Since the beginning of 2024, businesses incorporated in the US must submit a Beneficial Ownership Information (BOI) Report to the government. The purpose of the BOI (Beneficial Ownership Information) Report is to prevent money laundering and other financial crimes. Here is what you need to know about the Fincen Boi Declaration and we have collected all the details about submitting a free Fincen BOI Report Step by Step on this page.

What is Beneficial Ownership Information (BOI) Report?

The BOI Report is a new step in starting and sustaining an Usan business.

Our new venture platform: Startuphub is on publication

Our Startupphub vehicle, which collects on a single platform, from business idea to company installation, state selection, brand creation, bank and strip pre -approval tools to advertising text production

Click here to discover the platform now !

The Beneficial Ownership Information Law was announced in 2023, but as of January 1, 2024, it entered into force. Then he was canceled by the court decision, but he was re -activated from the beginning of March 2025.

The purpose of this report, which is available online with a simple form on the Fincen platform, is to collect personal information about businesses (and the people responsible for them) in order to make it more difficult to conceal financial crimes.

What is FinCEN BOD Statement?

FinCEN BOD declaration is a declaration made to determine who the true owners of companies are in the United States.

Purpose: To prevent money laundering and other financial crimes.

Who Should Declare? Most companies established in the United States (incorporated companies, limited liability companies, etc.)

Information to be Declared: Identity information of the company and its real owners (such as name, date of birth, address, identity document).

Deadline: For newly established companies, the company should usually be declared within 30 days after its establishment.

How to Declare? electronically through FinCEN's website.

Note: Since the EIN numbers of the companies arrive at a time of 1.5 to 2 months from IRS, it is impossible to report in 30 days (with EIN).

What are the Requirements for Fincen BOI Declaration?

The Fincen BOI report is submitted online via a form. There are some requirements when filling out the form:

- Company name

- Company EIN number

- US state where the company is incorporated

- Company's US address

- Company owner name and surname

- Company owner residence address

- Company owner date of birth

- Identity document of the company owner

- An e-mail address belonging to the company owner (no need for an llc corporate e-mail)

For Which Companies Fincen BOI Declaration is Required?

It is a report that must be completed for all companies formed in the USA.

Which companies are exempt from Fincen BOI declaration?

- Companies employing more than 20 full-time employees in the United States

- Companies that filed last year federal income tax returns with gross income or sales over $5,000,000

- Companies operating from a physical office in the US

The above companies are exempt from the Fincen BOI report. Additionally, some large organizations and companies with some status are exempt from this report. the full list of approximately 20 exemptions in these fincen documents .

Fincen BOI Declaration Time According to the Formment Date of the Company

The law became official in 2023, but two categories were created for the purpose of presenting this report;

- If the company was founded before January 1, 2024:

Companies formed before January 1, 2024 must fill out Fincen reports by January 1, 2025.

- If the company was formed on or after January 1, 2024;

Companies formed on or after January 1, 2024 must submit the BOI report within 90 days from the date of formment

Fincen BOI Declaration Step by Step Fincen BOI Reporting

Fincen BOI declaration, also known as reporting, is made online. You can submit your BOI report using the form at https://boiefiling.fincen.gov/

When reporting, make sure your information is correct and try not to provide incorrect information. The information you provide is under state assurance and stored in secure web areas.

The BOI declaration information presented is not publicly published or questioned. For this reason, there is no negative situation in terms of security because all this information is under state assurance.

You must obtain your EIN number before submitting your vacancy report. Because you are asked for the company's EIN number during the form filling stages. If you formed the company in January 2024 and applied for EIN, first wait for the EIN to arrive. You can file your BOI report after your EIN number arrives because you will have 90 days to submit the post-installation report.

Fincen BOI Statement

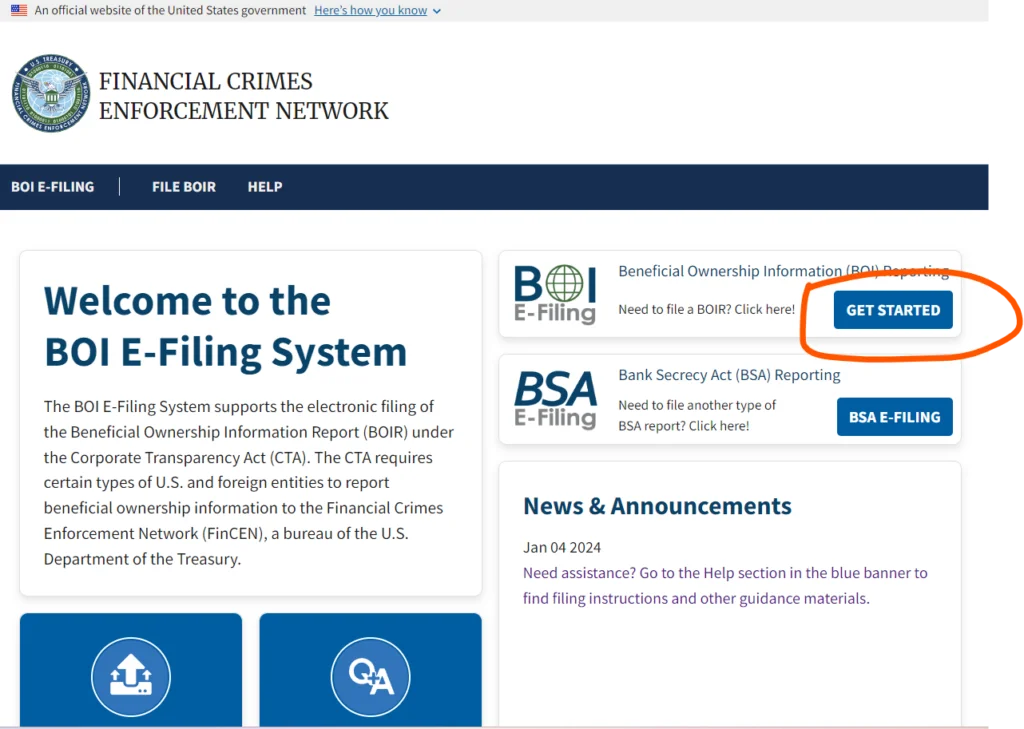

First, view https://boiefiling.fincen.gov/

Click on the Beneficial Ownership Information (BOI) Reporting E-Filing button

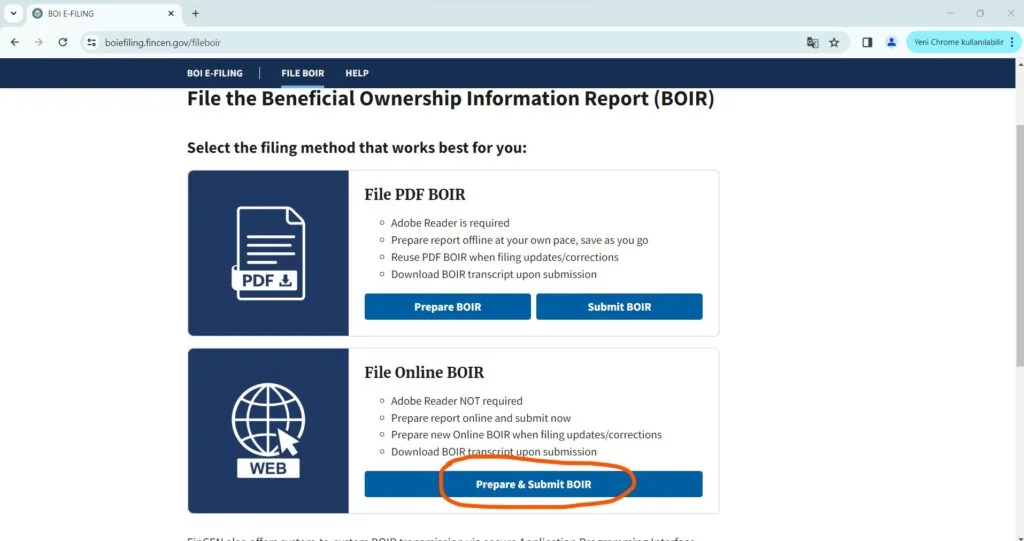

Click the File Online BOIR button

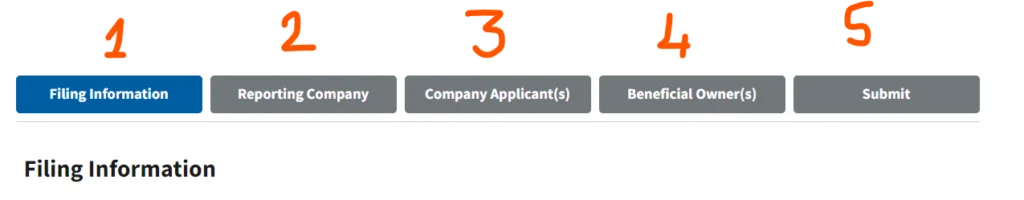

There are 5 steps in total in the form for reporting. You have the opportunity to go back and correct the steps. If you have a missing or incorrect entry, you can easily go back and correct it.

To fill out the form, you must first fill in the Filing Information tab. Since some steps were long, we could not show them in a single image, so we had to divide the steps into images. To avoid confusion, we have discussed each tab under a separate heading.

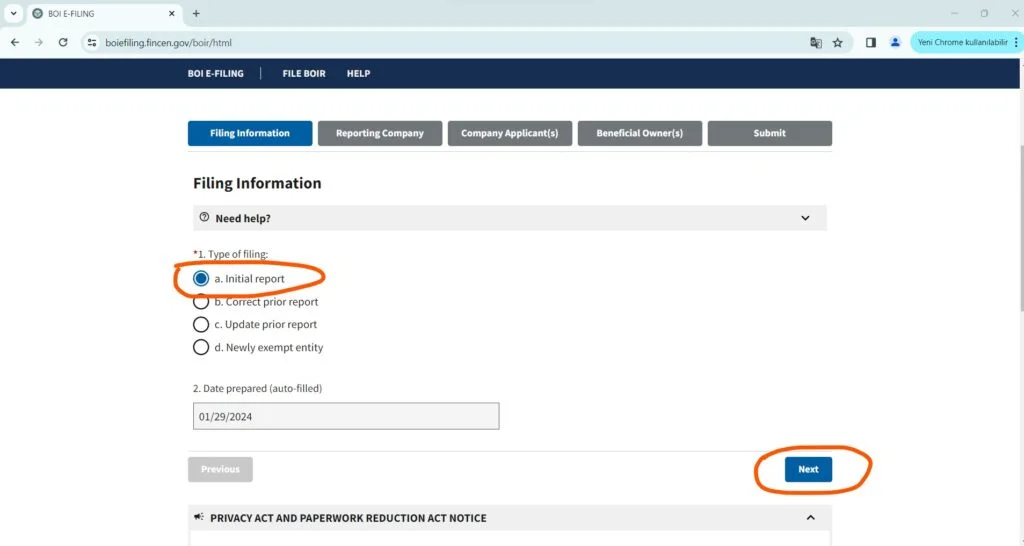

Filing Information

You can select only one option in the Filing Information tab and move on to the next tab with Next. a. Select Initial report because this should be your first time reporting.

Reporting Company Information

The next tab is the Reporting Company tab. Here you need to provide information about the company.

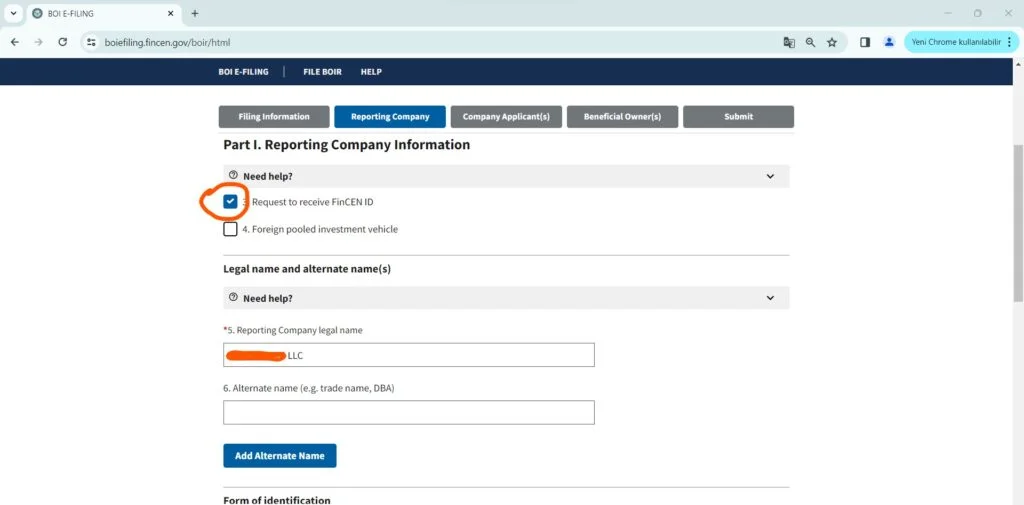

Check the Request to receive FinCEN ID box and write the company legal name right below. Then complete the other entries by scrolling down the page

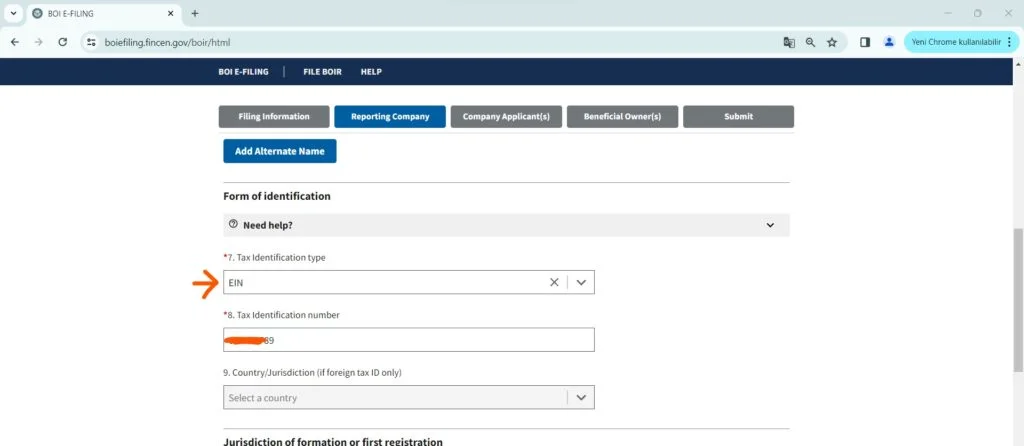

When you scroll down the page, you will see the Tax Identification section under Form of identification. Select EIN from the options and enter your company's EIN number as 9 digits (without hyphens)

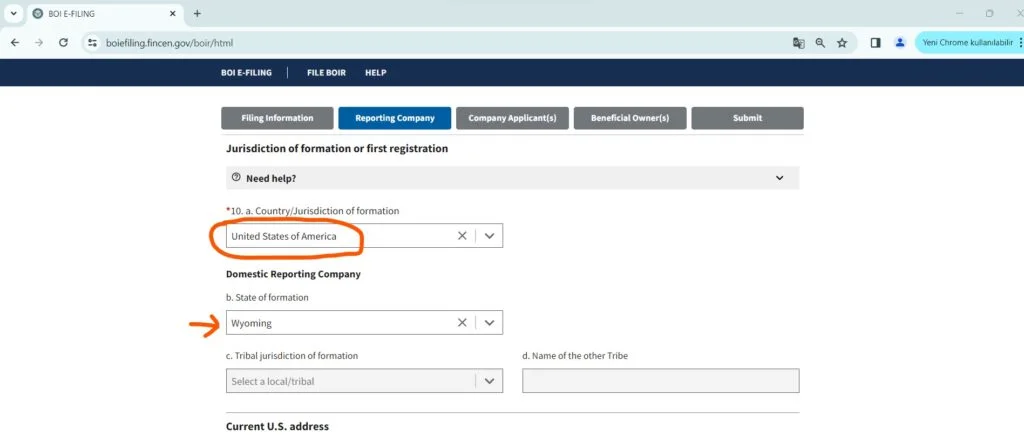

Scroll down the page and select Usa as the country in the Jurisdiction of formation or first registration section. As the state, select the state where the company is formed.

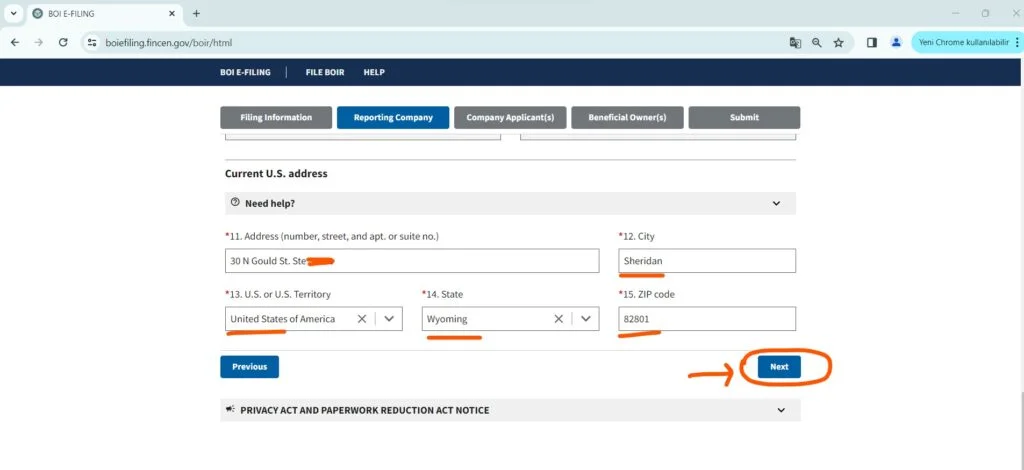

After selecting the country and state, scroll down again and fill in the Current US address section.

In this section, type your company's US address. After typing the address, you will finish this part by clicking the Next button.

Company Applicant(s)

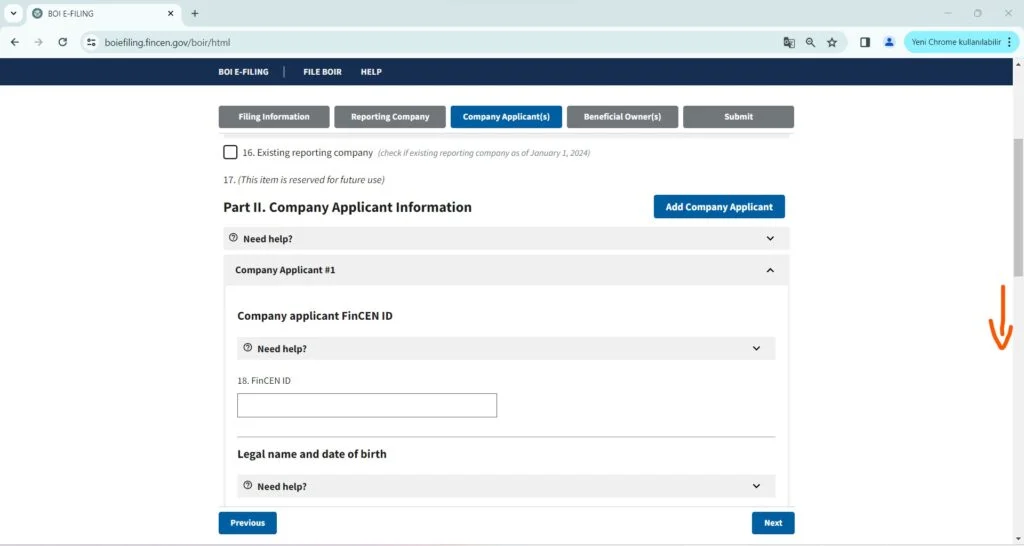

You must enter the company founder's information in the Company Applicant(s) section. But first, leave this first part blank because you do not have a Fincen ID before. After this process, you will receive a Finnish ID. If you already had a Fincen ID and created a new 2nd or 3rd etc. etc. in your name. If you were forming and registering the company, you would need to enter your Fincen ID here.

In summary, if you are doing it for the first time and do not have a Finnish ID, leave this part blank and scroll down the page.

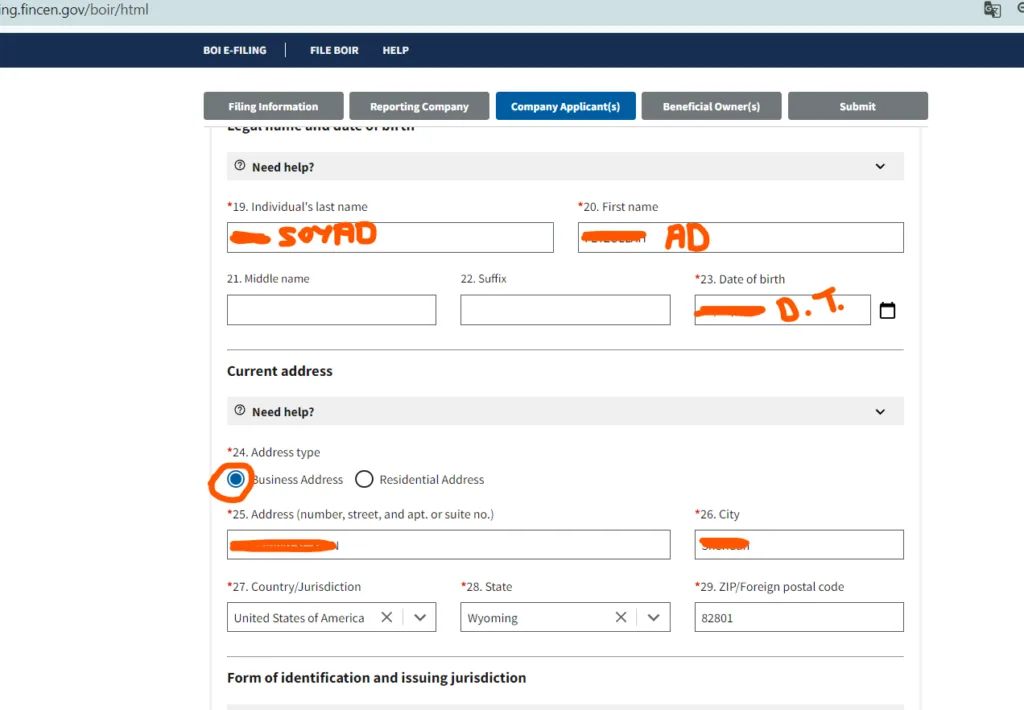

In the Legal name and date of birth section, enter your surname, name and date of birth by selecting them from the calendar. the Business Address at the bottom and enter the address of the Registered Agent company.

For example: If you formed your company in the state of Wyoming through Northwest RA, enter 30 N Gould St in the address field. You can enter Ste N, Sheridan, Wyoming, 82801. In other states, you can find and enter the Registered Agent address on your incorporation documents.

Do not use colons (:) or other punctuation marks or Turkish characters, just write your address using commas as a parser.

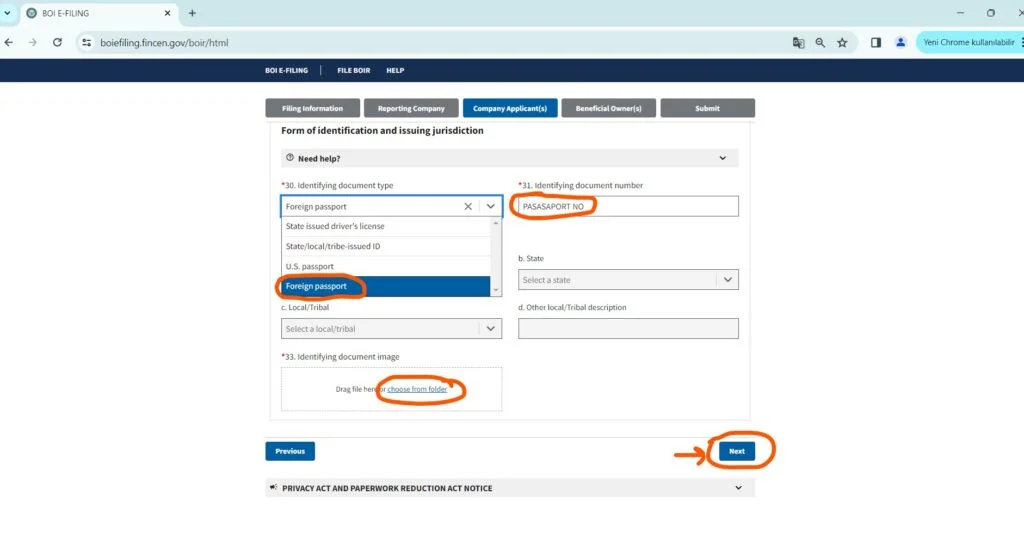

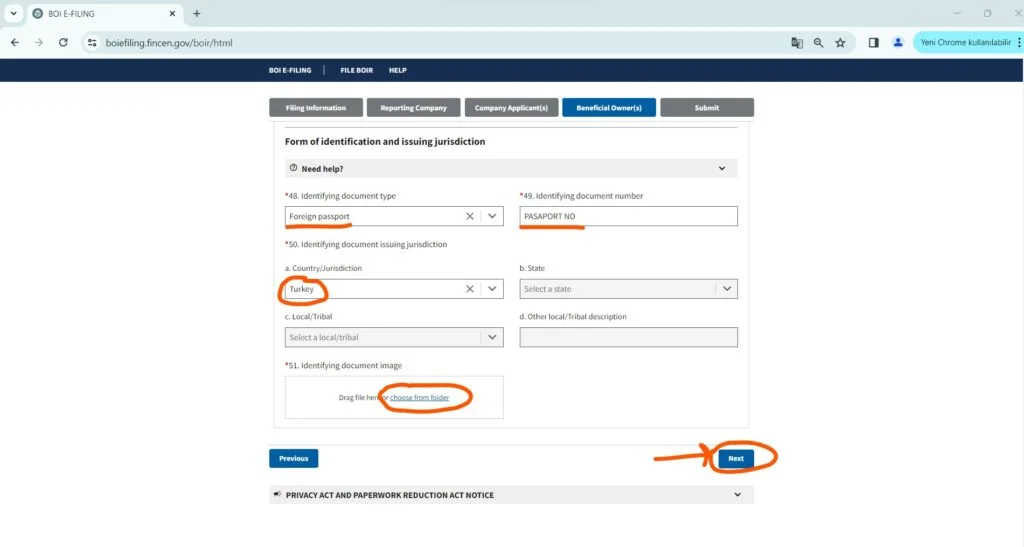

After entering the address and name and surname information, select the ID type by scrolling down the page. Upload your passport and enter your passport number on the right. Select and upload the photo of the passport from the Choose from folder section.

If you do not have a passport and it is impossible to get one in the near future, at least write your ID number and upload the front and back copy of the ID in the same picture as a single page. If you don't have a passport and don't make a declaration at all, it might at least make sense to upload an ID.

After making the necessary entries and uploading the document, you can move on to the next tab by clicking the next button.

Beneficial Owners

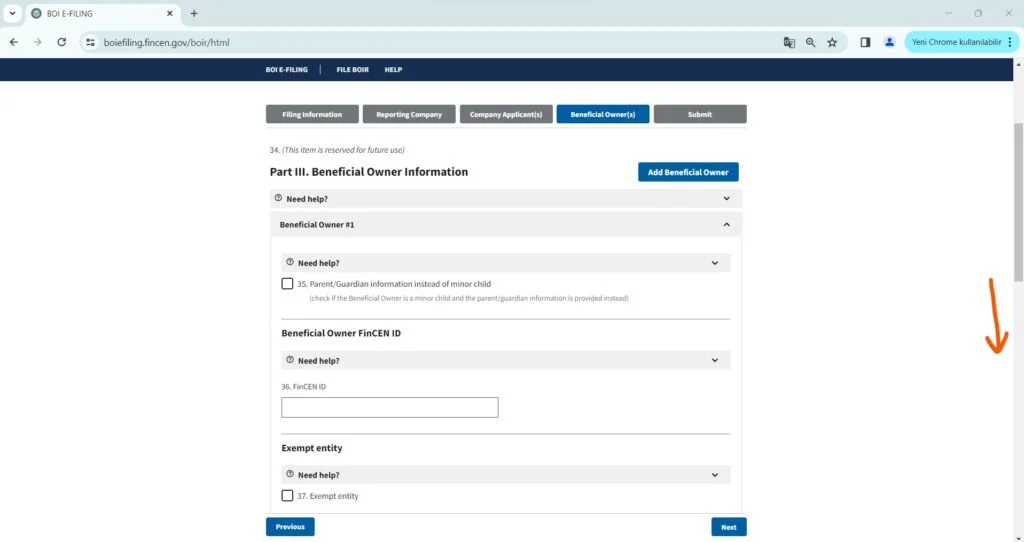

Actually, this part is similar to the previous tab. However, company owners (members) information is entered here. If the company has more than one partner, the information of each partner must be entered separately. In the previous tab, a single member can be entered as the founder or filer, but here it is necessary to add every company member.

If your company has a single member, you will only need to enter your own information.

Again, since you do not have a Finnish ID, you can leave this section blank and scroll down the page.

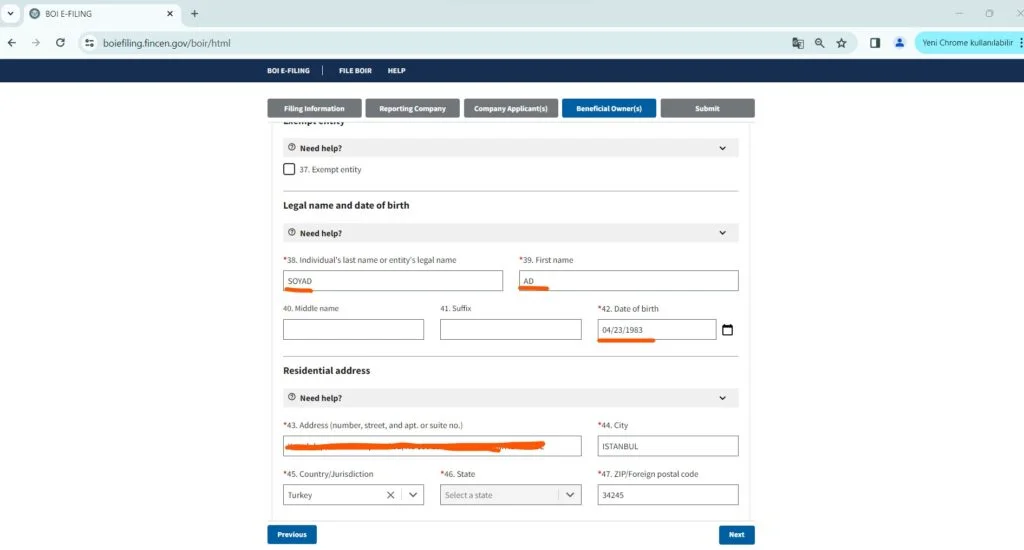

In the Legal name and date of birth section, enter your surname, name and date of birth by selecting them from the calendar. At the bottom, enter the address of your country of residence (Türkiye if you reside in Turkey) as Residential address.

Again, make entries only by separating them with commas, without using unnecessary punctuation marks and Turkish characters.

By selecting a foreign passport, select Turkey as the passport number and country of issue, if it was issued from TR. Then upload the image of your document to the system.

After making the necessary entries and uploading your ID, you can proceed to the final stage by clicking the Next button.

Submit

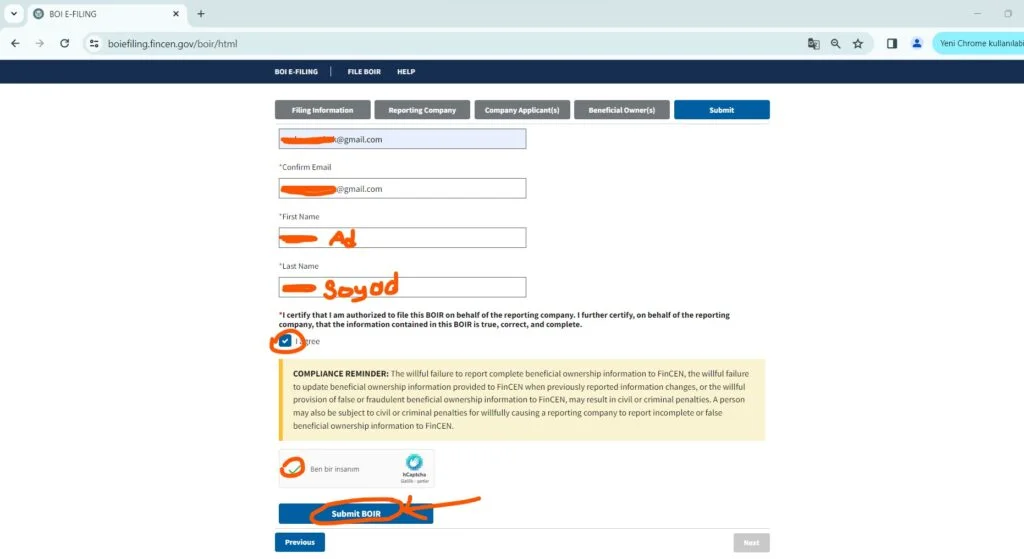

The Submit section is the last step of the Fincen BOI declaration.

This page asks you for an email address. Enter your e-mail address in the relevant sections. Type your name and surname and click on the I agree box.

After completing the Chaptcha that proves you are human, you can send the report by clicking the Submit BOIR button.

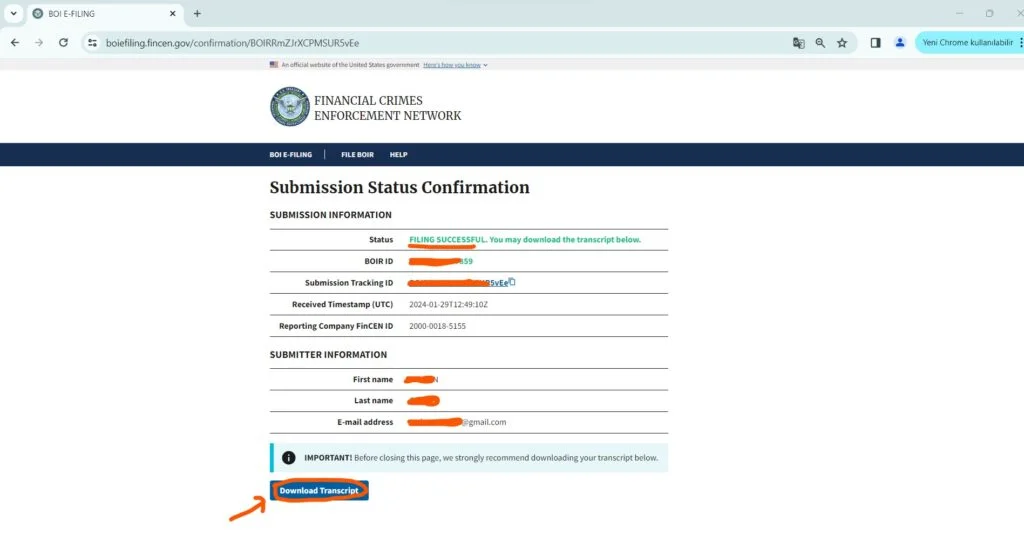

After sending the report, you will see a confirmation page like below. Here you will see some ID numbers and information. Take a photo of this page and click on the most important part, the Download Transcript button, to download and save the report as a pdf.

When you follow these steps in order, you will complete your Fincen BOI declaration report.

You can use your BOIR or Fıncen ID given to you on the page and in the pdf in the last step when you form new companies. You do not need to get a new ID every time; you can also declare the companies registered to you with the same ID.

We hope this detailed guide was useful. Don't forget to comment and share with your friends who own the company to support it.

We wish you good luck.

155 Comments . New Comment

Hello. I wanted to ask something with your follow -up.

If the BOI report has been canceled, what will be the old BOI reports? In case of necessity again, we need to give a new report again. They turned the process to corba. Or did I want to ask you because I could not follow the necessity of the BOi report. Kind regards

They came back soon, Boi (a few days ago), they say that the Boi report should be made within 30 days, but even Ein numbers come in 1.5 months. I don't think it will be a very effective application because he does not work rightly.

Now I already have my boi report. Do I need to give a boi report again Nazmi Bey? I have Ein number and I have it in my nimara. I gave the first report with SSN. Later on, I updated the report with EIN. Or should we present a report from zero?

If so, why should it be? Once done, it is okay, there is no need to make an identity statement.

Thank you, Nazmi. In fact, as the US administration has changed and pursuing aggressive policy to foreigners, human beings become anxious in a place that I have done wrong in a place. We're wearing a wall of the bidet as if they were not enough. We already have information in many US institutions, we have local TR addresses. The company took a lot of responsibility with the BOI report. If there is a deficiency in tax payments, or if the payment systems misunderstand and go to the finance, I don't know how to explain our problem.

I don't think it will be a problem. have a nice day

Hello,

Would you please help? I was sending the BOI report to fix it for the second time, but when I examined your site, I noticed that you were writing Istanbul to the City section of the Beneficial Owners section. In this case, the province should be written in the City part, or should the district be written? Since the concept of “City ile in Türkiye and the concept of“ City ındaki in Usa are different, I think you will know the right thing best.

Should the City concept (ie ie) in Türkiye be written for the BOI statement, or should the district name be used as in the United States? I would like you to inform me about this. You can delete my message later if you want.

I need information. Thank you in advance.

City province, you have asked you in a different comment. Anyway, if you do not make it very important, let it look at that part and do not detect you.

Hello. I founded my company on January 10, 2025 in the state of New Mexico through Nortwest. As soon as the company was installed, I threw fax to IRS for the EIN number, but EIN has not yet arrived on February 10, 2025. EIN is required to make a BOI statement. I can't do it because EIN doesn't come. 30 days given for boi is about to fill. Can I get a penalty in this case?

BOI no longer has been canceled: https://startupsole.com/fincen-boi-raporlama

I do not have an active passport and do not want to apply. Will I encounter any problems if I apply with a new identity document?

It would be better to upload your ID rather than not declaring anything.

This information was very useful, thank you very much for your effort and kindness in preparing it.

You're welcome, we're glad it was helpful.

Hello,

thank you for the detailed information on your page.

I have a question on the subject.

This year I established my single owner LLC company. Formation date: 07/21/2024. I didn't know that much about BOI. I just knew I had to complete it by the end of the year. But I see that the situation is different. I am in a situation like this; Since my business plan did not go as I expected, I was going to start closing the company. But I'm stuck on this BOI issue.

What is the dateline for my company? I realized that I was being punished. But I can't be completely sure.

Can I do this closing before making the BOI report? How long does it take to close a company? Thank you very much in advance for the answers.

Make and send your idle report now, it's a free and easy process. Then you can close whenever you want.

Thank you very much for your return.

Hello,

Thank you very much for the information provided on the page. Thanks to you, I handled my BOI declaration very easily.

The guy I filled out the IRS form with on Fiverr reminded me that I needed to fill out the BOI.

He said that I had to fill out BE-13 as well as BOI.

Do we need to fill out BE-13 as well? I own a single member LLC in the state of Wyoming.

Thanks.

BE-13 Filing: This includes filing exemption claims from surveys by the Bureau of Economic Analysis

Hello,

Within 45 days of incorporation or acquisition, a U.S. company with more than 10% foreign ownership must file Form BE-13 with the U.S. Bureau of Economic Analysis, a division of the U.S. Department of Commerce.

If your company does not have foreign ownership, there is no need for be13, it will be a waste of time, do it for you if you want, but it is unnecessary.

Thank you very much Mr. Nazmi,

I understand As a Turkish citizen, I am the sole owner of the company, I do not have any ownership or physical presence in the USA. More than 1 year has passed since the formment. As far as I understand, there is no need to fill out BE-13.

thank you so much

Thank you too, good luck.

Hello, my company has 2 partners, but I prepared a BOI report only for myself, do I need to prepare it for my partner as well?

Hello, you had to add both partners on the same form from the member addition page. You need to try to edit the existing report with your Fincen ID and add the other member. Reporting cannot be done again for the same company, but editing can only be done if possible.

I get a warning saying "Your Fincen ID does not start with 2" but my ID starts with 2. Can you help me?

Fincen ID system gives in the first report. Finnish ID is not written in the first report

Hello Mr. Nazmi,

I needed help with something. Now, I had filled out the BOI report before. Since my company was founded before January 2024, I think it was necessary to update the company address in the company applicant section. Register agent address must be entered as business address.

But I want to update the form. When I go to the Company Applicant section, it does not accept the FıncenID number, it gives a red warning, when I enter BOIR ID instead, it is accepted, then the address entry option is closed and it redirects me to the "Benefical Owner" section. I can't make any changes. When I leave Fıncen ID blank, only then the address section and passport information sections open.

Am I missing something or should I continue without entering Fıncen ID? At that time, it is as if you are filling out the form for the first time. I didn't know what to do, so I wanted to ask you. I would be happy if you answer, thank you.

Hello,

That part is not very important, what is important is to complete the report on time with the spouse number and identity information. If no change can be made, it can remain this way.

Thanks for your quick response. Yes, all of them are up to date, including the e-in number and identity information. Then, in this case, there seems to be no need to do anything, we should not muddy the waters :) Thank you again, good work.

You're welcome and I wish you luck.

Hello Mr. Nazmi. First of all, I would like to thank you for the useful information you shared. I filled out this report right after the company was formed in 2024 and entered the residential address. Based on your response to Mr. Sercan, I understand that it is not very important to make an update here, but in addition, my residence address changed last month. Based on your experience, do you think there is a need for an update for such a change? Thank you in advance for your response. Convenience in your work.

It may remain that way anyway, the BOI reporting process has been stopped by court order.

Nazmi Bey greetings again. I saw the news that there was a necessity again, the last day for notification was March 21, even after this period was extended for more than 30 days, but I wanted to ask you if there is a original primer. thanks.

Hello,

It is stated that it was removed according to the bulletin on March 26, you can see the press released. https://www.fincen.gov/news/news-releases/fincen-removes-beneficial-ownership-reportting

Hello,

The company was formed by Northwest Agent (NA) on October 8, 2024. I received support from NA for EIN and BOI. My EIN application has been made, but on the NA page it says the estimated result date is 50 business days, March 2025. Does it take this long to get an EIN? Also, is the 90-day BOI report period valid from the date of company formment or the date we receive the EIN number? If my EIN number arrives in March, can I make the BOI report without an EIN to avoid being penalized? Thanks.

Hello, ein numbers arrive in about 3 weeks. They state 50 days as standard, but it doesn't take that long. The BOI report starts during the company filing, that is, the formment period, and the 90-day period starts from that date. Don't worry, it will already be received by the time that period expires.

For the very quick response, thank you very much. Kind regards.

Hello Boi, I paid 25 dollars to Northeast to fill out the report. Which country should I choose in the Issuing Jurisdiction section? The company is based in Wyoming, USA. I live in Turkey.

Hello, you should choose USA

Thank you, for the company, I will enter my own Türkiye address in the company address section, the company address in the home address section, right?

Yes, but all of your questions are already written step by step in this article, so why do you want to get approval again?

Hello, should I write the city and district names (KOCAELİ, GÖLCÜK) in capital letters in the BOI report? Shouldn't Turkish characters be used? Also, which country should I choose in the 'Issuing Jurisdiction' section? I live in Turkey but my company is based in Wyoming, USA.

Do not use Turkish characters. The answer to the other question is on the page.

Hello, I did not enter the apartment building and the street while filling out the SS4 form. Will this cause a problem? I received my e-in number within 15 days. When I opened an LLC in Northwest, I did not enter only the street. How can I send the address in the address section of the BOI report?

No problem, you can complete your BOI report as in the guide.

Hello,

I am grateful for the information you have provided.

I need your help. I submitted a BOI report for my friend, but it gave me the wrong company formation year. The report should have been prepared for an llc formed before 2024, but I reported it as if it was formed in 2024. Unfortunately, I missed the 30-day correction period. What can I do now, how can I fix it?

Thank you very much.

Hello, you can try to contact Fincen and send a support e-mail regarding the issue. There is contact information on their website.

Hello, with the update on 03.10.2024 (October 3, 2024), it is stated on the official website that in the address section of the "Company Applicant(s)" section in the 3rd tab during the application, "company addresses", that is, registered representative address information, should be entered, not "residental addresses". you can check.

To check the notification:

Official Website link: https://fincen.gov/boi-faqs#F_12

Section: ” F. 12. ” // You can access the relevant notification by copying and pasting without spaces.

I wanted to point out that the last update was on June 11, 2024 because I love and benefit from this site.

If you see any missing or incorrect information, please comment below so that we can benefit from it. Best regards and love.

Hello, thank you for your information and support.

Mr. Nazmi, do we need to update the report?

Section 2 – Reporting Company: Address of the Company

Section 3: Company Applicant: The agency we are registered with

Section 4: Beneficial Owners: Ikemetkah address.

What kind of update do we need to make?

Yes, we need to update, we will complete it as soon as possible.

Now I have my private virtual address.

For the "- Reporting Company" section, my virtual address that I received for the company,

For the "Company Applicant" section, enter my agency address.

For “Beneficial Owners:” we need to enter our ikemetkah address?

In the reporting company section, will we enter the agency's address instead of the private virtual address?

1: Company private suite address

2: Company private suite address

3: residence address

If there is no private suite or virtual office address, then the registered agent address must be entered.

Mr. Nazmi, do we need to update? As pre-filled

you can update if you want

Sir, in your friend Emre's question, you answered "2: Company private suite address" for the "Company Applicant" section. You also told me that you can enter the Northwest agent address. Like the friend who asked the question, I also have a private suite address. I asked again, but I was in a dilemma, sorry. Please don't look.

Yes, if there is a private suite, it would be better to enter it.

Should FINCEN BOI be declared every year or only once when we form the company?

It is done one time only

Thanks

THANKS TO YOU, I COMPLETED MY REGISTRATION VERY EASILY. THANKS A LOT..

Hello teacher,

First of all, thank you very much for this useful information. Why did you enter the Residental address when entering the address in the Current Address question in the Company Applicant section? There is also a business address option. Can we write the suite number address we received from the Mail Forwarding company here as a business address?

Hello,

it is necessary to enter a residential address because you need to enter your residence address.

Hello Mr. Nazmi,

with your instructions, I entered a Turkish address in the Company Applicant section. You stated that we need to update it now. I founded the company in Wyoming with Northwest and purchased an address with a special suite number from wyomingmailforwarding.com. In this case, select the Business address option in the Company Applicant section. Do I write the address of the Northwest company or the address of the Wyoming Suite I purchased? Thanks.

Hello,

You can enter the Northwest agent address

Thank you, sir. So, which of the following should I choose when updating the form?

b. Correct prior report

c. Update prior report

Also, do I need to enter my FINCEN ID when updating so that they can recognize my company?

You can select update report, yes, enter the Finnish ID given in the first registration.

Hello,

I have previously made the Finnish boi declaration myself. Recently, the first year of my LLC company ended and I renewed the company. Do we need to make this declaration again or is it enough to declare it once? Northwest sent me an e-mail and said that we would do the Boi report for a fee. Since I founded my company in 2023, is it a reminder that the time given to us is ending? I wasn't quite sure.

Hello,

The Boi report is a one-time identification statement. It is not necessary to renew it every year. Northwest automatically sends emails to all its registered customers. If your BOI report has been submitted before, it does not need to be done again.

Thank you, good work.

Hello, I remember creating the BOI report a few months ago. However, I don't remember downloading and saving any documents as in the steps here. Therefore, is there any harm in filling it out again or how can I access this document and my ID information again? I want to be sure about the matter.

Thanks

At the end of the reporting, you are given a PDF report that you had to download and save. It may not be necessary, but the way to find out your Finnen ID may be to send a support request to Fincen. https://www.fincen.gov/contact

You cannot report to the same company again, you will receive a warning if you try to do so. The best thing would be to get support from Fincen.

When I contacted you, I received a dismissive response like "it was sent to your e-mail address". What exactly will be the problem if I refill it?

Multiple BIO reports cannot be made for the same company. You will receive a warning that it has already been reported when filling out the form.

I reached out and they are not giving out my ID number for privacy reasons. Will this cause problems for me in the future?

Hello, this is a very useful content, first of all, thank you. I have a problem, I realized while making this BOI declaration. I would appreciate it if you could answer me, I'm really confused.

The suite number of the virtual address I received is #60518 -example- and when I applied for EIN, I incorrectly declared #65108 -example- and my EIN number arrived without any problems. But since I just realized, I made the correct number as 60518 in all my accounts, bank records, and company establishment, and it is only wrong in the EIN file. In the BOI report, I entered the correct number to avoid any mistakes.

Firstly, will anything happen to me if the number on the BOI report does not match the number in my EIN file?

Secondly, how can I fix the error in my EIN file?

Thank you very much in advance, thank you for your efforts.

Hello

If you got the correct number, there will be no problem with the boind.

To change your address on your spouse's side, you need to mail a form to the IRS regarding the change of your address. Unfortunately, there is a change of address via another method.

Hello. There is something that makes me lose sleep.

1. I founded my company in the Northwest. However, I received a special virtual address for my company from another company in BOI reporting. This address is my private address, it is the address registered in banks and in the IRS system when obtaining an EIN. Should I write the registered agency address in the company address section of the BOI report? Or do I need to fix this?

Hello,

If the address belongs to you, there will be no problem, but if you want to change it, you can update it on the Finnish website.

So the virtual address belongs to me. I have never used the agent address anywhere. I also have my virtual company address in state records. But I am confused about whether I should write the address of the registered agent in the BOI report.

No, you do not need to write your address, if it is in the state records and you have written your own private address, leave it that way.

Hello,

Thanks very much for the information. I have a question: I applied for company formment last year. However, I did not receive an EIN number, although I do not know if there was an incorrect application. In this case, do you think I will still need to make this declaration?

Thank you.

If there is no EIN number, it is not necessary

Hello. My company was incorporated on October 26, 2023, and I reported it to the IRS on March 29, 2024, without making any sales, and the IRS immediately shut down my EIN and my company. Do I need to submit a BOI FINCEN report? Kind regards

Hello,

In this case there is no need for boi report

Hello. Since I have an SSN, I got my EIN number online by entering my SSN.

And I registered with payment systems such as Stripe, Shopfy Payments, Paypal with SSN.

Therefore, I entered my SSN number by selecting SSN instead of EIN in the blank reporting. And I completed the reporting successfully.

Will it be a problem if I enter my EIN and SSN? .

thanks.

No problem

Still, I filled in the information with SSN in the update section with the 3rd option and changed it to EIN number and I got the successful report. In fact, the previous Finnish ID matches the Fincen ID in the new report. As far as I understand, it seems to me that the latest report is taken into account as long as the Finnish ID is the same. I think the process continues when the report is sent, with the information in the previous report as if it is making a verification with EIN while the bar is filling. In addition, the Finnish ID received is actually a Finnish ID belonging to the company. It's not like it's a personal fincen id. and gives a rejection or success message depending on the situation. I think I won't encounter any problems in the future.

There is no problem, if it is successful, the reporting is completed.

Sir, how did you get this SSN? Any chance you can help? I have an llc in the US, I have an EIN number. I need to get the SSN.

You can get an SSN when you enter the United States legally, obtain a legal work permit, and work somewhere in the United States. Apart from that, you can get it as an Usan citizen. If you cannot comply with these conditions, you need to get ITIN. ITIN is a number that is generally very difficult to obtain and is generally given. AND it can take 8 -11 months. If you send your ITIN application along with your 1040NR declaration, it will be easier for you to get ITIN.

The ssn part is correct but the itin part is wrong. Itin no longer accepts personal applications. You must apply through an IRS-approved agent. Additionally, there is no need for a 1040 nr declaration. It is usually received within 2 and a half months.

There are different equations in ITIN, Mr. Nazmi. Since everyone's equation is different, while the IRS issues an ITIN to a person in 2 and a half months, the process can take much longer for different people. I believe that it should not be thought that everyone is given ITIN in 2 and a half months. Maybe your situation may be different from the people I witnessed.

The applications we make generally do not take more than 2.5 months, they may be trying a different application method, it is not a matter to be exaggerated. We have not yet had any applications that have been completed in 5 or 10 months. All applications made through an IRS-approved agent are completed quickly and 100% positively. However, we have certainly witnessed this in many cases, where dozens of personal applications were rejected. Of course, the applicant can choose any path he/she wishes.

Probably the people I witnessed followed a different path and were rejected. The healthiest information comes from you. I learned another new information from you. Thank you Mr. Nazmi.

Hello, it seems that my company was opened on 05/06/24. In this case, if I apply today, how long will it take to get my EIN number from the IRS? I couldn't deal with any fax work due to my busy schedule. What can I do if my wife doesn't arrive for my report? Will I be fined 500 dollars a day in this case?

Hello,

it will arrive in 4 to 5 weeks, probably in 3 months.

God bless you

If there is a change in our Ikemetkah address in Turkey, do we need to buy a new cup id? Or do you know how we can update the new Ikemetkah address with the existing Finnen ID? In other words, after getting your Finnish ID, can we log in to a user panel-like place with this number?

You can update, you will be given a Finnish ID, you can update with that ID.

Hello teacher.

First of all, I would like to express my gratitude for your efforts. I had 2 short questions:

1) This FINCEN BOI statement; It is given once within 90 days after the company is established and is never given again, right?

2) There is no harm in writing the Register Agent address we are registered with in the company address section, right?

Hello,

We can say that the answer to both of your questions is yes.

Hello,

thank you very much for this beautiful, understandable and detailed presentation. It's great that you share this valuable information.

my question; Company EIM number?

This number is in the 8th title of the APOSTILLE document, no. Is it the 9 digit number in the part?

You're welcome.

Ein can also be written on the apostille document, but you must have an official document for Ein from the inheritance, and it is the number written on the left side of the document under your name and company name.

I have a question about the boi declaration. Is it accepted when it is done with an ID instead of a passport? If it is not accepted, does it cause a problem? Can we do it again when we go and get a passport?

If you do not have a passport, it would be beneficial to at least declare your identity. Once declared, you cannot repeat it, but you can make corrections.

Hello,

First of all, thank you for this useful guide. It was a truly clear Boir guide.

I filled out the form, but some sources said it was necessary to get an extension for the 90-day period. I made a declaration on 29.04.2024 for an LLC established as of 31.12.2024. I did not apply for postponement or anything beforehand. Am I late now?

You were required to file your BOI report within 90 days of company incorporation. If you wish, consult a consultant about the issue. Since it is a new system, there is no clear information about the consequences of delay.

Thanks to the useful information in your article, I completed the BOI report of my company formed through you, instead of the intermediary agency, with the detailed step-by-step explanation in your article. I chose your company because you provided the most useful information I have seen so far. Thank you very much for providing us with such detailed information.

Thanks for your positive feedback. We wish you good luck.

Hello. If our LLC is a multi-partner LLC, must each partner submit this report? I wanted to ask because it also asks for data such as personal identity and address.

Hello, companies with more than one partner can be handled simultaneously in the same BOI report. While giving the report, a new owner can be added, the partner's information and address can be entered and the passport can be uploaded. In summary, there is no need for a separate report for each partner in the same company, you can do it in the same report.

Thanks very much for your quick reply. Enjoy your work

Hello

Our company was founded in 2023, Fincen BOI. I understand that we will make a declaration. Do I need to make this report before or after the tax declaration?

You can do it at any time until the end of the year. It is not a tax return issue. It can be done at any time.

Thank you for your efforts, we got rid of the northwest confusion and sent a clean statement thanks to you, thank you.

Thanks to you, I solved it, thank you for your efforts.

Thanks to you, I solved it, it was a detailed explanation, thank you.

Hello,

First of all, thank you for preparing such a nice content.

I entered my EIN number incorrectly when making the BOI declaration, how can I fix this?

I would be very happy if you could help.

Thank you, good work.

In the first step, “a. You can enter updated information by selecting "C Update prior report" instead of "Initial report". You do not need to get a new Fincen ID, just continue with the FINCEN ID you got the first time and complete the steps, this will be enough.

Thank you very much for your quick reply.

In the first step, “c. When I select “Update prior report”, in the following steps “f. Select EIN as "Tax Identification type" and take the next step "g. I also need to enter my EIN number in the "Tax Identification number" section. Will the EIN number I enter here be the EIN number I entered incorrectly in the previous BOI declaration? Will I enter and correct the correct EIN number in the next steps?

Also, when I enter the FinCEN ID sent in the BOI report to the places where FinCEN ID is requested in the next steps (such as "18th FinCEN ID"), it gives a warning like "FinCEN ID may not begin with 2", but the FinCEN ID sent to me starts with 2. Do you know the reason for this error or was it because I entered the EIN incorrectly that a correct FinCEN ID was not generated?

Since you continue with the Update option, you have updated your information, no further action is required.

Thank you, I am writing this to provide information about the FinCEN ID issue where I received an error.

“FinCEN IDs for individuals begin with 3, and FinCEN IDs for entities begin with 2.”

“18. This is the reason why I got an error in the "FinCEN ID" field, the same FinCEN ID as "36. When I use it for the "FinCEN ID" field, there is no problem.

Information source: https://fincenid.fincen.gov/assets/helpContent/FinCEN-ID-Instructions-20240101.pdf

Hello,

This Northwest has made me very tired about the Fincen declaration. It has been a very useful topic and forum. First of all, thank you. At the last stage I reached, I received the following answer from them.

My apologies my friend, after reviewing your intake form I must tell you that FinCEN is only accepting US physical addresses for the company's address. Registered Agent address, Virtual Office address or PO BOX are not able to be used. I really wish we could be more help to you on this. As this is such a new requirement from the government and FinCEN has not really given anyone any guidance on this.

We already know this part, but it continues like this.

Per FinCen under the CTA, the principal office address of the business must be provided in the initial (and subsequent) Beneficial Owner Information Report. As discussed in the Final Rule applicable to 31 CFR Part 1010, neither a PO box nor the address of an llc formation agent or other third party is considered to be an acceptable principal place of business. In the view of FinCEN, “such third-party addresses would create opportunities for illicit actors to create ambiguities or confusion regarding the location and activities of a reporting company and thereby undermine the objectives of the beneficial ownership reporting regime.

Here he stated the number of the decision taken, apart from the issues discussed in the forum so far.

Link for those who want to read: https://www.ecfr.gov/current/title-31/subtitle-B/chapter-X/part-1010

For convenience, the relevant section is: When you search by typing command F and address, 16-17 and It can be read in the 18th results.

I will also copy the relevant part here and state my question at the bottom.

Initial report. An initial report of a reporting company shall include the following information:

(i) For the reporting company:

(A) The full legal name of the reporting company;

(B) Any trade name or “doing business as” name of the reporting company;

(C) A complete current address consisting of:

(1) In the case of a reporting company with a principal place of business in the United States, the street address of such principal place of business; oath

(2) In all other cases, the street address of the primary location in the United States where the reporting company conducts business;

(D) The State, Tribal, or foreign jurisdiction of the reporting company;

(E) For a foreign reporting company, the State or Tribal jurisdiction where such company first registers; oath

(F) The Internal Revenue Service (IRS) Taxpayer Identification Number (TIN) (including an Employer Identification Number (EIN)) of the reporting company, or where a foreign reporting company has not been issued a TIN, a tax identification number issued by a foreign jurisdiction and the name of such jurisdiction;

(ii) For every individual who is a beneficial owner of such reporting company, and every individual who is an llc applicant with respect to such reporting company:

(A) The full legal name of the individual;

(B) The date of birth of the individual;

(C) A complete current address consisting of:

(1) In the case of an llc applicant who forms or registers an entity in the course of such company applicant's business, the street address of such business; or

(2) In any other case, the individual's residential street address;

If I make my Fincen declaration by not listening to Northwest and using the registered agent address determined by them, even though they give me the legal number here, am I not committing a crime? In my opinion, the relevant article still contains a gray area. It is not clearly stated as a physical office address, but I am not a lawyer. If the truths and interpretations turn out to be different, will an unpleasant development knock on our door in the middle of the struggle that we have started? Will Northwest find out that we are using their address, despite their statement, and seek sanctions?

If this issue is fixed by law, it means that no one can do business remotely without living in Usa. This seems very illogical for a country like Usa. But as I mentioned before, if there is such a law, my comments or ours are invalid.

If Northwest's information and warning are true, does it mean that we are recording illegally?

What kind of sanctions could this have?

How should we proceed to clarify this issue?

I wish everyone good luck and thank you.

Hello,

It is not a process that requires you to spend so much time and get bogged down in details.

https://startupsole.com/fincen-boi-beyani/

Follow the instructions in the notice here, report the statement and save the pdf. This will be enough.

Enjoy your work

Thank you for your answer, Mr. Nazmi, they did not leave any other option anyway. It was just a waste of peace and time. I wish you good work.

You're welcome, it's probably a problem with them, don't worry too much.

With the help of the directions on your page, I successfully created Fincen ID in less than 15 minutes. Thank you again.

My 6-7 weeks were wasted just because of this northwest's address imposition. Moreover, I listened to them and did not use their own address, I rented a Virtual address and gave that address. The men did not identify him and fill out the form. How can I complete this process without sharing this transcript (fincen*boi) with them (I do not want to share it because I used the RA address in the report). Are there any stages that need to be completed that I technically need to work with them now? I want to open my bank account directly by using the article on your site and continue on my own.

Hello everyone,

I could not send the BOI form via Northwest for the reasons I mentioned above. Afterwards, I followed the steps on this page one by one and was able to send the form via the legal website “fincen.gov”. As soon as the application was made, I was able to immediately receive the FinCEN ID and transcript (application confirmation document in pdf format) from the site. I received the response "Filing Successful", meaning the application was successful.

Actually, there are two more issues that bother me;

1- I sent this transcript to Northwest, currently my BOI form is still missing from Northwest. I expect them to add the form to their system and remove the warning that the BOI application is incomplete.

2- The application made through the official website fincen.gov was answered immediately without any evaluation. (Even if I had given incorrect information, the transaction would probably have been successful) I also have a Submission Tracking ID. In this case, I am not sure whether the answer will come after another set of manual checks or whether this matter is completely over.

In this case, I assume that the transaction has been completed positively. If there is any development, I will write again.

I would like to thank StartupSole officials again, who shared the flow with all the details on this page, Mr. Halit and all other friends who contributed to the forum.

In this way, you have actually sent the report and you will not receive negative feedback in the future.

With the method in this guide, there was no negative feedback even on the reports we sent 2 months ago.

We couldn't figure out why Northwest didn't accept this. There is no information in Fincen documents that agent addresses are not accepted. Those who carry out the transactions in this way but do not send the report can send it.

A refund of USD 9 can be requested from Northwest.

Astagfurullah, I would like to thank everyone who contributed!

Thank you very much for your comment, sir. I founded my company via Northwest just yesterday and got stuck in the BOI transactions. It is stated on their pages that "Registered Agents Address" cannot be used as an llc address. However, as I understand it, there is no problem when we apply through “fincen.gov”. I also applied for EIN right now (Thanks to StartUpSole, it did it on my behalf) and I'm waiting for it right now. After I get my EIN, I think I will use Northwest's own address because there doesn't seem to be any other way. Of course, if there is a different and legal way to declare the company address without using Northwest's own address, I would like to hear about it. Well-being

I think the only way to apply without using Northwest's own address is to live there. I'm not sure, but it would be good to do your research.

Where can we look for issues such as greetings and verification? I completed the application and received the filing successful notification. Do we need to do anything else? Have we completed the fincen-boi application for now? Or a notification to us etc. Is he coming? Thanks in advance for your help

It already gives you a pdf for verification, no need for extra verification, keep your document and your Finnish ID.

Thank you for your quick response. For now, I assume that the fincen-boi application is completed. They ask for a fee of $25-30 for the transactions in the article above. Thanks to your descriptive explanation, I easily completed the application by seeing what we did, why and how. I would also like to point out this in order to contribute to the community. Zip codes (postal codes) in the US address can be given as 9 digits by Northwest. It can be like (82801-****). When filling out the form on the screen above, 5 or 9 digit zip codes are allowed in the zip-code section. They can enter by removing the (-) sign. This is how I did it and it was accepted. Thanks again, good work

Thanks for your contribution

Hello everyone,

I also ran into the same obstacle as my brother Onur and was subjected to annoying and delayed answers from Northwest for a few days. The answers they gave me were more or less the same. Registered Agent, Virtual Office or Mailbox addresses will not be accepted by Fincen and They told a lot of things about why we should not use these addresses. By the way, I would like to point out that their customer support is extremely weak. After about 4 days of struggle, I had to make a decision (Because this is no joke. I have the last 30 days left to submit this form). I contacted my Turkish accountant in America, with whom we planned to work, and he said that this did not make sense and that thousands of his customers were using the addresses they received from RAs and that there should be no problem. After I sent him the screenshots of my correspondence with Northwest, he also became suspicious about the situation and asked me about the company and the company. After receiving the relevant documents and information such as my Turkey address, phone number and e-mail, Northwestin made our application with the address it provided for our company and sent me a screenshot of the "Filing Succesfull" transaction completed successfully page that it received from Fincen. Me and my son are on the internet. We did research, but we couldn't find anything solid to suggest that Fincen does not accept these addresses. It seems to me that this is something that Northwestern does not want and that it may be hiding behind such an excuse. This is my experience. I hope everyone here comes across it. and we get positive results.

Hello, first of all, thank you very much for sharing information in such detail. Companies charge between 60-100 dollars for BOI. Thanks to your detailed explanation, I was able to complete the process myself by following the steps. Such information is very useful. I will be happy to share your page in the Amazon groups I belong to.

You're welcome, the process is just that and it's quite easy. We thank you for your sharing support.

Hello;

I have an LLC that I formed in January 2023 and closed in October 2023. Do I have to file a declaration for this LLC? I would be very happy if you provide information.

Enjoy your work.

Hello, there is no need

Hello,

First of all, I would like to thank you for your very detailed information and support.

With your reference, I formed my company in Delaware through Northwest Registered Agent in January 2024 and entered the Northwest Registered panel to submit the BOI form.

“Company address cannot be Registered Agent address, PO Box or Virtual Office.”

I get a warning saying: As far as I understand from this message, only those who have their own physical address can make this notification. Or is there something I misunderstood? I still sent the form by typing the Registered Agent address.

I wanted to write here about the problem that all friends who set up an llc may encounter this year. If you could clarify the issue it would be greatly appreciated.

Thank you, I wish you good work.

Hello,

No problem, there is probably an error in their form in that part, because there is no harm in writing the registered agent address in the records as the company address. Only those who have their own physical address should send this form; all companies must send it. There is no error in what you did, don't worry, there will be no problem.

Hello again,

I am attaching below the response I received from Northwest Registered Agent on this matter. Unfortunately there doesn't seem to be an error. In this case, all those who form an llc remotely may encounter this very serious problem.

When the result of my BOI form arrives, I will share the latest status in this section. Applying directly to the Northwest Registered Agent as shown on this page may also be a solution. If there is a problem, I will try it that way too. (Northwest may be having trouble with this.)

Thank you, good work.

——————–

With this report, the Federal government would require a valid US address to provide, this cannot be your registered agent address, a virtual address, or a PO box. If you don't happen to have an address to provide, we'd highly suggest reaching out for legal counsel on your options for fulfilling this requirement; we do allow our clients to use our address where it's accepted, however, our address would be rejected for being a shared virtual address, we apologize for any inconvenience.

Hello,

Many people have reported BoI via Northwest before. Actually, this warning was not there before, it may be a new application. If you want, you can request a refund of the 9 USD service fee and easily declare your boi fincen yourself by using the guide in the link below.

https://startupsole.com/fincen-boi-beyani/

Enjoy your work.

Hello Mr. Onur, I am experiencing the same problem you are experiencing. Have you made any progress?

Thanks

Hello Mr. Halit and Startupsole Officials,

Ignoring Northwest's warning, I tried my luck and applied for BOI through Northwest. After about a week, I received the following error today. In applying for BOI; I understand that "Registered Agent" address, "Virtual Office" address or "Mailbox" address is not accepted. However, if true, it would mean the closure of thousands of remotely founded and managed companies. I guess and hope it's a problem specific to Northwest.

I will try to apply directly by following the steps on this page, as recommended by Nazmi Özer from StartupSole.

I will inform you when I receive a positive or negative response.

I wish everyone good work.

My best regards.

——————–

We tried submitting the BOI Report for ***** but the submission was rejected. The error was the Company Address listed was our Registered Agent address.

Currently, FinCEN requirement is the company address can not be the Registered Agent address, Virtual Office address or PO Box. The address also has to be located in USA. Please log in HERE and you should see a red banner that says You have Order Items Requiring Attention, click on that and complete the questionnaire. Once that is done our filing system will review and will submit the filing to FinCEN for processing if no additional information is needed. The completed filing will be uploaded to the Documents tab of your account and we will send an email notifying you.

If you do not have an address that satisfies their requirements then in this case I would highly recommend reaching out to FinCEN to verify their address requirements as while we know they do not accept Registered Agent addresses, it is unclear if there is an alternative address that can be provided. They can be reached by filling out an inquiry form at: https://www.fincen.gov/contact – you can also give them a call at 1-800-767-2825.

Thanks a lot. Thanks to you, I applied easily.

Thanks

For companies formed in 2024?

https://startupsole.com/fincen-boi-beyani/#Sirketin_Kurulus_Tarihine_Gore_Fincen_BOI_Beyan_Zamani

I founded the company with your guidance. Within 3 weeks, I received the EIN information I applied for with your campaign. I made the declaration today. It is appreciated that you share all the processes in detail, step by step, with visuals. Thank you very much for your help.

We wish you success in your new formation.

Very Helpful and I was able to answer your questions, thank you everyone, absolutely superb service, BRAVO.

It was a very useful post, thank you to everyone who contributed.