Closing an LLC in Usa varies in each state and situation, but the general procedure is almost the same. In this article, in general terms, how to close an LLC company in Usa? You will be able to find the answer to the question. Since it would be very difficult to give separate procedures for all states, we will talk in detail about what needs to be done in general and then the LLC dissolve process, especially for the state of Kentucky.

Types of Company Closing in Usa

Before moving on to the process of closing an LLC, you first need to know the 3 types of dissolution and their contents.

Judicial Dissolution

Business owners may choose to close their LLCs through judicial dissolution for a variety of reasons. The main reason for this type of termination is that the partners cannot agree on the terms and cannot find common ground regarding the sustainability of the business. As a result, one or more of the partners may want to dissolve the company. Judicial termination is the method chosen when partners cannot reach an agreement.

Administrative Dissolution

Administrative termination, implemented by the Ministry of Foreign Affairs, occurs due to the company's failure to fulfill certain obligations of its commercial enterprise charter. During this process, the state administrator suspends the rights, powers and operation of an llc. This may be due to many reasons, such as the company doing an illegal business or not paying the annual fees due to the state.

Voluntary Dissolution

As the name suggests, voluntary dissolution is when members or the owner of a single-owner LLC closes its company voluntarily. This happens when certain triggers occur, such as multi-member companies being decided by members' votes or the death of a member. These triggering reasons can often be one of the items written in the LLC operating agreement. The situation is the same in single-owner LLCs; the business owner can willingly close his company.

Closing an LLC in Usa (General Rules)

- Articles of Dissolution Filing: The filing process performed when the company is established is also applied when closing it. In some states, the Certificate of Dissolution must be filed with the Secretary of State along with the Articles of Dissolution. Once approved, your company is technically dissolved, but in some cases this may not be enough.

- Creditors' Settlement: Before dissolution can occur, the LLC must satisfy its current financial obligations. This means notifying your creditors that you will be closing the company. Some states require this before filing termination papers. However, even if your state does not require this, it is good business ethics. There is no such requirement in Kentucky.

- Cancellation of Licenses and Registrations: If you have a business license or license from the state, you will need to cancel them first.

- Checking Tax Debts: Check whether your LLC has a tax debt during the period it is active and close it if there is one. If you have exceeded state limits and collected sales tax, you must submit them to the state and not owe any tax.

- Cancel EIN After Closing: You need to cancel the EIN, which is the tax number you received from the IRS for your company, from the IRS after closing the company. To do this, you must fill out a form and fax it to the IRS. and fax numbers for cancellation are available the IRS website

In general, it works as above, but if you do not have sales tax to file with the state and you are a single-owner LLC owner, simply sending the Articles of Dissolution document to your state is sufficient.

In our main subject, the state of Kentucky, the situation is similar and there are not many details.

Now let's look at this state's procedures;

Closing an LLC in Kentucky

If you own an LLC in the state of Kentucky, there is a $15 franchise tax you must pay to the state each year. If you do not pay this fee on time, your company will be automatically terminated by the state government within 60 days from the due date. As we stated above, this situation is Administrative Dissolution.

Keep in mind that you will have to pay a $40 filing fee to voluntarily close the company.

To dissolve your LLC in the state of Kentucky, you complete the Articles of Dissolution and submit it by mail or in person to the Kentucky Secretary of State. You can pay this $40 closing fee by cash or check to the Kentucky State Treasurer.

Mail your completed Articles of Dissolution to:

By the way, you can download this form for free from the state website:

Links and preliminary information about the forms: https://www.sos.ky.gov/bus/business-filings/Pages/Dissolution.aspx

Articles of Dissolution: https://web. sos.ky.gov/forms/corp/IPD-Profit%20Corporation-Incorporators.pdf

Submit to Kentucky Secretary of State, Corporations Division.

Mailing Address:

Kentucky Secretary of State

Elaine N. Walker

Office of the Secretary of State

PO Box 718 Frankfort,

KY 40602-0718

USA

When these documents reach the ministry correctly filled out (payment must also be made), your company will be terminated within 2 business days. Your company name is then purged from the state database for reuse by someone else.

Getting Paid Closing Service

If you do not want to deal with the process of filling out documents, paying fees and mailing them to close your company in Kentucky, or if you are not confident in this matter, you can get service to close your LLC by getting service from Mycompanyworks company from this link Mycompanyworks.com handles the entire process for you for $99 + $40 state closing fee.

Mycompanyworks.com for a total of $139 .

Steps:

First, from this link .

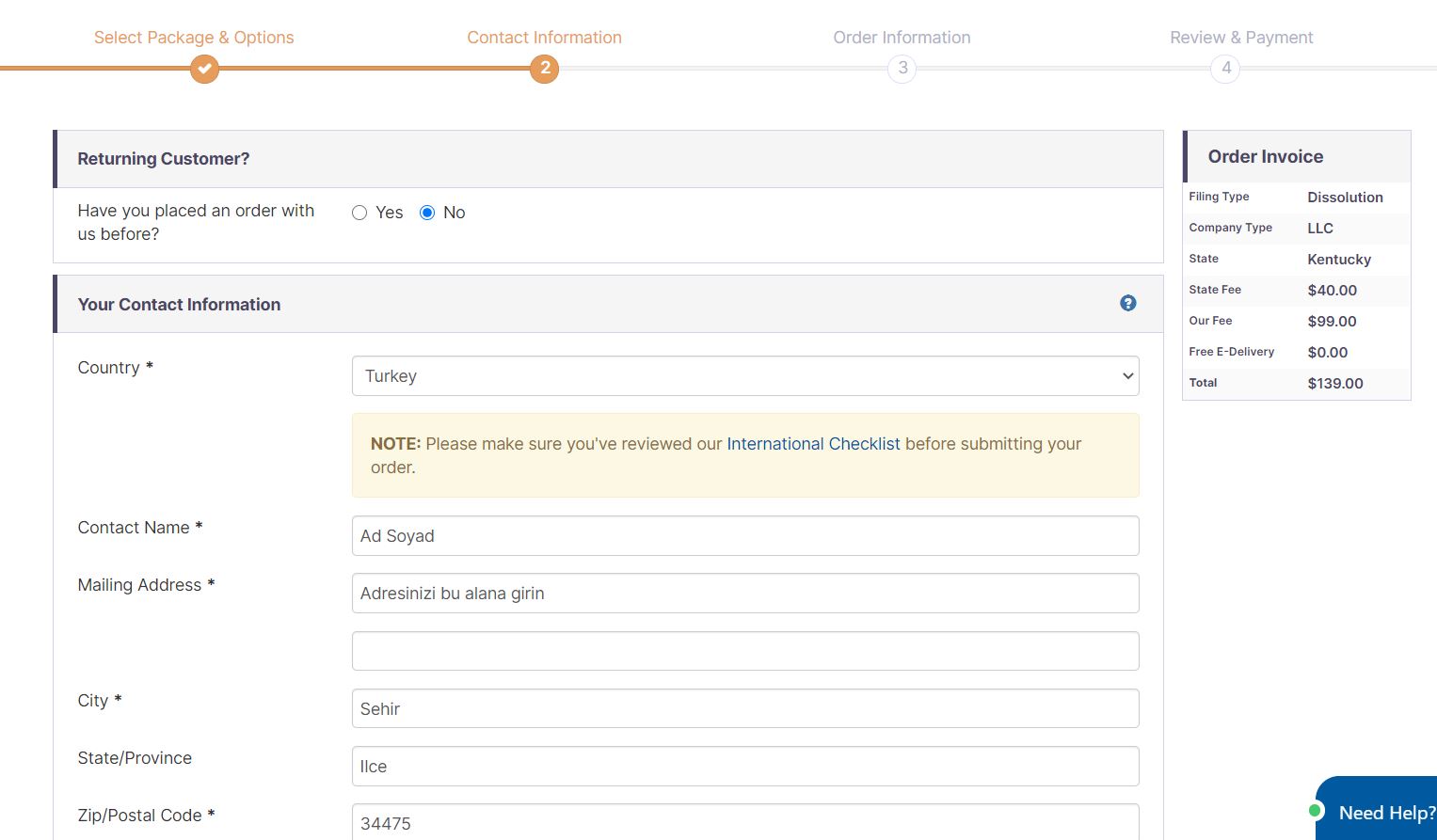

Select the state and company type (LLC) where the company is located. To receive documents digitally, select the Free E-Delivery $0 option and continue to the next step.

On the next page, you are asked to enter your contact information. At this stage, a customer panel will open for you and you will be able to follow up through the panel.

At this stage, you are asked to enter a lot of information. Fill in all fields as completely as possible.

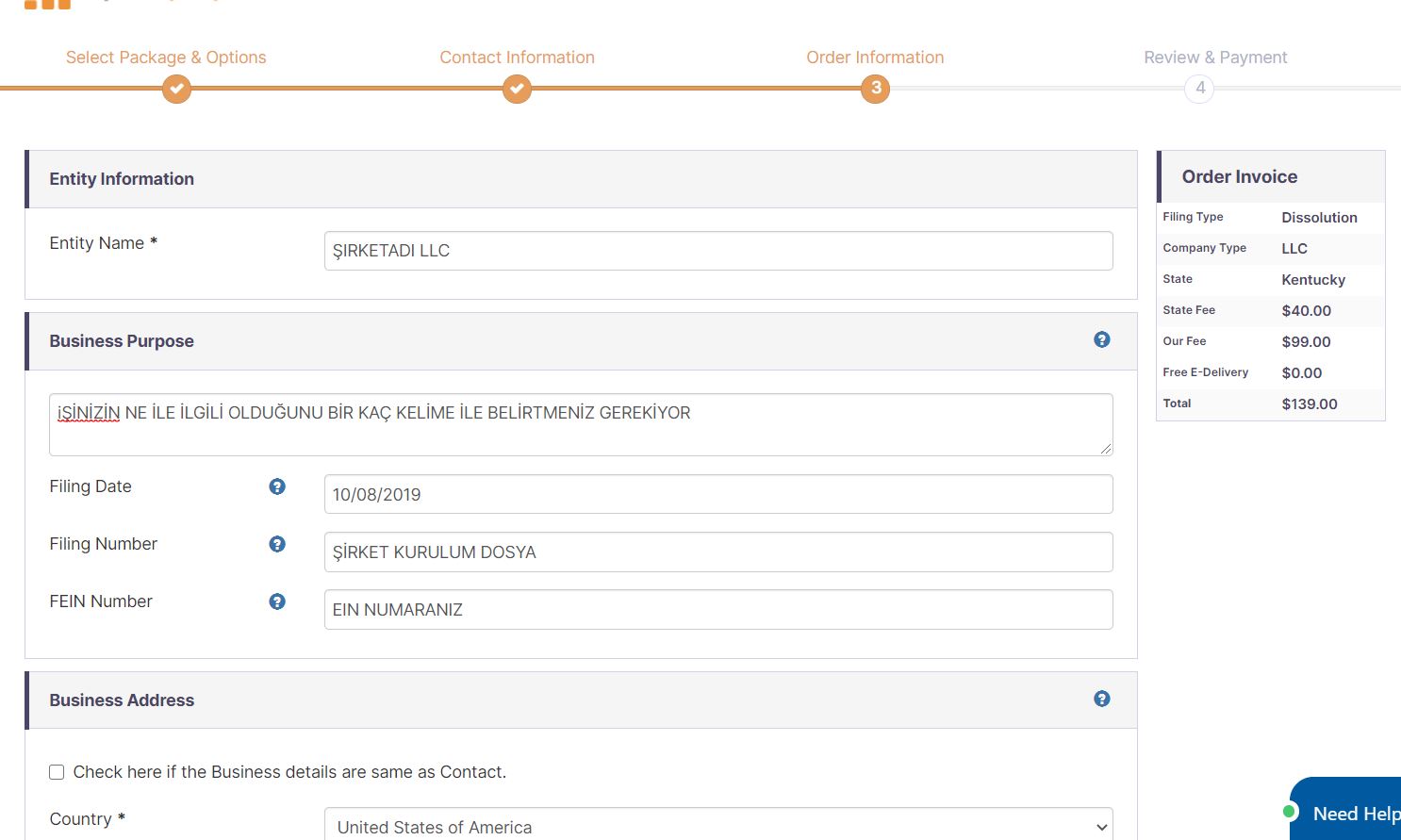

Enter the company name, company activity description, your EIN number, company formment date, file number given in the formment, company address, reason for closing the company, member information and many other information in these fields.

The purpose of providing this information is to ensure that they fill out the termination document correctly on your behalf. Fill out the entire form completely and complete the next step, which is the payment part.

The files will be prepared, they will carry out the necessary procedures on your behalf and will inform you when the process is completed. Depending on the workload, your company will be closed within a few days.

Note: They do not cancel your EIN number, you have to do this yourself. If you want, you can fax the cancellation form to the IRS yourself, or you can email Mycompanyworks and get paid support for this service. Because I did not find an EIN cancellation process on their website, you can still ask, of course, as always, the choice is yours. By the way, you can also close your company before canceling the EIN, so it does not have any priority.

If you do not pay the state annual franchise tax ($15), your company will be closed by the state government within 60 days. So, in this case, is it possible to make the company active again?

To return the company to operating status, an administratively dissolved LLC a reinstatement application .

There are various fees associated with this reinstatement application:

- The reinstatement penalty for LLCs is $100.

- You must also pay a lump sum filing fee of $15 each for all outstanding annual reports.

If you pay these forms and fees, your company will become active again. By the way, if you have not canceled your EIN, you can continue where you left off when the company becomes active.

Is a permit from the Department of Revenue required before the Kentucky Secretary of State approves your dissolution?

There is no need for such a situation in the state of Kentucky. You do not need a document or approval from the Department of Revenue, just submitting the form regarding the closure mentioned above is sufficient.

I hope everything goes well and you don't have to close your company, that's my primary wish, but if things go wrong, as you can see, closing an llc in Kentucky is as easy as forming one. Just some payment and a form and your company is closed.

However, if you do not pay the $15 annual franchise tax that must be paid to the state, your company will be automatically terminated administratively, as we have already mentioned above. Of course, I have not experienced this situation, but as a result of my research, I have not come across any information that administrative termination will cause you any problems in the future, as long as you do not owe any tax debt (if you made a short-term trade without exceeding the state limits). If you want to use this option and the termination of the company by the state government without charge seems reasonable to you, it does not seem to pose much of a problem. However, I recommend you do some research on the situation.

I hope it was a useful article, stay healthy.

30 Comments . New Comment

Greetings Mr. Nazmi,

I want to start the state and federal closing process for HOM NPS LLC in Wyoming before 2025, which I opened on January 10, 2024 with the articles on your website, without any commercial transactions.

As far as I understand, it is necessary to fill out this form https://sos.wyo.gov/forms/business/llc/llc-articlesdissolution.pdf I cannot send it because there is no money in the account. How can I close the company? Can you help me?

There may be a possibility that I may go to the USA, so I am considering closing the visa process according to the process, as it is easier and healthier.

Some information:

– EIN number was obtained, ITIN number was not obtained

– BOI Report was made

– Established on January 10, 2024

– Wise bank account was opened, there was no money in or out, no commercial transactions

– I am not a US citizen and currently live outside the US.

Company Information: https://wyobiz.wyo.gov/Business/FilingDetails.aspx?eFNum=129144215156238224061002135122035157207209145075

With love and respect,

FSC

Hello,

If you order the closing order through Northwest, the beer will be more costly, but you can have the closing order with your credit card, they will handle all the paperwork and forms, so the transaction will be easier and faster.

Hello, I completed the opening of my Montana LLC company in March-April 2024. However, I want to close the company because I cannot spare time right now. I have not made any money through the company in any way. Do I need to file taxes before closing?

Hello, you can close it, it seems there is no need to declare it.

Hello, I opened an llc in Kentucky 1 month ago, but I have not received the EIN number yet and I have not filled out the BOI form. Now I want to close my company. Will it cause any problems if I do not get an invoice and fill out the vacancy form?

Hello, if you have not applied for EIN and are going to close it, close it without applying for EIN and you do not need to fill out the EIN report.

Hello, I opened an LLC company in the state of New Mexico in April 2023 by following the information on your site. However, afterwards, I did not engage in any activity related to the company, did not obtain an EIN, or opened an account in the name of the company. What should I do to close the company? I would be glad if you can help me with this. If I do not take any action in this way, will the company automatically close down due to inactivity, or do you recommend closing it down before 1 year is up? Thank you.

Hello,

If the company remains active, there will be no problem, since it does not have an EIN number, you are not obliged to submit a declaration. If you wish, it can remain open this way and if you want to close it, you can place a closing order from your Northwest panel. They will send your closing petition and complete the termination process for you.

Enjoy your work

Do we have to file a tax return to register a Wyoming LLC Sole Member company? The accounting firm says that the declaration is mandatory in order to close the company. What method would you recommend?

If it is the first year of the company and you have earned income from your company in the first year, it may be healthier to file a declaration and then close it. It would be better to clarify the issue with a reliable and licensed CPA and start your transactions.

Greetings,

the information you provide is very valuable, first of all, I would like to thank you on behalf of everyone.

I have a small question in my mind: What happens if we do not cancel the EIN number? Also, you wrote above that you can send a fax to cancel the EIN number. Can this be done by fax or is it necessary to mail it to the address?

Hello, it would be beneficial to cancel it to avoid any tax-related problems in the future. It is not possible via fax, they compare the wet signature on the SS4 form you sent when purchasing the product and process it. Applications made via fax will not be taken into consideration. It is necessary to fill out the form, sign it and mail it.

Hello,

is the Administrative termination you mentioned for Kentucky also valid in the state of Wyoming? Thanks.

Yes it is valid

Hello, I would like to close Sole Member – Wyoming LLC. It was formed in January 2022 and I received my EIN number right after. I plan to close it before the end of 2022, that is, before the Tax Return period of the same year. I didn't make any sales, just my company was billed $40 for address etc. expenses. Should I make a Tax Return when closing?

Hello,

If you fail to pay the Wyoming LLC annual report, the company will be administratively dissolved by the secretary of state within 60 days.

All that remains is to cancel the EIN.

If you do not owe any taxes to the IRS, you can cancel your EIN number using the following method.

Sign and mail a letter to the IRS that includes the full legal name of the business owner, EIN, business address, and the reason you want to close your account. If you have a copy of the EIN Assignment document you received when your EIN was assigned, add it to the same envelope and mail it to one of the following addresses.

Afterwards, your EIN number will be canceled and you do not need to take any further action.

Internal Revenue Service

MS 6055

Kansas City, MO, 64108

Or

Internal Revenue Service

MS 6273

Ogden, UT, 84201

Hello

, I opened my company in the 6th month of 2022.

I applied for it last month.

It takes about 5 months.

If I want to close the company now, what steps do I need to follow?

As far as I understand, Ein is being cancelled.

Is there such a thing as canceling ITIN?

Finally, how or where should it be confirmed that the company is canceled or closed? I'm asking to avoid any problems in the future.

If you have any taxes, you need to pay them first. Then filing is required to close the company. Then, documents must be mailed to IRs to cancel the EIN. There is no need to cancel ITIN. ITIN will be automatically canceled if no tax is declared for 3 years.

Hello, since I no longer use the company I opened last year, I am waiting for my company to be closed with the Administrative Dissolution option, but I received an e-mail as follows.

ATTENTION:

We have attempted on numerous occasions to contact you regarding your

delinquent invoice owed to Inc Authority, thus far payment has not been received.

In the absence of payment or a reply, we will have to conclude that it

is not your intention to amicably resolve this matter. “We hope this is

not the case.” I would be very grateful if you could inform me what I should do in this case.

Incauthority must have sent this email. They may ask for payment for renewal, it is not a big deal, since you are processing through the state portal, the Dissolution process will be completed in a short time. Don't pay attention.

Thank you very much indeed, every time I asked a question you answered in the best way possible. I wish you a good evening

You're welcome 😀 Convenience.

Hello,

In the automatic termination of the LLC company in the state of Kentucky without paying Franchise tax, will the failure to notify the IRS Accounting (possible penalties) and the 99 USD to be paid after the first year of the registered agent, which is free for the first year, be eliminated? Can you give information?

Thanks,

Hello, you may not pay, the company will be terminated because it has not paid the fees, so you will not have to pay the registered agent fee.

Hello,

can single-member LLC companies be transferred to someone else? If your answer is yes, an article on this subject would be great. THANK YOU.

It can be transferred, but it is a process that is many times more costly than forming a normal company. Additionally, it is necessary to obtain an EIN again for the new company.

If the company does not have a great value, it will be an unnecessary action.

Hello, I formed an LLC company in the US state of Kentucky in May 2021 and I want to close it now. I read what you said in your article and a question came to my mind; If I do not pay the $15 franchise tax fee, will my company automatically close after 60 days and will there be any problems for me in the future after this closure? I wonder if there will be any problems when I form an llc again or go to the USA. Which way would you suggest? Thank you

Hello,

State documents state that the company will be automatically terminated within 60 days if the annual report is not paid (if no taxes are due and there are no obstacles). But we don't know if it will cause any problems in the future because the laws may change or you may have missed something. If you have the means, we can say that closing this company is the safest way.

At that time, it seemed like a cheaper solution to wait for it to close automatically by not paying the annual tax. In this way, when we decide to reopen after 2 years, we can pay the penalty and continue where we left off. Actually, I think it's kind of like ice cream.

So, that's an option, of course.