America's tax system can be confusing, especially for foreign nationals. One of the most frequently asked forms in this process is Form 1040NR It can sometimes be complicated for foreign individuals who own a company in the United States and derive income from that company to understand their tax obligations in the United States.

“Do I need to file Form 1040NR?”, especially if you have any financial ties to the US. The question becomes a frequently asked topic. Continue reading our article to eliminate confusion on this issue and clarify the process.

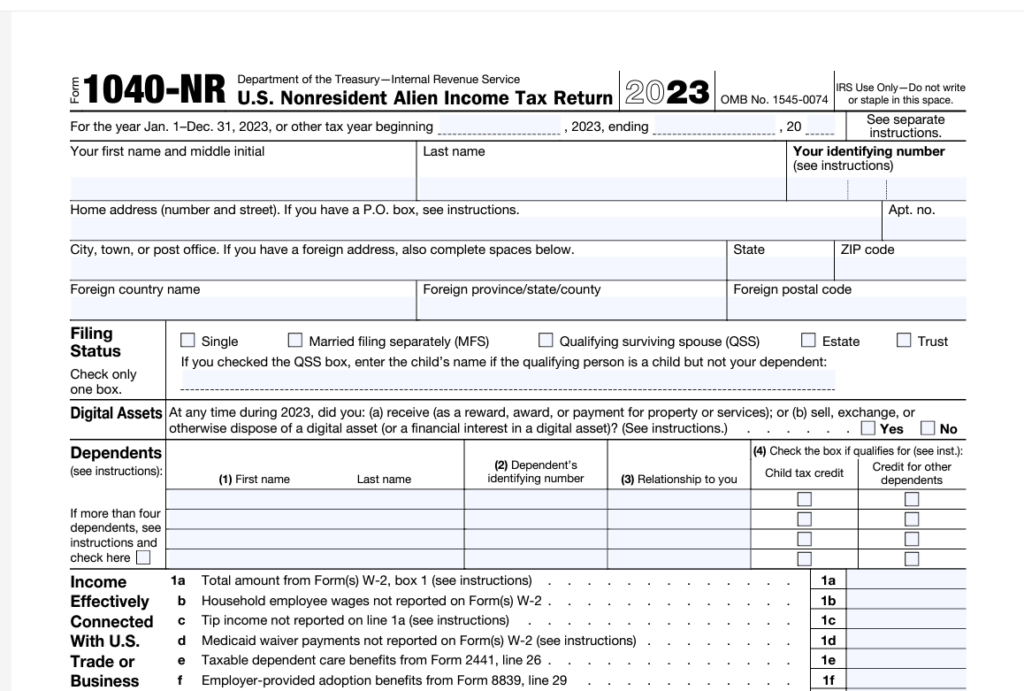

Let's take a detailed look at Form 1040NR and who needs to fill it out.

What is Form 1040NR?

Form 1040NR is the individual income tax return required to be filed by foreign nationals who earn income in the United States. It is used for individuals who are citizens of a country outside the USA and earn income in the USA to report their income to the IRS. The form is an essential tool in determining the tax liability of foreign nationals who have business or financial activities in the United States.

Who Should Prepare a 1040NR File?

- Foreign nationals doing business in the United States : If a foreign national does business in the United States, he or she must file Form 1040NR.

- Those who earn US-source income : Aliens who earn US-source income, even if they do not engage in a commercial activity, must declare this income with Form 1040NR.

- Representatives of a deceased person : If a deceased person has an ongoing tax liability, that person's representatives must file Form 1040NR.

- Representatives of trusts and estates receiving U.S. source income : If a trust or estate has U.S. source income, representatives must report that income.

Situations When You Should Not Fill Out a 1040NR File

If a foreign national does not conduct any business in the United States and does not receive any income from U.S. sources, he or she generally does not need to file Form 1040NR.

The Importance of Compliance with IRS Rules

Filling out Form 1040NR correctly is important not only for tax compliance, but also to benefit from the advantages arising from tax treaties with the USA and to claim a refund of overpaid taxes.

How to Fill Out Form 1040NR?

Accurately completing Form 1040NR Here are some steps and technical points you should pay attention to when filling out the form:

1. Download the Form and Prepare the Required Documents

- Form 1040NR from the IRS's official website .

- Have your income, expenses and tax documents ready. W-2 (if you are an employee), 1099 (if you are self-employed), and interest income statements from the bank especially important.

2. Enter Your Personal Information (Part I)

- In the first section, enter your identification information such as your name, address, country of foreign nationality, passport number, ITIN (Individual Taxpayer Identification Number)

- If you do not have an ITIN number, you must apply for an ITIN by filling out Form W-7

3. Income Declaration (Part II)

- This is the section where you will declare your income earned in the USA. If an employee report your salary and related tax deductions your W-2 form

- If you are self-employed, you must report all payments you receive on Form 1099-MISC

- Line 8 to 8 is for detailing your income. This is where you list US-sourced fees, commissions, interest, and other types of income.

4. Deductions and Tax Exemptions (Part III)

- You may be able to make certain deductions based on the time you spent in the US and tax treaties. you may be eligible for deductions or exemptions from certain types of income

- Advantages arising from tax agreements : Within the scope of bilateral tax agreements made by the USA with some countries, you can ensure that some income is excluded from tax. To benefit from these agreements, you must fill out Form 8833 (Treaty-Based Return Position Disclosure).

5. Tax Calculation (Part IV)

- In this section, you need to calculate how much tax you need to pay on your total income. US-sourced income is generally taxed tax rates .

- Your tax bracket according to the income you earn . For example, you may have to pay 10 percent tax on a certain income bracket and 22 percent on higher incomes. These rates may vary depending on the annual tax tables published by the IRS.

6. Prepaid Taxes and Refunds (Part V)

- If you have previously had income tax withheld , you can declare the prepaid tax amounts in this section on your W-2 or 1099-MISC forms.

- If you have paid too much tax, you can request a tax refund

7. Follow Deadlines

- April 15 : For those who do not engage in business activity in the United States but generate income.

8. Submit Form

- Send your completed 1040NR form and attachments to the mailing address designated by the IRS. If declared through a consultant (CPA), the Electronic filing (e-filing) option can also be used.

Additional Documents:

- Form 8833 : You must fill out if you will benefit from US tax treaties.

- Form W-7 : Required to obtain an ITIN number. (If there is no ITIN)

Common Errors:

- Using the wrong ITIN or SSN : Entering a missing or incorrect SSN or ITIN number can cause serious delays.

- Misunderstanding tax treaties : Misunderstanding tax treaties that the US has with some countries can lead to incorrect tax returns.

A professional accounting (CPA) company can help you take the right steps at every stage by providing services for people who have difficulty understanding these technical details.

Advantages of Getting Professional Help

International taxes are an area that requires detailed knowledge and attention. Misunderstanding the criteria can lead to serious penalties. That's why it's always a good idea to work with an expert.

U.S. tax liabilities relate not only to domestic transactions but also to international transactions. Although Form 1040NR may seem complicated at first, it can be easily tackled with the right guidance. If you are a foreign national or doing international business, do not forget to make your declaration on time.