According to the decision in the temporary article 93 of the income tax law no. 193 of the Official Gazette, the peace of existence was extended again until June 30, 2022.

According to the practice, money, gold, foreign currency, securities and other capital market instruments located abroad can be brought to Turkey without being subject to tax inspection.

What is Peace of Being?

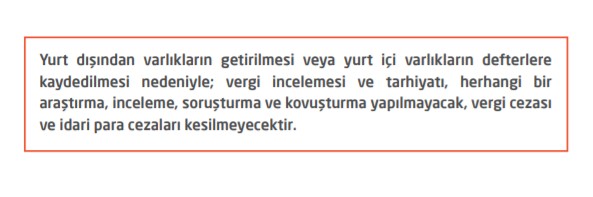

Asset peace is a temporary law that means that money, gold, foreign exchange, securities and other capital market assets located abroad will not be followed by the revenue administration and will not be taxed in any way if they are brought to Turkey in a registered manner.

This law first came into force on November 17, 2020 and has been extended many times since then. As of today, the peace of existence, which has been extended again, continues until the end of June 2022.

What Does This Mean? Is There an Advantage of Wealth Peace?

What Does This Mean? Is There an Advantage of Wealth Peace?

This means a very advantageous situation, especially for entrepreneurs and those who earn dollars abroad. If you have income from abroad, you can bring this income into the country tax-free.

If there were no asset peace, foreign currency or similar instruments regularly transferred from abroad to your individual account would be automatically reported to the revenue administration by your bank. When these reported incomes were investigated retrospectively, they would be subject to tax, including those in the past.

In short, when you regularly transfer currencies such as USD or EURO from abroad to your individual account (as long as you notify your bank), it will not be monitored or taxed in any way.

Brochures and informative information about this law are also available on the revenue administration's website. For detailed information, you can visit the website https://www.gib.gov.tr/varlik-barisi

You must bring it within 3 months

You must bring it within 3 months

After informing your bank of the amount you will bring, you must transfer your money to your account within 3 months. If you exceed this period, you may need to make a notification again.

How to Apply for Peace of Being?

It's easy!

We will share with you the step-by-step method applied by one of our followers, and you will not have any questions in your mind about what you will need to do at this stage.

What you need to do to benefit from the peace of existence;

- Determine the amount of Foreign Exchange, Gold, money or similar instruments you will bring

- Go to your bank and fill out a form

- Write your personal information and the type and amount of assets you will bring to the form.

- Fill out the form in two copies

- sign

- Keep a copy of this application document that you have stamped and signed by your bank.

- Transfer your money from your bank abroad (via Wise, Mercurybank or other transfer tools) to your own bank within three months

- Use, invest, withdraw or spend your money as you wish without paying taxes.

Is There a Sample Form?

The bank officer will give you the blank version of the form to be filled out, and all you have to do is fill out the form correctly (along with the amount of assets you will bring), sign it, and have it signed by the bank.

You don't need to do anything else.

What Happens After Filling Out the Asset Reconciliation Form?

After filling out the form, you will need to transfer your assets to your bank within 3 months. There is no need to take any further action.

According to the information provided by the bank officer, the bank will process this document and your ID number will be registered in the system, so you will be able to use these assets as you wish without having to pay taxes.

Existence Peace Sample Application Form

You can review a sample of the form that our follower applied for (with the information hidden) for information purposes.

All you have to do is write your personal information (TR number, name, surname, address, etc.) at the top, the amount of foreign currency you will bring in the middle, and the TL equivalent and current exchange rate in front of it.

Thanks to Wealth Peace, you can bring the income you earn abroad to Turkey tax-free.

Amazon is an asset reconciliation system where you can bring the foreign currency you obtain through e-commerce, digital product sales, software sales or similar means to Turkey without being taxed.

If you have income earned abroad, you can bring your money using digital banks such as Wise or Mercurybank. It is enough to indicate the amount of income to the bank and it is necessary to bring it within 3 months.

Meanwhile, corrections can be made for the amount to be brought according to the information on the revenue administration's website.

For example, you submitted the documents to the bank stating that you will bring 1,000 USD on January 4, 2022. 2 months have passed and your income has increased to 5,000 USD. It is stated that you have the right to edit the document by making a correction at this stage.

To get more detailed information, you can get information from the revenue administration's hotline at 444 0 189 (VİMER). If you obtain different information, you can always share it in the comments section at the bottom of this page.

2 Comments . New Comment

I went to the bank for this transaction, filled out the form, signed it and submitted it. The bank officer has never done this process before, we solved it together :)

I applied from Garanti and the bank told me that it does not matter whether you bring your money from our bank or another bank within 3 months, you will definitely not be subject to tax proceedings as we will notify you of this application.

I think everyone should take advantage of this opportunity.

Congratulations, it is very pleasing that it works. As you stated, everyone should take advantage of this opportunity.