Founded in Northwest, Wyoming, LLC announced that they are now accepting Amazon address verification codes in the address systems they provide for companies.

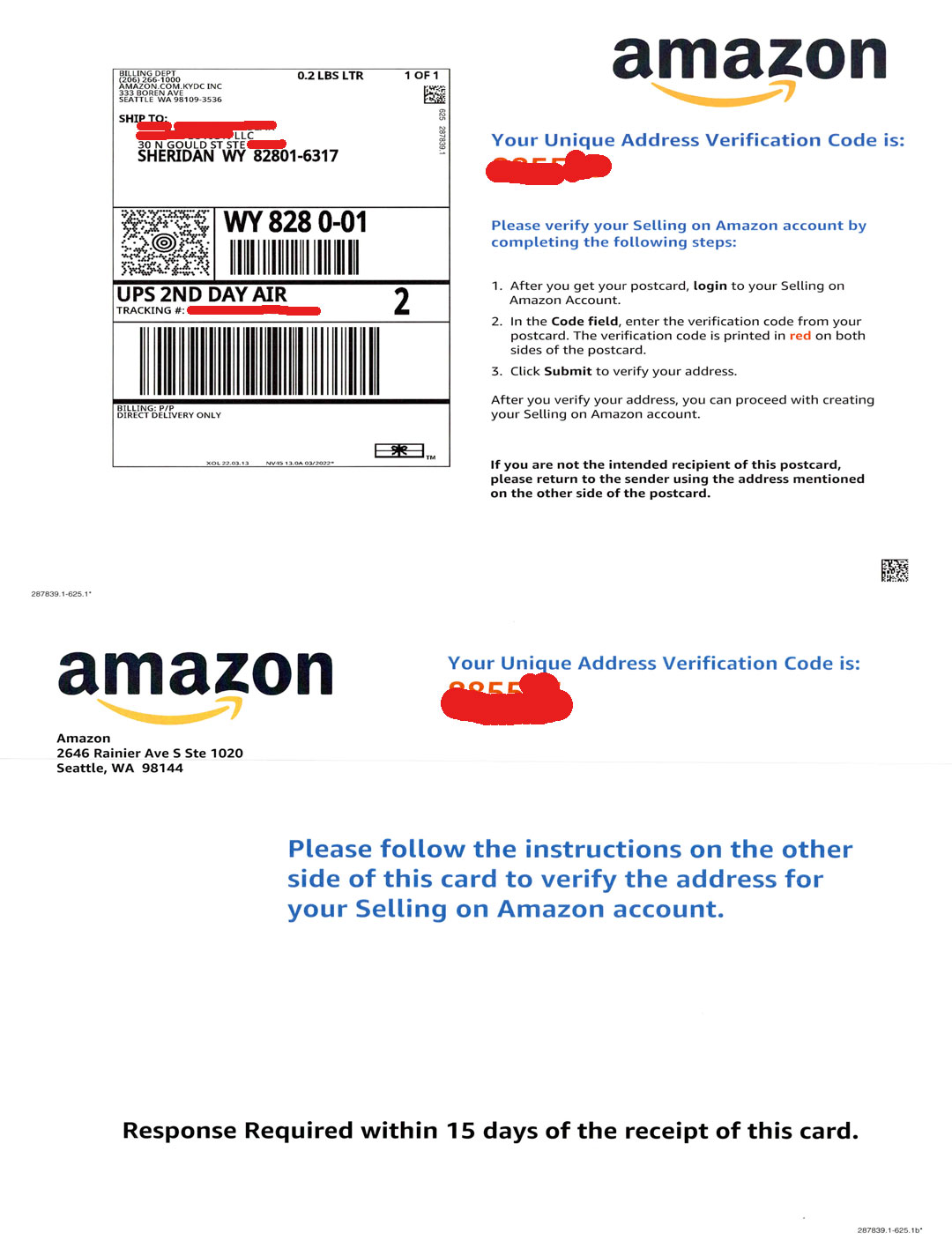

Amazon has now removed the utility bill application for amazon.com USA account openings. When you enter your US company address when opening an Amazon account, Amazon will send you a verification card as below for address verification within a few days.

Northwest registered agent stated that it does not accept this type of verification cards for businesses using shared addresses. According to the latest information, Northwest announced that it will now receive these address verification mails for its customers, even on free address plans, and will scan and deliver them digitally to account holders.

This card is sent to your US business address by mail, and you can easily verify your address within a few days by entering the unique verification code information provided to you in the account opening field. Incoming mail is digitally uploaded to your Northwest Registred Agent customer panel as usual and notified to you by email.

How Did the Verification Process Work Before?

How Did the Verification Process Work Before?

Those who follow know the subject better. In the past, Northwest did not receive this type of verification mail on its free address plans. In this case, as an alternative solution, an address with a private suite was purchased from Wyomingmailforwarding.com for a fee of $15 Sellers who received the codes digitally delivered to the business address containing this special suite could open their accounts this way without any problems.

Northwest Now Accepts Amazon Codes in Wyoming

Amazon Address Verification Codes in the past, announced that it now accepts these codes in the state of Wyoming and will open, scan and digitally deliver incoming mail on the same day as standard documents.

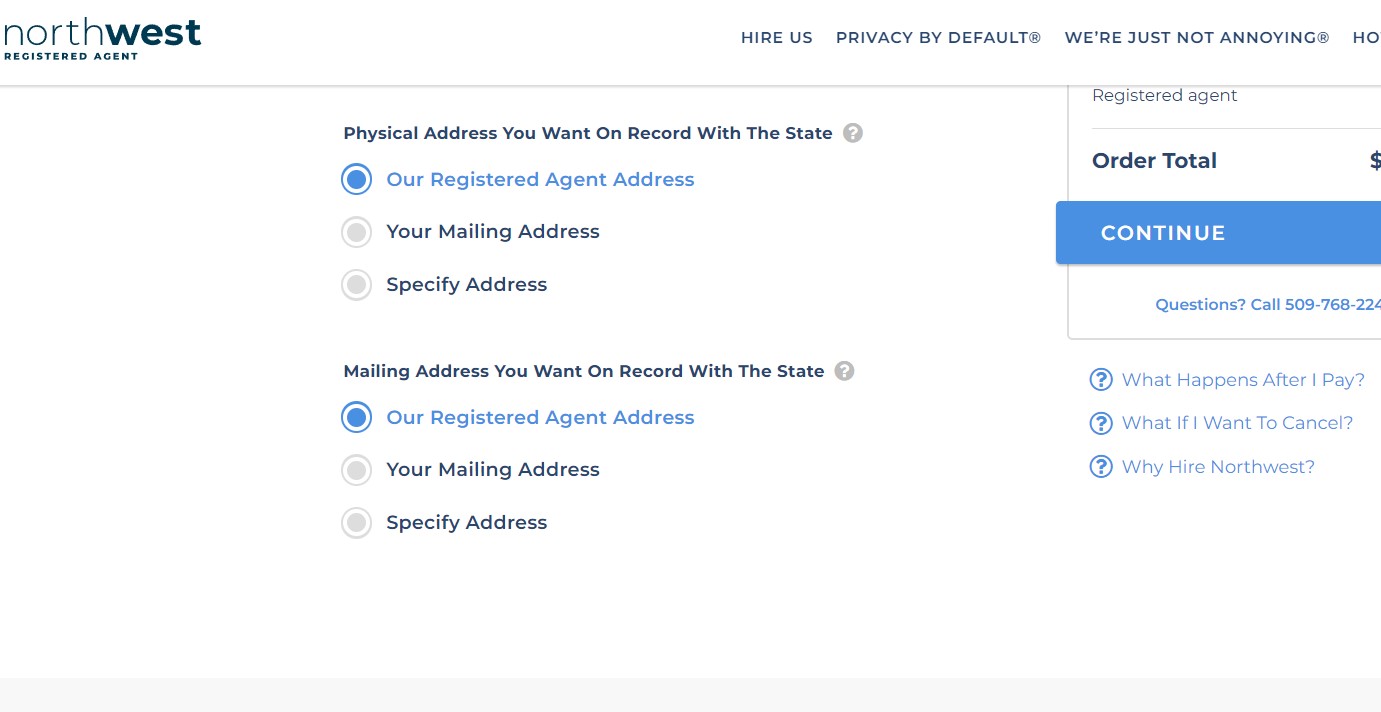

You don't need to pay any additional fee for this. With Northwest, you can form an LLC in Wyoming by paying $39+ in-state fees ($139 total). When setting up your Wyoming LLC company with Northwest, simply leave the Physical Address and Mailing Address as registered agent addresses.

In summary, it is no longer necessary to enter a Specify Address for Wyoming companies formed for Amazon business through Northwest.

Since it accepts the free company address verification codes offered by Northwest, you do not need to rent an address or virtual office from a private address company.

What Happens When an LLC is Formed for Amazon in the Northwest and Other States?

Northwest has announced that it accepts these Amazon address verification cards in the following states as well as the state of Wyoming.

If you are going to form an LLC company for your Amazon business, you can also choose the following regions as your state.

States Where Northwest Accepts Amazon Codes to Free Business Mailing Addresses

- CA– California

- DE– Delaware

- FL– Florida

- ID – Idaho

- IL– Illinois

- MT– Montana

- NY– New York

- TX – Texas

- WY– Wyoming

Amazon codes are accepted by Northwest in all of the above states.

If you form an LLC to open an Amazon account and do Amazon business in a state other than this list, they will not accept these codes to the company addresses they provide free of charge. They advertise that this service is only available in certain states (9 states above).

If you are planning to form an llc through Northwest for Amazon in a different state that is not on the list, it is useful to know that they will not receive the address verification cards and deliver them to you.

For this type of application, you will need to rent a virtual office with monthly payments from Northwest, premium mail forwarding or an address with a private suite from another address company, and show those addresses as the company mailing address.

NOTE: Almost no address company in the US accepts address verification PINs for Google Business registration. In addition, almost no virtual office or address company accepts Google Adsense (or Google Admob) address verification codes.

For Amazon, you can now incorporate Northwest in any of 9 states, including Wyoming. After this development, you have the chance to choose states such as Florida, where the Resale Certificate is easily obtained.

29 Comments . New Comment

Hello, I want to do e-commerce through Shopify. Do I need a virtual address with a door number for this? I would be glad if you could answer me.

Hello,

if you are going to do e-commerce only through shopify or the website, you do not need a special suite address. You can also open accounts with the standard address provided. There are many people who do business this way.

Hello, I have some confusion, I would be very happy if you could clear it up.

If we open the company in state A and at the same time receive a service such as a private mailing address suite address, but this suite address is in a different state B, and we tell Northwest to register the company to this suite address; In this case, my LLC company will be in state A ((will be subject to the rules there)) but will my company address ((my mailing address)) appear as state B? So, officially, my company is affiliated with state A, but its location will appear in state B? When I enter bank addresses etc. in official places, should I enter address B as the company address?

Or will my company address be a different address and my mailing address a different address? (I honestly don't know if that's possible) So do I have several different addresses defined?

The company will be registered in state A, and its mailing address will be in state B. The company registered in state A will have a registered representative address in that state, but the documents you will receive will be sent to state B.

If you are very confused, you can choose the address and installation in the same state

Yes, I think that will be the cleanest way.

I'm curious, in the e-mail sent by the agency for the company opening, you said that they should link the company to the mailing address. When I make this connection, the agency will appear in the state where I was formed as my registered representative, but will my company address appear at the premium mail address I received as an additional service?

While I was looking at the name from the link you gave for company name check in Wyoming, similar companies appeared. I looked at their details. In one of them;

formed in: wy

main office: an address in ca

mailing address: the same address in ca

registered agency address: the office address of the agency in wy.

It looked like. That's the reason for my confusion.

I'm sorry if I confused you too..

Yes, it is not a very confusing process that will appear in that form, there are people who use it this way.

Hello, after forming the company, when trying to connect a previously opened Amazon account to the company, it asks for push information. Is there another method other than this? ITIN will come at the end of the year, I think it hasn't arrived yet.

Could there be a possibility that we have made a mistake in a situation that we have never heard of before? If you want, you can review it again and if it doesn't work, ask Amazon or try to get expert support from a professional.

I think we have 2 or 3 addresses when establishing a company.

1-Residence address (Turkey)

2-Mail address (I understood that a mailbox address can be entered differently than residence by renting. Since we are in Turkey, we have no choice anyway. Bill address ones are very expensive)

3-Registered agent( As far as I know, it has nothing to do with our Amazon account)

QUESTION:

-Which of these addresses will we use when opening an Amazon account?

When registering with Amazon, I think we should use the mailing address we used in the Company setup. The document we will receive from Amazon at the end of the year and our mailing address in RSI must be the same. Please correct me if I'm wrong

yes you have two addresses

1- When registering with your agency (Northwest), it asks for your residence address. This address must not be fake and must be verifiable with an invoice. Your residential address does not appear on state records, but a US business address appears on records. Residence address is kept only in the agencies' database.

2- Let's not confuse this part. We explained the residence side in the first article. I think you mean the US company mailing address in this section. If so, Northwest already provides you with a free address. However, if you want to rent a private suite, you can look at paid address companies or rent a virtual office. In this case, you will have monthly costs.

3. Yes, it is irrelevant, it means your company's registered representative in the USA.

When opening an Amazon account, enter your US company address in the business address section. In the residence address section, you need to enter your home address in a format that you can verify with a bank statement and invoice.

When registering with Amazon, you write your company mailing address in the business address section, and the address on the IRs will be the same address.

Hello, I have been following your articles for a while. There is something I want to consult with you about and I hope you can help. Thank you in advance.

I opened a seller account on Amazon TR with a sole proprietorship company I established in TR about 8 months ago. Later, I opened other country marketplaces through the same account without listing any products. (Except UK) Now I want to do wholesale arbitrage in Amazon US and for this reason I established an LLC in Wyoming. I applied for an EIN and am waiting for a response. What I want to ask you is this:

Currently in my Amazon US store:

Business Address: My TR company address is registered

Deposit Method: My individual Payoneer US account is registered

In this case, since I need an EIN number to shop from a wholesaler in Usa, I need to shop with my LLC company that I have formed. Then, the platform I shop from will issue an invoice to my LLC company and send the products to the intermediate warehouse address I gave as the shipping address. How should I proceed if Amazon requests an invoice while listing the products before the products are prepared in the intermediate warehouse and sent to the Amazon warehouse? Logically, how can I remove the purchase I made with the LLC from the company's stock? Should I invoice Amazon or my company in TR? If I invoice the company in TR, wouldn't the company in TR be importing in a sense?

Otherwise, in the Amazon panel,

Business Address: LLC address

Deposit Method: LLC.

Do I need to change it to account?

If so, which company will be invoiced for the payments made to me by Amazon after I sell on Amazon?

Which side should we keep accounting on?

What will be the role of my TR company as long as I continue with the arbitrage model in the USA?

Crazy questions in my mind, what solution do you suggest? 🙂

I request your information,

Hello,

Unfortunately, we cannot provide detailed technical support regarding Amazon. If you want, you can get consultancy from an Amazon expert or try writing the same question under the topic in this link.

We have more followers who subscribe to this topic

https://startupsole.com/amazon-icin-amerikada-sirket-kurmak/

We hope you find the answer to your question

Hello. I deal with digital businesses such as service and consultancy, but my mind stays in Wyoming just because I might do Amazon work in the future. How much does it cost on average to file an annual report? How much do accountants earn? Do you think it would be unreasonable if I set it up in New Mexico?

Hello,

Wyoming annual report is 62 usd. It can be easily paid each year on the state website.

Accountants receive an annual declaration service fee of around 500 USD for small and medium-sized businesses, depending on the number of your transactions.

Actually, New Mexico is more advantageous for your business (there is no annual report), but the address offices of the agencies only receive Amazon address verification cards in Wyoming.

If you are going to do Amazon business, Wyoming makes more sense, the only difference is that there is an annual report fee of 62 USD. Apart from that, the state is not important since it will be a foreign company anyway.

When the Amazon job is done, you say that an annual report will be given in any case, because ITIN will be obtained. Then you say the only difference compared to Wyoming is 62 dollars. But if ITIN is not going to be obtained and Amazon work is not going to be done, New Mexico makes more sense. 500 dollars a year would be in our pocket, right?

Mr. Nazmi, what is the annual payment for New Mexico?

Please do not be confused that the annual report is not about Amazon. The annual report is the fee paid to the state. Whether you do an Amazon job or any other business, everyone who has an llc in this state makes this payment. Actually, it is called the annual report, but the essence of the matter is an online fee paid to the state. So it's not about taxes, it's about keeping the company compliant and active.

ITIN is a number required when filing annual individual taxes It has nothing to do with Wyoming or NM or other states. Some accountants also apply and obtain the ITIN number for you when preparing your tax return. Of course, we can recommend a competent accounting company in this regard when you reach that stage.

There is no annual state fee for New Mexico, so you do not have to pay the state, but if there is any commercial activity in your company, in and out of your company's bank account, until April of the year after you form the company, it must be declared federally to the IRS revenue administration. It is independent of the state and every company owner should get support from an accountant at the end of the year. Of course, the content and type of these declaration forms may vary depending on the work you do, your income level and the geography from which you earn income. So do not think that the standard is 500 dollars, it may be lower.

Sir, it has been changed to say, "Whether there is entry or exit from the bank account, it must be declared federally to the IRS revenue administration Do you have any knowledge about this?

Hello, from where did you get this information?

We met with a CPA working in the USA. It was a feature that came during the pandemic period. It was paid through this system like e_folder. If there is 0 income, the system does not accept it anyway. However, as of this year, it is necessary to declare it to the IRS, even by mail, he said.

There is a lot of information on these subjects, and the best thing to do would be to trust a CPA. What he means by annual declaration may be that every LLC company fills out form 5472. However, Form 5472 is not a tax return, it is simply reporting to the IRS the amount personally transferred from the US company's bank account to the bank in the home country.

If the business activity of the previous year is reported to the IRS at the end of each year by reporting the expense, income and net profit ratio to the accountant, it will be a risk-free business.

It was good to learn this news. Great.

Northwest, which has not accepted Amazon Address Verification Codes in the past, announced that it now accepts these codes in the state of Wyoming and will open, scan and digitally deliver incoming mail on the same day as standard documents.

Sir, I am not sure about the topic and comments since they are not dated. Is this information up to date? So, when we choose the registered agent address, they will parse the incoming documents according to the company name (Amazon verification code) and send them to us, is it true? This message was written on 11.10.2022.

Also, if I want to form an LLC in NJ with Northwest, if I want NJ as my address, as far as I can see, Northwest does not provide an address in NJ. . Is it true that we will need to get an address from another address provider?

Hello,

Yes, Wyoming also accepts the codes, you do not need to get an extra address, the issue is up to date.

This process is not valid in NJ or any other state. They only provide this respect in Wyoming. If you are going to install in a different state, you need to get a special address.

Hello,

We will form an llc in Delaware through you. Do we need to choose Virtual Office when setting up an llc for the Amazon verification code? Or can we proceed with Northwest's own address?

Northwest does not accept Amazon verification codes received at its Delaware address office. They only accept Amazon codes sent to Wyoming LLC addresses.

If you are going to set up in Delaware and plan to open an Amazon account, you definitely need to rent a virtual office in Delaware. Otherwise, they will destroy the verification letters sent to your Delaware address without forwarding them to you.

I also asked this in my question. Will I overcome the problem if I choose Virtual Office when forming an llc through Northwest? So, after Uniq gives us an address, does Northwest set up an llc with that address?

When ordering Delaware LLC, select the option to use Northwest address. When you reach the Optional Items step, select Virtual office Delaware and create the order this way.

After the order confirmation is received, you can send an e-mail in response to the confirmation e-mail stating that you want the company address to be recorded as the virtual office address.

If you do not send an e-mail, they will register it directly to Northwest's shared office address, but this does not pose a problem. After all, you will enter the virtual office address when registering with Amazon and the code will come to the virtual office. Amazon does not confirm the address in company documents, it just asks you to enter the code.

Of course, the choice is up to you. If you say you will use this virtual office forever, it would be more logical to register it as private.

Hello,

I did not think about Amazon when I opened an LLC, and as you suggested, I opened an LLc in New Mexico with Northwest. Later, I changed my mind about Amazon. How can I solve the problem in address verification? How to rent a private suite address and if you can help us in this regard, we would be grateful to you. Also, how is it possible to change the state? If it is possible, do we need to apply for such a thing from scratch? … the information you provide on your site is truly golden. Thank you.

Hello,

You can get a Wyoming address for Amazon address verification. Since you will only receive it for address verification, you do not need to change it to the state.

All you have to do is enter the code from Amazon and activate your account.

You can get one here:

https://startupsole.com/15a-wyoming-posta-yonloji-icin-adres-almak/