If you filled out the SS4 form correctly when you formed your company and applied for EIN, if everything goes well, the IRS will deliver your EIN number to you via fax. When you receive an EIN for the first time, the IRS will mail you an EIN confirmation letter, as well as a fax. This letter will be mailed to the address you provided on the ss4 form. This EIN confirmation letter is called CP 575.

What is CP 575?

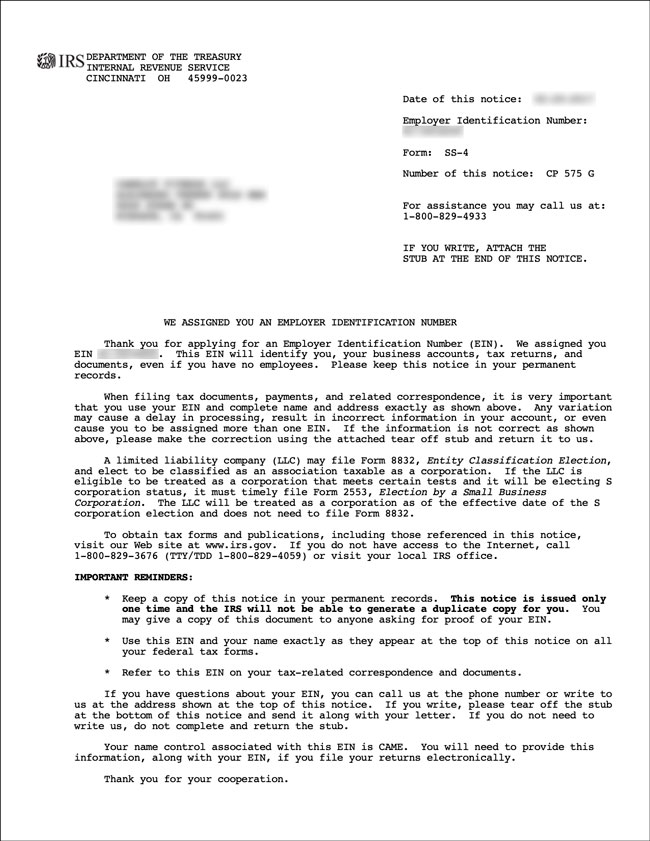

CP 575, as we mentioned above, is the EIN approval letter. When the IRS assigns you an EIN number, it processes it on the SS4 form by fax and sends it back, but the EIN confirmation letter called CP 575 is a one-time document automatically generated from the computer when your EIN is assigned by the IRS.

CP 575 will be sent by post to the address you wrote on lines 4a - 4b of the SS4 form within approximately 4 -6 weeks.

CP 575 somehow finds you if your mailing address is active, but it happened that this CP575 did not arrive or you lost it, what happens next?

If Cp 575 is missing or missing, 147C comes into play.

What is 147C?

We said CP 575 is automatically created with each new EIN and mailed to the owner. If this is lost, you will no longer be able to get a new CP 575. Instead, you may receive a 147C EIN approval letter from the IRS. In fact, both of them function the same as each other, but their names are different, and the reason for this is that, as we mentioned above, CP 575 is produced once automatically.

How to Get a 147C EIN Approval Letter?

The only way to obtain an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. Unlike the first application, it cannot be received by fax.

For security reasons, the IRS never sends anything by email. Instead, the IRS will send you an EIN Verification Letter (147C) in two ways:

- by mail

- by fax (you can use a real fax or a digital/fax)

Request by mail

It may take 4-6 weeks for your EIN Verification Letter (147C) to arrive if you tell the IRS official over the phone that you will receive it in the mail.

The IRS will mail your 147C Letter to the mailing address on file for your LLC. You can confirm this address while on the phone with an IRS representative

Requesting via Fax

If you choose to receive the EIN letter by fax, the IRS will fax Letter 147C while you are on the phone.

Tip: The IRS representative asks, “Do you have a private, secure fax with you?” When he asks, say yes.

Telephone Process to Request a 147C

- Call the IRS at +18008294933

- For English language, press 1.

- For Employer Identification Numbers, press 1.

- “If you already have an Employer Identification Number but can't remember it, etc.” Press 3 for.

- Tell the IRS representative that you have an LLC and need an EIN Verification Letter (147C).

- The IRS agent will ask a few security questions to verify that you own your LLC, answer them.

- Tell the IRS representative that you would like to receive Letter 147C by mail or fax

Cp575 EIN Approval Letter is a Document Like Below

147C EIN Approval Letter is a Document Like Below

Where to Use the EIN Approval Letter

Where to Use the EIN Approval Letter

Now you know what this means. An EIN approval letter is normally not required unless there is a very extra situation, such as opening a stripe account. Because if the company name you enter in the Stripe panel exactly matches the name on your EIN form, the EIN you enter from the IRS database is automatically queried and verified. In some cases, the company name may not match due to differences in case letters, commas, or punctuation. At this stage, stripe asks you for your EIN confirmation letter and your account is verified manually. However, this situation may occur in very complex company names or due to differences in the name written on the SS4 form, such as spaces and punctuation marks. In some cases, stripe synchronization with the IRS database may take up to a week. If your eIN approval letter has not yet arrived, you can enter the version of your SS4 form into the stripe panel and wait a few days.

In addition, some banks may request an EIN approval letter when opening a bank account.

Sometimes, accounting firms may ask you for an EIN approval letter to submit to the government in processes such as sales tax declaration or accounting transactions.

If you have not received the EIN confirmation letter after receiving the EIN, if it is lost and you need it, you can request your EIN confirmation letter from the IRS using this method.

15 Comments . New Comment

I haven't done anything yet. I just want to change the letter I in the company name to I. And since my agency has moved to a new address, I will send form 8822-b to the irs.

Let your ein confirmation certificate and company installation documents [email protected]

Is there a problem if we don't change it? So, is it possible to close the company and form a new company until the end of the year or thereafter?

Have you made any name changes from your state? What exactly do you want to change?

Hello, is it possible if I change my name in my ein but not in the company agreement? So can I call the IRS and request a change and not change the company name in NM state?

Unfortunately, you need to report this to the state first. Afterwards, you need to apply to the IRS with the new company name and new company documents. If it is not essential, do not make any changes because this process may take a long time.

How to contact irs to change company name

Irs phone number: +12679411099

Hello, I filled out the ss-4 form, but we cannot use Turkish characters in the ss-4 form and my company's name is NİZTR but it appears as N ZTR in irs cp575, what should I do for this, I would be glad if you tell me a solution.

Why did you choose such an llc name? Why didn't you specify it as NIZTR? You need to call the IRS and request a change.

Hello

147C EIN Approval letter has arrived at my address. Should I request the original of this document to my address in Turkey? Does it matter whether it is original or not?

You will use the pdf digital version of the document under all circumstances. You probably won't need it because they will never ask you for the original because there is no wet signature on it.

If this version of the document is legible and you have it, there is no need. However, if you want to have it in my possession, you can optionally have it mailed. It's up to you.

Yes, I think they made a typo, they wrote the i extra.

HELLO SIR, THEY SENT ME SUCH A CONFIRMATION LETTER AND IT WRITES EIN NO. BUT MY COMPANY NAME IS HIOMERS TRADING LLC ON THE TOP, NORMALLY IT SHOULD BE HOMERS TRADING LLC. IS MY EIN NUMBER ALSO OR THE COMPANY NAME IS SPELLED WRONG, HOW CAN I CHECK THIS?

Hello,

The CP575 document is your document from the IRS regarding the EIN number assigned to your company. Are you sure that your company name is spelled correctly on the SS4 form when applying for EIN?