A Detailed Guide to Forming an LLC in Usa and Its Costs

Starting an LLC in Usa: Can Be the First Step to Success in Growing Your Business

Establishing a company in America is a great opportunity for entrepreneurs and business owners to open up to the global business world. It not only provides access to the vast consumer market of the USA, but also makes it easier for you to gain a prestigious place in international trade.

The United States, one of the world's largest economies, is known for its business-friendly environment that encourages entrepreneurship. Whether you want to start a technology startup or expand in e-commerce, starting an llc here offers unlimited possibilities. It is of great importance to take the right steps to simplify the company formation process.

In this guide, we'll cover all aspects of starting a company in America By examining each step in detail, from company types to state selections, from costs to legal requirements, we will equip you to make the right decisions.

If you want to take your place in the business world in Usa, it is very important to benefit from the right guide.

If you are not a US citizen and want to form an llc in the US for any reason, you are in the right place.

On this page;

- Forming an llc in Usa

- Company type selection

- Company formation costs

- Advantageous states

and you can have a lot more information

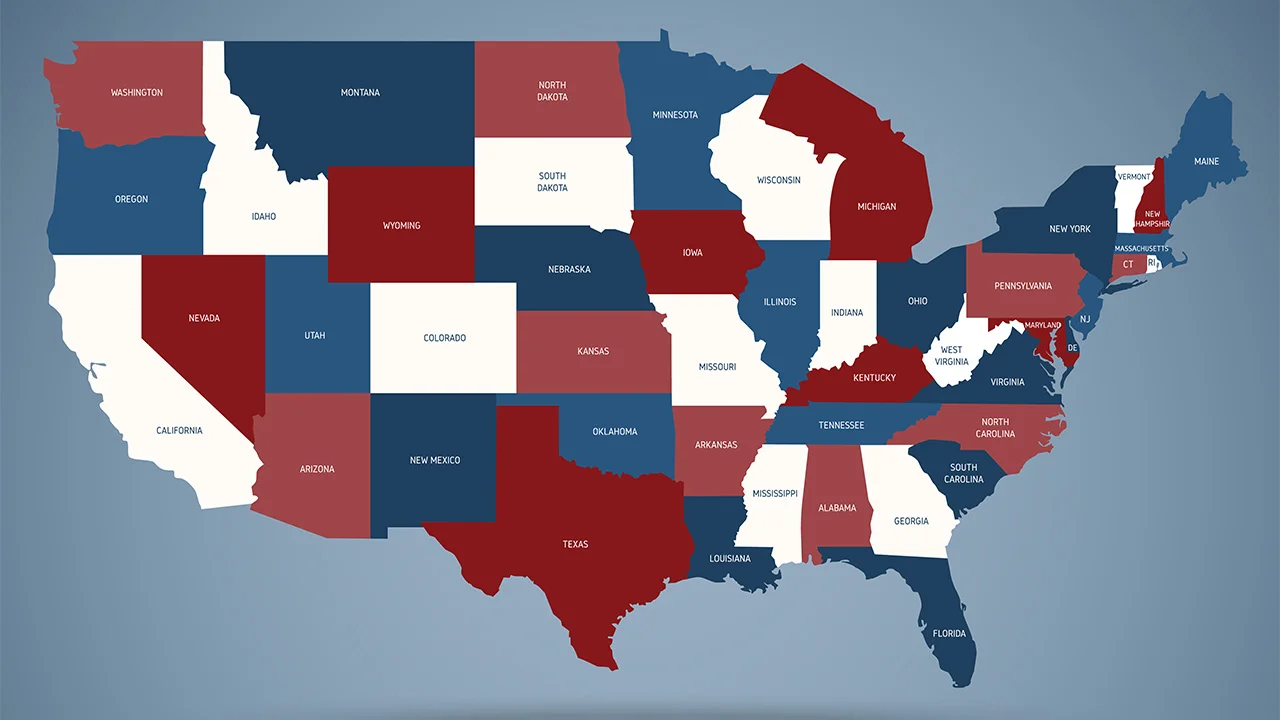

To get information about company formation costs in Usa and state selection by business type, run the cost form tool by selecting a state below

Types of Companies in Usa

There are two types of companies you can start in Usa as a foreigner. The first and most popular of these is LLC, and the other is Corporation type companies.

In the USA, if the LLC company has a single member, it is an organization that is not taken into account. LLCs' taxes pass to the owner of the company, but Corporations are different. Both the company and its members pay taxes on the income derived from the corporation type company.

Corporation type companies, which have double taxation, management difficulties and higher annual expenses than LLCs, are not preferred. Because all commercial activities that can be done with an LLC or Corporation company can be carried out without any problems.

How to Determine the Cost of Forming an LLC in Usa?

When you decide to form an LLC company in Usa, there are initial filing fees and costs to be paid to Registered Agents, which vary depending on the state where the installation will be made.

However, these costs are not at a daunting level, on the contrary, they are at reasonable levels.

The most preferred states for foreigners to form an llc in Usa are Wyoming, New Mexico, Delaware and Florida. Since the fees required by these states for initial installation are between $50 and $100, it reduces your initial entry costs considerably.

50 states in America and it is possible to establish a company remotely in these states. You can find a list of the installation fees of these states further down the page.

Forming an LLC in Usa, Costs and Things to Know

Forming an LLC in Usa, Costs and Things to Know

Regarding expenses and costs, you can find the price list categorized by state further down the page. Additionally, you can use the calculation form below to calculate the exact cost of an LLC company to be formed in Usa.

Depending on your answers in the form below, you will be able to obtain preliminary information about your general situation regarding taxation.

Company Formment Cost & Tax Situation Learning Tool

Filing Fees by State for Forming an LLC in Usa

When we look at filing fees, these costs are divided into two:

- One-time filing fee paid during installation

- Fees to be paid to the state in the next year following the formment and every year thereafter (also called Franchise Tax, Franchise taxes or annual report, Annual Report)

Things to know about filing costs;

- LLC filing fee one-time : This fee is paid to the state at the time of setup and you pay it one-time. Prices vary by state, the price list is available further in the article. When you choose a registered agent and place an order for installation, this fee is calculated from the beginning according to the state and included in other costs.

- Franchise Tax, Annual Report: Every year, states demand a fee from company owners under the name of annual reporting and a simple report that you can send online. When you establish the company, you do not pay this fee in the first year, you start paying it from the next year. These annual fees vary by state or some states do not have the payment. For example, in the state of New Mexico, there is no annual fee, report or payment.

Registered Agent Fees for Forming an LLC in Usa

Things to know about Registered Agent Costs;

- First of all, if you do not know anything about Registered Agent, what is Registered Agent . These registered agents, called Registered Agents in the USA, establish your company. These agencies must have a resident office in each state. Companies that meet these and certain conditions are authorized by the states for these works. You can find the pros and cons of many agencies on our Best Registered Agent

- While some of these Registered Agent companies do not charge an agency service fee for the first year, some collect this fee from the beginning. For example , Northwest, installation fee + first year agency fee is $39 including address. Northwest is a very large and well-established company with its own offices in almost every state in the USA.

Address Fees for Forming an LLC in Usa

Things to know about address fees

- When setting up an llc in Usa, you must provide an address where you can receive mail.

- If you set up your company with Northwest Registered Agent, the address is included in the package when setting up your LLC for $39. So, when you set up your LLC company with Northwest, you also have a business address where you can receive documents electronically.

- Another option is www.wyomingmailforwarding.com, where you can pay a reasonable one-time fee ($15) and make additional payments per incoming mail. To get an address in the state of Wyoming through this company, Getting an Address for Wyoming Mail Forwarding for $15 . There are also mail forwarding companies that provide monthly services. You can find a complete list and prices of these companies in our article titled Getting an American Address from Companies That Provide Virtual Addresses in the USA

Forming an LLC in Usa: Formment and Annual Expenses by State

We have discussed average costs so far. Next, we will give you brief information about a few states (the states where the most companies are formed).

If you want to look at the installation and annual costs of all states, you can look at the table at the bottom of the page or use the calculation tool above.

New Mexico: Initial setup fee is $52. There is no annual filing fee and you do not have to pay any fees or file a report with the state each year. ( New Mexico company formation guide )

Kentucky: The state of Kentucky is the most affordable with an initial filing fee of $40 for installation and a fee of $15 for annual filing.

Delaware: Initial setup fee is $90. Annual state tax and reporting (franchise tax fee) $300 must be paid by June 1 of each year or a penalty will be charged.

For example, assuming you established your company in the state of Delaware in May 2022, you must pay the annual franchise tax by June 1, 2023 at the latest. If payment is not made, a 200% increase + 1.5% monthly penalty interest will be charged. See: Establishing a Company in Delaware and Its Costs

Wyoming: Initial setup fee is $102. The annual reporting fee is $62. annual report fee online on the state website until 10 days before the establishment date of the next year following the company's establishment date.

For example, assuming you established your company in the state of Wyoming on June 1, 2024, you must make the payment by May 20, 2026 at the latest. See: Establishing a Company in Wyoming and Its Costs

Florida: Initial setup fee is $125. The annual state reporting fee is $138.

It must be paid online to the state by May 1 of each year. Reporting and payment after May 1 are considered late. In Florida, if your annual report is late, you must pay a $400 late fee, bringing your total to $539. If payment is not made, the Secretary of State will terminate your LLC after the 4th Friday in September.

In the table below, you can see the costs of the US states that are most preferred for company formment as of 2024.

Note: A general list of all states is right down the page.

| STATES | INSTALLATION FEE (ONE TIME) | FRANCHISE TAX & ANNUAL REPORT (EVERY YEAR) |

| Delaware | 90$ | 300$ |

| Montana | 35$ | 20$ |

| Florida | 125$ | 139$ |

| New Jersey | 125$ | 75$ |

| Colorado | 50$ | 10$ |

| New Mexico | 52$ | $0 (No Annual Fee) |

| wyoming | 103$ | 64$ |

| Kentucky | 40$ | 15$ |

As of 2025, the costs of forming an llc in Usa according to states and annual expenses

| STATES | INITIAL SETUP FEE (ONE TIME) | FRANCHISE TAX (TO BE PAID EVERY YEAR) |

| Alabama LLC | 200 dollars | $50 minimum (each year) |

| Alaska LLC | 250 dollars | $100 (every 2 years) |

| Arizona LLC | 50 dollars | 0 (no fee and no information report) |

| Arkansas LLC | 45 dollars | $150 (each year) |

| California LLC | 70 dollars | $800 (every year) + $20 (every 2 years) |

| Colorado LLC | 50 dollars | $10 (every year) |

| Connecticut LLC | 120 dollars | $80 (each year) |

| Delaware LLC | 90 dollars | $300 (each year) |

| Florida LLC | $125 | $138.75 (each year) |

| Georgia LLC | 100 dollars | $50 (each year) |

| Hawaii LLC | 50 dollars | $15 (each year) |

| Idaho LLC | 100 dollars | 0 (but an information report must be filed annually) |

| Illinois LLC | 150 dollars | $75 (each year) |

| Indiana LLC | 95 dollars | $31 (every 2 years) |

| Iowa LLC | 50 dollars | $30 (every 2 years) |

| Kansas LLC | 160 dollars | $50 (each year) |

| Kentucky LLC | 40 dollars | $15 (each year) |

| Louisiana LLC | 100 dollars | $35 (each year) |

| Maine LLC | $175 | $85 (each year) |

| Maryland LLC | 100 dollars | $300 (each year) |

| Massachusetts LLC | 500 dollars | $500 (each year) |

| Michigan LLC | 50 dollars | $25 (each year) |

| Minnesota LLC | $155 | 0 (but an information report must be filed annually) |

| Mississippi LLC | 50 dollars | 0 (but an information report must be filed annually) |

| Missouri LLC | 50 dollars | 0 (no fee and no information report) |

| Montana LLC | 35 dollars | $20 (each year) |

| Nebraska LLC | 100 dollars | $13 (every 2 years) |

| Nevada LLC | 425 dollars | $350 (each year) |

| New Hampshire LLC | 100 dollars | $100 (each year) |

| New Jersey LLC | $125 | $75 (each year) |

| New Mexico LLC | 50 dollars | 0 (no fee and no information report) |

| New York LLC | 200 dollars | $9 (every 2 years) |

| North Carolina LLC | $125 | $200 (each year) |

| North Dakota LLC | $135 | $50 (each year) |

| Ohio LLC | 99 dollars | 0 (no fee and no information report) |

| Oklahoma LLC | 100 dollars | $25 (each year) |

| Oregon LLC | 100 dollars | $100 (each year) |

| Pennsylvania LLC | $125 | $7 (every year) |

| Rhode Island LLC | 150 dollars | $50 (each year) |

| South Carolina LLC | 110 dollars | 0 (No fee and information reporting unless LLC is taxed as an S-Corp) |

| South Dakota LLC | 150 dollars | $50 (each year) |

| Tennessee LLC | 300 dollars | $300 (each year) |

| Texas LLC | 300 dollars | $0 for most LLCs (but No Tax Liability Report and Public Information Report must be filed annually) |

| Utah LLC | 54 dollars | $18 (every year) |

| Vermont LLC | $125 | $35 (each year) |

| Virginia LLC | 100 dollars | $50 (each year) |

| Washington LLC | 200 dollars | $60 (each year) |

| Washington DC LLC | 99 dollars | $300 (every 2 years) |

| West Virginia LLC | 100 dollars | $25 (each year) |

| Wisconsin LLC | $130 | $25 (each year) |

| Wyoming LLC | 103 dollars | $60 minimum (each year) |

How to Form an LLC in Usa?

- First, determine the state where you will form your company (Wyoming, New Mexico or Delaware are among the most preferred states).

- Choose a name for your company. We also recommend you to take a look at our article Choosing a Name for an LLC Company in the USA

- Northwest Registered Agent 's LLC company setup page special discounted

- Complete your company setup order by following the steps in the video below

- Get an EIN number for your company. the Free EIN Application Campaign, we complete your EIN application free of charge in the LLC company setups you make with our biizm reference. For details and pre-application, you can visit our Free EIN Application Campaign

LLC Company Formment Video in Usa

In the video below, you can find the steps to forming an llc online in the state of Kentucky with Northwest Registered Agent. If you are going to install in a state other than Kentucky, you can continue with the ordering steps by selecting the state you want from the state selection section in the first stage.

The video has subtitles, please turn on the subtitle feature while watching.

Advantages of Forming an LLC in Usa

Establishing a company in America has many advantages for entrepreneurs. We frequently include these advantages on our blog, but to summarize, we can list them as follows;

- companies in America pay relatively lower taxes

- of establishing a company in America are quite affordable.

- companies in America can do business with these companies not only in America but also in Europe or other continents.

- The company's installation times are quite short, even in some states (Wyoming) it can be completed in as little as 2 business days.

- Brands can patent their names in the USA by spending low amounts

- It is easier for people who form an llc in Usa and keep this company profitable to settle in the USA by obtaining an E2 investor visa.

- Accounting and tax declaration procedures are submitted only once a year, not monthly. In this way, there are no recurring expenses such as monthly accounting expenses.

- Especially, LLC companies are very easy to manage. It does not require monthly maintenance. It has low expenses, such as the registered representative fee and the tuition fee paid online to the state each year.

What Should I Do After Forming an LLC in Usa?

a company in the USA and receiving the company's establishment documents, there are a few simple steps that need to be taken for the company to start its commercial activities;

EIN (Employer Tax Identification Number): After establishing a company in any state in America, the first thing to do is to obtain an EIN number for the company. Obtaining an EIN is required for the company in the USA to open a bank account or apply for a virtual POS to receive payments from the website.

To obtain an EIN, that is, a tax number, it is sufficient to fill out a simple form and send this form to the US Internal Revenue Service by fax. If you decide to form your company in the USA with Startupsole, we can obtain your EIN number for you.

Company Bank Account in America: If you need to open a bank account for your company in America, you must first obtain an EIN number for the company.

Once you receive the EIN, you can easily open your bank account remotely online. The most well-known examples of banks where you can open an account remotely are Mercurybank and Wise Business. These banks do not require an in-person visit.

Accounting and Tax Declaration: After establishing your company in the USA, it is recommended that you first use a cloud-based accounting program to keep the income and expense statement.

You can automatically keep the income and expense statement by integrating it into your e-commerce site with this type of software.

Accounting and tax processes in the US are done annually. You can easily make your tax declaration by authorizing your accountant through the preliminary accounting software mentioned above. It is possible to easily find a reliable Turkish accountant in America. You can benefit from our guide on this subject here .

For foreign entrepreneurs, forming an llc in Usa and visa options (L1, E-2, etc.)

After establishing a company in the United States, especially one of the most curious about Turkish entrepreneurs, "What visa options have to manage the company by staying in the United States?" is the question. Visa types and critical details that you may need in this process:

1. Which visa types are suitable?

- E-2 Investor Visa:

- It is valid for citizens of countries with a trade agreement with the US (including Türkiye).

- You need to invest in the company “important and irreversible olur $ 100,000+ ).

- The visa time varies between 2-5 years and can be renewed indefinitely.

- Note: Your company does not have an obligation to office or employee in the state where it operates.

- L-1 Visa (Intracompany Transfer):

- You have to have an llc operating in Turkey and form a subsidiary in the USA.

- Suitable for people who will work in the administrator or expert position.

- The first application is approved between 1-3 years and offers the opportunity to switch to the green card.

- EB-5 immigrant investor visa:

- $800.000+ You can get a direct green card by investing.

- Investment should employ at least 10 people or to be made in certain regions (TEA).

- Other Options:

- H1B Visa: For expertise jobs (you need a sponsor company).

- B-1/B-2 Tourist Visa: It can be used for short-term travel for company installation ( commercial activity cannot be carried out ).

2.

- Investment and Income Certificate: Bank account breakdowns and financial projections of the company are requested for the E-2 visa.

- Business Plan: Prepare a professional plan that details the US company's activities and employment plans.

- Immigration Attorney Support: Work with an experienced lawyer or visa agency against visa rejection risk.

3. Frequently Asked Questions

- Question: "I established my company in Delaware, do I have to change the state to get a visa?"

Answer: No! In the visa application, your company is not a state, but the amount of investment and business plan is important. - Question: "Can I bring my family with E-2 visa?"

Answer: Yes, your spouse and your children under 21 years of age can also live with you and can receive training.

How should you move forward?

- Complete the company installation: Focus on visa application after completing the basic steps such as EIN, ITIN and bank account.

- Select the visa type: You can get support from a visa agent to determine which visa is suitable for you.

- Start the application process: Prepare your file with the immigration lawyer and financial documents.

Brand and Patent Protection processes while forming an llc in Usa

the USPTO (United States Patent and Trademark Office) to protect your brand and products , but this item is optional and is not required. Here are the critical steps of brand registration and patent applications for foreign entrepreneurs:

What is the difference between the 1st brand and patent?

- Brand (Trademark):

- Your company name protects the distinctive features of your logo, slogans or product.

- Example: Coca-Cola logo or “Just Do It”.

- Protection time: 10 years (indefinitely renewable).

- Patent (patent):

- It protects a new invention, technology or design.

- 3 types of patents:

- Utility Patent: Functional inventions (eg a new software algorithm).

- Design Patent: Product Designs (for example iphone's external view).

- Plant Patent: New plant species.

- Protection time: 15-20 years (varies according to the type).

2. How to make trademark registration?

- Pre -research:

- Check the similar ones of your brand via USPTO's TESS database

- Example: Investigate whether the name “startupSole” has been taken before.

- Choose the type of application:

- Teas Plus: Basic application ($ 250/class).

- Teas Standard: Flexible Application ($ 350/Class).

- Class selection:

- Determine which sectors your brand will be used (for example, “Class 35: Advertising and Business Management”).

- Note: Additional fee is paid for each additional class.

- After the application:

- USPTO review takes 6-12 months.

- If the appeal comes, you may need to answer with the lawyer.

3. Steps for Patent Application

- Set the patent type:

- For Utility Patent, apply for “non-provisional” (detailed technical drawing and explanation).

- Provisional Patent:

- It provides 12 months protection and saves time for detailed application.

- Cost: 70− $ 280 (for small enterprises).

- Get professional support:

- Work with Patent Attorney or Agency ( USPTO rejects 95 %of applications! ).

4. Practical Tips for Turkish Entrepreneurs

- Trademark registration:

- You can register your brand before setting up an llc in the USA.

- The registration in Turkey does not apply to USPTO!

- Patent Strategy:

- First you can get a patent in Turkey the PCT (Patent Cooperation Agreement) .

- Cost Management:

- Average cost for trademark registration: 500 - $ 1000 (excluding lawyer's fee).

- Utility Patent Application: 5,000 - $ 15,000 (including research, drawing and lawyer fee).

5. Frequent mistakes and solutions

- Error: "I have registered my brand only at the state level, no national protection."

SOLUTION: USPTO Federal registration, provides limited protection of state registration. - Error: "I made the patent application myself, it was rejected."

Solution: Patent lawyer knows technical language and USPTO standards. Reduce the risk by working with a professional.

Frequent mistakes made during the formment of an llc in Usa and how to prevent it?

Although it is exciting to establish a company in the United States, critical errors that can cause material losses and legal problems. Here are the 8 most common errors and tips on how to prevent these mistakes:

1. Wrong state selection

- Error: "Delaware is the best for everyone!" to choose a state without research.

- Risk: High annual costs (franchise tax), unnecessary tax burden.

- Solution:

- Choose the state suitable for your business model:

- E-commerce, technology, consultancy: Wyoming or New Mexico (Low Cost, Remote Management).

- For marketplace such as Amazoni Etsy, Walmart: Wyoming. (At the economic price, the address of the workplace, the address with Suit No to establish a company in this address. Sundays are the most logical state Wyoming for this.

- Analyze costs using StartupSole's gaps such as state comparison

- Choose the state suitable for your business model:

2.

- Error: “I have an address, there is no need for registered agent”.

- Risk: Abduction of official documents, the company “Delysted” (cancellation, termination).

- Solution:

- Rent a professional registered agent by paying $ 125 per year Northwest offers free registered agent in the first year in LLC installations.

- Note: StartupSole examines the agencies that offer registered agent service in all states. our page on this topic .

3. Trying to open a bank account without receiving a tax number (EIN)

- Error: “I have to open the bank account immediately, I will buy it later”.

- Risk: Banks do not open an account without EIN.

- Solution:

- Apply for EIN as soon as the company installation is completed .

- Tip: See this guide to get EIN free

4. Forget about the annual report and tax declaration

- Error: ım I founded the company, I don't need to send a report anymore ”.

- Risk: Punishment from the state , suspending or termination of the company

- Solution:

- Create the Annual Report calendar: Each state has a different date (for example, Delaware 1 March).

- Set automatic reminder: Northwest Agent sends you a reminder email .

5. Choosing the company type (LLC/Corp) wrong

- Error: "LLC is always better," he said to ignore the advantages of Corporation. (For big projects)

- RISK: Tax advantages missing, inability to attract investor.

- Solution:

- LLC: Simple Management, Pass-Though Taxation.

- Corporation (C-Corp): If you plan to get investment (VCs prefer C-Corp).

6.

- Error: ım Let's set up the company first, we register the brand and then ”.

- Risk: someone else can register your brand, the risk of lawsuit arises.

- Solution:

- your company name preliminary research .

7. Postponing the US bank account

- Error: "I use the account in Turkey," saying not to open the US account.

- Risk: Customer confidence decreases and suspends payment systems such as stripe/paypal.

- Solution:

- Mercury, Cenoz or Payoneer Business .

- Note: StartupSole contains a lot of advice and articles for a bank account.

8. Not receiving legal and financial consultancy

- Error: “I search on the internet, no tax, this is unnecessary expense”.

- Risk: Tax evasion, legal incompatibility penalties, closure of the company.

- Solution:

- Work with Turkish CPAs in the USA.

- You can browse our contracted cPa from our services

Prevent mistakes with startupSole!

If you do not want to fall into these mistakes while forming an llc in Usa, check out our articles that explain the process from start to finish:

Last word: Be proactive, disappear the risks from the beginning!

Most of these errors are due to lack of hastiness or information. How to establish a company in America? You can complete the process without any problems by reading our guide and professional support.

Conclusion

To form an llc in the USA, you designate a Registered Agent and as long as your company remains active, your company must remain affiliated with an agency. Northwest Registered Agent is among the most preferred agencies due to reasons such as its price advantage, free agency for the first year (thanks to our agreement), free address service in every state and very fast support.

The agency you choose collects the installation fee to be paid to the state secretariat and the company installation fee from you at the very beginning of the ordering phase. The company setup service fee for Northwest is $39, thanks to the discount we offer. Afterwards, your company will be formed by the agency in a short time, in line with the information you provide in the application form, and your documents will be delivered to you digitally.

No documents such as passport or ID are required. You must only enter your residence address correctly because if your address cannot be verified by the agency, you may be asked for additional invoices or documents.

53 Comments . New Comment

Hello,

if we establish an LLC company in the state of Wyoming using the address of the Northwest company, does it give us the Suite number as the address?

Thanks.

If you add premium mail forwarding in the optional items section on the order page, they provide a special suit number.

Hıcam Biley, I'm going to open a dropshipping site in the USA and I'm thinking of selling replica products. Are there any sanctions etc.? Thanks

As a company, there is no problem, but payment systems may not tolerate such products. You can look at Stripe's policies: https://stripe.com/legal/restricted-businesses

You may need to get special permission.

Mr. Nazmi, there are two separate items in the invoice that confuses me. The first one is “Registered Agent Service in Colorado” and is $0. The second one is “Renewal Service” and is again $0. Both are annual fees. If "Registered Agent Service in Colorado" will be $125 next year, how much will "Renewal Service" be? This confused me. I'm asking because I don't have a single pen.

Note: I did not include the $1 state filing fee and the $39 incorporation fee.

As far as we know, since the registered agent service is renewed every year, after you pay the 125 USD fee, they do not receive any money for the renewal and it will still appear as zero.

They probably show this as a separate service item worth zero USD.

But if you don't feel comfortable, you can send an e-mail to support mail.

Hello, with your reference, I started an llc formment in Colorado through Northwest. The registered agent service fee for the first year in Northwest's management panel is 0$, as stated on your page. Next year, $125 will be charged, again as you stated. However, there is another item on the invoice called “Renewal Service” and $0 has been deducted for the first year. What is this item and will it appear as a price other than $125 next year, because this fee is also calculated annually? Could it be the annual fee paid to the state?

Since you receive free service for the first year as a registered agent service, you will see $0 on the invoice. You must pay 125 USD as renewal fee next year and they will send you an information e-mail.

This fee is not related to the state fee, it is only the annual Registered agent renewal fee. Next year, this renewal fee will be $125 instead of $0 and will not be reflected as an extra cost.

Thank you very much for the valuable information you provided. If I apply for EIN for the company I formed with Northwest in November 2022 in January 2023, I do not need to file a tax return this year, right?

I think the company's tax declaration is based on the EIN issue date. Doesn't the company formment date matter in this case?

You're welcome.

Yes, if you apply for EIN at the beginning of 2023, you do not need to make any declaration until April 2024. The company's business activity is taken as the basis for the EIN assignment date. We wish you success in your new job.

Hello,

I will receive service from Northwest for establishing a company in America, but I cannot decide which state to choose.

All my work is done digitally, no physical product sales etc. no.

Which state will be the least costly tax-free in the coming years?

Hello,

if you are not going to deal with the Amazon business, New Mexico is the most logical. A state with no annual expenses.

I will not be doing any transaction with Amazon. We do business as digital service/consultancy. Is it similarly tax-exempt in New Mexico?

In fact, the logic is the same in all states. If the place you sell is not within the USA (if you sell within the USA but you have not exceeded the state limits), you do not have an economic connection in the USA. The term tax-exempt company actually means that an llc has no economic ties to the United States.

When there is no economic bond, it does not make much sense in which state the installation is made. In this case, every state becomes logical.

Read the article in this link carefully to fully understand the subject: https://startupsole.com/yabancilar-icin-abd-eyaletlerini-gore-satis-vergileri /

Hello, thank you very much for the valuable information.

Will New Mexico have a disadvantage if we do business/receive payment from a US company or person? Everyone recommends Wyoming, we don't want to be burned for $50 a year.

Also, how is invoicing done? I haven't seen any article on this subject. I searched but couldn't find it. Can you provide information or guidance?

Don't worry, your tongue won't burn. However, if you are worried about it, you can also choose Wyoming. Remember that there is an extra annual payment of $50.

We have a detailed article about the invoice here. We kindly request you and wish you luck.

https://startupsole.com/amerikada-ki-sirketten-fatura-kesmek/

I want to establish a family business (not a business) in New Virginia or Pennsylvania, USA. Our goal is to move our family to America and continue our life and business there. (There are lawyers, pharmacists and bankers in our family).

What should be done to stay in America after the company is established? Can I get a visa and residence permit? What should happen and be done to get it?

What kind of service can you provide on these issues?

What kind of methods should be followed to achieve our goal?

Hello,

You can establish your company in any state you want through authorized agencies. There are many guides on our blog, there is no problem with this, but the following process falls into the visa category, so we recommend that you get support from a professional who is an expert in visa procedures in order to foresee what you will encounter in this process. Unfortunately, we do not have any competence or license in visa matters.

That's why we don't want to mislead you.

Hello,

I think that when we establish a company to be a seller in Amazon USA, it will ask us for verification with an invoice. Is it possible to overcome this with this method?

In which state in the USA will I be exempt from tax on my foreign earnings if I establish a company?

Is it true that shareholders of companies established in the state of Wyoming have the right to keep their identity information confidential?

Hello,

The tax part is not related to where the company was formed, but to which country you sell to. For example, if you sell to US citizens, you will pay taxes after a certain limit. If you sell to other regions, you may not pay tax up to a certain level. Generally, single-member foreign LLCs are taxed this way. You can look at the tax articles on our website.

Wy llc shareholders can choose confidentiality during their installation application, but not every agency does this. In general, incauthority and incfile do not form joint stock companies, your name is visible in the records. Northwest and MyCompanyWorks form companies anonymously and your name is not mentioned anywhere.

HELLO, I AM WORKING AS AN OFFICER IN A PUBLIC INSTITUTION. CAN I FORM AN LLC? IS THERE ANY PROBLEM? AND YOU ARE THE MASTER OF THIS BUSINESS. HOW MUCH DO YOU THINK IT WILL COST? HOW CAN I FORM AN LLC? BECAUSE I AM NEW, I HAVE NO KNOWLEDGE OR EXPERIENCE ON THE TOPIC. CAN YOU HELP ME? THANKS

Hello,

Being a civil servant does not prevent you from having an llc abroad, and as far as we know, it does not pose a problem for you because your information such as your Turkish ID number is not available anywhere.

You can calculate how much it will cost with the cost calculator on this page. Prices vary depending on the state you will install.

If you want to get consultancy services from us at an affordable price, we can support you. [Email Protected] address to you detailed price information and the details about the process.

Thanks to you, I formed my LLC company in Wyoming at an affordable price and Ein arrived as of yesterday. The process took 29 days in total, including ein time. It does not take as long as said, I recommend it to my friends who will do the transaction from now on, I did not experience any problems during this process.

Thank you for forming such a platform. I appreciate your support and wish you continued success.

Congratulations on your new job and good luck.

Yes, now it takes around 25 days, the time period has shortened considerably and they are processed faster than before.

Can I get information about the process and costs of transitioning from LLC to C-CORP?

For this, you need to get support from a Registered Agent, you cannot do it on your own. The two types of companies are managed and taxed differently, and documents such as contracts and meeting minutes must be filed.

Can I get information about the process and costs of transitioning from LLC to C-CORP?

Unfortunately, I have no knowledge about this subject. You get service and switch from an agency, but you can ask any agency beforehand via e-mail.

I am amazed more and more every day. You respond to everyone completely and in a timely manner. This platform deserves YouTube and Telegram channels. I also checked incfile and for arizona it says “AZ State Filing Fee”

$85 “

Thank you, this is enough for now.

Incfile imposes additional costs on each state, they have such a policy.

By the way, when establishing an LLC in Arizona, you need to advertise in the newspaper. Each state has different rules and there are other states that require newspaper advertising.

If I remember correctly, you wrote in another comment that you were looking for states that do not have annual fees. I think you should research thoroughly, be careful not to get into any other trouble to save yourself from $15.20 per year.

Yes, I also take it into consideration in case there is a possibility of life in the future. NW C-corp also makes sense, I think we can access all the details on the state's website.

There is a newspaper ad in New York saying it is between 40 and 2000 dollars.

Yes, posting is required in NW. If I remember correctly, there is a newspaper advertisement requirement in 7 states. As I said before, examine the websites of the states in detail before making your decision.

You need to decide on a state and take into account all the conditions of that state. Check out the websites of the states, they provide the most accurate and up-to-date information. If you are going to have an llc in a different state than the one you will live in, this time it will appear as a foreign company, and then you will have to deal with tax and operational burdens.

I applied for company formation in Wyoming, and it cost a quarter of the price of the offer I received from outside. Thank you very much for your support

I will set up a USA company with the routers on your site to receive payments via Stripe. My question is, I would probably prefer Wyoming as a state. How long does it take to arrive lately? Do you know about how long should I wait after setting up a company?

Thank you in advance.

You're welcome,

Recently, the deadlines have decreased significantly and we see user comments that it takes 40 to 45 days. It seems like the intensity of 3 months ago is slowly starting to dissolve. Although we cannot give an exact date, I think that early application will be to your advantage.

Hello, thank you. There are enlightening topics. I have questions.

I want to open an LLC company in America to sell on Amazon and Ebay.

1) I met with a company and they asked for 1000 dollars for the company opening.

2) They said this process would take 6 months. And he asked for an address, a familiar address in America.

I don't have a familiar address. How can this issue be resolved as soon as possible? How can I apply for a company opening myself?

Hello, you are welcome, happy holidays,

1. What they offer you for opening an llc is important. I don't know its exact content, but it is quite a high figure, and they don't even provide an address. Ask about its content, because people start their companies with a cost of $100 and everything works correctly.

2. I don't fully understand this process because even in the slowest state in the USA, an llc is opened within 15 days, everything is done online there. The familiar address is also interesting. In fact, if they rent a virtual office for you, it still wouldn't cost 1000 dollars a year, including the address. It's very contradictory.

If you want to start an llc, you can do it yourself online. Many entrepreneurs have formed their LLC companies in Usa, step by step, using the methods on our website. Follow the steps in this guide;

https://startupsole.com/inc-authority-ile-amerika-da-company-establishment/

Guide to establishing a company related to Amazon: https://startupsole.com/amazon-icin-amerikada-company-establishment/

The important point here is that we usually get a mailing address at an affordable price (with a one-time payment of 15 dollars) and form companies on this address.

After all, forming an Usan company can have very different prices when you receive brokerage services. The important thing is to choose a state with low entry and annual costs, such as Kentucky or Wyoming.

Hello, first of all, you explained it very well. Thank you very much. Thank you. I have a few questions for you.

1-) I see a lot of states and most of them are good prices, from prices to annual fees. Now I am doing arbitrage on Amazon and I am about to reach the 20 thousand dollar limit and I will need to establish a company. I did some research and they suggested two states, most people say that wyoming and deleware tax rates are low. Is there a chance for me to learn the percentages for each state's income tax or can you write the most suitable ones?

2-) As far as I understand now, I will only have to pay income tax and I do not know how to pay it. Can you give me some detailed information about this?

3-) On most sites, people always say that they need an accountant. Do I need an accountant to pay income tax or something else, or will a stripe account work?

Thank you very much in advance for your answers.

You're welcome. Amazon is not our area of interest, but let's try to answer your questions anyway.

1. There are many states and the system works differently in each of them. Wyoming and Delaware are the most preferred states because intermediary agencies provide the most services in these states, so it is easier for them to transact in their own states, so they direct them there. There is not much difference by state. Kentucky has the lowest entry and annual costs, you can consider this.

2. You do not pay the tax to the state, your turnover has started to increase, as far as I understand, this has made you hesitant about the tax, this is normal. First of all, tax is not paid to the state, federal income tax is paid to the IRS. If you are going to form a single-member sole proprietorship LLC (which will be advantageous), you will be taxed as a sole proprietorship unless the IRS states otherwise. In other words, you are subject to tax as an individual, not like normal partnership companies. If your turnover will be at these levels, you only need to hire an accountant and fill out the 5472 form. At that stage, they tell you whether you will pay income tax or not, and probably as a foreign single-member LLC, you may not pay income tax for these amounts. The accountant decides.

They say you need to talk to an accountant because your tax situation is shaped by both your business style and the skills of the accountant you work with. My advice to you is to talk to the accounting expert mentioned below after forming your company. He is a complete expert in the field of Amazon and foreign companies and will give you the best answer. There is a 10-minute free support service, you can schedule a calendar from the website. In general, this person is an expert who is famous for reducing the taxes of foreign Amazon sellers. We do not have a partnership, but we sent an e-mail a few months ago, here is our interview and contact information, read this and be sure to contact him. However, form your company and apply for EIN first, because EIN deadlines are long.

Interview and contact information with the accountant: https://startupsole.com/abd-vergişma-form-5472/

Finally, Stripe account has nothing to do with income tax. Stripe is just a POS system used to receive payments by credit card.

Thank you very much for your answers. I looked at all your articles. One last thing is on my mind. If we apply for the EIN number individually, when we open an llc later, will this EIN number be valid for it or do I need to apply again?

You're welcome,

Individual EIN is the EIN you receive for yourself. It is only valid when you conduct transactions in the USA without a company, but it cannot be said to be of much use. An individual EIN cannot later be converted into a company EIN. So now, if you apply for an individual EIN in your name and wait for 2 months and then receive an individual EIN, when you establish an LLC company, this EIN will be useless, you have to wait another 2 months to get a new one for the company, the two are different from each other. I also have a personal EIN number, but when I founded my company, I applied for a new one on behalf of the company and the personal one did not work.

I'm sorry I'm making you tired, but I was going to ask you this. 1-) If we do the operating agreement ourselves, will we have to pay $40 for the installation alone?

2-) I will set up in the state of Kentacy that you suggested, you say it is the best, as far as I understand

3-) There are some conditions for those who have a company to get a green card, can you talk about them a little

4-) We will also enter as partners with 2 friends, do you recommend that we both establish a company separately or Is it a single company and 2 partners? Does this affect the green card status? Being a single company and 2 partners?

You're welcome,

1 – Yes, your cost is 40 dollars, but you also have a fax cost + address cost for EIN. The cost for the company does not prevent the formment of the company, which you can write an operating agreement for. Many people run companies this way, including me.

2- Annual costs and initial installation costs are affordable, you can access all information via the online panel and installation does not take more than 4-6 days, of course, the choice is yours.

3- Believe me, I have no knowledge about this, I would be misleading you.

4- If you become a two-member company in terms of tax, you will lose the advantage and be taxed like a full company. Therefore, it makes more sense for everyone to establish their own company to benefit from the advantage of a private company. If you think it will affect the green card process (as I said, you need to research), there is no risk in installing them one by one at the moment.

Hello, the information you provided is really detailed and useful. I thank you for this. However, I'm a little confused because there are many sources. I want to open a shopify store in America. And let's say I set up the company step by step, got an EIN number, and opened a bank account. If I start making money;

1- Will I be asked for an invoice to verify my address in America? Or is such a thing not asked at this stage because I am a registered agent?

2- Can we get the support of a registered agent at this point when opening an account for the company at Bank of America, and can a bank account be opened without any problems?

3- Finally, I have a question about taxes. I have to reach a certain amount to pay taxes. How will they understand that I have reached this amount? As a result, I don't have an accountant. (Or do I have to hire an accountant?)

Thank you in advance for your interest, have a good day…

Please, let's try to answer it point by point;

1. I don't know what you mean by address verification, but if you are going to do e-commerce with Shopify, you must first open a Stripe account after the company is established and the EIN is received. Since you will open a Stripe account on your company, Stripe accepts your company incorporation document, there is no problem here, many people have opened Stripe accounts with this method. Stripe is aware that you do not live in the USA and that this is a business account.

2. You do not need to open an account at the Bank of Usa. Wise or Mercury banks will serve you well, they are both reliable and free. You can get RA support, but they do not guarantee that your account will be opened and their prices are high.

3. Since you define an EIN in the panel to receive payments via Stripe, their system is integrated with the IRS and they periodically send the incoming payments and your financial statement to the IRS. This is how the IRS, the tax institution, provides checks. There is no need for an accountant in the first stage, depending on your income. You can keep your own accounting and issue your invoices. There are articles on this subject on our website.

Hello, thank you very much for your answer. Your answers to my 2nd and 3rd questions put the pieces in place. In the 1st question, exactly what I was talking about; In the case of a Stripe account opened in America, Stripe often states that in order to be contacted directly when a person has a tax liability, that person must "reside in America". If such a thing is requested, does our registered agent come into play here?

Also thank you for your quick response and interest.

You're welcome,

I don't know exactly where you got the information that that person must reside in the United States, but there is no such residence requirement in Stripe's "Requirements for opening a Stripe account in another country" document. What you say is true for opening an individual account, because in order to open an individual account in that country, residence must be documented. We are opening a commercial account with an American company. Since you will open a company account, it already supports this. Address proof is not required, you are only asked to confirm that you are the company owner, and this is done with the company establishment certificate. You can look; https://support.stripe.com/questions/requirements-to-open-a-stripe-account-in-another-country

If you read this stripe document in detail, you will already find the answer to your question :) Once again, I hope you have a good day.

There is a lot of information on the internet, but there is also a lot of information that creates confusion. Now I understand that fine line better. Thank you very much indeed. Have a nice day…

And I want to ask one more thing, with all my apologies. Let's say we've added Stripe as a payment method without any problems and we want to add Paypal as well. In the meantime, will we encounter any problems when opening Paypal Business?

Thanks…

Paypal asks for proof of your residential address. It's not like Stripe. Even if you open a business account, you must prove your address as a foreign company in that country. It is necessary to document the address of this company there, the company formment certificate is not sufficient. You need to prove the address with an invoice, it also requires you to have an ITIN number, stripe does not require an ITIN, you can open an llc account with an EIN. You can find detailed articles about this subject when you increase via PayPal on our blog.