned in the result document, but as a member (MBR). Both company partners can use this EIN document because the partner has a company structure.

As for taxation, in partnership structures, the income of each member is taxed separately, the declaration is made in this way, the company expenses are shared, the expenses are shared, but if there is a tax, the two partners share and pay 50%, 50%. Annual tax declaration costs are X2 costs, that is, if they are 500 USD, you will pay 1000 USD declaration service fee.

Thank you for your interest. Have a nice day.

Hello, even though there is no annual state tax for the state of New Mexico, do we have to report it?

There is no annual report in New Mexico, so no reporting is made to the state.

Hello Teacher,

Thanks for your sharing. I want to form an llc on e-publishing in Usa. For now, I'm planning it as a completely digital and online business. I want to receive payment online vian llc account. I will do more business outside of Usa. I was stuck between the states of New Mexico and Wyoming. When I form an llc in New Mexico, is it still necessary to work with an accountant and declare income and expenses? If a declaration is required, the only difference in this case is the 62 annual report fee paid in the state of Wyoming. Considering the future (Amazon etc.), Wyoming seems more logical. However, in New Mexico, once you form the company and then there is no declaration, accounting transactions, etc. If not, then it seems more logical. I need your opinions on this matter. Thank you very much in advance. Hello.

Hello,

Yes, in terms of taxes, every state is the same for foreign LLCs, annual federal income tax is declared, so the most cost-effective states are the most reasonable in terms of annual expenses. As you stated, the only difference is the recurring state fee of 62 USD per month, other than that, the entire procedure is the same. New Mexico will be enough for your digital business. By the way, if your income is from US citizens, you need to submit an income tax declaration every year, no matter which state you install in, this result does not change.

Thank you very much for the information you provided, sir. After the comment, I examined the forum a little more and saw that the Montana option has come to the fore in recent years. Considering the possibility of Amazon in the future, the state of Montana made a little more sense. Both installation and annual fees are low. In addition, the tax rate is 0%, just like Wyoming, in case of a possible sale in the future. What is your opinion on this matter? Based on your comment, I want to take action quickly and form the company through Northwest.

Hello,

it may also be in Montana. As you mentioned, it has become very popular in this state lately. Of course, we can recommend it.

Sir, I have a few questions, I would be grateful if you could answer them. I will be doing business abroad via Shopify dropshipping, so I will have no relationship with the USA.

My questions are as follows:

1) If I establish a company in the state of New Mexico, I will not need to make any annual declarations/send reports, right? (That's what I understood from what I read, I may have misunderstood)

2) I know you hesitate to answer so as not to take any responsibility, but I still want to ask, knowing that all responsibility belongs to me. Do you think the most suitable long-term state for this job is Wyoming or New Mexico?

3) Would you still recommend that we work with a tax expert? If so, which affordable CPAs would you recommend? (Again, I know and accept that all responsibilities belong to me, regardless of the answers to all the questions I have given and the steps I will take. Rest assured, I would only like to benefit from your experience.)

Hello,

1. The state of New Mexico is a state that does not require annual reporting or annual fees; you do not need to declare or pay anything to the state. There may only be forms that need to be declared annually federally, these can be form 15472 or NR 1040, and are determined and declared with the support of a consultant depending on turnover and income geography. Generally, tax is paid on income within the USA, income outside the USA is only reported with Form 5472, so you may not need to pay tax at the end of the year. It is useful to consult an advisor.

2. If you are not going to open an account with a US company on marketplaces such as Amazon or Etsy in the future, we recommend New Mexico, you do not need to deal with annual fees and annual reports. However, if you need to open amazon or marketplace accounts, you cannot get an address confirmation certificate from Amazon with a New Mexico address. If you set up with a private company address in Wyoming, you can both open an account with Amazon and trade with this company from your own site such as Shopify. In Wyoming, a state fee of 62 USD (called annual report) is paid every year, there is no other difference.

3. We recommend Tam Accounting, a US consultancy company consisting of a Turkish team specializing in foreign e-commerce companies. You can see some of our notes about the company here: https://startupsole.com/amerikada-turk-muhasebe-sirketi/

Thank you very much sir, by the way, thank you for your efforts, you provide a unique service.

You are welcome, we are happy if you benefited from it.

Hello teacher. I had 1 question, I would be grateful if you could answer it. When we form an llc, does the Register Agent ask us for proof of the address we live in?

Hello,

if your address cannot be displayed on the Google Maps platform, they may ask you for residence, although it is rare.

Hello, does Northwestern also offer any gas or etc. invoice services for the company?

Hello, unfortunately no address providers offer this type of services.

Hello. Today, I formed an llc in New Mexico through Northwest using your site. Right now it is asking me to fill out boi documents. When should I fill this out? After company formment? thanks

Hello,

As standard, the form is activated upon ordering, but do not fill it out now. You need to fill it out after your EIN number arrives. Boi has 90 days to complete from the date of company formment, there is no need to rush.

Thank you very much.

Hello, I completed the installation and payment process yesterday, but I did not share any ID or ID image. During the process, I was not asked which country I was a citizen of, etc. Will I send such official documents after the application process?

ID is not required at this stage, in fact it was not required at all until 2024 until the Boi Finnish report was released.

First of all, it will be useful to understand the logic of creating a legal entity in the USA in order to have an idea about why it does not require an identity card.

See this article:

https://startupsole.com/llc-sahiplik-kanitlama/

Then see this article for identity declaration: https://startupsole.com/fincen-boi-beyani/

Thank you for your descriptive answer. Conveniences.

Hello,

I completed my company setup with Northwest 1 month ago, and yesterday I received a 1-year Virtual Business Address with ipostal1.

I will fax the SS-4 form to the IRS for the EIN, but do I need to notify the state of the address change first or would it be enough to enter the address I received with ipostal1 on the SS-4 form?

Afterwards, I plan to open an account with Mercury Bank and then open an Amazon seller account. Another question I want to ask you is, is there anything I missed among these plans? I would be very grateful if you could answer it.

Enjoy your work.

You can also change your address afterwards, fill out your SS4 form with your new mailing address and send your application. Once the EIN arrives, you can open your accounts in the order you specify.

Thank you very much for your quick response.

Enjoy your work.

We kindly request you and wish you luck

While doing the installation, I realized that I was using only initials in spells and special characters in the name and surname section. I immediately sent an e-mail, but will they help me if it will cause a serious problem while forming the company?

They will get back to you via e-mail during the week, there may be a special character problem, if possible, have it corrected, you can re-emphasize that it is an important issue in the e-mail and they will help you.

Regardless of this issue, “Unfortunately, your order has not been processed yet. A warning email was sent saying "Our team has reviewed your order and noticed that some information is missing", but nothing is missing. There is a section called Online Federal Beneficial Ownership Information Report filing, it shows it in red, but it says FinCEN ID. How do I fill out this section? Should I not fill out this section after I receive my EIN number after the company is formed?

Incoming e-mail: https://i.hizliresim.com/kxud2h2.png

Warnings: https://i.hizliresim.com/fc9iehr.png

You do not need to pay attention to an automatically sent email from Fincen BOI service. Your installation continues and when the process is completed, your documents are uploaded to the system. You must make the BOI declaration after receiving the EIN number.

Thank you very much, I will make the Boi declaration from the northwest, right? https://startupsole.com/fincen-boi-beyani/ You explained how to do it outside the northwest here. Do you have a blog post on how to do it from the northwest?

Similar steps, actually we don't remember a guide for Northwest yet, if you want, you can follow the steps in our article, the same steps don't matter in the end.

They responded to my e-mail regarding my use of Turkish characters and opened a tab for me to edit my name. But what is bothering me here is, in the address section, should I say keep my address private or should I say use my own address and enter my residence address? I read that we had to enter our residence address for Mercury bank, but I did not write my address anywhere when making the purchase.

https://i.hizliresim.com/gndd1eb.png

Keep your address private, this section has nothing to do with Mercurybank

Hello,

with your reference, I applied for company establishment from Northwest in New Mexico on February 6, '24. On February 12, '24, I received a message saying that my company formation documents had been uploaded to the Northwest panel. I have established my LLC company in New Mexico, USA.

I paid a total of 89 USD. There were no other expenses incurred.

The explanations on every subject on your site were very helpful.

When I wrote a message, Mr. Nazmi responded immediately. Thank you so much, you are really doing a great job!

I also applied for a free EIN number, and they got back to me right away, even though it was late in the evening. I uploaded my signed document and Startupsole completed the application in 1 day. Now, after the EIN arrives, I plan to open a bank account with Wise (or Payoneer) and buy Stripe.

Design etc. abroad. Since I provide services, I established an LLC in New Mexico based on the recommendations on the site. Thanks for everything.

Thank you for your comment. We wish you good luck.

Thank you very much.

Hello,

1- I am thinking of establishing a company to publish mobile applications, which legal state would be appropriate? I'm not thinking of a sales type application right now, maybe in the future. Google ads etc. will generate income by displaying it, and users will also pay for the use of the service, to use the features in the application, etc.

2- User agreements for the application, etc. I think it should be written according to the USA. Is there anyone who provides support on this issue? Free if possible, otherwise paid may be considered.

3- When there is a legal situation, notification etc. Will it be sent from Turkey to a Northwest address in the USA?

4- Will users only make their payments to the bank account we will open in the USA, affiliated with the company? What are the pros and cons of opening an account in TR and having it done here?

Thanks…

Companies that provide company addresses in the USA do not receive Google Admob verification letters. Many address companies cannot accept Google verifications for legal reasons. However, different address companies may accept it, so research this issue first. There is no problem with other items. You can write the contract part by looking at it from competitors or have it written by a lawyer. The money you earn can come to your bank account in the USA, you can also use your personal account, this is a financial situation you are aware of.

Hello Mr. Nazmi,

I have just applied for company establishment with NorthWest from the link you shared. With your advice (because I will sell design services and digital materials), I chose the state of New Mexico. (I hope I didn't make any mistakes during the process. :))

I think I need to contact you when I receive establishment approval and information in order to benefit from the free EIN campaign.

My goal is to open a Stripe account and collect payments for the services I provide abroad.

Your site has been a very useful and sufficient resource for me. Thank you for your information and help.

Enjoy your work

Congratulations, I don't think it will be a mistake. If you have looked at the guide, there will be no problem.

You must first apply for free EIN, and you can do so now. We will receive your preliminary application and send you the necessary information and steps by e-mail.

You can make ten applications here: https://startupsole.com/ucretsiz-ein-basvuru-kampanyasi/

Hello,

I would like to convey here a problem we have been experiencing with NorthWest for about 10 days.

After forming an llc in New Mexico using the address provided by Northwest (about 4 months ago), the address where the company was formed in NM was changed due to the relocation of the Register Agent office. I learned this by chance. We emailed them about this situation. They say that the old address is not used and the new address cannot be updated automatically. When I check the state website, I see that the company's physical and e-mail address (in the founding documents) is the old address, and the new address where the "Register Agent" office has been moved has been updated. In this case, I think my principle and mailing address should also be updated, but they charge an extra fee for this.

The accountant says that the current address must be reported to the IRS for tax declaration etc. When I tell Northwest about this situation, they say that I can give them the new address they moved to. So, to summarize, unlike the company's certificate of incorporation (ONLINE ARTICLES OF ORGANIZATION), there are currently two different addresses in state records. And I just realized this situation, I don't know how long it's been like this. First; IRS (EIN), Bank accounts etc… many accounts were opened with the old address.

Is it normal for them to do something like this before even a year has passed since purchasing the service? Purchasing a new service seems quite costly. I just couldn't get out of it. I may have written it a little confusingly, but Northwest is also confused and I get different answers every time. Will this cause any problems with the state and the IRS in the future? Maybe there's nothing to worry about, I don't know. How should I proceed? Has anyone experienced such a situation before? I wanted to get your opinions. Thanks.

Hello,

Sometimes address offices can be moved to different locations, which is completely normal. Northwest itself automatically updates the registered agent address. Only the office address in the state seems old, and that is not very important. Important notifications already come to the registered agent address, and it is already up to date. For peace of mind, you can make the change yourself via the NM state portal.

In irs traffic, your accountant can make the change while making your tax return, in addition, you can make this change yourself according to the instructions in the irs documents below.

https://www.irs.gov/taxtopics/tc157#:~:text=To%20change%20your%20address%20with,address%20shown%20on%20the%20forms.

Fill out the form and write the new address on the form and mail it to the relevant address along with your proof of identity. They will make the change when they receive your mail.

Thank you Mr. Nazmi, I have been struggling with Northwest for days. I was a little annoyed because they did not explain the situation clearly and said, "No, we are not making updates. They pointed to the paid application for us to make the change." I'm relieved now. I couldn't find how to change my address through the state portal, but it's not a big deal, as far as I understand, there is no need to pay extra money. If I poke around the site a bit, I'll find it. Thanks again, good work.

Please, they have already changed the important part, sign up for the portal at the other address, your account will be approved and you can switch to the new address online by paying 20 USD, but it is not very important.

The important part is that the IRS will do it during the declaration or if you have time, it will be sufficient to fill out the form specified by the IRS and mail it to the relevant department of the IRS.

Greetings, I aim to open my company in January 2024, do I need to submit a notification to the IRS at the end of March 2024? Will these notifications (Tax declaration, etc.) be made in 2025?

If you install in 2024, your EIN number will be active in the new year, so there will be no declaration etc. until the first quarter of 2025. You won't have to give it. You declare your 2024 activities in 2025

Hello,

you explained the steps very clearly, thank you. I just want to ask this; Will we not need a bank account after establishing the company by following these steps? We aim to invoice large companies such as pharmaceutical companies. Could the Wise account cause problems? How does the process work? Thanks

Thanks. Yes, you will need a bank account, you can use digital banks for this. You can become a Wise business or you can also open an account with Mercurybank, which is the most preferred. Unfortunately, you do not have the chance to open an account in physical banks without going to the USA in person. For this reason, those who form companies and do business abroad use these types of digital banks.

Hello, I have to move from my current home in TR in 3-4 months. Is it okay if I give away my family's house when I form an llc? So will I be asked for an invoice document in the future to verify my address? I don't want to deal with the address change request again after 3 months, this is obvious because I want to open the company today and tomorrow. This point is stuck in my mind. I wanted to ask based on your experience. Thanks

Hello,

The address you provide when establishing an LLC is provided only for informational purposes to the registered agent. No one will ask you for verification in the future. Establish your company by providing your current residence address, and when you move, enter your new address from your Northwest agent account and it will not ask for extra verification.

If you proceed this way, you will not have any problems.

Thank you very much Mr. Nazmi

You're welcome, good luck.

I'm asking just to be sure; You don't need a residence or work permit in the USA for this job, right?

I'm also wondering, is there a problem if we want to invoice the work we do for Türkiye through this company? The address of the business is Usa, after all, but I want to invoice someone. I need to choose a home office here when I become a taxpayer. If I'm not mistaken, can I still have a tax certificate here if I show the company in Usa as the office?

Your company and company address will be in the USA. There is no need for an office or work permit in Türkiye.

If you are going to do business in Turkey and receive payment and invoice the transaction through your company in the USA, there is no need for a TR address, but it would be beneficial to consult a consultant for the accounting and tax aspects of the business.

Generally, US companies are formed for online business for global trade purposes. The work you do locally, turnover and receiving payments may have different tax consequences.

How can we get support for the declaration submitted in the first months of the year after company formment?

You can contact the companies below at the end of the year, not the current tax season.

https://startupsole.com/amerika-muhasebe-firmalari/

Thank you. When opening an Amazon account, is it possible that the company address we will open via Northwest is the same as different company addresses and the account will be suspended?

No one has experienced such a situation in the installations made so far, but if you want Amazon to be a platform that constantly changes its policies, you can confirm this yourself by asking Amazon support.

Thank you very much, Mr. Nazmi.

In another article, you said that if you are going to sell on Amazon, it makes more sense even though Wyoming state has an annual renewal fee. Could you explain a little more? Why does wyoming make more sense for amazon?

Installation for Amazon is possible not only in Wyoming but also in other states, there is a list here.

https://startupsole.com/amazon-icin-abdde-sirket-kurullenen-9-eyalet/

However, if you need a resale certificate, it is very simple to get it in Wyoming, and the annual LLC fee is quite low, so it seems more logical in the state of Wyoming.

Hello, your articles are very informative, first of all, I would like to thank you for this.

I want to do the various jobs I do under a company. Since I do independent work, it seems like I am not working all the time, which causes problems in jobs that require income proof such as loans or visas. Of course, I don't want to open a company in Turkey and pay Bagkur just for this reason, so I'm considering opening it in Northwest and New Mexico based on your explanations, but I have some questions in my mind.

My plan is this; To do the unrelated work I do within the company I opened and to be able to expand these jobs abroad at any point I want. For example, I am a psychologist and I do online consultancy, I do this mostly with my consultants in Turkey, but it would be great if I could receive and receive payments from abroad via Stripe, because with Wise stopping my transactions, I am currently stuck with SWIFT and Western Union. I also do tattooing, I do this job in Turkey, but when I set up a studio, it will be advantageous for me to have it under an llc name, I think it will make it easier when I go to other countries as a visiting artist. Of course, I don't know if it is possible for such a local studio to appear under an Usan company, even though it is in Turkey. I also earn income from YouTube and Twitch. I don't know exactly how owning an llc works in Usa, but in Turkey you have to pay your own fee to attract this income. Even though I am in Turkey, can I withdraw social media revenues such as YouTube through this Usan-based company? Partnership agreements generally depend on your residential address, but I thought maybe it wouldn't be a problem if my company was in Usa.

In short, I want to do many jobs through the company I established in America, and the majority of these jobs are Türkiye-based. At the same time, I want to be able to use this company in businesses such as e-commerce when the time comes, so methods such as stripe are more attractive. Most importantly, it is very important that he does not have to worry about paying his own bond. Do you think such a US-based company would work for my use case? Or would I be incurring expenses for no reason? In short, I want to be able to do different jobs together and take these jobs abroad when necessary without paying Bagkur. It seemed to me that I was on the right track, but I am very unfamiliar with these things, I would be very happy if you could tell me your thoughts.

Best regards,

Ahmet

Hello,

You can do more than one business with the llc company you will form. After opening a Stripe account, you can activate separate sub-Stripe accounts for each of your projects and receive payments by connecting a separate website to each project.

Thus, you do not need to form separate companies for different business lines. If you are not considering a marketplace business like Amazon or Etsy, New Mexico will be suitable. If you are going to use it only for striping, it will be economical and the maintenance costs will be almost negligible. On the bank side, you can solve the banking problem by opening a Mercurybank or wise businesses account.

You will not have a situation such as paying Bagkur etc. because there is no such application in LLC companies.

Hello, I do not understand the income tax part regarding forming an llc. Are state taxes and income taxes the same thing? If they are the same, where can I find out the rates? Also, the company I want to form is based on online education and there is no sales tax. In this case, can I submit the annual income and payment declaration? (without the need for an accountant). Thank you in advance for the answers

Hello,

There is no state tax in LLC companies, there is only an annual fee in some states, for example, it is 62 dollars in Wyoming and none in New Mexico ($0). Income tax is paid to the state, and this is called federal tax. You just pay your income tax to the government each year, rates vary depending on business type, turnover, and whether the income comes from US residents. If your income is from outside the USA (virtual POS Stripe calculates this geographically), there may be no income tax, but as a result of the income you earn from within the USA, virtual POS platforms such as Stripe will already send you a tax payment notification called 1099K. If you get this form, you can show it to your consultant at the end of the year and have the tax calculated. After deducting most expenses, a certain amount of tax is paid on the pure income obtained, but it is not at an alarming level.

You cannot submit the annual declaration, so we have a contracted company, Turko Tax, which consists of Turkish-speaking consultants who have the knowledge and ability to give you an advantage in expense calculation and tax payment.

If you are going to sell online education, definitely choose the state of New Mexico, because there is no annual fee or reporting in this state. As we mentioned, only the year-end tax declaration is filled out. It is necessary to submit a tax declaration whether you earn income or not.

So do we pay Income Tax? I live in Turkey and I mostly sell education from Turkey.

Can the company you recommend help you calculate the annual average cost?

Thank you also for your quick and detailed explanations.

Income tax means federal income tax. If your customers are generally from outside the USA (you specified by reading Turkey), you will not pay income tax, but you will have to fill out form 5472 every year and declare the amount of expense and income to the URS. Accountants quote a price of approximately 400 USD for this.

In conclusion, can I conclude this? I provide online education to my students in Turkey. If my company is in the USA (I'm considering that place because you suggested Nm), I won't have any state or federal taxes. So, what will be my annual/monthly expenses in this process?

Yes, the determination is correct.

You will not have monthly expenses, your annual expenses will be as follows;

125 USD renewal of registered representation (address included) to Northwest registered agent every year

Accountant expense for filing annual Form 5472 (amount specified in previous comment)

These expenses will be paid as of 2024.

In one of your articles, you were explaining how we can open an llc ourselves. I just don't understand why the 125 dollar payment will be made.

Would it be enough for me to follow your article and then contact the accounting company to open an llc? Or can I ask an llc to open an llc in my name?

Thank you for your patient response.

The payment of 125 dollars is already the annual renewal fee and you will be able to follow it from your Northwest registered agent panel. Before the 12 months are up, you will automatically receive a renewal notification to your e-mail and you can easily make payments from your card. There is no article for this because think of it as a subscription renewal, it is quite simple.

Follow our article, place your installation order, and then send your preliminary application to benefit from our free eIN service. This is enough for the first stage. We will send your application for your EIN number.

There is no need for an accountant now. You will have time until April 2024. Until then, it is enough to keep your income and expenses in Excel or a pre-accounting software such as waveapps.

You can make an appointment from the link below at the end of March next year, and the accounting company will call you and give you the details.

https://turkotaxacc-1.hubspotpagebuilder.com/startupsole

good luck

I read your article and all the comments. I am an importer and exporter of barbecue and hookah charcoal. LTD in Turkey. I have my company and it is also an LLC in the USA. I want to open an llc. I will sell on ebay as Dropshipping, mainly on technological products. However, I plan to buy home textile products from Bursa and Denizli and sell them to Wall Mart / K Mart stores. In short, can I use the company I will open in NM or WA in every sector? Also, since I will not start doing business as soon as I opened the company, will there be a situation where it will be closed or examined by the IRS even if I have made the accounting and north-west payments for an llc that is open but does not do business, that is, does not issue invoices?

Hello,

For these business models, form an llc in Wyoming and get a private suite address. Wall mart and ebay may also ask for your itin number in the future. You can do more than one business with US companies, you do not need to make any add-ons.

You pay the state fees and Northwest's annual agent fees, there will be no closure, don't worry.

Thank you, Mr. Nazmi. By the way, are you there in Turkey? So I asked if bigger consultancies were needed.

Hello,

I want to establish a company in New Mexico through your site.

However, I could not open the company name query page with VPN and could not query the name.

What should I do?

You need to select the US position from VPN systems, otherwise there is no access because many ip addresses are disabled because of safety. Nevertheless, if you can't login [email protected], we can check for you by writing a company name.

Hello, I am planning to move to the USA in the future, but I have not determined the state yet. I have read that the most logical thing to do when forming an LLC is to choose your own state of residence. I currently have the idea of forming the company in New Mexico and then moving it to the state where I will live, but would it be difficult and costly? So, at this stage, would you advise me to make a clear decision and form the company in that state, or to move the company later?

Hello,

If you do not plan to settle immediately, you can first set up in a state with low annual costs such as New Mexico, and then register the company in your own state in case of settlement. You will have costs similar to the installation, this seems like the most logical solution.

It is enough to file a tax return once at the end of the year, get a report from this software and submit it to the accountant so that you can have your annual declaration made. So how can I do this myself? Do you have an article on this subject?

You need to become a licensed CPA in Usa, for this you must go to school and complete the consultancy requirements, know US tax laws and be competent. Unfortunately, you cannot learn processes such as accounting and tax filing through articles.

For this reason, services are received from licensed consultants who are familiar with US tax regulations for year-end tax declaration.

Can I manage my company without hiring an accountant? Do you have a detailed explanation on this subject? I do not want to pay money to an accountant.

You do not need to hire an accountant and make payments every month. Free bookkeeping software is used for preliminary accounting. You can define income and expense categories by integrating it with your bank account.

There is an article here: https://startupsole.com/wave-ucretsiz-muhasebe-yazilimi/

It is enough to file a tax return once at the end of the year, get a report from this software and submit it to the accountant so that you can have your annual declaration made.

What is the fee we will pay to the Northwest every year when we form an llc in New Mexico?

Registered Agent renewal fee is 125 USD per year. Repeats every 12 months, including address service

What do we do if we don't have our number when filling out 5472 or 1040-NR at the end of the year?

ITIN is not required when declaring 5472. It is required for 1040-NR, but at the 1040 filling stage, the consultant also makes an application and sends your declaration to the IRS. Don't worry, since the consultants are experienced in this field, they know what needs to be done.

Hello,

thank you for the valuable article.

We have made our company application to use Paypal, based on your other articles, I will apply for it once the process is approved.

When the whole process goes smoothly and we are able to receive payment, do we need to make an agreement with an accountant in the USA?

Thanks.

I saw it later :)

https://startupsole.com/yardim/company-formed-after-surec-nedir/

I opened an LLC company with Northwest in New Mexico, thank you for your help, the current step is to obtain a Resale Certificate, but you can find it on this site ( https://www.taxjar.com/blog/2022-03-how-to-use-a-new- mexico-resale-certificate , there are 2 types of businesses, I guess our remotely established LLCs can be applied by filling out the first (NTTC) form, I would be glad if you could help me in this regard. thanks

Unfortunately, we do not have information on this issue. You can get support from the state secretariat. If you want, you can reach the support department by e-mail.

Thank you very much. I will contact you as soon as possible..

Hello, sometimes things are not going well. How can we acquire the company? Could you share your valuable information with us? Thank you very much. I wish you a healthy day.

This answer applies to Wyoming but may differ in other states.

First of all, if the LLC is not registered for local tax from the state (sales permit, resale certificate is not received), if the annual report is not submitted, it is administratively terminated and closed within a certain period of time.

If a tax registration has been made with the state, it will be terminated if payment is not made, but it is recommended to cancel this tax registration first as there may be problems in the future. If you do not have a tax record and have already chosen to terminate without submitting an annual report, you can rest assured that your LLC will automatically close without any problems.

All that remains is to cancel the spouse. If the company does not have any commercial activities during the year, it is necessary to physically mail a cancellation petition to the IRS together with the ein approval letter.

This irs page contains the address to which the cancellation request should be sent and other details.

https://www.irs.gov/businesses/small-businesses-self-employed/canceling-an-ein-closing-your-account#:~:text=The%20IRS%20cannot%20cancel%20your,reassigned%20to %20another%20business%20entity.

If you have the opportunity, do not close the company because, due to global variables, processes such as opening a bank account or establishing a company remotely and obtaining funding may not be easy in the future.

Disrupting an already installed system and reactivating it in the future may be more difficult and time-consuming.

Of course, if you say that I am withdrawing from these things, I have given up and want to close everything, the process generally consists of the steps above.

I hope it was useful.

Hello, today I was going to open an llc in the state of Kentucky through Northwest agency, I filled out all the information as you showed. During the payment, I filled in all the information on my bank card, but every time I tried, it gave me a payment failure warning. What could be the reason for this? Do I need to use a credit card? Is a debit card not enough? Also, I have a USD foreign currency account. Is the $79 fee deducted from there or directly from the TL account? I would be glad if you could help.

Hello,

Most of the overseas payment gateways may not accept local prepaid debit cards. Systems that will probably not accept the card you try, even if you have a sufficient amount of TL or USD in your account.

Actually, this is not about you, it is about the companies' payment policies.

If you have a credit card (or your friend's card), you can set a sufficient limit and make your payment instantly.

I understand, thank you. Thank you very much for your quick response.

You are welcome, if you have any issues, please write us and we will try to support you.

Hello, is it a problem if we do not provide our own information, if we enter a fake name, identity confirmation etc. Does this northwest want anything from us later?

Hello,

it is not a recommended method, we do not recommend you to continue this way because;

Identity confirmation etc. They don't want it, but you will have to use that fake name when applying for EIN to the IRS. Then, that fake name will not be compatible with your real identity and you will not be able to open an account anywhere. This creates a problem in banks, stripe or any other platform.

There is already anonymity in the state of Wyoming or the state of New Mexico. Don't worry, your name will not be published publicly anywhere.

Is there anonymity in the state of Wyoming or New Mexico and not in the others? I also have one more question. Open a stripe account beforehand and send your ID photo etc. I sent it for approval but it was not approved. Will Stripe cause any problems with this?

In the states of Delaware, Nevada, New Mexico and Wyoming, anonymity exists and your name is not on public records. In other states, your name may be publicly listed according to agency setup procedures.

Stripe only approves Turkish citizens if they form an llc in the countries it accepts. If you have previously used an individual account with a fake address etc. If you tried to get approval you may have been rejected.

If you apply legally with an Usan company through a website that complies with Stripe policies, your account will be approved 99%.

We started the company formation phase, but I forgot to add LLC to the end of the company name. Does it cause a problem?

No problem, if they have to add an extension during filing, they will add this extension themselves, don't worry.

Today, we started our company formment with Northwest in the state of Kentucky. If I can successfully open a Stripe account, I would like to thank you very much. And I have a question for you; When opening the company, they did not ask for any identification information other than my name and surname. How can this really happen? Is only my name valid? I asked Northwest live support and they said they didn't know. I wanted to ask you.

Don't worry, if you have a website that complies with Stripe policies, you will open your account without any problems.

Establishing a Us LLC is already something that anyone can do online. An LLC can be established by just specifying a name. The process is very easy.

You own the company by obtaining an EIN and opening bank accounts etc. for trading purposes. Things work the other way around; as a company owner, you will need to open a bank account in any case in order to do business with this company. This is where identity comes into play. No bank will open an account without ID and spouse.

Identity or person does not matter at this stage, since anyone can form a bank account or other accounts, just an empty company that does not have a spouse.

We discussed this situation with an expert in the past and this is what he said:

– If the identity document of the company owner is required to be recorded somewhere, add this document to the operating agreement called the operating agreement and have your document Apostilled, and keep your wet signed and approved documents.

Have a nice day.

HELLO? I INSTALLED IT AS YOU SAID, TODAY THEY UPLOADED TWO DOCUMENTS TO THE PANEL.

=SINGLE MEMBER LLC

= ARTICLES OF ORGANIZATION

I THINK I DO NOT NEED TO SIGN THESE AND SEND THEM AGAIN? WHEN I APPLIED FOR EIN, I SENT THE SS4 FORM TO THE IRS E-ARTICLES OF ORGANIZATION, I THINK

THERE IS NOTHING ELSE I NEED TO DO?

Congratulations,

=SINGLE MEMBER LLC: Print out this business agreement, sign it and keep it, you do not need to send it back

. = ARTICLES OF ORGANIZATION: Your company formation document, you do not need to send this either. When applying for EIN, you can add it to the rest of the SS4 form and use it when applying for EIN.

I can get an EIN to sell on Amazon with the LLC I formed through Northwest, right? Because I wanted to get additional service from here, but since I don't have an SSN, there was an extra fee.

You can buy it, but if you are not a US citizen, the agencies will ask you for something like $200. Filling out your SS4 form yourself and faxing it is an economical solution.

There is this guide here: https://startupsole.com/amerika-dan-ein-numarasi-almak/

Friends, my company, Wyoming LLC, was formed in one day. Northwest is an incredibly fast and reliable company.

Friends who will do the installation should not miss this price.

Thank you so much for this unique resource and discount. Northwest is an RA I have been following for a long time. That's why this campaign was very useful to me. During the installation, I chose the address I received from Wyoming mail forward as the address and did not set up the company to the northwest address.

The installation was completed in about 3 business days and the documents arrived, and I applied for eIN today. I recommend it to everyone. It was a very easy installation. Good luck to everyone, thank you to the authors.

You can also use the address you received from Wyomingmailforwarding or another address company when forming an llc with Northwest. There is no problem with this, of course it can be preferred according to need. We wish you good luck.

Good day, operating agreement seems to be a paid feature, but you said it was included at the end of your article. Is it because we can prepare an operating agreement ourselves free of charge? Finally, I would be very happy if you could answer whether there is a difference between the operating agreement we have prepared and the one they will give.

If you form an llc with Northwest, an operating agreement is given free of charge. We installed it 2 days ago and they sent it. Where exactly does it say that there is a fee?

In the pictures above it is already written as 50USD :)

Have a nice day. In your article, you said that the Operating Agreement was included, but in the additional section, a price of 50$ was requested. Is there a code we need to enter or am I missing something? I would be happy if you could help me.

They provide it for free, but if you want a special item, you have to pay extra. The standard version is quite sufficient. By the way, we have a similar contract, all of which contain standard clauses.

If something goes wrong, we can provide it to you. By the way, you can also search on our blog, there are a few templates available for free.

ok thank you very much

Okay, that's how I did it anyway. I wanted to ask a question to make me feel at ease.

Thanks again.

You're welcome, good luck.

Hello,

I started forming an llc with Northwest in Kentucky (thanks to you, I made this decision). But something stuck in my mind. There was no section to enter the Usan phone number. I wonder if I missed a screen or did I miss something?

Thanks again

Hello,

when installing with Northwest, only a phone number is required in the contact section (you can enter your TR mobile number). Anyway, these US numbers are not listed in any company documents. In the future, a US number may be needed when sending an SS4 form to the IRS or when a certificate from the state, etc. is needed. You can continue the installation as normal, no problem. By the way, if you have received a US number, you should have it for the next process.